“It was the best of times, it was the worst of times,” wrote Charles Dickens. We think it pretty well sums up the financial markets of 2018.

When the markets were soaring upwards in 2017 and 2018 to breathless commentary by the financial media, we told you that “risk assets”, as they are now called by the financially groovy, were detaching from cash flow reality. The lower the quality, the better it seemed for investors.

Dissed Credit

Investors whipped themselves up into a frenzy to get invested. Equities, junk bonds, distressed debt and leveraged bank loans were, as Superman used to say, “Up, Up and Away”. Sophisticated investors discredited themselves by investing in absolute garbage. We observed on these very pages that bank loans that contractually provided for dividends to predatory Private Equity sponsors even in default were definitely an indicator of very stupid lending and a peak in the credit cycle.

Reality Bit

We also told you that reality would soon bite and it did. After making new records in September and early October, the equity indices reversed hard and plummeted into year end 2018. Market volatility put paid to the illusion of “liquidity” for Exchange Traded Funds (ETFs) and sent entire markets into spasms of selling. Financial assets that were desperately sought after earlier in the year became “no bid” and prices plunged.

We’ve had a bit of a pop in prices since the bloodiest Christmas Eve in the stock market on record, but things ended the year well off peak prices. To save you and us from a ritual annual statistical rehashing, we have divided up CNN’s 2018 financial market wrap into Dickens’ categories with our emphasis:

The Worst of Times:

“The Dow fell 5.6%. The S&P 500 was down 6.2% and the Nasdaq fell 4%. It was the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade… December was a particularly dreadful month: The S&P 500 was down 9% and the Dow was down 8.7% — the worst December since 1931. In one seven-day stretch, the Dow fell by 350 points or more six times. This year’s Christmas Eve was the worst ever for the index.

The Best of Times:

2018 wasn’t all bad. The S&P 500 set an all-time record on September 20, and the Dow closed at its record on October 3. The Dow also closed more than 1,000 points higher on December 26 — the first time it ever accomplished that feat.”

2018 was also extremely volatile. As CNN said:

“The CNN Business’ Fear & Greed Index “has been stuck in “Extreme Fear” throughout much of the year. The Dow has swung 1,000 points in a single session only eight times in its history, and five of those took place in 2018.”

Words that Resonate Today

We had thought that the Dickens’ quote came from Oliver Twist or Hard Times but trusty Wikipedia reminded us that it was from his Tale of Two Cities. When we reread the rest of Dickens’ opening paragraph, we realized the considerable resonance that it has for today. His prose speaks of great opposites and divides with nothing in the centre, of being forced to choose sides when nothing seems constant or seems to make sense:

“… it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.”

Dickens’ wonderful words were describing the tumultuous period of the French Revolution but we found they resonated with the situation that we find ourselves in today. The Trump Presidency and the rise of populism in Western democracies have unleashed a tremendous uncertainty on the global body politic and economic. Exchange “Storm the Bastille” with “Make America Great Again” as messaging to an angry mob and you understand where we are going.

Nobody in the Middle

The current attack on the post war liberal order is not unlike the forces unleashed by the collapse of the French monarchy and the ensuing bloody revolution. It doesn’t take long watching either CNN or Fox News to understand Dickens’ “superlative degree of comparison only”. You are either with us or against us and the divisions are exacerbated by audience self-selection and the constant reinforcement of social media. The experts opining on the latest episode of the Trump reality show inevitably either pan or praise the Twitter crazed President. There is nobody in the middle anymore, you either love him or hate him.

Survivor Trump

Trying to figure out what Trump is up to when even he doesn’t know what his “gut instinct” will lead him to do is a fool’s game. The good news is that the framers of the United States constitution understood absolute monarchies and despots, since that is what they sought to avoid. The mechanisms they created to avoid destruction of their beloved democracy will work. It won’t be pretty politics and the drama will be high, but it will inevitably end one way or another. The twist and turns are part of the Trump show. What did the U.S. citizenry expect when they elected a reality TV star? Will Survivor Trump get voted off the Presidential Island or receive an Immunity Idol from Senate Republicans and survive impeachment? Who knows?

