Barrages of Money

Governments and central banks were right to proceed with record speed to support their national economies. These emergency measures have blunted the economic downside of the serial COVID shutdowns but were an artillery barrage of money instead of “precision guided” monetary and fiscal munitions. The advanced economies have largely reversed the economic shock of COVID but have also benefitted many who didn’t need help.

If the idea was that a rising sea of cash lifts all boats, it worked. Given the hit from pandemic shutdowns, things should have been dire for the United States economy. That did not turn out to be the case with the deluge of direct cash transfer payments from debt financing central governments, as the chart below shows. The U.S. government hoped to mitigate the worst of the COVID shutdown with its pandemic support programs but in a truly bizarre result, personal income in the United States has actually risen substantially during COVID pandemic.

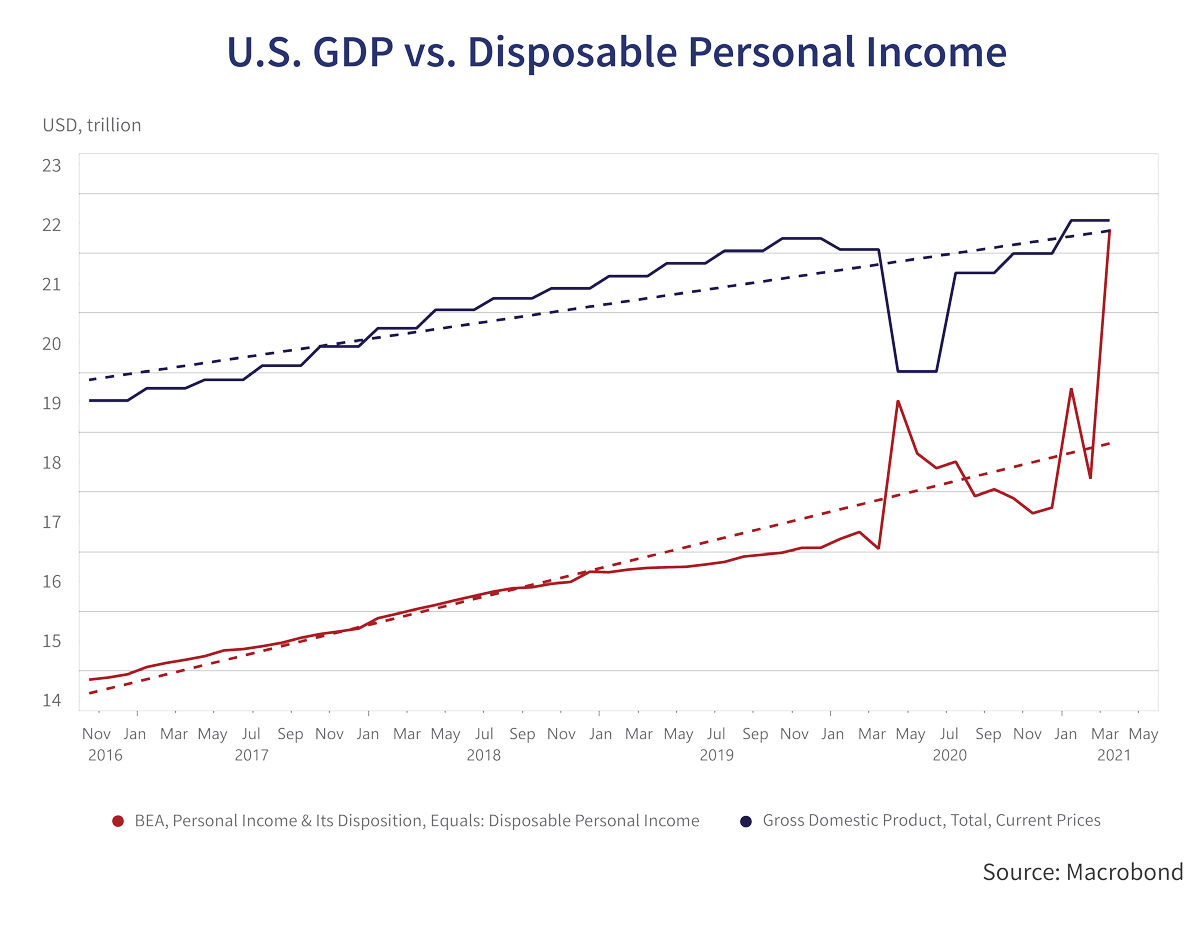

The chart below shows the monthly U.S. Gross Domestic Product (GDP), the aggregated value of all goods and services in the United States (blue line) which is how economists track “economic growth”. It also shows U.S. Disposable Personal Income (DPI), the aggregated personal income of all Americans (red line). We have fitted a linear trend line to each economic series (dashed lines).

Very surprisingly, DPI gained more than the actual drop in GDP during the worst of the COVID downturn, thanks to U.S. government pandemic support. The chart shows U.S. GDP peaked at $21.7 trillion in December 2019, just before the COVID pandemic hit and dropped $2 trillion in April 2020. It is now slightly higher, even though unemployment remains stubbornly high.

It Worked!!!

U.S. DPI peaked at $16.8 trillion a short time later in February 2020. It dropped $280 billion to $16.5 trillion in March as the pandemic shutdowns stopped normal economic activity. It then soared in April to $19 trillion, up $2.5 trillion with the Trump Administration’s CARES Act. This targeted the unemployed and certain industries like the airlines, but also showered direct cash payments on many Americans who didn’t need help. Waning pandemic programs in the Spring of 2020 saw DPI taper to $17.2 trillion by December 2020. This was still $400 billion above its pre-pandemic peak, a rather striking result with COVID public health measures still affecting many businesses!

The bump upwards in DPI from the additional November 2020 pandemic support programs and the recent Biden Administration’s recent American Rescue Plan Act (ARP) are obvious. The ARP included direct support for state and local governments and also the politically popular direct cash stimulus payments to all Americans. The huge $4.2 trillion jump upwards in DPI from $17.7 trillion in February 2021 to $21.9 trillion in March gives a recovering U.S. economy even more fiscal stimulus. At $21.9 trillion, DPI for March 2021 is almost the same as the $22 trillion GDP. That means that the March disposable income of Americans was almost the same as their total economic output, a truly stunning economic statistic!

