If you’re wondering about what is going on in the financial markets, you are not alone. There are so many cross currents in the financial markets at present that many highly educated and very smart people have no idea what is happening. This possibly includes us, but we won’t let this stop us from observing on the markets for our loyal readers.

The Perfect Twitter Storm

We are well delayed in our musings on the markets and more than a few of you have contacted us to find out when this Market Observer would be published. We admit to having found it very hard to write about these unsettled markets and our delay has morphed this edition from July to very late August.

The major reason that we are so tardy is that every time we neared completion, there was a Twitter eruption from President Trump that required a change in our trusty reporting. We told you not so long ago that financial markets had departed from reality and we were well into a “Not Normal” phase, especially monetary and fiscal policy in the United States. Well, since then things have deteriorated and we are now into what we think is a “Perfect Twitter Storm” phase, a confluence of ill advised economic and trade policies in the United States that risks disaster.

The spectacle of Trump using schoolyard name-calling to bend the Fed to his wishes for lower interest rates is truly bizarre. Just last Friday we were putting finishing touches on our draft when Trump launched a Twitter fusillade that called Jerome Powell, the Chair of the Federal Reserve whom Trump appointed, an “enemy of the United States”. Powell seems to have enraged Trump by making a speech in which he talked about the Fed’s independence and suggesting that the recent Fed interest rate decrease was only a mid course correction and not the start of the large interest rate decreases that Trump has been demanding.

The Hereby and By

Trump was also upset that China had just levied retaliatory tariffs against U.S. imports and suggested that President Xi was an enemy of the U.S. in the very same tweet that slagged Powell. So much for “loving” tariffs and stating that trade wars were “easy to win”, as Trump had previously bragged. An angry Trump then tweeted “I Hereby Declare” that American companies couldn’t do business with China. Who knows what the heck he meant but the equity markets, which had been improving to that point in the day, took exception and then plunged downwards. Bond yields also plunged anew on fears of trade wars and a slowing economy.

The problem to us is that, as on last Friday, investors are fixated on monetary policy and mesmerized by Trump’s bullying of the Fed, not the cash flows of the underlying companies and their securities. The latest Trump tweet seems to continually set the pundits and markets off balance. Stocks were up in the spring and early summer on enthusiasm at potential central bank easing and hopes for a strong economy. Bond yields were down at the same time on the same central bank easing but opposing fears of a weak economy.

This all reversed in late July when stocks cratered on Trump’s latest volley in his trade war with China. Trump’s trade tizzy also took bond yields to the lowest level they’ve been since 2016, in the aftermath of the Euro Debt Crisis when fears of sovereign bond default and depression dominated markets. Then stocks went back up again, then down on another Trump tweet.

Mood Swinging Markets

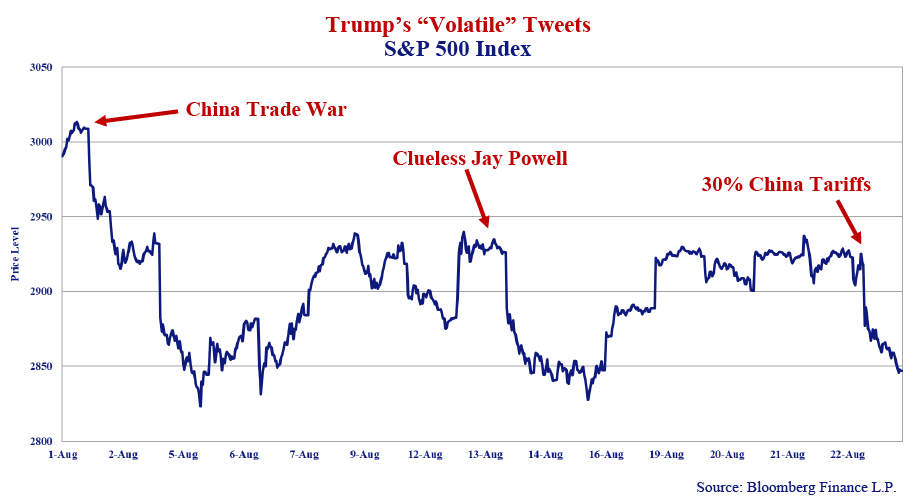

To show you how volatile the markets really are, we’ve created a chart of the S&P 500 stock index versus Trump’s tweets. As you can see from the chart, Trump moves markets with his tweets.

