“Nobody Told Me There’d Be Days Like These”

It is unlikely the late John Lennon was referring to losses in his fixed income portfolio when he penned his punchy ditty in the late 1970s. The song, released posthumously in 1984 on the Yoko Ono album Milk and Honey, refers to “strange days indeed”. Unfortunately, 2013 was a strange year for many fixed income investors as their “safe” bond investments produced negative returns for the first time in many years.

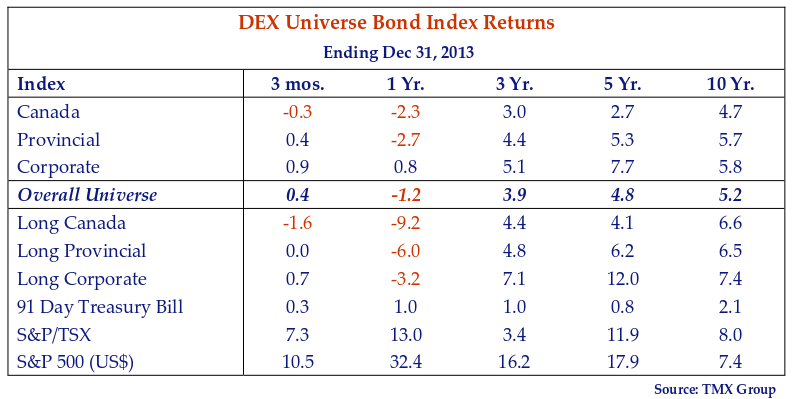

As the table above of the returns of the DEX Indices shows, the overall Universe Index returned -1.2% in 2013. Most sectors of the DEX Index were quite negative, with the Canada Index down 2.3% and the Provincial Index, with its longer duration, down an even more negative 2.7%. The overall DEX Universe Index was kept in moderately negative territory by the barely positive return of the Corporate Bond Index up +.8%.

Long bonds were savaged by rising rates. Long Canada bonds were down 9.2%. Contracting yield spreads led to better outcomes for long Provincial bonds at down 6.0% and long Corporate bonds down “only” 3.2%!

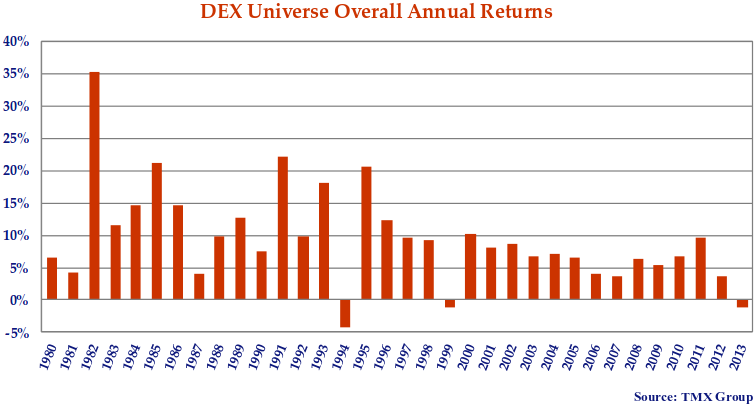

Many investors operate under the misconception that one never loses money in the fixed income markets. The following chart of the annual returns of the DEX Universe Index, Canada’s bond market benchmark, shows why people might think that way. The DEX Universe has only produced negative annual returns 3 times in the last 34 years.

The DEX Universe fell 4.3% in 1994 when the FOMC surprised the markets in February of that year with the first in a series of rate hikes. This resulted in a dramatic increase in U.S. Treasury yields and significant losses for fixed income investors around the globe. The bankruptcy of Orange County and Mexico were collateral damage from the Fed’s efforts.

The DEX Universe dropped 1.1% in 1999. The unwind of the Long Term Capital Management hedge fund and the aftermath of the Russian debt default created significant strain on the global financial system. This caused a dramatic widening in credit spreads and losses for fixed income investors.

