A Story Worth Telling

On October 19th of this year, Canso employees, family and friends gathered at the Canadian Warplane Heritage Museum in Mount Hope, Ontario. In the shadow of our namesake aircraft, the Canso, we celebrated 20 years as a firm.

The story of our Canso name began 75 years ago, when 18 year old Andrew Carswell of Balmy Beach in Toronto, like his father before him, volunteered for wartime service in WWII. His father, Sergeant Morrison Carswell MM, had fought at Vimy Ridge and survived 5 years of bloody trench warfare in WWI on the battlefields of Northern France. Morrison returned home and started a family. His son, Andy, enlisted in the Royal Canadian Air Force in May 1941 on his 18th birthday, and was trained as an RCAF pilot.

Andy was an operational bomber pilot in England by December 1942. His Lancaster bomber was shot down in January 1943 on his 4th operational mission, just above the deadly average 3rd mission, and he spent the rest of the war as a POW. Andy wrote a book about his war time experiences, “Over the Wire” (Wiley Canada, 2011), that we highly recommend.

Andy then returned to Canada and started his own family. Being shot out of the sky in a burning Lancaster did not sap him of his love for flying. He rejoined the RCAF in 1948 and went on to pilot the amphibious PBY-5A Canso aircraft in northern Canada on mapping and search and rescue missions. He was awarded the Air Force Cross by Queen Elizabeth for valour on several rescue missions.

John Carswell believed he had a better way to manage money and started his own firm in 1997. He identified the characteristics people wanted in a money manager: reliability, stability and performance. John thought these traits were embodied in the Canso airplane. In naming his new firm Canso Investment Counsel, John honoured his father while identifying why investors would ultimately hire his new firm.

In the midst of the two hundred attendees at Canso’s 20th anniversary celebration were none other than Mr. Andrew Carswell (age 94) and Mrs. Dorothy Carswell (age 96), long time clients of Canso! The same Andrew Carswell who returned home from the war, started a family and flew the Canso airplane. For Canso employees, the image above is much more than a plane – it is a constant reminder of where we come from, who we are and the promise we’ve made to our clients.

Level Beheaded??

It has been tough sledding recently for some of the world’s most powerful leaders. Angela Merkel, fresh off her 4th election win, continues to struggle to form a coalition government in Germany. Should she fail, the world’s most powerful level-headed leader may be out after twelve years as Chancellor.

In the UK, Prime Minister Theresa May continues to battle insurgents within her own party. Across the Channel, a stubborn Europe looks to extract more, not less, from Britain as they march towards independence. If recent BREXIT announcements are correct, the UK’s €39 billion Brexit payment will certainly rank as the most expensive divorce settlement ever.

Bond-Fire of Real Interest Rate Inanities

In the financial markets, Janet Yellen’s record of dependability and reliability put her instantly at odds with the anything but President Trump. Her replacement, yet to be confirmed Jerome Powell, is expected to continue on the same rate hiking path Ms. Yellen had embarked on. The bond market still clings stubbornly to its negative interest rate denial while the Republican Congress attempts to throw its tax cut fiscal gasoline on the red hot monetary policy fire. Prudent bond managers have moved far back from the market consensus to avoid scorching. The 1990’s bond market credit excess was termed “The Bonfire of the Vanities” in the book by Tom Wolfe. We look forward to a sequel of the current bond market real interest rate excesses to be called “The Bond-Fire of Real Interest Rate Inanities” at a digital bookstore near you!

Ain’t That a Shame

It’s been a difficult few months for music fans all over the world. We said goodbye to and mourned the passing of pop icons Fats Domino, Gord Downie, Malcolm Young and Tom Petty; country legends Don Williams, Glen Campbell and Mel Tillis; and, of course, former teen heartthrob David Cassidy.

