July 2011 Market Observer

Download PDFFear stalked the global financial markets in the second quarter of 2011. The downside, long forgotten in the investor rush to “get invested”, began to dominate greed. The liquidity induced euphoria of Bernanke’s QE2 faded and, as always is the case, financial fears begat financial fears. When markets decide to be bearish, investors and commentators always accentuate the negatives. Negative sentiment feeds on itself, growing stronger with every investor’s worst fears.

Fears Aplenty

And fears there were aplenty! At the macroeconomic level, problems smoldered and then burst into plain view. The EU rescue of Greece from its budgetary woes degenerated into a slanging match between European countries. The debate over who should share the pain of Greece’s debt default, be it overt or covert, threatened to tear the very fabric of Europe’s monetary union. In Asia, China’s prodigious credit creation was laid bare as black economic comedy. Much of it went to now insolvent local government funding vehicles that the central government was forced to bail out. In the U.S., the impending end of QE2 was accompanied by an acrimonious political debate on the federal debt limit and threat of a U.S. sovereign debt default.

On the micro level, investors now wondered why they were paying so much for so little in potential return. Retail investors pulled money from risk assets. Equities stumbled and then fell. High yield bonds came off their cash happy high and yields rose. Bank loans joined the swoon in prices. Terrified portfolio managers, habituated to begging for better allocations of new issues to invest their cash, watched in horror as money actually left their mutual funds! “Whisper Numbers”, normally the purview of equity earnings, began to circulate about investment flows into and out of the high yield and bank loan market. When the best argument for valuations involves the flow of funds into an investment, it is an obvious sign of credit excess.

Muddying the Waters

Stocks gave up much of their gains. Individual stocks like Research in Motion and Yellow Media came under selling pressure from nervous investors. Investors looking for a reason to sell can always find one. Chinese “reverse takeovers” of companies on North American stock exchanges came under increased scrutiny for accounting irregularities and even allegations of outright fraud. The finances of TSX listed Sino-Forest were questioned by short seller Carson Block of Muddy Waters. His claims of fraudulent books and Ponzi scheme status resulted in plunging stock and bond prices.

“The collapse in Sino-Forest’s share price is part of a massive flight of investors away from North American-listed companies with most or all of their operations in China. The value of the 18 Chinese companies on the TSX, the country’s exchange for quality companies, has fallen by 56 per cent since late April, far outstripping the drop in the S&P/TSX composite index of 6 per cent…” Chill falls over Chinese stocks, Martin Mittlestaedt, GlobeandMail.com, Jun 21, 2011

The board appointed an auditor to find out if there was anything amiss. Hedge fund manager John Paulson, famed for his short of the U.S. sub-prime mortgage market, didn’t wait for the report. He voted with his feet and sold his stake for a loss in the hundreds of millions. What does the TSX have to say about this fiasco?

“What we’re focusing on is letting the investor take the investor risk,” says Kevan Cowan, head of the TMX Group’s equity business.

Youse Pay Your Money and Youse Take Your Chances

Mr. Cowan’s sangfroid about having money removed from the unsuspecting is fair warning for those seeking to increase the risk of their portfolios. What is truly amazing about this episode of Chinese companies behaving badly is that is has happened before. In the late 1990s, a Chinese brewery in Shanghai, Noble China Inc., was purportedly purchased on behalf on Canadian investors and listed on the then TSE. When it turned out the brewery had been sold without the Canadian board’s knowledge, the Chinese CEO was fired. He was reinstated to the Board when it received no information on their purported investment for some time. Despite his reinstatement, Canadian investors lost all their money after a Chinese court ruled they had no claim to the brewery:

“The court decides to dismiss Canadian Noble‘s claim because the evidences provided by Canadian Noble against other three defendants are not factual or legal.” Controversy Over Stock Ownership, https://www.civillaw.com.cn/article/default.asp?id=41461

Even though Noble China was reviewed by legions of highly paid Bay Street investment bankers and lawyers prior to listing, it turned out that under Chinese law, the Canadian investors didn’t really own anything at all! To paraphrase Kevan Cowan of the TSX and carnival barkers everywhere: “Youse Pay Your Money and Youse Take Your Chances”.

So what do we make of the renewed fear afoot in the financial markets? Despite risk assets selling off, we believe that the economic recovery is still intact. We continue to believe, as we have said in previous newsletters, that a recovery following a credit bust will be a slow and drawn out affair. Either distressed financial asset prices have to fall enough to make them attractive to those holding cash or incomes have to increase enough to let the distressed creditors pay off their debts. Paying off debts with flat or falling incomes is a very long term proposition.