The negative 1.2% return of 2013 resulted not from “crisis” but from the simple fact that interest rates finally increased. Things that have fallen too far must eventually rise as long-term interest rates did. This upward move came in spite of the continued anchoring of short-term interest rates by G7 central banks and the ECB.

A collective wail from fixed income investors rose as the DEX Universe Index average return of 9.5% since 1980 vaporized and entered negative territory in the last half of 2013. When their grieving is over, investors and their advisors will undoubtedly compare this year’s negative fixed income returns to the stellar returns of equity markets: 32% for the S&P 500, 37% for Nasdaq, and even 13% from the commodity-heavy S&P/TSX.

The natural response of investors who have been left behind is to chase after the high returns that they have missed. It will take discipline and courage to fight the instinct to abandon fixed income investments. We believe the mistake is not in being invested in fixed income but rather in investing in the wrong segments of the fixed income market. We are not believers in indexed bond strategies. At Canso, we have favoured shorter duration corporate securities including investment grade floating rate notes because of their attractive yields. These performed very well when compared with the longer duration provincial and government securities which currently dominate the DEX Universe Index. We continue to see value in the Canadian corporate bond market at current credit spread levels, even in a rising interest rate environment.

Despite our value oriented ways, we come up for air from time to time to assess what is happening in the world around us. We are keenly aware of goings on in the financial markets and discuss events and trends frequently as part of our investment process. We review below a few events that captured our attention in 2013.

Grin and Bare It?

Each passing day of 2013 reduced the sting of the 2008 Financial Crisis. Its close cousins, the Euro Debt Crisis and U.S. Fiscal Cliff of 2011, became a more distant memory. The healing process was helped by the distraction of a revealing corporate crisis. In a great example of “grinning and baring it”, lululemon athletica inc. announced the discovery in March of unacceptable levels of “sheerness” in a batch of black luon fabric – the key building block in the trendsetting company’s flagship yoga pant. The resultant recall and inventory shortfall brought unwanted exposure to the company as well as many of its unsuspecting customers.

While customers and shareholders chafed at lululemons’s missteps, the U.S. Congress tried its best to get attention by precipitating catastrophe. The debt ceiling, budget battles, tax rates, entitlements, immigration reform, gun control and health reform seemingly went unnoticed as the economy rolled along. The paid by the minute pundits and 24 hour news stations did their best to foment crisis but it was not to be. Past political deadlock on any one or heaven forbid several of these issues would have sent the financial markets into a freefall and participants into a state of panic and paralysis. This was not the case in economically improving 2013. The mantra “that which doesn’t get fixed cannot hurt you” seems to have taken hold and lifted the markets. Even the 16 day U.S. government shutdown could not derail a rebounding U.S. economy, buoyant equity markets or Miley Cyrus’ unnerving tongue wagging habit.

Y-Eike-s Over Falling Commodities

A little over a year ago, Brazil’s Eike Batista bravely predicted he would soon become the world’s richest man. A scant 12 months later much of Mr. Batista’s corporate empire sits in the hands of creditors and his multi-billion dollar net worth has evaporated into the Sao Paulo skyline. Bloomberg reported in January 2014 that Batista “has a negative net worth.” At the risk of understatement, the Brazilian tycoon failed to appropriately manage expectations – most significantly his own. When commodity tycoons and companies meet excess capacity and falling prices, the result is never good.

Only the Faces Change

In the staid world of central banking managing expectations (hopefully rational ones) is top of the list of key success factors. No matter that the faces change – Stephen Poloz became Governor of the Bank of Canada in July and in the United States President Obama announced his choice of Janet Yellen to succeed Ben Bernanke as Chair of the Federal Reserve (the Senate just confirmed her appointment) – the message remains the same. We expect both the Governor and the Chair to continue their predecessors’ policy of anchored short term interest rates through 2014. The gradual withdrawal (or “tapering”) of quantitative easing (“QE”) in the US is likely to continue under Ms. Yellen but gradual is the operative word. While not without controversy, the world’s Central Bankers are keen to trumpet that rates will stay where they are for a very long period of time. That said, Central Bankers have less control over long-term interest rates and we expect these to continue to move higher.