The American consumers, businesses and governments that received the $1.9 trillion in ARP support have not obviously spent it all in a month. Some of the ARP money might not have even had been received by its intended recipients. What we are now seeing is that the “multiplier effect” of the pandemic fiscal support programs, where the $1.9 trillion fiscal stimulus creates much more in the way of income and economic activity. We wonder what will happen when the full force of the pandemic support programs and the massive forced savings of Americans start to be spent in earnest.

Record Incomes in a Recession

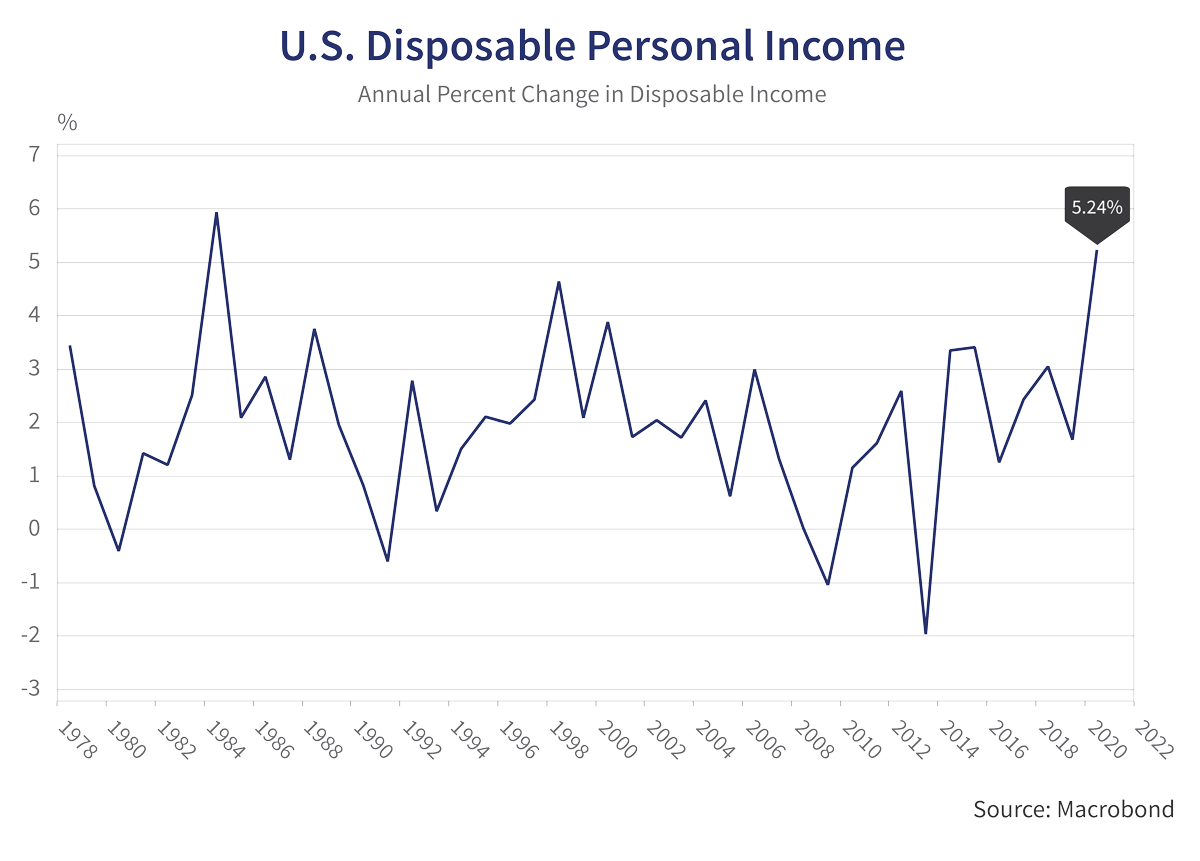

This has ended in a unique situation for the economic record books where consumers’ incomes rose during a recession. The chart below of the year-over-year change in DPI shows that it grew 5.2% in the pandemic year 2020 and is still growing in 2021, thanks to the U.S. government’s immense fiscal support programs. It looks to us that things might get even stronger, with higher income growth than in 1984 during the boom after the grim recession of 1981.

This is a recession like no other. How does the housing market have record prices and sales during the worst economic set back since the Great Depression of the 1930s? How are sales of consumer luxury items like hot tubs, water-ski boats and ATVs soaring in the face of unprecedented massive unemployment? The answer is obviously the forced savings of the COVID lockdown that reduced expenditures and unprecedented direct transfers to consumers, even to those who didn’t need them. Consumers that didn’t need the pandemic support seem to have quickly “disposed” of their windfall income gains!

Not a Very “Sleepy Joe”

Donald Trump terrorizes his enemies with insulting names. He settled on “Sleepy Joe” for Joe Biden. As President, Biden has turned out to be anything but “sleepy”. The Biden Administration has been prone to action instead of the histrionics and political dithering of the Trump presidency. Biden moved quickly to stem the pandemic and passed the $1.9 trillion American Rescue Plan Act, ramming it through despite Republican obstructionism.

More Money is Always More Popular

Now Biden is promoting his $2.3 trillion American Jobs Plan, an infrastructure bill with many politically popular measures. These government transfers are proving very popular with voters, probably because they are financed by government bond issuance and not tax increases. U.S. polls show that even Republican voters are onside with the Biden Administration’s cash largesse.

The good news for President Biden is that the U.S. Republican Party is presently occupied with its internal war between fealty to Ronald Reagan’s “government is the problem” and Donald Trump’s “I alone can fix it”. Trump was certainly no slouch when it came to borrowing money and giving it to voters, as the Trump Administration was running record-setting peacetime deficits in 2019, before the pandemic. Whatever one thinks about Trump, he is an instinctive self-promoter and also knows what “sells” to his loyal followers. It speaks volumes that, although Trump could not legally sign the cheques for the first round of pandemic support, he held things up to get his name printed on the cheques. Trump knew what voters wanted and now Biden is using his playbook.

