The second quarter of 2015 was one of booming bust, unfortunately for citizens of Greece and China’s retail investors. As the financial world waited to see if the U.S. Federal Reserve would get on with raising interest rates, China’s “Mom and Pop” stock investors and Greece’s Syriza party decided to risk financial oblivion in an attempt to turn back the financial clock to happier times. Their risk taking didn’t turn out well in either case and certainly didn’t stop the clock ticking towards dearer money in the U.S.

Radical Name Calling

With the financial expert class quite habituated to crisis watch, Greece held their focus once again. Negotiations between the new radical left Syriza government and Greece’s creditors descended into name-calling and a seemingly unbridgeable gap over continued austerity. Greek Prime Minister Tsipras then shocked Europe and called a national referendum on continued austerity. The Euro creditors pointed out that the referendum was really a vote on continued Euro zone membership. Without austerity, they said, it was back to the Drachma since the Greek government was running deficits and wouldn’t have enough Euros to pay its obligations.

An Expensive Temper Tantrum

The creditors were right. If someone didn’t supply the Greek government with Euros to spend, the only way around austerity was to print Drachmas. We had actually finished our draft of this newsletter over a week ago but it seemed a trifle premature to publish it while we were waiting for the results of the Greek referendum. Greek voters ignored the financial detail and they shocked the financial markets and voted “NO”. The referendum at the time seemed to be a “world changing moment” but now might go down in history as the most expensive temper tantrum of all time.

The Greeks might have been 60% against austerity, but they were more united in their opposition to leaving the Euro zone. Polls showed over 80% of Greeks wanted to keep the Euro. Greek Prime Minister Tsipras and Finance Minister Varafoukis had assured Greeks that they could reject austerity and keep their Euros when they encouraged them to “strengthen their negotiating position” by voting to reject the creditor demands. Varafoukis also assured Greeks that their banks would reopen on the Tuesday after the referendum. This did not turn out to be the case.

Voting Their Deposits

Greece had to declare a bank holiday as the European Central Bank froze its emergency funding ELA (Emergency Liquidity Assistance) to Greek commercial banks. Like all banks around the world, the Greek banks take in deposits and use them to make loans. The problem for the Greek banks is that their Greek depositors, fearing a return to the Drachma, were massively taking their Euro deposits out. They preferred to hold cash Euros rather than deposits that might be converted to Drachmas or “hair cut” in an attempt to recapitalize the Greek banking system. The withdrawals jumped as desperate depositors lined up to withdraw all the Euros they could after the referendum was announced.

The referendum triumph is looking increasingly hollow. As the Greek economy grinds to a halt with an extended bank holiday Tsipras had a choice of submitting to the creditor requirements or having a serious financial and economic meltdown. He submitted.

Game Theory

At the time of writing, the Greek government has agreed to a deal with its creditors even tougher than the one overwhelmingly rejected by Greeks just a week before. Prime Minister Tsipras recommended it to the Greek Parliament saying “it was like being asked to choose between your money and your life”. He is right in his characterization. A departure from the Euro zone would be disastrous for the Greek people. Mr. Varafoukis has resigned and his “game theory” negotiating tactics have turned out very badly for the Greeks. His mistake was thinking that the Eurozone would have to compromise with Greece for fear of “contagion”. This was not the case as the very bad news for the Greeks turned out to be not so bad for the rest of the world.

On Friday June 26th, the Greeks and the world went into the weekend expecting a resolution between the Greek government and its creditors. Tsipras then called the referendum on Saturday June 27th and by Monday it was obvious there was a complete breakdown in the negotiations. Based on prior experience during the Credit and Euro Debt Crises, the expectation was for dramatic turmoil in the global financial markets. Stocks did fall, peripheral Euro bond yields rose and “safe haven” bond yields dropped in Germany and the U.S. The damage was quite limited compared to the worst of the Euro Debt Crisis. The Euro actually rose in trading by the end of the day on the Monday after the referendum announcement.

The Greek negotiating strategy was that a Greek departure from the Euro would hurt their European creditors so much that they would be forced to weaken their austerity demands. A German newspaper ran a picture on its front page showing Mr. Tsipras holding a gun to his head saying “Stop or I’ll Shoot” which summarized things quite well. There was no doubt that an exit from the Euro zone would have been financial suicide for most Greeks but they estimated a very high cost for Europe.

