Turn Out the Lights… the Party’s Over

Back when network television was a big thing Monday Night Football was even bigger. When the game was out of reach Don Meredith crooned the Willie Nelson classic “Turn Out the Lights… the Party’s Over”. Those lyrics might be even more appropriate now in our Netflix streaming age with the Federal Reserve on the brink of raising interest rates.

It seems strange and almost surreal that the decades’ long fixed income party might finally be coming to an end, despite Greece teetering on the brink of financial oblivion and the Chinese stock market melting down. The U.S. Federal Reserve now seems determined to “normalize” interest rates since most of the Credit Crisis economic damage has been repaired, especially in the healthy U.S. labour market.

Last Call For Monetary Inebriation

While the ultimate outcome of the situations in China and Greece remain unpredictable, the raising of interest rates by the Federal Reserve sometime in the remaining months of 2015 seems almost certain. Janet Yellen has issued a very clear last call for monetary partygoers in her public statements and we expect that the easy money party is nearly over. When this widely expected and meticulously telegraphed event occurs it is certain to have a very real impact on the bond market. Ms. Yellen has taken great pains to prepare the markets but we suspect the result will be much worse than she and the consensus believe. Remember the Greenspan/ Bernanke “measured increases”? Everything was fine until the financial world ended.

Investors, like all humans, become used to current conditions and the current bond investor’s best forecast of the future seems to be that the present environment will continue. We are not so sure. It’s not that bond investors don’t see what’s going on, it’s probably that things have been good for so many years that they cannot conceive of anything different.

All Good Things Must End

We point out that the FTSE Universe Bond Index has generated positive returns in all but three of the last 35 years so it’s only the old bond managers (and we have a few of those) who have seen a significant downside to bonds. We don’t think the future will be as kind to those in longer-term bonds. “All good things must end” but few in the bond market seem to be prepared. Very negative returns are looming for those who overindulged on longer duration assets during the “long and loving it” bond party.

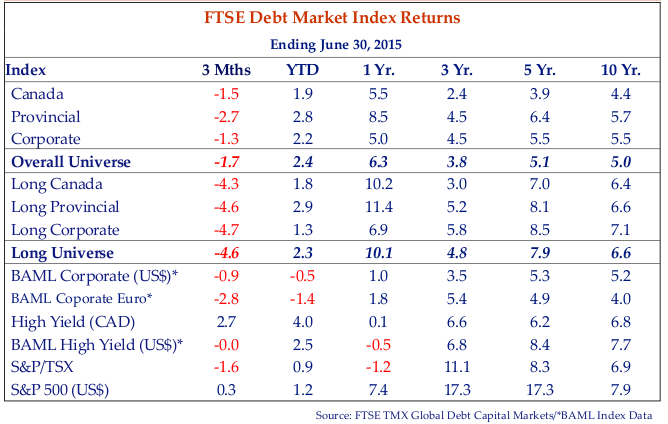

The 2nd Quarter of 2015 gave us a little taste of what might be in store for the bond market. Despite another “Greek Crisis Rally” in the last few days of the quarter, the Canadian bond market still had a negative performance as the chart below shows. The three months ended June 30th show red negative returns for everything but high yield bonds.

This Might Sting A Little

Yields reversed most of their first quarter declines while credit spreads moved modestly wider. The Overall FTSE TMX Index generated a -1.7% return in the three months ended June 30. The Corporate Index generated a -1.3% return, outperforming the longer duration Canada index at -1.5% and the longer still provincial index at -2.7%.

After a stellar first quarter, longer duration assets took it on the chin in the 3 months ended June 30, 2015. The FTSE TMX Long Bond Index generated a -4.6% return with long Canada’s at -4.3% and long provincials at -4.6%. The Long Corporate Index underperformed at -4.7% due to a combination of rising benchmark yields as well as widening credit spreads.

Why Do You Have to Be Like That?

