“Our unconscious minds recognize changing circumstances well before we consciously react… we have been telling you for some time that our investment instincts are on high alert. Like a rustle in the forest that signals danger, we see the signs in the current financial markets that suggest caution is warranted.“ Canso Market Observer, July 2014

Tired of lecturing you on financial excess and investment stupidity, we spent our last Market Observer discussing the biology of trading. We also told you that things were so positive in the investment markets that investors were drunk on their own success, which we believed was potentially a very dangerous situation for investment portfolios. As John Coates suggests in the Hour Between Dog and Wolf, humans are much more cautious when there is obvious risk about.

Risk Makes a Comeback

A euphoric first half to 2014 saw investors throw caution to the wind as they continued to ride the tide of central bank liquidity to ever-higher market levels. Risk then made its comeback tour in the third quarter of 2014. After a “Full Speed Ahead, Damn the Torpedoes” summer, all the market indices were down in September. The Dow was only off -.2% but the NASDAQ and S&P were down -.8% and -1.4% respectively. The commodity heavy TSX was down -4.0% as oil and other commodities fell in price. Prices outside North America fared worse with the Global MCSI EAFE Index off -3.8% in US$ terms.

Bonds did not offer much of a safe haven, as the MLX Investment Grade index in the U.S. was down -1.1% and the Canadian FTSE/TMX Bond Universe fell -.5%. High yield swooned with the withdrawals from mutual funds and ETFs, with the MLX US HY down -2.5%.

It didn’t take much for people to get nervous. As we tell our young staff, when markets are bullish investors look for bullish evidence but when they are scared, everything seems negative. Investors now are starting to consciously and unconsciously move out of “risk assets” as the day of monetary policy reckoning and rising interest rates approaches.

The Big “Gross Out”

The big bond market event was the dramatic departure of Bill Gross, the celebrity bond manager, from PIMCO aka “the world’s biggest bond fund”. According to press reports, Mr. Gross quit before he was fired for his negative behaviour towards other staff members. It’s funny how that works. When everything is rosy on the performance and especially the compensation front, then a little bit of an abrasive personality is easily tolerated. When performance flags and compensation is threatened, then the knives come out.

Mr. Gross was a founder of PIMCO and had a tremendous long-term track record, besides being easily one of the most recognizable investment personalities in the financial and popular media. In better days, his antics towards colleagues were known as “friendly fire”. Sadly, he left on other than good terms for a new position running a much smaller bond fund at Janus capital.

What really surprised us about the “Gross Out” incident was the damage it caused to the corporate bond market. Spreads widened after Gross’ departure from PIMCO, right in time for quarter end, as people speculated on what the management change meant for some of the huge positions that PIMCO holds.

This is not unique to this incident. When investors turn negative, they start to reduce risk by selling things that were attractive when they were biologically impaired and seeking risk. No, the financial media is not yet full of negative news but the “smart money” senses some thing is different. The lower quality sectors of the credit market now seem to be entering the “Fear Phase” of the credit cycle. The wall of money that rushed into bank loan and high yield mutual funds and ETFs has now reversed into withdrawals. The leveraged loan and high yield reports show a foreboding and steady drumbeat of withdrawals compared to the jubilation of huge inflows not so long ago.

Breathless on the Way Up

The tone of the LCD newsletter is instructive. LCD started out as a small digital news site that covered the Leveraged Bank Loan market and extended into High Yield and now Investment Grade bonds. After it gained a following, it sold to S&P, which is a large financial information service of which credit ratings are only a part. S&P is owned by McGraw Hill, the publisher. Note that the S&P credit ratings service came in for a lot of criticism and was investigated by the SEC and Congress for its inaccurate ratings of structured debt in the Credit Crisis.

