The Greatest Fools Are Running Things

The “Greater Fool” investment theory postulates that when the price of a financial asset soars well above its fundamental value, the price appreciation is due to the prospect of a greater fool buying it from the foolish owner.

By their own admission, the publicity-seeking and experimental economists running today’s central banks are now the Greatest Fools of all. They are buying bonds with no regard to their price or value in their desperate attempts to improve their economies with ultra low and even negative bond yields.

Bond portfolio managers are watching this financial inanity with trepidation but most are bowing to performance pressure and holding on to their very overvalued bonds. Having a shorter duration than your index has led to career disaster for generations of bond managers since 1981. Hugging your benchmark duration and hoping things don’t go too wrong is today’s most popular bond manager career strategy.

Incredible Complacency

This is quite a change from the almost certainty in 2009 and 2010 when everyone, including taxi drivers and our relatives, were convinced that interest rates would soar from the easy monetary policy of that time. We commented that this strong consensus view risked yields going in the opposite direction. This happened during the Euro Debt Crisis from 2010 to 2012 when yields began their plunge to today’s paltry levels.

We are now in exactly the opposite situation to the inflation scare in 2009 and 2010. There is incredible complacency about the effects of the current experimental monetary policies. We can’t help but think this is a contrarian indicator of serious import. Investors believe that the tsunami of money flowing out of central banks and into the markets will continue forever. This is despite the constant assurances from the Federal Reserve that it will indeed slow its production of money and raise interest rates.

No One Knows

People are confused. Both sophisticated and very naïve investors alike are asking us to explain “the meaning of negative yields”. Our response is simple: no one knows, not even the central banks creating them. Negative nominal yields are a very recent phenomenon with no historical precedent. The technical explanation is easier. Central banks are busy buying bonds and bidding up their price to levels that make the yield to maturity negative. A negative yield to maturity means that the present value of the expected cash payments on a bond is less than the current price of the bond. This is analogous to a negative IRR (Internal Rate of Return) on a project that means more cash is put into a project than it produces in a Present Value sense.

Where does this put the bond market? Our take is that we are still in a long period of bottoming bond yields. How negative can bond yields go? Not that negative, as obviously there would be an unlimited supply of bonds if borrowers were paid handsomely by lenders to issue them. The same goes for consumer interest rates. Very negative interest rates on consumer savings would end up with cash in mattresses and safety deposit boxes.

Ultra Unpopular

Eight years after the Credit Crisis, the popularity of ultra loose and experimental monetary policy is fading rapidly. Where Central Bankers used to get slavering media attention for their “Bad-Ass Economist” policy innovation, there is a growing groundswell for them to stop their experimentation. Republican Presidential candidate Donald Trump, however flawed and policy ignorant, understands this. His aggressive complaints about Chair Janet Yellen and the Federal Reserve’s low interest rate policies resonate with Americans outside the Wall Street thought bubble.

We are not talking about the left here. It is right wing populism that objects to funny money. Trump is a Republican. Theresa May, the accidental British Prime Minister, heads the British Conservative party. She has also pointed out the dire effects of low interest rates:

“While monetary policy, with super-low interest rates and quantitative easing, provided the necessary emergency medicine after the financial crash, we have to acknowledge there have been some bad side effects,” the prime minister said. “People with assets have got richer. People without them have suffered. People with mortgages have found their debts cheaper. People with savings have found themselves poorer. A change has got to come. And we are going to deliver it.”

Change Has Got To Come

“A change has got to come. And we are going to deliver it.” That’s pretty strong rhetoric. It is quite astounding that this indictment of the current monetary policy regime comes from a Conservative Prime Minister in a speech to a Conservative Party conference. Mrs. May has also messaged the party faithful the assurance that banks will get no special treatment in the “Hard Brexit” she seems to be leaning towards. So much for “conservative” economics!

We find it hard to disagree with the criticisms of the monetary shenanigans of the world’s central banks. In our view, these unbalanced policies create serious economic uncertainty that hurts the economy and is clearly distorting the allocation of capital. Chief Financial Officer or ordinary saver, negative interest rates are literally creating financial stupefaction. Uncertainty creates indecision. If you are trying to plan for the future and you have no idea what is currently going on, it is likely you will just give up and do nothing. The messaging of the Central Banks indicates confusion and the financial system is reacting to it.

Financial Engineering

The distortions to the financial system are affecting the allocation of capital. The “innovative” monetary policy is also not helping Joe Q. Public. Most of the money and credit being created is going into financial engineering that has returned with a vengeance. Corporations with large amounts of cash on their balance sheet, like Apple, are issuing very low coupon and very long-term debt that they don’t need to fund share buybacks and dividends. They are not using the money for investment in physical and human capital.

