Surprise, Surprise, Surprise! … Gomer Pyle, USMC.

“One of (a Canadian financial institution’s) major arguments in support of its lack of loss reserves is its conservative lending profile – i.e. (high) average credit score. This article points to the increasing trend of “surprise” bankruptcies whereby consumers with high credit scores go bankrupt out of the blue.

It’s happening more and more in Canada. One of the reasons why people are able to have such high credit scores is that interest rates are so low, leaving coverage ratios high.” Jason Bell, one of our young analysts at Canso Investment Counsel quoting Suddenly bankrupt: People with great credit scores are hurtling into crisis, Financial Post, John Greenwood and Melissa Leong, 13/05/25.

Jason made a great point during one of our frequent email discussions which we thought was important to share with you: “When people make the claim that Canadians have great credit scores, what they really should be saying is Canadians have really low interest rates which are allowing them to borrow more than ever before.”

The Canadian Field of Debt Dreams

Jason is right on the mark. At Canso, we continually make the point that if the coupon and borrowing cost is zero, why wouldn’t you borrow as much as possible? This was the Canadian government’s “Field of Debt Dreams” approach to improving the Canadian economy after the credit crisis. Picture Canada’s Jim Flaherty, the “Debt Whisperer”, in the corn stalks on a farm in his Whitby riding hearing voices: “If you guarantee it, they will lend it”…

The mighty Canadian banks answered the call of the “Debt Whisperer”. Why wouldn’t they have? They were offered a no lose proposition with the benignly named Insured Mortgage Purchase Program (IMPP). As we have detailed many times before, it was all profit and no risk for Canada’s mortgage lenders. They rose to the challenge and went on a mortgage securitization bender without compare. Brave (but stupid?) Canadian consumers also patriotically rallied around Ottawa’s “Call to Debt Arms”. Aided and abetted by the extremely easy monetary policies of the Bank of Canada, Canadians have now borrowed themselves into world beating debt levels.

Why Question Your Economic Wisdom?

Right now, there’s nary a negative thought to be had on the subject of mortgages and residential real estate, especially in the unsuspecting Canadian financial media. We Canadians are thoroughly enjoying our global reputation for financial prudence and economic wisdom. There’s more than a little swagger in the step of Canadians at global business and economic forums. As our politicians and mandarins strut their financial stuff on the adoring world stage, the afterglow for Canadian consumers is quickly fading with the prospects of the housing market.

We don’t want to go back to being mere hewers of wood and diggers of commodities. If you’re thought to have found the secret of economic success in the middle of the deepest recession in generations, it’s hard to question your own wisdom. Like the Irish, whose “Celtic Tiger” economy was built on a shaky foundation of real estate price growth and ill-advised mortgage lending, Canadians must eventually confront our financial imprudence.

The Recipe for Infinite Housing Price Growth

Despite the evidence, we Canadians are unshakeable in our conviction that we have discovered the recipe for infinite housing price growth. Excess condo construction? That’s to house rich foreigners. Unaffordable housing? Just watch a few Canadian reality TV housing shows. We are a super race of real estate investors and everyone wants to come and buy our pimped out and very cool houses.

When a strong investment consensus like this forms, those with the most to lose reject all notions that threaten their self-deception. Thoughts or ideas that conflict their comforting shared delusion are rejected out of hand. This will not continue indefinitely. The morning after the bubble bursts, Canadian homeowners will be having regrets about their financial promiscuity as would anyone who has participated in a wild orgy without adequate protection. Canadian politicians, bureaucrats, regulators and reporters will also be regretting their lack of skepticism. Their regrets will soon turn to anger and demands for retribution for those who caused the problems.

What?? Is the perfidious Canso calling into question the obvious and shared Canadian truth that we have the best banks and financial system in the world?

Yes.

IED (Incredibly Excessive Debt) Implosion

You might now be considering a petition to have our citizenship removed for “Un-Canadian” thoughts. Before you ship us off to a penal colony on Baffin Island, consider that Canso probably has the largest percentage of former military officers on staff of any Canadian financial company. Patriotism is not the question.

Our problem is what will happen to our beloved Canada when the government guaranteed mortgage bubble bursts. Inevitably, all lending based on rising financial asset prices flounder as prices reach extremes. Bankers historically have shown that they cannot conceive that financial asset prices can fall more than 50%. When it happens, they go into a catatonic shock and stop lending against that asset. Complicating matters is that Canadian regulators and politicians seem incapable of understanding that Canadian housing prices can fall, despite the prior record in Canada and the obvious example of our neighbours to the south.