LCD rather breathlessly reported on the huge inflows into Bank Loan and High Yield mutual funds and ETFs over the last few years. As our readers know, these flows have exceeded those before the Credit Crisis, as we have reported in past newsletters. The problem is that the good fortunes of the proprietors of LCD, who sold out to S&P, as well as the bankers and underwriters creating low quality credit, were created by very misleading sales pitches to retail investors.

Rebellion of Retail

The pitch for bank loans to retail was that they were very low risk assets, “senior secured”, and floating rate protection against rising interest rates. In the last cycle, it was CDOs and CLOs marketed to institutional investors hungry for yield that bought dodgy credit in their hast e to “get invested”. This time it has been retail investors stepping up to the risk trough until recently. They now seem to be recognizing that the meagre return of their loan investments is not really worth the trouble since it is barely positive.

The S&P Levered Loan Index is 2.1% year-to-date to September 30th in US$ terms, faring poorly compared to 6.7% for the MLX Investment Grade Bond Index. The generous call provisions on bank loans do a lot of damage to investor returns. A bank loan is usually issued at a discount but the hot market meant most funds had to buy in the secondary market at $102 or higher, while the index “buys” on issue. Since most bank lo ans are callable at $101 for the first 6-12 months and then at par thereafter, a bank loan fund that buys a loan in the secondary market at $101 or $102 which is then called, would be subject to a capital loss that might not be offset by coupon for the outstanding period (3 months interest at 4% is 1%). Deduct the fund management fee and the flat return would be negative.

What is rather shocking to us is that CLOs catering to institutions are now replacing disappointed retail investors as the not too discerning demand for bank loans. It seems the late credit cycle “stretch for yield” has not been dampened at all by the horrible experience of CLO investors during the Credit Crunch. Yes, the current CLO crop does not have “market triggers” which would cause them to sell down collateral, but our rather jaded opinion is that the selling pressure from retail fund withdrawals and the plunging prices of the lousy levered loans themselves will once again make for huge CLO losses.

A Credit Crisis “Tell All”

We read a couple of books this summer that turned out to be helpful to our market view. The first was Stress Test by Tim Geithner, the former Governor of the New York Federal Reserve and later the Treasury Secretary for the Obama Administration. His hero worship of Robert Rubin and Larry Summers is surprising but if you can get past the gushing, the book is well worth reading. It is a “tell all” account of Geithner’s role in fighting the Credit Crisis. As the New York Fed Governor, he was central to many of the financial institution rescues and Fed decision-making in the Credit Crisis. As Treasury Secretary, he continued in his financial crisis-fighting role. Anyone who believes that “the authorities” had any idea of what was going on should read this book. They were utterly and hopelessly unaware of the immense speculation in the financial markets before the crisis. They then flailed wildly in their responses during the Credit Crisis.

Nobody in Charge

While it is comforting to think that so meone somewhere is actually in charge, we were disabused of this notion very early in our working life. A study of military history and service as a young officer is a very effective education in human frailty. If the very well organized, well trained and disciplined military can make huge and costly mistakes with their limited objectives, it is quite apparent that a bunch of economists, bureaucrats and politicians trying to decide monetary policy for a very complex economy don’t have much of a chance to get things right.

While Geithner and the U.S. financial elite were successful in their rescue of the global financial system in the aftermath of the Credit Crisis, it was their policy failures that caused the problems in the first place. The regulatory vogue to deregulate the financial system was, in our opinion, the very cause of the Credit Crisis. Geithner glosses over the role of his mentors, Rubin and Summers, in repealing Glass Steagall, our grandparents’ regulatory response to the 1929 Wall Street Crash which had separated commercial and investment banking. Geithner, by his own admission, and the Greenspan Fed also encouraged the mania in securitization and derivatives as an improvement that would make financial markets more efficient and credit more available.

