The Canadian corporate bond market was not for the faint of heart in the third quarter of 2011. The budget debate in the United States and the subsequent downgrade of the U.S. from AAA combined with the Euro debt crisis to send government yields lower. Canadian credit spreads moved well wider in sympathy with the swoon in the global credit and equity markets.

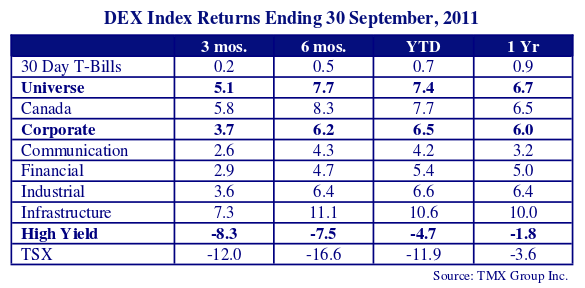

This can be seen in the table below of the performance of the DEX Universe Bond Index and its component indices. Contrary to the prophecies of doom for the bond investor, the panic over the Euro debt crisis sent bond yields much lower and bond prices much higher. T-Bills returned a paltry 0.2% in Canada, compared to a robust 5.1% for the DEX Universe. Equities plunged globally, with bank stocks down up to 50%. The TSX was down 12% as investors abandoned commodity stocks. Even gold was down, in clear defiance of infomercial and internet spam investment advice.

Government bonds were the recipient of the flight to safety in a perverse response to the downgrade of U.S. Treasuries. Ben Bernanke and the Federal Reserve reinforced the uptrend in long Treasury prices with “Operation Twist” and bought up long bonds. Canadas soared 5.8% in the quarter while corporate bonds lagged at 3.7% as credit spreads widened. Financial and communication bonds struggled well behind at 2.9% and 2.6%. Canadian high yield bonds swooned at -8.3% as credit reality finally caught up with this new and improved “Made in Canada” market.

Clearly, credit was not the place to be in the quarter with corporate bonds underperforming Canadian government bonds by 2.1%. Financial bonds underperformed Canada bonds by 2.9% as the global banking crisis affected even Canada’s banks. The laggard sector for the quarter was Communications, as long spreads backed up on the sizable Rogers and Shaw long issues. Infrastructure followed the lead of provincials with their long duration and higher prices recording an excellent 7.3% return.

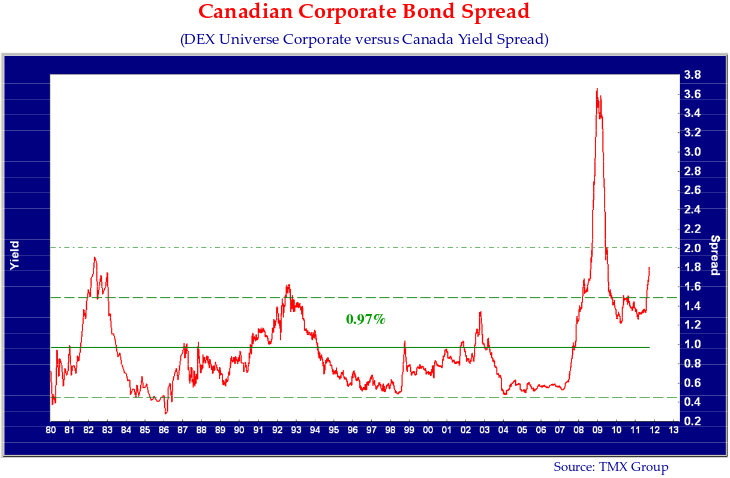

High Corporate Bond Spread

The yield spread on Canadian corporate bonds moved out by 0.42% from the end of July to the end of September as can be seen in the following graph. The current 1.8% spread is well above the average 0.97% since 1980 and the highest level since 1981, excluding the credit crisis levels of 2008. It is just shy of the 1.9% level during the severe 1981 recession.

