Yes, 2015 was the year that interest rates finally started up… sort of.

Money is now scarcer in the good old USA after the Federal Reserve finally tightened monetary policy in December. The Fed raised its Fund Rate by .25% from a target band between 0-.25% to between .25% -.5%. Chair Janet Yellen and her colleagues at the Fed finally mustered up enough courage to set the Fed Funds rate at above zero for the first time since the depths of the Credit Crisis in 2008. Markets have seed and sawed but the world didn’t end on December 16th, 2015 with the first tightening of U.S. monetary policy in seven years.

Monetary Reality Bites

The reality has so far not been as bad as the markets feared, although the financial media is trumpeting the “worst start to a trading year” with the stock markets down over 7% at the time of writing in mid January 2016. The tightening of Fed policy has not led to disaster so far in the government bond market; bond yields are falling in early 2016. The reality of tighter monetary policy did bite stocks, high yield bonds and other “risk assets” hard as these fell in price in late Fall 2015 after the Fed widely broadcasted its intentions.

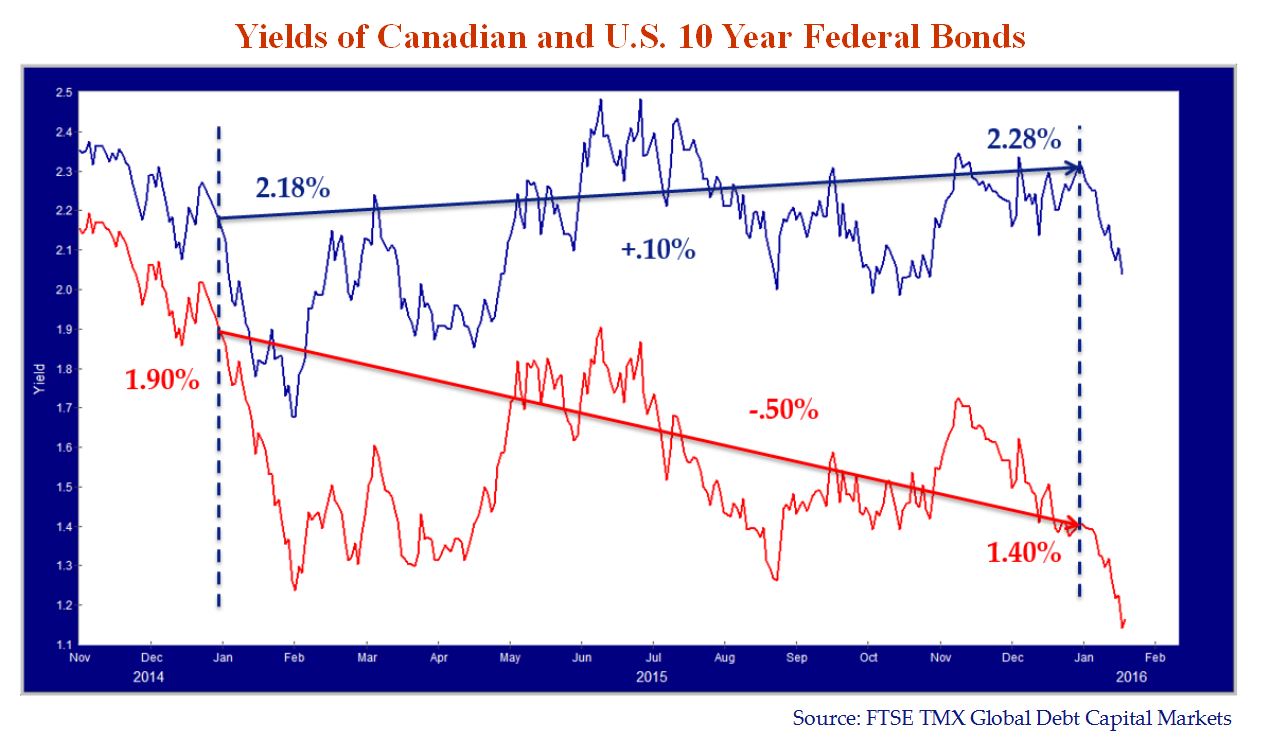

The safety bid for government bonds helped bonds to hold up fairly well. In the chart below, we show the U.S. and Canadian 10-year federal bond yields. The blue line shows the 10-year U.S. T-Bond increased only 10 basis points (.1%) from 2.18% at December 31, 2014 to 2.28% at December 31, 2015. This was lower than the Fed Funds rate increase of .25%.

