The financial markets are a safer and more pleasant place for investors in the spring of 2014. Really!

If you are an investor in some of the insanely overvalued social media stocks like Facebook and King Digital Media, the recent IPO of the maker of the mobile game Candy Crush, you might beg to differ as some of these stocks have fallen 30% from their highs. Yes, bond and stock prices are still going up and down but financial cataclysm is off the table. Long gone are the financial crisis worries of 2011 and investors are basking in the warm afterglow of higher portfolio values. As predicted on these very pages, Europe did not disappear in a Euro debt meltdown and currency break up.

It’s All Greek to Us

Far from it! As we go to press in April 2014, Greece has just issued its first long term bond since its default in the spring of 2012. Just two years have passed since investors were handed steep losses in Greek debt. The second Greek bailout required private creditors to write down their bonds by 46.5% of face value in March 2012. At the time, there was intense speculation that Greeks would politically refuse this deal and exit the Euro currency zone in a “Grexit”.

How did some of these very same investors react to Greece’s return as a borrower? The Hellenic Republic issued €3 billion of 5 year bonds at 4.95% on April 7th, a yield spread of 4.3% compared to German government bonds of the same term. The demand was overwhelming with more than €20 billion of orders from 550 accounts. What a difference a couple of years and a “stretch for yield” can make!

Chumping at the BitCoin?

Paper money, the “fiat currency” so despised by gold bugs and bitcoin enthusiasts alike, did not completely lose all its value as central banks ran the presses to defend against financial crisis. The champions became chumps and were themselves skewered by their willing suspension of disbelief. Super heroes and super financial instruments only exist in fantasy. The financial protective qualities of bitcoins and gold became questionable as they defied the breathless expectations and melted down from their peak levels. Although gold had a resurgence in the last quarter, it clearly is not the “one way trade” that its fan club expected.

Party Like It’s Not 2011

What’s a poor consensus investor to do in a period of unexpected market joy? Join the party, of course! Envy is not just any old sin; it is a powerful market force and the financial fears of 2011 are long gone. When the press is full of hot market stories of easy money made, the tendency is to want to “Get Some”! Joe Consensus missed the rally and now he is now inevitably drawn to the media darling investments that excite. Social media stocks, speculative bank loans and junk bonds are the investments de jour. Why play it safe when there’s money to be made?

High and Excited

The New York Times discussed this phenomenon in an article that points out that value investors tend to win out over longer periods of time. Why is that people are attracted to risky stocks trading at insanely expensive levels?

“Growth gets so much publicity, especially during a hot market,” James Cullen, a longtime value investor, told me during the market turmoil this week… “It’s always been that way. The market keeps hitting new highs and people get excited. They want to chase momentum.” A Chance for a Market’s Wallflowers to Bloom, James B. Stewart, New York Times, April 11, 2014

“So Over” Value

As the NYT article points out, not all stocks are expensive but the crowd has moved on from the value strategies that were popular in the dark days of financial crisis. In the immediate aftermath of the Credit Crisis, many investors moved completely out of equities and other risky securities to satisfy their need for capital preservation. These same investors are now rushing towards risk and “Story Stocks”. This has left many good companies and securities out of the limelight and trading at historically reasonable valuations. Why would this be when most academics argue that markets are efficient? As our clients and readers know, we believe it stems from what we call “investor fashion”. As in any human pursuit, most participants are followers and defer to the experts of the day, usually those getting the most press coverage.

The “Talking Heads” getting the attention of the financial press during the Credit Crisis and Euro Debt financial panics were what we called the Doom Sayers. Portfolios were suffering and predictions of financial disaster filled the financial media. The portfolio strategies getting attention were those that focused on limiting downside risk. The investment experts that are now in vogue are those that spin tales of market gains and immense wealth. The market is “so over value”. What’s exciting about missing downside when there’s so much upside? The 50 employees of messaging company WhatsApp get to split the $15 billion that Facebook recently paid for the company. This proves to the investment masses that financial dreams do indeed come true!

