Banking Horror Picture Show

“A banking crisis replete with political machinations in a very small and previously obscure country on Europe’s periphery…”

Dark music plays with a heavy and ominous drumbeat. Background picture fades to nervous citizens in front of a bank.

“The fate of the global financial system in the hands of a bunch of suspect political hacks that seem to lack any redeeming qualities…”

BANKING CRISIS IN EUROPE!!!

Soundtrack fades the ominous drumbeat and moves to shrieks and panicked cries worthy of a Hitchcock thriller.

You will forgive us for thinking that we’ve seen this movie before. Like Bill Murray in the movie Groundhog Day, Europe seems doomed to repeat its peripheral credit and banking crises until it gets it right. This time it was the global financial and economic powerhouse of… Cyprus??

The Modern Financial Horror Genre

A funny thing happened on the way to financial doomsday this time around. The modern horror genre of “Financial Contagion” was still dominating the cable news cycle. The financial paparazzi were still out in force, hanging on every utterance of the Troika, th at evil gang of financial apparatchiks who delay rescues for peripheral Euro countries in banking need. Things didn’t quite go according to banking bailout plan for plucky little Cyprus, however. The strategy of holding the world financial system to ransom was tried and tested, but the script changed dramatic ally for the worse when The EU demanded “bail ins” or losses by the senior bank creditors.

An Investment Spin Award?

The Cypriot government plan contemplated a “deposit tax” which would be levied on all deposits, including those that were below the insured limit. This did not go down well with bank depositors worldwide. Let me get this right, they thought, my deposits are fully insured to the €100,000 limit but then you remove 12% of my money through the artifice of a “deposit tax”? This creative plan should have won an award for “best spin” at an investor communications awards ceremony.

The global financial elites did not like it. What? they thought. Does this mean that the whole deposit insurance jig is up? We can’t earn huge profits with other people’s money in speculative investments and let the governments clean things up if they don’t work out? We can’t “wink-wink nudge-nudge” impart the horrible truth that our financial institution is de facto government guaranteed which supports our lucrative compensation structure? What’s the point of going to Davos and hobnobbing at the World Economic Forum with government and regulatory elites if you can’t depend on them to come through for you in your time of need?

Remember the Cypriot Alamo!

The Cypriot legislators gathered for their once in a lifetime chance to matter globally. “We don’t accept that you can push us around”, they voted at the start of the week. Their brave but futile legislative Alamo ended badly, however. The vote cratered the support package from the Eurozone. The talking heads of the financial media once again spun nightmares of global banking meltdown. By the end of the week, however, the Cypriot political tune had changed in tone from trumpeting defiance to abject capitulation. Risking an unsupported banking meltdown, the Cypriot political leadership threw in the towel and went cap in hand to Brussels where they unilaterally surrendered to the Eurozone Finance Ministers.

A “banking holiday”, a suspension of withdrawals by depositors, was implemented. Currency controls were imposed. Financial commentators wrung their hands and pointed out that this meant Cypriot Euros differed from other Euros. They saw grievous import for other peripheral Euro countries. A “bank run” and mayhem was predicted by the talking heads. The hotter talking heads predictably predicted total global financial collapse and the end of financial life on the planet Earth as we know it.

Nothing Much Happened on the Way to Armageddon

Boy, were they wrong. Nothing much happened on the way to Cypriot financial Armageddon. It did not make for riveting cable news television. TV crews outnumbered the Cypriots waiting in front of their dodgy banks. No banking run. Not much in the way of in dividual or global financial panic. The electronic “Financial Contagion” and “Banking Panic” banners seemed a bit over the top with videos of Cypriots placidly strolling the streets.