The real question that we have is what will happen when Trump recognizes that his Twitter tantrums are hurting the stock market and his chance for re-election? We know that Trump follows the stock market closely and uses it as his proxy for economic success. Right now, we wonder if and when Trump declares victory in his trade wars, what will happen to the bond market if the stock market soars in response.

Bonds Scream Recession as Stocks Party On

Bonds are now “priced for perfection” with yields at Recession if not Depression levels. That is not an exaggeration. The U.S. 30-year T-Bond broke through 2% recently in late August, something that didn’t even happen during the Great Depression of the 1930s when deflation was rampant and prices were dropping at 3% to 4% per year with unemployment approaching 30%.

Bond investors must be expecting absolute economic disaster. The current inflation rate and the current state of the U.S. economy do not justify the extraordinarily low levels of bond yields. The 1.91% yield on the Long T-Bond recorded at 9:30 am Wednesday, August 28th is almost the same as the most recent 1.8% year-over-year increase in the July Consumer Price Index (CPI) reported by the Bureau of Labour Statistics. The CPI less Food and Energy index was even higher at 2.2%. The monthly increase for July was 0.3% for both the all items and less food and energy, which annualizes out to 3.6%.

No Inflation Concern

Despite President Trump’s frequent assertion that there is “No Inflation”, the July CPI report shows clearly that there is still inflation in the U.S. economy. The general lack of concern over inflation is reflected in the April 22nd Bloomberg Businessweek cover shown here, that blared “Is Inflation Dead?”. Magazine covers tend to come at the peak in any vogue or fashion, so this confirms our long-held suspicion that interest rates and bond yields are towards the end of a long bottoming phase.

Trump is Right About the Economy

Despite Trump’s demands for lower interest rates, he continually points out that the U.S. economy is doing well, which it is. The doom and gloom camp, which includes most bond portfolio managers, points to the “weakening” after the unsustainable fiscal jolt of the Trump tax cuts. Things are actually not bad, with the unemployment rate still at record lows and consumer confidence high. Trump’s trade wars have shaken the confidence of the financial chattering class, but the average person still says the job picture is good. Trump’s crackdown on immigration and his trade tariffs are making U.S. workers more competitive and their wages are continuing their slow march upwards.

Shake It Off!

