The More Things Change

As the saying goes, the more things change, the more they stay the same. There is not much change in our investment thinking this quarter, as there has been not much change in the economy or financial markets.

Concerns still abound about the U.S. economy. It contrarily continues on the strong side, despite President Trump’s best efforts to derail it with tariffs and trade wars. The Federal Reserve is still tightening U.S. monetary policy. The good economic news is not limited to the U.S. and even Europe seems to be recovering from its monetary and debt malaise. Global interest rates are therefore grudgingly rising in fits and starts.

The “Not Normal”

Bond managers got used to the “New Normal” of low interest rates. They got so used to low yields that even the negative yields in the German bond market didn’t seem that strange to them. We commented at the time that the negative yields were inane and would be an historical anomaly but many “market experts” were buzzing over what they saw as obvious rationale for such financial stupidity.

We think this was the “Not Normal” phase of the low yield mania. Many bond managers are still yearning for lower yields but we think the summer of 2016 will be the long-term secular bottom for yields and the peak of the deflation hysteria. There is little excuse now for central banks to be “erring on the side of caution” and leaving interest rates at their current extremely low levels.

Expert Tut-Tutting

Borrowers and investors are still in denial about rising rates, thinking that current yields below inflation are “normal” as they have been habituated to by their friendly central banks. As our clients and readers know, interest rates and bond yields are normally higher than inflation but they are not now. U.S. inflation is currently running at 2.8% year-over-year, .8% higher than the current Fed Funds Rate at 2.0%. The Fed is signaling that it would like to raise the Fed Funds Rate to 2.5% by the end of 2018, 3.0% in 2019, and 3.5% in 2020. This has many market experts tut-tutting over the Fed’s rashness in daring to have higher interest rates.

The Tut-Tutters are well off base with their concerns. The Fed’s current targets are still low by historical standards. Our historical analysis, which we have talked about in our past newsletters, suggests “normal” short-term interest rates are 2% above inflation. This would put the Fed Funds Rate at 4.8%, 2.0% higher than current inflation of 2.8%. The “normal” level for interest rates is a matter of debate but there could clearly be much higher interest rates ahead.

The Trump Reality Show

We must admit to more than a little news fatigue. The reality star President of the United States is bringing us our new reality of “Trump all the Time and Everywhere”. Whether jetting to the Singapore Summit to meet with his new best buddy Kim Jong Un, tweeting early morning INSULTS! or starting an “Easy to Win” trade war with China and close U.S. allies, Donald J. Trump has dominated the news cycle.

This is not by accident and seems to be a considered strategy. In a moment of candor before his campaign, Trump admitted to a reporter that he thought he was “winning” when everyone was focused on him. Trump’s presidency is using the formula of a reality show: dramatic unveils; twist and turns between contestants; backstabbing; currying favour and the final ritual humiliation. If everyone is watching, the ratings are good and the President is happy.

The Trump Tear Down

Railing against the established order is Trump’s thing. What are we to make of a President who seems to be tearing down the very world political and economic order established by the United States itself after the Second World War? Trump is a real estate developer and his modus operandi is that if he tears something down, he gets to rebuild it and put his name on it. It seems that Trump is in the mood to raze anything done by previous administrations, and replace it with his own policies, even if the existing policies and treaties were good for the U.S.

The problem is that policy and precedent have very little to do with the current administration. Long-term allies are treated like enemies and enemies, especially ruthless dictators, are treated with deference and respect. Complicated political, strategic, economic and business relationships are sacrificed to appearances and sloganeering with little regard for the consequences. In “Art of the Deal” Trump terms, there are only two dimensions of winners and losers. The President wants to “win so much” that it entails that everyone else must lose. Serious policy takes a back seat to the Trump Show that must go on and its search for “ratings success”.

There was a time when people thought that Trump might moderate his extremes and grow into the Presidency. The reality of the Reality President is that the norms of politics and diplomacy are in tatters. It seems that anyone who commits to service of this President falls into his thrall and adopts his “counter punch” pugnacity, hitting back “twice as hard” to enemies real and imagined.

Self-Humiliation and Debasement

Watching the Trump advisors making the Sunday Morning TV rounds after the G7 debacle was a study in self-humiliation and self-debasement. They were playing to an audience of one, President Trump on Air Force One flying to his Singapore reality show. Larry Kudlow, Trump’s economics advisor, and Peter Navarro, Trump’s trade advisor, followed up the G7 debacle in Quebec with Sunday morning television appearances that set a new low for international diplomacy. Their boss was upset with Canadian Prime Minister Justin Trudeau’s final G7 press conference where Trudeau said Canada “would not be bullied” in its trade dispute with the U.S. and the NAFTA negotiations. It seems that Trump thinks that fighting back is beyond the pale.

Watching the educated and experienced Kudlow and Navarro use the verbal abuse vocabulary of schoolyard tough guys was at once repugnant and fascinating in the grand reality show tradition. They both accused Trudeau of “betraying” Trump by his comments. Navarro proved his baseness to the Trump Base by saying there was “a special place in hell” for anyone who “defied” President Trump. Navarro later apologized for his histrionics but it said a lot about the pressure he is under as a Trump advisor / television apologist. Kudlow literally showed the pressure when he was hospitalized just after his Sunday interviews with a heart attack.

