2013 turned out to be quite good for risky financial assets, despite worries from the financial calamity contingent at the start of the year. Developed world equities were up strong double digits, junk bonds were up strong single digits and corporate bonds substantially outperformed their government cousins.

Safety Bites

It is not unusual for market rallies to surprise. A “Wall of Worry” seems to be a necessary precondition for a strong rally. Indeed, market rallies usually occur in the face of professional fear mongering. Experts who “got it right” in down markets refuse to believe in any potential upside and they are the ones getting the press coverage. Those who “got it wrong” are terrified at making further mistakes and are shell shocked, hiding deep in their fox holes.

U.S. Treasury bonds, the “safe assets” so loved by the investment generals fighting the last war, ended up costing their holders dearly. The absurdly low yields on safe government bonds of the Euro Debt Crisis and the Fed’s Quantitative Ease didn’t provide much protection from rising yields, as we have predicted many times on these pages.

Lack of Downside Surprises

The rally in risky assets wasn’t without drama. Despite political crisis after crisis, the U.S. economy refused to roll over and die, defying the gloom and doomsters. Even the charge of the Tea Party “Light on Common Sense Brigade”, which threatened a default on U.S. Treasury debt, didn’t convince consumers to head up to the hills with their rifles and pocket books. When the U.S. economy continued to surprise with tepid strength, the jig was up.

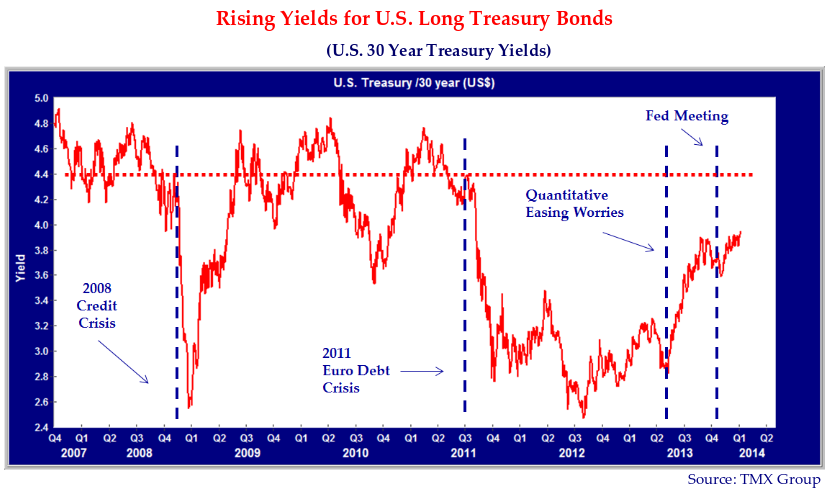

U.S. Treasury bond yields reached their lows in the third quarter of 2012 and have been rising ever since. The trend to higher yields accelerated in the summer of 2013 when Professor Bernanke began musing about returning Fed policy and yields “to normal”. The bond and stock markets then had palpitations at the thought that the novel Quantitative Ease program might end and yields could actually rise. The good professor quickly backtracked with a “Just Kidding” but left the door wide open to end QE.

In the fall, the U.S. economy continued to surprise to the upside, or perhaps showed a lack of obvious downside, and the stock market regained its vigour and resumed its upward climb. The stock rally of course evoked the requisite negative voices questioning valuations but was not to be blunted in its charge.

Credit Dressed

Corporate bonds, junk bonds and bank loans were also bid up further in value, as the credit markets embraced risk with abandon. Government bonds were now saddled with the “Loser” tag. This forced consensus bond managers to buy into risky credit to dress their portfolios in the latest fashion of Wall Street. Risk was back in vogue with market strategists and funereal bonds were definitely “OUT”.

The question became not whether the Fed would reverse QE, but rather when they would. The experts of Wall Street, intellectually and emotionally invested in the “More Money is Better than Less” school of economic thought, called for a very long and extended period of further QE. It helped that the dovish Janet Yellen was nominated and confirmed as Ben Bernanke’s replacement as Fed Chair. What could be more monetary friendly than a motherly, left-leaning university professor from California???