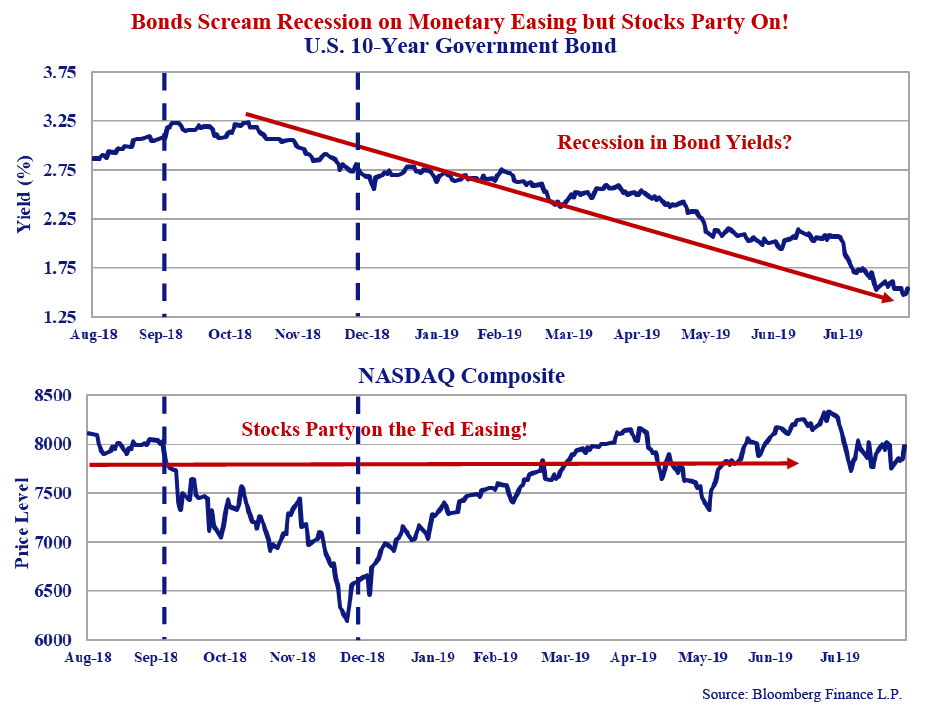

Perhaps that’s why stock investors are not particularly worried by the prospect of economic doom that the bond market is pricing in, even though things have become a little choppy lately due to the Trump Twitter tantrums. As Taylor Swift might sing it: “The economic haters are going to hate, Shake it Off!!”. And that is certainly what equity investors seemed to have done. The chart below shows that the 10-year U.S. Treasury yield was 3.18% on October 3rd, 2018 when the Nasdaq stock index was 8,025 and started its downtrend. When the Nasdaq bottomed at 6,193 on December 24th, the day before Christmas in a thin market, the 10-year U.S. Treasury yield was 2.74%, down 0.5% from the peak.

The Nasdaq then trended up to its present 7,973 and is almost back to where it was before the stock market cratered in late 2018 when bond yields were much higher. The interesting thing to us is that the 10-year U.S. Treasury yield has continued to fall to its present 1.51%, down another 1.23% despite a rising stock market and a reasonably strong economy. This is near its 2016 all time low in the midst of the Euro Debt Crisis.

How can stocks hold firm on central bank easing at the same time bond yields were falling because of a weak economy? Clearly, bond investors are expecting economic cataclysm, but stock investors still seem to be excited by the prospect of monetary easing and more money to chase up the value of the stocks they hold.

The Pointer Sisters Sang It

We think it is because everyone is excited. We could call our current situation the “Pointer Sisters Market”, after their 1980s hit “I’m So Excited”. Stock traders, equity portfolio managers and individual investors are excited by more money and rising stock prices. Lower bond yields mean that bonds are also going up in price and this gets bond traders and fixed income portfolio managers excited as well. Lower yields mean people are “stretching for yield” and bidding up the prices of corporate bonds and bank loans, which gets investment bankers and credit traders excited too.

Lower Rates Ahoy?

This all results from the market consensus that the Federal Reserve will not just suspend their program of increasing and “normalizing” interest rates, they will continue to lower interest rates despite a reasonable economy and robust employment. This is what the Fed’s Open Market Committee seems to have done in July at President Trump’s behest, wilting under a severe Twitter bombardment.

The chart above of the U.S. 10-year yield shows that it has plunged since Trump amped up his Twitter tirades against the Fed in late 2018 and early 2019. As we’ve said, inflation is still peaking over the Fed’s 2% target. As the economy hasn’t really slowed enough to justify yields this low, one can only suspect that the bond market is thinking that the Fed will yield to Trump’s demands for lower interest rates. It might also be fears of Trump’s trade war, but higher tariffs on most goods imported from China could very well push inflation even higher.

The Invisible Gland?

As we have told you many times, markets are not efficient predictors of the economic future. Yes, they move on investor expectations, but this is more the psychology of investors than Adam Smith’s “Invisible Hand”. The best work we have ever seen on market expectations for inflation suggests that the experienced last 12 months inflation is a pretty good proxy for investors’ long-term inflation. That is running at over 2% so bond investors must believe in a serious economic slowdown to be buying 10-year bonds at yields of 1.5%.

