Professor Bernanke and the Federal Reserve really did it this time! There is real fear of rising interest rates for the first time in the two years since the Euro Debt crisis of 2011. Actually, Bernanke and company at the Fed didn’t do anything. They just mused about perhaps not buying as many Treasury bonds as they are currently. This was enough to get people thinking that perhaps the Fed wouldn’t be “quantitatively easing” and printing money until the “cash cows come home”.

Not A Mused

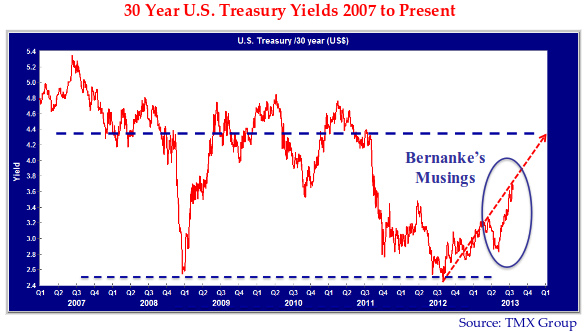

The bond market reacted violently to Mr. Bernanke’s musings. Yields, which were already in an uptrend, gapped upwards in the second quarter. This can be seen in the chart of 30 Year U.S. Treasury yields below. The thought of life with rising interest rates was too much to bear for investors accustomed to sunny markets with intermittent heavy showers of money.

Investors sold off bonds and anything remotely interest rate sensitive. Most other things financial did a swan dive as well, as traders “knee jerked” to risk avoidance mode. After the very public harpooning of J.P. Morgan’s “London Whale” and insider trading now putting people into prison, times are tough for those who “trade the market” for a living. What’s a Master of the Universe to do during crunch time without a special informational advantage and nobody to collude with?

Like a fishmonger or any other merchant selling things, traders at investment banks are now acting their proper part in the drama of the markets. Throughout history, traders have “gone flat” or neutral at the first sign of financial panic. The credit crisis ended the tragic comedy of the universal banks availing themselves of implicit government backing and taking inanely large positions in risky assets with “other people’s money”. Now traders are working with much more expensive and much more limited amounts of capital and playing by different rules. They dispose of their excess inventory if they think demand will drop or their wares will spoil.

Financial End Times Delayed

It does not help that regulators are pressing banks hard on proprietary trading. Risky proprietary positions are now very much a thing of the past. This means investment dealer inventories are now supposed to be in support of “client flows” which makes inventories now very low. Bond traders sold off their inventory. Corporate bonds, high yield bonds, bank loans and equities sold off as well. Even gold, that comforting standby in times of financial cataclysm, saw plunging prices. The Financial End Times now seems just a little bit delayed. This combined with the prospect of receiving higher income on other investments takes away just a little bit of the lustre of what thoroughly modern economists call the “barbarous relic”.

Double Bottoms Up

As we have been saying in our last few newsletters, we believe the low in yields was seen in the summer of 2012. The previous chart shows the 30 Year Treasury Bond yield formed a “double bottom”, touching 2.5% in December 2008 in the panic over the Credit Crisis and revisiting this low in the aftermath of the Euro Debt Crisis in the summer of 2012.

As the chart shows, a few musings from Professor Bernanke were enough to send bond yields soaring in 2Q 2013, despite the confident forecasts of experts promising low yields for a very long time. Those seeking safety in the bond market were sorely disappointed. The 30 Year Treasury yield moved up to 2.8% in May 2013 and then gapped up to nearly 3.7%, where it finished June. This was a drop of 15% in the price of this bond.

The reverberations of the carnage in the Treasury market were heard around the globe and sent investors scurrying away from risky financial assets. As we have predicted for some time, the elastic nature of the “stretch for yield” meant for a sudden snap back for the prices of riskier investments when higher yields seemed apparent for safer assets. Emerging markets became the submerging markets and high yields translated into high diving prices.

Professor Bernanke’s economic speculation set in motion a change in the market consensus. The thought that bond market yields might not stay below actual and expected inflation “forever more” was a revelation to those accustomed to easy credit. This is not uncommon. At the lows and highs of every investment cycle, financial market experts find reasons for the status quo to continue. It never does. This wishful thinking reflects the very human tendency towards “recency”, where our most recent experiences dominate our predictions for the future.