Not More of the Same

Once again proving our theory that economists usually forecast that present conditions will continue, the Fed surprised economists at the December Open Market Committee Meeting by modestly cutting back their QE bond buying. This shocked the bond market into a belated recognition that things were indeed getting back to “normal” economically and inevitably for monetary policy.

This can all be seen from the graph above. It shows that long Treasury yields bottomed in July 2012, at lower levels than during the 2008 Credit Crisis, and then rose until March 2013. As complacency set in about the continuation of QE, yields fell until Professor Bernanke’s fateful musings about getting policy back to normal in May 2013. Yields then soared from 2.8% to 3.9% in September until calming words from Mr. Bernanke and the other Fed Governors lowered the yield to 3.6% by October. Continued strength in the economy moved yields back up and then the Fed delivered its “coup de grace” in December that sent yields at year-end to their highs for the year.

2013 hasn’t been a fun time for investors in government bonds. Long Treasury yields started the year at 3.0% and ended at 4.0%. This increase in yield dropped the long T-Bond price by 17%. The MLX Investment Grade Bond Index had a negative return for 2013 at -1.3%. Adding insult to injury, bondholders nursing their price wounds saw equities soar. The Dow Jones Index was up 29.1% and the broad market S&P 500 Index was up 31.9%. The riskier NASDAQ was up 36.1% with the global MCSI World Index up 22.5%. Even the commodity heavy TSX returned a very respectable 13.2%. So much for “avoiding risk”!

Grieving Bond Managers

Whoever said, “Hell has no fury like a women scorned” probably had never encountered a client who had missed a rally. Client discontent inevitably causes portfolio managers fighting a market trend to “throw in the towel”. In our last Market Observer, we used Elisabeth’s Kubler-Ross’ “Stages of Grief” to illustrate how bond managers would deal with what we considered the inevitable “normalization” and increase in bond yields. Even though the Fed has announced only a partial end to its QE ways, the consensus now realizes, to quote Churchill, that this is the “Beginning of the End”. This puts us well through “Denial” and “Anger”, past “Depression” and well into “Acceptance”.

Not Loving It

How much has investor psychology changed since the “Long and Loving It” days of the summer of 2012 when bond prices hit their highs? As we have opined on these pages in the past few newsletters, negative returns are not something that most bond investors are familiar with. The U.S. Barclays Bond Market Index returned -2.1% for 2013. This is one of only three negative return years since 1976. A Bloomberg article confirms our suspicion that the bond market had a lot of fair weather friends who would not be so pleased by negative bond fund returns:

“Bond mutual funds in the U.S. posted record investor withdrawals of $80 billion this year as investors fled fixed income in anticipation that interest rates will rise further… The redemptions, which were through Dec. 23, represented 2.3 percent of bond-fund assets… The previous annual record for redemptions from bond funds was in 1994, when investors pulled about $62 billion in the full year, or 10 percent of assets, as interest rates rose, according to ICI… As investors retreated from bonds, they returned to stocks. Exchange-traded and mutual funds that invest in U.S equities took in about $162 billion in 2013, the most since 2000, according to data compiled by Bloomberg and the ICI. The Standard & Poor’s 500 Index of stocks gained 30 percent this year.” Bond Funds Post Record $80 Billion in Redemptions in 2013 By Margaret Collins and Charles Stein, Bloomberg.com, Dec 31, 2013

Wither (ing) Yields?

So you are again witnessing the strange spectacle of a bond manager questioning the prospects for bonds. A fair question is what we think is in store for the bond market. Without spending too much time on “top down” economic thought, we direct our readers to our previous musings on the historical “normal level of yields”. To summarize, short-term Treasury Bills should normally be about 2% above inflation and the yield curve premium for long bonds adds another 1-2% above this. With the central banks of the world targeting 2% inflation, this implies 4% T-Bills and 5-6% for long Treasuries.