Private equity firms are also engaging in financial engineering. They are using the current credit mania in bank loans and high yield bonds to borrow money at low interest rates to add leverage. They are not using this capital to fund new projects, rather they are also paying themselves large dividends and churning their existing investments. We see a steady flow of bank loan issuance that funds trades of portfolio companies between private equity firms at ever higher debt multiples and valuations. Higher valuations mean higher portfolio assets under management and more fees to the private equity sponsors. What could possibly be wrong with this?

Borrowing Pays Dividends

Bank loan borrowing is literally “paying dividends”. A recent example of the current credit mania is the recent Ancestry.com “recap” (recapitalization) bank loan transaction that is described below. We have annotated the LCD News email describing the deal with our own comments in brackets:

“Investors today received allocations of Ancestry.com’s $1.9 billion term loan financing package, sources said. The $1.4 billion first-lien tranche (L+425, 1% LIBOR floor) (a “high yield” of only 5.25%!!) broke for trading at 100/100.5 (it was bid up in price by the underwriters to keep the buyers happy), while the $500 million second-lien (likely receives nothing in bankruptcy) (L+825, 1% floor) (9.25%) broke at 100.5/101.5….. Terms were finalized at the tight end of talk (as expensive as possible) on the first-lien and tight to talk on the second-lien (ditto). Proceeds will be used to refinance the issuer’s existing $728 million covenant-lite B term loan due 2022, $300 million of opco notes and $390 million of holdco PIK toggle notes (these funds pay down existing debt) as well as to fund a return of capital to shareholders (a nice way to say they borrowed money to pay themselves) totaling $485 million. With this transaction, leverage runs 4.6x through the first-lien debt and 6.5x total (lots of leverage), sources said. The provider of online family history research is backed by a Permira-led investor group.”

Ancestry.com recap TLs allocate; terms; LCD News email October 14th, 2016

EBITDA Attitude Adjustment

The key thing to note in this deal is that $1.4 billion went to refinance existing debt and $485 million was paid to “fund a return of capital” to the private equity sponsors. These borrowings were larger, at 6.5 times debt to EBITDA than the ones they replaced, enabling the large payment to the equity sponsors. Bloomberg recently reported on the concerns of regulators about overstatement of EBITDA. Since regulators limited bank loans to 6 times EBITDA in the aftermath of the Credit Crisis, there has been a trend to “adjust” EBITDA with add backs that make it seem higher, thus permitting higher debt levels for bank loans.

Doubling Up

Bloomberg commented on a recent bank loan transaction for the UFC, the martial arts promoter:

“Regulators have criticized deals that push a company’s debt load to more than six times its earnings. In the case of UFC, they’re focused on accounting adjustments that more than doubled the mixed martial arts promoter’s cash flow projections, said the people, who asked not to be identified because the matter is private.

Such earnings adjustments — known as add-backs — are a common practice when estimating a company’s future profitability after an acquisition or buyout. What regulators are reviewing is whether they are too optimistic, making companies appear more creditworthy than they are.”

Goldman Sachs Said to Receive Fed Warning on UFC Buyout Debt; Bloomberg Markets; Sridhar Natarajan, David Carey; October 6th, 2016

What is clear about the current “suspension of disbelief” in the credit markets is that it results from a massive stretch for yield by debt investors. As always, this will not end well when the liquidity music stops. Until then, underwriters will be creating dodgy deals to satisfy the seemingly insatiable demand.

Chugging Along

Despite the fantasy in the financial markets, the reality is that the U.S. economy keeps on chugging along. Economically, things aren’t that bad stateside, no matter what Donald Trump says. Even the labour market is showing obvious strength.

