Well, we don’t have too much new to say about the Canadian corporate bond market.

Yes, really…

You’re probably wondering how your loquacious correspondents of things financial could possibly have run out of interesting things to say. The problem is that things are pretty much turning out the way we expected. We have been telling you for quite some time that bond yields would get back to “normal”. After the good Professor Bernanke publicly agreed with us and it became clear that the Fed’s quantitative easing might no longer be required, bond yields have been rising around the globe. Canada is not an exception, although Canadian financial types really do believe they are “exceptional”.

Non-Starting Crises

As far as the interminable “Death Watch” for the world financial system, it is once again on hold. This does not mean that doom-saying talking heads are not searching for a new crisis to latch onto. With the Euro Debt Crisis waning and the Fiscal Cliff a non-starter, it looks like all hopes for Financial Armageddon rest with the Tea Party and its Kamikaze attack on government funding. Gold bugs and various other financial crisis addicts are hoping desperately that the Republican Party will follow through with its political death wish and see a default on U.S. Treasuries.

Perhaps the Republican Party will actually accomplish its own political suicide and in the process destroy confidence in the solvency of the U.S. government. We think saner heads should prevail, although the political theatre produces television-ready drama. With 75% of Americans saying in polls that they already blame the Republicans for this government dislocation, all but the most maniacal Republicans in Congress are looking for a face saving way out. Even if the Tea Partiers manage to succeed in their default wishes, we think the world will definitely not end, as it didn’t after the Credit and Euro Debt Crises. After some disruption, things would eventually get back to the business at hand.

Government Finance by Deposit?

Perhaps Professor Bernanke will ride to the rescue. The Fed broke many existing “rules” in its innovative rescue of the U.S. financial system during the Credit Crisis. The Fed now considers its mission to include a healthy economy and there could be few things as bad for the U.S. economy as default by the U.S. government. Who’s to say that money created by the Fed and deposited into the Treasury’s bank accounts is actually “borrowing”? There could be quite a debate on what constitutes debt and borrowing if the budget imbroglio continues in Washington. Consider that the Fed is now printing money to buy bonds from the Treasury with its “quantitative easing.” This was unimaginable a few short years ago.

The “Golly Gee Whiz” Economy

On the subject of the U.S. economy, we told you some time ago that the yield curve was going to get very steep as the quantitative ease bond buying ended. With the Fed and other central banks keeping short-term interest rates very low through continued accommodative monetary policy, we believed a very steep yield curve would result. This is happening. We also told you that a very steep yield curve is perhaps the most potent predictor of economic strength. Well, “Golly Gee Whiz”, the U.S. economy seems to have developed some underlying strength despite the naysayers and worriers.

Spreading Fair Value

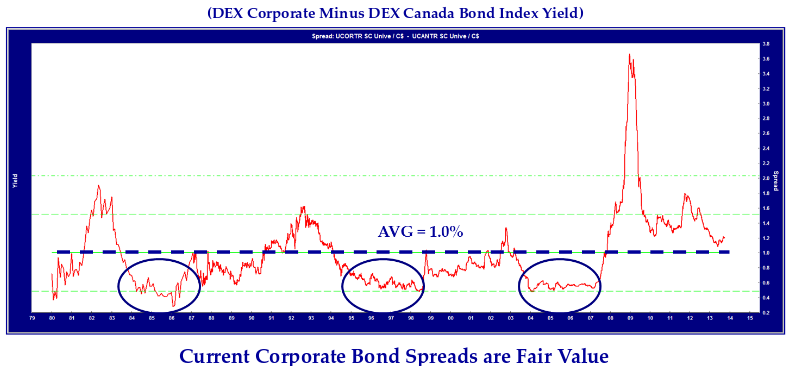

Given our view that the financial world was not ending, the U.S. economy was recovering and that bond market yields would rise, we thought investment grade credit spreads were good value. Inspection of the chart below (yes, we were looking for an opportunity to refer to a chart) shows that Canadian corporate bond spreads at 1.2% have stayed high enough to be considered “fair value” compared to the historical average of 1.0%. They are well above their lows of .5% during the very loose monetary policy periods of 1984-88, 1994-98 and 2004-08.

Circles of Insanity

We have circled these periods in the chart. As we did this, we remarked on how regular these periods were. We pointed out to our colleagues that every ten years we have a period of credit insanity, as investors forget what they learned during the last “financial panic”.

Monetary policy was actually loosened well before these periods in the aftermath of a credit or financial market debacle. In 1984 we were just coming out of Paul Volcker’s severe monetary policy tightening and recession of 1981. In 1994 we were just coming out of the commercial real estate collapse of 1992 and the tightening of monetary policy in 1994, which led to the bankruptcy of Mexico and Orange County. In 2004, we were just coming out of the dot.com bust of 2000, which resulted from the loose monetary policy after the Asian Contagion and the Long Term Capital Crisis of 1998.