Substance over Form

In March following the surprise resignation of Pope Benedict XVI, the College of Cardinals elected Jorge Mario Bergoglio as the 266th Pope of the Catholic Church. We wish the Pontiff well as he seeks to corral and inspire the world’s 1.2 billion Catholics. His focus on substance over form and the “little guy” will hopefully be an example to corporate management who could use a little deflating of their self-enrichment ethos.

A Veri Good Deal

Continuing our play on things religious, we think “the wheat needs to be separated from the chaff” in the credit markets. One deal that caught our eye was the largest corporate bond deal of all time. Verizon Communications Inc. raised US$49 billion in September with a multi-tranche offering of fixed and floating rate debt securities to fund a game changing transaction of their own. Proceeds were used to fund the acquisition of Vodafone Group plc’s 45% stake in Verizon Wireless. The sale dwarfed the previous record for a corporate bond offering of US$17 billion set by Apple Inc. in April. Canso was an enthusiastic participant in the Verizon transaction for several reasons, including:

- Use of proceeds to buy a valuable cash generating asset well known to the company;

- Reasonable post transaction leverage and expectation for future debt reduction; and,

- Pricing at a significant concession to other corporates and to existing Verizon securities.

This type of strategic and business driven transaction suits our investment philosophy whereas many transactions driven purely by financial engineering, including leveraged dividend recapitalizations, do not.

“Only the Shadow Knows”

As the old radio show used to say “Only the Shadow Knows What Evil Lurks in the Hearts of Men” but Edward Snowden, a former Central Intelligence Agency employee, gave us a pretty good idea of what the U.S. intelligence community was up to. Snowden disclosed literally hundreds of thousands of classified NSA documents in June. His revelations included confirmation the U.S. government spied on its own citizens, the heads of foreign governments and anyone else who uses a cell phone or the internet.

Regulation Light

While we are not sure what relevance Angela Merkel’s pizza preference is to U.S. national security, we were hoping that a Snowden equivalent might shake-up disclosure practices in the financial markets in 2013. More shocking to us than any covert activity of the U.S. government is the lack of decent disclosure in certain areas of the financial markets that directly impacts millions of citizens.

In the financial markets where “full, true and plain disclosure” is supposed to be the cornerstone of all securities regulation, investors continue to be duped into investment products without proper disclosure of the risks inherent. Two particularly galling examples are the proliferation of leveraged loans backing “Floating Rate” mutual funds and the continued refusal of Canadian regulators to require disclosure of company credit agreements. We applaud the diligent work of the Canadian Bond Investors Association, of which we are a proud member and our colleague Joe Morin is the President. The CBIA, as one of its many initiatives, continues to work towards enhancing the disclosure practices in the Canadian capital markets.

In previous Corporate Bond Letters we have expressed concern over perceived excesses building in the high yield and leveraged loan markets. The recent proliferation of floating rate mutual fund products in Canada backed by leveraged loans heightens our concerns. Retail investors are pouring money into these products. They seem to think of these very, very low quality loans as money market surrogates and their defence against rising interest rates. Given that most of these loans are financing extraction of dividends for private equity sponsors, we worry about what will happen when there is no one to buy.

The Edsel Seemed Like a Great Idea Too

In September 1957, with the help of Madison Avenue’s top ad agencies, the Ford Motor Company launched the most hyped new automobile in the history of four wheeled transportation. Within three years and after $250 million of expense, the Edsel was discontinued and its name became synonymous with failure.

Huge Fees, Huge Risks

We are never surprised when greed prevails over common sense in the financial markets but we admit the goings on in the leveraged (non-investment grade bond and loan) markets have us scratching our heads more than ever before. Unlike the Edsel the leveraged loan markets are in no danger of extinction. They serve as an important source of finance for thousands of companies. These markets, like the Edsel, now suffer from a serious design flaw. The current leveraged loan model now on offer has very naïve money supplying capital to very shrewd financial operators. This never turns out well. The banks are a big fan of this unregulated market because it provides them huge fees for their efforts, much like the securitization market before the Credit Crisis.