Some might say it is not very nice for a specialty fixed income manager to predict the end of the fixed income party. To that we reply as we have since the beginnings of Canso – not all fixed income investments are created equal. Our predicted period of rising yields does not imply negative returns for all fixed income securities but security selection is paramount in the world we see ahead.

The fixed income party has all types –the life of the party, the hanger-on and, of course, the designated driver. As at a normal party, beer leads to wine, which leads to spirits, which leads to trouble as the night wears on. The finale of the bond party has not been pretty. All but the most prudent have stretched for yield through either duration extension or credit speculation. The most irresponsible have done both.

Over exuberance and overindulgence eventually lead to hangovers – both for the partygoer and the investor. Increasing risk for modestly higher potential payoffs is never a good idea and eventually can lead to catastrophe. The era of making easy money in the bond market by owning long duration assets is fast coming to an end. Despite this, many bond portfolio managers still cling to their “benchmark duration” to stay in the performance pack. This might reduce the performance risk for the portfolio manager but the risk has grown substantially for client portfolios. We point out that the Universe Index (then Scotia Mcleod) duration was 4.8 years in 1997 when we started Canso, compared to the current 7.4 years. The extra 2.6 years in duration means that the Universe falls an extra 2.6% in price for every 1% increase in its yield.

Just What Is Normal These Days?

It is quite easy to lose sight of just what is normal in today’s instant gratification culture. Ideas and experience are informed by technology, short and shallow, with a tendency to the absurd (insert your favourite reality television show here). In the financial markets, normal is a steady drumbeat of “market watch” and trite commentary. Deeper thought and experience is discounted in favour of lost cost and passive management. Our research based, bottom-up and long-term Canso approach seems positively archaic in a world dominated by celebrity, “selfies” and Snapchat.

At Canso we acknowledge some things have changed but there are many other things which have not. Call us old-fashioned but we believe the study of history is important in life and in the financial markets. Take interest rates. As we’ve explained many times in past Corporate Bond Letters, the “normal” levels of short-term interest rates are fair value at inflation plus 1-2%. With Canada’s last twelve month inflation reading of 1.0% this implies short-term interest rates of 2.0 – 3.0%. A positively sloped yield curve implies long rates of 4.0 – 5.0%. This means that even with a flat or 0% inflation rate, Canadian bonds are more than fully valued in the sub 2% range.

The Trouble With Normal

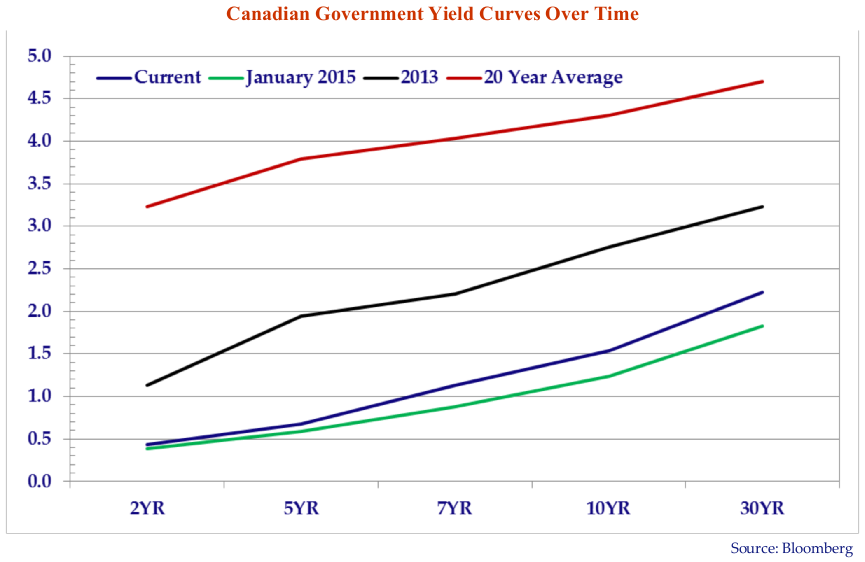

The Bank of Canada introduced inflation targeting in 1991. It took several years of jawboning to convince financial markets they weren’t kidding. The red line in the chart above shows the average Canadian government bond curve over the 20 year period dating back to July 1995. We think this is a fair representation of where Canadian interest rates should be in a normal environment since it spans the 20 year period that BOC explicit inflation targeting took effect. It includes periods of boom, like the dot.com stock markets and the current housing bubble, and bust, like the 1998 Asian Contagion and the 2008 Credit Crisis.

