Last quarter, we used the metaphor of a highway for what we thought might happen to the economy and the financial markets. We believed that “this time is different” and that despite large doses of monetary liquidity, a la Greenspan, the global economy would be stuck in slow growth for a considerable period. A debt deleveraging is a drawn out process, absent very high levels of inflation. The reduction of debt and offsetting decline in spending by individuals and governments would make for a very grudging recovery which would put the economy squarely in the slow lane.

Into the Ditch of Financial Crisis

The response of policy makers was important. Their actions or inaction would decide the issue as they were driving and the rest of us were along for the ride. If they accelerated monetary or fiscal stimulus, we believed that things could move into the middle or fast lane. If they steered too much towards fiscal retrenchment and/or monetary policy was curbed by political factors, the risk would be veering right off the road. As it was, we thought we were driving on the rumble strips warning us that we were already onto the shoulder. A serious policy error might put us into the ditch of a financial crisis. Well, we were right. The recent economic entrails confirm that the real economy is barely growing in real terms. We also were right that a policy error could careen our economic car out of the slow lane and perhaps into the ditch of financial crisis.

The political shenanigans of Congress that threatened U.S. default cratered confidence and ended up in a historical downgrade of U.S. Treasury bonds from AAA by the S&P rating agency. With th e downgrade happening on a Friday evening after the stock market close, risk managers had the weekend to consider their response. The financial covariance models that underlay modern risk management demanded their due. Risky assets, stocks and corporate bonds plunged, and U.S. Treasuries, the assumed “riskless asset”, soared in response. Th at the downgraded U.S. Treasury Bonds rose in response was lost in translation from quantitative to common sense. That a discredited credit rating agency opinion was of any informational value whatsoever was not questioned even when the U.S. government pointed out that S&P had got their figures wrong. The market wanted to sell off risk to flee to the safety of Treasuries and it did.

Better to Sell on Rumour

Questions about the solvency of European financial institutions then arose from the decision to “bail in” bond investors with losses on the Greek sovereign debt. This created fears that other heavily indebted European nations could default to ease their debt burdens. France and Italy, both burdened with high debt loads, became suspect and their credit spreads widened. This put all European financial institutions under credit suspicion. Investors then began pulling funds from them indiscriminately led by U.S. money market mutual funds still feeling the pain of the Lehman default. It was better to sell on rumour than to suffer in default.

The balances on deposit at the European Central Bank climbed as even European banks chose to leave their monies on deposit with the ECB rather than risk it with each other. The panic soon spread back across the Atlantic. U.S. banks suffered their own crisis of confidence as the Federal Housing Finance Agency, the regulator of bankrupt Fannie Mae and Fred die Mac, filed a lawsuit against the major money center banks for misleading representations and warranties on mortgage securitizations done at the peak of the housing boom. In the spirit of kicking someone who is down, Bank of America was sued for transgressions done by Merrill Lynch and Countrywide well before they were acquired by BOA. The fact that Fannie and Freddie lobbied Congress extensively for the right to buy subprime mortgages at the time and attested to their credit sophistication in Congressional hearings was lost in the clamor. With all the lawsuits, all banks could go bust and U.S. banks were sold off as well. The wisdom of the Obama administration saddling the banks with seemingly unlimited damage claims at a time when the financial system was recovering is questionable. Like the Tea Party’s campaign to default on the U.S. government’s debt, this was definitely a doozy of a policy error!

The result of all the policy nonsense was a global financial panic beginning in mid August. Bank stocks plunged anywhere from 30% to 50%. Bank credit default swaps gapped wider as counterparties hedged their exposures to the banks. Prophets of economic doom dominated the airwaves with plenty of advice for policy makers. By September the panic was in full flight with bruised and battered investors recoiling in horror from the volatility and price carnage.

The Fed Twisting and Shouting

Of course, Ben Bernanke and the Federal Reserve were drawn into battle against all enemies of American financial stability, foreign or domestic, real or imagined. At the August 9 th meeting of the FOMC, they announced that since things were worsening economically, the discount rate would be left at zero at least until 2013. This was a “shout out” intended to assure investors that they could assume financial risk due to the certainty that interest rates would not increase unexpectedly. Demonstrating the law of unintended consequences, the stock market sold off in reaction to the Fed’s grim economic outlook and bank stocks were hammered as investors realized that the carry interest from the banks’ large holdings of government bonds would be minimal.

