It is very clear that the U.S. economy has now joined the other major economies and the global financial market in recovery. On Good Friday, bond traders manned their desks to await the release of the March U.S. Employment Report. While payrolls increased by 162,000 jobs, a little less than anticipated, overall employment grew at the strongest rate in the past three years.

A Good Good Friday!

Bloomberg markets contacted a happy Scott Brown of Raymond James who had made the closest forecast to the actual number. “There’s a lot of good news in this report…We’re clearly on the recovery path. We expect to see this continue to build. We’re on our way.” It was a good Friday for stock futures which rose in anticipation of a stronger economy and earnings. The U.S. dollar also rose in anticipation of economic strength and higher interest rates. Good economic news was unfortunately bad news for the bond market as prices fell and Treasury yields rose.

Our view has been for some time that the economy was recovering and that the unprecedented government and regulatory intervention would rescue the world’s major banks from their suicidal financial urges. Lowering interest rates to zero and stuffing banks full of cash proved up to the task of saving the banks from the crazed financial strategies of their overpaid management teams.

Once again we feel it germane to point out that the solution to the credit crisis, absurdly low interest rates, happens to be what caused it in the first place. Granted, this is not universally understood and agreed upon. Misters Greenspan and Bernanke and their Federal Reserve staff apologists are fervently making speeches and writing reports to show that their “Cash ‘O Rama” credit creation binge had nothing to do with the subsequent credit implosion. We beg to differ.

The Power of Rudimentary Observation

From our day to day vantage point in the financial markets, it was obvious to us that excess credit creation and easy money caused the credit crisis. We formed this view well before the proverbial stuff hit the fan. Unhampered by the necessity to generate reams of mindless analyses, we actually watched the response of investors to the heavy rain of financial manna from central bank heaven. When money is cheapened, investors and financial institutions tend to squander it on speculations rather than carefully invest it. Yes, this sounds like a little 20/20 hindsight, analyzing the markets perfectly in the rear view mirror. Fortunately, we can quote our February 2007 client reports and Market Observer newsletter:

“A significant economic risk comes from the financial markets where asset pricing and credit are showing a serious departure from reality. The Wall Street Journal titled a year-end 2006 article “Investors Riding the ‘Cash’ Rapids” and characterized an “(investment) world awash in cash”. When as august a publication as the WSJ speaks to its readers in this manner, one has to wonder about the efficacy of the prior tightening of monetary policy. Despite its skepticism and given its Wall Street base, the WSJ concludes that the benign conditions should persist: “But for now, the river of cash seems unlikely to suffer a dollar-related drying up. Indeed, it can be very hard to figure out what will end the flood of liquidity.” –WSJ

“Given our contrarian souls and many credit cycles of experience, unlike the WSJ, we do not have any difficulty imagining circumstances that could end today’s financial orgy. Our prime suspect is the lack of caution in the credit markets that will eventually prove its own undoing.” Canso Client Reports and Market Observer Newsletter, February 2007.

In defence of the heinous crime of quoting our own prose, we do so to prove a point. The date of our musings was early 2007, well before the mainstream investment consensus and financial press had ever heard of Credit Crunches, Collateralized Debt Obligations or Credit Default Swaps. Without the benefit of economists, financial engineers and whiz-bang quantitative methods, it was possible for some crotchety credit analysts stuck out in the wilds of Richmond Hill, Ontario to conclude that investors and bankers had gone completely and utterly bonkers.

We came to our conclusion by the rather rudimentary technique of observing credit spreads and deal structure, with nary a linear regression nor correlation table employed: “Detailed study of monetary aggregates is not needed to conclude that “living is easy” in the world’s financial markets. The obscene year-end bonuses of investment bankers are testament to the vast sums of money being placed into increasingly expensive and dubious investments.” We use our obvious perspicacity in 2007 to highlight our current concern that the WSJ’s “Cash Rapids” of 2006 are a mere trickle compared to the tsunami of cash and credit unleashed by the world’s governments and central banks in response to the credit crisis.

