Turkey and Trump

With the end of the year drawing closer, our American friends celebrated their Thanksgiving and mourned the passing of George Herbert Walker Bush, the 41st President of the US. George “HW” was fondly eulogized as a selfless and professional public servant and politician. This stood in stark contrast to the ominous legal problems and declining political fortunes of the current and 45th President, Donald J. Trump. “President T.”, as he has taken to calling himself, has created the polar opposite of HW’s legacy with an administration mired in scandal, self-interest and Twitter self-pity.

Slip Slide n’ Away

Across the pond, European political leaders stumbled in the face of their publics’ resentment. Angela Merkel resigned as head of the CDU party, a prelude to her eventual exit from German politics and a direct repudiation of her handling of the European migrant crisis. President Emmanuel Macron of France faltered in the face of the widespread “Yellow Vest” public protests. These started over higher gas taxes and quickly morphed into complaints over his “imperial” style of politics. Macron just threw in the political towel and decided that blowing European budget limits was a better idea than getting “Stormed in the Bastille”.

Even those opposed to the idea of European unity got bashed. British Prime Minister Theresa May attempted to stick handle Brexit over the goal line and got stopped dead by determined opposition on all sides. She just survived a Conservative Party leadership contest for the great honour of begging those dastardly Europeans for their help in getting Britain out of Europe. This makes sense to whom??

Canadians reveled in their annual Grey Cup parties, lighting up their legal joints along with their traditional beer fuelled revelry. Canadians’ hangovers were made worse by media coverage of former Governor General’s Adrienne Clarkson’s expansive and very expensive expense reports. Justin Trudeau’s deficit financed corporate tax cut went largely unnoticed as the snow and winds of winter kicked up across most of the country. Oil prices plumbed to crisis level lows, leaving most Albertans even more out in the cold. Christmas, New Years and higher oil prices can’t come soon enough for the Western Canadian oil patch.

Things Can Change

Things change quickly in the financial markets over a short period of time and the recent few months are a vivid example of this. Just when it appeared at the end of September that the equity markets were coasting into year-end on a positive note and yields were moving to normal levels, risk made a rather forceful comeback.

We had been warning you in these very pages that caution had been thrown to the wind by investors desperate to “get invested”. Our call was that prices had been pushed up so high in the credit markets that the potential returns did not justify the risk. We admit we like to be right, but the violence of the “correction” impressed even us! The mindless rush into indexed Bank Loan and Junk Bonds by naïve retail investors reversed suddenly and bids disappeared as redemptions soared.

Equity markets also plunged around the world and bond yields headed south as investors sought a place of refuge in government bonds. Between September 30th and December 11th, the S&P 500 fell 9.1%, moving into negative territory for the year. Credit spreads, most notably high yield, widened dramatically. Investors bid up US treasuries and during the same period, yields on 10-year US Treasuries fell 0.18% or 18 basis points (bps) to those of us bond market investors.

Breaking Bond Market News

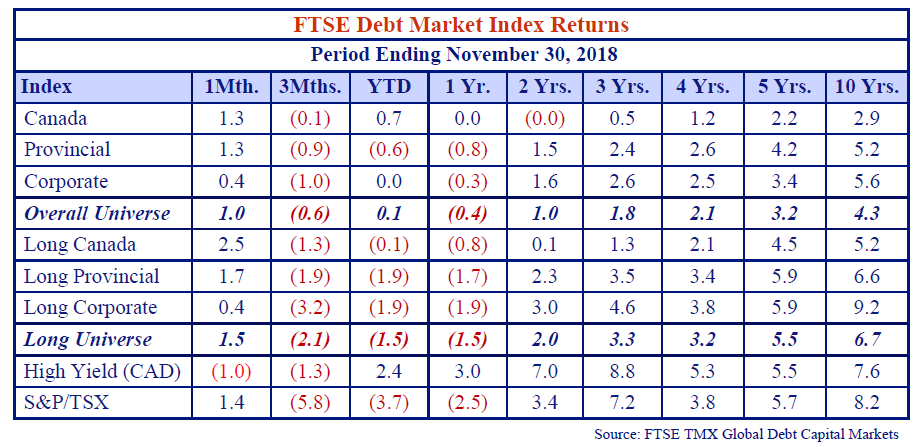

We usually provide a table of the last quarter’s Canadian bond market performance in this publication, but we are breaking with tradition. Higher government of Canada bond yields had anchored negative returns across Canada’s fixed income markets in the 3 months ended September 30th, but yields have declined dramatically since then. We’ve provided updated returns to November 30th in the table below to keep you up to date with bond market “Breaking News”.