Recall that in the period leading up to the 2008 Financial Crisis, loose monetary policy coupled with investors reaching for yield produced record inflows into CDOs and CLOs. In turn these CDOs and CLOs purchased bonds and loans created by Wall Street bankers. Similar to the mortgage market, the underwriting of corporate bonds and loans focused on quantity and efficiency, measured by speed to market, not deal quality. Many banks also provided leverage to these investing vehicles creating greater concentration of exposures and increasing systemic risk.

As the 2008 Financial Crisis unfolded prices of leveraged products fell. Falling prices precipitated investor redemptions and lender margin calls which precipitated selling which pushed prices even lower. The indiscriminate buying that drove the market pre-crisis turned into indiscriminate selling during and after the crisis. At its low point leveraged bond and loan prices fell as much as 40 – 50%.

Lessons Learned Easily Are Quickly Forgotten

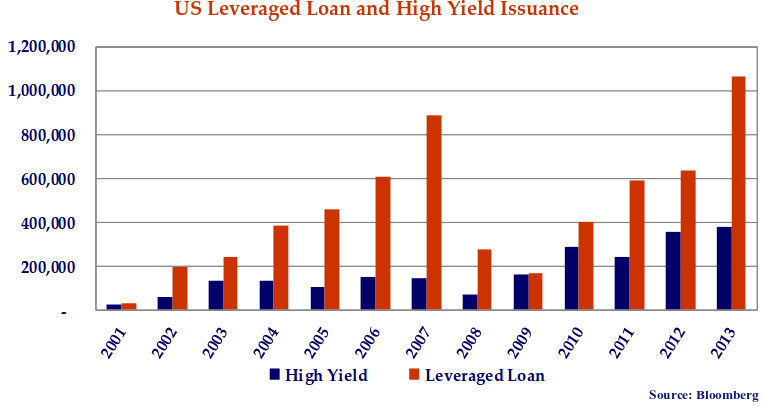

We are always surprised by the ability of investors to forget the lessons of previous cycles when greed raises its ugly head. New issue volumes in the U.S. leveraged loan and high yield bond markets in the following chart show how true this is.

The leveraged markets set about rebuilding in 2009 as soon as the smoke cleared from the Credit Crisis. Some commentators believed that investors had learned their lesson and risky deals would be a relic of more speculative times. With interest set to rise, they did not count on the demand of retail investors for “safe investments”. It turns out that risky bank loans and bonds packaged into “Floating Rate” mutual funds and ETFs were just what investors needed for income and safety! When fees are involved, underwriters are anything but shy.

New issue volumes climbed steadily through 2012 before skyrocketing to new records in 2013. Leveraged loan new issue volume topped $1,067 billion in 2013 – 19.7% higher than the previous record set in 2007 and an astonishing 67.5% increase over 2012. High yield bond issuance also hit a record in 2013 at $379.8 billion up 5.9% over the previous record set in 2012 and 159.1% over 2007’s pre-crisis level. The leveraged markets are currently very much alive.

Not Endearing Terms

Financing terms changed dramatically in lenders’ favour in the immediate aftermath of the Credit Crisis. With CDO and CLO participation in the market substantially reduced, real money buyers were able to exact more restrictive covenant packages, reduced leverage levels and higher credit spreads from borrowers. As time passed, market activity increased with large retail flows into Bank Loan ETFs and mutual funds. Even CDO’s and CLO’s reemerged as short investor memories gave way to a desperate urge to keep up with cash inflows. These vehicles now dominate the leveraged markets with as much as 70% of new issue term loans (“TLB”) channeled into CLO’s alone. This is notable as these vehicles buy and sell based on fund flows into (good times) or out of (bad times) these structures, not company fundamentals. The performance of the leveraged finance sector was a disaster in the 2008 Financial Crisis as bank loan and high yield bond prices plunged due to cash outflows and panicked selling.

