2017 turned out to be an excellent year for financial assets. The U.S. stock market boomed last year, reflecting the stronger U.S. economy and anticipation of the Republican tax legislation that was passed in December. This significant corporate tax cut will boost earnings going forward and companies will also be able to repatriate capital that was stranded in offshore tax havens, both of which will be a boon to shareholders of U.S. companies.

The U.S. equity indices soared. The Dow Jones returned a strong 28.1%, the S&P 500 climbed 21.8% and the Nasdaq soared 33%. The high yield market was strong with the FTSE TMX Canada High Yield Index at 9.9% and the BAML US High Yield Index at 7.5%. Even the investment grade bond market held its ground, as a flattening yield curve and narrowing credit spreads kept the investment grade indices positive with the FTSE TMX Universe in Canada at 2.5% and the MLX IG in the U.S. at 6.5%.

Trumpeting the Stock Market

President Trump was quick to take credit for all the good stock market and economic news. Despite this, his personal popularity is mired at historical lows and the U.S. seems to be stuck in a constant cycle of social and political upheaval. Michael Wolff’s revelations about the Trump presidency in his book, Fire and Fury: Inside the Trump White House, boggle the mind, but the real world seems to be choosing to ignore the political theatre.

The U.S. economy continues to chug along quite nicely in spite of the tawdry reality show in Washington. The strength in the U.S. economy has gone under the radar for years. We have been constantly harping on the positive economic situation on these pages in the last few years, despite the pervasive feeling of economic malaise.

Candidate Trump very effectively tapped into this angst during his campaign by constantly disparaging the economy, which was well received by his disaffected supporters. Things changed rather quickly when President Trump took office. He was quick to take credit for any and all economic improvement. Perhaps it took the constant Trump Twitter bombardment for the economic recovery to be fully acknowledged.

Desperate for Weakness

The bond market still seems to be divorced from this economic improvement, with yields hanging tenaciously at recessionary levels. This bond market consensus not only ignores the economic positives, it desperately clings to any shred of statistical weakness to justify its absurd valuation that still has real yields (after inflation) at historical lows. Even the Federal Reserve has now finally accepted the improved economic reality and grudgingly bumped up short-term interest rates.

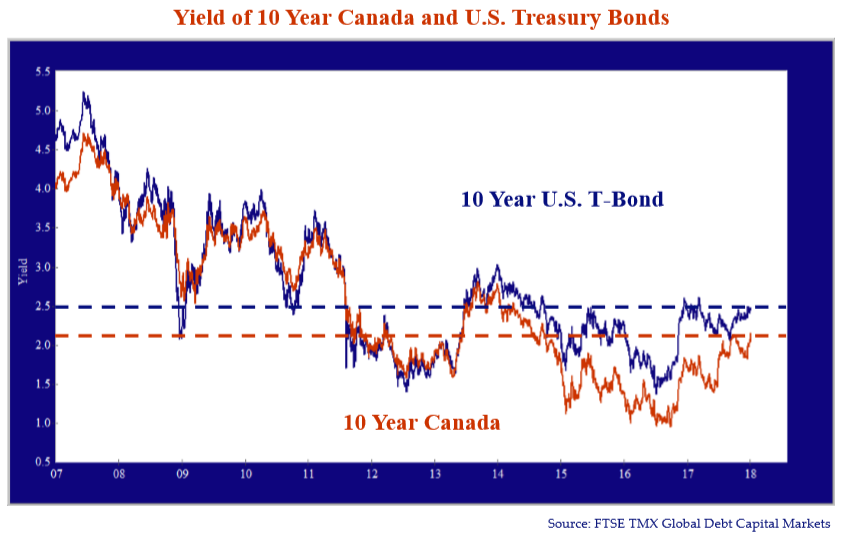

The chart below of U.S. and Canadian 10 year government bond yields shows they have moved up sharply over the last year and are now reaching the levels before the Euro Debt Crisis and the experiments in quantitative easing started in 2011. As we have said many times before, we think that yields have reached their generational lows and will be in an uptrend for many years.