On September 21st, due to Wall Street’s demand to “do anything” to ease its pain, the Fed launched Operation Twist. This is a program of selling short term Treasury bonds of its existing “quantitative easing” portfolio and using the proceeds to buy long Treasuries. It is intended to lower long term interest rates without expanding the money supply. Lower rates, the Fed explained, would make for cheaper financing for businesses and consumers, thus creating stronger economic growth. Once again, Professor Bernanke and his PhDs on the FOMC ran into unexpected consequences. Due to the fear of financial collapse and market uncertainty, long treasuries were already in short supply and soared in price. Far from financing a rush into risky assets, the rush into Operation Twist caused credit spreads to widen further and added to the sell off in risky assets. Stocks continued further down and investment dealers continued liquidating their portfolios of corporate bonds in favour of front running the Fed into long Treasuries!

One might ask why the Fed still continues to throw curve balls at the unsuspecting markets. It is trying to instill confidence but its efforts seem to destabilize whatever market equilibrium there is. Monetary policy is obviously going to continue very loose for quite some time in any event. Despite the financial turmoil in Europe, the economic statistics have actually been coming in above the dire forecasts of those who believe that the financial and economic end is near. Investors and the markets are ignoring the positives and focusing on the negatives.

It’s Hard to be Happy on Wall Street

The financial markets are in a deep funk, perhaps brought about by the realization and recognition that the self-interested gravy train of financial innovation is drawing to a close. Voters and politicians alike are on to the fact that the thoroughly modern financial markets are rigged against them. The bankers lobbying hard against meaningful financial reform had their arguments thoroughly eviscerated when a junior UBS trader, Kweku Adoboli, blew $2 billion in a trading loss. UBS had maintained its risk management was excellent and its “value at risk” on any trading day was $80 million. The fact that Adoboli’s transgressions date back to 2008 was a show stopper. The Swiss government and public were not amused after having rescued UBS during the financial crisis in 2008. The argument in favour of the “universal bank” as a national Swiss champion now seems a trifle irrelevant.

Are things as bad as portrayed by the sensationalist financial media and gloomy bank strategists? Just remember, these strategists go to work each morning past “Occupy Wall Street” protestors camping out to protest greedy banks and bankers. At work, they know the financial turmoil of the past quarter has meant a large drop in underwriting income and quite possibly trading losses. In the mercenary world of investment banks, this means substantial layoffs to lower expenses in line with reduced revenues. Bonuses will also be well down as they should be. An institutional client is suing Goldman Sachs and their compensation committee for paying out large bonuses to employees while profits and the stock price plummeted over the past few years. Personally, these “experts” should be in a grim mood and we think it is colouring their outlook considerably.

Trading Rumour and Innuendo

We also think the fears of a Greek default are overdone and are probably already impounded in the market. U.S. and European bank stocks are down by up to 50% since early August which reflects a lot of bad news. Credit default traders are responding to innuendo and rumour and pushing prices out on very little substance. The CDS of Morgan Stanley blew out 3% after the ZeroHedge website, reputedly run by a disbarred stockbroker guilty of insider trading, ran an article on Morgan Stanley’s exposure to France. That his figures were flawed was not important to the professionally ignorant traders who reacted to the “news”.

What will happen with Greece?

It will default either covertly or overtly. The Europeans want to manage the process to avoid a Lehman like crisis. The current plan is to keep the bonds at par but extend the maturities and lower the coupons. This is the time tested bank remedy of keeping the book value high while earnings fill the hole. This is a crisis of balance sheets and confidence, not liquidity. Will it lead to a systemic breakdown of the European financial system and the collapse of the Euro? We think not.

Good News from Europe??

The market wants quick and obvious resolution to the crisis. This won’t happen. The Europeans are hampered by a political structure that can’t respond quickly. On the other hand, slowly but surely Europe is putting together its solution. The good news is starting to appear, much to the chagrin of those who thrive on the Armageddon scenario. Europe created the European Financial Stability Fund (EFSF) and is now expanding its capital. Most of the Euro zone countries have approved the increase in capital and at the time of writing only Slovakia had still to act. The successor to the EFSF, the Europe an Stability Mechanism (ESM) is slated to go into operation in 2013. The ECB has also created a swap line for unlimited U.S. dollars to provide dollar funding to the European banks that are shut out of the U.S. money markets. It also restarted a credit crisis program to lend for longer terms of up to 13 months. Most importantly, it reinstated a covered bond purchase program. Covered bonds are a key source of European bank finance and this is a very important development.