The Back of the Upper Hand?

With the shift in buyer base back to structured vehicles, borrowers have now once again regained the upper hand in the leveraged markets. “Covenant light” deals, higher leverage tolerances and tighter credit spreads are now the norm. Financially motivated transactions are the “Deal de Jour” including dividend recapitalizations and leveraged buyouts which benefit Private Equity deal sponsors. The bank underwriters seek to maximize fee income. This means they are more concerned with keeping issuers happy than structuring proper lending transactions.

All of this works to the disadvantage of lenders. This is why at Canso we have chosen to largely avoid new issue leveraged loan and high yield transactions. Canso does selectively participate in these markets when we can influence the structure and pricing of a transaction for the benefit of our investors.

We believe that the record volume of new bank loan and high yield issuance will create many opportunities when the next crisis hits. We are not certain when this will be but we are patient investors. Traders churn their portfolios, hoping to exit in time. If value is not available, we are content to await the next buying opportunity.

As we have said previously, we are watching the lower quality segments of the credit markets with some trepidation. It is amazing to us that so-called “credit professionals” can buy absolutely terrible deals. Then again, we stand ready to buy their better deals when tough times again arrive.

Where Do We Go From Here?

On the heels of the poor performance of the fixed income markets in 2013 and in the face of further increases in longer term interest rates, the obvious question is where do the markets go from here? We draw some inspiration from the Olympic movement to answer that question.

“Citius, Altius, Fortius”

While few might recognize this Latin phrase most would understand the English translation as the Olympic motto “Faster, Higher, Stronger”. Attributed to Henri Didon, a Dominican Priest, this phrase was proposed by his friend Pierre de Coubertin on the creation of the International Olympic movement. The motto was officially introduced at the 1924 Paris Olympic Games.

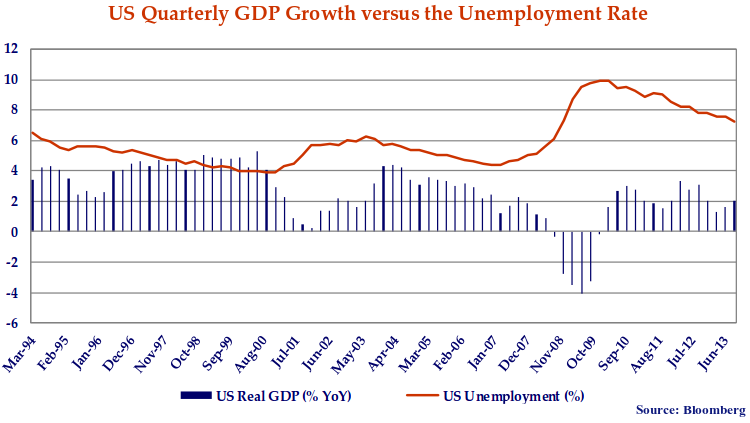

Faster

South of the border, the U.S. economy continues to show signs of strengthening and we expect this to continue and possibly accelerate through 2014. We remain concerned about the state of the Canadian economy and the potential excesses built into the housing market (see Canso’s Canadian Housing Market Px dated July 2013). Despite the weak economy we see, we think Canadian interest rates will be set by a quickening of the U.S. economic pace in 2014.