Things haven’t been much rosier in the fixed income world. Bond investors not used to loss experienced a whole lot of it in the last 12 months. In fixed income, Corporate bonds were the best of a bad lot in the 3 and 12 months ended September 30th, 2017. Spreads narrowed as interest rates rose keeping losses in Corporates to -1.3% and -0.4% respectively in the 3 and 12 months ended September. Government of Canada’s generated -1.8% and -4.7% returns over the same periods. Long Corporates outperformed long Canada’s by an amazing 1.0% and 8.6% over the last 3 and 12 months but still generated -3.6% and -1.6% losses over those periods (Source: FTSE TMX Global Debt Capital Markets Inc).

It’s A Long Way to the Top

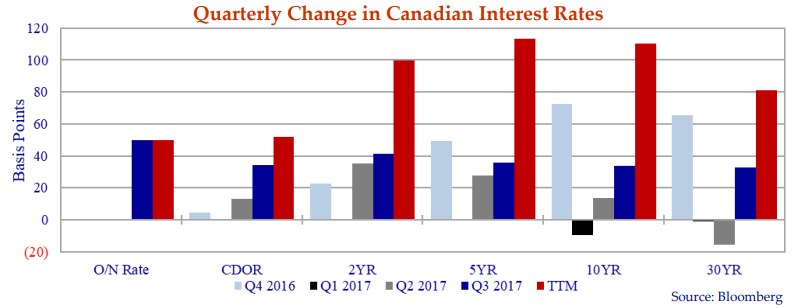

We’ve long suggested interest rates would move higher from the central bank administered artificially low levels of the last decade. In the 12 months between September 2016 and September 2017, something remarkable happened in the Canadian bond market – we were right! Interest rates from the Bank of Canada Overnight Rate (O/N) all the way out to 30 year Government of Canada bonds significantly increased.

The chart above depicts interest rate changes across the Canadian yield curve over the last four quarters. It demonstrates interest rates do not increase either uniformly across the curve or in a straight line.

Bank of Canada Overnight Rate increases occurred in Q3 2017 (July and September) while CDOR increased in Q2 and Q3 2017 in anticipation of the BOC increases. Q4 2016 and Q3 2017 witnessed large increases in 5, 10 and 30 year bond yields. Over the period, the yield curve steepened from O/N to 5 years and flattened from 5 years to 30 years.

Yellen and Screaming Higher Rates

The path to higher rates begins with higher administered interest rates in response to undeniably stronger economic data around the world. After being immobilized by their Credit Crisis trauma for the better part of a decade, the world’s major central banks were roused from their inactivity. The Federal Reserve raised rates twice in 2017 (March and June), for a total of four times since 2015. In possibly her last act as Fed Chair, Ms. Yellen is expected to announce another rate hike after the Fed’s December 13th meeting. She’s also readied the markets for the reduction of the Fed’s massively engorged balance sheet.

Even the pathologically policy inert Bank of Canada raised rates 25bps at each of its July and September meetings, essentially reversing its panicked 2015 oil crisis easing. Despite the ritual British BREXIT seppeku, the Bank of England joined the interest rate fray raising rates 25bps a few weeks ago as well.