Mortals Shouldn’t Interfere with the Financial Gods

Geithner rails against what he calls the “Old Testament” moralists and others who thought rescuing the very institutions and people who caused the crisis was a “moral hazard”. He admits to at times lacking empathy and he can’t seem to understand the fuss over rescuing rich bankers. It seems from his point of view that if a lot of greedy and grasping maniacs profited from government largesse after blowing up the financial system, it was subsumed by the “greater good”. Sitting up in his financial Mount Olympus, he truly believed that the mortals shouldn’t interfere with the work of the Gods. Those who wanted caps on compensation didn’t understand that this was incidental to doing his divine work.

What was very surprising to us was how little Geithner and other senior financial bureaucrats at the Fed and the Treasury really understood about the credit markets. Where we were pointing out the “Securitization Mania” in 2004 in this very newsletter, the problems in the structured credit markets came as a complete surprise to senior U.S. policy makers in 2008. “Mania” now seems to be one of Geithner’s favourite words. It is fascinating to us that Geithner now subscribes to the idea of a credit cycle, which has been a “founding principle” of Canso since 1997.

From our vantage point, the fact that those “in charge” don’t seem to have a clear picture of the financial markets and economy validates our “bottom up” investment philosophy. It is very hard to time markets, especially with central bankers seeming to change their policy guidance and targets on almost a daily basis. The track record of the Federal Reserve and other central banks in economic forecasting is poor. As Geithner recounts, the “Great Recession” was already well underway before Economics Professor Ben Bernanke and the Fed Open Market Committee recognized it.

Piketty on the Markets

The other book that we read this summer was the prodigious, at nearly 700 pages, Capital in the Twenty First Century by Thomas Piketty, a French economist. Piketty’s book is very controversial, as he concludes that capital is being more and more concentrated in Western democracies due to the slow rate of economic growth and the high return on invested capital. Ideologues on both the right and the left are either panning or praising the book. Piketty’s solution to the unhealthy concentration of “patrimonial wealth” is a tax on capital. This is very much against the current economic orthodoxy that holds that taxing capital impedes investment and therefore economic growth.

What we found truly interesting were Piketty’s findings on rates of return on capital. He used historical records in a number of Western economies to calculate returns on capital. Both France and Britain have extensive tax records on income and wealth that he used to examine what the actual historical return was on invested capital, both for real and financial assets.

The Magic 5% Real Objective

The most widely cited and used investment rates of return are those that date back to the early 20 th century, for example Ibbotson and Sinquefeld’s Stocks, Bonds, Bills and Inflation on historical financial market rates of return. The late Sydney Homer’s A History of Interest Rates takes a longer historical look at interest rates but does not include other investable assets. Piketty’s research concludes that a 5% real rate of return is what has been achieved on both financial and real assets. He even turns to literature for validation, using the novels of Balzac and Jane Austen to show what income a rich lifestyle would require. Whether it was the payment for land rent by peasant farmers to rich nobles or government bonds held by the “rentier class”, he finds his magic 5% rate of return is what is necessary to persuade even the wealthy to invest their capital.

A Fertile Debate

His conclusions about the rate of economic growth are very interesting and germane to the current debate about the future level of economic growth. Piketty suggests that the 3% real rate of economic growth recorded in the boom years of the 20 th century breaks down into 1% of growth from productivity and innovation and 2% from demographic or population growth. Clearly, with fertility rates falling below replacement in most Western societies, the prospects are not good for real growth.

Even the BRICs will suffer in Piketty’s future since he points out that the high growth rates of developing nations results from a “catch up” in technology. Once a developing nation achieves technological parity with the developed nations, he demonstrates that growth inevitably slows considerably.

This does not augur well for China, as its terrible demographics due to the “one child” policy combine with its maturing technological “great leap forward” to suggest its now slowing growth will get mu ch worse. This could be quite a surprise to investors that expect China to continue to grow at very high rates. Fellow BRICs Russia and Brazil have very poor demographics as well, which will be a challenge once they complete their move to technological parity.

The implications for India are good, as it has a very young population and desperately needs to build out its infrastructure and services, as its new Prime Minister, Mr. Modi, is promising. While India is very sophisticated and wealthy in its upper classes, the vast majority of its rural and undereducated population has a long way to go to “catch up”.