We are not amusing ourselves at the Cypriots’ expense. The citizens of Cyprus have suffered immensely. We have a point to make. An island in the Eastern Mediterranean with a population of 800,000 or so, Cyprus had become a banking haven for crooks and tax evaders. As Forbes explains:

“The size of the banking system in Cyprus was according to Standard & Poors over five times the size of the GDP estimated to be $23 billion for 2012. (Our forever maligned (U.S.) banking system is less than one times GDP) Known as a tax haven, Cyprus attracted tens of billions in foreign deposits. Russians and others set up businesses on Cyprus to take advantage of a corporate tax rate of only 10 percent as well as a perceived climate of lax oversight…. Cyprus has (now) promised to allow independent oversight of, to be implemented, anti-laundering legislation. Also, Cyprus will raise its corporate tax rates and committed to increase withholding taxes… These measures effectively end Cyprus’ status as a tax haven and given its place of prominence in the economy will create, in my opinion, not a trickle effect, but a waterfall of pain.” (Canso emphasis) Forbes; March 31, 2013; Life On Cyprus After The Bailout; Richard Finger.

Bailed In Rather Than Out

We think something important actually changed for the better in the financial markets in the first quarter of 2013. Yes, the financial media and the self-proclaimed financial experts went on “death watch” for the global banking system over the banking crisis in Cyprus. The results were very grim for Cypriots and their capital flighty friends.

- Senior bondholders and depositors above the deposit insurance limit were “bailed in” and will receive less than the amount they invested; and

- Junior bondholders and shareholders were wiped out.

The senior bondholders and uninsured depositors above the €100,000 limit at Cyprus Popular Bank are now estimated to have lost 60% of their funds. It is being wound down and merged with the larger Bank of Cyprus. The Bank of Cyprus didn’t fare too well either, with a recapitalization that wiped out shareholders, junior bondholders and left senior bondholders and uninsured deposits with losses of 40%.

Positive Contagion is Afoot

“How can this be good news?” you might be asking. No, your friends at Canso have not become financial sadists. The Cypriots are not suffering without purpose. We think the politicians and financial apparatchiks have finally got it right and “positive contagion” is afoot in the global financial system.

If you’re thinking that “contagion” is bad for the financial system, you’re right. If a bad bank has borrowed money from a good bank, the good bank goes down with the bad: financial dominoes; KreditAnstalt and all that.

Creation from Destruction

Positive contagion in the world financial system is the opposite. What we’re saying is the object lesson of letting a bad bank fail is good for the financial soul. This is Josef Schumpeter’s “creative destruction”.

Our faithful readers know by now that we feel that the rise of mathematical finance destabilized the global financial system and created a credit and derivative mania. The advanced mathematics of theoretical physics was used to justify high salaries for people with very little actual financial acumen. Any idiot with a spreadsheet could claim to be a trading genius. We have taken some heat for calling “financial engineers” the “idiot savants” of the global banking industry, but as we say in the bond world, “we’re still on that trade”.

Bad News for the Banking Glitterati

In the 1930s, as we’ve said before, it took the politicians and regulators the whole decade to finish their investigations and get to the bottom of what actually happened. We think we’re about half way through the current equivalent process.

The good news for global taxpayers is that, as the “tough love” Cyprus banking bail out suggests, global regulators now realize that they were set up for failure by their former banker friends. The bad news for the banking glitterati is that they now will have to work harder going forward. The rather mundane business of collecting deposits and lending them out in loans is their humble fate. Jetting about the Globe, spouting quantitative mumbo jumbo and bulking up by acquisition has gone the way of the extinct Dodo Bird.

Cozy Island Tax Havens Are Sinking

And people will be closely watching to see how well the bankers are running their banks. Even artful European tax dodgers, Russian oligarchs and Latin American drug lords now care very much about the quality of their bank. The days of cozy island offshore tax havens are well past. The regulatory crackdown is in full swing, with electronic lists of tax evaders making the rounds of national tax authorities.

In the giddy days of “financial innovation”, the flow of international capital was said to be so fast and unstoppable that any attempt to intervene would be futile. The regulatory apparatchiks threw in the towel. If world capital flows are an unstoppable force, why bother? With the Cyprus “bail in” and the crackdown on offshore tax cheats by global tax authorities, the flow of capital has been slowed a trickle.