Flawless to Hopeless

One of our favourite financial market scribes is Howard Marks, the founder of distressed debt firm Oaktree Capital Management. We think this quote from his book “The Most Important Thing” perfectly summarizes the recent turmoil in the financial markets.

“… in the real-world things generally fluctuate between ‘pretty good’ and ‘not so hot’, in the world of investing perception often swings from ‘flawless’ to ‘hopeless’…”

Howard Marks, The Most Important Thing

It would seem the investment world is in a “hopeless” phase. It may be a short-term tantrum or the beginnings of a longer-term decline. What is certain is when the markets implode, opportunities are created as good securities are marked down with the bad.

Safety in the Yield Numbers

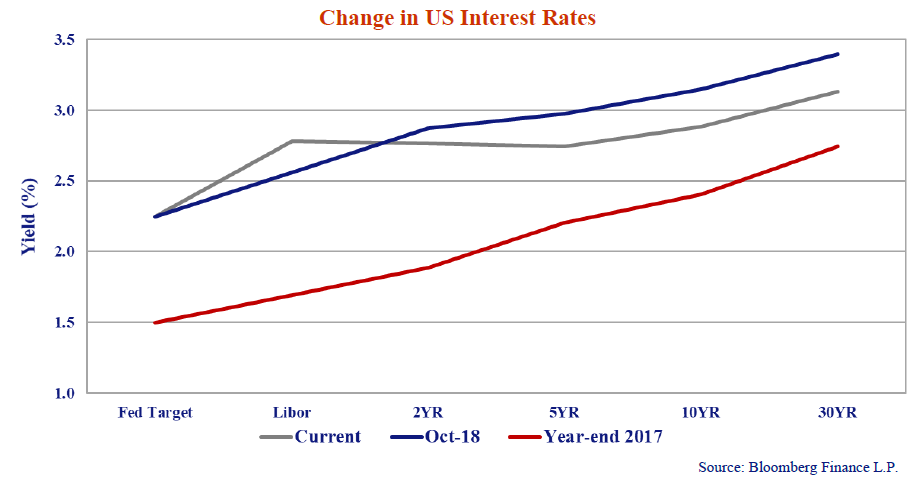

The uncertainty and upset in the equity markets translated into falling US Treasury bond yields. Investors fled to the safety of government bonds, bidding up prices and sending yields back down to levels seen earlier in 2018.

The chart above shows the current US T-Bond yield curve, the yields across bond terms, versus its position at the end of October and at the end of 2017. After moving steadily higher in each of the first 3 quarters of the year, yields on 2 to 30-year treasuries fell significantly in October, November and into December. Despite this, yields on all major US bond market benchmarks are still up substantially year-to-date in 2018. The Fed Funds target rate is up 0.75% after three 0.25% increases thus far in 2018. The FOMC meets again on December 19th and is likely to hike rates again.

The current happenings in the bond market don’t change our view that yields are heading up. In previous Newsletters we’ve outlined the case for US interest rates to be higher. There remains an enormous amount of stimulus in the US in the form of low (albeit higher than previous) interest rates, tax cuts and government spending. In our view, rates should continue to normalize which in our estimation equates to short term interest rates equal to inflation (currently hovering around 2%) plus 1 to 2%. This implies a US 2-year yield of 3 to 4%. A positively sloped yield curve indicates a range for the 30-year bond yield of 4 to 5%.