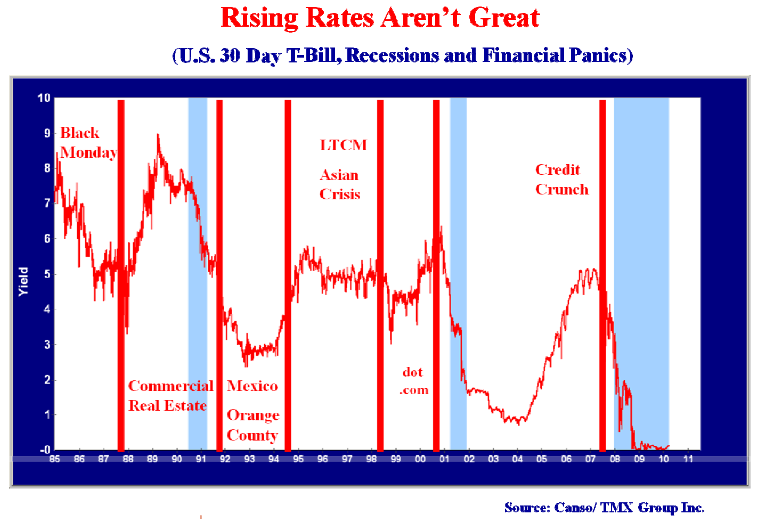

Rising Rates Aren’t Great

We are already seeing frothy credit markets in response to these stimuli. It is truly amazing to us that a mere year after the near death experience of credit markets, investors are again buying lousy deals. We once again quote the WSJ on the subject of credit promiscuity, a mere 3 years after their “Cash Rapids” article and a mere one year from the depths of the credit crisis:

“The rally in the corporate-bond market and a steady supply of easy money courtesy of the Federal Reserve are encouraging investors to take more risks. And Wall Street bankers and companies are taking advantage where they can.

Some of the riskier borrowing practices that flourished at the height of the bubble have begun to find buyers. Among them: so-called pay-in-kind bonds that enable companies issue more debt as interest payments, rather than pay cash. Companies are also issuing bonds to pay big dividends to their owners. Citigroup last week arranged a collateralized loan obligation, a complex security of loans that are sliced and diced and sold to investors.” Bond Buyers Accept More Risk, Mark Gongolff, Wall Street Journal April 5, 2010.

The credit amnesia of lenders makes us somewhat jaded at what will happen when monetary policy is finally tightened. The problem is purely and simply that the modern credit structure is based on the foundation of absurdly low interest rates. With anything close to appropriate monetary policy and reasonable interest rates, the whole edifice shudders and collapses on itself. The following chart, “Rising Rates Aren’t Great”, shows the U.S. 30 day T-Bill rate since 1985. We have also plotted recessions in blue shading and financial crises with red bars. Starting with the modest back up in short term rates in 1987, which led to the Black Monday stock market crash of 27%, even a modest increase in short terms rates causes financial disaster and /or recession.

The emergency easing after the Black Monday stock market crash was Alan Greenspan’s first taste of the financial crisis heroics that he became addicted to. The 1987 emergency easing was followed by a recovery in the stock market but the first Greenspan credit bubble was soon blown in the commercial real estate market. The subsequent Fed tightening and rising interest rates led to the near collapse of the major U.S. money center banks due to the implosion of their commercial development loan portfolios and caused the recession of 1991-92.

In 1994, Greenspan retracted his easing with a sharp increase in rates which was followed by both the Mexican and Orange County debt defaults which were of course followed by a Fed easing and lower rates. It didn’t take much of a rate increase to cause the spectacular Long Term Capital Management hedge fund to implode, of course followed by an emergency Greenspan easing. This liquidity then led to the dot.com stock bubble, recession of 2001-2002 and subsequent emergency easing. Get the picture?

The Power of Rudimentary Observation

Our cause for concern is what happened last cycle. After the recession had run its course, rates bottomed in 2004 and Greenspan tried something new. The Greenspan Fed widely broadcast its intention to raise interest rates in “measured”, modest and steady .25% increments, in a “normalization” of administered rates. The genesis of this idea was Greenspan’s rather naïve belief that, given market efficiency, that investors would incorporate this into their decision making and avoid thus avoid financial disaster. We were not enthused by Mr. Greenspan’s policy. In our reports and the Summer 2004 Canso Market Observer we said:

“Monetary Asphyxia?

