Did I Shave My Legs for This?

Another quarter in the books and the confusion, doubts and jitters of fixed income investors remain. Continued central bank procrastination, falling government bond yields and modest credit spread compression summarized the quarter. “Damn the torpedoes”, fixed income investors who reached for yield in longer duration assets or high yield corporates reaped the highest returns.

Britain, supposedly the home of some of Europe’s more rational citizens, opted for the irrational by voting to exit the EU. Unfortunately no one who thought leaving the EU was a great idea actually bothered to hatch a plan as to what that meant. In the immediate aftermath of the vote bond yields around the globe fell and stock markets swooned before rebounding because when in doubt buy! And in the bond markets buy a lot before your local Central Banker gets in front of you!

As we go to press 30 year Government of Canada bonds yield 1.69% after touching a record low yield of 1.55% on July 8th. 30 year bond yields are 46bps lower than at the start of the year. The average Canadian corporate bond yields 2.5% with a duration of 6.3 years. This market is stark raving mad! As Patsy Cline sang in the 50’s – Crazy! or if you prefer a little more amp think 80’s and AC/DC’s Hell’s Bell’s.

Ooh I Want to Tell You, It’s a Long Run

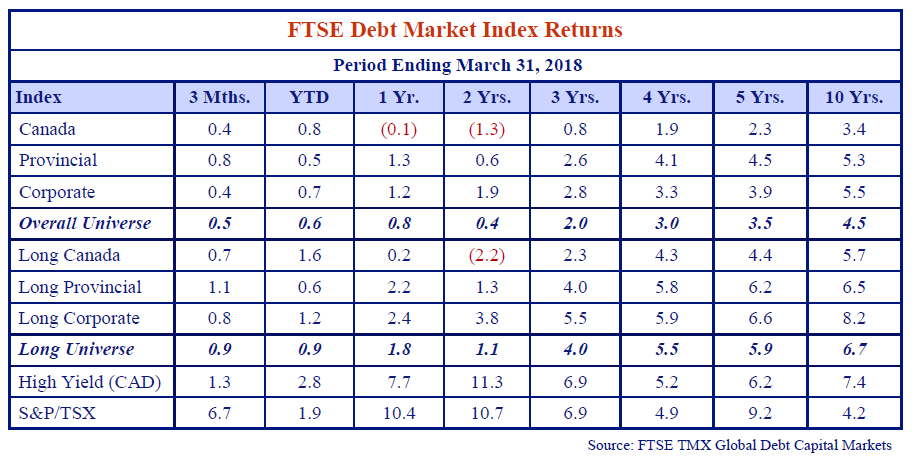

In the 3 and 6 months ended June 30th, Canadian investment grade corporate bonds returned 2.5% and 4.0% respectively, exceeding returns on Government of Canada bonds of 2.0% and 3.2%. In a now familiar theme corporates lagged the returns on longer duration Provincial bonds of 3.6% and 5.3%. The Universe Index returned 2.6% and 4.1% in the same periods.

In the investment grade markets longer dated securities proved once again to be the source of highest return. Long corporates generated 5.2% and 8.7% returns for the 3 and 6 months ended June 30th respectively, versus long Canada’s 5.1% and 8.0% returns and long Provincials 5.8% and 8.3% returns.

After a horrific start to the year, US high yield proved the best performing bond market of all returning 5.9% and 9.3% for the 3 and 6 months ended June 30th. High yield bested all other bond markets and equity markets too, clobbering the 3.8% 6 month return of the S&P 500 by a whopping 5.5%.

Makes Me Wonder

The day after 30 year Government of Canada bond yields touched 1.55% we sat in the Canso conference room for our regular morning meeting. Between staring at our shoes, fidgeting nervously and some heavy sighing we wondered aloud if we had it all wrong.

Yields were plumbing new lows the world over. In large parts of the world lenders were now paying borrowers for the pleasure of owning fixed income. What was a credit focused investment firm supposed to do when everyone else seemed relieved of their senses?

Exploiting inefficiencies in the credit markets? Why bother when yields on government debt were falling through the floor! Why not go all-in on long bonds and take the rest of the decade off? What client wouldn’t forgo interest income for the enormous capital gain to be had when 30 year Canada bond prices hit $203 as yields turn negative!

Or better yet why not invest in the stock market? Or Private equity? Or Timber? Or Unicorns? Or TU a combination of Timber and Unicorns? Surely if government bond prices were going to the stratosphere then other asset classes must be headed to the moon. No one ever admits to being invested in fixed income anyway. With all markets devoid of reason why not roll the dice with the higher beta crowd?

Stop Right There!