Low and Slow

It is worth considering Piketty’s implication for the mature and developed Western economies. If 3% real growth in the 20 th century was 2% population growth and 1% “other” due to technological improvement, what should we expect in the 21 st century? The U.S. and Canada have immigration flows that benefit population growth, but as we have pointed out in the past, if the immigrants themselves have only one or two children, then population growth will inevitably slow.

If an economy sees flat or negative population growth, then GDP growth will certainly slow. For example, if population growth is zero then real GDP growth will be 1%. If population growth in an economy were to go negative, which is very possible in China, things are not good from a GDP point of view. A population decline of 1% means that real GDP growth will be zero.

A “Little Inflation” Helps the Wealthy

You might believe that Piketty has forgotten about the “advantages” of inflation for a politician or policy maker. The current vogue in monetary policy and political circles is that “a little inflation is not a bad thing” to get the economy going. Piketty comments that inflation only results in shifts of wealth. This is really his concern about wealth distribution. As he points out, the wealthy do much better than the overall population in periods of inflation since they are better at investing their money.

His major conclusion is that if the economy is barely growing in real terms, any real return above this to the owners of capital will mean their wealth grows compared to others. At the limit, this means that one wealthy family could own everything in a country or society. Piketty believes that the 20 th century was an aberration, where the dislocation and inflation from revolution and global war eviscerated the wealth of many families in the Western world.

It is certainly true that traditional feudal and agrarian societies saw concentration of wealth. Those who owned land rented it out and lived on their tenant farmers’ payment of land rent. Piketty believes that the capitalist triumph of the United States was driven largely by immigration and the expansion westward. A gentleman farmer renting out lands in Ohio saw his tenant farmers move westward to get their own lands. Massive immigration meant massive demand and huge opportunity in new markets for those with established skills.

Crimes Against Modern Portfolio Humanity

You might have noted above that in our discussion of inflation we said that Piketty believed that the wealthy were better at investing their money. “Mon Dieu” you exclaim in your best French! Challenging the capitalist system is one thing, but rejecting the thoroughly modern investment belief that it is impossible to outperform by active management is beyond the pale, even for a perfidious Frenchman! Such a notion would shake the very foundations of modern finance, not to mention the hugely profit able passive management industry. Before you march Monsieur Piketty in front of the intellectual guillotine for crimes against Modern Portfolio Humanity, at least give him a hearing.

A key part of Piketty’s thesis is that real rates of return on capital will exceed real economic growth leading to an ever-increasing concentration of wealth. Piketty also believes that this will be exacerbated by what an investment consultant would call the “Investment Alpha” of rich people. For an investment professional, this is even more heretical than his belief that capitalism might collapse onto itself.

We, as our readers know, have never believed in efficient markets or the financial academic consensus that nobody can beat the market indices on a sustained basis. We have the distinct advantage over the finance professorial community of actually working in the inefficient and real financial markets on a daily basis. There have been a lot of careers built on the rather trite statement that “the average investment manager is average”. As we have argued in the past, how much credence would be given to a sports expert who argued that the average hockey or baseball player is average? Portfolio management is a human skill set. It makes sense that some people are better at it than others, like pitching a baseball or shooting a puck.

Piketty on Portfolio Management Skill

Piketty’s work puts paid to a lot of the data mined bunkum that passes for “financial research”. If investment returns were truly random and nobody could outperform the markets, why would wealth become more concentrated over time as Piketty demonstrates? If a wealthy family hired what they thought was a skilful portfolio manager, from an efficient markets point of view, they would perform the same as everyone else.

That really intrigued us was Piketty’s look at portfolio management skill. Using the annual lists by Barron’s of the world’s richest people, he looked at private fortunes over time. Barron’s uses disclosed investments under securities law and other methods to assess the fortunes of the wealthy for their rankings. Using this, Piketty was able to determine the implied rates of return.