Big Government Is Back

It is one of Canso’s economic beliefs that “more money” is always more politically popular than “less money”. The difference now is that the massive government response to the pandemic is engendering a change in belief to big government as the solution to economic woes, not the problem as has been the case for many years. We had been talking about the “Command and Control” fashion in monetary policy for some time before the pandemic. Now we have the fiscal spending power of government back in fashion with policy makers and voters alike.

The Fiscal Hounds Have Been Unleashed!

It looks to us like the belief in using the “top down” economic tools of government to solve society’s problems will now be the rule, not the exception. Fiscal stimulus is de rigueur in the economic halls of power and the Keynesian fiscal hounds have been unleashed in a manner not seen in a generation.

Joe Biden Trumps “The Donald”

Joe Biden seems to have combined the populist appeal to self-interest of Donald Trump with a growing belief in the power of government to make people’s lives better. Americans understand that Biden has used the full power of the U.S. government to save the lives of many U.S. citizens with his COVID response. This has given him the political capital to call for a massive repudiation of the “government as the problem” orthodoxy of Ronald Reagan and all Presidents since:

“In a speech to a joint session of Congress Wednesday, with a soft-spoken, almost whispered urgency, President Biden made his case for a breathtaking overhaul of America’s social contract. The President’s argument, in just his first 100 days, for $6 trillion in new spending would have been unthinkable before the coronavirus… suddenly a nation skeptical of government began looking to Washington for help.” Donald Trump saw it coming; CNN; May 2, 2021

Shameless Complaints

Republicans are of course pushing back. Since Trump pioneered the financial appeal to voters by giving them money and running deficits, it is hard for them to complain. Then again, if you can’t admit publicly that Trump actually lost the election, you probably don’t have a lot of shame left.

Fox News Sunday with Chris Wallace last week was replete with Republicans accusing Democrats of “radical” and “socialist” ideas. Wallace also verbally jousted with Cecilia Rouse, Chair of President Biden’s Council of Economic Advisors. Wallace pushed back on the price tag of Biden’s proposals saying at $6 trillion, it was six times the $856 billion in inflation-adjusted terms that Roosevelt spent on his New Deal to get the U.S. out of the Great Depression of the 1930s. “With things going so well, why not trust the private sector to keep the economy growing… Why not allow the private sector to do this instead of the public sector?” complained Wallace.

So, the battle has been joined. Big government as the solution, not the problem. Wallace summed up the conservative case with “is having the government decide winners and losers what we want?” Rouse responded that it was direct government investment in vaccine development that defeated COVID. She added that everyone needs to pay their fair share of taxes and that the Trump tax cuts did not result in increased economic benefits, except for the rich.

Republicans face a strong headwind since taxing the wealthy and corporations to support social programs is very popular with Trump voters. Part of the reason they elected Trump was that they didn’t like having the short end of the economic stick. Electing a wealthy narcissist wasn’t the best solution to their economic woes, but Biden comes from a blue-collar background and understands what it feels to be on the outside looking in:

“We’re not going to deprive any of these executives of their second or third home, travel privately by jet,” Mr. Biden said after brief remarks on an economic aid program he signed into law this year. “It’s not going to affect their standard of living at all. Not a little tiny bit. But I can affect the standard of living that people I grew up with.”

“The comments were the latest example of Mr. Biden and his party embracing the political and economic upsides of his proposals to tax the rich — a fight that the White House is eager to wage as the president engages in bipartisan negotiations over his $4 trillion economic agenda and a contrast to how Democratic presidents in the past have talked about their tax-increase proposals.” Biden Leans Into Plans to Tax the Rich; New York Times; Jim Tankersley and Annie Karni; May 5, 2021

A Real Problem for Bonds

This is a real problem for bonds. What bothers us now is the bipartisan idea that debt-financed income redistribution is sustainable in the long term. This can only happen if nominal growth increases government tax income and inflates away the accumulated debt in real terms. That should terrify a bond investor since it depends on their willingness to buy bonds that go down in value, what investors of the 1970s termed “certificates of confiscation”.

Spend and Raise or Cut Taxes???

Everyone is now in favour of spending. Democrats are certainly returning to their “Spend and Raise Taxes” roots. Republicans are still hewing to their “Spend and Cut Taxes” philosophy that Trump put into overdrive during his days in office. Trump claimed the “supply side” effects would offset the reduction in revenue. It didn’t and Trump’s tax cuts are estimated to have added at least $3 trillion to the U.S. national debt. That’s quite a legacy for the Tea Party Republicans that railed against Obama’s spending ways!

Familiar Champions for Fiscal Policy

A willingness to “Borrow for the Future” means there are now more levers for a policy maker to push on. Government spending and fiscal programs are very much the financial fashion of our day. The former champions of activist monetary policy are now active champions of fiscal policy and are very much in a position to use them.

Mario Draghi stared down the markets as Chair of the European Central Bank during the Euro Debt Crisis in 2012. His “whatever it takes” moment saved the Euro, but he unleashed quantitative easing and negative interest rates by buying government debt. Why shouldn’t borrowers get paid by lenders to hold their money he decided? Draghi is now unleashing fiscal stimulus as Prime Minister of Italy. Worries that the EU will crack down on their member governments over budget deficits are long gone as even the prudent Germans and Dutch are now using deficit financing to get things back on track economically.

Janet Yellen, the current Biden Administration Treasury Secretary, was Fed Chair during both the Obama and Trump Administrations and certainly did her part for easy money. She is now part of the massive increase in fiscal spending by the Biden Administration. Yellen has signaled higher taxes for the wealthy to pay for the social programs of the American Jobs Plan and floated the concept of a global minimum corporate tax. Ronald Reagan and Margaret Thatcher would not approve!

OHHHH, Canada!