As we point out again, the current fashion in official Ottawa has been to lecture Canadians about the “excessive levels” of their personal debt. IEDs (Incredibly Excessive Debts) are dangerous to our financial health. Official Ottawa and Financial Canada hope that consumers with high debts will see the problem of their own making and not blame them. The problem is, as the statistics now show, we are all “tapped out”.

Nowhere to Go But Down

There is nowhere to go for the Canadian housing market but down. The real estate market has now slowed in volume by 10-20% year-over-year in most Canadian markets but prices aren’t dropping. There are two things at work here. One is that in any financial asset market, market tops see declining volumes well before prices drop. The other factor is the statistics of the “average price”. When the housing market slows, it is the lower end that weakens first. This is especially the case now in Canada with the tightening of insured mortgage underwriting standards. If there are 4 houses sold in a month, and one happens to be $4 million dollars, this biases the average price up. This happens every cycle and gives the bullish a reason for hope.

As we have pointed out many times over the years, “real estate professionals” tend to use “gentle” terminology during market downturns. Have you ever heard a real estate commentator talking about “plunging prices”? There is a very good reason that recent articles on housing have focused on month over month statistics and average prices. This “accentuates the positives” in the face of grim prospects. Even the positively positive Canadian Association of Accredited Mortgage Professionals (CAAMP) is getting worried. When the perennially optimistic practitioner of the “dismal science”, economist Gregory Klump of CAAMP, throws in the towel, we know something is up. Mr. Klump recently shifted gears from a “nothing is wrong” approach to the Canadian housing market to a “something bad is happening” stance, demanding immediate reversal of the tightening of CMHC mortgage standards.

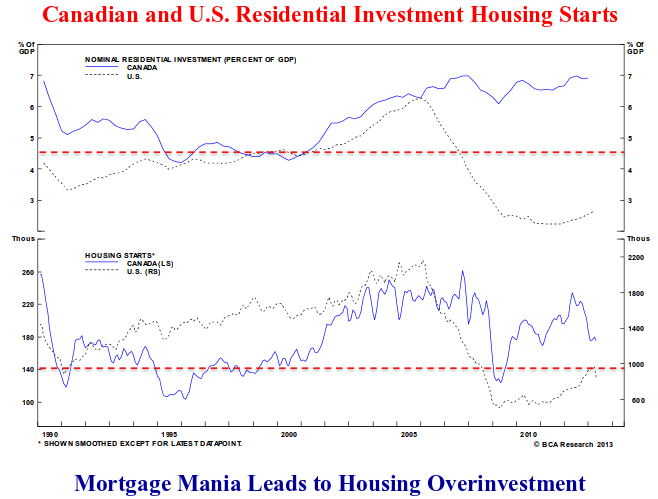

This is too big a subject to cover in this newsletter, so we have decided to make the Canadian housing market and the Canadian insured mortgage bubble the subject of a Canso Px (Position Paper) to be published shortly. We have dug fairly deep into this mess and the reading will not be for the faint of heart. It is sufficient for this discussion to understand that Canada will experience considerable economic stress as the housing bubble bursts. The chart below shows the prodigious amounts that Canadians have invested in their homes.

Canadian Housing on Credit Steroids

The chart on the next page, from the very astute Bank Credit Analyst researchers, shows Canadian and U.S. residential investment and housing starts. A bit of simple math proves our point that the Canadian housing market has been on credit steroids. We have taken the liberty of adding the red line to both charts. Note that in the Canadian 1990 housing bubble, Canada was investing 7% of GDP in residential real estate, while the U.S was investing 4%. Canadian levels fell to 4% during the housing collapse of the early 1990s and stayed there until 2001. For the five years from 1995 to 2000, both Canada and the U.S. were investing 4.5% of GDP. Both Canadian and U.S. residential investment rose from 2001 to 6% in 2006, reflecting Alan Greenspan’s “swan song” monetary heroics and the credit bubble.

The Sky was the Limit!