The value in a corporate bond at 1.8% above its Canada cousin is obvious. The question is whether we are proceeding down the path of a Credit Crisis spread blowout. If credit spreads proceed out to the 2008 wide of 3.6%, it would mean a capital loss of over 10% for the holder of a corporate bond, which would not be made up for by the extra yield.

Obviously, sentiment over the Euro sovereign debt and banking crisis (see Canso Market Observer) is very bad and after surviving the debacle of 2008, Canadian bond investors can’t be faulted for waiting to see what happens before they leap back into credit. Most Canadian bond portfolio managers are already “overweight” corporate bonds and this has hurt their performance versus a Universe benchmark heavy in government bonds. Right now, with very poor secondary liquidity, most are “trapped long” in corporate bonds in any event and have been involuntary participants in the “pain trade” as spreads have widened.

Spreading the News

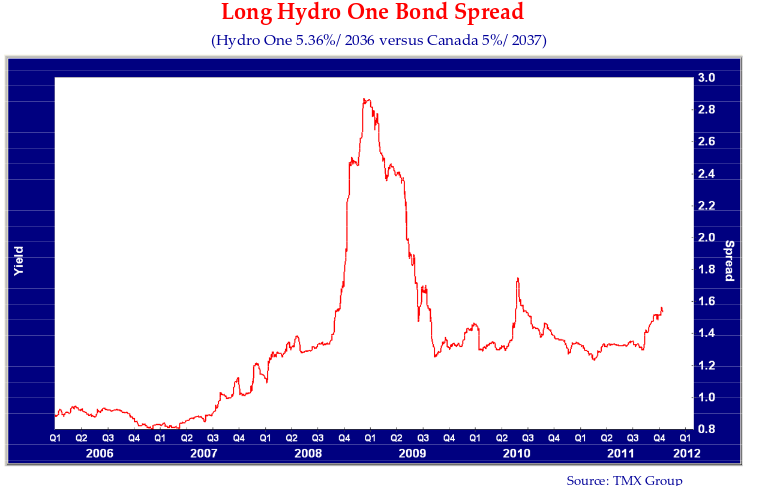

The bad news is that spreads have widened. The good news is that we don’t expect Canadian corporate bonds to reprise the unmitigated disaster of the credit crisis. As Exhibit A for our view, we turn to Hydro One, our “canary in the coal mine”, for confirmation that our positive outlook is warranted.

Hydro One is the regulated electrical transmission utility for Ontario and is not highly exposed to the vagaries of the global capital markets. In the chart on the previous page, we show the graph of the yield spread on a long Hydro One bond versus a similar maturity Canada bond. This yield spread was 0.8% in early 2007 and rose to 1.4% in 2008 as monetary policy tightened. It then blew out to 2.9% as liquidation by CDOs and other leveraged players substantially widened all credit spreads globally during the 2008 Credit Crisis.

It then took almost a year for the spread to subside to the pre-crisis level. Note the spike of 0.5% during the previous Greek Euro debt scare last spring. Things then got back to normal until the recent widening from 1.3% to almost 1.6%. This is nowhere near the highs of 2008 during the credit crisis and is even subdued compared to what happened last year. So, you say, why does this matter? Spreads could blow out, as in 2008, if the Euro crisis moves into high gear and all the countries of Europe default.