Tariff and Trade Wars be Damned!

Despite all the trepidation and emotional exhaustion caused by the 24/7 Trump antics, the financial markets seem to be taking the turmoil in stride. Tariffs and trade wars be damned, it is full speed ahead and the markets are steaming along quite nicely, thank you very much.

There is good reason for this market optimism. The U.S. economy remains strong and unemployment is at generational lows. The Federal Reserve has finished its mortal combat with its deflationary enemy and maintains its withdrawal of monetary stimulus.

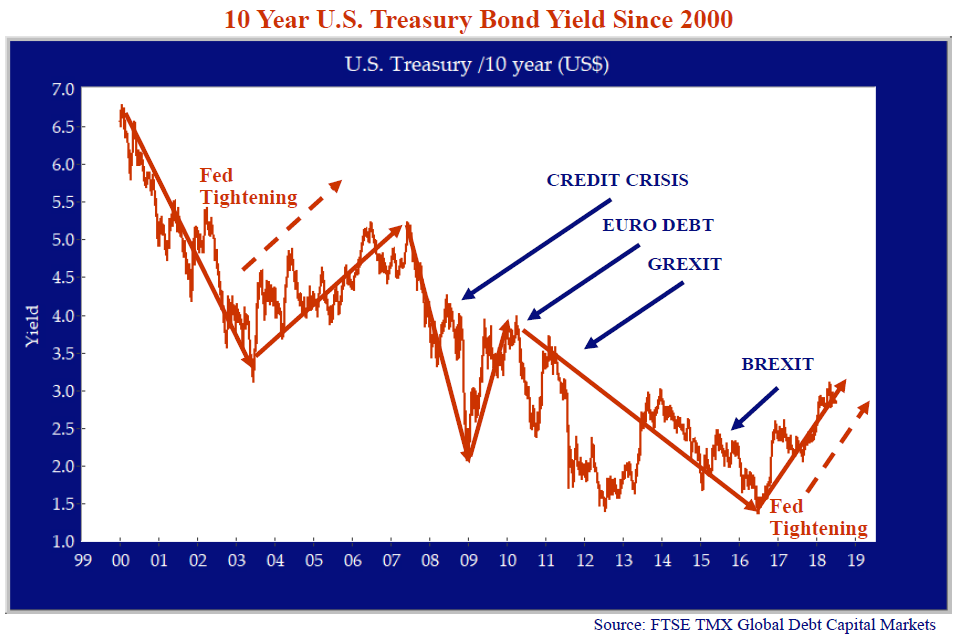

There are ups and down as investors try desperately to figure out the method behind the Trump madness, if there is any. Will trade wars and politics derail the economic expansion? Not enough to change things in the short term. We think the bond market is reading the tea leaves properly. The graph below of the 10 Year U.S. T-Bond yield shows that yields are bouncing around in the short term but are still in their rising pattern, well up from their lows reached during the deflationary hysteria of 2016. Despite a minor downdraft recently, the current 10-year yield is 2.8%. This is more than double the low of just over 1.3% in July 2016.

The Trumperverse Non-Effect

A look at the chart above shows that negative economic or financial market events like the Eurodebt Crisis (2011), Grexit (2012), and Brexit (2016) have caused yields to plummet in a “flight to safety” ever since the Credit Crisis of 2008. What is very interesting now to us is that the current Trumperverse political and economic conniptions are not causing a similar downdraft in yields. We think this results from the realization that bonds, and U.S. bonds in particular, are not the safe place they used to be.

Ex-Strolling Bond Market History

Since most current bond market investors have not been at their craft very long, we think it germane to take a stroll through the recent history of bond yields since 1999. The 10-year UST yield plunged to a low of just over 3% with the monetary easing by the Federal Reserve after the dot.com market crash of 2000, just over where it is now. The Fed then began tightening monetary policy in 2003, raising interest rates in a series of “measured increases” of .25%. It believed the financial markets would “efficiently” incorporate these into investor expectations. The 10-year UST yield reached a peak of 5.2% in the summer of 2007.

In their inefficient human investment glory, investors did not incorporate the Fed’s “measured increases” into their greedy market calculus. The financial party peaked in a Bacchanalian lending orgy that ended very, very badly with the Credit Crisis of 2008. The Fed of course had to ride to the rescue with its unprecedented monetary easing and yields then dropped to their post crisis lows of just over 2.1% in December 2008.

The ingrained Pavlovian financial market response to the Fed’s monetary largesse was swift and the financial markets rallied powerfully throughout 2009 and into 2010 with yields peaking at near pre-crisis levels at 4% in the spring of 2010. The Euro Debt Crisis, the worry that smaller Eurozone countries would default on their Euro denominated debt, followed quickly in the summer of 2011. This once again saw the central bank Super Heroes strut their crisis fighting super powers.