The Canadian yield curve fell to the all-time low levels shown by the green line following the surprise BOC interest rate cut in January. Rates have moved higher since then to the current levels illustrated by the blue line. Today’s levels are still well below the year-end 2013 levels illustrated by the black line. It is interesting to note the historical 20 year average long bond rate of 4.73% is within the 4.0 – 5.0% range we would expect based on our assessment of normal.

Low and Not Loving It

Canadian interest rates are very low and we believe that market forces may soon change this dynamic. International investors have believed and benefitted from the Canadian financial Nirvana story for 20 years. They are only now starting to understand the Canadian economic miracle may be coming to an end – or perhaps that it wasn’t a miracle in the first place. The commodity boom is over and the Canadian residential real estate market is overheated and seems destined for a speculative blow off. Borrowing imprudence at the individual consumer and provincial government level is a significant challenge.

We believe the inevitable path for Canadian interest rates is higher as the U.S. normalizes monetary policy. This view does not seem to be shared by Bank of Canada Governor Poloz who seems determined to run an independent monetary policy. This could be problematic for a small open economy. It would be nice to be able to forget about what the rest of the world is doing but sometimes reality bites. We were shocked when the BOC cut rates in January. We were not as surprised but just as disappointed when they cut rates again this week. We will point out the BOC administers rates only at the very front end of the curve – the overnight rate – and market forces determine interest rates out the yield curve.

Rapping Fifty Cent??

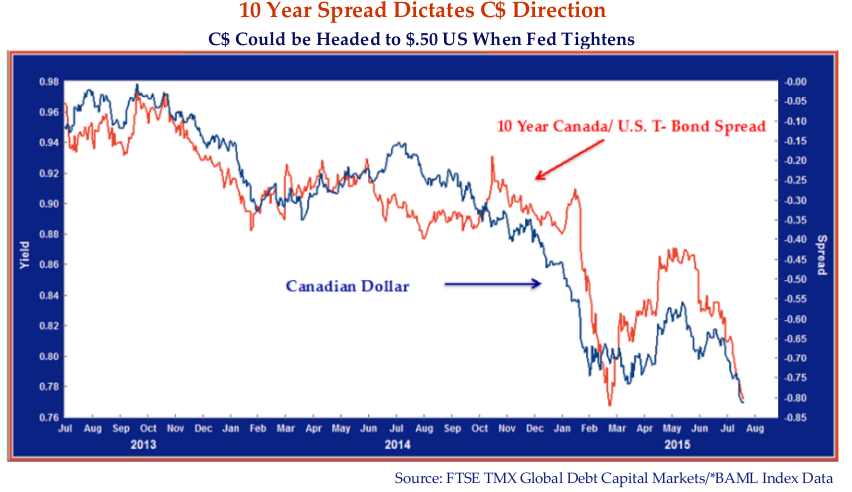

There is no mystery to what is happening to the Canadian dollar. The chart below shows the tight correlation between the 10 Year Canada/ U.S. yield spread and the Canadian dollar. The lower our interest rates compared to the U.S., the lower our dollar. Mr. Poloz seems hell bent on stimulating the Canadian economy through a lower Canadian dollar. Keeping Canadian interest rates much lower than the U.S. risks a currency crisis and a Canadian dollar in free fall.