Things are Different This Time

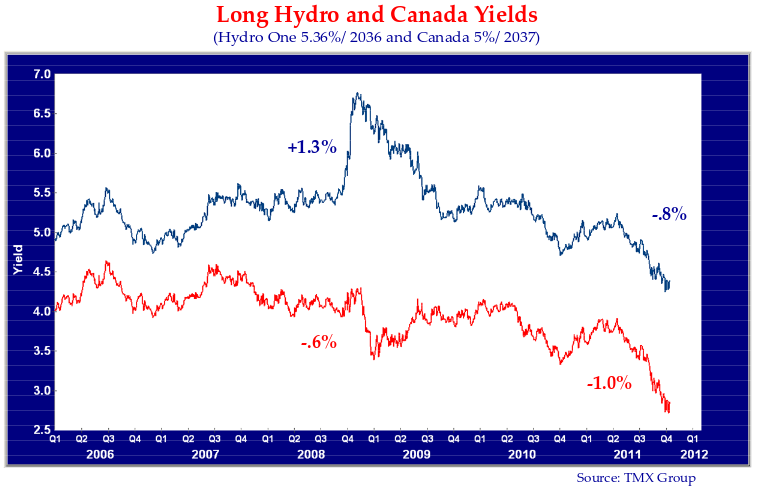

Since the spread is the result of subtracting the Canada yield from the Hydro One yield it is useful to take a look at the underlying change in yields in the chart below. The yield spread increase of 1.9% during the credit crisis was a combination of the Hydro One yield rising 1.3% and Canada yields falling 0.6%. What stands out is the absolute rise in the Hydro One yield. This reflected the massive liquidation of credit by leveraged players like hedge funds and proprietary traders at investment dealers. A sale by a CDO of U.S. dollar TransCanada Pipeline bonds in the U.S. led to a sell off in Canadian dollar TransCanada issues in Canada and a rise in yield. A comparable utility like Hydro One rose in sympathy as the market yield rose.

Things are happening differently this time. In the current crisis, both Canada and Hydro One yields have fallen. The Canada yield has fallen 1.0% but the Hydro One yield has only fallen 0.8%, causing the spread to widen 0.2%. We believe this reflects the lower level of liquidation compared to 2008. The spread widening that we are observing seems largely to be investment dealers reducing inventories into their October 31st year end. This has not widened the credit spread by anything like what we saw in the Credit Crisis. Banks have been carrying much lower inventories than prior to the Credit Crisis and are restricting proprietary trading given regulatory change. The leverage available to hedge funds is also much lower due to margin tightening by their prime brokers.

A Plague on Maple Bonds?

The exception to this in the Canadian corporate bond market is the Maple bond sector. These are foreign issuers that raise funds in Canadian dollars in the Canadian domestic bond market. The experience with Maple bonds during the credit crisis seared many Canadian bond managers. After suffering the default of Lehman and the Icelandic banks, many have pulled back completely from this sector. They also have seen their clients modifying investment policies to restrict their ability to buy Maple issues. Overall, this means there are far fewer buyers for Maple issues.

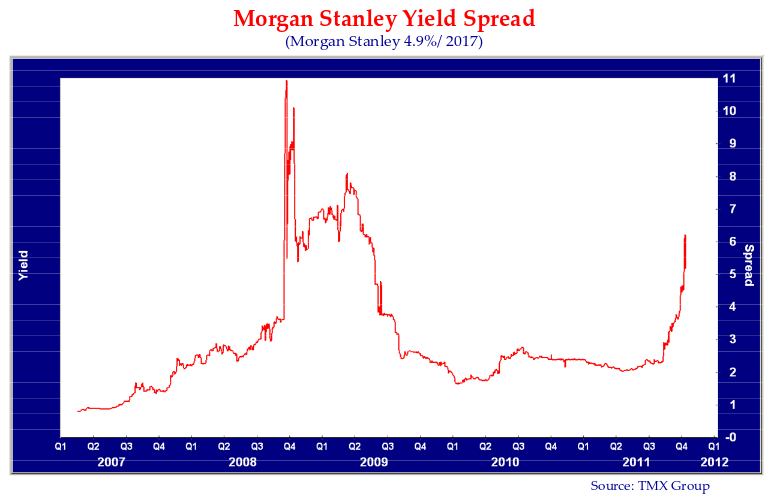

The financial sector of the Maple market has been hammered the worst as Euro and U.S. issuers tumble in their home markets. As yield spreads widened in Europe and the U.S., Canadian spreads moved out well in excess of other market levels. In the graph below, we show the spread of the Morgan Stanley 2017 Maple issue. While it is nowhere near the wide level of 2008, it has widened much more than in the U.S. market and far more than Canadian financial issuers.