As can also be seen from the red line in the chart on the previous page, Canada went against the grain of rising U.S. rates, to its currency peril. The Bank of Canada actually lowered the BoC rate by .25%, from 1% to .75%, in January 2015 and again by .25% in July to its current .5%. Canada bond yields followed down, falling .50% from 1.90% at December 31, 2014 to 1.40% at December 31, 2015. This pushed up the value of a 10-year Canada by just over 4%. Rising bond prices saw the FTSE TMX Universe Bond Index finish 2015 with a very positive 3.5% return.

“Poloz-a-Looza” Continues

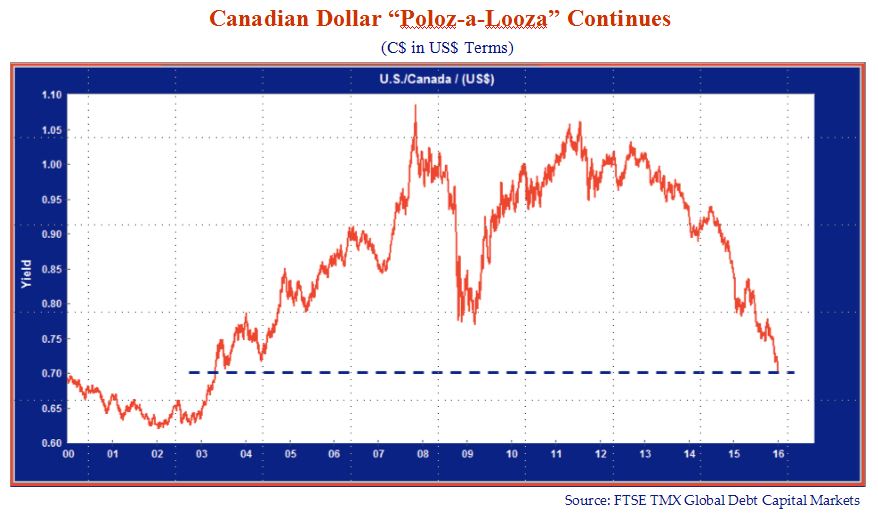

While falling yields and rising bond prices might seem a better outcome for Canadians than their American neighbours, the BoC and its Governor Mr. Poloz, in their zeal for economic stimulus, have lowered the relative wealth of Canadians quite substantially. Their continued “Poloz-a–Looza” currency depreciation saw the Canadian dollar take a 16% hit versus the U.S., falling from $.86 U.S. to $.72 U.S. This compares to the high for the Canadian dollar of $1.08 U.S during the commodity mania in late 2007 as the chart below shows. At the time of writing in mid January 2016, the Canadian dollar has broken $.70 U.S. which puts it back to the levels of the pre-commodity boom period in the early 2000s and down over 35% from its peak in 2007.

Nothing Positive About Negative Yields

Given that Mr. Poloz is now talking about negative interest rates as a potential economic stimulus tool, which we think is a really, really bad idea, we expect continued currency depreciation for the Canadian dollar. There’s a big difference between using novel “quantitative easing” techniques in the U.S. and Europe and a small open economy like Canada. How low the Canadian dollar goes really depends on Mr. Poloz’s seemingly adventurous nature.

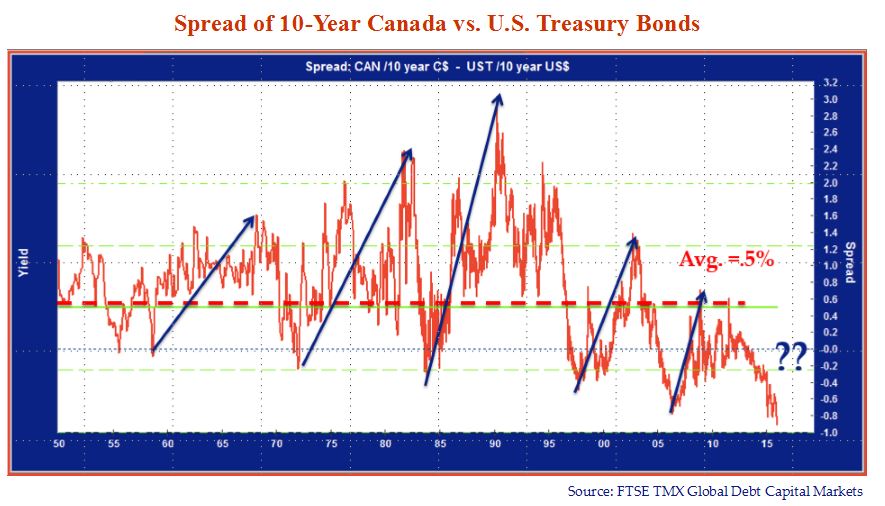

As we have discussed in previous newsletters, Canadian yields are usually higher than U.S. yields. We have graphed this in the chart below that shows the average yield spread (Canada-U.S. Treasury yield) between 10-year Canada and U.S. T-Bonds has been +.5% since 1950. The current -.9% yield spread is the lowest since 1950. What is truly astounding is that this record negative spread (Canadian yields below the U.S.) is happening during a period of severe global commodity weakness.

