“FAKE” Markets

The drama has been unrelenting over the last quarter, but luckily it does not involve the financial markets. The Washington reality politics show featuring the Tweeter in Chief versus the “FAKE MEDIA” has transfixed the American and global public. Financial markets have been relegated to the news minor leagues, which has not been a bad thing for their performance.

The stock markets are making new highs and are showing very low measured volatility. Some market strategists attribute this to investor complacency. Perhaps, or maybe traders are focused on the volatility in politics and the bizarre spectacle that is unfolding daily in Washington. Research shows that the human attention span is limited to a few subjects at a time and traders are no exception to this rule. From insulting Presidential tweets, to the legislative Republican infighting over health care and the Russians, there’s a lot to keep attention away from the financial markets.

Nothing Spectacular

Those looking at the financial markets probably see a definite lack of drama. The U.S. and global economies are chugging along on an underwhelming growth path. A recent Bloomberg National Poll found Americans happy with their personal financial and employment situation even though they aren’t pleased with President Trump:

…58 percent of Americans believe they’re moving closer to realizing their own career and financial aspirations, tied for the highest recorded in the poll… A majority expect the U.S. stock market to be higher by the end of this year… Just 40 percent of Americans approve of the job he (President Trump) is doing in the White House, and 55 percent now view him (President Trump) unfavorably, up 12 points since December. Sixty-one percent say the nation is headed down the wrong path, also up 12 points since December. Bloomberg Politics: Americans Feel Good About the Economy, Not So Good About Trump, John McCormick, July 17, 2017

The U.S. economy is not spectacular but growing enough to keep cash flows and stock values increasing. Employment is still growing. Anecdotally, we keep on hearing advertisements for truck drivers for J.B. Hunt, Schneider National and even Walmart Trucking on CNN and Bloomberg satellite radio. Transportation activity is a pretty good economic indicator and a shortage of truck drivers is good news for both the economy and wage growth.

Market pundits declare inflation dead or alive but not much changes in the real world. The Fed managed to get in another .25% interest rate increase at their June meeting and are telegraphing more to come, albeit tentatively, without disastrous financial market outcomes. The Bank of Canada joined the “Get Dem Up” monetary gang with a .25% increase of its own in July.

The unloved bull market in U.S. stocks continues, without a lot of affection by strategists and investors. The as expected .25% increase in the Fed Funds rate in June was barely a blip on the U.S. stock market’s radar. The S&P 500 total return index was up 3.1% in the 2nd quarter despite the Fed tightening and signaling an exit from quantitative easing.

Too Low for Too Long

Investment bank economists and strategists are desperately clamoring for a more modest tightening program. There’s no inflation they say, so keep rates low forever and our bonuses big. This begs the question of the economic allocation of scarce resources. Interest rates are the price of money and too low for way too long has distorted the financial system in many ways. The money the Fed created through its conventional and unconventional monetary policies has sent asset prices soaring upwards but it has also warped the investment process.