Back to the Basics

What we counsel is to get back to the basics, especially with the markets. As any economist can tell you, a financial system exists to allocate scarce resources within an economy. Let’s take stock of where we currently are at economically in the U.S.:

- The U.S. economy is in decent shape. It is bumping up and down statistically, but is still running at reasonable levels even given Mr. Trump’s self-destructive economic policies. The Trump trade wars, Federal government shutdowns and his Fed attacks have not hurt growth. It is at a decent 2-3% level with unemployment continuing at generational lows.

- Inflation is near the Fed target of 2%. The latest U.S. Consumer Price Index (CPI) was 2.2% for the 12 months ended November 2018, the very same as it was last year at 2.2% for the 12 months ended November 2017, so it is hard to say that the Fed has undershot or overshot its target of 2%.

- Monetary Policy is Not Restrictive. The current Fed Funds target is 2.5% after the 0.25% increase on December 19th. This puts the real Fed interest rate at 0.3% (2.5% – 2.2% CPI). Yes, the Fed is removing its emergency accommodation, but monetary policy cannot be considered restrictive with real interest rates still just above zero.

- Fiscal Stimulus. The Trump budget still provides deficit spending as far as the eye can see according to the Congressional Budget Office. We expect this to continue, as it is ludicrous to expect that the newly elected Democratic majority Congress will cut spending in advance of the 2020 election year. It is equally ludicrous to expect the Republicans to roll back their tax cuts or reduce military spending, signature issues to the Republican base. There is risk of higher deficits if Trump wants to “keep on winning” by cutting deals with the Democrats. This would add to the deficit fun by funding their flagship Democrat health care promises. These all make it highly unlikely that the fiscal stimulus will recede anytime soon.

Party On??

The real question overhanging the markets is whether the Federal Reserve will continue to raise interest rates. As we have said many times on these pages, lower interest rates are more popular than higher interest rates and there is a massive lobby against higher rates, led by President Trump himself. As we’ve laid out above, even with Trump’s invective and the uncertain political environment, there is not much of case that the U.S. economy is weak or threatened with recession.

The markets desperately want the party to continue. At the start of 2019, the market consensus believes the Fed will pause, given the trade uncertainty and market upset. They also seem to be convinced that Fed Chair Powell will be bullied into pausing by an outraged President.

I Want Zero!!!

Trump was quick to take credit for the surging stock market after he was elected. Unlike President Harry Truman, however, the “Buck Never Stops” with Trump. Seeking a scapegoat for the sell off in stocks, he has taken to publicly lambasting Fed Chair Powell, who Trump himself appointed, for doing exactly what he said he would do and is required to do.

It used to be a convention that U.S. Presidents never commented on monetary policy, but Trump has broken sharply with it. He not only frequently tweets that the Fed shouldn’t raise rates; there have also been press reports that Trump wants to fire Powell. Treasury Secretary Mnuchin had to clean up that mess by publicly stating that Trump did not believe he had the power to fire Powell, which spoke volumes. If Trump actually does try to fire Powell, we expect that the markets, especially bonds, would react violently.

We Want More Money

Trump is actually putting Powell in a tough position. If the Fed doesn’t continue with its “normalization”, the critics will quickly attribute this to Trump’s invective and pressure so Powell now has less latitude to pause without seeming to cave to the Tweeter in Chief. Trump frequently complains that President Obama had “zero interest rates” and that he doesn’t. The fact that Obama’s zero rates occurred in the context of the Credit Crisis and Great Recession doesn’t seem to faze Trump since he has no interest whatsoever in being briefed or reading anything about economic policy. If the stock market is going up he is happy!