Canso didn’t come into existence to follow the investment herd. Neither has slow and steady Canso necessarily been accused of being a trendsetter. At Canso, our disciplined investment process ensures we never reach for yield unless appropriately compensated for the risk. We stick to our knitting – analyzing issuers, cash flows and trust indentures. Challenging markets often result in some of our finest work.

Challenging markets are nothing new and certainly nothing new to Canso. We have been there before. In 1997 John Carswell founded Canso with the belief the credit markets were horribly inefficient. Employing a bottom up fundamental approach these inefficiencies could be exploited (in a good way) through individual security selection on behalf of Canso’s clients.

The establishment of Canso occurred in an extremely challenging credit environment. The odds of creating a viable investment firm focused exclusively on corporate credit even in hindsight seemed long indeed.

In 1997 the Canadian investment grade market consisted of $29 billon par value of bonds across 165 issues. The Canadian High Yield Market a minuscule $3.6 billion across a scant 18 issues. BBB rated corporates comprised only 5% of the Canadian credit market. Investment grade credit spreads of 40bps and BBB spreads of 67bps did not indicate compelling value.

In 1997 Canso’s relative value determinations produced investments in Legacy REIT, NAV Canada and Saskatchewan Wheat Pool to name a few. Canso survived, grew and investors did well by Canso’s disciplined approach through seemingly difficult market conditions. We employ the same disciplined approach today.

When the Going Gets Tough

At Canso we continually test and retest our assumptions and conclusions surrounding the credits we own and those we have opted not to. We lose sleep at night wondering whether we’ve missed something in our analysis. That is why you hire an active manager and more specifically Canso.

So “what if we started Canso Investment Counsel today?” A blank slate, capital to invest and challenging markets. What would be the key determinants of portfolio composition? What would the portfolios look like?

Tabula Rasa

First a comparison of credit markets today versus 1997. The Canadian investment grade corporate and high yield markets total $438 and $9 billion respectively or 13X larger than 1997 when Hillary Clinton’s husband was President. BBB rated corporates now comprise 39% of the Canadian market.

Further, despite our Canadian roots, clientele and patriotism, Canso looks for investment opportunities the world over. Anywhere the rule of law allows for the enforcement of our contractual remedies as a lender is fertile ground for Canso to invest.

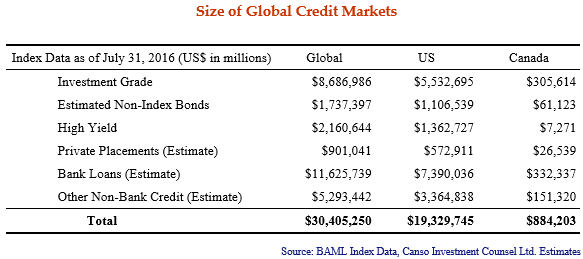

Per the Table below the size of the global credit markets and therefore the potential investable universe is staggering. Incorporating Canso’s own estimates with the data from BAML Indexes, we estimate the global credit markets at some $30 trillion (excluding emerging markets).

Simply put the credit markets are larger than ever and inefficiencies exist across all markets and geographies. Our dedicated team of 27 investment professionals provide the scale and expertise to rout out opportunities regardless of location.

There’s Gold In Them Thar Hills

Canso’s principal business is lending money. We lend money to companies large and small, public and private, Canadian and foreign. Canso lends in bond or loan form, fixed or floating, long or short-term, secured or unsecured. As a lender the critical element of our analysis process is the determination of appropriate compensation for the risk the borrower does not pay us back. This is credit risk.

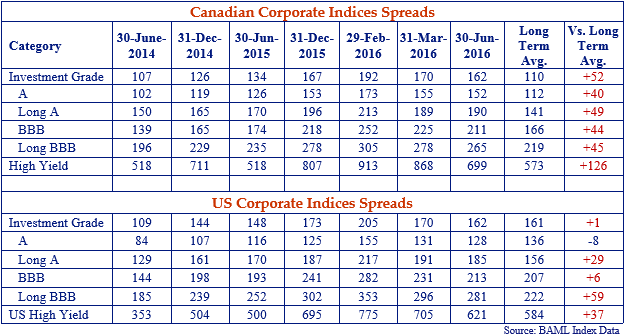

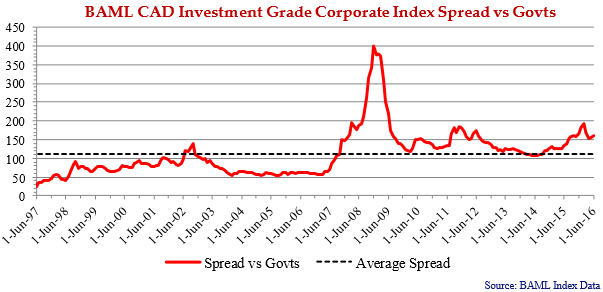

Credit risk is reflected in the credit spread for an issuer. The table below shows recent credit spread activity for Canadian and US Investment Grade and High Yield Markets.