Ridiculously Safe

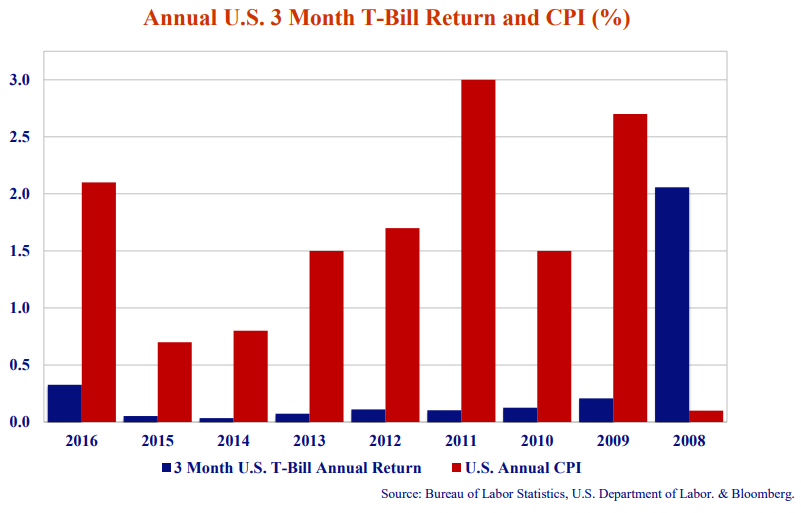

Returns on “safe investments” have been taken by central banks to ridiculously low levels, courtesy of ridiculously low administered interest rates. These continued well after the emergency policy during and after the Credit Crisis of 2008 to 2009. As the chart below shows, the annual returns on 3 month U.S. T-Bills for the last 9 years are paltry. The 2.1% annual return in 2008 dropped to .21% in 2009 with the onset of “emergency” monetary policy.

The Credit Crisis eased in 2009 and the stock and credit markets soared. The U.S. economy eventually emerged from recession in 2010 but the Fed continued to push its “zero bound” low interest policy. This saw a mere .13% T-Bill return in 2010, .10% in 2011, .11% in 2012, and .07% in 2013 before bottoming at a miniscule .04% in 2014.

Even with the unemployment rate dropping to generational lows and the financial markets reaching new highs, the Fed continued to pursue its extreme monetary policies. Low interest rates persisted and 2015 saw an increase of .01% to a whopping .05% return. It was only when the Fed embarked on its desultory tightening that interest rates were moved above zero and the return for 2016 reached .33%.

A Real Bad Deal

We have also plotted the U.S. annual CPI for the same period on the chart above. Note that inflation bottomed in 2008 during the Credit Crisis and Great Recession at .1% but was a very positive 2.6% by 2009 with the recovery in the economy and commodity prices. U.S. CPI has been much higher than T-Bill yields and returns ever since. This means that investors, pension plans and individual savers alike, have been receiving a negative real return on their investments after inflation.

Now interest rate times they are a changing as the folk singers used to say. The investment consensus of interest rates “low for longer/ perhaps forever” was blown apart in November 2016 when yields rose sharply after the surprise election of President Donald Trump. This came as a shock to the “this time it’s different” school of financial thought. Remember the pundits in January 2016 applauding the European Central Bank for its nonsensical quantitative easing program of buying up every bond in Europe?

Bond Buying Gluttony

The efforts of Mr. Draghi and his ECB chums actually drove up the price of German government bunds to the point that yields went negative. This meant the buyer was paying more for the bund than they would get back. We discussed this in our January 2016 Market Observer, pointing out that while the ECB had succeeded in its bond buying gluttony, the excitement of negative yields hid the absolute stupidity of what was happening. Buying a bond that guaranteed the holder would get back less money than they lent to the German government was a ridiculous investment proposition to us.

Now there is hope for the oppressed income investor! The year-to-date return for U.S. T-Bills for the 6 months ended June 30th, 2017 was .37%. Even better, the increase in the Fed Funds rate all the way to 1.25% means that 2017 might actually see an annual return above 1% for the first time in 10 years!

The idea of both the conventional and unconventional monetary policies of the global central banks was to expand credit and encourage the economy. The problem is that these extreme monetary policies have gone well beyond encouraging economic growth. They caused investors to “stretch for yield” into very risky securities and to accept very low future returns at extremely high risks which they do not understand.

Risky Loan Business

At the risk of being accused of harping on our previous themes, we see plenty of evidence of this in the bank loan market. Bank loans used to be negotiated transactions between a banking syndicate and a client. The banks wanted to get their money back so their emphasis was on conservative lending. The rush of retail investors into floating rate bank loan funds has debauched this proposition. These “Prime Loan Funds” are promoted to the investing public as safe and secure investments in both their mutual fund and ETF flavours.

An Orgy of Credit Gullibility

This demand means that the banks can now sell their loans to bank loan funds, units of which are held by unsuspecting and unsophisticated individual investors. The problem is that most of these loans are made to private equity fund companies in a veritable orgy of credit gullibility. The financial system is supposed to allocate money to worthy projects but this is not what is happening in the bank loan market. Money is borrowed to fund payouts to the private equity owners or to buy companies from other private equity funds in a daisy chain of overvaluation.