Markets also move on the physiology of investors so there might even be an “Invisible Gland” at work. Professor John Coates of Cambridge has detailed in his wonderful book, “The Hour Between the Dog and Wolf”, his research into the human biochemistry of investing involves the natural chemicals and hormones that our human bodies evolved for evolutionary success. These reward us with pleasure for social interaction and procreation, prepare us to deal with danger, and tell us when to avoid pain and flee.

Since we’ve been over this before, we’ll just summarize his work by saying that markets going up increase testosterone, particularly in young men who form the majority of financial traders. Coates’ work also shows that cortisol, the hormone for panic and fear, floods traders’ bodies in market downturns and puts them into a state of terror.

A testosterone build-up fuels very risky investor behaviours. Think of the movie “The Wolf of Wall Street” and the chest thumping machismo that it chronicles. While the traders in the movie descended into illegal behaviours, the more reward the markets dish out, the more risks that traders and investors tend to take on.

“The Fed’s About to Lose Control…”

In this market and at this juncture, we believe that investors are literally chemically stoned on higher securities prices and their recent financial success. As the Pointer Sisters sang (our additions in brackets):

“I’m so excited, and I just can’t hide it

I’m (The Fed’s) about to lose control and I think I like it

I’m so excited, and I just can’t hide it

And I know, I know, I know, I know, I know I want you (to ease monetary policy)”

The legendary British economist John Maynard Keynes called this “Animal Spirits” and this is what causes financial bubbles. Bubbles are not based on financial reality, they stem from financial illusion, dreams and hope. It is hard to tell when you’re in a bubble, because like everyone else, your body is besotted with “feel good” chemicals.

Bubble, Bubble, Monetary Toil and Trouble

Former Federal Reserve Chair, Alan Greenspan, was once thought to be an economic genius for his “Great Moderation”. It is now thought that he aided and abetted the Credit Crisis with his serial monetary easing, so perhaps in keeping with our musical musings, we should now call him the “Great Pretender”. Greenspan once said that it was impossible to see a financial bubble when you were in one. We beg to differ. You just need to go back in our newsletter archives to the mid 2000s to verify our claim that the pre-Credit Crisis bubble was very evident in the risky investor behaviours of that time.

Greenspan was literally the “Doctor Feel Good” of the financial markets, a pusher of the body chemicals of reward. Greenspan’s belief was that it was impossible to identify bubbles, perhaps reflecting that he didn’t want to be blamed for “ending the party”. He believed the role of the Fed was to support the markets in the aftermath of bubbles bursting rather than preventing them. This famous “Greenspan Put” made investors forsake their economic role as allocators of capital and encouraged the risky behaviours that ended in the Credit Crisis.

We are now again seeing more and more risky investor behaviours, literally too many to iterate and in any event, we’ve been pounding the Canso newsletter table on Leveraged Loans, High Yield, Pot Stocks, Bitcoin, Private Equity and other forms of pending investment self-destruction for some time. We won’t bore you with more examples, but caution is now in order for risky assets.

Keeping At It

Greenspan didn’t have to cope with Donald Trump’s tweets and his bullying tactics towards the current Fed Chair Powell. Politicians have been trying to influence the Federal Reserve since its creation. As we frequently say, more money is always more popular than less money and politicians want to be popular, especially the populist President Trump. We have literally entered into new territory with Trump. Before Trump, Presidents and politicians in general would refrain from commenting on Federal Reserve policy to ensure its independence from political pressure.