What is really striking is that U.S. residential investment fell from 6% to under 3% in the real estate bear market. After the overinvestment of 1-2% a year from 2002 to 2007, they have underinvested by even more. The chart above of U.S. housing starts is even more telling. From a level of 1.4 million housing starts, they rose to 2.2 million before collapsing down to 600,000. Even now, with a housing correction underway, the U.S. is only just reaching the 1 million starts level, which is lower than the levels in the early 1990s. Clearly, an economy pays dearly for its housing overbuilding sins.

Canada, on the other hand, “reached for the sky” and moved from 6% in 2006 to 7% at present, courtesy of CMHC and the IMPP. Note that Canadian housing starts plunged from 220,000 to 110,000 during the credit crisis and recession of 2008 to 2009 along with the U.S. Courtesy of the “Debt Whisperer” and the IMPP, Canadian housing starts moved quickly back up to their former 220,000 level while the U.S. continued its downtrend.

Manna From Bank Heaven

The evidence is clear. We Canadians, like the Chinese, borrowed our way out of recession. The only difference is that the Chinese, with their “Command and Control” economy, ordered their bankers to throw caution to the wind and lend recklessly. We bribed ours to lend recklessly with the IMPP and its riskless “manna from bank heaven”.

There is no question in our minds that Canada will experience a very sharp downturn and recession when the housing bubble bursts. This is not something that anyone wants to hear. Reading accounts of the Irish, Spanish, Portuguese and U.S housing bubbles, this is normal.

Good U.S. is Not Great for Canada

The question we are asked, given our view, is what will happen to interest rates. We think we will have the unenviable problem of a weakening economy with rising interest rates. The normal response to a weakening economy is a drop in interest rates. While we expect a desperate Bank of Canada to anchor short-term interest rates and do everything to avoid raising them, long-term bond yields will be set by international factors and capital flows. In past newsletters, we have explained that short-term interest rates are artificially low on a global basis, as monetary authorities around the world deal with our generation’s version of a Great Depression.

The problem for Canada is that things are improving economically in the United States and the rest of the world. As we have pointed out before, we estimate that U.S. short-term interest rates are currently at least 2% below a “normal level”. With a 2% inflation target and “normalization” of Federal Reserve policy, this should put U.S. Treasury Bills at long-term bond yields at 4% and long Treasury yields at 5%. Even if U.S. inflation stays at a more subdued 1% level and monetary policy remains accommodative, we would expect T-Bills to increase from the current 1% to 2% and long Treasuries to at least 4%.

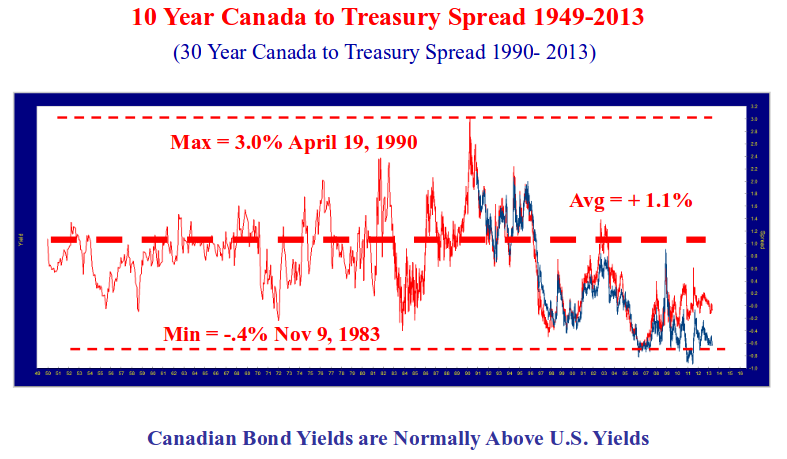

“Normal” Canadian Yields are Higher than U.S.

Canadians might argue that long-term Canadian bond yields are currently below those in the United States and should stay there. As the chart below shows, this is also not “normal”. Canadian long-term bond yields tend to be higher than those in the U.S. We only have Canadian long bonds/yields back to 1990 so we have used the relative “yield spread” between the ten-year Canada and U.S. Treasury bonds back to 1949. As the chart shows, Canadian 10 Year bond yields have averaged 1.1% above those in the U.S. since 1949.

Notably, the current -.30% spread is almost as low as the -.35% low for the entire period in November, 1983. This was a similar period to the present. Interest rates and inflation had been high and were falling with loose monetary policy. The commodity cycle was waning but Canada still benefitted from its status as a commodity producer.