One might hope that the portfolio managers of these funds would be prudent in their loan analysis and selection but that is probably not the case. The portfolio managers have to invest when money goes into their funds for fear of the dreaded underperformance disease, which can prove fatal to careers. As we have said many times, the bank loan mania will not end well. We witness a constant stream of dodgy bank loans being called and refinanced at ever-lower interest rates and with ever-looser protections and stuffed into unsuspecting retail investors through the miracle of “Prime Loan Funds”.

Not Much!!

So what does the retail investor get for her or his participation in a bank loan fund? Not much!! A look at the S&P/LSTA (Loan Syndication and Trading Association) U.S. Leveraged Loan 100 Index is in order. This index tracks the U.S. leveraged loan market and has paid a whopping 1.4% year-to-date to June 30th, 2017. Yup, that’s right, a 1.4% return for a portfolio of loans rated well below investment grade. If this keeps up we’re looking at a 2.8% annual return. This might seem like a healthy return compared to the paltry returns on safer investments but it is where T-Bills used to trade before the central bankers entered their alternative yield universe. A retail investor would receive a lower return than this since the index return is without fees and assumes buying at new issue prices. In our experience, investors, whether passive or active, get poor fills on new issue loan deals and would usually be buying in the aftermarket at higher prices just to get called later at a lower price.

Restriction on Addiction

The world’s central banks have lowered interest rates, the price of money, to ridiculously low levels and now they understand the distortions they have caused in the financial markets. Simply put, the low interest rates from the central banks have caused borrowers to take on more debt than they should have and also have sent financial asset prices into the stratosphere. It has also led to immense speculation by borrowers and investors alike. The central bankers won’t admit this, but they are desperately trying to restrict the availability of credit through moral suasion and prudential regulation. This is a bit like a cocaine dealer complaining that his addicted clients are using more after he lowered his prices.

Restricting the supply of credit is a difficult thing to do. The regulators are playing “whack a mole” with financial institutions and borrowers trying to do an end run around their new “prudent guidelines”. The Canadian residential housing market is a case in point. Every time OSFI, the Canadian financial institutions regulator, has attempted to restrict the availability of mortgages, the mortgage market has done an end run on the initiative since originations are so lucrative for the mortgage players. As we’ve said many times before, the Canadian residential housing market is rife with mortgage fraud, tax avoidance, money laundering and unethical practices which governments have chosen to ignore at their peril.

Only The Shadow (Market) Knows

The restriction of insured mortgages has resulted in a move by borrowers into the private “shadow market” for second and third mortgages to get more money via higher loan to value ratios. The first mortgage lenders can then lend on the house value without considering any other of the borrower’s debt. The recent OSFI guidance for mortgage lending included the idea that lenders should take the total debt of their borrowers into account. This is not an earthshattering credit practice but one that has been sorely lacking in the Canadian market.

The Harder the Government Tries, the More Prices Will Rise

The inability of governments to restrict mortgage credit is not confined to Western Democracies like Canada and Australia. China, a command and control economy run by the all-powerful Communist Party, has its own struggles. The Wall Street Journal recently reported on the difficulties in China:

“The harder the government tries to control the market, the more prices will rise,” Mr. Pei said.

With each new policy intended to restrict home purchases, buyers are piling in. Stressed about the prospect of being left behind, many are borrowing heavily, believing prices will continue to rise despite the restrictions and will soar if the government has to lift restrictions to spur economic growth.

Another article of faith is that the Communist Party won’t allow housing prices to collapse. “The government will spare no effort to make sure there are no big swings in the property market,” says Ni Pengfei, a housing expert at the Chinese Academy of Social Sciences, a government think tank.