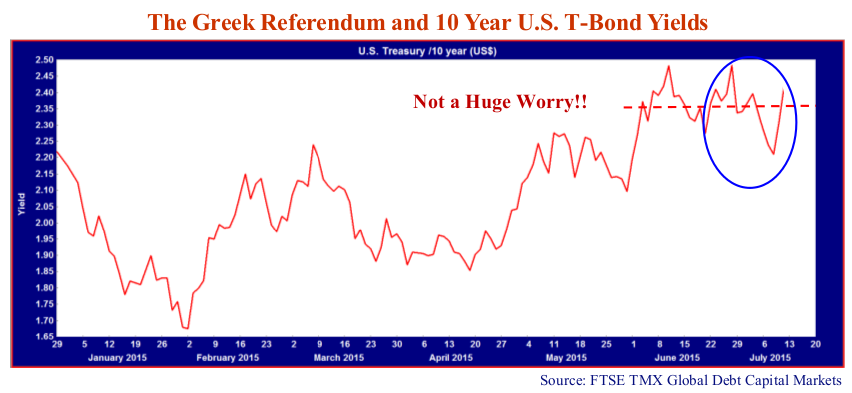

Unfortunately for the Syriza government and Greek people, the moderate response of the financial markets seemed to suggest that the markets believed that the rest of the Europe would do just fine. This reduced the Greek negotiating power significantly. The chart below of the U.S. Treasury 10 year yield doesn’t indicate much stress from the current Greek debt debacle at all, which placed the Greeks in the unenviable negotiating position that they are currently in.

The U.S. T-Bond 10-year yield had climbed from 1.7% in February to almost 2.5% in June just before the Greek referendum was announced. We have circled the period of the Greek debt negotiations. Note that the yield fell to 2.2% after the referendum was called but have now almost gone back to where they were prior to the referendum call. It is clear that we are not repeating the Euro Debt crisis hysteria when U.S. yields plunged on a flight to safety.

As many an expert has pointed out, it sometimes takes quite a while for the stresses of financial problems to surface. That being said, Greece is a very small part of Europe and the real issue is whether people assume other countries would exit the Euro after Greece. After the pain that Greece is so publicly going through, we think the other peripheral Euro countries like Portugal, Spain and Italy are having an object lesson in the true social and political costs of an involuntary exit of the Euro monetary zone. Empty ATMs and crying pensioners in front of shuttered banks do not make a great sales pitch for financial irresponsibility. It might be better to actually collect taxes and reduce government spending than end up with a vastly depreciated national currency that buys far less.

Bull in a China Stock Shop

China has been experiencing its own financial bust. The naïve belief of inexperienced Chinese retail investors that the Chinese government wanted the stock market to go up had them employ margined stock investing on a massive scale. Margin investing was fine on the way up as it amplified the gains but it is now amplifying the losses on the downside. Margin calls are now panicking investors despite the attempts of the Chinese government to calm things down.

Despite the efficient market dogma, investors are prone to very human emotions. As Canso has always believed and Professor John Coates has now demonstrated with his physiological research, financial markets are anything but efficient. The euphoria and panicked terror of the Chinese stock market boom and bust shows this in spades.

It is not surprising that the Chinese government is finding it difficult to stop the downdraft in Chinese stock prices. It’s not that they’re not trying. They have suspended trading in individual stocks, forbid insiders from selling stocks and directed state-linked entities and stock brokerages to start buying. Despite all this effort, stocks are still down 30% from the peak.

Invincibility Meets Reality

This is not surprising from an investor psychology point of view. Coates and other researchers have shown that the chemicals and hormones of the human body overrule logic in traders on both the upside and downside. As Coates terms it, traders are a “clinical population” rather than the logical humans who set prices in the efficient markets of financial theory. Testosterone, generating feelings of invincibility, urge those with gains to take even more risks as with the Chinese investors employing huge levels of leverage. On the downside, cortisol freezes investors with foreboding and doom.