In Canada, the Trudeau government first ran for office on a pledge to run deficits in an election bid to attract votes and has doubled down on this strategy. Their recent post-pandemic budget, “A Recovery Plan for Jobs, Growth, and Resilience” was the first in a couple of years and included $101 billion in new spending, with money for non-pandemic items like a national childcare program and green energy. Finance Minister Chrystia Freeland promises stimulus spending of 4.2% per year, all debt financed. A deficit of $354 billion for this year is predicted and it will likely be sizeable for many years to come. As Bloomberg’s Canadian budget commentary put it: “Trudeau has long pledged not to boost taxes on middle-class Canadians, choosing instead to rely on debt to finance his ambitious agenda.” This puts Canada, formerly thought to be financially prudent after the Credit Crisis, as one of the global leaders in deficit financing.

Bond Yields Are Up

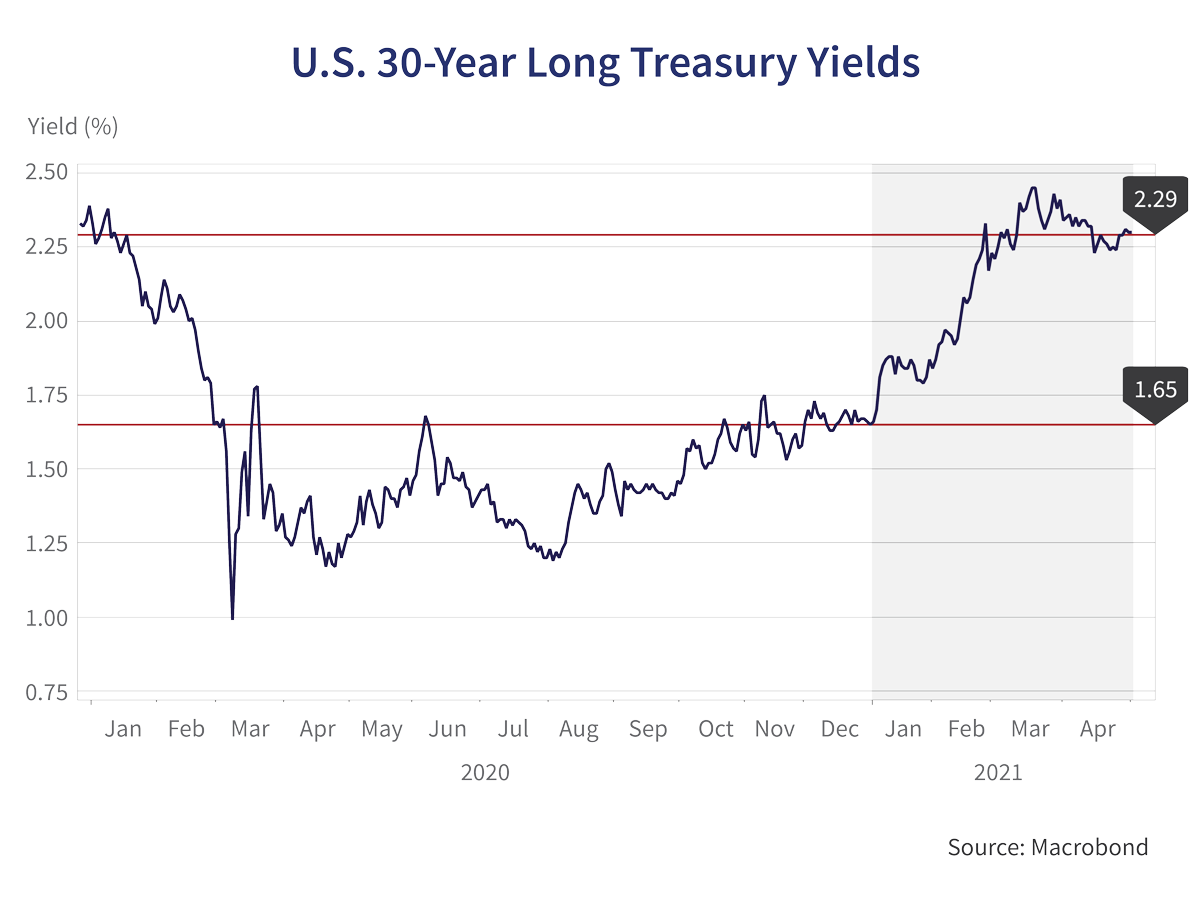

This has not been good for the bond market. It is a dangerous game to predict bond yields and we tend to leave that to the “experts”. On the other hand, we are paid by our clients to avoid overvalued assets and we have been very worried for some time with the complacency in the bond market after 40 years of falling yields. Our last Market Observer warned you about rising yields. The 30-year Treasury was then at 1.65% after reaching a low of .82% on March 9th in the first leg of the COVID panic.

Out of the Bond Wilderness

We were one of the few voices out in the wilderness of bond market commentary that actually thought bond yields could rise. There are huge career risks to a bond manager with this heretical line of thinking. Anyone in our line of work who seriously considered that interest rates and bond yields could rise after years of them declining has long ago been professionally ostracized or terminated for poor performance. This complacency has now resulted in significant pain for bond investors.

Not Good Times for Bonds

We have updated the chart below that we provided in the January 2021 Market Observer. We left off with the 30-year Treasury at 1.65% and we predicted a further increase in its yield. It is now up .7% from when you last saw this chart. This seemingly modest rise in yield has put price of this supposedly safe investment down a tragic 10%.

The bond market overall is having a bad time. The ICE U.S. Treasury Bond Index is -3.5% year-to-date to April 30th and even the broader Investment Grade Bond Index is down -3.0%. Our home country and increasingly fiscally imprudent Canada is doing worse at -5.5% for the FTSE Government Bond Index and -5.0% for the broader FTSE Universe Bond Index.

Perversely, it is the supposedly safer and longer-term government bonds that are doing the worst. The S&P U.S. Treasury Bond Current 30-Year Index clocks in down -19.7% in the last 12 months to April 30th. Clearly, those who fled to the safety and the strong performance of bonds during the worst of the pandemic last year are now regretting their decision. One can excuse them for thinking economic Armageddon was looming with the COVID pandemic but the flight to safety crowd have taken a drubbing while those brave enough to buy riskier financial assets are doing very well.