How quickly will we get there? Well, it depends on the markets and the monetary authorities. The Fed has taken great pains to say that it intends to err on the side of higher inflation in its attempts to reduce the “social cost” of unemployment. We don’t need to get too deep into the discussion of whether this policy shift risks reprising the 1970s “inflation unemployment tradeoff”. Suffice to say that we think that targeting a “minimum” 2% inflation eventually risks something higher. Janet Yellen, inbound as the new Fed Chair, clearly believes the “social cost” of unemployment is very high. What she thinks of the trade-off between the cost of inflation and unemployment is something that we will soon find out.

Steep on It

This argues for a very steep “yield curve”, the difference between short and long Treasury yields. This normally runs at 2% and has been over 4%. We think the Fed’s commitment to maintain loose monetary policy for the foreseeable future and err on the side of higher inflation makes for a very long period of low policy short-term interest rates and a very steep yield curve due to market forces. Since a steep yield curve is the most powerful economic portent we know of, this augers well for the U.S. economy.

This also suggests the prospects for the bond market are not grand, with no further increase in yields indicating returns at the level of current coupons of 3-4%. Rising yields would very quickly take returns to the negative territory of 2013.

Buff Equities

We think the equity market is in much better shape. Although some market pundits suggest that equity market valuations are “stretched”, they are referring to the recent past. Price earnings multiples in the stock market are not excessive compared to historical norms. We also think that the U.S. and European economies are on the mend and will see better days ahead.

Cresting of the Commodity Wave

The cresting of the credit boom in China and the resultant bust in commodity prices is not good for those economies that did well while others struggled. We think China, Australia and Canada will struggle with slow growth if not enter recession.

Commodity prices are already in decline as all the capital investment from the peak years has come on stream just in time for falling prices, as is always the case. Gold bugs still argue for their first and eternal love but the double-edged sword of ETFs (Exchange Traded Funds) flows has cut deeply. While ETF gold buying forced prices up during the bullish price run, the opposite is now happening. As Bloomberg reported:

“Investors pulled $38.6 billion from gold funds this year, the most in data going back through 2000… Holdings in the 14 biggest gold ETPs plunged 33 percent since the end of December to 1,764.1 metric tons, on pace for the first annual decrease since the funds started trading in 2003, data compiled by Bloomberg show. The removals, along with slumping prices, erased $74.5 billion in the value of the assets.”

Gold Bull

It is hard to overstate the speculative demand for gold during its manic price increase phase. As we remarked in our April 2011 Market Observer, the enthusiasm for gold had at that time moved beyond its normal religious fervor to cult status: “Is it Time to Stockpile Gold Bars? Gold bugs are promoting gold as the only financial asset worthy of investment.”

Things are now much different. The speculators, recognizing a failing trade, are bailing:

“Billionaire John Paulson, the largest holder in the SPDR Gold Trust, the biggest ETP, said on Nov. 20 that he personally wouldn’t invest more money into his gold fund because it’s not clear when inflation will quicken. (George) Soros sold his entire stake in the SPDR Gold Trust in the second quarter.”

The institutional shift into commodities as an “Asset Class” now also seems to be reversing. CALPERS, the California public sector pension fund and leader in the shift into commodity investment, has cut and run from commodities as an “asset class”.

The emerging markets are also experiencing the flip side to the money fools rushing in where Angels fear to tread. As investments flows reverse, they will find that fundamentals don’t matter. Brazil already has seen the collapse of Eike Batista’s resource empire into bankruptcy as capital became dear.

Accentuate the Positives??

The first draft of this publication was met with some criticism, if not catcalls from the Canso bleachers. The observation was that the message was not upbeat enough, and risked depressing our readers. Your editorial staff was taken aback, since the authors did not feel this “disturbance in the force” in their literary efforts.