We are currently reading a book called Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson. It recounts the life of John Law, a Scotsman who convinced France to introduce paper money and create a Royal Bank to finance France’s deficits. He then created the Mississippi Company that benefitted from the vast increase in money supply and ended up in a stock speculation and bust on a massive scale. The term “Millionaire” was first used to describe those who had made a killing on the Mississippi stock that soared in value with no fundamental underpinnings. Law became a classic stock promoter, making up things to maintain an ever-higher stock price. None of the riches and resources claimed by the company were actually there and things ended very badly for the investors.

Gleeson published her book in 2000 and refers to the “Irrational Exuberance”, as Alan Greenspan termed it, of the then booming speculative dot.com stock markets. The Chinese authorities should read this book before they go to far down the path of trying to manipulate their way out of a stock margin boom. The French ended up in a complete financial collapse and eventually in the French Revolution despite their massive efforts to avoid a bust. The Chinese seem to have stabilized their market by cease trading over 50% of their stocks and having government affiliated entities buy stocks. Only time will tell if they end up like the French.

ZIRP All Yield

All the excitement with Greece and China obscured the reality that the Federal Reserve really doesn’t have much of a reason anymore to remain at emergency “Battle Stations” for its interest rate policy. It became clearer over the quarter that U.S. employment was sustaining at non-recessionary levels. As we saw in the chart above, this made U.S. and global bond yields rise in spite of the drama with Greece.

Despite the media limelight on China and Greece, we think the important issue for the global financial markets is whether or not the U.S Federal Reserve will finally do away with its ZIRP (Zero Interest Rate Policy) and tighten monetary policy. As we have said many times before, more money is much more popular than less money.

Ms. Yellen and her colleagues have looked for every excuse to delay the inevitable. The Greek crisis and first quarter slow down in the U.S. economy offered up a reason not raise the Fed Fund rate in June. The easy money junkies in the financial markets are desperately hoping for a further delay in September, but the writing is on the wall due to a reasonable U.S. economy and a vastly improved employment picture.

Now we are at the opposite juncture in the Inflationista/Deflationista sparring match. The serious (consensus) investment thinkers are firmly convinced that deflation is inevitable and it very well could be. On the other hand, our experience and reading of investment history suggests that such a popular investment notion usually has little chance of becoming reality.

What’s Normal?

The real question is what will be the “normal” level of bond yields once monetary policy is restored to a more normal operation. The Fed will obviously be creating less money and interest rates should increase as money becomes harder to obtain. As we have shown many times on these pages, the normal level of historical interest rates is for T-Bills to be at 2% above inflation and bonds to be another 1% above this yield. Humans quickly become habituated to their present situation and most of us cannot conceive of yields being any higher than they are at present. With 10-year U.S. treasury yields now at 2.4%, there definitely is room for yields to increase.

Loony Tune Yields

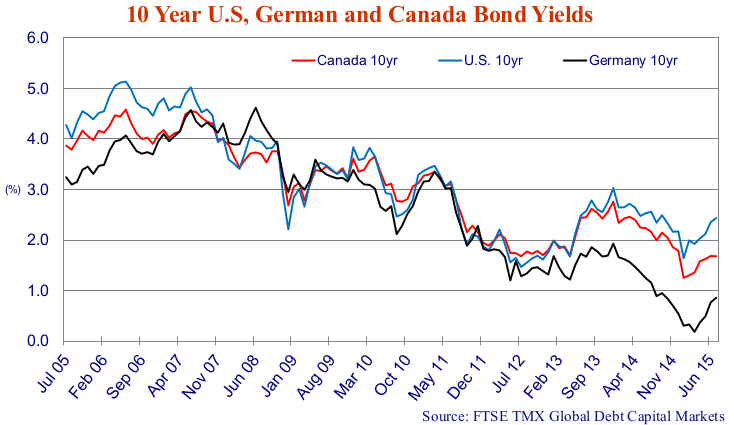

In our last Market Observer, we discussed the negative yields that were then in fashion in Europe. Our rather mundane observation was that an investor would have to be Loony Tunes to engage in such behavior, despite the nattering of the investment fashionistas. Sometimes it pays to be grumpy and unfashionable and this time was one of them. Our observation that negative yields depended on the Greater Fool theory was spot on. The chart below shows that despite Greece and China, yields have been rising since the lows in early February. Investors in German bunds have been slaughtered as the 10-year bund rose from .1% to the current .84%, despite the Greek dramatics when one would have expected a flight to quality into bunds.