If Mr. Poloz continues on this course of currency depreciation, we believe we could break through the 2003 low of $.62 U.S. To make its intentions clear, we would suggest that the BOC should have a public relations campaign featuring the aging rapper Fifty Cent. He would be cheap to hire, as he just went bankrupt. “Tanking the Buck” might be an appropriate theme Rap for the campaign.

The lower Canadian dollar doesn’t seem to be helping the economy. Governor Poloz admits to being “perplexed” by the lack of stimulation of the manufacturing from the much lower Canadian dollar. We have been saying for some time that cutting rates 25bps will not put one more drilling rig to work in Alberta and it will not bring back any of the shuttered manufacturing facilities in Ontario. It does risk a currency crisis and serious inflation.

Canada has significant structural disadvantages that have built up in the economic “Lazy Faire” of the commodity and residential housing booms. Ontario has very high energy costs relative to other provinces and more importantly many US states. Sergio Marchionne of Fiat Chrysler, a Canadian, pointed this out to Premier Wynne this week. The BOC rate cut only buoys the already overextended Canadian consumer – leveraged through inflated residential real estate fueled by low floating rate mortgage rates. The upside to inflation is already being seen in the CPI. The BOC is already discounting the elevated level of the “Core” CPI as a feed through from a lower dollar. Too bad consumers can’t pay in BOC adjusted terms.

The BOC rate cuts send an SOS signal to the international investment community that Canada is struggling without a practical benefit to the underlying economy. We expect international investors to start taking a more critical view of the Canadian sovereign (federal and provincial) credit situation. The downgrade of Ontario by S&P to A+ last week could be viewed as an early warning shot. We see a possible outcome as selling of Canadian government and provincial securities that will put upward pressure on rates out the curve and more downward pressure on the Canadian dollar.

Long Live the Canadian Drachma!

It’s one thing to lower the Canadian dollar to stimulate the economy but exchange trading is very momentum and trend based. Once currency depreciation takes on a life of its own, it is very difficult to reverse. We are now seeing more U.S. dollar based investment products. If financial product marketing is any indication, Canadians now seem to be grasping the extent of their loss of purchasing power. In the lead up to the recent Greek referendum, Greeks were told that a return to the Drachma would see their savings devastated by a 40% depreciation versus the Euro. From the post Credit Crisis high of $1.06 to the current $.77, Canadians have seen a 27% depreciation with what looks like more to come so we’re almost there. Long Live the Canadian Drachma!

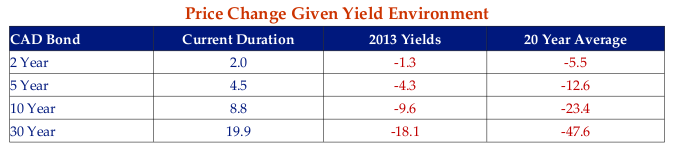

Pop Goes The Bond Price

The looming rate increase in the US by the Fed means that we are pretty gloomy on the prospects for Canada, the CAD dollar and especially longer duration assets. The following table highlights the potential impact of interest rate increase and it is not a pretty picture. The table demonstrates the impact of rate increases back to their higher levels in 2013 and the 20 Year Historic Average would have on bond prices. Note that the table assumes the rate changes are instantaneous. The results are sobering to say the least.