Wining and Printing

Mr. Bernanke and his central bank brethren have printed copious amounts of money to allow banks to rebuild their profits and balance sheets. They also want investors to give up hope on getting any return at all from safe government bonds and be forced into more risky investments. All that money printed has to be invested and the banks are only too happy to help income starved investors and charge trading and underwriting fees along the way. This means Bernanke’s largesse is showing up in the financial markets in the form of the inflating prices of financial assets and commodities.

The excess money creation has even reached the art and wine markets. Fine art and fine wine has been bid up at auction by investors looking for “diversification”. Bonus happy investment bankers and Asian businessmen are trying to find something useful to do with their share of the excess U.S. dollars that Mr. Bernanke has printed. They know better than to invest in what they are selling to the great financial unwashed. As the Financial Times reports:

“… In fact, in recent years, fine wine prices have behaved in a very similar way to shares, experiencing a sharp drop in late 2008 and a spirited recovery thereafter… One reason is the predilection of investment bankers for ploughing their bonuses into wine, as a form of portfolio diversification. Unfortunately, this has occurred to such an extent that fine wine prices now offer little or no hedge against the stock market – and are becoming increasingly correlated with the trend in bank bonus payments.” Heady prices require a stomach for risk, Peter Temple, Financial Times, July 1, 2011, https://www.ft.com/cms/s/2/6c1b26f6-a0ba-11e0-b14e-00144feabdc0.html#ixzz1RAVOeZIO

Better an Impressionist painting or vintage Bordeaux than a Chinese reverse takeover! For those familiar with in vestment history, this trend in art and wine investment causes a strong sense of déjà vu and also a deep foreboding. Japanese investors with zero interest rates at home and excess U.S. dollars bought up Impressionist art just before their stock market crashed in the late 1980s.

Good News for Goods and Services

Despite the speculative orgy that low interest rates have engendered in the financial markets, there is some good news for those who produce and sell goods and services in the United States. Corporations are benefitting from the strong credit markets and are enjoying generationally low interest rates. These have helped, along with the recession cost cutting, to put corporations in better financial condition than they have been for many years.

Another fascinating effect of ultra low U.S. interest rates is the weakened U.S. dollar and the vast improvement in U.S. export competitiveness. This is even affecting the Chinese, which have allowed only small appreciation of the yuan versus the dollar. The Chinese export model of buying up U.S. dollars to maintain an artificially low yuan exchange rate has backfired. China and the other Asian exporters have seen huge increases in their domestic money supplies as a result of buying up U.S. dollars. This has engendered an inevitable inflation problem. Chinese monetary policy is being tightened to try to control the inflationary spiral without much success so far. The cost of living is up substantially for the average Chinese worker. This has resulted in unprecedented protests and wildcat strikes. Wages have now been raised by government direction to quell the social unrest. Many western importers are seeing increases of 20% or more in the price of their Chinese goods which is feeding into inflation in the west.

Deflated Consumers

The only thing that the central bank cash bonanza has not pumped up is consumer incomes in the U.S. Low interest rates make for low incomes for seniors, an increasingly important spending demographic as the population ages. Corporations have also been able to keep wages from increasing due to the high level of unemployment. This is good for corporate profits but terrible for consumer spending.

So with the consumer picture so negative, what will the U.S. economy do? Well, we believe it will continue to grow but much really depends on policy. In a previous Market Observer (January 2011), we used the analogy of an economic highway with a fast lane of strong economic growth and inflation, a centre lane of modest economic growth and a slow lane of continued recession. We thought we were in the centre lane of modest economic recovery, which we continue to believe. To answer the question of which lane of economic growth we would be in, we responded that it depended on which way the driver, economic policy makers, turned the steering wheel.

Punch Drunk Drivers?

It now looks to us that economic policy makers are wandering between lanes. Bernanke, ever the Great Depression scholar, panicked when the economy drifted into the slow lane in the middle of 2010. He then implemented QE2, the purchase of U.S. Treasuries by the Fed to avoid his worst fears of debt deflation. Since the monetization of debt is the most potent form of monetary policy, this was a powerful stimulus to the U.S. and global economy. It is also not happenstance that both core and overall CPI inflation in the United States has moved up considerably.

Now that the inflation rate has picked up well above anything the Federal Reserve anticipated, Bernanke is attempting to steer back into the centre lane. The recent Fed meetings have been notable in their dropping of their low inflation language. The financial markets were disappointed that no further quantitative action is being taken by the Fed in the form of a follow up to QE2. The truth is that the Fed has succeeded in its quest to defeat deflation, if it existed in the first place.

Things could still go either way economically, into the slow lane of renewed recession or the fast lane of inflation depending on monetary policy. With governments limited by their budgetary woes and government spending increasingly politically untenable, the prospects for renewed fiscal stimulus are fading quickly. Despite the end of QE2, monetary policy is still extremely loose in the U.S. and this is the central debate of economic forecasters. Will policy continue loose or will it tighten?