Seven years later in 1990, the spread was +3.0%, the highest for the period. Prophetically, this was during the last housing collapse in Canada and combined with weak commodity prices to severely weaken the Canadian economy. In the early 1990s, Canada was suspect from a credit point of view. There was talk of Canada “hitting the wall” and losing access to the international debt markets with an IMF rescue.

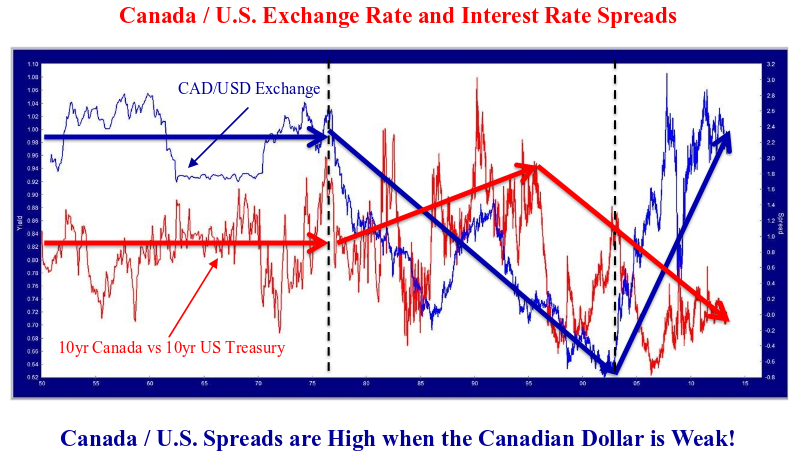

A Weak Loonie Means Wide Spreads

The chart on the next page shows pretty clearly that the Canada U.S. yield spread moves inversely to the strength of the Canadian dollar. When the Canadian dollar is strong, as it has been for the past 10 years since 2003, the yield spread falls. When the Canadian dollar is weak, the yield spreads rise to levels well above the U.S. Treasury.

This is not an accident. Canada is a small, open and commodity-based economy. When Canada is out of favour or people worry about our finances, investors must be compensated for holding Canadian assets.

While we don’t think Canada will be forced into an IMF rescue, we expect that as commodities lose their mojo and the housing market weakens, investors will at least become less enamored with the credit allure of Canadian bonds and the vaunted Loonie.

It could develop into a major reversal and mass liquidation of things denominated Canadian. We are now proud of the fact that world central banks are “diversifying” out of the U.S. dollar into the vaunted Loonie. These are the same central banks who sold out their gold reserves at the price lows and began to buy back at the highs. Since central bankers have perfected the art of “wrong way” trading, do we expect them to rush into depreciating Canadian dollar assets? “Au contraire”, as we would say in our other official language, it’s likely central banks and sovereign wealth funds will head for the proverbial hills.

There’s a good reason that short positions on the Canadian dollar are at highs. The Bank of Canada will under no circumstances raise short-term interest rates in the recessionary environment that we see for Canada. The speculative currency traders understand this. This makes for a very weak Canadian dollar if the Canadian economic miracle is called into question.

How weak? Why, let’s try an experiment with “recency”, the psychological predilection of humans to overweight their most recent experiences. Where do you think the Loonie could go if commodities are out of vogue and the Canadian economy is much weaker than the U.S.? You probably came in at $.90 U.S. How about $.68 U.S. in 1986 and $.62 in 1984, as the chart above shows! We think, given the housing market implosion that we see and potentially the solvency of the Canadian government, the Loonie could go even lower. How low? Well, we don’t think the Bank of Canada will look to “defend” the Loonie until it penetrates $.70 U.S; this argues for higher inflation from imported goods.

Beyond Bed, Bath and Beyond

You might argue that a much lower Canadian dollar would be good for Canada’s manufacturing competitiveness in the major U.S. market. That’s true, but it will take some time for the sector to adjust. The evidence from the industrial area near our offices in Richmond Hill is not good. Many former factories, forced out of existence by the high Loonie, are now distribution centres for imported goods. A high Loonie made it much more profitable to warehouse imported consumer goods for Bed, Bath and Beyond than to assemble or manufacture anything. Consumers watching housing shows and “pimping out” their new residences with mortgage borrowings will soon be watching their spending and possibly looking for a new job.

