It’s been a financial thriller so far in 2008. When most of the world’s largest and most sophisticated financial institutions came to the terrifying realization that their innovative ways had loaded their balance sheets with virtually worthless credit detritus, their fears overcame them and they panicked. Their direct knowledge of their own credit ineptitude made them highly suspicious of the credit quality of their peers and they stopped lending to each other. Ben Bernanke and his colleagues at the Federal Reserve recognized the signs of an incipient banking crisis and they moved quickly to head it off.

The Fed started by dropping rates precipitously to quell the panic in the credit markets. It kept up its rate reductions but also created new and novel ways to get money into the hands of America’s bruised and bloodied banks with lending programs with acronyms rivaling those employed in nuclear disarmament talks. The quarter ended with an impromptu and unprecedented direct intervention by the Fed into Wall Street with the rescue of insolvent investment dealer Bear Stearns. Bernanke and company then created another acronym program on the fly to get money into the hands of the other Wall Street investment dealers before they too suffered an illiquid fate. To the Fed Chair Ben Bernanke, the financial crisis took precedence over any lingering concerns over inflation. His frantic efforts to avoid financial meltdown made Alan Greenspan’s rate reductions look absolutely quaint by comparison.

Off Balance Innovations

Mr. Bernanke was right to approach this credit crisis with determination. The global credit markets, the mechanism which takes savings and puts them into the hands of borrowers, had ground to a halt as a result of the sub-prime mortgage crisis in the United States. The potential for large losses on asset-backed structures that included sub-prime mortgages had made investors question the accuracy of all credit ratings on securitized structures and a “buyers strike” developed. Since the “innovations” of the Greenspan era had shifted funding of a large portion of the global financial system “off balance sheet” from commercial banks to these securitized structures, this buyers strike caused credit mayhem on a scale not seen since the 1930s.

Wary investors voted on credit quality by closing their wallets and the sources of funding for securitizations rapidly dried up. With AAA rated securitized structures being downgraded below investment grade in some cases, investors responded by selling existing asset backed issues. This caused asset backed secondary market prices to plunge which was exacerbated by margin calls to leveraged investors holding these issues.

We’ve commented on the credit stupidity of what we have called the “securitization mania” for several years. It created a system where lenders were more interested in the fees generated by their securitizations than in their credit quality. Investors relied on credit ratings that were distorted by specious quantitative models and the lure of the lucrative fees from the securitization gravy train.

The Great Desecuritization

Alan Greenspan’s incredible naivety in believing that financial innovation was placing risk in the hands of those who understood it was laid bare for all to see. Quite the opposite had transpired. The Greenspan faith in financial innovation perversely culminated with those in the know laying off their risks to the unsuspecting. Canadian retail investors, corporate cash managers and public sector pension funds looking for a little extra yield ended up with Asset Backed Commercial Paper that provided credit protection to sophisticated global investment banks. Norwegian towns invested in highly rated securities financing toxic U.S. sub-prime mortgages and had to slash their operating budgets to make up for their huge losses. The global banks like Merrill Lynch that drank their own credit Kool-Aid took massive losses for the sin of believing their own propaganda.

The modern financial system based on third party securization and derivatives is now in shambles. In our last report we dealt with the inevitable result of what we termed the “Great Desecuritization”. Banks have depleted their capital with credit losses and need funding to finance the securitized assets coming back onto their balance sheets and to provide for new client loans. Greenspan’s excessive monetary stimulation and free market dogma left his successor Ben Bernanke with limited room for maneuver. Bernanke must put Greenspan’s credit Humpty Dumpty back together again with a very limited numbers of policy tools. It will not be easy.

The First Cut Wasn’t the Deepest

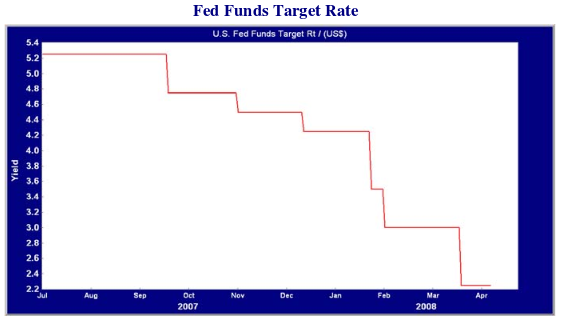

Ben Bernanke was appointed Chair of the Fed on October 24th, 2005 and was sworn in on Feb 1st, 2006. The Bernanke Fed continued with three of Alan Greenspan’s “measured” .25% increases in the Fed Funds rate and then left rates unchanged for over a year. He then reduced the discount rate by .5% in August of 2007 as the sub-prime credit crisis became apparent. He followed up with a .5% reduction in The Fed Funds rate in September as he was coming under increasing pressure to reprise the Greenspan Fed’s emergency rate power dives from very vocal politicians and business leaders. His next two moves were very controversial .25% decreases in Fed Funds in October and December which caused much consternation in the financial chattering classes as the sub-prime meltdown was full blown by this time.

