It is not an easy thing to write this newsletter. We are first and foremost portfolio managers charged with managing our clients’ money, a task we take very seriously. We want our newsletters to inform our clients and readers about how we view the markets. We do not point forecast the very uncertain macroeconomic and financial future. We are bottom up and valuation driven, not market timers, and we are more interested in the pricing of financial assets and the state of investor psychology.

We have been writing about the markets for a long time. We started Canso in September 1997 and began managing our first institutional corporate bond mandate in October 1997, which we are proud to still manage today. Our first client report went out in January 1998 and we turned our client reports into our Canso Market Observer and Canso Corporate Bond Letter in 2004, which are archived on our Canso corporate website. We recommend taking a tour through these if you want to understand how we think about the markets over time.

Emotional Capital Call

As our clients and readers well know, we think that the financial markets are inefficient, contrary to everything that the so-called financial experts say. Since investors are unfortunately “human”, the very human emotions of fear and greed tend to rule the markets in a very repetitive way. The problem with this for your Canso editorial team, is that as they say in French, “plus ça change, plus c’est la même chose” or the more things change, the more they stay the same.

We believe that most investors are locked into a repeating financial market cycle of capital expansion and destruction where greed and fear replace rationality. This is the very opposite of Schumpeter’s economic business cycle of “creative destruction”, where new businesses replace failing old ones. Investors, by their very human nature, are repeatedly sucked into a cycle of senseless “capital destruction”. They make terrible investments when their greed and desire to conform overwhelm considered analysis. They are then terrified after losing lots of their money and then shun great investments at cheap prices at market bottoms. It is not coincidence that corporate bond yield spreads are the highest when defaults are the highest!

Repetitive Writing!

Over 20 years of writing about the repetitive markets makes it hard not to be repetitive. As we once again stared at a blank Word document page, bereft of inspiration, we took a look at our newsletter archives. Interestingly, we found what we were now thinking was very much what we said in our 2nd Quarter 2004 Market Observer, the oldest one in our archives. We have added emphasis to note the similarities to our current market view:

“Tightening monetary policy means there will be less investment capital for riskier investments as investors can obtain better income from Treasury Bills and bonds. The optimistic and the consensus financial market view seems to presently believe that “measured” Fed interest rate increases will result in what was called a “soft landing” in the 1990s. We are not so sanguine. It is the lack of oxygen that causes death by asphyxiation. Whether one is strangled slowly or quickly is a moot point if the outcome is the same…

… The extraordinarily easy monetary policy of the last four years has made borrowing very attractive with interest rates at generational lows. Given prospective inflation in the 2-3% range, a “normal” interest rate environment should have short-term interest rates in the 4- 5% area and long rates towards 7%. This represents a substantial increase from the current levels. Borrowers will see their interest payments climb, especially those who have stayed floating rate to benefit from the steep yield curve…

… The major effect of rising interest rates will be felt in asset prices. Profuse lending has caused large asset price increases in everything from residential houses to the stock market. Less money will mean less willingness to lend and less cash-flow available to service rising debt payments. Call us “quantity monetarists” or simply old-fashioned, less money is not good news for lofty asset prices.”

Canso Market Observer, 2nd Quarter 2004

Interest Rates Are Increasing

Our thinking now is not much different today. We are telling people that interest rates and bond yields are going up. We have made the point repeatedly that there is presently no reason to have negative real interest rates when the U.S. economy is in good shape.

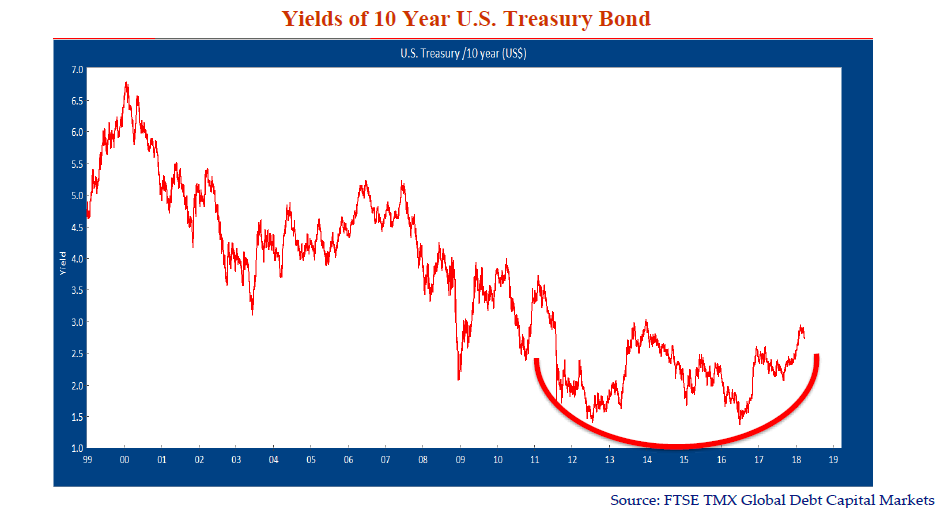

The chart above shows the yield on the 10-Year U.S. Treasury Bond. Note that yields are bottoming and have increased from the low of the summer of 2016. We’re back to the levels of 2011 before the central banks started their bond buying frenzy.