Selling Dreams

As we’ve pointed out previously, Estee Lauder used to say that she didn’t sell cosmetics, she sold dreams. Investment bankers pitching their IPO wares use a similar technique. Investment sex sells. Why do people pile onto risky and overvalued stocks? Bruce Greenwald, the director of the value investing program at Columbia Business School, explains:

Why would such an anomaly (the outperformance of value stocks) persist? Professor Greenwald points to what is known as the “lottery preference.” People “will always overpay to try to get rich quick,” he said. “That’s why lotteries never fail even though they’re bad investments.” People also believe stories with “complete certainty that they cannot know to be true,” he added. “Portfolio managers are always saying things like, ‘Tesla is the future,’ or ‘Amazon will dominate the web.’ ” New York Times

The Portfolio Problem

The current preference for risk extends into the credit markets. The government bonds that offered safety during Euro Debt crisis are out of fashion. The current problem for the bond portfolio manager is finding enough “product” to invest the cash flows into their funds. Risky bonds are back in fashion with the inevitable late credit cycle “stretch for yield”. Greek government bonds and loans financing dividends to private equity sponsors are hugely popular with those seeking yield.

Professionally Stupid

The professionally stupid are both emboldened and empowered by the low level of current defaults among corporate bond issuers. This is not an auspicious portent. As we are getting tired of pointing out, the credit cycle means that the lowest arrears are experienced when credit spreads are the tightest at the peak of the cycle. It is very difficult to default when people are willing to lend you money to pay your interest!

Since your trusty correspondents have plied their credit trade for many years, we have the dubious benefit of experiencing many credit cycles that only comes with age. This helps us to compensate for our investment failings. When we humans think we are using “cold hard facts”, we know that we are very likely falling prey to our psychological predispositions. As you know from previous editions of this newsletter, the investment staff at Canso read “Thinking Fast and Slow” by psychologist Daniel Kahneman to remind us of the pitfalls of our own biases and instruct us in methods to overcome them.

What You See is Not What You Get

We humans are social animals and our brains are very sophisticated biological computers. A recent article in the Washington Post, “What you’re seeing right now is a composite of images past and present, researchers find”, caught our attention. The title could have come from one of our CIO’s rants at our daily trading meeting. The article explained that test subjects exposed to seeing lines at different angles in an experiment would average them over a 15 second period:

“What you are seeing at the present moment is not a fresh snapshot of the world but rather an average of what you’ve seen in the past 10 to 15 seconds,” said study author Jason Fischer, a neuroscientist at the Massachusetts Institute of Technology.” What you’re seeing right now is a composite of images past and present, researchers find, Meeri Kim, New York Times, April 5, 2014.

We humans live in our own virtual reality which represents the world around us. The data comes from our senses, which feed our brain with data inputs. As the article points out, if we reacted to all the visual stimuli that we see through our eyes, we would have a rather overwhelming and jerky representation of the world around us. Our brain simplifies our reality by “smoothing” the visual image data. The people in the study saw random lines at different angles but remembered the average of the lines they saw over the previous 15 seconds.

Magicians know about this visual smoothing as well. They know the human brain watches an object travelling in a straight line intermittently but projects the path from this sampling. This means other visual inputs can be assessed at the same time. A curved path, however, requires the mind to watch at all times because it is hard to predict the end path. This is “sleight of hand” employed by magicians. When they move their hands in a circular motion, it focuses their audience on the hand moving in a curve and it ignores what the other is doing! Since the focus and concentration is less for a straight movement, it is not used when trying to distract the audience.

Sex, Drugs and Rolling Clients

Investment bankers and Penny Stock promoters use a version of this trick. Showing a chart of a stock price going straight up tends to catch the attention of those seeking instant riches. It also diverts the “mark” from the details of an investment. We just watched the movie The Wolf of Wall Street about Jordan Belfort, a stockbroker of modest upbringing from Brooklyn. He made a fortune promoting penny stocks, both legally and illegally. He was eventually convicted of criminal fraud and went to jail. Despite the graphic sex and drug antics of Jordan and his colleagues, we think the movie is well worth watching as a study on investment human nature.

What we found interesting was his training as a stockbroker at a large Wall Street firm. It seemed to consist of advice to snort cocaine, frequent prostitutes and get clients to trade as much as possible. When Jordan told his mentor that he wanted to put his clients into good investments, the mentor told him that the goal was to get them to trade. “You don’t let them take their money out; you get them to buy something else”. The mentor then went on to say that they got 2% of the client’s money for each (no discount brokers) and maximizing commissions was the goal.