Critics claimed that Bernanke was letting his fear of “moral hazard” and inflation interfere with his duty to rescue the economy from certain sub-prime doom. Bernanke was actually trying to free up the credit markets without risking an inflationary backlash. The Fed created a new program in December called the Term Auction Facility (TAF) which allowed banks to borrow against marketable securities including mortgage and asset backed securities. Its goal was to replace the short-term funding disrupted by the securitization meltdown.

By January of 2008, Bernanke knew that the credit crisis was worsening and the economy looked to be weakening. If he tried to ride out the storm he risked a massive deflation in financial asset prices which would devastate the economy. There was also immense political pressure to act in this U.S. Presidential election year. Since the Fed normally tries to stay out of the way during a Presidential campaign, most of the Fed’s monetary policy initiatives for 2008 needed to be front end loaded.

The Bernanke Fed’s next moves are stunning as the previous chart shows. The Fed had an emergency meeting by telephone on January 22nd that lowered the Fed Funds rate by .75%. The FOMC then reduced the discount rate by .5% at its regular meeting just over a week later on January 30th. Even “quick to draw” Alan Greenspan had only lowered rates by .5% and never twice in a week! Bernanke followed this up with a .25% reduction on March 16th and then another .75% on March 18th. The March move was actually met with disappointment by the markets as they had been anticipating a 1% decrease!

Rescue Me!

March also saw the Fed undertake a series of term repurchase transactions where primary dealers could tender collateral for funding which it followed up with swap lines with the ECB and Swiss National Bank. On March 11th it created the Term Securities Lending Facility (TSLF) to lend up to $200 billion of Treasury Bonds for 28 days (compared to overnight) to primary dealers in exchange for a broad range of pledged securities including mortgage and asset-backed securities.

Less than a week later, the Fed arranged for the rescue of Bear Stearns by JP Morgan Chase. Bear is a SEC regulated investment dealer and JP Morgan is a deposit taking bank. This action had to take place under an extraordinary provision of the Fed’s charter since Bear Stearns is not a deposit taking institution and thus does not fall under the Fed’s current mandate. This included an unprecedented direct Fed guarantee of a $32 billion portfolio of Bear Stearns assets to facilitate the deal. It was clear at this point that the threat to deposit taking institutions from the failure of Bear, a major derivative player and counterparty, meant that investment dealers were now under the Fed’s purview. Indeed, in the aftermath of the Bear transaction it created the Primary Dealer Credit Facility (PDCF) which is similar to the Fed discount window for banks which enabled the 20 Primary Bond Dealers who deal with the Fed to borrow against a broad range of investment grade collateral.

Bearing Pain For No Gain?

The haste of the deal was amazing, given its complexity. The deal was structured over a weekend of furious negotiating and scheming. It turns out that the haste of the Fed to avoid the potential derivative disaster of a Bear Stearns bankruptcy had put JP Morgan into a potentially excruciating position. As we listened to the late Sunday night conference call by JP Morgan executives disclosing the deal, we were astounded when they stated that they were irrevocably guaranteeing all the Bear Stearns trading obligations that existed at the time of the deal’s announcement and all those that would be incurred until the deal closed. While this clearly met the Fed’s objective of avoiding the bankruptcy of a major swap counterparty, it left JP Morgan hung out to dry. Although the board of Bear had agreed to support the deal, it legally only could commit to recommend the deal to the Bear shareholders. It agreed to submit the deal repeatedly to the shareholders for a period of a year but could not legally guarantee the deal would be closed.

This was incredible to us. The Fed had stopped a derivative meltdown but JP Morgan had irrevocably guaranteed the Bear trading obligations without certainty that the deal would close. The Fed had also agreed to backstop a $32 billion pool of Bear assets. It occurred to us that since the Bear shareholders now had the JP Morgan guarantee and a Fed backstop, they could vote to reject the deal. JP Morgan had guaranteed Bear’s trading obligations for potentially no compensation. They had accepted all Bear’s pain for possibly no gain!

Indeed, since the deal was at $2 per share for a stock that had traded at $30 on the previous Friday, what incentive did the Bear shareholders have to do the deal? CEO James Dimon of JP Morgan Chase was reportedly furious at the poor drafting by his legal and financial advisers. The problem had to be fixed. The next weekend Bear and JP Morgan hammered out a new deal at $10 per share. The Bear board agreed to issue the legal maximum of 39.5% of its shares to JP Morgan without a shareholder vote which would ensure the deal would close.