Canadian yields have normally been below U.S. yields in periods of commodity strength, as the BoC attempts to keep the Canadian dollar from appreciating and manufacturing exports competitive in the U.S. In periods of commodity or financial market weakness Canadian yields usually rise above U.S. as the Canadian dollar weakens with commodity prices.

Look Out Below!

Having Canadian yields below the U.S. in a period of severe commodity weakness is unprecedented. In our view, this is the reason that the Canadian dollar is so weak. If the Bank of Canada truly intends to keep Canadian yields far below U.S. yields, there will likely be severe Canadian currency weakness, if not a currency crisis. Note in the chart above that the negative spread during commodity booms usually turns to a very high positive spread during commodity busts, as shown by the blue arrows. In the commodity boom of 1995-98 the Canada/ U.S. 10-year spread bottomed at -.4% in 1997 just before the Asian Contagion. When the Canadian dollar weakened in the early 2000s and hit a low of $.62 U.S. in 2002, Canada bond yields climbed to +1.4% above U.S. T-Bonds in 2003. The spread then fell to -.8% in 2006 in the China commodity mania before climbing to +.7% in the midst of the Credit Crisis of 2008.

Flighty Capital

We are not sure how low the Canadian dollar could go if the BoC persists with its current strategy. The BoC rate at .5% is still above the U.S. Fed Rate at .25% but if Mr. Poloz lowers yields or takes them negative, we think capital flight is not out of the question and the Canadian dollar could go lower than its 2002 low of $.62 U.S. Canadians are now only just realizing how much their currency has depreciated and how much more expensive their groceries and other imported goods are. If Canadians want to protect themselves against currency depreciation, they easily can. It is very easy for Canadians to open U.S. dollar bank accounts at their bank and/or invest in U.S. bonds and other securities. Would the average Canadian accept -.5% on their investments when they can invest in the U.S. at a positive interest rate in a currency that holds its value? We think the answer is obviously YES and Mr. Poloz would need to put currency controls on Canadians if he really wants to take Canadian interest rates negative.

Our other observation is that we think that lower Canadian interest rates would probably not provide much economic stimulus. Canada has already heavily overinvested in residential real estate. Consumer credit is freely available, even fraudulently available since nobody in power wants to stop mortgage fraud “for shelter” as was the case with the recent Home Capital fraud incident.

Pathological Liars’ Loans

Canadians have a very misguided faith in the “higher standards” of our mortgage market. We discussed the massive fraud in the Canadian mortgage market in our previous newsletters and 2013 Position Report on Canadian housing and mortgages. We were recently reviewing an insurance application that stated: “knowingly providing false data is against the Insurance Act and Criminal Code”. To our knowledge, there has been no legal or disciplinary action taken against any of the mortgage brokers who were cut off by Home Capital for falsifying income and other mortgage data on mortgage applications. This was clearly against the law.

Despite falling under the Insurance Act, mortgage insurance in Canada is truly different since OSFI, CMHC, the Financial Services Commission of Ontario and the Mortgage Brokers Association have not taken any steps to punish the offending mortgage brokers who really are guilty of a criminal offence in the Home Capital fraud. Industry insiders have told us that the brokers implicated in the Home scandal have just gone on to practice their falsification trade with other financial institutions. Where Canadians used to marvel at the “Liars’ Loans” in the U.S. mortgage boom, we now have our own “Pathological Liars’ Loans” that are all completely Federal government backed!

Marginal Pricing

In terms of the global financial markets, there really isn’t too much to say about the Fed’s tightening of monetary policy that we have not already said in our previous editions but we’ll say it again anyway. In response to financial crisis and recession, the Fed and other global central banks produced far more money than has been needed in the real economy. The surplus has flowed into financial assets, raising prices and driving down yields. At the margin, less money supplied by the Fed and other central banks means less money available for financial asset purchases and lower prices.