It takes discipline and resolve to invest well in difficult markets. If you took the advice of our Canso client letters and newsletters over the past year, you have done well. That was hopefully the case and you are not alone in your investment prosperity.

“Stimmie Elation”

The stock markets and many other financial assets are still doing well. All the money sloshing around the economy and looking for a home has hit the financial markets with a tsunami of new investor money. Markets have not just departed from reality, they are in an alternative financial dimension and recording new highs on an investing craze on Robinhood and other trading Apps. These allow people with little or no knowledge to place their bets after reading Reddit for a minute or two. Many of these investors are using their government transfers to speculate. The New York Times reported that many Americans were ploughing up to half of their unneeded stimulus payments or “Stimmie” into the stock market:

“But one of the biggest tools deployed by the U.S. government to cushion the economic blow — stimulus payments — is also driving a huge surge in investing by small traders. Analysts at Deutsche Bank recently estimated that as much as $170 billion from the latest round of stimulus payments could flow into the stock market. They conducted a survey of retail traders in which respondents said they planned to put roughly 40 percent of any payment they received — or $2 of every $5 — into the stock market. Traders between the ages of 25 and 34 said they expected to put half of their stimulus check into stocks.” Recast as ‘Stimmies,’ Federal Relief Checks Drive a Stock Buying Spree; Matt Phillips; New York Times; March 21, 2021

Can’t Get Enough

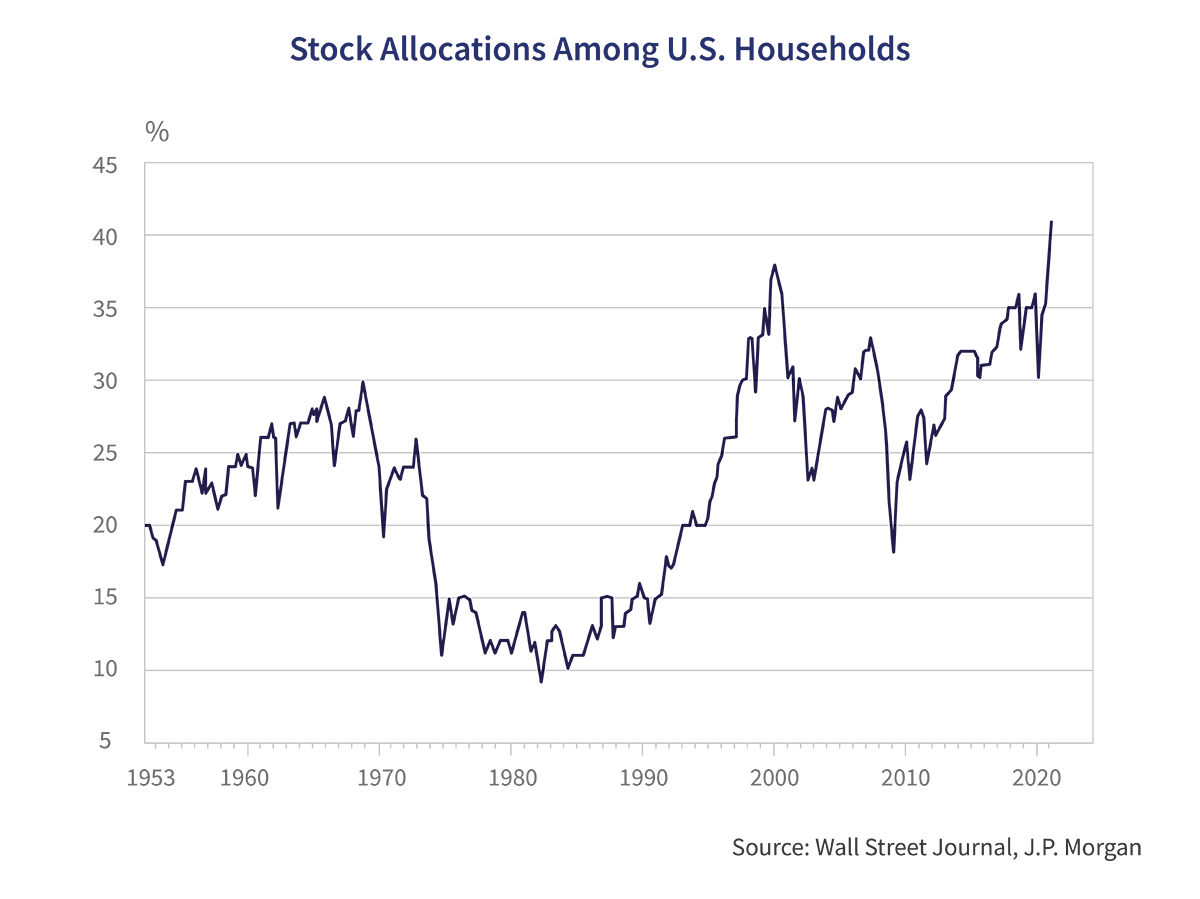

The Wall Street Journal also declared in an article headline that “Americans Can’t Get Enough of the Stock Market” and went on to say that Americans were holding the highest stockholdings on record, as their chart below shows:

Easily Wasted Money

Another Canso belief is that people waste their money on risky investments when it is too easily available and that is certainly the case at present. A reading of financial history will show that it is axiomatic that expanded money supply and freely available credit are a necessary condition for financial asset bubbles.

A Lack of Cash Leads to the Crash

Financial asset bubbles burst when people want to exchange their miraculous paper financial fortunes into cold hard cash. People are content to sit on their investments when prices are rising but financial bubbles burst when there are no more people to buy. As prices stop rising, falter and then start downwards, this panics formerly bold investors.

When the price decline becomes precipitous, people rush to take their profits and there are not enough willing buyers with cash to pay them. This engenders a fear-driven downward price movement on the same scale as the prior ebullient move upwards in price. Things of course end badly for those left standing when the music stops in this desperate game of financial musical chairs. We see this again and again on individual investments like Bre-X and sub-prime mortgages. We also see it in the markets overall with meltdowns like October 1987 and the dot.com bust of 2000.