The investment consensus is on Trump’s side in this debate. They want up, not down, low rates and more money supplied, precisely the opposite to what the consensus would have been when monetarists held sway on Wall Street. The Wall Street Journal summed up the situation well and we have added our own emphasis:

“Investors are betting that U.S. interest rates will end 2019 no higher than where they started, a sign of diminished confidence in the economy.

Fed funds futures, which investors use to bet on the direction of Federal Reserve policy, early Wednesday showed an 87% probability that policy makers will finish the year with interest rates at or below their current level. Those bets represent a dramatic shift in market sentiment. As recently as early November, futures prices were showing a 90% probability that rates would end the year higher in 2019.

Since then, volatility in the stock market has surged as investors have become increasingly concerned about the prospects for global growth and the Fed’s pace of tightening. The yield on the 10-year Treasury note, a reference rate for everything from mortgages to corporate loans, has tumbled back below 3% after reaching multiyear highs in November.

The shift in investor sentiment has occurred even as data continues to suggest that the economy is growing at a robust pace, with unemployment near its lowest level in 50 years and high consumer confidence. This sets up a tension between the central bank—which must manage rates in keeping with its twin goals of stable prices and full employment—and investors, many of whom would prefer looser monetary policy.”

Investors Are Betting That the Fed Hits Pause on Rate Hikes, Wall Street Journal, January 2, 2018

Betwixt and Between

There is no middle ground in the markets at the start of 2019, much like the politics of our times. Stocks are either going up or down, they are not holding even. Yields are either going up or going down. The economy is either growing or plunging into recession. This can be seen in the frenetic action in the stock and bond markets. As you read above, stocks cratered into December, with a record plunge on December 24th, Christmas Eve, and then a record rise on December 26th.

Crash Diving Bonds

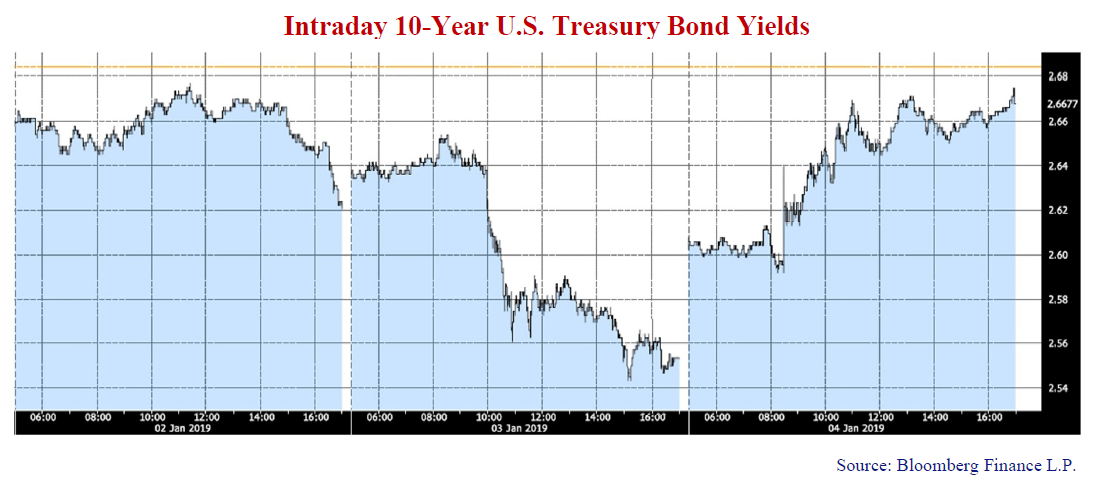

We are also seeing bond yields dive and soar, depending on the headlines of the day. The chart below shows the U.S. 10-year T-Bond opened on January 2nd at 2.66% and then proceeded to plunge to 2.55% by the close on January 3rd with equity market troubles and worries of a weak economy. By noon on January 4th, we were back to 2.67%, as a strong U.S. job report and an easing of monetary policy by the Bank of China sent the stock market back up. This doesn’t sound like much, but an 11 bps (0.11%) move in the 10-year yield in a day is quite something for boring bond managers like us!