About to Get Real

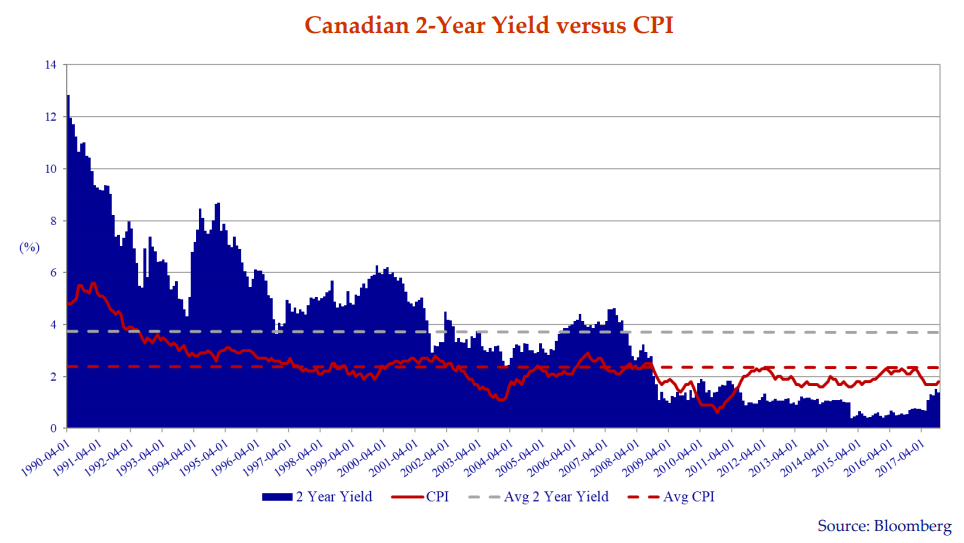

Our assertion, interest rates should be higher, often leads to the question “what is the normal level of interest rates?” We suggest “normal” equates to positive real interest rates which in our view is inflation plus 1 to 2 percent.

The chart above depicts the yield on 2 year Government of Canada bonds (the blue shaded area) versus the YoY Canadian CPI (the red line). The series dates to 1990, just prior to the Bank of Canada’s implementation of its current inflation targeting policy. For the period, 2 year yields averaged 3.9% versus inflation at 2.4% or a difference of 1.5% – the exact midpoint of our estimate of where normal interest rates should fall.

Since the Credit Crisis, with the exception of a brief period in 2010, Canadian 2 year rates have remained significantly below CPI. Said another way, real yields on 2 year Canada bonds were negative for most of that period. We believe we are in the early days of a normalization of interest rates and ultimately we expect real yields to be positive across the yield curve. We have a long way to go to get back to “normal”.

