Perceptions Were Everything!

The first quarter of 2016 saw some of the most manic trading in our combined market experiences. We believe that this was a “perceptional market”, one driven by investor perceptions, what John Maynard Keynes called “Animal Spirits”, rather than economic and financial reality. It didn’t take much to set things off. One not particularly insightful comment from a FOMC member or an isolated economic statistic was enough to create a massive move up or down in stock prices, currencies, commodities or bond yields.

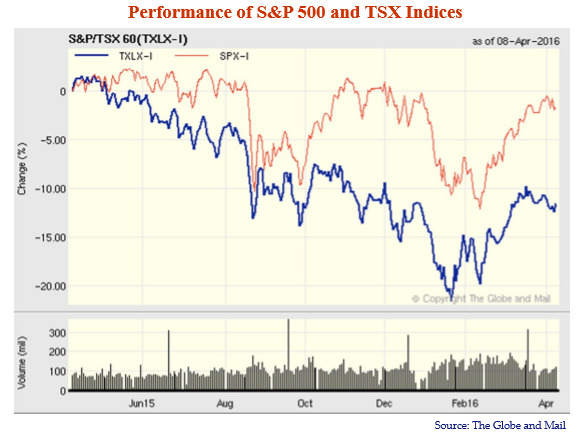

The chart above of the S&P 500 and the S&P/TSX 60 Indices shows quite clearly that the market weakness began in the summer of 2015. This coincided with the growing realization that the Fed might actually raise interest rates above zero, which it eventually grudgingly did in December. The commodity heavy TSX had weakened earlier and trended down for the rest of 2015. It then plunged in the manic market blues of January and February 2016. The S&P recovered somewhat at year-end 2015 but then collapsed into a full-blown sell off in 2016 until a bottom formed in mid-February. Then the financial market threw off its shackles of fear and began a strong run up until the end of March.

Risky Assets

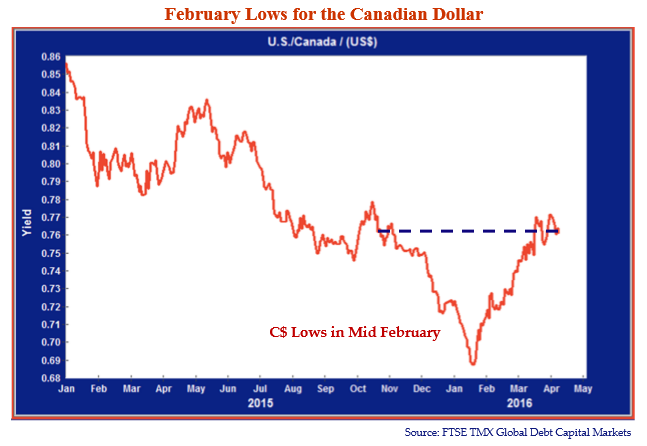

The Canadian dollar, which now seems to trade as a “risk asset”, also traced this manic path, as can be seen from the chart below. Note the steady decline from the summer of 2015, which turned into a rout in January and early February. By the end of March, it had once again regained its U.S. $.75-.77 levels of the fall of 2015.

Junk Bond Redemption

Many other risk assets saw their prices plunge in this “risk off” exodus and amazing price redemption. We were particularly struck by the market movements in junk bonds. As we reported in our January 2016 Market Observer, the decline in energy prices savaged the high yield market in 2015. This did not surprise us, as we had been warning our readers and clients on this for a couple of years. High yield is sold on the idea that its ample yield will cover a multitude of credit sins so it is “safer” than equities. The problem is that when everyone wants into a high yield mutual fund or ETF, there aren’t enough bonds to go around and underwriters create terrible issues to meet the demand. When the flows reverse, there are no buyers as everyone is suffering from redemptions. Prices then plunge which is exactly what happened this time around.

The Canadian FTSE High Yield Index recorded a -3.8% return in 2015 and the U.S. BAML High Yield Index was off -4.6%. Things got even worse in 2016. On February 12th, the U.S. High Yield Index was off a further -4.6% year-to-date and the Canadian was off a further -2.9%. The high yield market then reversed itself with a vengeance and rallied into March 31st. The U.S High Yield Index actually finished up +3.3%, rallying nearly 8% from its bottom and the Canadian High Yield Index was up .9%, rallying 4% from its bottom. How’s that for a “yield product!”