While we pointed out that the Canadian economy would directly have a 3-4% reduction per annum due to a drop in residential investment, we did not dwell on the “multiplier effect”. As any economist can tell you, housing is an “exogenous variable” in their economic models. This means they have no idea how to forecast it but they know it is very important because of the “multiplier effect”. While Canadians are now investing 7% of our GDP in houses, this does not include the legions of indirect beneficiaries of CMHC’s housing largesse. It is pretty clear that with real estate sales down 10-20% off the peak, real estate agents are seeing a substantial drop in their income. What about the real estate lawyers, bank mortgage administrators and mortgage brokers? How about advertising spending, home renovators, home stagers, and even car dealers that all benefit from the real estate boom. We have seen estimates that 30% of current Canadian GDP is connected to residential real estate.

“Plague on Our Houses?”

The poor Canadian consumers who rushed to the debt parapets to create their country’s “financial miracle” will have a major problem: recession, plunging housing prices, higher inflation, a very weak currency and higher interest rates. Obviously, voters will be questioning the government policies and economic principles that have brought the “plague on their houses”.

The only way for normal people with inadequate income to repay excessive amounts of debt is to default or to wait for rising income to skate them onside. The problem with waiting for rising incomes to skate you onside is that incomes have to rise. This is why it is always politically attractive to allow inflation. A 4% inflation rate halves the value of a debt in real terms over 10 years. This is why the British are allowing much higher rates of inflation. So are the Chinese.

We believe that the U.S. government and the Fed are trying for some “stealth inflation”. If published inflation rises and interest rates therefore rise, the problem is that, although the principal will be reduced in real terms, the servicing costs of borrowing will increase as well. Note that on the Shadow Government Statistics website, John Williams claims the switch to “Hedonic Quality Adjustments” by the Clinton Administration in the late 1990s has caused a drop in reported inflation of 2-3%. It is much easier for politicians to demand lower “published” inflation from the statisticians than to deal with the fallout of higher interest rates.

The problem for Canadian borrowers is that at the BOC inflation target of 2%, it takes a much longer time to reduce the real value of debt. Witness the Canadian 4.25%/ 2021 RRB that now has an inflation accrual of 48% since it was issued 22 years ago. This is the compounded inflation since it was issued in November, 1991.

Mr Poloz’s Problem

We think that the new Governor of the Bank of Canada, Mr. Poloz, will be under immense pressure from politicians to keep interest rates low. If he has to choose between higher interest rates or 4% inflation and a depreciating Loonie, he will err on the side of higher inflation and a lower Canadian dollar. This is a dangerous game once investors figure out higher inflation is in the cards. International investors will be selling their Canadian denominated assets and Canadians will be flocking into US$ bank accounts and U.S. bonds and equities. This implies a very steep yield curve in Canada and eventually some short-term interest rate increases in defense of the Loonie.

That’s why we like floating rate notes. No matter the reported inflation, we will benefit by rising rates. While the $100 principal we lend will be at risk, the shorter terms and rising cash coupon offer more protection than an inflation-linked RRB which will be slaughtered by rising nominal and real rates.

It will not be pretty for Canadian consumers and mortgage default rates when rates rise. The “prudential mortgage standards” implemented by Mr. Flaherty only examine the ability of borrowers to cope with the current 5 year fixed mortgage rate which is now artificially low. Up to 30% of mortgages now are floating rate. Irate consumers, like in the U.S., will be suing the Canadian banks for “artificially inducing” them into borrowing excess amounts. Like politicians in the U.S. and the U.K., Canadian politicians and civil servants will be seeking cover by hammering the “evil banks”. The banks will just have to suck it up and take it like those in the U.S. and the U.K.

We hope that we will have a soft landing like the banks and governments are praying for but it is doubtful this will happen. The evidence is pretty damning.

We’ve noticed a trend in Ottawa that those most involved in the mortgage mania are voluntarily or involuntarily leaving their posts. Julie Dickson, Superintendent of Financial Institutions, is retiring. Mark Carney of the Bank of Canada has moved on to the Bank of England. Karen Kinsley, CEO of CMHC has “retired”. Marc McGinnis, Vice President of CMHC Insurance and Securitization left his post recently “without comment”. Even Bank CEOs seem to want to exit on a high note. Ed Clark, former senior civil servant and CEO of TD Bank is retiring.

As the saying goes, “Success has many authors, failure but few”.