Higher

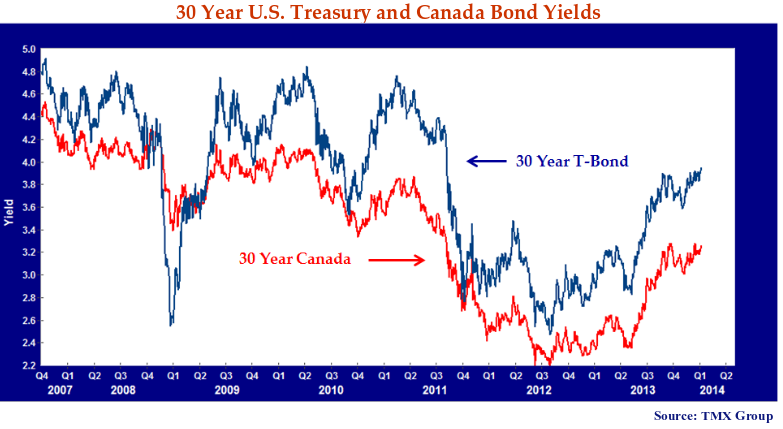

With the U.S. economy expanding faster than many had expected we believe the Federal Reserve will to continue to taper (albeit gradually) its Quantitative Easing by further scaling back its purchases of U.S. Treasury bonds and Mortgage Backed Securities. This reduction in demand for bonds will support a continued upward trend in longer term interest rates. With short term interest rates pegged at current levels in Canada and the U.S. we expect the yield curve steepening that began in 2013 to continue and to move to historically steep levels.

Stronger

An expanding U.S. economy combined with a steepening yield curve provides a continued favourable environment for corporate bonds and credit products. We believe credit spreads will continue to tighten. We remain duration averse as we believe the normalization of longer term interest rates has a considerable way to go.

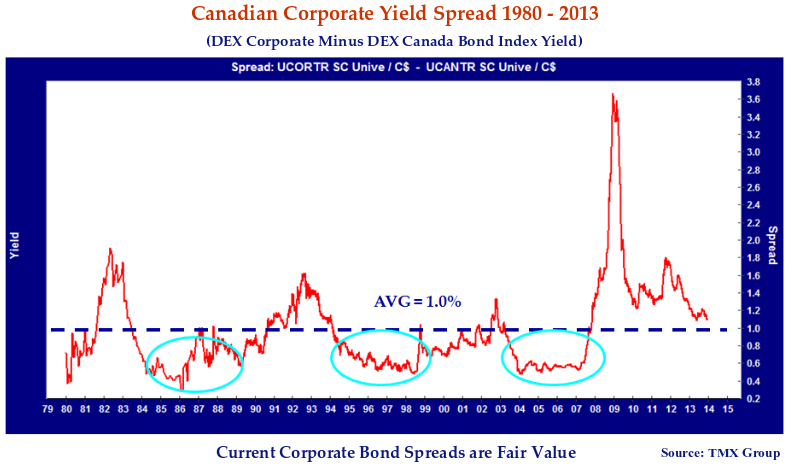

The chart below shows the movement of Canadian investment grade credit spreads.

Inspection of the chart shows that Canadian corporate bond spreads are just above the 1% historical average and are still “fair value”. They are well above their lows of 0.5% during the very loose monetary policy periods of 1984-88, 1994-98 and 2004-08. We think that with the continued loose conventional monetary policy that we see, corporate bonds are in for a period of tightening spreads. Credit spreads usually increase at the end of the credit cycle, when monetary policy is tightened.

The More Things Change…

At this time of year we at Canso dutifully prepare and distribute quarterly and annual returns to our investors. Invariably we hear “Your performance has been great. What are you going to do now?” We remind our clients and ourselves that successful investing generates returns over long periods of time and through the extremes of economic and financial cycles. At Canso we spend much of our time ensuring the consistency and continuity of our investment approach.

Our approach resists the allure of the latest investment fads or knee jerk reactions to short-term market moves. We are long term investors and not traders. We analyze each and every investment opportunity on its own merits and in an agonizing level of detail. We buy the securities with the cheapest valuations, which includes an assessment of both their risk and return. We do not “stretch for yield”, but ensure that we are paid for the risk we assume in our portfolios. We look at countless transactions and select but a few. Our approach is deep value and contrarian and not restricted to one type of security or asset class.

We continue to believe there is value to be extracted from the credit markets. Much of this value is already embedded in our portfolios and we expect to realize that value with the passage of time. We will selectively add new positions when relative value dictates we do so.