There is considerable debate over the proper course for monetary policy. One camp suggests the very weak recovery cannot take higher interest rates and monetary policy should stay loose. They worry that rising rates will cause more damage to the economy than temporarily higher inflation. The other camp believes the economy cannot be mended by monetary means and that continuing loose will inevitably result in higher inflation which will be a bigger problem. In Europe, the conservative ECB has just raised its benchmark lending rate by .25% to 1.5% despite the debt crisis in Greece. In Britain, the Bank of England has maintained interest rates at a record low of .5% to en courage economic growth. This is despite official British inflation running at 4.5% compared to the official target of 2%. In the U.K., a considerable debate has emerged. “Save our Savers”, a lobby group of savers, sent a letter to all members of the Monetary Policy Committee of the Bank of England:

- Dear Committee member,

>“As the Bank of England says in one of its own publications: ‘Low and stable inflation is crucial to a thriving and prosperous economy.’ We are in a recession intensified by the highest level of consumer debt in our history and yet the MPC’s inaction is undermining the propensity to save and exacerbating the problems of an unbalanced economy.

A country without savings is a country without a future.

We request that the MPC observes its mandate to bring inflation back under control.”

Source: https://www.thisismoney.co.uk/money/news/article-2012193/Interest-rate-decision-Bank-England-holds-amid-calls-tackle-inflation.html#ixzz1RQfuuwOD

A Moving Inflation Target

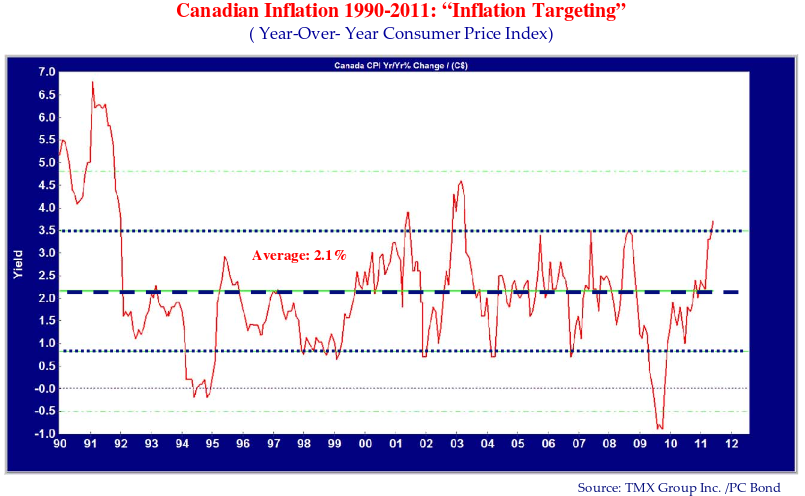

We believe that the inflation die has already been cast in North America. The Fed and the Bank of Canada will decide the issue by their reaction. So what is happening with Canadian inflation? Well, a look at the following graph of Canadian year-over-year CPI shows the period from 1990 to the present. This is the period when the Bank of Canada has followed its inflation targeting regime. The average CPI over this period of 2.1% shows that the BOC has been fairly successful in targeting the CPI at or below 2%. The average of 2.1% doesn’t do justice to the variability of inflation over the period which has ranged from a high of nearly 7% in 1991 to the low of nearly -1% in 2009 during the recession after the credit crisis. It also shows clearly that deflation has recently been defeated and now inflation is becoming a problem.

Inflation fell from a high of 3.5% in late 2008 to a low in 2009 of -.8%. Most recently, the CPI in Canada has moved up strongly with the readings for May 2011 at 3.7% overall and 1.8% ex food, energy and other “volatile components”. The graph shows the average CPI as the thick blue dashed line. The two thinner blue dotted lines are one standard deviation about the mean. Note that the current 3.7% is more than 1 standard deviation above the average which has not happened very frequently since 1990. What this suggests to us is that the BOC is going to be forced to tighten monetary policy fairly soon.

This high a rate of inflation is a problem for the BOC’s credibility. Governor Mark Carney must be hoping that his calls for moderating energy prices and a lower CPI are accurate. If not, he is risking an inflationary spiral with his continued ultra loose monetary policy. What is even more surprising is that inflation is running so high when the strong Canadian dollar has put downwards pressure on imported good prices.

Studied Inflation Ignorance

Mr. Carney has a difficult job ahead of him. Canadians have the highest level of consumer debt in history, as a result of the very low interest rate environment. Much of this debt is floating rate and this makes Canadians very exposed to rising interest rates. Mr. Carney has taken to scolding Canadians for their low savings rate and high consumer borrowing. This has to be taken with a grain of salt since it is his actions that have really caused the problem. As “Save Our Savers” pointed out to the Bank of England, Mr. Carney has really encouraged Canadians with his low real rates to borrow and not to save. If interest rates are well below inflation, why should anyone save at a negative rate of return? Alternatively, why not borrow as mu ch as is possible with real rates so negative.