Rising bond yields will also raise discount rates, which will be a headwind for other financial assets. Investors and portfolio managers who have only known falling yields will find it hard to adjust to this different world. Consumers will be in for a surprise as well. Canadians are now seeing their residential mortgage rates reset higher for the first time in years, which very well might be their situation for many years going forward.

From Overvaluation to Beyond!

We believe the world central banks have been fighting their war against “all disinflationary enemies, real and imagined” for far too long. We are still very concerned about the long-term effects of ultra-easy monetary policy on the financial system and think that the central bankers have set up for another financial disaster. We believe that people end up squandering their capital on very speculative investments when capital is too cheap. Our fear today is that, to paraphrase Buzz Lightyear, we have gone from “From Overvaluation to Beyond!!!” This time is certainly not different and is probably much worse, with today’s speculation in “crypto currencies” on par with the Dutch tulip bulb mania.

Blockheaded Investment

The current crypto currencies mania is evidence of not just euphoria, but of financial insanity. We believe the investment lust surrounding Bitcoin and other crypto currencies is a direct result of the distortion of proper financial allocation by the world’s central banks.

Bitcoin is a virtual currency that is produced by solving cryptographic problems, with the libertarian goal of removing money from government control. The Bitcoin technology uses a decentralized network of volunteer programmers and computers to keep a record, known as a blockchain, of all transactions that is publicly available. Bitcoin has soared in value, as it has become the speculation of choice for investors worldwide. In the stock market, companies that have changed their names to include the word “Blockchain” have seen their prices soar thousands of percent.

In a hot stock market with money to be made, there usually is no shortage of crappy new issues created by underwriters to meet investor demand and Bitcoin is no different. The twist for crypto currencies is that no stock needs to be issued; only new virtual coins need be created and sold. The original Bitcoin crypto currency has been joined by many other new currencies: Ethereum, Ripple, Cardano, Stellar and Iota have all caught on in a digital currency whack-a-mole game.

Token Regulation

Crafty promoters are hyping their “Initial Coin Offerings” which gives investors virtual currency in exchange for real money. It is more than a little astounding to us that investors are essentially financing companies without gaining ownership of the companies’ stock, only ownership of their crypto-currency! We are amazed that regulators are permitting this. Just because people are willing to buy something does not mean it should be allowed. Even in good old Canada, the regulators seem to have drunk the virtual Kool-Aid. As the Investment Executive reported, The Ontario Securities Commission has approved Ontario’s first-ever regulated Initial Coin Offering:

“We are pleased to announce that we just approved the first token offering out of Ontario. It is important that we continue to foster innovative new ways to raise capital and invest, and this announcement is a testament to the dedicated support we are providing in this space,” the commission says in a statement… The firm is planning to create 1 billion FNDR tokens on the ethereum blockchain, and to distribute up to 200 million of them as part of the offering (raising around $10 million).

A Ripple in the Bitcoin Force

Token Funder has raised $10 million and plans to help other token issuers take advantage of the unsuspecting Canadian investing public, under the digitally cool supervision of the OSC. They are not alone. As we said earlier, there are already many crypto currencies and nothing is stopping the creation of new ones. This means that there actually is no scarcity of digital currency. As the New York Times reported on Ripple tokens, there is huge money being made:

At one point on Thursday, Chris Larsen, a Ripple co-founder who is also the largest holder of Ripple tokens, was worth more than $59 billion… Other top Ripple holders would have also zoomed up that list as the value of their tokens soared more than 100 percent during the last week — and more than 30,000 percent in the last year. The boom has turned Ripple into the second largest virtual currency, within striking distance of the original behemoth, Bitcoin. (New York Times, Rise of Bitcoin Competitor Ripple Creates Wealth to Rival Zuckerberg By Nathaniel Popper January 4, 2018)

Ripple is a profit maximizing company which intends to act as a financial transaction Blockchain ledger for banks. What interests us is that the Ripple tokens are soaring in value, not the Ripple equity that represents ownership in this profit oriented company. If you remember back to your Economics 101 course, money is useful in that it acts as a medium of exchange and store of value. In the case of Ripple, which is selling its services to banks as a transaction record-keeping system, the value of the tokens is simply speculative demand.