Wishful Thinking About Interest Rates

Even if forewarned, wishful thinking takes hold. We have commented on the human desire to find comfort from the current situation in these very pages. Those that are successful in marketing investment products in a low interest rate environment have no desire to change their ways or scare their clients. Those who were forced into the wrong action do not want to be wrong again. Portfolio managers and investment committees that were supremely confident in 2010 that interest rates would only increase, probably threw in the towel in late 2011 and extended term to “stop the pain”. To reverse course now would only confirm their weak investment character.

Punchy Policy

There is no good way to “take away the punch bowl”, from those accustomed to lots of money and bond buying. We emphasize once again that tightening of monetary policy never ends well. The Fed tightening in 1994 resulted in the bankruptcy of Orange County and Mexico. The Fed tightening of 1998 caused the collapse of hedge fund Long Term Capital, mayhem in the emerging markets and the bankruptcy of Russia. The Fed then tried something new and broadcast its intention in 2005 to raise interest a “measured” 0.25% each quarter until policy was “normalized”. The idea was to prepare the financial markets for higher yields ahead, in the “rational expectations” sense. This obviously didn’t work as the credit and financial markets seized during 2008.

Mr. Market Takes Charge

This time around, the Fed has not done anything. It is not tightening conventional monetary policy or even ceasing its bond buying ways. It was sufficient to suggest it might. We speculated that it would be “Mr. Market” that did the tightening this time around as the forces that caused yields to fall to generational lows reversed. We also thought that this would not result in total financial disaster, as the very steep yield curve that we saw ahead would result in very strong economic growth. There are very few things as potent in predicting economic strength as a very steep yield curve.

This seems to be what is now happening. How far can yields rise? In the previous chart, we have plotted a dashed blue line that was the prevailing yield level before and after the credit crisis of 2008. The 30 Year Treasury yield was comfortably above 4% before the credit crisis in 2008 and reverted to this level after things “normalized” in 2009. As we have pointed out many times, T-Bills historically are 2-3% above inflation and the yield curve typically adds another 1-2% for long bonds. With inflation in the 2% range, this suggests T-Bills at 4-5% and 30 Year Treasuries at 5-6%.

The 5.4% yield in the summer of 2007 was not unusual in this regard, nor was the 4.8% reached in 2008 and 2010. What was extremely unusual, as we have pointed out to you many times, is how low bond yields became due to quantitative easing by the Federal Reserve. Note the plunge during the Euro debt crisis in 2011, which took investors by surprise. This fall in yields was exacerbated by the surprise of sovereign default that sent international capital flows into the U.S. treasury market.

Zero Virtual Reality

The current level of U.S. 90 Day T-Bills at 0.04% is virtually zero. The 30 Year Treasury Bond at 3.6% still leaves a substantial upside for interest rates, even given their most recent increase. As we have been saying in our last few reports, we do not expect Dr. Bernanke and the Fed to actually tighten conventional monetary policy for some time to come. This will keep short-term interest rates near zero. On the other hand, the Fed is currently buying more Treasuries than the Treasury is issuing. This implies when they stop, all things being equal, yields should rise given the substantial drop in demand from this source.

We look for a very steep yield curve as long Treasury bonds rise in yields to more “normal levels” as the Fed stops its bond buying ways, but continues printing money and keeping short-term interest rates at very low levels.

Curvaceous Policy

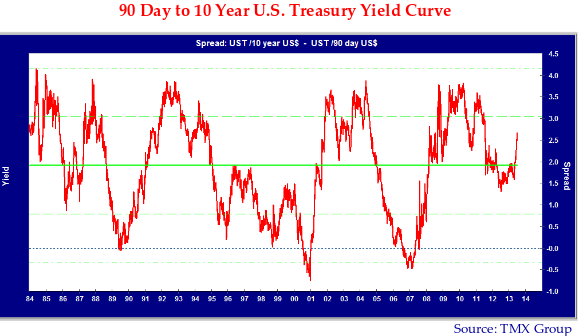

What will the yield curve look like with the Fed holding interest rates near zero and the market “normalizing yields”? We could just throw out the current numbers and add a bit, which seems to be what passes for sophisticated economic analysis at present. In our naivety, we usually “graph the data”, which we have done in the chart below. This shows the U.S. Treasury 10 Year Bond yield less the 90 Day U.S. T-Bill yield since 1984.