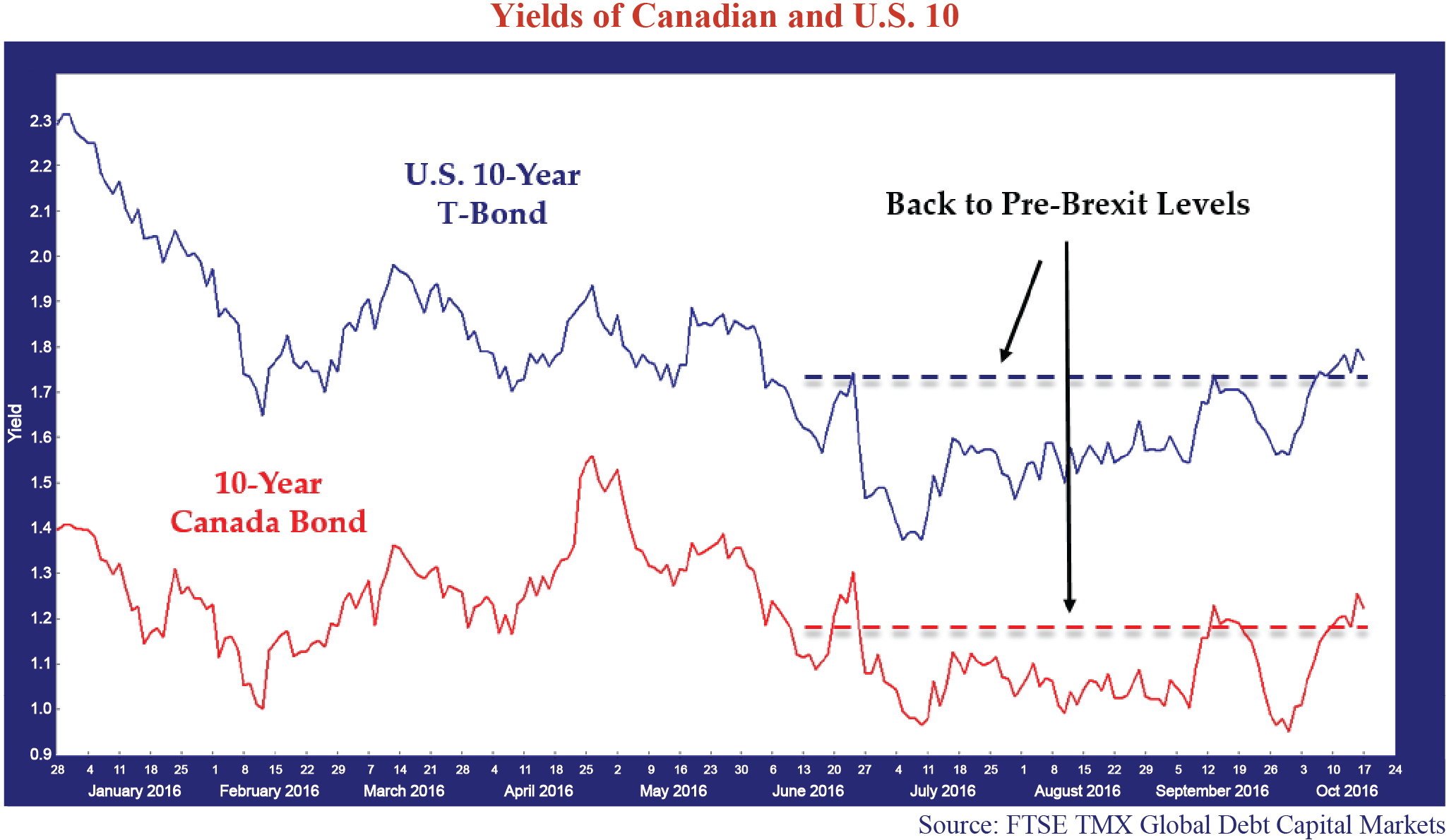

Will Chair Janet Yellen and the other FOMC members finally get up the nerve to raise interest rates now that the U.S. economy is quite obviously doing well? Brexit worry, the go-to summer excuse for delaying monetary tightening, has faded into background noise in everywhere but the United Kingdom. The bond market is definitely doing some of the work for Ms. Yellen. Inspection of the chart on the following page shows that 10 year U.S. Treasury (blue line) and 10 year Canada (red line) yields are pretty well back to where they were prior to the Brexit shock in late June.

High Pressure Hosing

Ms. Yellen recently made a speech to a Boston Federal Reserve conference where she wondered aloud about the desirability of a “high pressure economy” to boost labour force participation and wage growth. Ms. Yellen’s high-pressure musings are hosing the bond market. As Bloomberg reported on the bond market reaction: “Federal Reserve Chair Janet Yellen may have just shattered the complacency among investors in the longest-dated U.S. sovereign debt.”

The spectacle of bond investors buying bonds at negative yields amazes us. As we said earlier, the only reason to do this is the expectation that the Greatest Fool central banks will buy these absurdly overvalued bonds or that we will indeed be in a seriously deflationary environment. Ms. Yellen’s “high pressure” economic musings make deflation very unlikely.

Why Not Buy Overvalued Bonds?

We turn to John Maynard Keynes, perhaps the greatest economist of all time, for wise counsel on buying overvalued bonds. As our readers know, we very much believe in a credit cycle and the psychological and biological predisposition of humans to do exactly the wrong thing at the wrong time. The Wall Street Journal Intelligent Investor column recently reported on a study of Keynes’ investment success with the Oxford University endowment funds. Keynes did very well by going against the grain and investing in stocks in the depths of the Great Depression. The WSJ points out that Keynes remarked on successful investment strategy in his seminal book “The General Theory of Employment, Interest and Money”:

“The spectacle of modern investment markets has sometimes moved me towards the conclusion that to make the purchase of an investment permanent and indissoluble, like marriage, except by reason of death or other grave cause, might be a useful remedy for our contemporary evils. For this would force the investor to direct his mind to the long-term prospects and to those only.”