Stupid Is As Stupid Lends

We think you get the picture. Monetary policy is made very loose to stop a financial crisis. When monetary policy is finally tightened and rates finally start to rise, all hell breaks loose and the Fed is forced to loosen again. The money then flows in to the credit markets that then elevate to a pinnacle of credit stupidity with very tight credit spreads as everyone rushes to “get invested”. When monetary policy is eventually tightened after this period of credit stupidity, the credit bubble bursts and people flee the credit markets in terror. As our muse Forrest Gump would put it, “Stupid is as Stupid Lends.”

They Won’t Get it Just Right

The Credit Crisis of 2008 was a particularly severe financial panic, as it affected the solvency of the global banking system through U.S. residential mortgage securitization. Each time, some maintain that the Fed and other monetary authorities will get it “just right”. This never happens.

We just had a conference call with a client who maintained that the Federal Reserve had learned its lessons on inflation in the 1970s and would never make that “mistake” again. We begged to differ. We pointed out that the Fed Chair is chosen by politicians, invariably for their selfish political reasons. Given that politics can and will dictate the behaviour of Supreme Court Justices, why should the realm of monetary policy be free from interference? Indeed, Alan Greenspan was one of the most ideological and politically oriented Fed Chairs in history. His lobbying against the regulation of derivatives and in favour of the removal of the Glass Steagall separation of investment and commercial banking was utterly and purely ideological. Both of these ideological triumphs directly contributed to the severity of the 2008 Credit Crisis.

Yellen Wants “A Little More Inflation”

The fates conspired to have President Obama announce his choice of Janet Yellen to succeed Ben Bernanke as Fed Chair the day after our client discussion. I think the choice of Ms. Yellen proves our point. The New York Times had a long article on Ms. Yellen and her belief that the Fed’s mission is economic and social, rather than strictly controlling the price level. As the Times summarized:

“Her confirmation also would reinforce the Fed’s evolution from an institution run by market-wise bureaucrats focused on controlling inflation to an institution run by academics committed to a broader mission of steady growth and minimal unemployment … Ms. Yellen’s intellectual roots and leadership style both suggest that she would push somewhat more forcefully than Mr. Bernanke to extend the Fed’s stimulus campaign… She has expressed greater concern about the economic consequences of unemployment, a stronger conviction in the Fed’s ability to stimulate job growth and a greater willingness to tolerate a little more inflation in order to reduce unemployment more quickly.”

Note the perceived willingness of Ms. Yellen to tolerate “a little more inflation” to get a better employment outcome. We made the point to our client, well before we read this article on Ms. Yellen, that this was precisely the problem of the 1970s. Politically, it was always more acceptable to have a “little higher” inflation than unemployment. The Fed Chair at the time, Arthur Burns, had eased monetary policy to overcome the negative effects of the 1973 Arab Oil Embargo. This worked but there was a lot of pressure on him to “keep easy” when unemployment stayed higher than politicians wanted.

More Money is Always More Popular Than Less Money

There is always a good reason to keep monetary policy loose. More money is always more popular than less money. If you consider the 3 periods of very tight corporate bond yield spreads since 1980 that we have remarked on, they all occurred after a period of excessively loose monetary policy. Loose money creates credit “bubbles”. Alan Greenspan said famously that it was very hard to detect a bubble when you’re in one. He should know, since he was quite an accomplished bubble creator and was personally responsible for all the periods of tight credit spreads that we have remarked on. Not only were spreads tight in these periods, the underlying credit fundamentals of new issues were quite poor as investors “stretched for yield”.

Our current view is that while we expect quantitative easing to end, we do not expect actual monetary policy to tighten for some time. This means the yield curve will steepen and credit spreads should continue to tighten. Credit spreads usually increase at the end of the credit cycle, when monetary policy is tightened.

Our Proprietary “Circles on a Chart” Methodology

Now we can be the fearless economic forecaster that we have always wanted to be. You will note the circles of “tight spreads” occur every 10 years: 1984-88, 1994-98 and 2004-08. It looks like, using our very complicated and proprietary “circles on a chart” methodology, that the next period of very tight spreads should be 2014 to 2018.

Coming at it another way, we expect Professor Bernanke will partially or completely end Quantitative Easing before his term ends. Taking a page from Machiavelli, he would be the “bad cop” who ended this controversial program and then Ms. Yellen could replace him and be the “good cop” who maintains easy monetary policy. This would allay some of the more vociferous criticism of the Fed. It would then leave Ms. Yellen free to keep monetary policy very loose for some time.

The Fed is currently “broadcasting” that easy money will continue at least through 2014 and they are looking at unemployment as their key indicator. Our ballpark estimate of two to four years before monetary policy is tightened and short term interest rates rise suggests that we could have a period of tight credit market spreads from 2014 to 2018. We think this period of tight spreads might be shorter than four years, as the credit stupidity we are now seeing in the bank loan and high yield markets suggests a more accelerated cycle this time around.

The Only Game in Town

That being said, corporate bonds and credit are the “only game in town” for bond managers in a rising interest rate environment. Our aversion to long term/ duration and the reasonable levels of investment grade credit spreads suggested to us that we invest in the floating rate bonds of high quality issuers. This led to one of the more “contrarian” moves that we have made in our collective investment careers. We sold long-term corporate bonds as yields bottomed in 2011 to 2012, which we then replaced with floating rate assets. As we point out in our companion Market Observer newsletter, this was not a “top down” macroeconomic call but a reaction to the scant cash flows available on fixed income investments.