Tightening monetary policy means there will be less investment capital for riskier investments as investors can obtain better income from Treasury Treasury Bills and bonds. The optimistic and the consensus financial market view seems to presently believe that “measured” Fed interest rate increases will result in what was called a “soft landing” in the 1990s. We are not so sanguine. It is the lack of oxygen that causes death by asphyxiation. Whether one is strangled slowly or quickly is a moot point if the outcome is the same.” Canso Market Observer Summer 2004.

Of course, as always, cheap money begat speculative behaviour from professionally stupid investors and bankers. They had only their bank’s money to lose and huge bonuses to gain. The result of this new fangled “measured” Fed increase strategy was the unmeasured implosion of the global credit markets.

What Happens When They Go Up?

Our rather skeptical view of the current run-up in the credit markets has to do with the last rather violent ascent and descent of U.S. short term interest rates. From the previous low of 1% in 2004, the Fed’s “measured” .25% increases culminated at the peak in the 5% range in early 2007 when we wrote about the WSJ’s “Cash Rapids”. Clearly, the Fed’s “measured increase” program did not slow down the credit markets in a smooth and similarly “measured” manner. The subsequent credit crisis and recession were the worst since the Great Depression of the 1930s. The question now is, since rates have literally hit bottom, what happens when they go up?

As we have said in previous reports, debt is not a problem when the coupon is zero. In real terms, the coupon on current short term debt is less than zero. Rates cannot be left at zero forever and will have to be raised at some time. A considered inspection of the graph above does not leave a warm fuzzy feeling about rising rates. Rates fell from the peak in 1990 for three years until 1992. Rates fell from the peak in 2001 for three years until 2004. From their peak in 2007, rates have now fallen for almost three years.

The debt accumulated since the dot.com bust has been unprecedented. It must continue to be serviced by the cash flows of governments, corporations and consumers. The current economic good cheer is very much due to the unprecedented market intervention and low interest rates by monetary authorities worldwide. The gazillion dollar question is how much rates can rise before the jig is up. The Fed is obviously very worried. Its assurances that it will maintain low rates for the foreseeable future are an indication that it considers the rising rate pain threshold to be very low indeed.

Inflation Targeting Regime Change?

The rapid reversion from abject fear to speculative market activity is a direct result of the monetary stimulus. As in 2004, it will take considerable tightening to quell the enthusiasm of investors drunk on monetary stimulus. We think that the credit and equity markets should be fine for the next year, absent a spectacular financial implosion like a bankrupting Greece or a Chinese credit implosion. Rising short rates and competition from equities makes rising government yields and falling prices likely.

Thankfully, it looks to us like a serious rate increase is a fair distance off. Central bankers and politicians are loath to strangle an economic recovery to defeat an inflation enemy hiding very deep in its foxhole. Monetary policy will lag inflation as it always does. So great is central bankers’ fear of financial cataclysm that it probably will lag by an even longer time period than normal. They will probably ignore what previously would have been considered high levels of inflation. Whether higher inflation will even be considered an enemy is not assured. A recent paper by an IMF economist argues that current monetary regime of inflation targeting at 2% has caused economic damage and the target should be raised to 4%. With long Treasuries at 4.5% and long Canada’s at 4%, this is a fairly radical policy proposition.

Born Again Risk Aversion

Delay in tightening monetary policy will be not a bad thing for the financial markets at first. Tightening monetary policy means fewer dollars. More dollars means higher prices for financial assets and higher commissions from trading and selling. Pundits are now talking about a “rotation” from bonds to equities which usually is the case. We are not so sure this time around. There’s nothing like a 40-50% haircut in portfolio value to get someone’s attention. What we are seeing from both our individual and institutional clients is a novel recognition that equities bear substantial capital risk and this seems to have changed their longer term risk preference.

Gone is the cavalier “buy on dips” and “stocks for the long term” mentality. What seems to have replaced it is the quest for up front financial income, be it interest or dividend. This might simply be a reaction to the severity and length of the equity market downturn, especially in formerly safe stocks like financials. Whether this born again risk aversion will sustain once the fear is sufficiently aged and greed sufficiently emerged is another question.