Our Spidey Sense is Still Tingling

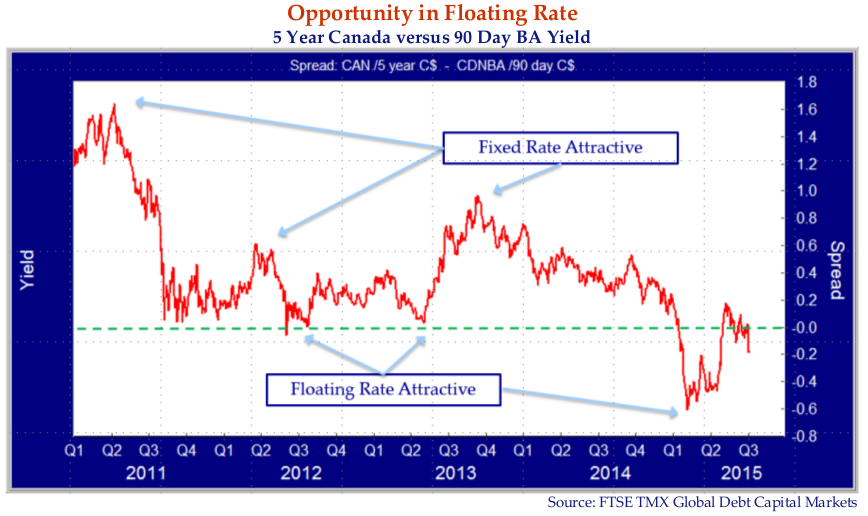

Canso’s investment process involves the ongoing assessment of relative value opportunities in the fixed income markets. In the first half of 2015 we sensed the combination of low yields and decent credit spreads made investment grade floating rate notes attractive versus fixed rate notes.

We appreciate that from the outside our increase in floating rate assets might be interpreted as a top down call on interest rates. This was not the case as the key driver of our move to floating rate was a view of the more attractive relative value in floating rate notes over shorter maturity fixed rate bonds.

The chart below illustrates the dramatic shifts that occurred in between Canadian 90 day Bankers Acceptances and 5 year GOC fixed rate bonds over the last 5 years. At the high points on the graph 5 year Canada bonds yield substantially in excess of BA’s and at these points fixed rate corporate bonds were very attractive. At the low points of the graph – most notably in the early part of 2015 5 year Canada bonds yield substantially less than BA’s (an inverted curve) and floating rate notes were extremely attractive on an all-in yield basis.

Last One Out Turn Off the Lights

We’ve been talking and writing for some time about the credit and liquidity challenges of floating rate funds backed by leveraged loans. Retail investors poured money into these products as a defence against rising interest rates with little knowledge of the credit risks of the underlying assets.

“Full, true and plain disclosure” is supposed to be the cornerstone of all securities regulation. Unfortunately thousands of investors have and continue to be duped into investment products without proper disclosure of the risks inherent. In the latest bout of concern over the lack of liquidity in the corporate bond markets investment funds backed by leveraged loans and other assets are now being allowed to take out credit lines in order to meet redemption requests.

It is hard to fathom how the bright lights at the OSC and SEC think allowing a fund the latitude to borrow money to meet redemptions is a good idea but apparently they approve. The stupidity of this leaves us speechless – almost. There are two circumstances under which a fund would need to borrow. The first the existence of a mismatch between the settlement dates for assets sold to raise cash for the redemption and the date of the redemption itself. The second is the inability to sell assets to raise cash.

Regardless of the reason, issues abound with funds borrowing to meet redemptions. In no particular order these issues are (not an exhaustive list):

- Who bears the cost of the borrowed funds?

- What if the settlement of the trade fails? Or the expected settlement date is substantially longer than anticipated (this is often the case with leveraged loans)?

- If the credit line is fully drawn and additional redemption requests are made who is entitled to proceeds from a sale of assets? The bank or the unitholder?

- Does the bank have priority claim on the assets of the Fund?

Finally, allowing funds to put credit agreements in place to meet redemptions brings to light an age old problem in Canada. The terms and conditions of these Credit Agreements are not disclosed to the public. Once again we highlight the good work of the Canadian Bond Investors Association (CBIA) an organization that continues to work on behalf of all Canadian fixed income investors. One key initiative of the CBIA is the requirement all credit agreements be publicly disclosed so investors can make informed investment decisions.

Farewell to a Friend

The allure of the investment business attracts all kinds. Among the thousands of analysts, bankers, salespeople and traders who populate the industry are more than a few hustlers, opportunists, and charlatans. The financial business is challenging, demanding and stressful and often brings out less than the best in people. Most careers are measured in months and years.