Morgan Stanley has come under more pressure as the investment dealer sector has fallen out of favour with worries over a European and global banking crisis. There were internet rumours over its lending exposure to France and concerns over reliance on wholesale funding despite a $180 billion liquidity stockpile. These moved the MS spread out in the rumour-mongering CDS market which in turn moved cash bond spreads by almost 300 bps. Due to the lack of demand for Maple bonds and selling by investment dealers and Canadian credit funds, MS issues have moved more than 1% higher in yield spread in Canada than the domestic U.S. equivalents. This is the same for Goldman Sachs and General Electric Capital issues.

The Canadian investors who were so besotted with U.S. investment dealers in 2006 now avoid these “pigs” like a financial plague. The result is a rare situation where these Maple bonds can be bought at substantial yield premiums to their home markets if one believes they will survive this financial panic. We have taken the opportunity to add to our holdings in several very cheap Maple names.

An Elvis Sighting Index??

What is a bond investor to do in the midst of so many investment crosscurrents? The answer is to look at valuations. What is absolutely hated, despised and trading at very wide spreads? Maple financials answer the description, especially brokers and banks. What is absolutely loved and priced for perfection? Government bonds come to mind.

The consensus now hates banks and other financial institutions due to the coming “debt collapse” that is obvious to one and all. Internet chat rooms and taxi drivers subscribe to this prevalent view. Economists and investment strategists who didn’t even know what a CDS was a few years ago now follow them very closely. They’re probably not aware, as detailed in a recent academic study, that providers of these “fear measures” get their data from parsing emails between traders and clients. I wonder if they’ll start to follow the “Elvis Sighting Index” based on parsing email spam?

While we shunned things financial and believed bankers had departed from credit reality in the build up to the last Credit Crisis, we now once again defy the consensus and dare to believe that there will be a bank or two that survives the current hysteria.

Europe will dither and dally but eventually the crisis will be resolved one way or the other. The global financial system could take some hits but it will likely survive. When the uncertainty fades, we think the current spreads will narrow with considerable upside.

Income Safety is Not Government Bonds

Right now, those portfolio managers heavily weighted in government bonds are no doubt telling their clients how defensive their portfolios are. The clients should be asking the important question of what they will do next. With the DEX Canada Index yielding 1.6%, there is a lot of bad news built into the prices of government bonds. There also isn’t much income available to investors.

The average bond mutual fund fee of 1.5% pretty well guarantees a zero return over the next year for a fund totally invested in Canada bonds. With long Canadas at 2.7%, pension fund liabilities have gone up while their large equity holdings have gone down. Corporate bonds might seem risky at present, but financial income starvation ends ultimately in failure for investors whose portfolios will dwindle as capital is spent.

This is why we are still very bullish on corporate bonds, given the historically very wide spreads. If yields stay low in a disinflationary or even deflationary environment, the current 1.8% spread on corporate bonds is higher than the current yield of 1.6% on Canadas. Doubling one’s income in a diversified portfolio of corporate bonds is an attractive thing to do. At the long end, the 3.2% spread available in Rogers Communications long bonds is pretty attractive to a pension fund stuck in long Canadas at 2.7%. If rates rise, if and when the fear of financial disaster fades, downside of government bonds is high. In this scenario, yield spreads on corporates would narrow and limit the price decline of these issues.

As bottom up value managers, we know any macroeconomic forecast is prone to error. Forecasting political machinations and decisions is even more perilous. All we can say is any outcome short of total failure of the world financial system argues for corporate bonds. We don’t know what will happen if and when Greece defaults but in the current financial panic, much downside is already built in. As the late Baron Rothschild is credited with saying, “The time to buy is when there’s blood in the streets, even if the blood is your own.“