Politicians of all stripes thought it best to leave the key decisions of monetary policy to the objective and independent members of the Federal Reserve Open Market Committee (FOMC). Paul Volcker was the Fed Chair who raised rates to punitive levels to break the inflationary cycle of the 1970s. We are currently reading his book, “Keeping At It”, for a dose of financial sanity in our twisted economic times. Volcker describes in his book an incident where he was called to a meeting with President Ronald Reagan. His Chief of Staff, Howard Baker, informed Volcker, with Reagan sitting right there, that “the President doesn’t want interest rates to be raised before the election”. Volcker says that he was so surprised by this political intervention into monetary policy and the inappropriateness of the meeting that he just stood up and walked out. Volcker recalls that the meeting was held outside the Oval Office, probably to avoid the tape-recording equipment there. This now seems very quaint with Trump’s overt verbal abuse of Powell and the Fed.

The Costs of Insurance

To us, it all comes down to the direction of central bank policy and how much “policy insurance” that central bankers want to bake into their monetary strategy. The danger right now is that U.S. monetary and fiscal policies are already loose. The Fed just gave up on “normalizing” interest rates with its recent drop in the Fed Funds rate and reversed its quantitative tightening which had seen it let the maturing bonds in its now vast holdings of U.S. Treasuries roll off.

All Hail the “King of Debt”

On the fiscal side of things, the U.S. is now running the largest deficits outside of wartime and things won’t be getting better. President Trump is reputed to have said recently that he doesn’t care about the huge deficits and massive government debt since they won’t be a problem until he is out of office. I guess we should have expected this from the self-proclaimed “King of Debt” and a serial bankrupt. The Republican Tea Party financial conservatives are now nowhere to be seen on deficits and debt and it is highly unlikely that the left leaning Democratic Party will suddenly find financial probity. This means that no matter who wins the 2020 Presidential election, deficit spending will be with us for some time.

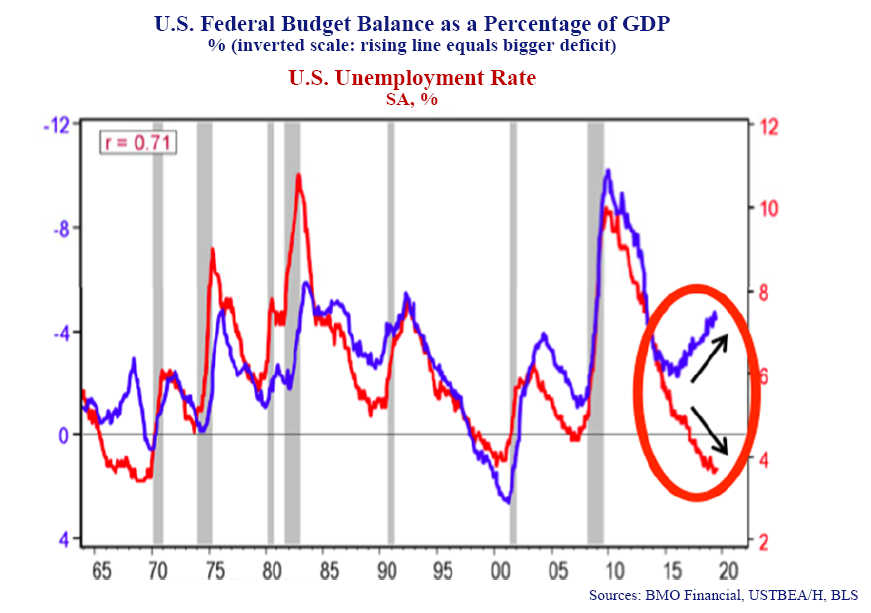

It is very unusual to be running such large deficits in a strong economy with low unemployment. The economists at BMO Financial had a good chart on this that we show below and thank them for their excellent insight.

This shows the U.S. fiscal deficit as a percent of GDP (inverted) on the left-hand scale and the unemployment rate on the right-hand scale. Note since 1965, the usual case is that when unemployment rose, the deficit grew more negative as the government ran deficits to fight unemployment and a weak economy by borrowing and spending. When the economy improved from the fiscal stimulus and unemployment dropped, the deficit dropped as well as government revenues grew. Budgetary surpluses were even achieved in the late 1960s and 1990s.