Suspension of Disbelief and Delusionary Fervor

All episodes of financial folly in history have been accompanied by a willing suspension of disbelief. People normally want to believe especially if they’re excited. We’re not talking about just the Credit Crisis nor the more recent Euro Debt Crisis. The Dutch tulip bulb mania, the South Seas Bubble, the Stock Market Crash of 1929, the Albanian Ponzi schemes of the 1990s, the dot.com bubble of the 1990s and all other financial speculations that we know of were injected with a delusionary fervor by significant historical change or technological advancement.

David McCullough’s, “Path Between the Seas: The Creation of the Panama Canal, 1870-1914” is a wonderful historical read on the creation of the Panama Canal. Most people don’t remember that Frenchman Ferdinand de Lesseps, who successfully built the Suez Canal, also tried unsuccessfully to build a canal through Panama.

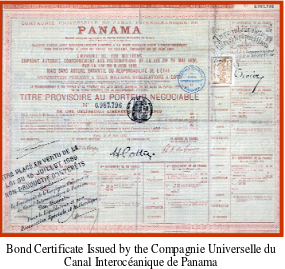

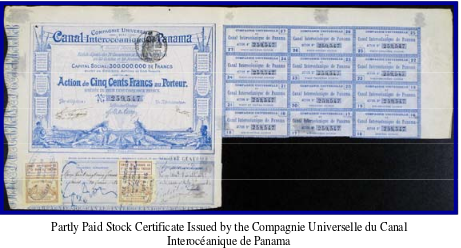

It was an unmitigated disaster. Indeed, we have a bond and a share of the bankrupt Compagnie Universelle du Canal Interoceanique on the walls of our Canso offices, which are shown on this page. McCullough set the historical context for the failed venture and his words rang with investment resonance:

“The very times themselves seemed so immensely, so historically favourable. If there was one word to characterize the spirit of the moment, it was Confidence. The feeling was that the revealed powers of science, “the vast strides made in engineering and mechanical knowledge,” … had brought mankind to a threshold.”

Bad Ideas Can Spread Quickly

We have digressed, as we are so capable of, to the Panama Canal to make a point. Human beings are social animals. Some evolutionary anthropologists and psychologists believe that man’s evolutionary adaption to social groups helped homo sapiens to outcompete his cousin Neanderthals. Our advanced communication with speech and written language probably created the conditions for technological and social advancement. Ideas could travel freely between people and even between their units of social organization: family clans, tribes, towns, cities and states. The trouble is that bad ideas spread just as fast.

Too Smart to Fail

The Glass-Steagall Act of the U.S. Congress in 1933 prohibited the combination of commercial and investment banking. This act had been a response to the 1929 stock market crash, which at the time had been attributed to excessive margin and leverage in the financial markets. In the 1990s, the Wall Street financial lobby saw Glass-Steagall as antiquated, and lobbied for its removal. They argued that, perhaps affected by the fervor of the dot.com bubble, advances in technology and risk management made them “too smart to fail”. In 1999, after 66 years in effect, Congress repealed this sensible legislation.

Alan Greenspan, Robert Rubin, Larry Summers, and Timothy Geithner all argued in favour of giving the U.S. money centre banks the scale they needed to compete globally. Their ill-considered notion was that computers and modern risk management techniques made bankers smarter than their grandfathers. At the time we argued that a spreadsheet model based on modern financial techniques was a poor description of reality and things would end badly.

The Credit Crisis proved us right, as excessive leverage and margin in the banking system imploded the financial system and plunged the global economy into the worst recession since Glass-Steagall was enacted during the Great Depression. Large scale turned into “too big to fail” and governments around the world were forced to bail out their banks.