For example, the Bill Gates family sold down some of its Microsoft stake over time and Piketty was able to attribute returns to the continuing Microsoft holding and their diversified investment portfolio. Piketty found that the larger fortunes did better than the smaller fortunes. He also took a look at U.S. university endowment funds, which have published extensive data for some time. Again he found that the larger funds outperformed. This goes against the modern portfolio orthodoxy that size should be detrimental to investment performance, since larger funds “become the market”.

We are very grateful to Monsieur Piketty to have provided some validation to our rather lonely assertion that portfolio management skill exists and that it is possible to add value by active management. So you ask, all this discussion of books is very interesting but what about the immediate future?

Wither the Markets?

Whither the markets? Well, Tim Geithner’s account of his activities during the Credit Crisis confirms to us that nobody is “in charge” and policy makers tend to be reactive rather than proactive. Th ere is a good reason that policy makers do not try to “pop the bubble” of a speculative boom. They are very much consensus thinkers by training and experience and it is highly unlikely that they could even identify a bubble in any even t, as Alan Greenspan has admitted. The sheer terror of the financial authorities during the Credit Crisis, as described by Tim Geithner, would suggest to us that Fed Chair Janet Yellen will have to be dragged kicking and screaming into raising short term interest rates, for fear of instigating another financial and economic crisis.

Dangerous Duration

Our view continues to be that policy makers would rather risk higher levels of inflation than cause another recession by an early tightening of monetary policy. The problem is that the bond market will react to actual inflation or even tightened monetary policy quite violently, based on the increased sensitivity of bonds to changes in yield. The sensitivity of bond prices to change in yields is measured by the “duration”, which takes into account the present value of bond cash flows on a weighted basis. Bonds change in percentage terms by their duration for each 1% change in yields, i.e. a bond with the current universe duration of 7 years changes 7% in price for each 1% change in its yield.

Mathematically, duration gets longer and bonds more sensitive given a lower yield to maturity and lower coupon. All outstanding bonds now have a very long duration on a historical basis due to the drop in bond market yields and new issues have very low coupons. This puts the durations of the current crop of new issue 30-year Canada bonds at 18 to 20 compared to 8 to 10 years in the 1990s.

It is notable that moving from T-Bills without capital risk and a yield of .8% to a Bond Universe Index yield of 2.2% only increases yield by 1.4% but increases the capital risk by 7 times. We think the bond market is a very risky place to be at present, with the additional yield for extending terms very little compensation for the increased capital risk. The set up for a bond market rout is exquisite, with bond managers having been faked out several times since 2009.

Avoiding Bond Euthanasia

As value investors, we don’t need to predict interest rates. We only need to look at whether we are compensated for the risk assumed. Extending term to increase portfolio yield is a very seductive thing. Bond mutual fund portfolio managers are under pressure from their sales force to explain how their fund can do well when its yield is not much more than the management fee. A less experienced portfolio manager would find it very popular to increase fund yield by term extension.

We know that the consensus seeks to explain current market levels very persuasively. One such explanation is the “New Normal” which suggests growth and inflation will be much lower than expected and therefore yields will stay low. We don’t disagree with lower levels of growth but would argue that it doesn’t necessarily follow that bond yields should be low. Clearly, with monetary policy targeting “at least” 2% inflation, having bond yields at 2% doesn’t scream value.

The good Monsieur Piketty’s research suggests that a long term real return of 5% on capital is reasonable. We have point ed out in previous newsletters that bond yields in the Great Depression were in the 2% range and inflation was minus 3% for a 5% real return. Will deflation return as in the 1930s? We don’t think so and certainly it hasn’t in the aftermath of the Credit Crisis where it has run in the 2% range.