The desperate home buyers are exposing Beijing’s inability to control a housing market it has been relying on for economic growth. A decade ago, the real-estate sector, including construction and home furnishings, accounted for about 10% of China’s gross domestic product, according to Moody’s Investors Service. It now accounts for almost one-third, reflecting both a dearth of other investment options and the petering out of manufacturing growth.” China’s Booming Housing Market Proves Impossible to Tame; Lingling Wei and Dominique Fong; Wall Street Journal Online, July 12th, 2017.

Rational Oligopoly Meets Irrational Mortgage Insurance

This all seems very familiar to Canadians. Risk free mortgage lending via 100% government backed mortgage insurance was used to stimulate the Canadian economy after the Credit Crisis. This was very successful in juicing the Canadian housing market but created tremendous profit incentive for mortgage lending. Due to the regulatory zero risk rating of insured mortgages, banks were able to lend without using any capital against these loans. This made the return on investment extraordinarily high if not exponential. U.S. based Citibank research analysts recently made headlines in the Globe and Mail with their recommendation of Canadian bank shares. Their blunt reasoning said what no Canadian analyst or regulator dares admit:

“The secret to the Canadian banks’ success, and their strong capital build and return characteristics, is the Canadian banking market which is a rational oligopoly backed by an efficient mortgage insurance regime.”

We agree with the analysts at Citibank that the Canadian banking system is a “rational oligopoly” but their description of the Canadian mortgage insurance system as “efficient” is well off the mark. As recent Federal government reforms suggest, the Canadian mortgage insurance system is irrational, as it encourages risk-free residential mortgage lending over other types of lending and high volumes over proper lending practices.

Buffett Comes Home

The well-publicized turmoil at alternative mortgage lender Home Capital ended with Warren Buffett coming to the rescue. His terms were not substantially different than the emergency financing by the institutional investor HOOPP but included an equity injection and his seal of approval. Since we disclosed in our May Market Observer that some of our funds had a short position in Home Capital shares we now feel obliged to say that we covered in this position. We bought back the shares well before Mr. Buffett got involved and before the shares rallied substantially from their lows.

We respectfully wish Mr. Buffett well with his investment but the recent slowing of the Canadian residential housing market is long overdue. It still amazes us that people are willing to accept the logic of huge increases in home prices but refuse to entertain any price movement in the opposite direction. As we’ve told you many times before, rising prices in any asset market convince sellers to wait for higher prices and stampede buyers into buying.

A Phony Real Estate Price War

The FOMO (Fear of Missing Out) buyers were stampeded into the hot Canadian housing market in early 2017 at what might be the speculative peak. Now the market logic is reversed for Canadian housing. Sellers are rushing to sell before prices fall and buyers are waiting for lower prices. Our anecdotal evidence and our market contacts tell us that the buying frenzy of early 2017 has morphed into a phony war where prices are down but nobody wants to admit it. For Sale signs are coming down as disappointed sellers are advised to wait for a stronger market. The problem is that prices have actually fallen from their peaks levels and the market is much weaker. Sources tell us that the 15-20% increase in the hot spring 2017 Toronto market has been completely reversed and perhaps prices are even a bit lower.

As with any “no lose” investment proposition, the downside to the Canadian residential real estate mania will be merciless. We are told that appraisers in the Toronto market have been instructed to not use the market top prices from December 2016 to May 2017, as current prices are down substantially. This has led to a surge of buyer’s remorse from people who bought in this period. It has also led to financial stress as the appraisals are coming in far lower than necessary to finance the peak price deals. Many buyers who thought they would wait to sell their existing home are now stuck with two properties to carry. The result has been people walking away from their purchase offers and deposits. The problem with this is that the seller can then conclude a transaction at a lower price and sue the defaulted buyer for any losses on the actual selling price compared to the contracted price.

Bonds and Mortgages on the Up and Up

The fuel for the Canadian housing market was absurdly low mortgage interest rates that are now going up. The 5-year Canada bond saw its low yield of .46% on January 15th, 2016 and is now almost 1% higher at 1.45% on July 11th, 2017. Since the 5-year mortgage rate is based on bond yields, the major bank 5-year rates have increased from 2.4% in early 2016 to the current 2.8%. This has lagged the increase in bond yields and looks set to increase further.