At June 30th the average Canadian investment grade credit spread was +162bps – substantially wider than the average dating back to 1997 of +110bps. With the exception of the Credit Crisis (2008) and the Euro Debt Crisis (2011) Canadian corporate credit has never been cheaper. This is true across credit quality and term. There is value in them thar’ hills for those willing to do the work to find it!

The opportunities in corporate credit based on the size of the investable universe and current spreads are more compelling today than when John first hung up his Canso wing in 1997.

When the Volcano Blows

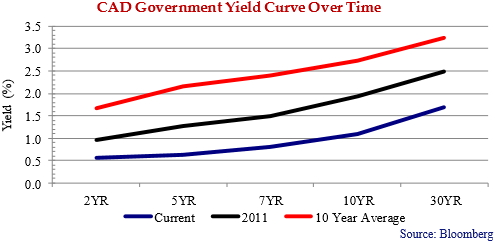

We devoted a good portion of the latest Canso Market Observer to a discussion of interest rates. In summary, we believe ultra low Canadian government bond yields are unsustainable in the long term. Core inflation is running near 2% in Canada and the US and we believe interest rates should reflect a 1 – 2% premium to inflation. This implies substantially higher administered and market rates than today’s levels.

Interest rate risk is at an all time high and unsuspecting investors are on the verge of having their heads handed to them by reaching for yield in long duration assets. Any number of factors could drive rates higher. These factors could include an increase by the Fed at one of its remaining three meetings in 2016 (i.e., a change in administered rates) or changes in investor perceptions of Canada’s credit quality relative to the US (i.e., a change in market determined rates).

We’ve been singing from this hymn book for a long time now. This is a trade we’d much rather be too early for than too late. The overwhelming risk is to higher rates and we believe rates will eventually go higher in both Canada and the US (but perhaps for different reasons). The devastating impact long duration can have on a portfolio in a rising rate environment combined with a relatively flat yield curve gives a bias to higher quality floating rate notes.

All Is Well, Remain Calm

The world is a dangerous place. Bond yields are negative in parts of Europe and Japan, Central Banks are increasingly adding corporate bonds and Donald Trump is the Republican Presidential Nominee.

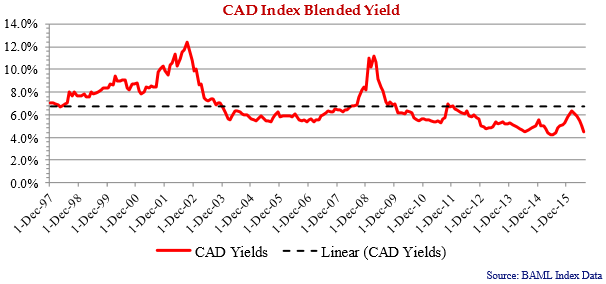

We’ve discussed credit risk and interest rate risk. In the chart above we show the yield of an equally weighted portfolio of Canadian Investment Grade and High Yield Bonds. Today that yield is 4.5% which in a 1.0% 10 year world we think looks pretty attractive.

In summary be patient, chose risk wisely and invest for the long term (but not necessarily in long-term).

Anarchy in the UK

On June 23th, 52% of the eligible voters who cast ballots in the UK ticked the box to leave the EU. Needless to say we were surprised by the result. Our experience told us that as some of the more reasonable people in Europe, Britons would choose the reasonable path of staying in as opposed to opting out.

Apparently there is a sense of nostalgia, particularly amongst older Brits for a UK free from the “expense, gridlock and tyranny” of Brussels. While the older crowd harkens back to the days when British inventors wowed the world with steam-powered engines, threshing machines and ciphers, younger people seemed to prefer a seat at the table and a say in all matters defense, economic and immigration.

Nevertheless, the English opted for the unreasonable path. The Bank of England did its part to ensure the sound functioning of the financial system. It has lowered interest rates to combat what appears to be a skidding halt to the UK economy.

Prime Minister Theresa May seems a sensible choice and is opting for a go slow approach. She has wisely put the Leavers in charge of the negotiations who may find them a tough go. At the end of it all we expect Britain may find itself in a union that does not look too dissimilar to where they are today, but without the influence they previously had.

Economic and political upheaval aside we feel compelled to point out the credit quality of our UK exposures remains undented by the Leave victory. Heathrow and NatGrid boast utility like cash flows and stable credit quality. Lloyds and RBS are solid banks with much improved capital levels and stable domestic bank franchises.

Farmer’s Blues

Canso’s investment process is by design meant to be devoid of emotion. That said we can’t help but be a bit nostalgic and sentimental when certain of our investments mature or are taken from us through corporate action. As farmers’-in fall, we are now in the latter stages of harvesting a number of investments made during and in the immediate aftermath of the Credit Crisis. Unlike farmers, our growing season is often measured in years not months reflecting our predisposition to hold investments to maturity.