Dr. Doom Sings Mama Cass

We actually are quite upbeat on the U.S. economy, Europe and the risk markets and have been since the depths of the Euro Debt Crisis in 2011. We also have been saying that the chance of another financial meltdown is very low. Even bankers are not stupid enough to go bust when they are being stuffed full of cash by the central banks. It can take some time to transition from the negatives to the positives. Now even the media stars are getting into the act. Nouriel Roubini, the preeminent Doomster, is sounding a bit like the Mama Cass song “It’s Getting Better, Growing Stronger”:

“The advanced economies, benefiting from a half-decade of painful private-sector deleveraging, a smaller fiscal drag, and maintenance of accommodative monetary policies, will grow at an annual pace closer to 1.9 percent,” … Moreover, so – called tail risks will be less salient in 2014.”‘Dr. Doom’ Roubini gets bullish on global economy CNBC, 2 Jan 2014

Yes, we are quoting the now positive “Doctor Doom” on the not so negative prospects for the world economy and financial system. How’s that for POSITIVE!

Of course, the cheering section can be quite wrong when it comes to the markets and economy which should give one pause. In defence of “going with the grain” and risking being consensus, we think it is still very early to be a contrarian. If one feels the need to defy the consensus, that’s fine for psychological empowerment but it is not a great investment strategy.

The Economy Cashes In

We think the consensus is becoming positive, as it should. Is it ill-considered to think things are in good shape? We think not. We are a long way from unbridled enthusiasm and speculation. Accommodative monetary policy might very well turn out to be inflationary but this will take some time. Rising short term interest rates are also quite a ways off. Loose monetary policy means that aggregate cash flows in the economy are still rising. This is good for the price of financial assets.

Yes, we see pockets of speculation in bank loans, high yield bonds and social media plays in the stock market. Does this mean all financial assets are risky? No, it simply means that overvalued assets are risky and should be avoided. Once yields rise to a “normal level”, we think the financial markets will settle down as they realize that it is better to have a good “real economy” than great financial markets.

Aiding and Abetting

Market commentators, largely employed by financial institutions, have a huge vested interest in “More Money” or loose monetary policy. Since more money translates directly into higher financial asset prices, they are always in favour of looser monetary policy. Since higher financial asset prices mean more money to invest and better bonuses for those who aid and abet investment, it is very hard to find an economist or market strategist who argues against looser monetary policy. Profits for financial types mean lots of money to pay lobbyists to keep the gravy train from pulling out of the station.

A Central Lack of Income

The problem is that if Main Street does not start sharing in the growth, we think that the political climate will reflect the poor economic conditions. Politicians know this with their instinctive bank bashing, especially in the U.S. and U.K. Central banks seem to be the last to “get” that their efforts are inordinately benefitting the already rich.

Perhaps the central banks will recognize that keeping financial incomes low is counterproductive. In National Accounting, GDP (Gross Domestic Product) equals GNI (Gross National Income). Lower interest payments for debtors means lower interest income for lenders. Savers in bank deposits are eking out barely positive real returns while rich investors with stock portfolios are seeing strong gains. Rising interest rates would especially benefit retirees dependent on interest income and the solvency of pension plans who pay their pensions.

The Real Reality

When it comes to the non-financial and mundane business of actually making things, we are very positive about the potential for real growth in the “real economy”. The business vogue of “offshoring” benefitted countries with low cost labour. As cheap machines and technology are increasingly substituted for cheap labour, we think the “reshoring” of manufacturing will inordinately benefit the developed economies.

The real economy also looks to us to be in its innovative phase, where new technologies are widely adopted and adapted. This happened during the Depression in the 1930s where automobile, air travel and the radio came into widespread usage after being discovered much earlier. This does not mean high returns to investors in these technologies, as excess capacity will drive down pricing and keep inflation low. On the other hand, it will be excellent for high real growth and real consumption.

We have a sneaking suspicion that perhaps things will turn out much better than the consensus is expecting. We close with some more Mama Cass lyrics:

“That it’s getting better, growing stronger… It isn’t half of what it is going to turn out to be….”