Mario Draghi, head of the European Central Bank, headed off a Euro Zone currency and debt crisis by declaring he would do “Whatever it Takes” to preserve the Euro and its currency zone governments. This time Draghi and the other central bankers improvised their way into “Quantitative Easing” or stuffing themselves to the gills with government and even corporate bonds.

As things settled down for European sovereign debt, yields went back up to over 3% before plunging again in 2012 on Grexit, the prospect that Greece would exit the Euro. Yields increased to over 3% after a successful EC negotiation with a new Greek government and then plunged once again on Brexit, the British referendum that approved a withdrawal from the European Community. Brexit then took yields in June 2016 to what we believe will be generational lows of 1.3%.

Up and Rising

“Hey, Hey Up and Rising” is the chorus of the Maritime song “What Do You Do With a Drunken Sailor”. Yields have been up and rising ever since the summer of 2016 as the U.S. economy and inflation have strengthened substantially. Bond managers have probably been doing a little drinking to drown their sorrows at their sinking portfolio ships.

As we said above, we are now quite fascinated that President Trump’s attacks on political and economic normalcy have not changed the trend in bond yields to any great extent. We think the reason for this is that the bond market is recognizing down deep that Trump’s efforts to destabilize will eventually show up in higher inflation.

An Inflationary Witch’s Brew?

This time around the bond market is recognizing that the U.S. economy is strong, monetary policy remains loose and the Republican tax cuts are leaving a huge hole in U.S. government finances. Cutting tax revenues and increasing government spending by deficit financing is usually the policy prescription for combatting recession. The U.S. economy is strong and definitely not in recession. Unemployment is at generational lows but the U.S. government deficit is now the highest it has ever been in peacetime, adding fiscal stimulation exactly when it is not needed.

As we said earlier, inflation is running at 2.8%. President Trump is doing his best to get it higher with his tariffs. Trump’s blue-collar base in the Mid-West shops at Walmart and most of what they buy is made in China. The 10-25% tariffs that the Trump administration is applying to Chinese imports will increase the price of most of what Walmart sells and this will be directly passed through into the inflation rate.

We now have an inflationary Witch’s Brew of:

- A strong U.S. economy;

- Still loose U.S. monetary policy;

- High U.S. government spending and extremely stimulative fiscal policy;

- Negative real interest rates;

- Very low unemployment;

- Significant restrictions on illegal and legal immigration that increases labour costs; and

- Tariffs on imports particularly low cost Chinese manufactured goods.

As we have said for some time, it seems to us that we are setting up for significantly higher inflation. At the very least, the Fed will continue to normalize interest rates above inflation. This means to us that the course of interest rates and bond yields is upwards.

Not Knowing Prudently

We do not know when or what will eventually happen to the financial markets but we think it prudent to consider the downside in our investment decisions. Money has been far too cheap for far too long. We are currently seeing immense speculation in the financial markets that will not end well. The bank loan and high yield bond markets are being driven by the stretch for higher income. Their prices will not respond very well to rising interest rates and bond yields.

Bitting Off More Than They Can Chew

Speaking of an astounding financial speculation, we discussed the crypto-currency mania in our January 2018 Market Observer. Bitcoin had soared from $966 at the start of 2017 to $19,187 by mid December 2017. The increase of 1,886% in just under a year certainly got everyone’s attention. It also created a huge market for Initial Coin Offerings (ICOs), where start-ups created their own crypto-currencies to raise money.

We told our clients and loyal readers that we thought ICOs were nothing short of outright fraud dressed up as “FinTech” and that this financial speculation would end badly:

“This time is certainly not different and is probably much worse, with today’s speculation in “crypto-currencies” on par with the Dutch tulip bulb mania… The current crypto-currencies mania is evidence of not just euphoria, but of financial insanity. We believe the investment lust surrounding Bitcoin and other crypto-currencies is a direct result of the distortion of proper financial allocation by the world’s central banks.”

Well it looks like we were right. The path for Bitcoin has been sharply downwards and it is now down to $6,675, off 65% from its peak. The ICO market raised a lot of money from naïve and greedy investors and the speculation and fraud was rampant. This was not “long-term” investment in the new “crypto-currency asset class”. Bloomberg reported on a Boston College study that concluded buying coins in an ICO and selling them immediately is the “safest investment strategy”. The study also found that:

“About 56 percent of crypto startups that raise money through token sales die within four months of their initial coin offerings.

That’s the finding of a Boston College study that analyzed the intensity of tweets from the startups’ Twitter accounts to infer signs of life. The researchers determined that only 44.2 percent of startups survive after 120 days from the end of their ICOs. Half of ICOs Die Within Four Months After Token Sales Finalized, Olga Kharif, Bloomberg.com, July 9, 2018

Capital at the Ready

Investors are currently taking high risks for low potential returns. When we buy risky investments at Canso, we need to be compensated for the risks we take. We are currently buying higher quality investments and keeping our clients’ capital ready for the next buying opportunity that will undoubtedly appear.