Doving Down the Markets

It didn’t hurt that Fed Chair Powell made “dovish” comments at a conference in Atlanta. On a panel with other former Fed officials, he didn’t say much that was new, other than sounding less resolute about the need to raise rates.

“Stocks rallied Friday after Federal Reserve Chairman Jerome Powell said mild inflation gives the central bank greater flexibility to set policy in the year ahead and that the Fed wasn’t on a fixed path to push its benchmark interest rate higher…

Fed officials last month penciled in two rate increases this year, but Mr. Powell said that path could change if recent market volatility causes the economy to slow more than officials anticipate. “We will be prepared to adjust policy quickly and flexibly and use all of our tools to support the economy should that be appropriate…

…Mr. Powell said markets have tumbled in recent weeks and aren’t expecting any Fed rate increases this year because investors are placing greater weight on risks to the outlook that haven’t yet shown up substantially in U.S. economic data.”

(Loosely translated: “Mr. Market, chill out. We understand that you are having a tizzy fit over bad things you worry about but we will come to your rescue if necessary”.)

Curting Trump Out??

Powell also took the opportunity to assert the Fed’s independence from political interference when he said “curtly” he wouldn’t resign if Trump asked him to:

“Mr. Powell also curtly addressed speculation that President Trump’s unhappiness over monetary policy might lead to his removal as Fed chairman… Mr. Powell said Friday he wouldn’t resign his post if Mr. Trump asked him to do so, which is important because it isn’t clear whether the law would allow Mr. Trump to fire the Fed chairman…

Mr. Powell said the public shouldn’t worry about whether the central bank would yield to political pressure. “The Fed has a very strong culture around non-political activity,” he said. Making decisions based on data—and not politics—is “very much in the DNA of anyone who’s spent any time at the Fed.”

Fed Chairman Powell Sees Flexibility on Rates This Year; Nick Timiraos; Wall Street Journal; Jan 4th, 2018

“Tis Better to Pause, or to Pause Not?”

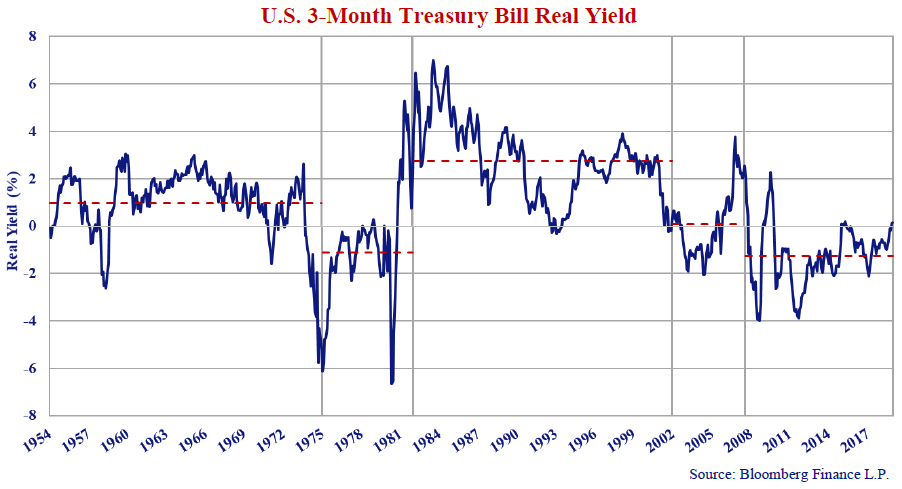

The question for the markets and the Fed, as Shakespeare might have put it, is: “Tis Better to Pause, or to Pause Not?” If we put aside the Trump drama, we can look at historical interest rates as our guide to tell us whether the Fed will pause. The chart bellow shows the “real yield” of the U.S. 3-month Treasury Bill, its yield less the year-over-year change in U.S. CPI. Inspection shows how unusual it is to have real interest rates this low in the middle of a reasonable economy.