Spreading the Bid/Ask

We often talk about bid/ask spreads at Canso and believe that in aggregate, they lead to overall market movements. Most investors, however, are too well schooled in the completely impractical and useless “efficient market theory”. This postulates that all knowledge is equally shared among investors and immediately incorporated into market prices. They grasped for explanations of why the market for risky assets fell after the summer of 2015. Both sensible and ridiculous commentators offered opinions aplenty. In our modest opinion, uncertainty caused the bid to disappear. The good Professor Coates (Hour Between Dog and Wolf) attributes this to an increase in fear and the body chemical cortisol that makes traders indecisive and prone to non-action. This creates illiquidity as most traders hide beneath their desks rather than risk a mistake.

Some commentators, particularly those employed by large banks, blame the illiquidity on the financial reforms after the Credit Crisis which limit bank trading inventories. We find this explanation to be patently ridiculous. As we have said before, we have never met a trader who would willingly buy something that he or she expected to fall in price. What about hedging you ask? Well, hedging means selling something else short to protect the position you are buying. This then would make this hedge, which would be highly correlated to the original hedged security, fall in price. The correlated hedging security falling in price would lower the price of the original security as well. More likely, traders knowing their clients have to sell something would be shorting the heck out of it, causing the price to fall further.

Gap Fashion

In Canso terms, the indecision in the markets caused the bid to drop and prices to “gap” downwards until buyers were willing to buy. We were particularly struck by the inane commentary on some bond issues, like Bombardier, trading below their par value of $100. Commentators in the financial media were saying that this meant the company’s equity was worthless. Our take on many of these bond issues at low prices was simply that there were far more sellers than buyers and the prices dropped to significant discounts until buyers were attracted. Yes, there were some issues trading with actual default risk impounded in their prices, but many were simply battered down by waves of selling.

Experimental Central Bank Economics

In terms of the real economy, we think that the biggest commodity bubble of our lifetimes has burst and it will take some time to reduce the excess supply through capacity closures and/or increased demand. On the other hand, the U.S. economy seems to be doing reasonably well, which even Chair Janet Yellen of the Federal Reserve is now being forced to admit.

Life is not easy for a central banker these days. They are expected by the markets to be experimental economists. They view their role as playing around with real policies and affecting real economies as though it was a simulation back in their classroom teaching days. The problem is that they have no idea whatsoever what they are doing and they admit it! Now that “negative interest rates” are the policy vogue for central bankers, they are all musing about how to implement these policies even though they have no evidence at all that they are effective. Thank goodness that the U.S. economy is making much of this speculative theory irrelevant by just chugging along.

Grandma Yellen’s Interest Rate Time Out

The Federal Reserve and its Chair Janet Yellen is still doing its best to come up with creative reasons not to raise interest rates. “Procrastination is a Virtue” seems to be the motto of the Yellen Fed. Why raise interest rates to normal levels when you can find something, somewhere globally not to? The Fed seems to have moved from “data dependency”, where it sought to use data to guide its actions, to “market dependency” where it waits for a market tizzy to tell it what to do. If the market kids have a bad enough temper tantrum, Grandma Yellen gives them their demanded “interest rate time out”. The frenzied markets calm as traders lie down on their mats for their investment nap, and Grandma Yellen reads them fairy tales of magical negative interest rates where people have to pay you to use their money.

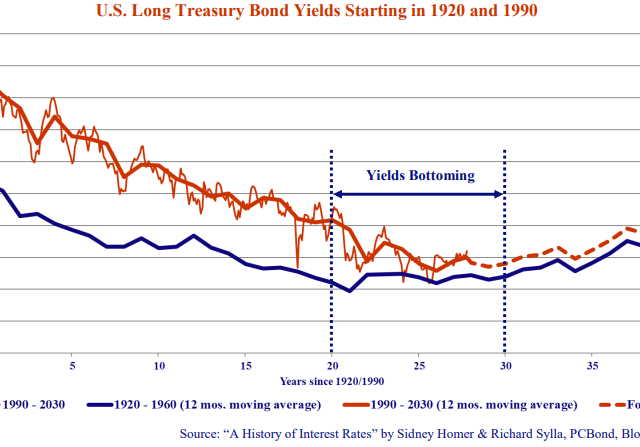

Whatever Grandma Yellen does with interest rates in the short term, we think the bond market is in a long bottoming phase for yields, short of a major increase in inflation. We refer you to our updated U.S. Long Treasury chart above that shows our 1990 to 2016 experience still tracking the 1920 to 1960 experience quite well.

Canada Goes Its Own Way

Canada is still in a financial world of its own, not in a good way, with very low yields during a global commodity bust. In February, the markets believed that the Bank of Canada would lower interest rates further and the Canadian dollar dropped precipitously as can be seen from the chart on page 2. When jokes starting being made about the “Canadian Peso” and fake Canadian banknotes appeared with Justin Trudeau in a Sombrero, the political calculus changed suddenly. As we pointed out, in our January Market Observer, it became quite a question of confidence for the Canadian dollar. Governor Poloz of the Bank of Canada then made it clear that there wouldn’t be further declines in Canadian short-term interest rates. The Canadian dollar rebounded a strong 12% from its low of $.687 US to the current $.769 in early April.