Residential real estate has been key to Canada’s economic resurgence after the Credit Crisis. It is also very exposed to rising mortgage rates which is why we were surprised that the Bank of Canada is actually raising interest rates. The BOC took its discount rate from .5% to .75% this past week. CDOR, the Canadian interbank financing rate, has now increased to 1.24% from .89% before the BOC started telegraphing an impending rate hike. CDOR is up .50% from its bottom on August 24th, 2015.

The Problem that Won’t Go Away

Canada has the same residential housing problem as China. Both governments know that their housing booms are speculative and cannot continue but also realize how important their housing industries have been to their economies. As the Wall Street Journal article said, China’s low interest rates and pro-housing policies caused residential investment to go from 10% of GDP in 2007 to the present 33%. This makes it very important to China’s economic success and a huge problem for the government to deal with.

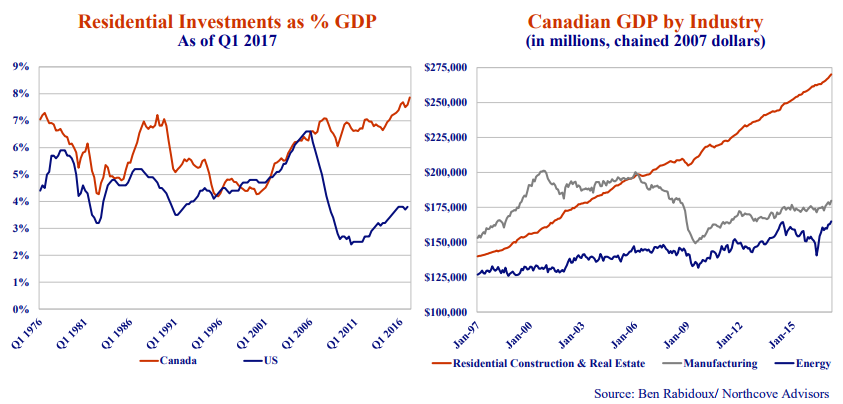

Looking at the historical chart below, provided by Ben Rabidoux of Northcove Advisors, Canadian investment in residential housing has also increased from about 4% of GDP in 2001, to the current 8% in the first quarter of 2017, which is the highest level in 40 years. The chart also shows the residential housing investment in the U.S. Note that the two periods in 1976 and 1988 when Canadian housing investment were much higher than U.S., Canadian investment then fell to U.S. levels in the succeeding 5 years.

What is surprising is that Canadian investment at 8% is so much higher than the U.S. at 4%, and is the highest in 40 years once again. One can see the U.S. housing boom paralleled the Canadian from 2001 to 2006, both rising together to 6.5%. The U.S. plunged afterwards to only 2.5% and only now has recovered to 4%, approaching historical average levels. In the same period the Canadian housing market soared to 8%, the largest departure from the U.S. since 1976. When ancillary real estate services and credit intermediation are added to residential construction the total is just above 19% of GDP.

Given the geographic, social and economic links between Canada and the U.S., one would suspect that the housing investment pattern would be similar, and it was from 1995 to 2006. The current 4% of GDP difference between Canadian and U.S. housing investment on 2016 Canadian GDP of $2,068 billion ($2.068 trillion) equates to an overinvestment of $87.2 billion compared to historical levels. What is the difference now?

We believe that it is the huge mortgage insurance subsidy that makes mortgage lending incredibly profitable for the lenders. This subsidy has severely distorted allocation of resources in the Canadian economy away from other areas. The chart on the right above shows how much residential construction and real estate services have grown compared to the manufacturing and energy industries over the last 20 years since the Credit Crisis. Residential real estate now dwarfs manufacturing and energy and is now approaching more than both combined.

Bad Interest Rate Behaviour

Canada, like China, stimulated residential housing to escape the worst of the global economic recession following the Credit Crisis. The government hubris in China and Canada and their relative economic and financial success has given way to the stark realization that their economies are dangerously overleveraged and distorted.