Debt Partying

The Federal Reserve complained after the Credit Crisis that monetary stimulus needed to be combined with fiscal policy stimulation by government deficit spending. President Obama proposed fiscal stimulus but, under pressure from the Tea Party activists, the Republicans who controlled Congress rejected higher spending. Things have sure changed!!

Fiscal policy in the U.S. is now very loose. The Republicans who control the Presidency, the House and the Senate in Washington have shamelessly embraced deficit spending with an abandon that makes Justin Trudeau’s Liberals in Ottawa seem prudent! As we have said in the past, the “Cut Tax and Spend” Republicans are locked into lower tax revenues and higher military spending and ignore the deficits their ideologically rose-coloured glasses can’t see.

BIGGLY Deficits

This time around, things are even worse. The Republicans have been forced to rely on Democratic votes in the Senate since their own dogmatic Tea Party members won’t vote for any budget increase. The “Dems”, as Trump calls them, demanded a commensurate increase in non-military spending as a price for their support. The spending floodgates have now opened with deficit spending far into the future. It is a good thing that President Trump “loves debt”, as he said during his chequered business career. He is now presiding over one of the largest deficit increases in U.S. history. President Trump is given to self-superlatives but we doubt he will be bragging about his “BIGGLY Deficits” on Twitter. As the New York Times reported with our emphasis:

“The national debt, which has topped $21 trillion, is expected to soar to more than $33 trillion in 2028. By then, debt held by the public will almost match the size of the nation’s economy, reaching 96 percent of gross domestic product, a higher level than any point since just after World War II and well past the level that economists say could court a crisis.

The new C.B.O. projection is the first since President Trump signed a tax cut that is expected to cost the government nearly $1.9 trillion over 11 years, then signed legislation to significantly boost military and domestic spending over the next two years. The figures are sobering, even in a political climate where deficit concerns appear to be receding.” “Federal Budget Deficit Projected to Top $1 Trillion in 2020”; Thomas Kaplan, New York Times, April 9, 2018

Wisdom Deficit

It is not conventional economic wisdom to be running these huge deficits when the economy is doing well. As the Wall Street Journal commented: “It is unusual for the federal budget deficit to significantly expand outside of wars or recessions.” It is also not common for monetary policy to be so accommodative with a strong economy. This means we now have considerable fiscal and monetary policy stimulus in the U.S. at a time when the economy is nearing full capacity.

Central bankers are tasked with supplying the right amount of money to support the economy but unfortunately they are humans and prefer to “err on the side of caution”. This creates a cyclical tendency to keep policy loose and interest rates low for too long. This distorts the financial system by making capital too cheap. There are huge incentives to borrow and assume debt for borrowers. Investors are inevitably lured into increasingly risky investments in their quest for income. The reckless borrowing inflates asset values further. The higher asset values support even more debt that is unsustainable at higher interest rates. When interest rates rise, financial market havoc results as asset values plunge.

Unmeasured Markets

Things did not end well after our 2004 Market Observer. The “measured” interest rate increases by the U.S. Federal Reserve were supposed to broadcast the Federal Reserve’s intentions to the markets. These higher rates would then be incorporated into what academic economists call “market forecasts”. Clearly this did not happen and when interest rates went high enough, the financial markets imploded with the Credit Crisis of 2008 that spilled over into the actual economy as the Great Recession.