Speculation is Afoot

The speculation afoot in the markets is endemic. In our view, these markets are more speculative than the dot.com stock boom of the late 1990s and the leveraged betting on subprime mortgages that took place before the Credit Crisis in 2008. The current markets have some of the riskiest investment behaviours that we have ever witnessed. Bitcoin and other cyber currencies with no investment merits other than their speculative nature are de rigueur with the Wall Street investment banks. They are well on their way to achieving the exalted “Asset Class” status that forces the institutional lemmings to throw themselves over an investment cliff.

Negative Cash Flows Are in Demand

Negative cash flows are not a problem for issuers. You don’t even have to have a real business. What’s not to like about a company that raises money just to find something to invest in? Special Purpose Acquisition Corporations (SPACs) are a current investor fashion, with the aim of their promoters going out and buying something. Those who read investment history like us are probably thinking of the investment trusts of the 1920s that were sold on promises of the riches awaiting the individual investor but that really only enriched their promoters.

Popular Beats Prudent

This certainly is a stock promoter’s market. Who’s to know if your “investing friend” and self-proclaimed expert on Reddit is really a financial predator? Market manipulation is a crime, but the legions of pandemically bored retail day traders and stock punters “pumping and dumping” are seemingly immune from regulation. Regulators are anything but brave. If it is cool enough and in investor fashion, the regulators tend to defer to popular over reasonable.

The Financial Times reported on a company that hedge fund manager David Einhorn mentioned in his letter to investors. The company, Hometown International Inc., owns a single New Jersey-based sandwich shop that had $13,976 of sales, but was valued at over $100 million in the very illiquid and scam prone over-the-counter market. Think the Boiler Room stocks of the “Wolf of Wall Street”. It trades only a few thousand dollars of stock a day, but the stock has soared from $1.25 to $13 in the six months.

Not a Marginal Trend

There’s nothing like a bit of leverage for excitement when you’re locked down and seeking investment thrills on Robinhood. Not only do American retail investors have the highest stock ownership on record, borrowed money is doing its part to accelerate the move upwards in stock prices. A margin account allows a brave investor to borrow up to 50% of the value of their common stock holdings. As the price increases, the investor can borrow more money and invest in more of their stocks. Higher prices engender more money borrowed and ever-higher prices.

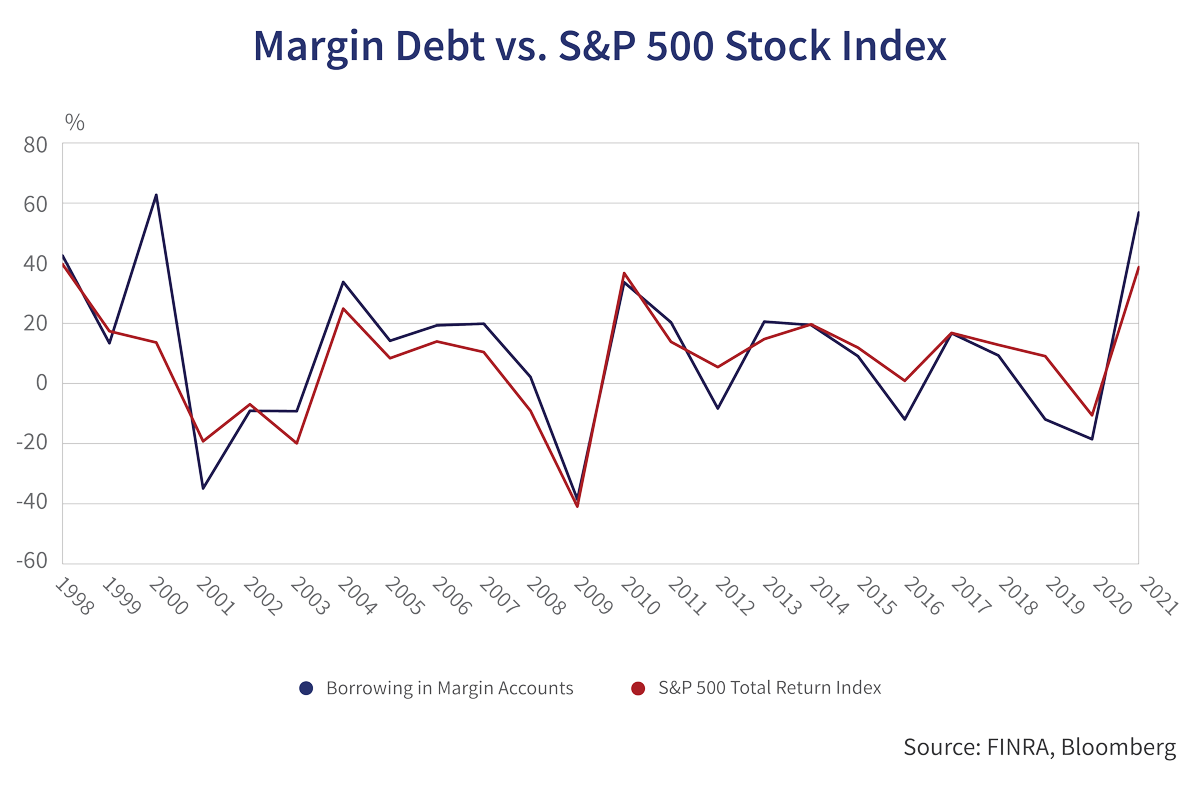

The chart below shows the year-over-year increase in margin debt as the blue line compared to the year-over-year total return of the S&P 500 stock index in red. This is what a financial economist would call a “high correlation”, but we would call a self-fulfilling prophecy. When stock returns are high, the use of margin debt is high. Directionally, this suggests to us that a lot of borrowed money is going into the markets and margin growth is now nearly at the level of the dot.com boom of the late 1990s.

Red Hot is Not Overheating??