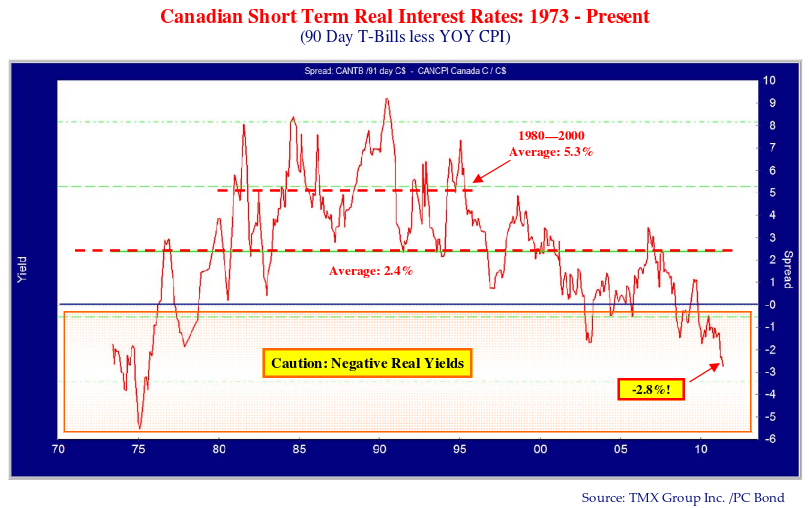

The danger in Mr. Carney’s studied ignorance of the rising inflation rates is captured in the following graph of Canadian real yield from 1973 to the present. This shows the real yield of Canadian 90 Day T-Bill yield less year-over-year CPI which has averaged 2.4% for the entire period. We have shown the negative real yield area in the chart in orange, as we believe it is very dangerous territory for the Mr.Carney to explore. Notably it shows that the current very negative -2.8% was only equaled in the build up to the very inflationary 1970s. This is not a good period for Mr. Carney to choose to emulate into his present day efforts.

Note that the period of negative and low real rates from 2000 to 2005 didn’t end very well either. When rates were finally raised from 2006 to 2008, the credit crisis resulted.

The problem for Mr. Carney is that he cannot keep up his “See No Inflation Evil” act without risking significant inflation. How high do rates have to go? Going to the average 2.4% real rate with inflation at the current 3.8% would indicate a 6.2% yield on T-Bills! We think that Canadian borrowers cannot take anywhere near this level. We look for Mr. Carney to raise rates to between 2% and 3% and hope that a fall in commodity prices cools things down.

What if he doesn’t raise rates or ends up with “too little too late”? To cope with the oil shock in 1973, central banks globally kept monetary policy far too loose for far too long. Inflation rose from 1% in 1971 to over 12% in 1976 when wage and price controls were instituted and brought it back down to 6%. When these were removed in 1978, inflation surged upwards and peaked once again at nearly 13% before Paul Volcker of the Federal Reserve and John Crowe of the Bank of Canada applied very tight monetary policy medicine. Real rates rose to very high levels and stayed there. The accommodative -2% real rate soared to a very restrictive 8% in 1981. From 1980 to 1990 Canadian real T-Bill yields averaged 5.3% and inflation plummeted.

Monetary Rumble Strips

Going back to our economic highway analogy, we think our drivers, the Bank of Canada and the U.S. Federal Reserve, have either dozed off at the wheel or have shut their eyes to ignore the growing inflation risk. Perhaps when they careen through the fast lane onto the shoulder and tire rumble strips, they will wake up in horror and pull back onto the highway before they crash and burn in a monetary policy sense.

They don’t want to tighten. It will be very unpopular but it’s their job. Yes, things will still be soft economically but that’s far better than an inflationary spiral. Their central banking forebears tried to staunch economic wounds with monetary policy bandages and ended up with the patient nearly dying of inflation shock. We can’t say what they’ll do but we’ll be watching closely.

And what of the markets? With inflation moving strongly above official targets, both the Federal Reserve and the Bank of Canada are likely to raise rates. They will do so grudgingly and as slowly as possible. Once it is apparent that the inflation genie has escaped its bottle, they will try to catch up and they will inevitably overcorrect in their tightening.

One way or another, interest rates will be rising, short of China suffering a credit implosion or a Euro debt default. Monetary policy tightening or inflation rising will both bring higher interest rates. This will put pressure on both the stock and bond markets and discount rates rise and prices fall.

The risk to our forecast is a financial crisis. China is our most likely candidate since their aggressive monetary policy tightening will eventually work. This will lower commodity prices and hammer stock markets globally. Europe seems to be managing their debt crisis but a Euro meltdown is not out of the question. The odds of both of these are growing.

2023

2022

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2007

2006