While the sex and drugs is over the top, the movie is a pretty accurate portrayal of the role of an investment dealer. These are very smart people who make a career of taking money from their clients. Belfort was amazed when he found out the bid/ask spread on penny stocks and the amount of revenue it could generate. There are differences in presentation with large investment banks but the skill set of separating the unsuspecting from their money is much the same. Wall Street and Bay Street banks have done the very same thing with OTC derivatives which offer them large profits buried in the structures of these products. As we tell our young colleagues, our job and that of a good financial advisor is to ensure that we invest our clients’ money in things that are understandable and with risks that can be assessed. This is the exact opposite of the goal of an investment bank salesperson or trader. As many books on Wall Street point out, their best case is selling their most sophisticated product (highest risk and commission) to their least sophisticated client (won’t recognize the risks and understand they are being taken advantage of).

Virtual Investment Reality

You might be wondering about where this discussion is going. Well, after the last few quarterly newsletters of explanation and analysis of the financial markets, we find ourselves without too much new to say. We also find ourselves once again despairing of the repetitive nature of the investor desire for financial self-destruction. We much prefer to be in markets where risk is shunned. Today’s market, where risk is actively sought after by those with the least understanding, makes it very difficult to find risky investments with sufficient compensation. This is a time to use normalized metrics and historical experience to judge the risk and return of investments. At Canso, we do this by recalling, if not reliving, periods when markets departed significantly from historical valuations.

Pilots know that their senses can mislead them into dangerous situations when normal visual cues are not present. They are trained to fly on instruments, even when their senses are giving very different inputs. The behavioral investment biases of humans mean that training, analysis and experience must be used to compensate for the distorted picture that the investment senses are transmitting.

The Canso Experiment

At a recent morning meeting at Canso, we did our own experiment in virtual investment reality and asked our investment staff where the 5 year Canada bond yield had been in 2010. Most of the responses were under 2%. This is not surprising, as the Canada yield was 1.7% at the time of the meeting. The participants were “anchored” to this level and psychological “recency” dictated that their guesses were biased towards their most recent experiences.

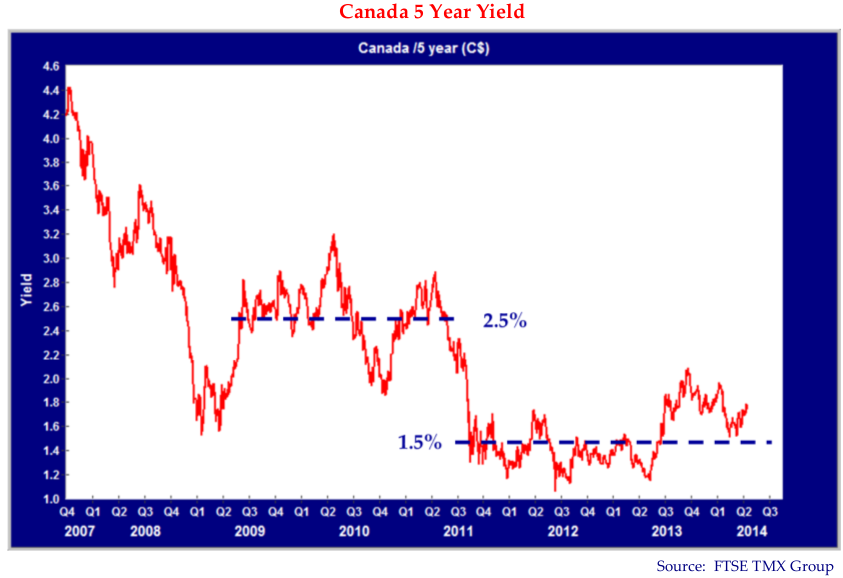

To put the question in context, the Credit Crisis had run its course by then after a sell-off in 2008 and a strong recovery in 2009. This was prior to the second act of the Euro Debt crisis of 2011. What was the yield? As the chart below shows, it averaged 2.5% in 2010, beginning the year at 2.8% and rising to 3.4% in April as the economy recovered from the Credit Crisis. It then fell to 1.9% in the first act of the Euro Debt crisis before rising to 2.5% by year end.