Hopefully the Greeks yanking their deposits from their banks didn’t invest in the German bond market. A yield increase of .7% might not sound serious, but it translates into a 5% decline in the value of a “flight to safety” 10-year German bond. As we have said frequently in the past, the increased sensitivity of bonds to yield changes (longer duration) means that small changes in yields create large changes in bond prices. Everyone loved the increased prices on the way down in bond yields but we are not so sure that they will like the significant downside to their bond prices on the way up.

Playing the Interest Rate Fool

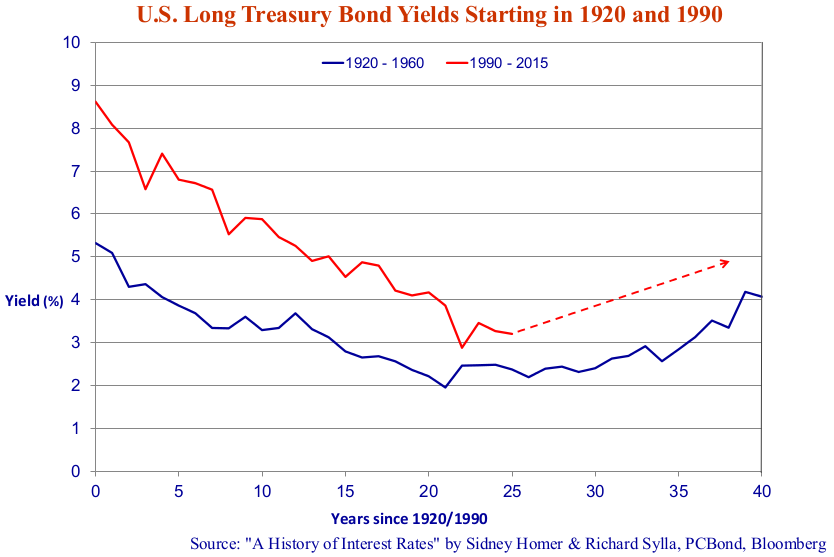

We believe that trying to forecast interest rates is a fool’s pastime. However our discipline is valuations and history is our guide. Our chart comparing U.S. Treasury yields in the periods from 1920-1960 and from 1990 to the present in our last edition generated a lot of interest from our readers so we have updated it for the recent increase in yields. If history is our guide, then we have definitely seen the bottom in yields and we should have an increase in the 1% area over the course of the next few years, as we show with the dashed red line.

1920 was just after the First World War ended. Our supposition was that this was a period when the immense industrial capacity created by the war caused a debt financed capital boom and eventual deflationary pressures. 1990 was a period where the “Peace Dividend” from the end of the Cold War and the collapse of the Soviet Union led to another capital boom and deflationary bust. The human, financial and technological capital that was diverted from military spending to consumer goods and capital investment was immense. Add to this the productive capacity of Eastern Europe and China, and we were set up for a similar capital spending boom and deflationary bust to the 1920s.

We were quite surprised by the historical parallel in interest rates, as were our readers. We really shouldn’t have been, since we are firm believers in the business and credit cycle. If history is indeed our guide in this case, we are looking at a reflation which most central banks around the world are attempting to accomplish. We don’t know if and when interest rates will rise, but based on history, the potential returns on fixed rate bonds could be negative for a number of years. Demographically and technologically, as we have discussed in previous editions, there is a case for inflation to stay low but our bet is that the governments and central banks will succeed in creating some inflation. This means that at best we are looking at modest returns for fixed income.

The temptation for investors, governments and voters will be to demand better economic performance through both monetary and fiscal policy stimulation. An economic improvement is unlikely, given the very low returns to incremental capital investment, given the large existing capital stock. The problem for fixed income investors is that if monetary policy succeeds in its quest to find the holy grail of higher inflation, it could result in what the good professor Thomas Piketty, the author of Capital in the Twenty First Century, calls “euthanasia of the rentier class”.

We are not being paid to assume the massive interest rate risk inherent in fixed income investments at the current very low level of yields. If and when interest rates rise, current bond yields are much too low to offset any price depreciation. We plan to avoid the bond euthanasia with our shorter portfolio term and high floating rate debt positions.