The chart above shows that the real rate was between 1% and 2% for most of the period. This makes sense, as savers should receive a small and positive return above the prevailing inflation. In the 20 years from 1954 to the onset of high levels of inflation in 1974, the real rate on T-Bills averaged about 1%. From 1974 to 1981, we had negative real rates of -1.1% during the inflationary period, when the CPI stayed at higher levels than interest rates, peaking at 14.4% in 1980. The Fed under Paul Volcker then tightened policy and crushed inflation which has stayed under control ever since. The real yield of the 3-month T-Bill has averaged 2.75% over the 20 years from 1981 to 2001 in this moderate inflation environment.

“He Did It His Way”

The exceptions were the financial crisis fighting of the Fed. Former Fed Chair and professional musician Alan Greenspan made financial market rescues his signature song. Newly installed as Fed Chair, he “saved the markets” after the Black Monday stock crash of 1987 to much acclaim. This morphed central banking into its current backup role for the financial markets. Talk about doing it “My Way”, Greenspan even “pre-emptively” eased policy over fears that computer clocks would stop for Y2K in 2000. This didn’t turn out to be a problem at all, but all the liquidity ended up causing the 2000 dot.com bubble. When that bubble burst, Greenspan then moved rates to “emergency” levels after the stock implosion and kept Fed policy with negative real yields at -1% from 2001 to 2006.

The problem with all these central banking heroics is that they distort interest rates, the pricing mechanism for the allocation of capital in an economy. The market knew that financial mayhem would be met with plunging interest rates and called this the “Greenspan Put”. The period of negative real yields in the early 2000s was followed by a brief period from 2004 to 2006, where the Fed made “measured” 0.25% increases every quarter, hoping that the “efficient markets” would impound this information.

Nobody Said It Better

Most economists are true believers in efficient markets who postulate that they impound all available information. As you know, we at Canso don’t think this is the case and even in 2004 we weren’t very hopeful that markets would efficiently impound these “measured” rate increases. Our loyal readers know we like to weave popular song references into our newsletter so, to paraphrase a James Bond theme song, “Nobody Said It Better” than we did in 2004:

“The optimistic and the consensus financial market view seems to presently believe that “measured” Fed interest rate increases will result in what was called a “soft landing” in the 1990s. We are not so sanguine. It is the lack of oxygen that causes death by asphyxiation. Whether one is strangled slowly or quickly is a moot point if the outcome is the same… We expect the economy will sustain its momentum for the next year or two. The major effect of rising interest rates will be felt in asset prices. Profuse lending has caused large asset price increases in everything from residential houses to the stock market. Less money will mean less willingness to lend and less cashflow available to service rising debt payments. Call us “quantity monetarists” or simply old-fashioned, less money is not good news for lofty asset prices.”

Canso Market Observer; October 2004 (with 2019 emphasis added)

It is well worth reading the musings of the obscure credit manager from a “non-descript office building in the Toronto suburbs”, as Bloomberg News referred to us. We note with some pride that we were talking about the bubble in U.S. residential housing in 2004, way earlier than most. We also discussed the credit bubble throughout the run-up to the Credit Crisis, with particular emphasis on how all the “credit innovation would end badly”.

We’re So Vain…

For our younger readers, Carly Simon sang Nobody Does it Better in July 1977 as the theme for The Spy Who Loved Me. Roger Moore was Agent 007, three Bonds ago. This was higher inflation times with the U.S. CPI at 7.7% year-over-year. Bond yields were also high with the 10-year U.S. T-Bond yielding 7.2% and the 10-year Canada at 8.3%. It was Simon’s best performing song and charted at Billboard’s #2. We were a little chastened to find out that her next most popular song was You’re So Vain, which seems quite appropriate given our self-congratulation above.