Canadian consumer debt is at historical highs. Many Canadian homeowners are dangerously overleveraged and have stayed in floating rate mortgages to obtain the lowest possible rate. According to ratehub.ca, 30% of Canadians have floating rate mortgages. Ratehub.ca quotes closed 5-year floating rate mortgages in the 2.7% area. This is up .5%, from the lows, reflecting the .5% increase in CDOR, which banks use as their funding benchmark and in their Mortgage Backed Security (MBS) pricing. Floating rate mortgages have lost much of their yield advantage since the current 5 year fixed rate mortgage rate is about 2.8%, also up .5% from its low.

In his comments on the recent BOC July rate hike, Governor Poloz pointed out how exposed Canadians are to interest rate increases, given the high level of consumer debt:

“Asked if today’s rate hike should be seen as a first step in removing the “insurance policy” taken in 2015 or the beginning of a series of upcoming rate hikes, Governor Poloz pointed out that since 2014 the economy has evolved and may behave quite differently than prior to the oil shock. So, one should not take the policy rate of 2014 as a reference point. The economy may be more sensitive to higher interest rates than in the past given the accumulation of household debt for example. However, the Governing Council is confident that the economy can absorb today’s rate hike. While monetary policy is not on a pre-set course, rates should be expected to be higher over time. The policy stance will be adjusted according to the evolution of the economic outlook.” National Bank of Canada Financial Markets BOC Policy Monitor, Bank of Canada hikes policy rate for the first time in 7 years, July 12, 2017

Regime Change!

It is clear that there has been a significant shift in the global monetary regimes in the last few months. Mr. Poloz’s comment that “rates should be expected to be higher over time” is very similar to the recent statements by other central bankers. We’ve gone from central bankers assuring skittish markets that they will do “everything necessary” to support their economies, to them broadcasting their intent to “normalize” interest rates. Given that historical “normal” interest rates on T-Bills are 2% above inflation, even assuming the current 1.5% inflation rate persists suggests a 3.5% T-Bill rate. This is 2.5% percent higher than current levels.

Higher Rates Ahead

“Higher Rates Ahead!” is the message of central bankers. The world ahead is one we have contemplated and prepared for. We expected rising rates, given the steady but unremarkable economic growth. It seemed to us that the rationale for “emergency” monetary policy was looking more and more tenuous and even central bankers would have to eventually recognize this. Our view was definitely an unpopular and lonely viewpoint so we think that many investors will be shocked at what is happening to their portfolios. It won’t take much further increase in yields to put paid to the idea that interest rates and yields will be low forever.

Up, Up and Away

Baby Boomers will remember the Fifth Dimension singing “Up, Up and Away” in their beautiful balloon. Since most central bankers are Baby Boomers, perhaps they sang this in unison at their central bank confab, the ECB Forum on Central Banking that was held in Sintra, Portugal in late June. Fueled by fraternity and perhaps a spot of liquid courage, they all came out of their meetings sounding the alarm that interest rates were headed higher, perhaps with a little too much enthusiasm. As Reuters reported, the ECB had to walk back President Mario Draghi remarks the very next day:

“The euro fell from a one-year high on Wednesday, after the European Central Bank said markets misjudged ECB President Mario Draghi’s comments a day earlier.

The hints in Draghi’s speech to a major central bank conference in Portugal convinced investors that its policymakers are ready to start to withdraw the emergency stimulus for the economy that has dominated policy-making for almost a decade.” Reuters, Euro drops after ECB says market misjudged Draghi, June 28th, 2017.

BOC Governor Poloz was probably still in the warm afterglow of his Sintra sojourn with his central bank homies when he announced the .25% increase in the BOC rate on July 12th. There was no mistaking the messaging. Barrie McKenna of the Globe and Mail summarized the day of the announcement:

“The Bank of Canada’s first interest-rate hike in seven years has set in motion a complex unwinding of a near-decade-long era of easy money.” Globe and Mail, Bank of Canada raises interest rates for first time in seven years, July 12th, 2017.