We think the monetary authorities will succeed in their quest to achieve their 2% inflation target, since it is well within their powers to succeed. Even a 0% inflation rate would only mean a 2% re turn on the average bond which is very low by historical standards. The life of the “rentier”, the bondholders of the 19 th century, was pretty comfortable with yields at 4% and non-existent inflation for a 4% real return. Higher inflation in the 20 th century pretty well removed all bondholder wealth.

Inflation over the market’s rather low current estimate would result in what Piketty called the “euthanasia of the rentier class”. We wish to avoid “euthanizing” our client portfolios and thus are positioning our portfolios to be short of our duration targets. In our view, U.S. and Canadian government long-term bonds have a credit rating of AAA but have a CCC capital risk profile. That being said, we are first and foremost a credit manager and prefer to generate extra yield by assuming credit risk rather than interest rate risk. One assumes a tremendous amount of capital risk to increase yield in government bonds. If we have to assume a risk to increase our portfolio yield by 1%, we would much rather buy a corporate bond than a long-term Canada.

Concentrating on Stocks

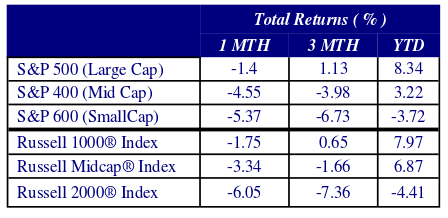

What about stocks? The stock markets are bouncing around and flattening out, with investors concentrating on fewer and fewer stocks. The stocks of larger companies are outperforming the stocks of smaller companies, as can be seen in the following table.

Small Capitalization stocks in the S&P 600 and Russell 2000 fell 7% in the quarter versus a slightly positive return for the large capitalization indices. This is fairly normal for a financial market cycle, as widening bid/ask spreads on less liquid assets lead to lower mid prices.

Geithner on Canadian Housing

What of Canada? Our Canso Px on the Canadian housing market caused quite a stir last year. Since then, Canadian house prices have only increased and negative sentiment on residential real estate is hard to find. Clients and others have asked us whether we’ve changed our view. As we said at the time, it is very hard to “time the markets” and manias take a very long time to play out. Since we wrote our report, Canadian homes have become even more expensive as a multiple of income and Canadian consumer debt is even higher so we still believe that Canada is in a residential real estate mania of epic proportions. Anecdotally, we are seeing increasing signs of speculation. We ran across one young man with 3 Condos and a house that he is renting out. He was seriously considering borrowing more money against the price appreciation in his portfolio and buying another 8 Condos!

On the other hand, as economists say, Canadian regulators and policy makers now seem to be lulled into sub-mission. The late Jim Flaherty seemed to understand how overextended Main Street had become when he was Finance Minister. His replacement, Joe Oliver, seems to be hoping everything will work out. There are a lot of Canadians betting on a real estate “soft landing” and we hope they are right. The problem is that the fundamentals always win in the end. We do not know of an y credit-fuelled mania that has ended well. Canadians, including housing experts and regulators, want to believe, which is not exceptional. In Stress Test , Tim Geithner refers to a study by economist Wie Xiong of Princeton University that analyzed the personal transactions of people involved in mortgage securitization during the housing boom in the U.S.

“They got caught up in the frenzy like everybody else, buying bigger homes for themselves and speculating in the real estate market even as prices defied gravity. Throughout the financial system, “insiders” were putting their own money where their mouths were; many of them ultimately lost a lot of money doing so.”

That sounds a lot like Canada at present. We thought we would end with a quote from Mr. Geithner that Canadian policy makers might heed (our emphasis):

“It (the U.S. housing crisis) started with a long mania of overconfidence, the widespread belief that house prices would not fall, that recessions would be mild, that markets would be liquid. The mania fuelled too much borrowing, too much leverage…

Borrowers took too many risks; creditors and investors were way too willing to finance those risks; the government failed to rein in those risks; and then was unable to act quickly or forcefully enough when the panic hit.”

We think the “rustle in the forest” is growing louder. The easy money has been made for this cycle and caution is warranted.