Not Normal

We were a little early in our belief in 2004 that asset prices would suffer from rising interest rates. The financial markets aren’t efficient now and weren’t then. The Fed’s attempt to prepare the markets with measured increases failed terribly. By 2008 the financial world had imploded with the Credit Crisis and we have had “emergency” and very negative real rates since then, until the most recent Fed raise put us into positive real yield territory.

It is obvious from our chart above that real interest rates at zero are not that normal, let alone desirable. So why the strident calls for the Fed to stop tightening? The simple reason is that the lobby for looser monetary policy is powerful, even without the President excoriating the Fed.

Wall Street loves easy money since more money makes for more profits for those peddling financial products. Borrowers like easier credit since it gives them more buying power. Retailers selling their wares on credit want more credit creation. Anybody with a mortgage wants lower interest rates and higher house prices. Trump is a leveraged real estate developer and benefits from lower interest rates so he would be complaining in any event.

Punched in the Market Face

In the face of all the market pressure for easy monetary policy, the task of the Federal Reserve is not a popular one. The Fed knows its actions will be criticized and much pressure will be put on it. Current Fed Chair Jerome Powell just said that the “public shouldn’t worry about whether the central bank would yield to political pressure” and there’s a long tradition of resisting it. There’s a famous analogy of the Fed removing the punch bowl just when the party is getting going that comes from a speech by the then Federal Chair, William McChesney Martin Jr., to the Investment Bankers Association of America in 1955:

“In the field of monetary and credit policy, precautionary action to prevent inflationary excesses is bound to have some onerous effects— if it did not it would be ineffective and futile. Those who have the task of making such policy don’t expect you to applaud. The Federal Reserve, as one writer put it, after the recent increase in the discount rate, is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

So you are asking yourself, is this Canso pontificating going anywhere? Well, it is. Our point is that we still believe that interest rates are unusually low and that they probably will be headed higher, absent a complete economic collapse. What does “normalization” mean? We have told you in previous newsletters that real rates of interest on T-Bills tend to be 1-2% above prevailing inflation and have shown you this again in our chart above.

Zero Chance

The math is simple. The current Fed rate is 2.5% and the CPI is 2.2%, for a current real rate of 0.3%. With the real rate currently barely positive, we either need to have a steep drop in the current 2.2% CPI to near zero or rates are going up, if the Fed doesn’t cave to political pressure. For example, if the Fed thinks that a 1% real Fed rate is “normal”, with current inflation at 2.2%, so then it is headed to 3.25% (3.25% – 2.25% = 1% real), another 0.75% higher.

The market is now not pricing in any hikes in 2019 because, as Fed Chair Powell said, “investors are placing greater weight on risks to the outlook that haven’t yet shown up substantially in U.S. economic data” such as slowing economic growth and moderating inflation. How much moderation in inflation are investors expecting? Well, as we have said, “normal” real rates would be 1% at a minimum so the market expects inflation to fall from 2.2% to 1.2% to keep the real rate there (2.25% – 1.25% = 1% real).