Easy Money Comes and Goes

We humans have a psychological tendency to extrapolate the present into the future. The current low yield world is a case in point. Most investors now cannot conceive of yields increasing much beyond where they are, even though bond yields are at historically low levels. Easy money comes and goes as monetary fashion changes. President Trump is looking at appointing some very conservative and “rules based” economists to the Fed Board and possibly replacing Janet Yellen as Chair.

At Canso we spend time looking at financial history to protect ourselves against the very human tendency to extrapolate the present into the future. In a historical context we think we are in a cyclical period of bottoming interest rates. The update of our graph (May 2017 Market Observer) comparing the long U.S. T-Bond yields over the 40-year period from 1920 to 1960 to the present period since 1990 continues to show a very strong parallel. This suggests we have seen the bottom for interest rates and bond yields.

Sensitive Bonds

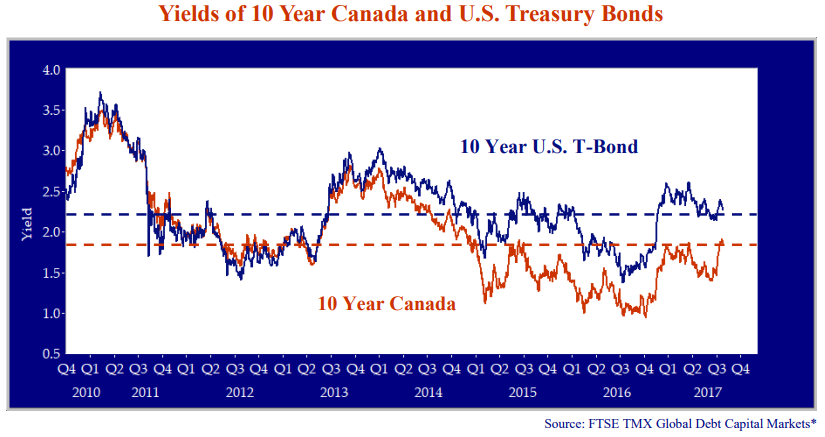

Looking at the recent past in the graph of 10-year Canada and U.S. T-Bond yields above shows how much yields have increased over the last year. The U.S. 10-year T-Bond had its low yield of 1.37% on July 8th, 2016 and has now increased almost 1% to 2.33%. The 10-year Canada bond dropped below 1% and hit its low yield of .95% on September 29th, 2016. It is now at 1.9% up almost 1% as well. Both of these bonds are very sensitive to yield changes. The 1% increase in yields drops these bonds’ prices at least 8%. Adding in their approximately 1% yield over the last year puts the total return on these bonds negative in the 7% range.

We have plotted a dashed blue line for the 10-year U.S. T-Bond on the graph above and a dashed red line for the 10-year Canada. These show that the current U.S. T-Bond yield is at the same levels as yields in 2011 before the Euro-Debt Crisis and well above the lows of that period. The Canada 10-year bond yield is lower, at the same levels as early 2012. We find it interesting that bond yields and prices have swung wildly over the past 5 years but have ended up at the same levels they started at. There has been lots of drama in the bond market, but the buyer of 10-year bonds has just collected their coupon over the period.