Papering Crypto Transactions

There is quite a bit of risk in even holding digital currencies. There is no regulation by governments or monetary authorities and digital currency exchanges have been hacked. People who lose or forget their passwords cannot access their holdings. There is no one to complain to nor prove the provenance of your lost holdings. It is estimated that up to 40% of BitCoins are in this monetary suspended animation. Many crypto-currency investors keep their passwords on paper in safety deposit boxes in a perverse twist for a digital mania.

What is truly amazing about the virtual currency mania is that the currencies have little value other than what speculators will pay for them. Proponents argue that the supply is limited but this is obviously not the case with the many new digital currencies being created. The fact that governments cannot track BitCoin or other digital currency transactions means that they are indeed useful for money laundering by sundry terrorists and criminals but this creates a risk in itself.

Digitally Cool Government Fools

We are amazed that governments, with the exception of China, seem to be mesmerized by the digital coolness of this mania. They haven’t moved to stamp out the illicit uses of digital currencies with regulations that apply to financial transactions in the real world. The current global financial system has been digital for many years. When governments finally recognize that digital should not mean exempt from scrutiny and apply regulation or criminalize digital currencies, even this limited utility will be moot.

Blooming Digital Currencies??

The real selling point for cyber currencies is that everybody wants them and they are increasing exponentially in price, which creates even more demand from speculators. This is little different from any other financial mania from the beginnings of recorded history. By ironic coincidence, a movie about the Dutch tulip bulb mania, Tulip Fever, was released in September 2017 as the digital currency craze was in “full bloom”. In this financial mania of 17th century Amsterdam, tulip bulbs were changing hands for the price of houses. At least the bulb buyers could rationalize the astronomically high prices they were paying by the beauty of their potential flowers.

Berry Amazed

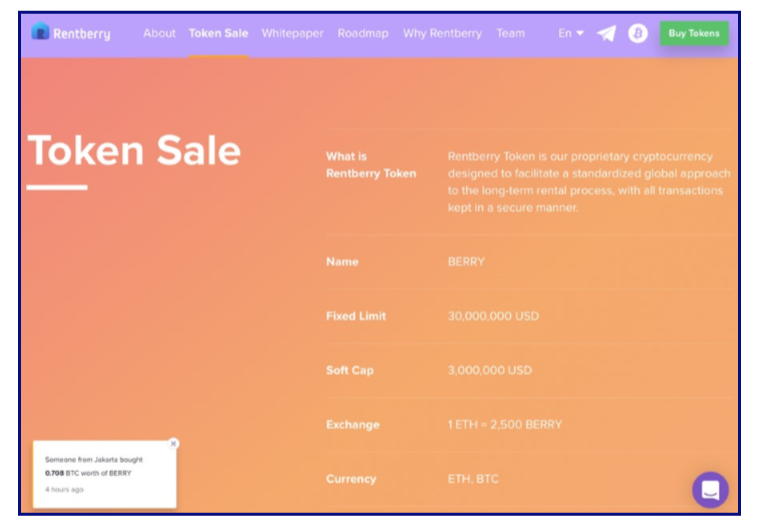

The connected Internet world makes it really easy for today’s digital speculation to occur. Checking the markets while on vacation, we found a Banner Ad for a “Token Sale” for Rentberry. Clicking the ad brought us to the Token Sale page that we show above. It explained that the “Rentberry Token is our proprietary cryptocurrency designed to facilitate a standardized global approach to the long-term rental process, with all transactions kept in a secure manner.” As we read the page, we were regaled with pop-ups saying that “Someone from Moscow bought .35 btc Berries” and watched in amazement as people from Jakarta, Singapore, New Delhi and various Chinese cities bought tokens. We operate in a highly regulated investment business where marketing and advertising are strictly controlled. Rentberry is using the digital marketing techniques of travel sites to raise money from small investors worldwide. Buying in the first 15 days brought a 33% bonus! It amazes us that governments and regulators are choosing to ignore this “digital innovation”. Separating fools from their money on a mass digital scale seems to be a very prosperous and growing sector, ignored or even encouraged by regulators. Charles Ponzi would be quite jealous of today’s crypto-currency efficiency!