Alberta Clippered

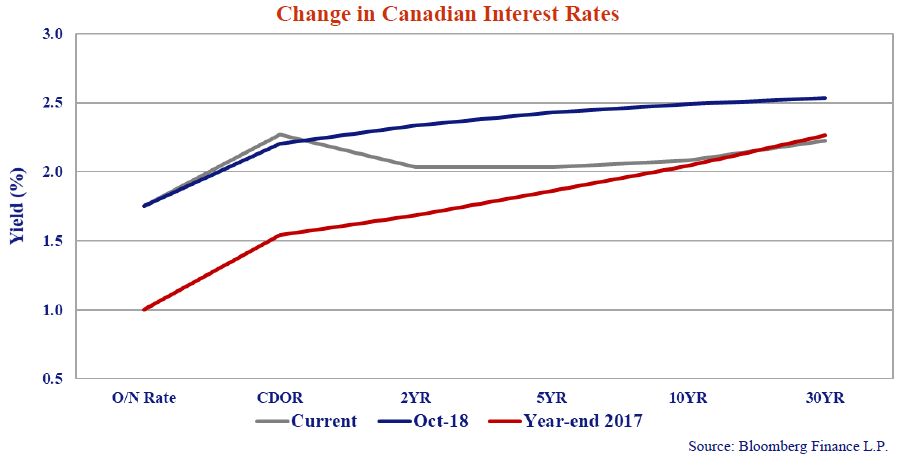

The Bank of Canada has raised Canadian short-term interest rates three times in 2018, 0.25% each time. The Bank of Canada was on hold at its December 7th meeting, citing concern over the economic impact of falling oil prices in Alberta as one reason for keeping its overnight rate unchanged at 1.75%.

Starting from a lower base, Canadian interest rates followed US interest rates higher in the first three quarters of 2018. The November drop in bond yields has been much more dramatic in Canada than the US. This leaves Government of Canada 10 to 30-year bond yields virtually unchanged versus the start of the year.

Economic expansion is slower and lower in Canada. We continue to expect the Canadian economy to grow, albeit at a more modest pace than the United States. The Bank of Canada will continue to raise rates at a slower pace than in the United States. We also expect that Canadian interest rates should normalize versus US interest rates.

Passitively Cheap

Canso was founded on the belief that the financial markets are inherently inefficient. This is quite a quaint and outmoded viewpoint in the current vogue for “passive and cheap” investment management.

The marketing of the theory of efficient markets by financial firms has resulted in the proliferation of passive investment vehicles known as exchange traded funds (“ETF’s”) meant to mimic the performance of these efficient financial markets. Touting low fees and instant liquidity, backers of ETF’s have enticed trillions of dollars to passive equity and fixed income vehicles into these “miraculous” investments. These vehicles would be wonderful if markets were as efficient as their promoters professed them to be. We beg to disagree.

A General Disaster

Every once and awhile we are reminded of just how inefficient markets can be. We point to the example of the current rout in securities of General Electric (“GE”). GE traces its routes to 1892 and its founders include the legendary inventor Thomas Edison and famed investor J.P. Morgan. The company operates in numerous businesses including Aviation, Health Care, Oil and Gas and Power.

As one of the world’s largest and oldest public companies, GE is one of the most scrutinized and analyzed corporations on the planet. One would then expect the “efficient” financial markets to have impounded all possible information, as hypothesized by efficient market theories.

That was unfortunately not the case. GE had gone from its “never disappoint on earnings” culture in the 1990s under their then famous and now infamous CEO Jack Welch, to now staggering from one disastrous investor conference call to the next. Welch’s culture of accounting magic has been laid bare with write-offs and restatements galore. The turn in GE fortunes are nothing short of Greek tragedy. The huge GE Capital financial arm which threatened the US financial system during the Credit Crisis has reduced from a $1.5 trillion portfolio to the current $125 billion.

A Culp of Reality

GE’s very recently installed CEO, Lawrence Culp, held his first quarterly earnings call with analysts on October 30th. Mr. Culp committed public company treason during the call and told the truth about the necessary steps required to ensure GE remained a going concern. He said that GE faced several challenges which in aggregate necessitated the reduction of the quarterly dividend and the rework of its underperforming power business. The stock fell. Mr. Culp followed up his October 30th performance with a November 11th interview during which he stressed the importance of selling assets to reduce debt to maintain the company’s balance sheet strength and financial flexibility. Everything Mr. Culp said seemed very logical, well thought out and necessary.

It is the market reaction to Mr. Culp’s November 11th call that should give any active management detractor and passive vehicle promoter pause for thought. For all the analytical firepower combing over GE’s voluminous disclosure it appears most stock and bond investors “didn’t see it coming.” The stock tanked, and GE credit spreads widened significantly.