A key Canso belief is that when capital is too easily available, people waste it on ill-advised investments. Now that investors are sensing the monetary tide receding, they are now growing fearful of their portfolio quality. What seemed a great investment in a hot market now seems to be quite risky. As Professor John Coates has demonstrated with his biochemical research on traders, when markets are hot and things are doing well, testosterone courses through veins of traders and they are literally “drunk with success”.

Once markets and prices start going down, fear and cortisol kick in. Certainly that was very much the case in 2015. When the financial markets were peaking in June after many years of rising, concerns were few. By December, everything was a problem and “capital conservation” was the order of the day. In mid January 2016, investors are worried. Commodity prices are down and the Chinese stock market is flailing, despite government attempts to stem the rout. As Kate Warne, an investment strategist at Edward Jones, told the WSJ, falling stocks create fear:

“It’s very frustrating and painful day to day,” Ms. Warne said. “When stocks start dropping, investor fears increase, which leads to more drops in the short term.” WSJ Online; U.S. Stocks Sell Out Amid a World-Wide Rout; January 15, 2016

Commodity Prices Down for the Count

Over the last few years we have been harping on the wildly speculative commodity and credit markets. Our opinion was that the crazed and massive credit creation in China as an economic stimulus tool after the Credit Crisis had created a commodity mania of similar dimensions. We told you that the “command and control” Chinese economic bureaucracy, in its efforts to stimulate the economy were engendering the biggest credit bubble in human history. Now that the bubble is bursting, the markets are terrified and commodity prices are plunging. We think that commodity prices are down for the count and not recovering anytime soon. The capacity added to meet the excess Chinese capital investment will not likely be used up any time soon.

Credit Idiocy

Frankly, in the high yield and bank loan markets we have marveled at the credit idiocy afoot. Why anyone in their right mind would buy a lousy deal that relied on very high valuations and very low cash flows was beyond us. As we say in every cycle, the pitch that “high yield does well with rising interest rates” is dead wrong. High yield tends to sell off with rising interest rates as money becomes scarcer.

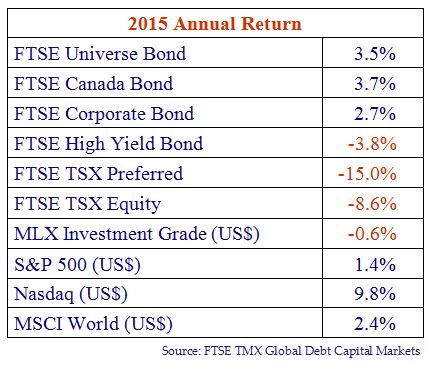

Usually it takes time for higher rates to bite the credit markets but this time, it has occurred even before the Fed actually raised rates. High yield bonds, Small Cap stocks, bank loans and other illiquid assets sold off as the bid dropped and then disappeared. The table below shows that U.S. and Canadian high yield bonds had negative returns, as well as Canadian equities and preferred shares.

The notable point about these returns is that the less liquid assets performed the worst as the bids dropped in an illiquid market. No matter what the intrinsic value of a financial asset, if there are more sellers than buyers then the price will drop until it is distressed enough to attract a bid. This is particularly the case for Canadian preferred shares that were down -15% in a very illiquid market as the Rate Reset structure came under pressure from retail selling.

Not Defensive

Our concerns on high yield bonds and bank loans have been borne out. Rather than the “defensive” performance promised by purveyors of speculative credit, high yield bonds and bank loans began falling in price prior to rising interest rates and/or a setback in government bonds or equities. The problem is that the flows into and out of high yield and bank loan mutual funds and ETFs have turned negative. In 2013, retail investors bought the defensive sales pitch and have been sorely disappointed. As they withdraw their money, the portfolio managers have no choice but to sell at whatever bid they get, even for reasonable issues. Some high yield issues are down in price over 20% and bank loans have fallen by over 10%.