Hasty Deregulation

In one fell swoop, after a weekend of hurried dealings in the face of what it perceived to be financial doom, the Bernanke Fed changed the regulation of U.S. financial institutions forever. This cannot be understated. Investment dealers have always fallen under SEC regulation and have had looser capital standards than deposit taking banks. Derivatives had always been considered “financial innovations” under Alan Greenspan with a Wall Street lobby that resisted any regulatory intrusion into their bold and brave world of financial engineering. Now that the Fed had put taxpayer dollars at risk by rescuing Bear Stearns out of fear of the collateral derivative damage to banks, the jig was up for “regulated lite” investment dealers and unrestricted derivatives.

Paul Volcker, Greenspan’s tough predecessor as Chairman of the Fed, was not amused by the Bear rescue. In a speech he pointed out the massive regulatory stretch by the Bernanke Fed: “The Federal Reserve has judged it necessary to take actions that extend to the very edge of its lawful and implied powers, transcending in the process certain long-embedded central banking principles and practices,” he said in a speech to the Economic Club of New York on April 8th (Volcker Says Fed’s Bear Loan Stretches Legal Power, Bloomberg.com, April 8, 2008). Volcker was also concerned that a dangerous precedent had been set: “The extension of lending directly to non-banking financial institutions — while under the authority of nominally ‘temporary’ emergency powers — will surely be interpreted as an implied promise of similar action in times of future turmoil”.

Born Again Regulation

Like their predecessors after the Great Crash of the 1930s, politicians have already circled to assign blame to the evil doers of Wall Street. The present Congress started in early April by publicly shaming the Wall Street executives who collected huge personal payouts while investing in shoddy derivative deals that had melted down. The recent announcement that bank examiners were being assigned to vet the Wall Street investment banks is the final nail in the coffin of Alan Greenspan’s deregulation dreams and derivative risk shifting fantasy.

Now that the Wall Street bleeding has been staunched with taxpayer backing, the question of what happens going forward is becoming easier to discern. We think that the Fed and the rest of the Washington financial complex have experienced a “born again” conversion to big government and regulation. Where the markets and easy money monetary policy were the answer to any economic ill during the Greenspan era, government direction is now the solution. To those who point out the temporary nature of the Fed’s myriad of programs, we point out the temporary measure called income tax that was instituted during the First World War.

The current response of market manipulation and direct government intervention in the United States has more in common with Putin’s crony capitalism and China’s directed capitalism than it does with what Schumpeter called the “creative destruction” of capitalism. Perhaps Professor Bernanke’s Fed embodies the “corporatism” or directed socialism that Schumpeter postulated would result from democracies voting to avoid the destructive downturns of capitalist economies.

Economic theorists aside, we are clearly seeing that capitalist governments, both democratic (U.S.) and “directed” (China), will not permit the pain inherent in periodic market cleansings to disturb their social or financial fabric. This risks the true benefit of market economies, the efficient allocation of capital and scarce resources. The question of why the U.S. government allowed Bear Stearns shareholders to be sacrificed and the JP Morgan shareholders to be enriched by the Fed’s action needs to be asked. Is it really different from the Putin government’s destruction of Yukos and its support of the other politically pliant Oligarchs? Both governments see their policies as furthering their national objectives.

Slow or No Growth

That things are different after the Bear Stearns rescue is obvious. What remains to be seen are the ongoing distortions to the global economy and financial system caused by this new enthusiasm for government intervention. It is clear that developing countries struggling with foreign exchange problems or financing deficits are not likely to accept the historical World Bank prescription of “short term pain for long term gain” when developed nations like the United States won’t swallow their own bitter medicine of financial market adjustment. We think that the orchestral lessons of the “Maestro”, Alan Greenspan, are not lost on other global financial and economic bureaucrats. Why pull just some of the behind the scenes levers when you can pull them all?

It now seems apparent that the United States is entering a recession or a period of very slow growth. The Fed and bond market bulls are hoping desperately that this will be accompanied by a sharp reduction in inflation. This is probably the only outcome that justifies the current low level of administered rates and Treasury bond yields. We are not sure that this will be the case. We have maintained for some time that there is a reasonable risk of recession combined with inflation in the United States.

Is the Free Ride for American Consumers Ending?

The direct market interventions and monetary stimulus of the Fed are easing the credit crisis but risks higher levels of inflation going forward. In the face of rising energy and food prices, easy money policies provide more fuel for movement upwards in the U.S. and global price levels. The weakness of the U.S. dollar is raising the inflation danger level as well. The dollar has suffered as the Fed lowers U.S. interest rates. When Paul Volcker was asked whether he predicted a dollar crisis after his speech, he responded: “you don’t have to predict it, you’re in it.” This means higher prices for American consumers. As an excellent New York Times article puts it, “The free ride for American consumers is ending”.