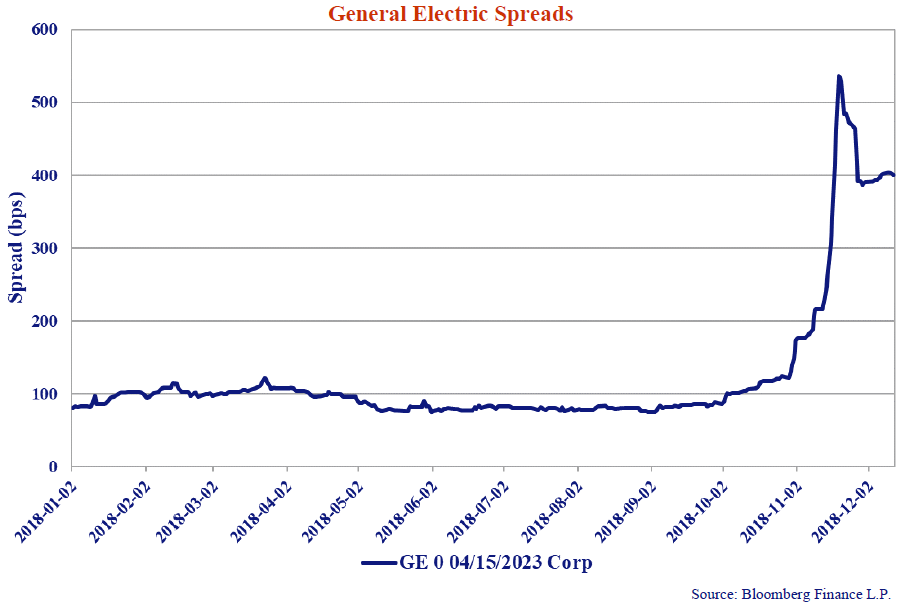

GE issues bonds in markets around the world. The chart above illustrates the yield spread (risk premium) on a USD floating rate note over the last year. The magnitude of the recent spread movement is nothing short of monumental. In October and November, the credit rating agencies downgraded GE to BBB levels. With yield spreads in the 400 – 500 bps range, GE is trading at “B” type levels.

Anyone who follows GE should not have been surprised by anything Mr. Culp said on his call and during his interview. There is no doubt GE needs to reduce leverage, streamline and divest certain businesses. It also needs to manage exposures in the remaining GE Capital business and reduce its large pension deficit. It will take time to work through all these issues. All of Mr. Culp’s talking points seemed reasonable and rational things to say. The markets reacted as if the company was a few steps out of bankruptcy court. Nothing about the current trading prices of GE stock and bonds seems efficient to us.

Nobody’s Perfect

We like GE, warts and all, at the current prices for its securities. We added considerably to our GE positions as spreads widened and the stock price plunged. We don’t need companies to be perfect, we need to be compensated for the risks we assume, and we believe this to be the case with GE.

GE explains why we like “Fallen Angels” so much. There are so many GE bonds that the sellers now vastly outnumber the buyers like us. GE fell from grace with investment bank and credit rating analysts when they owned up to their actual situation. The analysts were embarrassed by their failure to recognize what was going on and of course overcorrected and “punished” GE. We find it interesting that analysts have a lot invested professionally in their “relationship” with an issuer and feel “jilted” when things go wrong. They are so invested in their relationship with a company that when things go wrong, they emotionally go through a “bad breakup”. John Coates explored the biochemistry of trading in “The Hour Between the Dog and the Wolf”. Perhaps he should turn to the large genre of “Relationship Advice” for a new study of investment analysis emotions.

Clearly, market emotions have run amok with GE. Technically, it is not even a Fallen Angel. It has been downgraded from A status to BBB status, still solidly investment grade. The timing was awful. GE became “unloved” when the credit and equity markets were selling off, so things were very ugly, as no buyers and lots of sellers make for plunging prices.

Buy the Buy

At Canso, we saw the market reaction to GE’s announcement as a buying opportunity. The average spread on the $48 billion GE securities in the ICE Investment Grade Corporate Index widened from 0.96% to 2.67% in just over 2 months. GE’s bonds were down anywhere from 1 to 2% for its very short-term bonds and up to 30% for longer term bonds. This occurred in what is the largest and most efficient corporate bond market in the world.