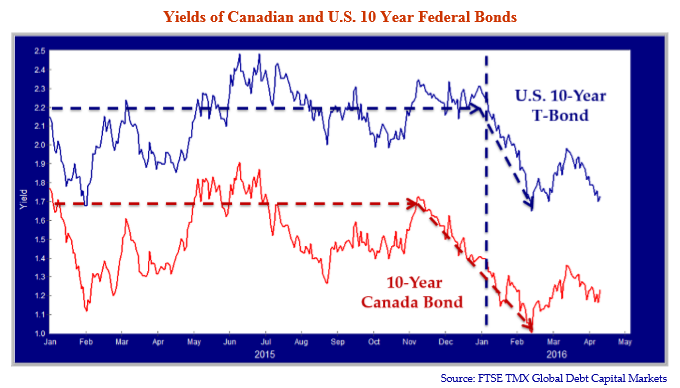

The chart above shows that 10-year Canada and U.S. Treasury Bond yields reached their lows in mid-February, corresponding to the lows in the stock market. Note that the 10-Year Canada yields hit 1.0019% at the close on February 11th, 2016. This compared to the U.S. 10-Year at 1.65% on the same day. We have remarked before on these pages that it is very unusual for Canada to have lower yields than the U.S., especially during a commodity bust. Note that while U.S. yields have risen a little since mid February, Canadian yields have increased more, narrowing the Canada/U.S. spread, which is one of the reasons why the Canadian dollar has appreciated substantially against the U.S. dollar.

Every Bond Investor is Part of the 1%

The 1% level on the 10-Year Canada was quite something for a bond manager to consider. We were also struck by the 1.1% yield at March 31st on the FTSE TMX Canada Index. For most of our career, a T-Bill yielded well more than 1%. We checked the historical record, as we foolishly do at times, and confirmed that since 1973, when it was created, the Canadian 90 Day T-Bill Index had never been below 1% until October 2008, during the Credit Crisis monetary easing.

The Federal Index constitutes a significant 36.3% of the FTSE Bond Universe Index. Even with provincial and municipal bonds adding their higher yield to the FTSE Government Index, its yield is still only 1.7%, historically a T-Bill type level. It takes the healthy (irony intended) 2.7% of the Corporate Index to move the overall Universe Index yield to 1.95%.

Yes, the overall Universe return for the first quarter of 2016 was 1.4% so bond managers and their clients were reasonably happy. They might think a little bit about how this return was generated. Given the Universe had a yield of 2.0% on December 31, 2015, the yield generated over 3 months was .5% and price appreciation accounted for .9% of the return. This won’t continue forever, as yields are already starting from a very low base. As the prospect for sharp drops in yields is lower than the prospect for a moderate increase, we think shorter term and floating rate bonds are attractive in the fixed income market.

Of Demographics and Demagogues

It seems to us that demographics in the Developed and the Developing World are slowing aggregate economic growth below the levels of the last millennium. The good Dr. Piketty (Capital in the Twenty-First Century) pointed out that much of the post war growth spurt resulted mostly from population growth. Modern lifestyle means fewer people, which makes for slower nominal and real GDP growth, as Japan is seeing in the extreme.

Revenue and profit growth will be slower as well. The post Credit Crisis plunge in interest rates doesn’t leave much room for further drops for the discount rate on cash flows. We expect that this means bonds and equities could be in for sideways markets, of course with lots of bumps and turbulence along the way.

Market timing the ups and downs could be a profitable strategy, but as we think even the policy makers don’t have a clue what is really going on or what they are doing, this makes timing a risky strategy. We think security selection is going to be the investment strategy of choice for the next few years, as choosing companies and securities prove to be a more consistent path to investment success than trying to exploit short term moves in a trendless market. Of course we are biased by our value discipline, which at times is a harsh master.

The good news is that despite the gloom and doom, things don’t look all that bad economically in the U.S. and are surprising to the upside in other parts of the world. Traders and strategists are pleading and begging for “soft” economic numbers so Grandma Yellen will continue her kind monetary ways. We are not sure when or why the Fed will raise interest rates, given their amazing prevarication on the subject.

The U.S. Presidential election looks to be the wild card. If Mr. Trump were to be elected and followed through on some of his more radical economic promises, we could be in for some pretty interesting international trade dynamics. It is hard at this point to guess at winners and losers from tearing up the “bad trade deals” but it promises mayhem in the markets.