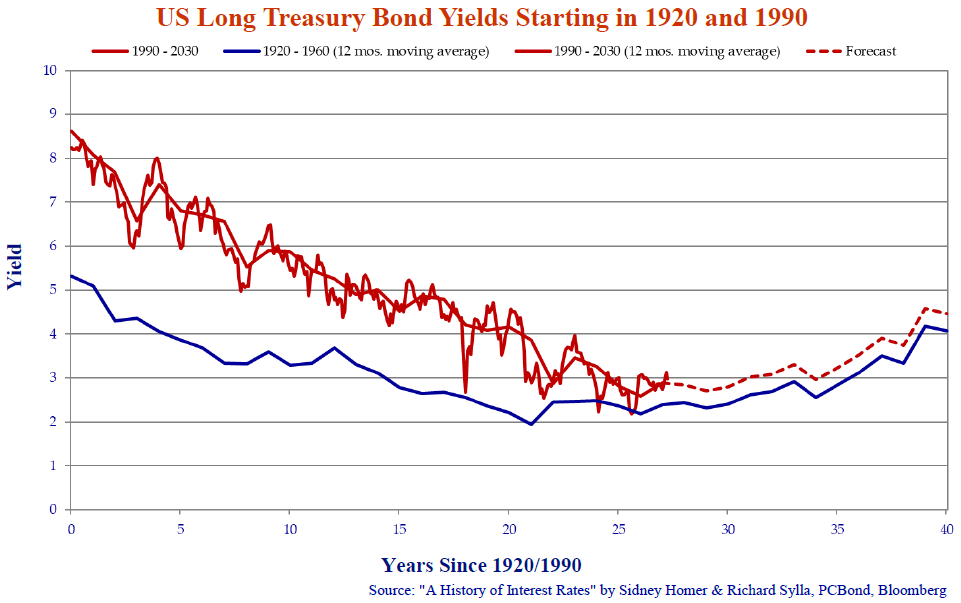

The Credit Crisis and Great Recession terrified the world’s central banks. They then responded by taking interest rates to generational lows and employed “quantitative easing” by buying up bonds to further lower yields. Bond yields are rising from their lows but we also think they will inevitably rise as the lack of fiscal and monetary discipline moves real yields higher. As you might know, we also think that we are in the rising phase of a long-term interest rate cycle. From the chart below, you can see that the yield path from 1990 is still paralleling the 1920 to 1960 experience.

The ultra-loose monetary policy cheapened capital to the point that people are now again wasting it, throwing it into not just ill advised but incredibly stupid investments.

Smashed to Bits

We were amazed by the Bitcoin mania last year, which we featured in our last Market Observer in January. We had been watching in stupefaction as the hordes of Bitcoin lemmings inexorably marched themselves over the capital destruction cliff. Our opinion was that Bitcoin was one of the largest financial bubbles in human history. We knew the Bitcoin peak was near when approached at a party by an individual investor from a small Northern BC town. She asked what we thought of Bitcoin. When we told her it was a great way to lose all your money, she snapped back: “that’s what they said about Facebook”! We explained that Facebook was a real business with real prospects and revenues but she was not in the mood to listen. She was mesmerized by the media attention to the climb of Bitcoin from $966 USD at the start of 2017 to a price nearing $20,000 and she wanted in.

Hopefully, she did not get sucked into the Bitcoin frenzy. The party was on December 17th, right around the $20,000 peak for Bitcoin. The chart below shows that Bitcoin has since plunged in price, currently quoted at $6,679, down 67% from its peak and our conversation with this wannabe Crypto-Billionaire.

Real Bubbles Popping

As we said, people waste their capital on foolish and ill-advised speculative investments when money and capital is too cheap. Canada is no exception to this rule. It seems like the speculative bubble in Canadian residential real estate is finally popping. Higher interest rates are biting as homeowners and speculators are rolling over their mortgages at higher mortgage rates for the first time in many years. The “look the other way” Canadian regulators are now being forced to confront Canada’s rampant mortgage fraud after considerable media coverage. They are cracking down on fraudulent income documentation and actually implementing mortgage-lending standards.

Cleaning Up the Money Laundry

Regulators, despite their best efforts to look the other way, are also cracking down on residential real estate money laundering by “international buyers”, albeit only after significant press coverage. As a small investment firm with 50 employees, we have had to invest a lot of time and effort in Anti-Money Laundering (AML) compliance. We were stunned when FinTrac, the Federal agency charged with enforcing AML gave the residential real estate industry a pass when they discovered there was absolutely no compliance with legislation. It seems these poor little “small businesses” with thousands of employees did not understand they were supposed to comply! Things have now changed on the ground. Someone we know just made a real estate purchase and had to fill in a FinTrac form for their real estate agent on the sources of their money. It sounds like real estate brokerages and condo developers are finally taking AML compliance seriously.

The income tax auditors from CRA have even joined the real estate crackdown party. After turning a blind eye for many years to Canadians and foreign investors alike misusing the primary residence capital gains exemption, sellers now have to report their housing sales. Tax auditors are even looking through real estate transaction records to see if the sales have been reported. We have also heard from real estate industry sources that CRA is contacting small time contractors to tell them that they will have to pay capital gains tax on sale since their projects are not owner occupied.

No Value Preservation

All this is chilling the Canadian real estate market. Sales are dropping and prices are falling except in the downtown neighbourhoods favoured by the banking and financial class. Even these will eventually feel the pain as declining mortgage volume impacts bank profits and employee compensation.