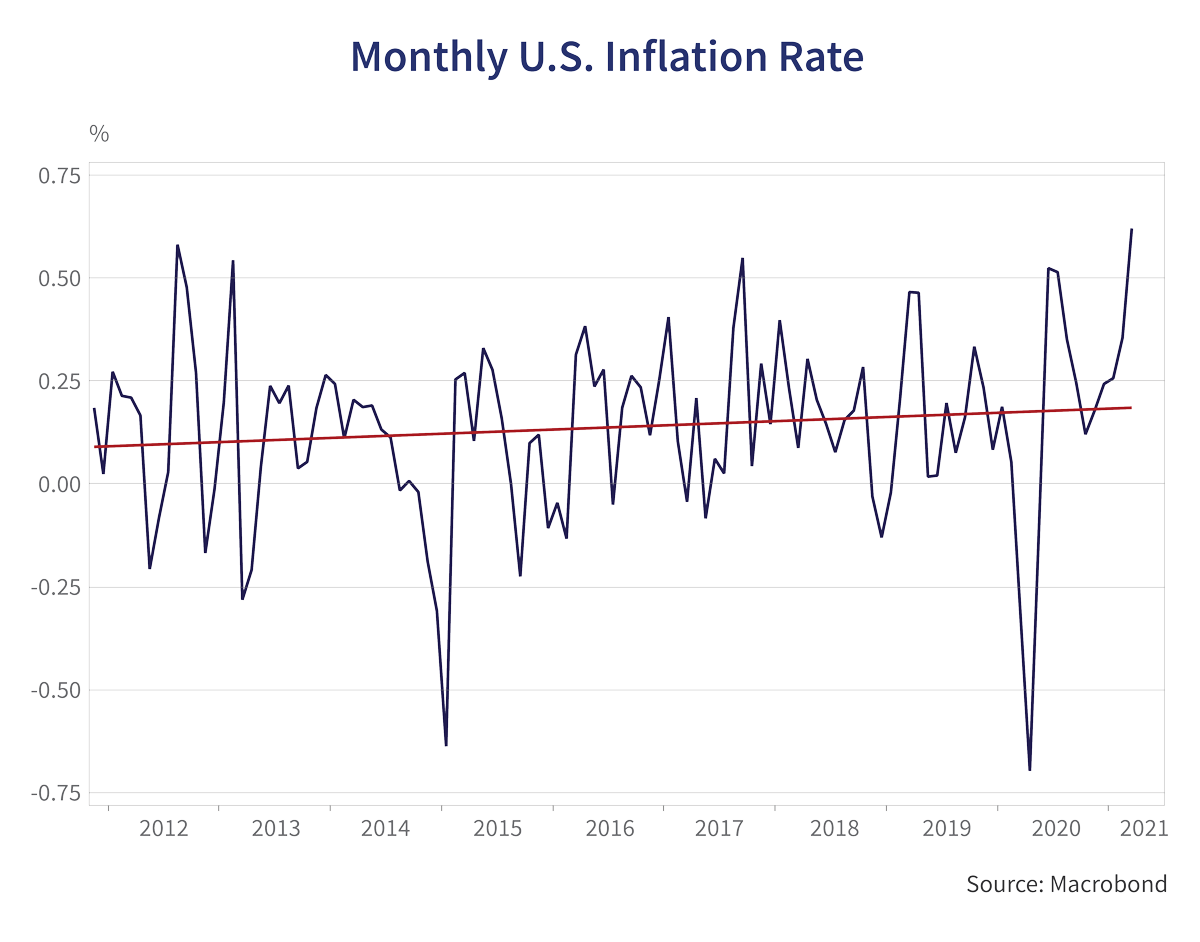

The problem with all this red hot economic and market excitement is that this unprecedented monetary and fiscal stimulus could lead to “overheating” and the return of inflation. The “experts” and politicians tell us not to worry about inflation. The chart below of the monthly U.S. Consumer Price Index tells a different tale. U.S. CPI has been moving upwards over the past 10 years. The red line shows the trend line and the blue line is the monthly reported CPI change. Note that the trend has been up from .1% monthly or 1.2% annualized to the current .2% monthly or 2.4% annualized.

One should also note that the current .6% for March 2021 ties for the highest over the last ten years and equates to an annualized 7.2%. As we pointed out to you in recent Market Observers, The Fed and other central banks have now stated that they will not respond to inflation quickly, preferring to compensate for periods of “below target” inflation by permitting periods of inflation well over their official 2% targets. It looks to us like that could soon be the case.