You will note that the average spread tends to very close to 2% and is currently 2.6%. What is pertinent to our discussion is that the highs tend towards 4%. This represents the points when monetary policy has been the most “accommodative”. Our suspicion is that, since Professor Bernanke and the Fed Open Market Committee have been “innovating” by buying truckloads of bonds, once yields are left to their own devices we will be looking at something higher than has been the historical case. With the Fed aiming for 2-3% inflation, we believe that bond yields will move to the 5% range or higher. This suggests a yield curve spread of 5-6%.

No Bluster from Ben

What should we make of Mr. Bernanke’s recent PR campaign to tell the world that the end of “Quantitative Ease” bond buying does not imply monetary policy tightening? This is not bluster. Take him at his word. He wants a very steep yield curve, which is very good for economic activity. His reassurance that conventional Fed monetary policy will remain accommodative for “some time” confirms our belief that he is after a very steep yield curve.

The problem for Professor Bernanke is that he understood that his innovative “quantitative easing” risked a serious inflation problem. Higher levels of inflation follow central bank buying of government bonds in almost every instance we know of through financial history. Mr. Bernanke knew the risk he was taking but he believed it was necessary to kick start economic growth.

The End Game for Innovation

He also knew that he had to quit his bond buying ways at some point. His recent broadcast of this is meant to get the markets used to the idea. We also don’t think that the informal and/or accidental announcement by President Obama of Mr. Bernanke’s intent to retire as Fed Chair and return to his teaching post at Princeton is happenstance. We believe that Mr. Bernanke wants to leave the eventual tightening of conventional monetary policy to his successor. He is preparing for his departure by phasing out his unconventional monetary policy and paving the way for more “normal” monetary policy.

Was the unconventional policy necessary? That is a question for the economic history books. It didn’t ignite inflation or hurt the economy. Given the huge worries over the Euro Debt crisis, it came at a time when investor preference for U.S. Treasury bonds was very high.

Will Quantitative Ease Prove Addictive?

The problem with all the “innovation” in monetary policy lies in the future. When Alan Greenspan first used “emergency” liquidity in the 1987 stock market crisis, he was hailed as a hero and got into the habit of throwing copious amounts of money at all crises, real or perceived. It is instructive to recall that he eased monetary policy “preemptively” ahead of the Y2K computer doomsday scenario. Y2K proved to be a hoax perpetuated on the unsuspecting by information technology consultants in search of billings.

All the money that Mr. Greenspan created ended up forming, in our view, a credit bubble and the resultant credit crisis of 2008. Let’s hope that Mr. Bernanke’s successor doesn’t follow the same pattern of “quantitative easing” at all economic enemies, real or imagined.

Open for Business

The markets are getting used to the idea that quantitative easing can be stopped without financial cataclysm. Things are getting back to normal and the financial markets are opening up. After a few weeks of catatonic shock, the credit markets have opened back up and new issues are once again being done. The equity markets are also starting to behave relatively normally again. This proves Mr. Bernanke’s point. Rising bond market yields that reflect stronger economic activity are not something to be feared.

The problem for bond investors is that their one way “runaway train” of falling yields is coming to a close. For a generation of bond investors that has only known falling yields and rising bond prices, this is a revelation. The “safe” trade from equities to bonds does not look so safe any more. We expect individual investors to be shocked by negative returns, as they were in the 1970s. It’s one thing to talk about “beating the index” when the total return is positive, but quite another when returns are in negative territory. We expect the current flows out of bonds and interest rate sensitive equities to continue for some time.

Flight From Quality

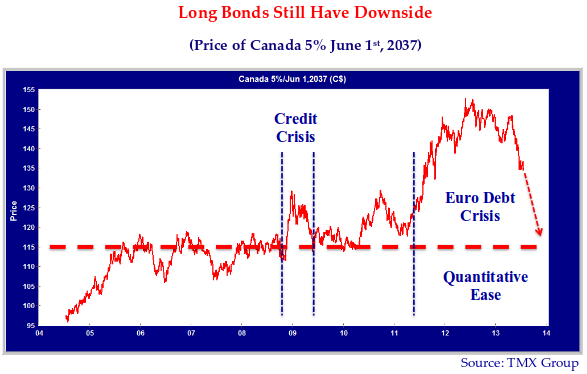

The problem now is that there is still considerable downside in the price of long-term bonds. In the chart above, we have graphed the price of the Canada 5% of June 30, 2037 since 2004. You will note that its price rose from $95 to $115 as interest rates fell until 2006. The price then bounced between $110 and $115 until the Credit Crisis when it soared to $130 in late 2008 and early 2009. When it became apparent that the financial panic had been stemmed, the price then reverted back to the $115 range before spiking up spectacularly to nearly $155 in the summer of 2011 during the Euro Debt Crisis in the “flight to quality”.