While the context of the WSJ article was equity investment, we thought it apt to consider today’s bond market valuations in this light. Clearly, with central banks targeting inflation at over 2%, anyone buying a 30 Year Canada Bond at 1.8% and a 10 Year Canada Bond at 1.3% cannot be planning to hold these investments “till death do we part”. Those buying very risky junk bonds and bank loans at 5% yields cannot be counting on holding them for the long term. Yes, those investors with malleable investment philosophies have benefitted recently by their holdings of longer-term bonds and ever-junkier bonds. Their assumption is, of course, that they will sell out in time. We doubt this.

Out of Flavour Investing

Canso clients and friends will recognize the similarities in flavour between our “Buy and Hold Until Maturity or Whatever Else Happens” and Keynes’ marriage analogy. One of the keys to the Canso investment philosophy is to assume that we hold a fixed income investment until maturity, redemption or default. This puts us in the position of having to buy something that we assume we cannot sell or trade out of. This makes our analysis of the business, its cash flows and its fundamental value very important to our buy discipline. Estimating the normalized value of a business is essential to our Maximum Loss discipline that leads to our position sizing.

Keynes was not a market timer and didn’t buy at the absolute bottom. He was buying equities in the 1930s based on fundamental valuations and then seeing them drop in value. It took tremendous discipline for Keynes to keep on investing into a falling market when professional opinion and the market consensus were going against him. We see a parallel today. Those not risking their capital at ultra low yields are definitely “out of favour” and suffering on the bond performance front. Like Keynes buying stocks when they were still falling in price, bond investors shunning the huge risks in the bond markets have been wrong in the short term.

Oh, Canada

We thought it appropriate to update our thoughts on the Canadian real estate market. We wrote a Canso Px (Position Report) on the Canadian real estate market in 2013. We described the speculation, fraud and foreign money laundering that were rampant in the Canadian real estate market at the time. We also pointed out the 100% government backing of the mortgage insurance market was encouraging speculation and making housing more expensive rather than more affordable. Our main conclusion was that Canadians would pay the maximum amount they could borrow for their houses and financial institutions were incented to lend them as much as possible.

The Most Indebted People in the World

We were criticized at the time for daring to comment on what we saw as speculative credit excess. Since then, everything we detailed has turned out to be accurate, if not worse in practice. Speculation, fraud and money laundering have been disclosed in the press with little concern by government and regulators until they became public issues. House prices have continued to rise over the past 3 years and Canadians now are some of the most indebted people in the world as they borrowed more to support the higher prices.

The Department of Finance, recognizing the huge subsidy of government backed mortgage insurance, has now taken further steps to restrict mortgage credit. These have included severely restricting bulk portfolio mortgage insurance and taking measures to limit portfolio insurance to primary residences, houses priced under $1 million and amortizations less than 25 years. This was necessary, as mortgage brokers had figured out ways to circumvent these previous limitations by writing mortgages and then bulk insuring them for MBS issuance. There also is serious discussion of some sort of risk sharing by lenders in mortgage insurance.

Housing Red Alert

Will Canadian house prices finally settle back to earth? As we said in our 2013 Px, speculative credit excess always ends badly. It often takes a long time for an asset price bubble to burst and prices can be stretched far above fundamental values. As Alan Greenspan famously said, it is very hard to detect a bubble when you are in one. We think restricting the availability of mortgage insurance is the first step in restoring sanity to the mortgage market. The momentum in the housing market now seems unstoppable, but then again, this is usually a precursor to a very hard landing.

Curiously Evan Siddall, the CEO of CMHC (Canadian Mortgage and Housing Corporation), recently wrote an opinion column in the Globe and Mail. He replied bluntly to those in the real estate industry who said the recent mortgage insurance changes would have “unintended consequences” by stating that the unintended consequences were indeed intended! He wrote that: “High levels of indebtedness coupled with elevated house prices are often followed by economic contractions.” He also commented that the speculative housing market conditions would cause CMHC to issue “our first ‘red’ warning for the Canadian housing market as a whole.” It sounds to us that official Ottawa is finally recognizing that ultra low interest rates and risk free mortgage lending are not the best way to provide cheap housing.

Resisting Temptation

As our clients know, we do not avoid risk. We demand, however, to be compensated for the risks we assume. It is getting harder and harder to find value in today’s bond markets. We are doing our best to protect our portfolios. We have been making profits on many positions that we acquired during the Credit and Euro Debt crises as these investments have matured or been redeemed. We also have seen several of our “special situations” return principal to us. We are investing the proceeds primarily into floating rate bonds and higher quality securities. This is a time in investment markets when those accepting huge risks they don’t understand, look to be winning in the performance sweepstakes.

When the credit cycle ultimately turns down, we will be ready to invest once again in shunned and cheap investments. Until then, our job is to resist the temptation to join the frenzy and preserve capital.