Excelling In Error

We find it interesting that JP Morgan’s faith in spreadsheets was shown to be ill placed in the U.S. Senate investigation into the “London Whale” trading disaster:

“A post mortem analysis of Iksil’s trades revealed that he was using Microsoft Excel excessively, making a number of formula errors that caused him to underestimate the risks of his positions.” U.S. Senate Report, March 15, 2013; JPMorgan Chase Whale Trades: A Case History of Derivatives Risks and Abuses

It sounds like our constant refrain of many years that giving a banker a spreadsheet does not make him smarter than his grandfather was pretty close to the mark with Mr. Iksil. The enthusiasm for “technology” during the formative years of the internet probably caused regulators and banking executives to be swept up in the fervor of the times. A spreadsheet can be a seductive thing, the delusion of precise calculations masking the leaps of belief necessary to embrace the faulty mathematics of the “models” employed.

Sarah Gordon of the London Financial Times writes in her article “Call in the nerds – finance is no place for extroverts” of April 24, 2013 that studies show extroverts and risk seekers are attracted to the riskier areas of the financial markets. The problem is that their temperament makes them poorly suited for roles in these areas. Perhaps behavioural economics will correct the mistakes of mathematical economics but our expectations are low. The human investment condition seems to be that of a moth to the flame. The flame is so attractive that the moth cannot resist its attraction, which results in injury or even death for the moth.

Peering Around the Financial Corner

Investors have now learned the searing lesson that the bonds of sovereign nation states and financial institutions are not “riskless assets”. It’s a bit like bond investors from 1981 to 1996 who had so learned the lessons of high inflation that they saw inflation around every cyclical corner and demanded a very high real interest rate to compensate them for this risk. We think the next 15 years or so will have investors peering around every financial corner to identify the coming sovereign or banking crisis. Their preoccupation will make these types of crises very unlikely. This consensus knowledge will see higher real returns for these “suspect” assets.

Gold Bug Out

So where is the investment consensus putting its money? Well they had put it in commodities and gold, that financial tonic for all that ails investors in financial crisis. Gold is now in a panicked sell off, with it down 50% from its peak price. We went over some of our back issues and take some pride that we noted the dangers that awaited the headlong rush into the protection of gold. Gold Bugs we were not! Two years ago we were suspicious of the huge amount of publicity involving the shiny yellow metal. In our April 2011 Market Observer we said:

“Is it Time to Stockpile Gold Bars? Gold bugs are promoting gold as the only financial asset worthy of investment. Television and internet spam are filled with gold hawking advertisements… Although inflation has moved up recently we don’t see a clear and present danger of exceeding the monetary sound barrier with a resulting inflation sonic boom.”

A year ago, in our April 2012 Market Observer, we were worried about selling from institutional investors and ETFs:

“Rushing the Commodity Exits: We think a surprise could be building in the commodity markets, which have seen prices move only upwards for a number of years. An outlying scenario that is so farfetched that it appeals to us is a collapse in commodity prices… There has been a lemming like rush of institutional investors into “inflation sensitive” commodities which could reverse suddenly with price weakness. The boom in exchange traded commodity ETFs could also reverse, adding to the selling pressure. When a commodity ETF has money withdrawn, it has to sell.”

What Worries Us?

We must admit to be rather impressed by our perspicacity. The trouble with being right is that it’s a hard act to follow. What worries us now? Not the U.S. economy, which we think is on the mend. Not the Euro Debt Crisis, which we think is all but over. Not the U.S. stock market, which we think is in good shape.

The Canadian economy and the Canadian housing market worry us. We have covered these subjects amply in editions gone by. The other thing we point out is that interest rates could rise without an increase in inflation or economic activity. The current level of interest rates is artificially low. As we’ve shown in past editions of our Market Observer and Corporate Bond Letter, “normal” interest rates would be 2% higher for T-Bills and 3% higher for long term bonds. This would cause substantial carnage in the bond markets.

It seems to us that Canada, China and Australia are now paying for their sin of using excessive credit support to escape the recession in 2008-2009. This let them fiddle while the U.S. economy burned. Now the tables are turned and the U.S. looks to be exiting its post Credit Crisis slump while China and commodity producers Canada and Australia are all slowing dramatically. If you live by the commodity sword you die by the commodity sword.