What Makes the Canadian Dollar Strong and Free

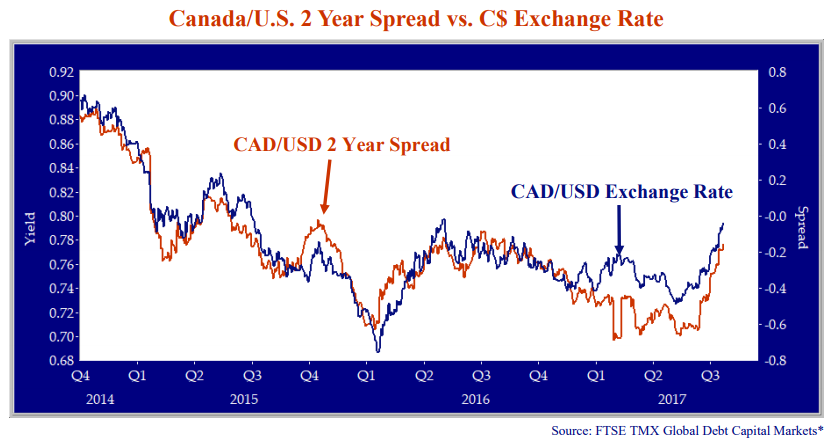

A discerning reader will see that the Canada 10-year yield has increased substantially more than the U.S. T-Bond since the end of May. This is because of Mr. Poloz’s very aggressive signaling of higher interest rates ahead. Most investors thought that the BOC would be quite careful about increasing interest rates due to the high leverage of Canadian consumers. His newfound interest rate tough guy persona was quite a shock to investors and the Canadian dollar. As we have told you in previous Market Observers, the Canadian dollar tracks the spread between 2-year Canada and U.S. T-Bonds quite closely. We show the 2-year spread and the Canadian dollar in the chart below.

Note how closely that the red line, the 2-year spread, tracks the blue line, the Canadian dollar. Also consider that the spread collapsed by 44 bps in a little over a month, moving from -.63% on June 8th to -.19% on July 14th. This meant that Canadian bond yields increased .44% more than U.S. The Canadian dollar responded by moving up by $.05 U.S. over the same period. Now Mr. Poloz has to contend with a strong Canadian dollar, which hurts Canadian exporters, and higher interest rates, which hurts high debt Canadian consumers.

Bond Return Negativity

The increase in bond yields will be reflected in portfolio values since bonds go down in price as yields go up. We have commented several times in past Market Observers about the upcoming shock to the bond market system when returns on “safe” bonds go negative. We are now almost there. The FTSE TMX Canada Bond Index was -2.4% for the 12 months ended June 30th, 2017. The overall FTSE TMX Canada Universe Bond Index was pretty close to negative at .02% for the same period. Rising yields do not discriminate as even inflation-linked bonds were negative, with the inflation-linked FTSE TMX RRB Overall Index clocking in at -2.75% for its 1 year return. Yields have continued to rise in July, going from 1.76% on June 30th to 1.89% on July 14th on 10-year Canada bonds. This .13% increase in yield translates into a further -.8% price depreciation. Yields were falling in July 2016 after Brexit so it looks to us like us we will see even more negative bond returns on a year-over-year basis for the 12 months ended July 31st.

Clearly bond investors will not be in a happy mood if this continues. Will the end game of this cycle be a financial panic like the Credit Crisis? We think not. Our recent thinking concentrates on how the economy and financial system will react to normal interest rates. It is interesting that even though interest rates and bond yields are increasing, the equity and credit markets are doing well.

Interest Rates Bite

Our parting thought is that we’ve got a long way to go to have a scarcity of money and credit. Monetary policy has been exceptionally and probably generationally easy for almost 10 years. There would have to be a lot of monetary tightening to make capital hard to get in the traditional monetary sense.

We think that it will be the level of interest rates that eventually bites rather than a scarcity of funds. All the leveraged homeowners, private equity companies and investment funds have been so habituated to low interest rates that even small increases will be hazardous to their health. Perhaps loan documentation should be wrapped like the scary cigarette packaging with stark warnings and sad pictures of defaulted borrowers.

Investment Brave Hearts

It is very hard to be investment brave when others are fearful and cautious when others throw investment caution to the wind, but we think we do a reasonable job at it. We have positioned our portfolios to benefit from rising interest rates with significant weights in high quality floating rate bonds. We are also seeing our portfolio quality increase as many of the special situation bonds we bought at much lower prices are called or mature. As we have said before, we are now in a period where we are working hard but finding it quite difficult to find exceptional value.

Fear not, it might take a while and we have no idea when it will happen, but we will be prepared when great value again becomes available.