With these programs, European banks have access to adequate liquidity. Most banks have already large liquidity reserves in any event which allow them to continue for months if not years if they are effectively shut out of the credit markets. The concern with European banks is one of capital and solvency and not liquidity. The Euro zone finance ministers met in early October and it seems they have resolved to take national action to stand behind their banks before the EFSF and ESM come into operation. Whether this takes the form of a TARP like capital injection or debt guarantees, it would go a long way to reduce the immediate panic and hysteria.

Some Want a Messy Greek Default

What is important to remember is that there is a huge constituency for a “messy” and uncontrolled Greek default. Those holding CDS on a Greek default will get nothing paid out on their “insurance” from the current restructuring deal. The “voluntary participation” of a mere 21% loss by private creditors was ruled not an event of default by the International Swaps and Derivatives Association (ISDA). There are literally billions at stake and those hoping for an involuntary Greek default that would meet the CDS definition are obviously promoting this outcome in the markets and the media. They might still be disappointed. Where there is a will there’s a way and it now seems that the Europeans are now moving in the right direction.

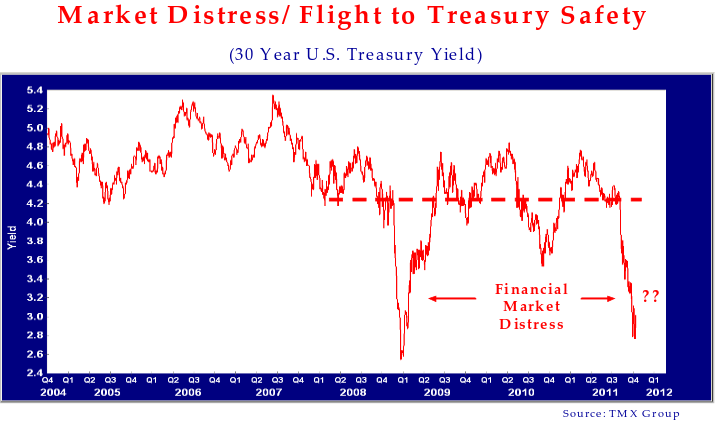

You still might ask why we believe that the financial world is not coming to an end with the obvious distress in the capital markets. We show the yield of the 30 year U.S. Treasury in the chart below.

Fighting the Last War??

The 30 year treasury yield plunged during the credit crisis in 2008 as it has during the current 2011 Euro debt scare. In 2009, it didn’t take very long for the yields to go back up to where they were previously. Like now, market commentators then focused on the worst case scenario to justify the very low treasury yields.

We show the “normal” level of long Treasuries in the dashed line. Drawing a line on a chart is less than persuasive, you might suggest. Inflation is bound to trend downwards as a result of the drop in commodity prices due to the current crisis and the economy will weaken. Yes, but inflation fell and the economy weakened in 2009 when long Treasury yields rose 1.6%. Our simplistic take is that the very low current government yields are a result of the sheer terror and tremendous uncertainty over the Euro debt crisis. Like old generals, the consensus is fighting the last war, that of bank illiquidity and potential failure.

The difference this time is that corporate yields, apart from financials, have followed Treasuries down. Inspecting the chart, one could conclude that yields will soon be rising from the emergency low levels. Yes, inflation will fall with commodity prices and the Fed is Operation Twisting, but absent all Europe disappearing into a financial abyss, we believe the stampede into the safety of government bonds will subside as the crisis exhausts the market emotion. The other odd thing is that the current market fear is that governments, albeit Euro and peripheral, will default on their debt and that there won’t be the political will among perfidious Europeans to remedy the situation. Wasn’t it the U.S. that started this crisis with the Tea Party advocating defaulting on the U.S. debt?

Go with Gut Feel

Our gut feel is that banks have reacted to all the negatives by selling inventories and reducing risk as directed by the very models that failed UBS. They also are trying to increase liquidity “just in case”. Like the last financial panic, the current crisis will eventually be resolved at something better than the market’s worst fears. Right now, we believe it is a time to be buying and not selling. The prophets of financial doom are having their days, weeks or perhaps months but the underlying situation is not as dire as they expect or predict.