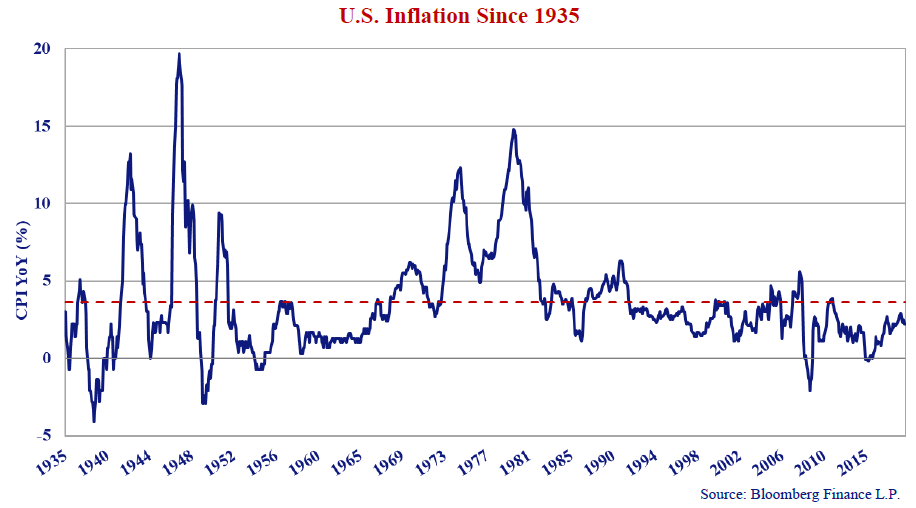

Dropped or Kicked Inflation?

How likely is such a drop in inflation? We present a chart above of the U.S. CPI since 1935. It very strongly suggests that it would be unusual to have CPI at 1%, let alone zero or negative. Unless things are much, much worse economically than we understand, we think the Fed will continue to “normalize” monetary policy. We don’t have to get into the details, but what it means to us is, as in 2004 to 2006, we will be seeing interest rates rise and financial asset prices continuing to drop.

This is not great for bonds, which have rallied recently to expensive levels if the economy continues on its merry way. The current 2.67% yield for the 10-year U.S. T-Bond only offers 0.47% real yield above current 2.2% CPI inflation. If T-Bills pay at least 1% above inflation, bonds should pay more and they do with a historical 2.3% since 1963.

Equities have the benefit of higher cash flows due to the Trump corporate tax cuts and rising earnings, but they will eventually come under pressure as well. Higher bond yields make for high equity earnings yields and lower Price/Earnings multiples. It is not coincidence that the lowest PE multiples occur at times of higher interest rates and inflation.

Whoa Canada!

We are more worried about Canada than the U.S. As you well know, we believe Canada escaped the worst of the Great Recession by juicing our housing market to absurd levels. Combined with weak commodity prices and dunderheaded (yes, we said that) pipeline policies, it seems to us that Canada will struggle economically as the housing market fades. Canadian oil continues to be “trapped” at much lower prices due to inadequate pipeline capacity so the Canadian energy sector will do much worse than global peers. The markets seem to share this view, as Canada bonds yields have stayed lower than those in the U.S. One of our major worries is that Canadian bond yields could correct upwards violently if the Bank of Canada lags the U.S. Fed in tightening or even loosens its monetary policy.

The Loan a’ Rangers

We think the odds of a financial crisis are low, due to the banking reforms put into place after the Credit Crisis. The big risk that we see today is a good old, down and dirty sell off in the credit markets. As we have been harping on for some time, we see the major problems coming from the leveraged credit markets; both high yield bonds and leveraged bank loans.

The banks are acting as “Loan Arrangers”, packaging and selling loans to mutual funds and ETFs and, as we said in 2007, “selling to the unsuspecting”. A lot of recent, and therefore crappier, issuance has been into securitized CLOs (Collateralized Loan Obligations) that slice and dice them into tranches. These are then sold to institutional investors who should know better, based on the implosion of CLOs in the 2008 Credit Crisis.

Since the source of most of this crappy credit is from Private Equity sponsors, we find it difficult to believe that the Fed will move to rescue them. There will be little dislocation, other than marking prices down in default and handing the unsuspecting creditors significant losses. In recent PE restructurings, the lenders have thrown in the towel and taken their lumps and left the sponsors relatively intact.

Watching and Waiting

We are still mostly watching and waiting, but have found some good opportunities in the recent sell off, some that we sold not that long ago at much higher prices. As we said then, when nobody saw any risk, it was time to sell into the very attractive bids and invest in higher quality that offered us a better risk and return profile. Now that retail investors are selling out of ETFs that must then sell to fund the withdrawals, we are starting to see good values emerge.

Happy New Year!!