Out in the suburbs, things aren’t as rosy. The Toronto Star recently reported on a group of home-buyers in the Mattamy Preserve subdivision in Oakville. They bought in the hot markets of early last year and are having trouble with mortgage financing’s and cannot sell their existing houses at the prices they thought they could. According to the buyers, their problems are not due to their own lack of caution, they result from factors beyond their control. They are blaming everyone but themselves:

“A group of Oakville home-buyers, struggling to finance the pre-construction houses they bought in February 2017 at the height of last year’s real estate frenzy, are blaming “reckless” provincial housing policy and new mortgage rules for putting them on the brink of financial ruin…

… Declining real estate sales in the Toronto region have meant the buyers have not been able to sell their existing homes for the amounts they anticipated when they contracted to buy new houses in Mattamy’s Preserve development near Dundas St. W. and Fourth Line. After they failed to sell when the market plunged or they took lower-than-expected prices, they say they couldn’t get larger loans to cover the difference… The buyers want the government, the banks and builders to come together to find a solution for buyers in their “impossible” position. “They bought their prebuilt homes at the market’s peak. Now they face financial ruin”; Toronto Star, April 4, 2018 By Tess Kalinowski, Real Estate Reporter

No Sympathetic Reaction

We have been saying since 2013 that the Canadian real estate mania would not end well. The plunge in interest and mortgage rates after the Credit Crisis has only made things worse as people piled on cheap debt. As the Toronto Star reported the next day, the government and Ontario Housing Minister Peter Milczyn had little sympathy for the Mattamy home-buyers looking for someone to bail them out:

“On Thursday, politicians and builders said that the buyers should have known they were at risk when they signed contracts with a builder… “The government is not here as a backstop for real estate transactions gone bad,” said Milczyn.”

One would have expected the liberal and left leaning Toronto Star to rail against “the system” and have a bit of sympathy. We were then amazed to read the first paragraph of the Star opinion column on the overextended Mattamy home-buyers by Heather Mallick. It was worthy of a Canso Market Observer. We have discussed the research of Professor John Coates, the author of The Hour Between Dog and Wolf, on the human biochemistry of investment boom and bust on these pages. Mallick channeled Coates with her allusion to the highs and lows of drug addiction:

“The Toronto housing bubble resembles a drug epidemic in that it’s dangerous, addictive and will destroy your health, bank account and family. The pills dangle before your eyes. Yes you get a wonderful floating high when you score a big profit based on nothing but the passing of time and well-timed flip. But sooner or later you’ll encounter a sudden drop in the market and it will do you in.”

Mallick’s intuitive observation of the very human physiology and psychology of investment ties into the simple and ongoing theme of our latest Market Observer Newsletters. Their human behavioural tendencies have been repeated throughout financial history’s boom and busts. Toronto’s frenzied residential housing market participants cannot stop themselves from financial self-destruction.

Real Capital Destruction

Our fears of the downside of the Canadian housing market are starting to be borne out. The Toronto Star reported on a recent court case where a bidding war frenzy ended badly:

“In a case a judge called a warning to prospective buyers in the GTA’s erratic housing market, a couple caught up in a bidding war will have to pay $470,000 after reneging on a multimillion-dollar deal to buy a Stouffville-area house…

… “When the residential real estate market is a rising market, most people — perhaps with the exception of first-time buyers, are happy homeowners and investors,” Ontario Superior Court Justice Mark Edwards said in the decision.

“When the market turns and drops, it is not for the faint of heart. The facts of this case tragically demonstrate how one family, presumably desperate for their dream home, became embroiled in a bidding war and overextended their ability to finance the purchase price of that dream home.”

Couple ordered to pay $470,000 after reneging on Stouffville home deal; Toronto Star, Julien Gignac Staff Reporter, April 15, 2018

Clamouring for Risk

Superabundant money makes for very poor investment decisions by amateurs and professional investors alike. When Canadian bond yields bottomed at less than 1%, we were amazed that “market professionals” considered that this was the “new normal” and were encouraging the investment masses to lock in yields at levels far lower than inflation. Like the amateur real estate speculators in the red hot Toronto housing market, professional investors were also clamouring for very risky investments, forced into them by low interest rates, the fear of not “being invested” or the fear of being left behind.

Herd on the Street

At times like this, discipline and patience are necessary for successful investing. Watching from the sidelines as people throw themselves into very risky and speculative investments that are sharply increasing in price is not easy, given the normal human instinct to belong and not be “left out”. The herd stampedes in and out of the markets but we seek to be paid for the risks we assume in our portfolios. Right now, risks are rising and potential returns are falling.

We are finding better value in higher quality investments so our overall portfolios are increasing their quality as we take sales of some of our special situation positions. We await the better values that will appear when the herd stampedes out of the markets.