“Developing countries have had bouts of inflation before. Indeed, some are famous for them, like Brazil, which experienced triple-digit inflation in the late 1980s and early 1990s. But two things make this time different, and together promise to send prices higher at Wal-Mart and supermarkets alike in the United States, just as the possibility of recession looms. First, developing countries now produce nearly half of all American imports. Second, inflation in these countries is coming at the same time that many of their currencies are rising against the dollar. That puts American consumers in a double bind, paying at least some of producers’ higher costs for making their goods, and higher prices on top of that because the dollar buys less in those countries.” (Asian Inflation Begins to Sting U.S. Shoppers: New York Times, April 8, 2008)

Soaring Prices and Dragging Financials

The developing countries that have pegged their currencies to the U.S. dollar as an export strategy are now experiencing the inflationary downside of rising U.S. dollar commodity prices and their money supply expansion. Food prices are soaring and citizens are on the streets protesting, sometimes violently. Faced with this rising social discord, China and many other developing nations with U.S. dollar pegs are instituting price controls and food rationing. Given the rising global tide of U.S. dollars that will result from Mr. Bernanke’s monetary ministrations to America’s ailing banks, the commodity inflation could get worse.

The tension between an economic slowdown in the United States and global inflation is acute. If the U.S. slowdown in consumer demand slows the rest of the global economy substantially, the prospects for moderating inflation are reasonable. If not, higher prices are inevitable. Perhaps there was a bit of longing when Mr. Bernanke testified before the Joint Economic Committee on April 2nd. “It now appears likely that gross domestic product (GDP) will not grow much, if at all, over the first half of 2008 and could even contract slightly,” Mr. Bernanke told lawmakers”. The Fed Chair cannot express a desire for a recession to reduce inflation pressures but it seems to be his only hope of meeting the price stability portion of his mandate.

The outlook for the financial markets is improved, since the Fed’s direct interventions and monetary ease have oiled the seized gears of the credit markets. They have not, however, improved the underlying profitability of financial institutions. Liquidity has been restored but the gravy train of securitizations and private equity buyouts has jumped the tracks and lies in a smoking derailment of discounted securities. The steep yield curve will eventually work its magic on deposit spreads for banks but loan losses and security write downs have yet to peak. Credit spreads are easing, but funding and capital requirements should make for a healthy supply of financial issues overhanging the market. Overall, we think that the financial sector will continue to be a drag on the equity market and economy for some time.

Student Loan Disruption and Parent Eruption

The non-financial sectors are definitely slowing as consumers retrench due to falling house prices and dearer credit. Desecuritization and tighter credit standards mean that credit will continue to be tight for some time. This suggests that the U.S. is in for some credit problems outside of the mortgage sector. We can see this in the student loan market where lowered government funding and credit market dislocation has meant a severe disruption of student loan funding. Private student loan lenders dependent on securitizations have stopped making new loans as their funding dried up. Legislators are now scrambling to make sure funding is available for the critical June to September student loan season. There are few things angrier than a parent unable to finance their child’s education and this is an election year. Legislators have now given the Department of Education the ability to buy Federal guaranteed loans to free up lender capital to make new loans. If Bernanke and Co. is now exchanging Treasuries for assorted and sordid investment dealer creations, why wouldn’t the Feds buy loans guaranteed by the U.S. Treasury? As we have said, government intervention is back in vogue in Washington!

Credit card debt, auto loans and mortgages are also much harder to fund in the U.S. and most other developed countries. Ford Credit and GMAC are now seeing rising loan losses on their auto loan portfolios. This all feeds through to credit availability and pricing. This is a substantial headwind for consumption and will reduce global final demand. Although the equity markets have recently rallied on the prospective effects of the policy efforts of governments around the world, we think it will be some time before actual profit improvement will occur. The risk is that sustained inflation will result in shrinking margins for manufacturers and rising interest rates on longer term bonds. This could see lower equity prices and wider credit spreads than is currently captured by the market consensus.

Financial Big Brother?

That being said, the efforts of Bernanke and his fellow central bankers have headed off the collapse of the global derivative banks. This brain trust is now concentrating their efforts on restoring the health of the balance sheets of the financial institutions they regulate. In the U.K., the Governor of the Bank of England “met” with the CEOs of the major banks to “suggest” that they do equity issues to allow them to get on with the important business of making loans available to homeowners. Not by happenstance is the recent announcement from The Royal Bank of Scotland of a major rights issue which will improve its ability to make new loans. Its capital ratios were depleted after its acquisition of AB Amro. It is also now going to pay some dividend in kind after protesting loudly not too long ago that its capital was sufficient.

Central banking has morphed into central planning. It is somehow appropriate to our times that Alan Greenspan, acolyte of Ayn Rand and believer in rugged individualism, indirectly released the hounds of bureaucracy into the financial markets by his unflagging promotion of derivatives and financial innovation. To turn an Orwellian phrase: