Our last two Market Observers have been polar opposites in their counsel. The January edition was entitled “Full of Bull” and blared caution on the speculative financial markets:

“In the credit markets, the “Stretch for Yield” is now in full bloom. We think the credit markets are getting expensive and despair of all the money now chasing yield in “Private Credit” and “Alternatives” … people currently stampeding into private debt do not have any idea of the damage a turn in the credit cycle will do to their portfolios.”

We were obviously very worried about the speculation afoot in the financial markets and particularly in the credit markets. In our experience, old generals and the financial markets always prepare to fight the last war, but we believed the next market dislocation would be a traditional market rout, brought about by an unexpected shock.

A Shocking Shock

We didn’t predict the COVID-19 pandemic, but it sure didn’t take very long for this unexpected shock to appear, and shock it did. The markets peaked in mid-February on its ebullience at the monetary ease from the Federal Reserve. They then crashed in March when the full scope of the COVID-19 pandemic and the economic damage it would wreak became apparent.

The lesson in the downside of speculative excess was violently taught to the previously unwary. Investor panic still gripped the markets in April when our last Market Observer urged buying amidst the marked down pricing of the pandemic markets:

“We are doing a lot of buying of cheap bonds… The huge liquidity assistance provided by central banks to the markets has considerably narrowed spreads, but the good news is that many securities are still very cheap on a normalized basis.”

It was apparent to us by that time that the huge monetary and fiscal stimulus by governments around the world had kicked in and markets were improving:

“As the central bank liquidity programs swung into action, markets started to improve and the panic selling lessened. Buyers started “lifting offers” and sellers waited for better prices and prices “gapped” higher. That said, prices are still well down from a month ago. Things will eventually improve and those with capital to invest can still find great values and will make money as things normalize.”

Of Masks and Men

We ended our April Market Observer with the thought that the “real question is what is ahead for the pandemic”. Our answer was that we were not medical experts but that“it seems to us that the countries that have implemented the most restrictive social distancing and lock downs have fared the best with the COVID-19 pandemic”.

We said in early April that it would take at least 2 months for the lock downs and social distancing to work and the economy to start rebounding. We were actually spot on with our forecasting, as things indeed did start to improve in June. The problem now is the United States cannot seem to muster the political will or societal patience to follow its own public health advice. President Trump declared victory when social distancing dropped the rate of infection and new cases. He then put himself in charge of the “Great Economic Re-Opening” but things now seem to have opened up too early and too quickly. The U.S. is now showing a huge increase in infections and hospitalizations and many states, like Florida, Texas and California, have had to close down again.

Other regions and countries, like the Europeans and New Zealand, have made steady progress through effective social distancing programs to the point where they have very few cases and the rate of transmission is very much under control. They are now getting their economies back up and running but the United States is shutting down again in many states as the pandemic flares up again. As Bloomberg reported:

“While COVID-19 cases have plateaued and sloped downward in industrialized economies in Europe and Asia, the U.S. is still clocking in at record levels of new infections and accounts for 25% of global fatalities.. Promising treatments are emerging, yet an effective vaccine is still months away, if not longer.

If the virus is not contained soon, a new surge of infections in Sun Belt states like Florida, Texas, Arizona and California could push up the daily tally to as high as 100,000, warned Anthony Fauci, the nation’s top infectious-disease fighter, in a Senate hearing this week.

“What we’re seeing over the last several days is a spike in cases that are well beyond the worst spikes that we’ve seen,” said Fauci, director of the National Institute of Allergy and Infectious Diseases, in a BBC radio interview Thursday. “That is not good news. We’ve got to get that under control or we risk an even greater outbreak in the United States.

Bloomberg News; Life, Liberty and Face Masks: Virus Preys on Divided America, July 2020.

The U.S. has politicized their pandemic response to the point where mask wearing has become a political statement. Unfortunately, the COVID-19 virus does not care about political positioning. It seems to us that, rather than shut down again, as is happening in Texas and Florida, a public health order to wear masks would be a reasonable thing to do. If mask wearing drops transmission rates by up to 60%, as studies show, then slowing down spread would be much easier.

Masking Disaster

The good news is that the news on COVID-19 coming out of Texas and Florida is so bad that even faithful Trump Republicans like Texas Governor Abbott and Vice-President Pence are counselling mask wearing. We seem to be very fortunately past the touting of miracle cures, wishful thinking and into the grim realism necessary to actually lower infection rates to acceptable levels.

The bad news is that the U.S. economy will be much slower than its developed world peers in recovering to “normal”. Thankfully, the financial markets seem to be looking through the COVID-19 pandemic and discounting an end to social distancing. The fiscal and monetary stimulus has been incredible in scale and rapidity, making the Credit Crisis programs seem mundane by comparison.

A Fearless Rally

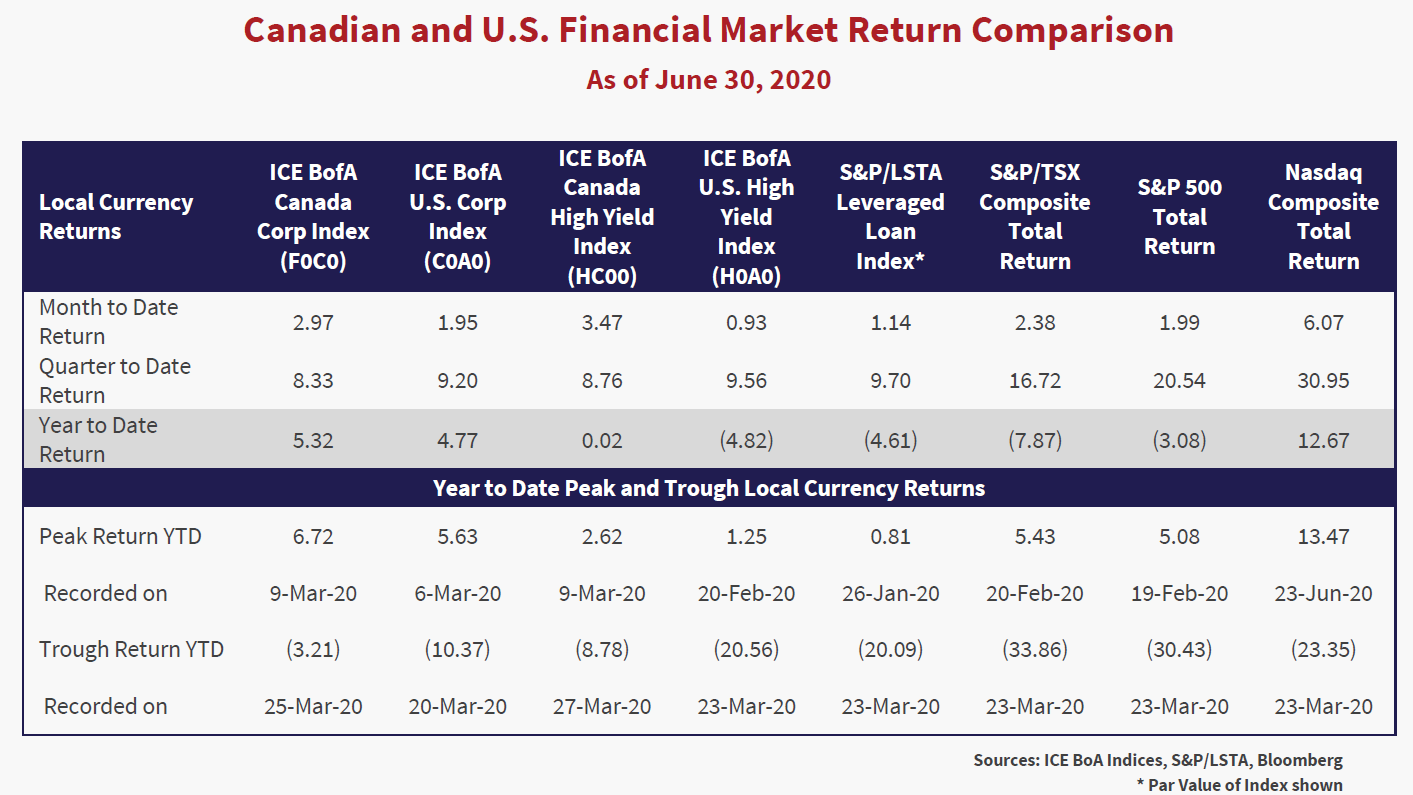

The table below shows the returns for various Canadian and U.S. financial market indices ending June 30th, 2020. It also shows the peak and trough year-to-date returns that each Index achieved. This shows quite obviously that the financial markets have almost recovered completely from the COVID-19 sell off, despite the economic uncertainty. For example, the ICE BofA Canada Corporate Bond Index of Investment Grade corporate bonds was up +3.0% in the month of June, +8.3% for the second quarter and sits at +5.3% year-to-date. That is nearly as high as the +6.7% it recorded on March 9th, incidentally the day the global equity markets plunged. The downdraft in equities sucked down credit and corporate bonds in its wake vortex. It took only 16 days for Canadian corporate bonds to fall -9.3% to end up down -3.2% on March 25th, before recovering +8.8% to the current level.

The equity markets have also moved very quickly from despondency to jubilation at the Fed’s monetary largesse. Despite the economic havoc wreaked by the Novel Coronavirus, the S&P Total Return Index is only down -3.1% for the year, not too far off the high of +5.1% in mid February. The S&P got there by falling -33.8% from the February high and recovering +39.3% off its lows to its level at the end of June. The higher “digital component” of the NASDAQ has seen its Total Return Index not only turn positive but blow through its February highs. Its high of +13.5% was recorded on this past June 23rd and then it settled back to up +12.7% at the close on June 30th. This was up a powerful +47.0% from its lows on March 23rd, having been down -23.4% on the year at that time. All of the other Indices show very strong recoveries from their steep drops as well.