I Think I Love You

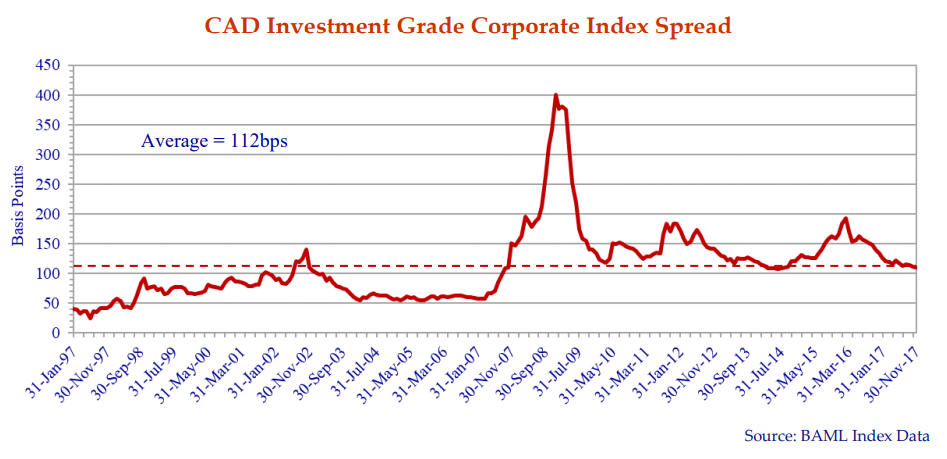

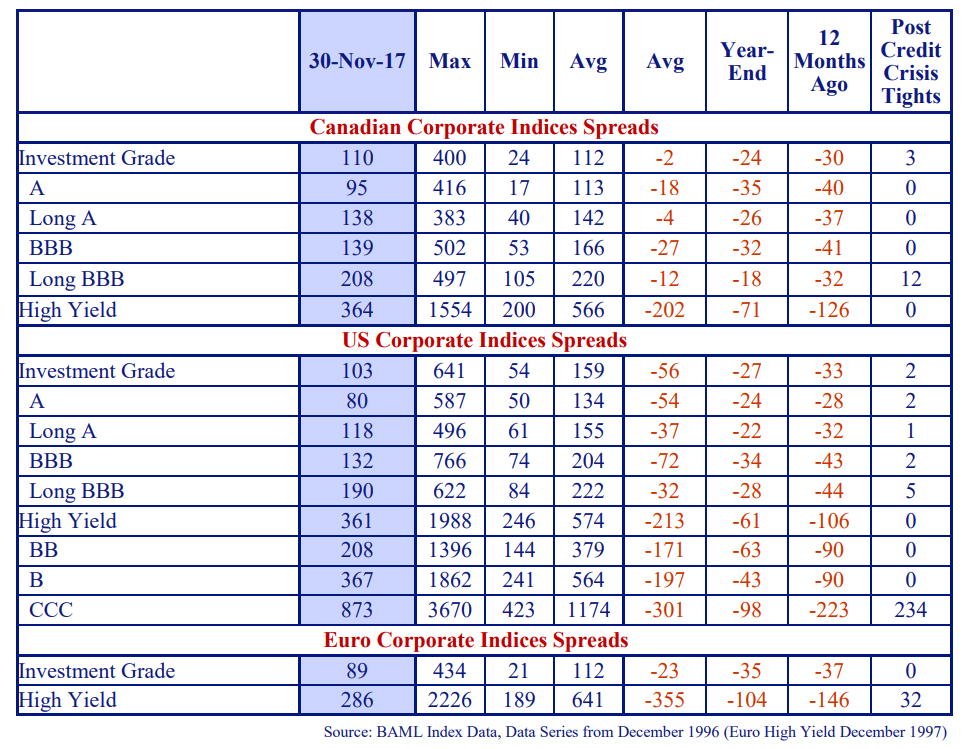

In the credit markets, investors in Corporate bonds have continued to benefit from spread narrowing. Following a significant widening in February 2016, credit spreads have compressed. In Canada, investment grade spreads at 110bps are just through their long term average of 112bps. They are just 3bps wider than post Credit Crisis tights of 107bps in June 2014.

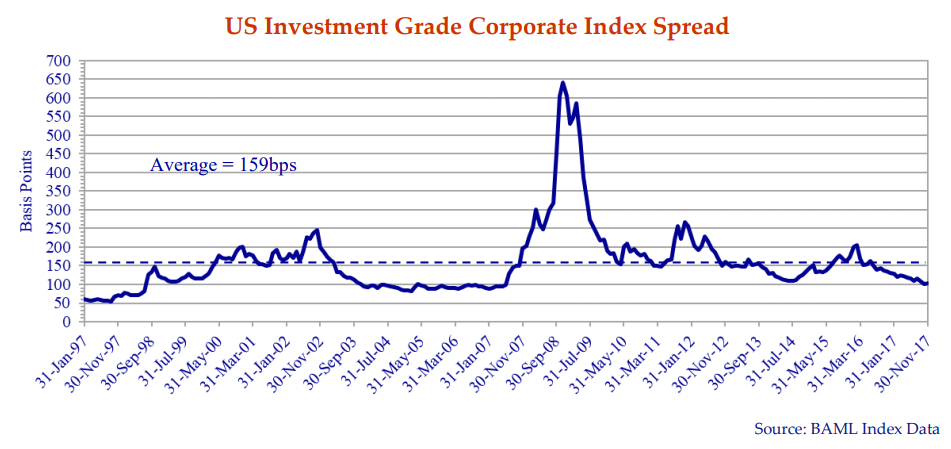

In the US, investment grade spreads at 103bps are 56bps through long term averages. All segments of the US credit markets are at or near post Credit Crisis tights.