Rentberry might be a legitimate company, however buyers of their tokens are not receiving equity in this company. They are buying “scarce” tokens for the Rentberry rental housing payment blockchain. While Rentberry promises a fixed limit of $30 million USD, there is nothing to stop a competitor setting up another rental housing blockchain or even Rentberry creating another token to expand their service.

Drunk on the Luck Truck

What is it that drives normal people into a greedy lust to buy something that is going up in price? We recounted on these pages that Professor John Coates found that the blood levels of testosterone were very high in traders when they were making money in strong markets. This encouraged them into very risky professional and even personal activities. This is the current state of the crypto currency markets. So much money is being made publicly that everyone wants in. Mr. Larsen, the co-founder of Ripple is a shining example to the speculative masses:

“It’s amazing what’s going on,” said Chris Larsen, Ripple’s co-founder and chairman. “You’ve got to be standing in the middle of the road when the luck-truck hits you…”

There is probably a lot of testosterone coursing through Larsen’s body after his billions of increase in his personal net worth in the last year. There are also a lot of small time investors trying to get in the way of the “luck truck”.

Depressed Markets When the Bubble Bursts

The problem for all these instant millionaire and billionaires is that at some point they need convert to conventional currencies to actually spend it. The last trade in their crypto currency of choice is currently setting their net worth. In any illiquid market, a lack of supply leads to prices gapping upwards on substantial buying. When the buying turns to selling, the opposite will be the case. The sharp gaps upwards in price on limited volume will turn into sharp plunges in price.

Coates found that physiology is different in down markets. The stress hormone cortisol kicks in and he says that traders and markets go into a depressed “clinical state”. He concluded, as we have known for many years, that traders were literally “drunk with success” at market peaks and despondent during sell-offs. In the recent sell-off in Bitcoin, trading blogs were giving the phone number of suicide help lines to the despondent traders losing money.

The Clamour for Digital Doesn’t Extend to Stocks

We have already remarked most of the speculation in this cycle seems to be in the price of digital coins and tokens. Stock promoters are taking advantage of the digital currency lust, but what is unusual about this speculative bubble is that individual investors are not storming into the stock market:

“Rather than celebrating this wealth-generating machine, individual investors have made clear in multiple surveys just how little enthusiasm they have for this stock market. For years, analysts have described an “unloved” or even “hated” stock rally, where prices defiantly rise despite one of the weakest U.S. economic recoveries on record… “It is the most disliked bull market of my career,” said John Fox, chief investment officer at Fenimore Asset Management. “No one is excited. This is not like 1999 and 2000, where you went to a bar and CNBC was on TV.” (The Wall Street Journal, As Dow Tops 25000, Individual Investors Sit It Out By Akane Otani and Chris Dieterich January 4, 2018)

We have individual investors clamouring to buy crypto currencies with little intrinsic value but turning up their noses at stocks that represent ownership in actual companies with actual earnings. This might actually be a good thing, since the speculation in this bubble is outside of the conventional financial markets.

This might not last long. The investment banks are envious at the money being made and are now setting up trading desks for crypto currencies in the hopes of siphoning off some of the riches.

The Crypto Mania Will End Badly

It is very hard to watch from the sidelines when people are literally making billions of dollars. The attractive force of greed needs to be offset by discipline. When the prudent investor explains the risk, the wannabe crypto billionaire says that’s what people said last year before the huge run up. There is not much one can say to these true crypto believers.

The Investment Way Forward

This is the hardest point in the investment cycle for us, as those around us succumb to their speculative urges. What is a prudent investor to do? The same thing as always, find good businesses and securities to invest in. Are crypto currencies worth a punt? In the sense of gambling or lottery tickets they might be, but we think this crypto mania will end very, very badly.

Our portfolios continue to be more conservative in their security selection, as valuations move us into higher quality. Our bond portfolios have shorter durations and significant weights in floating rate notes, as we think they are very cheap compared to fixed rate.

The current market calls for strong investment character and the discipline to resist the siren call of speculation. We believe we are up to the task!