The U.S. financial markets faced monetary policy reality in the third quarter of 2005. Despite the passionate pleas of those addicted to loose money and low interest rates, the U.S. Federal Reserve persisted in its normalization of interest rates. Alan Greenspan, the Fed Chairman, continued his “measured” program of short-term interest rate increases with two quarter percent increases in the Fed funds rate from 3.25% to 3.75%. This moderate pace was met with horror and disbelief by economic and market professionals. “The economy slows”, they protested. “How could you?”

We are bemused by this reaction. Inflation is running over 3% in the U.S. with wage and salary increases in the same ballpark. Energy and commodity prices are increasing smartly. The economy continues to run at high levels of capacity utilization. The speculative residential housing market has moved from the ridiculous to the sublime. Greenspan knows from the 1970s that these ingredients combined with loose monetary policy are incendiary for inflation.

“Hurricanes Katrina and Rita”, Wall Street offered up abjectly, “Surely, Mr. Greenspan, this will be your excuse to stop the rate increases or at least delay them.” The Fed response was to point out correctly that the rebuilding effort would be inflationary. Government assistance and insurance payouts will be used to replace infrastructure, homes and buildings that were destroyed for no net gain in fixed investment.

Write the Cheques First, Ask Questions Later

Insurance replacement spending is time sensitive and cost insensitive. A family waiting for their house to be rebuilt wants it done yesterday, not tomorrow. Who cares if the bill is 10-20% higher than it should be? Next to a war, this type of disaster is probably the most inflationary type of spending there is.

Certainly, the criticisms of the President for the inadequate response in the immediate aftermath of Katrina have ensured an avalanche of federal government rebuilding money. The early signs are that the oversight of this huge spending program will be poor. Like the early days of the rebuilding of Iraq the political imperative seems to be: “write the cheques first, ask questions later”. Or maybe don’t ask questions at all if the contractors are politically correct.

Those rare U.S. conservatives who are actually financially conservative are disoriented in the face of this new fiscal demand on top of the expensive war in Iraq. The numbers being thrown around suggest that the Katrina rebuilding will equal the cost of the war in Iraq. To add to this potent fiscal brew, Mr. Bush the Younger seems convinced that the only way forward is to continue his tax cut programs which reduce tax revenues. Even anti-tax conservatives are wondering about the wisdom of the pending removal of U.S. federal estate taxes. This important tax revenue could cease at a time when program spending and “pork barrel” appropriations are increasingly out of control even before considering the cost of Iraq and Katrina.

The Presidential Propensity to Spend

Fiscal discipline in the U.S. is nonexistent. Spending is being financed by government debt. It is not coincidence that the U.S. Treasury has announced the reinstatement of the 30 year Treasury bond. The large drop in the President’s popularity in the aftermath of Katrina will make matters worse. With an eye on his legacy, the remaining time in the President’s final term is going to be spent both literally and chronologically. Spending programs and tax cuts boost popularity. Spending cuts do not. This enhanced Presidential propensity to spend will encourage Congress to spend its way into the mid-term elections. Presidential contenders will also make expensive promises of their own.

Monetary Impressionism

Mr. Greenspan’s own term as Fed Chairman runs out in January 2006. He has to be concerned about the massive stimulus of the very loose fiscal policy. The spending frenzy is gathering momentum which will encourage him to compensate by continuing to tighten monetary policy until his successor takes over. We see at least another couple of rate increases towards 5% before Mr. Greenspan retires and possibly a continuation by his successor hoping to make a good first monetary impression.

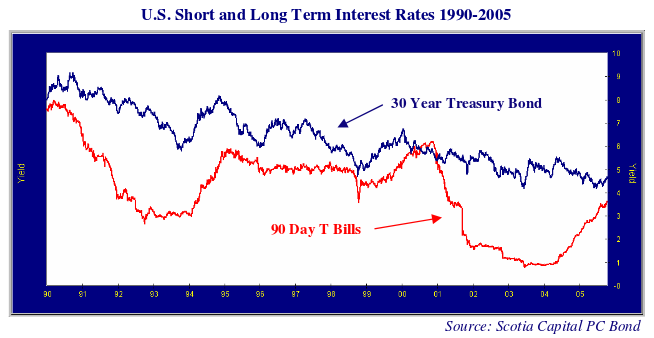

Long term interest rates are now following short-term interest rates upwards, as the chart below shows. Long term interest rates in the U.S. bottomed at 4.17% in June 2003, when the Treasury announced the cessation of the issue of 30 year bonds due to the budget surplus. This low was nearly equaled two years later in June 2005 despite raging budget deficits, tightening monetary policy and rising short term interest rates! Since then long term U.S. yields have risen to 4.6%.

As we’ve seen in the bond market, monetary policy takes a while to work. The eventual impact of monetary tightness will take the steam out of the economy and the speculation out of the financial markets. It is difficult to know when this will happen in advance, suffice to say it is always a surprise to market participants who have taken on too much risk for too little payment. As we said last quarter, maybe the surprise this time around will be that interest rates do not drop precipitously.

If rates do drop, it will be a result of a financial crisis. Current “financial engineering” reflects the speculation of a market peak. Our favourites for financial implosion are still the mathematically and financially elegant mortgage hedging and credit derivatives. These are two financial strategies that have their basis in financial engineering but reek of practical stupidity. Stay tuned. If one or both of these blow up in their proponents’ faces, the downside could be severe for markets.

The credit market is priced for perfection. Credit spreads are woefully inadequate for the risk inherent in much of today’s financial innovation. We continue to be wary of the financial markets, since so much money is being invested so stupidly. We continue to raise cash and improve the quality of our portfolios.