Highway to Credit Hell

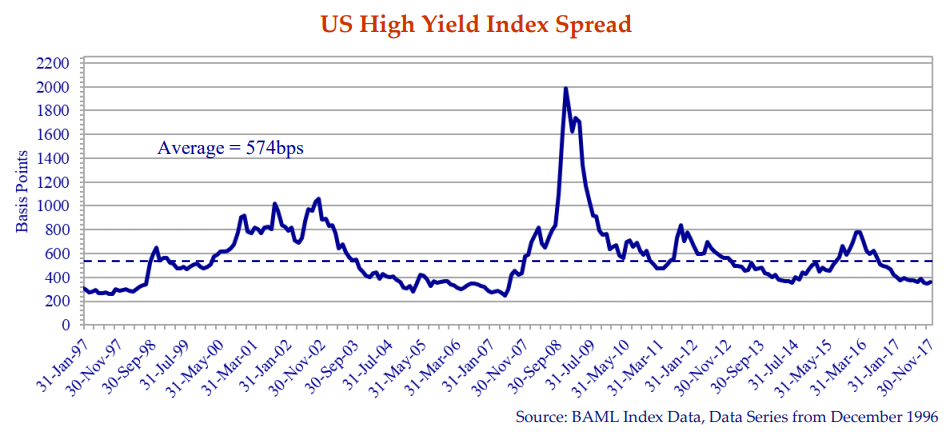

At 361bps, US high yield spreads trade 213bps through historic averages of 574bps. BB’s, B’s and CCC’s are all well through long term averages.

We’ve discussed at length the perils of the US high yield and leveraged loan markets. Borrowers benefit from loose terms and tight pricing at the expense of lenders. We prefer to lend elsewhere while we wait for the lending scales to rebalance in our clients’ favour.

Maple Bonds Forever??

A rather sordid chapter of Canadian investment history came closer to its end recently with the call of another Maple bond issue. Many European banks took advantage of the growth in the Maple bond market (bonds issued by foreign issuers in Canadian dollars) before the Credit Crisis. Royal Bank of Scotland (RBS), Commerzbank, Lloyd’s Bank and many others borrowed in Canadian dollars to fund their expanding global operations. Pre-Credit Crisis, when a bizarre Moody’s methodology change made all 3 Icelandic banks AAA rated, they all issued Maple bonds to Canadian investors. They also all defaulted in 2009, in one of the lesser known and more grievous financial scandals in Canadian history. The Credit Crisis brought a screeching end to the Maple bond party, as Canadian investors saw their financial Maple bond holdings hammered.

Devil Bond Partying

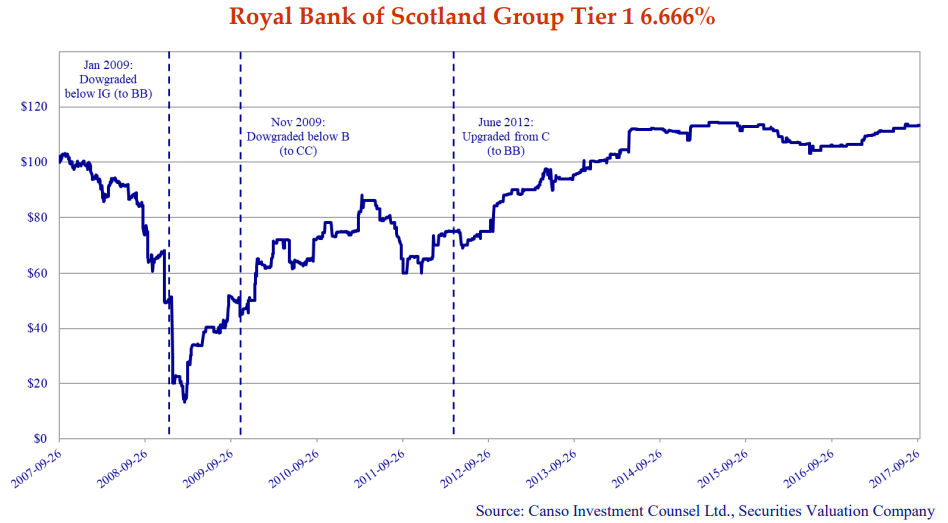

A long and non-linear association between Richmond Hill based Canso and City of London based Royal Bank of Scotland ended on October 6, 2017, when RBS called its CAD 6.666% Perpetual T1 bonds at $113.32 ($100 par plus 2 missed coupon payments). These were called the “Devil Bonds” due to their unfortunate and rather ominous 6.666% coupon. This was celebrated with Canso panache at a very entertaining and devilish party.