This is the way that fiscal policy is supposed to work. Debt financed government spending counteracts weak private sector spending in recessions. That debt is then paid down with higher tax revenues in a strong economy. The problem is that politicians like to spend no matter what. Despite Candidate Donald Trump’s promises to balance the budget, the Trump Administration cut tax revenues and actually increased its spending creating massive budget deficits.

Hey! Big Spenders…

The amazing thing about this chart is that it shows for the first time a rising deficit with falling unemployment, just since Trump was elected. Unemployment is as low as it was when the U.S. government was running surpluses but now, we have large and increasing deficits from debt financed government spending, but nobody seems to care. As David McIntosh of the Club for Growth said:

“It’s pretty clear that both houses of Congress and both parties have become big spenders, and Congress is no longer concerned about the extent of the budget deficits or the debt they add.”

Right now, we think bonds are priced for perfection with monetary and fiscal policy very loose so stayed tuned to the Trump show. “The Donald” knows how to work a crowd and build suspense. We find it hard to believe that he won’t try to right the stock market ship just before his electioneering starts in earnest by striking an agreement with China.

Reasonable Canada

Canada is a little better off than the U.S., with more reasonable fiscal and monetary policy. As the U.S. markets come to grip with reality, however, we expect that Canada will be dragged along by the “trends of our friends”. If U.S. bond yields move up, Canadian yields will grudgingly follow along. The lower level of the Canadian dollar has benefitted Canadian manufacturers so it is unlikely that Bank of Canada will tighten monetary policy if the U.S. is on hold.

The Alternatives Reality

Low bond yields have created a stampede out of more pedestrian marketable investments into “Alternatives”, which we think is going to end very badly. Thanks to the Fed and the world’s other central banks, there is a lot of liquidity sloshing around out there and investors are still oblivious to risk in their haste to “get invested” and be fashionable. This ranges from Life Insurance Settlements to foreign farmlands and forestry plantations. Virtually anything can be packaged into a slick marketing presentation and sold to the slavering alternative masses.

This frenzy reminds us of the commercial real estate debacle in the late 1980s. Real estate had done exceptionally well for many years as interest rates dropped and rents went up with inflation. It ended very badly. Institutional investors piled in just in time for the great sell off where prices dropped up to 50% on some properties.

“Paying the Offered Side”

We’ve spoken about bid ask spreads and liquidity many times in these pages and it is something that is fundamental to the Canso investment philosophy. The bid side is where a willing investor will buy an asset and the offer side is where a willing investor will sell it. The difference between bid and ask is the “price spread”. A very liquid $100 U.S. Treasury bond might have a 1 cent price spread or .01%. A liquid corporate bond would be less than $1 or 1% and an off the run corporate bond might have a 1–2% price spread, and a high yield bond might be over 2%.

The current investor in alternatives is, in bond terms, “taking out” the offered side on these very illiquid assets. In bond terms, they are paying $100 for something that might have a bid side of $50 or lower in a down market. They are being very fashionable, but they have no idea that the very stylish “Private Debt” they are buying, which we have done our whole careers, might end up at 40% of what they paid if nobody wants to buy it. For now, the alternative investor is confident as part of the alternative investing herd that their assets are highly desirable and sought after. Markets are fickle and liquidity can disappear in a nanosecond. While these illiquid assets are not subject to daily market price fluctuations and are not marked to market, it will take only one desperate seller at the bottom to reprice everyone’s portfolio holding of Zimbabwe farmland.

It’s Time for Caution

With all the liquidity sloshing around the markets and potential returns well below the risks that investors are willing to take on, we are growing increasingly cautious.

We still think higher quality is cheap and investors are overpaying for expensive lower quality assets in their quest for returns. Our portfolios are increasing their quality and liquidity.

Stay Safe in your investing!