Inflation Help Wanted

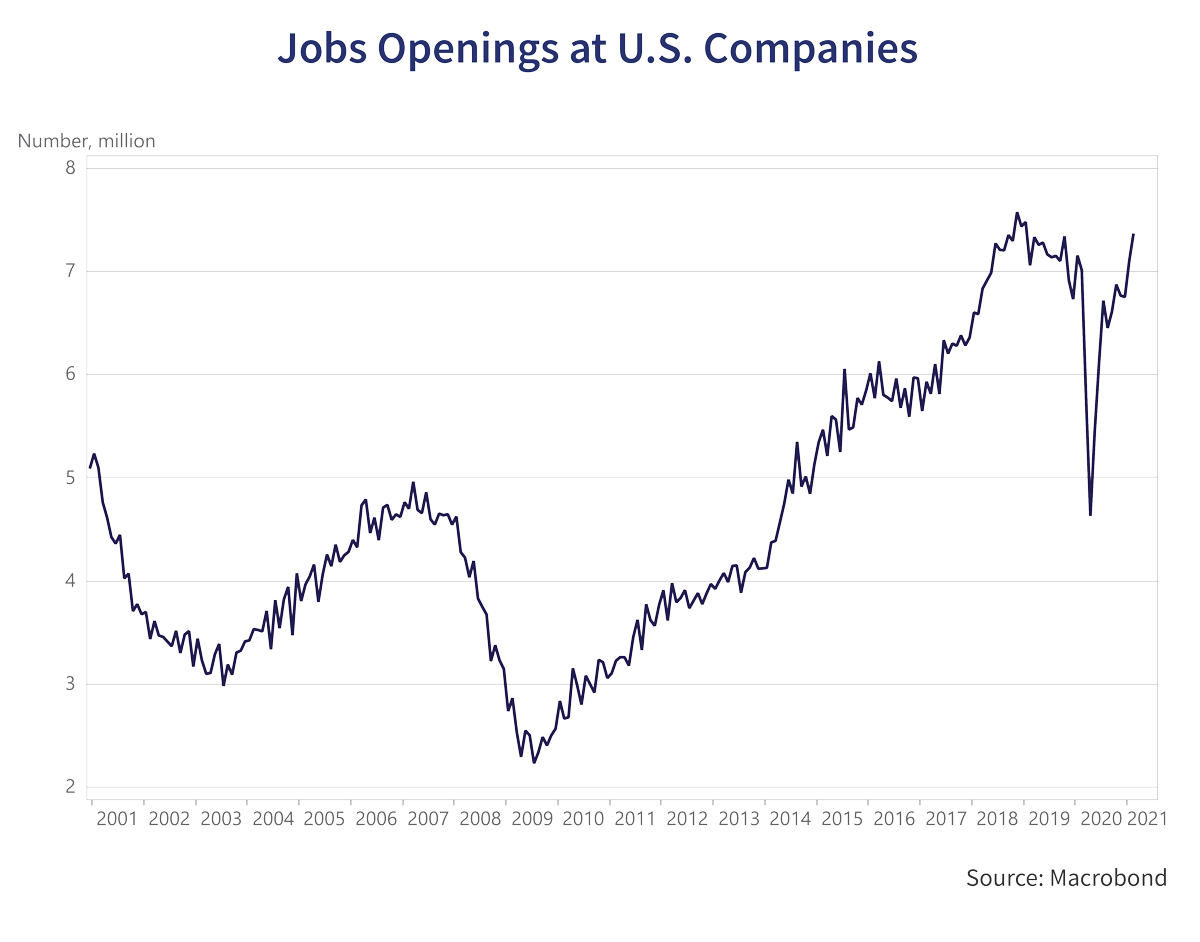

Are we at the start of a protracted period of higher inflation? We very well could be as all the requirements are in place upon exit for it: a hot economy, easy money, lots of government spending and huge fiscal stimulus. The chart below tells an interesting tale.

Employers are looking to hire and job openings in the U.S. are near their pre-pandemic all-time high. There’s no scarcity of money in the United States and locked down consumers are raring to get out and about and spend their pandemic savings on things other than Uber Eats and Netflix. This surging demand for their products means that employers want to increase their capacity to meet demand, but they are having a hard time finding employees to fill their payrolls. This suggests to us that higher wages might be coming.

Not Contained Container Price Inflation

Employees aren’t the only things that are showing signs of scarcity amongst monetary and fiscal plenty. Commodity prices are rising. Lumber prices have soared with the demand for housing. There are shortages of essential inputs for manufacturing like microchips. Many consumer goods from cars to furniture are on lengthy back orders.

This partly results from the strain on the global supply chain that is based on easily available imports and has broken down in the face of COVID disruption and surging consumer demand as this Bloomberg article suggests:

“Container shipping rates are heading higher again, driven to new heights by unrelenting consumer demand and company restocking from Europe to the U.S. that are exhausting the world economy’s capacity to move goods across oceans… But the wave of stimulus buoying consumption has inundated the supply side — the manufacturers of goods that often rely on global distribution chains.” A Summer of Sold-Out Ships Awaits as Sea Cargo Chaos Intensifies; Brendan Murray; Bloomberg News; May 3, 2021

Is Inflation Past the Inflation Future??

The “experts” tell us that the future will be the past in terms of inflation. They are holding fast to their low inflation worldview, despite all of the evidence like soaring demand for labour and record prices for things as disparate as ocean transport and used cars. Turning points in the market consensus are raft with misapplied “expertise” and tunnel vision. If you’ve built your very lucrative career as a forecaster on interest rates falling forever, it is hard if not impossible to change course.

A Wooden Stake into the Hearts of Bond Funds??

We hold true to the course of rising inflation and interest rates. This gives us tremendous concern for retail investors who have no idea that their bond funds are not “safe”. A loss of capital on a supposedly safe investment is not something that is easily swallowed by retail investors. It is not happenstance that both the Yellen Treasury and Powell Fed are considering “gating” U.S. bond mutual funds from redemptions in volatile periods to prevent the systemic risk from non-bank credit in such a situation.

While dictating a suspension of bond fund withdrawals might seem wise, further losses before “the market clears” would likely put a wooden stake into the hearts of fixed income funds for many years to come. Retail investors would rather have zero interest bank accounts than risk being trapped in bond funds that are going down in value.

Waiting for Scarcer Money

We told you in our January Market Observer that we thought we were more in the “Raging” than “Roaring” 2020s. The surging economy and surging financial markets have agreed with us for now. How does this all end? Not well if history is our guide and money becomes scarcer at some point in the future, as it inevitably will. This might take a while. Central banks have committed to holding nominal short-term interest rates at the “zero bound” for some time. This means no shortage of cash to invest or credit available for levered investments. The central bankers have also given themselves the intellectual and moral justifications they need to allow inflation to be “above trend” to make up for the periods “below trend” without raising rates.

Buy Cheap Cash Flows and Stay Away from Overvaluation!!

What of a day of reckoning for the financial markets? We think an abject liquidation sell-off is still a ways off, as the pain of the bond market is offset by the enthusiasm for equities. We expect that the current market strength could last for at least a year or two.

Don’t Fixate on Fixed Rate and Lower Quality

We prefer floating rate issues to fixed rate bonds. The weakest credits are the most expensive on a relative basis, so we are staying away from the overvaluation that high yield and bank loan investors are forced to accept. On the other hand, it is never easy to call a bottom or top, so a disciplined investor looks to buy into weakness and sell into strength. We look to be continuing to sell our fully valued holdings into the strong markets and substantially raising the quality of our portfolios in the months ahead.

We buy cheap cash flows and sell expensive ones and that’s what we intend to do!!!