A Crap Shoot

We were very much alone in 2011 with our view that floating rate assets offered tremendous value. Trendy investment firms are now heavily marketing “Floating Rate” investment products. Does the recent and fervent flogging of things floating rate by the hucksters of Wall and Bay Streets worry us? Not really. Floating rate investments can be either bonds or loans. They also can be very high quality issuers or very low quality issuers.

What is very curious to us is that the current vogue in “floating rate assets” has attached itself to the bank loans of very highly levered issuers. We are watching the lower quality segments of the credit markets with a sense of foreboding. The “Term Loan B” bank loans being purchased by the current crop of “floating rate funds” are very low quality. These are primarily funding for private equity sponsors to extract their money out of very low quality private equity deals they have sponsored.

One of our enduring Canso investment beliefs is that if investors have large amounts of money they have to invest, investment bankers will create enough crap to satiate their demand (sorry for the language but we were actually thinking something a bit stronger). This is now happening in spades in the bank loan market and will not end well when monetary policy is finally tightened. As we have noted for many years about the high yield market, we believe the bank loan market is now very “flow driven”. Since it is an “asset class”, which tend to be things of investment wonder at some times and absolutely hated at others, we expect that the flows into and out of bank loan funds will be highly correlated with fear and greed.

The Bank Loan Race to the Bottom

The last iteration of the “Term Loan B” market did not end well. CDOs and CLOs before the 2008 Credit Crisis had lots of money to spend, since investors had buckets of money to invest courtesy of loose monetary policy. Everyone now knows about the “race to the bottom” in the mortgage securitization market. Few people realize that the same thing happened with bank loans. Bankers sold loans to the CDO and CLO managers who had to buy whatever was available when their deals closed and they had to “get invested”.

Some CDOs and CLOs were forced to liquidate their holdings when they breached a market based collateral value test. Once the prices of the loans started to fall more funds had to liquidate and there was more selling. You might be under the mistaken belief that the bankers who had created the loans would view the lower prices on the loans they created as a buying opportunity. This would be very far from the truth.

A career banker does not buy a loan that is depreciating in price. Imagine the conversation: “Hey boss, our loan is down 40%… I think we should buy more”. This banker would be fired for even considering such a radical thought. In our experience, bankers have a powerful urge to sell when something is falling in price, for fear that it will fall more. This is why some bank loans were down 30-50% during the Credit Crisis.

The Term Loan B market then dried up in 2009 and there were dire predictions that many issuers would default as they would not be able to refinance. This assertion did not consider the innate human capacity for investment stupidity when money is easily available. With the easy money policies of the world central banks, not only were the loans refinanced, the private equity sponsors got to refinance at much lower interest rates. Even better for these “masters of leverage”, they have been able to borrow money to pay themselves healthy dividends.

When Joe Q Public Sells

What has us quite worried is that most of the recent Term Loan B bank loan deals are being purchased by bank loan mutual funds and ETFs. As we have said before, good lending matches assets and liabilities in liquidity. Both bank loan mutual funds and ETFs allow their investors to withdraw their funds on as frequently as a daily basis. So, what happens when Joe Q Public wants his money back? The “Floating Rate” mutual fund or ETF must sell bank loans.

There’s a pretty good chance that if Joe Q is selling down his bank loan exposure, then Susie Q and Grandma Q Public will be as well. The problem will be that with all the funds selling bank loans to fund redemptions, there won’t be anyone buying. This is exactly what happened last time around. Certainly not the originating banks, which will have already taken their fees and really won’t want to hold the substandard deals they created when times were good.

We await the buying opportunity. Until then, we are happy to buy investment grade floating rate bonds and to pass on most of the substandard Term Loan B bank deals that we are now seeing. With LIBOR floors at 1% and 3-4% credit spreads, the 4-5% yield on the current crop of Term Loan B issues really doesn’t compensate the holder for the risk we believe they are assuming. Deal structures are also getting weaker and the call provisions much more liberal. Since we don’t have to “get invested”, we prefer to wait for better value in the bank loan market.

Canadian Housing Still Worries Us

We remain very wary of the Canadian housing market. The response to our position paper on the topic was interesting. No one really took exception to our contention that Canadian housing is unaffordable. Their counter argument was that it should stay unaffordable for a variety of reasons. This might happen, but the odds are with the cash flows. Mortgage interest rates have risen since we published our paper and housing has become even more unaffordable.

Invest Well Now or Pay Later

We continue to think that the Canadian economy is in for a rough stretch as the housing market slows from its overheated bubble levels. This might seem to argue for lower Canadian interest rates but with yields rising in the U.S., this is not likely.

We continue to like investment grade and floating rate bonds. The lower quality segments of the credit markets are very speculative and it is “buyer beware” with declining deal quality.

Investors need to be particularly cautious at this point in the credit cycle or they will “pay later”.