An Average Response

While 2.5% doesn’t sound high now, it is quite a ways over the yields in the 1% range from August 2011 to May 2013. As the chart shows, the most recent couple of years saw interest rates average 1.5%, even with the recent increase. Our Canso investment team stood guilty of “averaging” the most recent interest rate environment and they are fixed income professionals! The public at large are even less cognizant of the fairly high likelihood that interest rates could increase now that the U.S. Federal Reserve is reducing its “Quantitative Ease” bond buying ways. If you expect the present to be the future, as is the human psychological predisposition, you might not be prepared for an increase of 1% in interest rates which would only take us back to levels immediately in the aftermath of the Credit Crisis.

A Historical Reaction

Policy makers are erring on the side of too much money and inflation, in their obsession to not repeat the mistakes of the Great Depression. As we have remarked in our past editions, we look to history to inform us on the prospects for interest rates. Given that the world’s central banks are now targeting inflation of at least 2%, in their efforts to vanquish deflation, we think there is a pretty good chance that inflation will hit or exceed their goal.

As we have discussed in previous newsletters, the normalized level for short term interest rates is 2% above inflation and longer term interest rates are usually 2% above this. In both Canada and the U.S., this means that short term yields should be in the 3-4% range and longer bonds at 5-6%, given inflation in the 1-2% range. We think that policy makers are likely to overshoot their inflation target, as they have many times in the past indicating even higher interest rates.

One on a Million

The problem is that, the human brain doing what it does, it seems to most of us that interest rates will continue in the range that they have been for the last few years. The average Torontonians buying houses in bidding wars don’t seem very aware of the interest rate risk they are taking. They seem to be reacting to the house value insurance cap by CMHC. The market in Toronto is very competitive for anything under $1 million since the Harper government will now not assume the credit risk for any house selling above this amount. Given that most people paying for CMHC insurance have only a small down payment (and the 3% insurance premium is added to the principal!), the increase of 1% in their mortgage rate translates into an increase in their payments to more than $6,000 a year, which is an 11% increase. It also happens to be about 5% of the average pre-tax family income in Toronto.

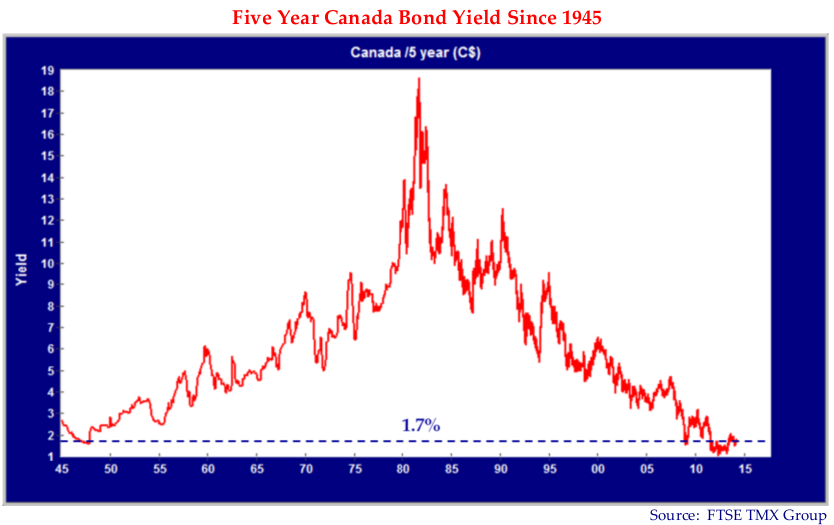

Our purpose here is not to repeat our view that Canadian housing market is quite overvalued, it is to reiterate that human beings are anything but rationale when it comes to investment decision making. The chart above shows the yield on the 5 year Canada bond since 1945. It shows that although the five year Canada yield has recently risen to 1.7%, it is still lower than at any time since 1945, save the extraordinarily low yields in the 2011 to 2013 period which form our recent experience. Will it go up? Despite our “average feelings”, statistically it is almost a certainty!