Harvested and soon to be harvested securities include Depfa ACS 2025 and 2035 covered bonds tendered in February 2016. GE Capital Canada tendered for a number of CAD securities in May 2016. Royal Bank of Scotland Perpetuals (fixed floaters) will be redeemed August 12, 2016. KIMCO Realty bonds were called for redemption in late August 2016. Commerzbank and Lloyds Bank are closing in on their respective expected maturities.

This Ole House

Canso predicted the end of the Canadian housing boom in July 2013 with the publication of our Canadian Housing Market Px. Three years on following a dramatic escalation in housing values we may just be proven right! Does anyone really believe the value of the average detached home in Toronto is $1.3 million?

We note regulators and politicians are starting to focus on the anecdotal evidence we uncovered three years ago. The evidence included the impact foreign investors were having on the markets. We also heard credible evidence of dubious practices by market participants, both buyers and intermediaries. In a refreshing move the same regulators and politicians are now also collecting statistical data to uncover what is really happening in the real estate markets.

No doubt this recent flurry of activity will finally shine light on what most have known for some time. Foreign buying of Canadian residential real estate is one of the key drivers of price inflation at least in the major metropolitan markets of Toronto and Vancouver.

The other key driver remains ultra-low interest rates. The availability of floating rate mortgages has allowed Canadian’s to purchase homes that otherwise would be out of reach at interest rates perhaps just 0.50% – 1.00% higher.

We Can Work It Out

Sometimes things don’t go as we expect. Postmedia Network Inc.’s acquisition of Sun Media in 2015 is a case in point. Consumer demand for digital and print media evolved rapidly in the last 18 months. Advertisers changed how and how much they were willing to pay to reach consumers. These factors combined with substantial leverage at Postmedia meant something had to give.

On July 7th, Postmedia Network Inc. announced a proposed recapitalization transaction. Canso worked with Postmedia and 2nd Lien Noteholders on the proposal. Canso believes this is the best possible deal to receive full recovery on the existing Postmedia 1st Lien notes.

The key components of the proposal include:

- 1st Lien Noteholder (Canso is the largest holder of this) principal reduced to $225 million by way of $78 million cash payment at par.

- Improved excess cash flow sweep.

- $40 – 50 million of estimated proceeds from asset sales payable directly to 1st lien debt holders

- Maturity date of the existing 1st Lien note extended to 2021 from 2017. Coupon rate remains 8.25% and security package remains the same.

- Existing 2nd Lien Noteholders will own 98% of the equity of Postmedia.

Implementation of the recapitalization results in improved debt leverage and interest coverage. The consensual recapitalization plan is expected to be filed with the Courts in August with implementation in the fall.

Canso’s Maximum Loss discipline allows us to lend to challenged companies with the expectation of recovery in a downside scenario. As a lender we can improve the probability of full recovery by lending at the top of the capital structure with appropriate downside protections if things deteriorate. Postmedia is a case in point.

I’ve Gotta Get a Message to You

Canso’s mission is to generate returns for those who have entrusted us with funds to manage. Successful investing generates returns over long periods through the extremes of economic and financial cycles. Canso exploits inefficiencies through investments in mispriced securities across the capital structure of issuers from around the globe. In short through active management we buy cheap stuff.

Canso’s portfolios are comprised of a series of individual security selection decisions each with its own relative value considerations. Our current portfolios reflect two distinct themes from those relative value deliberations.

First, we believe interest rates in Canada are too low. Reported inflation and sovereign credit risk suggest to us Government of Canada bond yields should be at or above parity with US treasuries.

In a flat yield curve environment with CDOR at 90bps and 10 year Government of Canada bond yields just a few basis points higher, we believe it often makes more investment sense to own floating rate notes versus fixed rate bonds. In portfolios with this latitude, holdings in FRN’s comprise 30%+ of total market value. This lowers portfolio duration and insulates the portfolios from expected increases in market yields.

Secondly, we believe opportunities exist in a number of special situations in the market. Canso was formed to exploit inefficiencies in the credit markets on behalf of Canso’s clients. These inefficiencies manifest themselves in all sorts of market conditions, geographies and industries. We continue to believe our special situations offer compelling value including Bombardier Inc., Navient and Yellow Media to name just a few.

We follow hundreds of companies and situations and invest in relatively few. In our portfolios, top 10 exposures by issuer typically measure between 50 – 60% of portfolio market value. We don’t want to diversify away the return potential of our highest conviction ideas while at the same time we don’t want to bet the farm on any one position.

Like our namesake the Canso, we believe in performance over time.