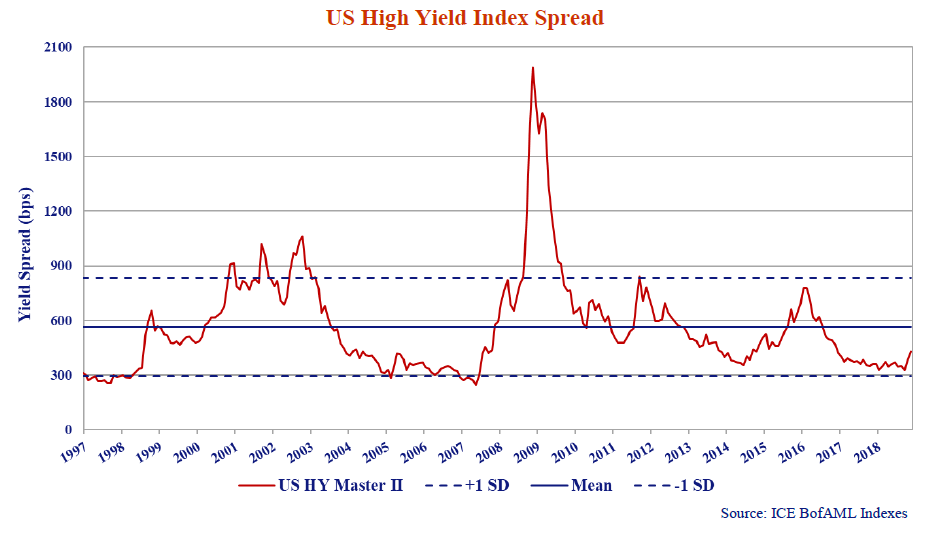

We’ve been cautioning for some time that reaching for yield down the credit spectrum would eventually cause discomfort. Owning credit seemed the easy thing to do from 2016 to 2018. Speculative bonds did very well as high yield credit spreads tightened almost 4.5% over these two years, as the chart below shows. Credit spreads have been moving wider since the start of 2018 with the pace accelerating in recent weeks.

You Don’t Lite Up Our Lives

The paltry yields were not the only problem we saw with lower quality credit. We’ve written extensively of our growing concern with aggressive pricing and reduced protections in both the high yield and leveraged loan markets. As investors rushed to “get invested”, pricing and covenants advantaged issuers at the expense of lenders.

According to J.P. Morgan, approximately 80% of leveraged loans are now “Covenant Lite”. Covenant lite means no contractual protective covenants which are financial tests such as:

- Debt/EBITDA which must be maintained for the life of the loan;

- Incurrence covenants which control total leverage and are financial tests such as Debt/EBITDA that must be met when new debt is incurred.

- Restrictions on payments to equity holders at the expense of debt holders.

Another problem is these ratios are often now based on EBITDA calculations which may bear little reality to the actual earnings potential of the business and have been defined for borrower “flexibility”. Exceptions to restrictive covenants or “Carve Outs” for dividends, future acquisitions and asset securitizations were once the exception but have now become commonplace.

We have been quite vociferous in our commentary on this financial “innovation”. More recently, financial notables including The Bank of England and former Federal Reserve Chair Janet Yellen added their voices to the growing chorus of people espousing caution over the leveraged loan market.

Visions of Corporate Bond Sugar Plums

We employ an active management strategy at Canso to exploit inefficiencies in the financial markets. We look forward to markets driven by fear where we can find cheap securities. The financial markets currently appear to be in one of Howard Marks’ “hopeless” phases. Equity markets are falling, credit spreads are widening, and investors are fleeing to the perceived safety of government bonds.

We do not agree with the “hopeless” consensus. We are actually quite hopeful at the prospects for the much-cheapened securities like GE bonds that we are now buying. We were once quoted during the aftermath of the Credit Crisis as saying that bonds were so cheap that it was “like being in a Candy Store”. You might now say that Bond Christmas has come early, with visions of corporate bond sugar plums dancing in our portfolios.

Only a few short months back we were warning that investors had collectively lost their minds in a speculative frenzy. Our portfolios were the most conservative they had been since the Credit Crisis. We were frequently asked how we would “outperform” when bond yields and credit spreads were so low. Our response was that our job was to wait for the inevitable “repricing” and be ready to invest when others were frozen in terror.

That’s what we are now doing!!

From all of us at Canso we wish you and yours the best for the holidays and a Happy New Year.