Our Grandfather’s Interest Rates

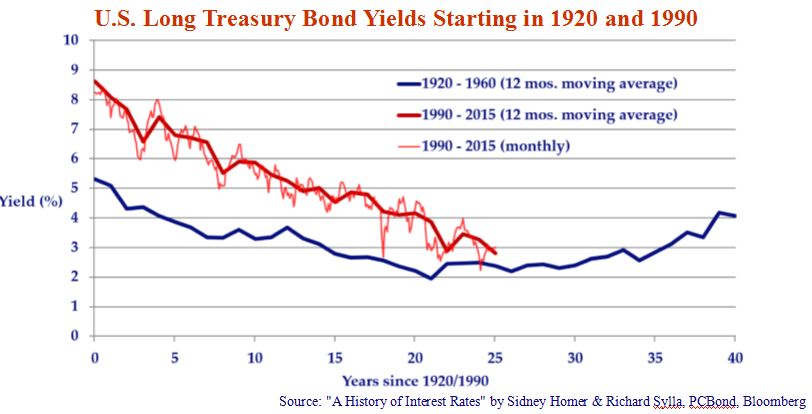

We are not convinced, however, that tightening monetary policy means End Times for financial asset prices and the economy. In fact, the U.S. economy continues on its merry way with jobs and incomes rising as of the December employment report. U.S. consumer confidence has stayed high. The Fed is in no hurry to jack up interest rates but we continue to think that bond yields are bottoming, as we show in our updated longterm U.S. T-Bond yield chart above. It will take a long time for the bottom in yields to be made, absent a sharp rise in inflation. U.S. T-Bond yields (the blue line) bottomed at 2% in 1941 (Year 21 in the chart) and then climbed slowly to 4% in 1960 (Year 40 in the chart).

Those expecting lower or even negative yields will be quite disappointed if history is our guide. The red line is the current yield history since 1990 that seems to be tracking the 1920 to 1960 experience quite well. Historical parallels are obviously dangerous, if slavishly employed as forecasting tools. On the other hand, the intergenerational change in the credit cycle is quite obvious from the chart above. We seem to be sharing the experience of our grandfathers, with yields now bottoming. The difference is that our yields are 1-2% higher, perhaps reflecting the “innovative” and very loose monetary policy and support to the financial system by the Fed and other central banks.

ZIRP All

Since the average experience of a practicing trader or portfolio manager is probably under ten years, there are many participants in the financial markets who have only known ZIRP, the emergency “Zero Interest Rate Policy” instituted by the Fed in the aftermath of the Credit Crisis of 2008. History to most traders and investors is their last quarter and they have little context for comparison. With absolutely no experience of tightening monetary policy, these investors have no idea what to think about what Ms. Yellen and her Fed colleagues have just done.

Who Knew Free Money Would Be Popular?

Young traders and portfolio managers have no idea how unusual it is to have zero interest rates. From the Bernanke Fed FOMC minutes from 2010, which were just released, we get an idea about how different this policy really was:

KEVIN WARSH (Fed Governor 2006-11): Thank you, Mr. Chairman. I am going to try to answer two questions in my discussion today. One is a familiar one: What is the most significant development since we last met? And the second is, Who knew free money would be so popular? [Laughter] How to Make the Fed Laugh, Luke Kawa Bloomberg News; January 15, 2016

In 2010, the FOMC members were laughing at the absurdity that money was free, which indeed it was for seven years until the Fed just raised the Fed Funds rate. Where the idea that money would be free was almost inane in 2010, by 2015 it had been baked into financial normalcy. There is a whole generation of traders and portfolio managers who have not known anything different.

The Fed has been diligent in telling the markets that they will be cautious with their policy going forward, i.e. they’ll still be printing and digitally creating money very effusively. Still, there will be a slower rate of money and credit creation and therefore lower prices for financial assets at the margin.

Safe and Sorry?

That being said, we still worry about the government bond market. So far in 2016, bonds are going up in value as “risk assets” fall in price. It will be interesting if the risk markets stabilize and the “flight to safety” bid disappears. Many people who have invested in “safe” bond funds have no idea they could fall in value with a very slight increase in bond market yields. Investors are still fighting the last war, worrying about credit crisis and falling stock markets. To us, market declines are a natural part of investing and we stay invested in longterm assets unless they are extremely overvalued. All the concern about dealers not being able to make markets in corporate bonds like the good old days before the Credit Crisis seems a little misplaced to us.

Following this discipline, we currently have a very short portfolio term with a substantial position in floating rate investments. We don’t think that buying longterm bonds at a yield equal to the central bank’s inflation target is a good use of our capital. In terms of overvaluation, we worry about who will be buying long-term government bonds if and when they fall in price. A government bond at 2% is equivalent to a stock at a 50 times P/E multiple except there is no prospect whatsoever of growing earnings with a fixed bond coupon.

The real problem, except perhaps for insurance companies and pension funds, is there is no natural buyer for long term bonds if yields eventually increase. People talk about “hedging” but this simply means the buying trader shorts other long duration instruments like Treasury futures or shorts more short-term bonds to protect her positions. This still pressures prices downwards. A government bond crisis where the “safe and sorry” holders of long-term government bonds have no one to sell to?

That’s negative for yields!!