What now for long Canada yields? Our suspicion is that we’re in a “flight from quality” and headed back to the $115 range, as we show with the dashed arrow. This would be a nearly 20% correction from the current $135 price. We are not so sure that bond investors are prepared for the downside that the bond market is offering.

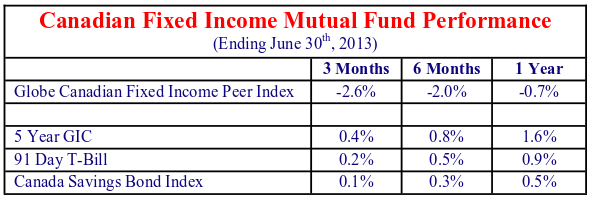

In Canada, bond mutual fund investors are about to open their June 30 th , 2013 Semi-Annual Statement and they are in for a surprise. The table below shows the GlobeFund Canadian Fixed Income Peer Index of mutual funds ending June 30th . This shows the average Canadian investor in a fixed income fund has lost 2.6% of their value in the last three months and 0.7% over the last year.

Those bond managers old enough to remember the great bond selloff of 1994, which includes several of us at Canso, realize that negative returns on bonds are not popular with clients, no matter how well informed or educated they are on investments.

Losing the Income Popularity Contest

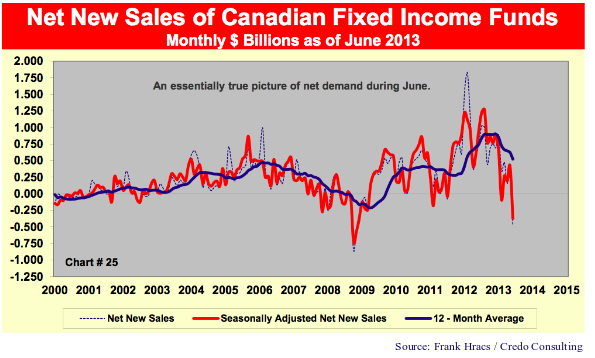

We have also included some popular individual investor “bond substitutes” in the table above, which have positive returns. We suspect that as bonds show negative and flat returns, they will be attracted to investments that don’t get “marked to market” and promise safety rather than sorrow. Investors of all types will continue their “chase for returns” and lower their fixed income targets as they invest in whatever has strong recent performance. Current mutual fund flow reports confirm that bonds are losing popularity in both Canada and the United States. The chart below by mutual fund analyst Frank Hracs shows that the sales of Canadian fixed income mutual funds has been steadily declining from a positive $1.8 billion in February 2012 to an actual net withdrawal of $465 million in June 2013.

This will not be good for the current elevated level of bond prices. As we have said in previous newsletters, we think much of the demand for bonds came from those who have been “forced into the trade” by declining yields and the need to “hedge their exposure”. Human nature being what it is, the point of maximum pain from lower yields in late 2012 and early 2013 coincided with both individuals and investment committees deciding to throw in the towel and protect themselves from a further drop in yields. They were just as certain that yields would fall further from this point as they had been that yields could only rise in early 2011.

The Medium is the Message

We have positioned for rising yields with a significant weight in floating rate securities. As we pointed out in these very pages, when we could pick up yield by switching from fixed rate to floating rates securities, it appealed to our bottom up and value ways. We also pointed out that inflation linked bonds were very interest rate sensitive and that rising real yields on nominal bonds did not auger well for RRBs and TIPs. These have been crushed by the recent move up in nominal real yields.

As we suggested, well in advance of the rise in yield, we were in for a major change in expectations for fixed income instruments. This is in process at present. It will not be one way, as the market tries to figure out Mr. Bernanke’s message.

We think Marshall McCluhan was right on: “the medium is the message” when it comes to interest rates.

Perhaps more apropos: “the medium is the messenger”.