The chart above shows the price of the Devils dating back to original issue in 2007. We’d like to say we bought our entire holdings at our low trade of $16 but, to our discredit, we originally bought on new issue at $100. To our credit (pun intended), we invested with educated conviction across the life of the security. While we eventually got what we were promised for the bonds we bought in the original issue, we made some serious money on bonds we purchased from distressed sellers.

Two key points need to be made. First, our view from the beginning was RBS was a money good investment. When the UK government effectively “nationalized” RBS during the Credit Crisis, we were thankfully proven correct. Even better, our analysis of our now distressed holding convinced us that buying more was a good investment for our clients. Over the life of our investment, RBS Devils generated an annualized return of 11.1%, as our distressed purchases paid off. A devilishly good performance.

Prairie Comment Sense

On a recent road trip out West, a client asked us if Canso “had ever made a mistake [in an investment sense]”. The short and easy answer is “Yes”. We are fallible humans and haven’t always been right. As John Carswell likes to say, “if you haven’t made mistakes you haven’t taken enough risk.” He also notes the key is not to avoid risk, it is to price it appropriately.

In our November 2014 Corporate Bond Newsletter we highlighted our purchase of the formerly high flying Teleglobe Canada Inc. bonds at $55 which ultimately paid creditors a paltry $4.60. This was not our finest hour. On the other hand, our Maximum Loss analysis accepted that there was significant risk in these bonds and limited our position size.

The client’s follow-up question stated with endearing prairie bluntness was, “had the people responsible for the mistakes been fired?” The answer an unequivocal “No”. It might seem common sense to demand perfection from your portfolio manager and be ruthless in your employment practices. To us this is a recipe for a revolving door of young and naïve managers who “know not what they do” to your portfolio and follow the market consensus. The other alternative is to force your portfolio manager into closet indexing, which is why passive portfolio management is now the investment rage. Note that Canso has never shown any predilection whatsoever towards looking like an index.

Importantly, each investment experience at Canso adds to the collective knowledge of our firm. Arguably the value of our experience and mistakes is adding to our collective investment knowledge which increases the likelihood these mistakes will not be repeated. The real value of Teleglobe was the lesson we learned on the value of assets with huge potential but limited cash flows. Lots of promise does not make up for lack of revenues.

Are You Not Entertained?

Our single minded focus at Canso is to generate returns for those who have entrusted us with funds to manage. This includes John Carswell’s parents, John himself and all of our staff who are invested in our Canso funds. Successful investing generates returns over long periods through the extremes of economic and financial cycles, no matter what uncomfortable questions we get from our clients. We exploit inefficiencies through investments in underpriced securities across the capital structure of issuers from around the globe. In short “we buy cheap stuff”.

We have cautioned for an extended period of the risk of increases in interest rates – both administered (overnight rates) and market determined (the yield curve). We have also cautioned of the weakening of credit underwriting standards and mispricing of credit generally.

Higher… and Higher

As the song goes, “Higher and Higher…”, our current bias is to higher quality. We are increasingly finding that higher quality bonds are better risk-adjusted value that their lower quality peers. We have stocked up on high quality floating rate notes across our portfolios – assuming limited credit risk without the associated interest rate risk. We realize and willingly accept this may give rise to periods of underperformance versus the benchmarks against which we are measured. Over the last three credit cycles, we have had the most questions from clients when we had the most conservative portfolios. Our constant refrain was “just wait”. We are content to sit in quality and low risk when there is meager compensation, as is now the case, for assuming huge risks.

Our bottom up fundamental approach gives us the confidence to invest in securities others avoid and to avoid securities others are clamoring for. If the markets stumble, we would expect to opportunistically pick up cheaply priced assets on behalf of our clients.

From all of us at Canso, we wish you the best for the holidays and a very Happy New Year!