While it is still not clear if and when the economy will fully recover, there is lots of money being pumped into securities purchases by the Fed and this has given a lot of comfort to those buying securities. It is not clear to us at this point how much of this is due to “retail money”, but certainly retail investors are in and buying. There are a lot of punters playing the markets with a fervour we last saw prior to the dot.com boom of the 1990s.

The question is whether this massive speculation will end well. It never does but, as we have told you very often, it speaks to the fact that when capital is too easily available, people tend to waste it. From the Dutch Tulip Bulb mania to the dot.com tech bust, rapid monetary expansion never ends well for the naïve investor.

Portnoy’s Complaint

This time around, we have the spectacle of a legion of millennials using the RobinHood App to easily trade stocks while getting their information from someone who admits he knows nothing about the stock market. Bloomberg profiled frustrated sports commentator Dave Portnoy. With sports closed down, he now applies his smack talking and sports prognosticating talent to the financial markets. Who needs to understand the markets when you just “play” them, like sports betting?

“Barstool Sports’ Dave Portnoy had bought just one stock in his life before the quarantine hit. When the country shut down in March, canceling sports and sports betting, the founder of the brash media empire considered sexist by some dusted off his old E*Trade account and started day trading.

“With the volatility, it is kind of like watching a sports game,” said Portnoy, 43, who started live streaming as “Davey Day Trader Global” to his 1.5 million Twitter followers with the caveat: “I’m not a financial advisor. Don’t trust anything I say about stocks.”

Despite the obligatory warning, Portnoy has touted stocks like InspireMD Inc. and Smith & Wesson Brands Inc., while dissing the acumen of Warren Buffett, the world’s fifth-richest person and widely regarded as one of the greatest investors ever. “I’m sure Warren Buffett is a great guy but when it comes to stocks he’s washed up,” Portnoy tweeted Tuesday. “I’m the captain now.”

Portnoy and his ilk have been part of one of the greatest rallies in history, adopting as a mantra the online slogan of “stocks only go up!”. Market watchers are being forced to ask to what degree retail interest has become a self-fulfilling prophecy in many parts of the market — and what dangers it poses for its sustainability…

That’s changing. Stuck at home with plenty of free time, government stimulus checks, no sports to bet on and, for better or worse, a figure like Portnoy turning investing into entertainment, more and more young people are wading in for the first time.”

The Madness of Crowds Buying Stocks

Is Portnoy, the self-proclaimed “captain” of stocks that “only go up”, wrong to hype the stock market? Not really. There’s nothing like greed and the dream of getting rich to suck people into a hot market. Stock speculation is well established as a part of the financial markets. Isaac Newton was the scientific genius who discovered gravity but he suffered huge losses during the stock market crash of 1720. Newton said after that he “could calculate the motions of the heavenly bodies, but not the madness of the people”.

Every generation is forced to learn the hard lessons of investment fear and greed. Charles Mackay wrote his “Extraordinary Popular Delusions and the Madness of Crowds” in 1841 that included chapters on “Economic Bubbles” like the South Seas Bubble that wiped out Newton and the Railway Manias of the 1840s. Warren Buffet’s mentor Benjamin Graham had been wiped out in the Great Crash of 1929 and wrote his famous value-investing book the “Intelligent Investor” as a result. We have quoted John Kenneth Galbraith’s excellent book “The Great Crash 1929” many times in these pages.

Only the medium changes over time. In the 1920s it was “Stock Tippers” and taxi drivers saying: “Psst, want a hot stock to get rich?”. Modern day stock hyping has moved from bored day trading Boomers watching Jim Cramer yell and scream his recommendations on cable TV to millennial sport Bros streaming Portnoy digitally and buying and selling on an App. Only the age of the viewers and the medium of delivery differ.

Does this all mean that Canso thinks the financial markets are overvalued? No. There is substantial speculation, but we are still finding good values, particularly in pandemically affected stocks and bonds. If things eventually recover then these issuers will still have real businesses, albeit involuntarily altered to a more digital state.

A Steep Price for Long Bonds

Since we just finished a more exhaustive discussion of the economic ramifications of the COVID-19 pandemic in our June Corporate Bond Newsletter, we will limit our dismal science comments. We simply reiterate that we think that government bonds are pushing the limits of investor tolerance. Long bonds in Canada at 1% and in the U.S. at 1.4% are vastly overvalued but no central bank will tighten up monetary policy for some time to come.

It looks to us that long bond yields will rise and “steepen” the yield curve. This time around, the Trump Republicans are pushing fiscal stimulus alongside the Democrats. Portnoy’s sport Bros, sitting at home collecting their unemployment benefits and pandemic cheques signed by Donald J. Trump are testament to this!

Hard Alpha Awaits

As we’ve said before, the markets have rallied hard on monetary ease and the “Easy Beta” has been captured. Portnoy and his investing fan club are chasing Hertz stock without understanding it very probably will be wiped out in the Chapter 11 filing. It is the “Hard Alpha” that remains to be captured in Hertz and other companies and that’s where we are spending our time.

We are seeing reasonable companies that have been severely affected by the pandemic do financings at 10-15% yields. Controlling the downside means that there are still great bargains to be had!