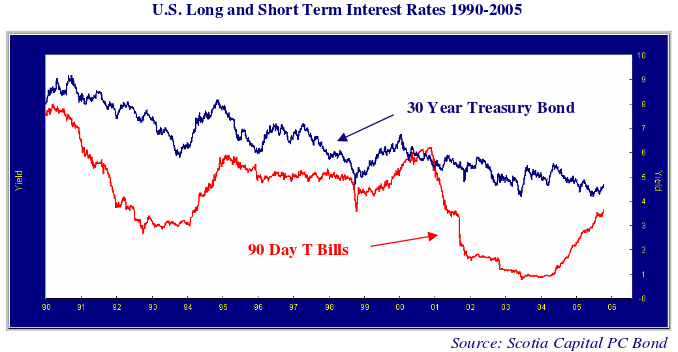

It has now become apparent that even hurricanes and high retail gas prices haven’t really slowed down the U.S. economy. This has moved the credit markets off its spring and early summer “high oil prices are deflationary” consensus. Fixed income investors now wonder about the strength of the economy and can’t discount tightening monetary policy. As the chart below shows, short term rates have been on the rise since mid 2004 but longer term rates have actually fallen over much of the period. The bond market now does not like what it sees and interest rates have started to rise for longer term bonds.

At Canso, we’re not big believers in sophisticated interest rate theories. Our simplistic and naïve view of interest rates suggests that real and nominal interest rates should rise with the tightening of monetary policy. We believe that this happens for two reasons. Firstly, less nominal dollars available for investment means a higher price (or interest rate) for those providing capital. Secondly, higher interest rates on lower risk investments like treasury bills means less stretching for yield by financial income dependent investors. Treasury bills at 4% take some of the shine off longer term bonds at the same yield. Credit suffers by comparison as well. A “high yield” bond at 5% seems a tad riskier when short term rates could be at that level in the not too distant future.

Long-term U.S. bond yields seemed to have made their cyclical low of 4.17% in June of 2003 with the announcement by the U.S. Treasury of its suspension of issuance of 30 year long bonds. The recent spring “oil is deflationary” rally came close to this with a 4.19% bottom in yield on the long bond. It has been downhill for long bond prices and up for yields which snapped back to 4.57% at the end of September. Although we do not profess to be experts at technical analysis, it would seem to us that the double bottom of June 2003 and 2005 will form the base for long term rates for some time to come.

We believe that the current credit markets are very speculative. Rising interest rates will not be kind to weaker borrowers and many of the current crop of new bond issues will not survive to the end of this market cycle. Current credit spreads are so tight that they do not compensate lenders for the credit losses that they will eventually face.

Mortgages That Go Boom

The current innovation in residential housing financing bears some mention. Financial institutions are desperate to keep their mortgage volumes high. This has caused a boom in new types of mortgages which reduce the payment burden for borrowers. In the United States, interest only mortgages are being offered which do not require repayment of principal. As rising short term rates have increased payments, “negative amortization” mortgages are now being offered. These financial IEDs (Improvised Explosive Devices) have payments that are below the level required to pay interest. The interest shortfall is financed by increasing the principal.

Canada is not immune from this mortgage market innovation. The down payment requirement for an NHA insured mortgage was reduced to 5% last year. This does not seem to be “borrower friendly” enough for some potential homeowners. As reported in the National Post, Scotiabank is now offering to finance the 5% down payment for “selected customers”. All this mortgage lending depends on rising home values and the assumption of credit risk by the federal governments in the U.S. and Canada. Financial engineering has taken the government insurance programs that were meant to provide affordable housing and turned them into backstops for the stupidest lending practices imaginable.

The Canuck Petro-Buck Goes High Octane

A strong Canadian dollar has been good for Canadian bond yields. Canadian long-term yields only made their cyclical low at 4.09% in June of 2005 and the chart below shows that they have not risen recently in tandem with U.S. rates. This is due to the enthusiasm for the Canuck buck as the new kid on the petro-currency block. Inflation is not so big a worry to a foreign bond investor if you are a major oil exporter and home to the Alberta tar sands, billed as the biggest oil reserve outside of unstable and geopolitically incorrect Saudi Arabia. The strong investment flows into the Canadian energy sector have moved the Canadian dollar to $.85 U.S., a level not seen since the last energy boom in the late 1980s.

The Bank of Canada and David Dodge are in a difficult spot. The U.S. continues to raise interest rates and the Canadian economy is strong and operating at a high level of capacity utilization. Raising interest rates would be a normal central banker response but the strong Canadian dollar might even get stronger! Mr. Dodge is making suitably broad hints on the rising interest rate front and raised the Bank of Canada overnight rate to 2.75% in September from the 2.5% level it had held since October 2004. A further 0.25% increase to 3% followed in mid-October. While Canadian dollar appreciation keeps imported prices low and helps on the inflation front, it is very dangerous to the Canadian manufacturing sector, particularly in Ontario and Quebec. We believe that this negative turn in terms of trade with the U.S. will cause significant weakness in central Canada. This makes us very vigilant on the credit front.

We think the Canadian bond market is very exposed to economic weakness and a setback in energy prices. Canada long bonds have gone from trading their traditional .25% above U.S. long bond yields to .5% below. If the petro comes out of the Canuck buck, a move back to the normal spread would see a relative depreciation of almost 10% in the Canadian long bond. Ouch!