The Real Interest Rate Reality

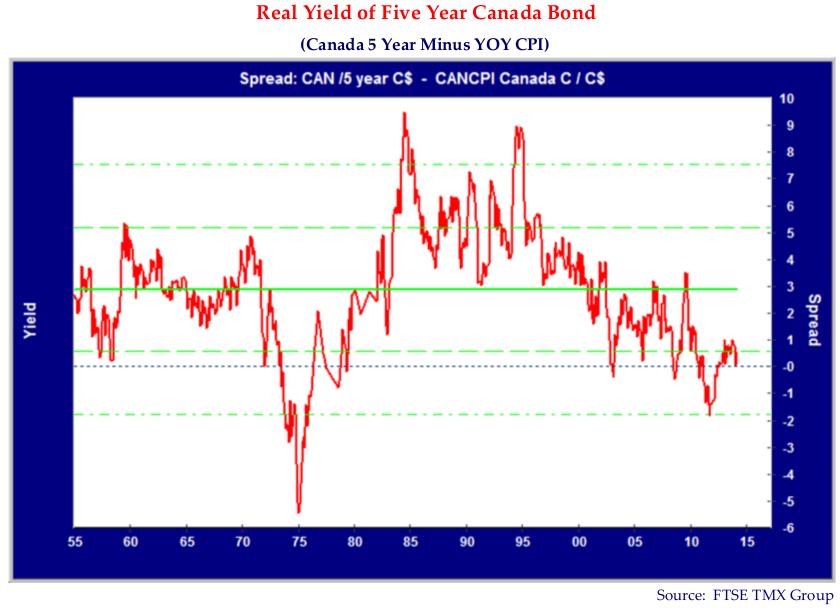

We also plotted the 5 year Canada “real yield”, the nominal yield minus inflation, in the chart below. It shows the average real yield since 1955 is 3%. Those who rationalize the current low yields with economic weakness and deflation would find it helpful to examine the period from 1960 to 1970. In this period of low inflation, the real yield also averaged 3%. Real yields were quite negative in the inflationary period from 1974 to 1980 when inflation rose much higher than interest rates. They then peaked in 1985 as inflation dropped and yields stayed stubbornly high until 2000. The only other period of negative real yields is during the Euro Debt crisis in 2011-12. The real yields were the result of the monetary authorities pushing down interest rates to “emergency levels”.

The “emergency levels” of interest rates are now the predominant influence on our collective human “virtual reality”. We have averaged them to our new virtual investment reality, just as the test subjects averaged the angles of the lines displayed over 15 seconds. The only way to protect against our biases is to look back at history and to create a realistic model. Those expecting low interest rates to continue will not appreciate what comes from this analysis. History tells us that the current 1.7% yield for a 5 year Canada is an historical aberration that we should not expect to be continued. Taking the official inflation target of 2% and adding 3% would suggest a 5% yield for a 5 year Canada in a more normal policy environment, which is not comforting for those hoping for lower interest rates to continue. Even assuming zero inflation would indicated a 3% yield for the 5 year Canada, which is nearly double the current 1.7%.

Here Brained!

It is a feature of financial markets that the unexpected usually causes the most damage. Although higher interest rates have been feared for some time, the fact that those fears have not been realized is also comforting to the consensus and builds on expectations that the future will continue much as the present. We are always surprised by the human capacity to ignore change until they are forced to recognize the new reality.

Home buyers mortgaging their million dollar homes and bond managers should all be very careful to ensure their exposure to rising interest rates is within their pain threshold. A rise in interest would also affect the riskier sectors of the credit markets. A need for financial income and the lack of alternatives is also forcing many investors without credit skills into some very risky investments. The yield of the recent Greek government bond issue is about the same as that on many speculative bank loans and high yield bonds at just under 5%. This might seem attractive with T-Bills well below 1%. If, however, T-Bills return to 4% (the normal 2% above the 2% central bank inflation target), risky credit might not be so attractive. If one seeks payment for the risk assumed, long-term bonds and risky credit are both lacking.

Grandiose Standing

Some of our clients are now asking about the “precautions” we are taking in our portfolios since we believe that risk is rising in the financial markets. We are not macroeconomists and strategists, although we stand very guilty of pontificating on these matters. While we do not make “top down” changes to our portfolio based on macro factors, our portfolios tend to take care of themselves over time, given our valuation discipline. Rather than try to discern the unknowable future, we demand to be compensated for the risk we assume. When a corporate bond or stock is cheap compared to our long term and normalized valuation, we hold it. When something is expensive relative to its investment risk, we sell and invest in something cheaper.

We find ourselves now selling many of the holdings that we bought in the aftermath of the Credit Crisis at very attractive levels. The proceeds of these sales are going into higher quality securities because risky securities are getting expensive. Rather than claim a grandiose and megalomaniac ability to forecast markets, we resign ourselves to the much more pedestrian talent of valuing cash flows. It takes a lot of investment research and discipline but, as the good professors are now demonstrating, it pays in the end!