People of character and integrity stand tall above their peers and these are the people that Canso chooses to deal with. To that end we pay tribute to our good friend Tom Fernandes who retired this month after over 40 years of distinguished service on the Fixed Income Sales desk at Merrill Lynch Canada. Tom dutifully served the needs of Canso and his other clients through bull markets and devastating crashes. No matter the circumstance Tom’s approach was hardworking, humble and thoughtful. Throughout his long and storied career Tom was the consummate professional. He was always a gentleman with a big smile, a hearty laugh and a huge heart. We will miss him!

Tom’s honest and ethical approach serves as a reminder that honouring responsibilities to one’s firm and one’s clients can be done well and without compromise and we salute him for this. In both his professional and personal life there is no doubt Tom Fernandes is the definition of success. We wish Tom and his family nothing but the best in his much deserved retirement.

Things That Go Bumpf In the Night

What is Canso worried about these days? The latest installment of the Greek crisis? Russia, Ukraine and the Crimea? Chinese margin extension for stock market speculation? The price of oil or gold? There is a lot of bumpf out there to get one worried.

The musings of strategists, economists and Central Bankers provide occasional fodder for our daily meetings but these concerns do not cause us sleepless nights. Even our view that interest rates are going considerably higher doesn’t prevent a solid night’s sleep. Our study of investment history informs us that speculation and fear are endemic to the financial human condition.

In complicated times we rejoice in the relative simplicity of what we do. We find cheap things to invest in and strive to understand the risks we assume. Through the implementation of our well-defined process we emphasize issuer fundamentals and construct our portfolios to perform in spite of the broader macro picture.

We Can’t Control the Wind But We Can Adjust the Sail

Presently, we think the bond markets are in the final stages of an extended binge. Low yields, excessive leverage, loose covenants and super extended term financings all make us scratch our heads. We expect a period of rising rates, higher defaults, much lower recoveries and eventually, we believe, a return to more conservative lending standards.

We believe the biggest and least understood risk in the fixed income markets is duration. As yields rise investors will come to the sobering realization that rising rates can and will produce significant losses for holders of longer duration assets. The downside is huge!

Our bottom up fundamental relative value approach dictates that we are keeping duration as short as allowed through the use of investment grade floating rate notes. In our investment grade mandates we augment these with longer fixed rate securities with wider spreads. In our Broad and Value mandates we continue to invest in our special situations – Blackberry, Bombardier and Yellow Media too name a few.

Opportunity Always Knocks

After a period of strong performance, we frequently get the question of “What Will You Do Going Forward?” with the implication that it will be hard to repeat. Our answer is that we will look to take advantage of market opportunities when they present themselves as we did in the Credit Crisis and again in the Euro Debt Crisis. Our bottom up fundamental approach gives us the confidence to invest in securities that others avoid and to avoid securities others are clamoring for.

We are always asked the question of “When Will You Under-perform?” during our new business presentations. It’s not something that we preoccupy ourselves with, since we take a very long-term view and know that cheap investments are not popular by definition. We do what we do and really don’t care what other people are doing or what’s in the index. The answer is easy, we underperform when our investments are out of favour, as was the case in the Euro Debt Crisis, or more frequently when we are quite conservative in a speculative market as was the case in the lead up to the Credit Crisis.

The first quarter of this year saw us underperform as our shorter duration and credit caution hurt. This past quarter made up for the underperformance in the first quarter. Things have been seesawing back and forth since then in July but we expect if the Fed moves to raise rates in September, yields will definitely be in an uptrend which will benefit our shorter duration.

Right now, we continue to sell into strength. We expect that the next crisis will be one of rising interest rates and scarce capital, as burned investors bail on losing positions. As always, we expect there will soon be great investments available to those with the capital and discipline to invest. Long bonds, bank loans and high yield come to mind as we think investors will recognize that their stretch for yield has turned into a kamikaze price dive.

We look forward to illiquid markets and cheap investments. Until then, we are happy to do our research and watch from the sidelines.