It is hard to get excited about much these days. It is March and still cold outside. It is dark when the alarm sounds since we lost an hour of sleep when we recently “sprung forward” to Daylight Savings Time. Our great grandparents created DST to give themselves more time for spring planting. We are now told it makes us more accident prone and is not even healthy for us.

Springing Backwards

Although spring seems to be in the air at times, it also seems that we “sprung backwards” in morale and morals. The news cycle offers little hope. Cataclysm and pain dominates. Our politicians seem to be plumbing the depths of appropriate behaviour and civility. The lower the bar, the better. U.S. politics features yelling, screaming and name calling, all behaviours banned in nursery school.

The Scandalous “SNC Scandal”

Canada is not any better. Driven by their need for ratings and attention, Canadian politicians and the slavering media seem determined to destroy a good company, SNC Lavalin, over the actions of a few people. We must disclose to you that we own the bonds and stock of SNC since they are very cheap with all this “bad news”. To us, the real scandal is the utter stupidity and hypocrisy we’re seeing from Ottawa.

This has been hanging over SNC for many years. To put the timeline in context, The Arab Spring protests in 2011 resulted in the overthrow of Libya’s Gaddafi regime, the very family that received the bribes. Dictator Muammar Gaddafi was killed by a mob of angry Libyan rebels in October 2011. In 2012, the SNC Board terminated all those involved for cause that same year and cooperated with the investigation. The individuals involved were charged and convicted. Finally, the SNC Board appointed a new CEO from the U.S., Robert Card, in 2012. He instituted very clear ethics and compliance standards and got rid of the management who had been involved in the scandals. He was replaced by current CEO Neil Bruce in 2015.

Deferred Prosecution Agreements

The problem is the criminal charges against SNC as a company. Bringing criminal charges against a company is widely considered a bad idea since Arthur Andersen, the U.S. accounting and consulting giant, was charged, convicted and went out of business. The conviction was subsequently reversed by the U.S. Supreme Court but the damage was already done and thousands of innocent employees, suppliers and customers were grievously harmed. The preferred solution is now a “Deferred Prosecution Agreement” (DPA) under which a company admits to a crime and promises not to engage in the behaviour in the future by implementing appropriate controls. The company then pays fines and restitution without shutting down and hurting innocent parties.

In Canada, the Attorney General (who is also the Justice Minister) is authorized to instruct the Director of Public Prosecutions to enter into a DPA instead of criminal proceedings. The former Attorney General, Judy Wilson-Raybould decided to forgo the DPA and to allow the criminal charges to proceed. She was recently replaced in a Cabinet shuffle by someone who seems more amenable to a DPA. When the Globe and Mail reported in February that Wilson-Raybould was subjected to “political pressure”, it was game on for the press and the political opposition.

Sheer Hypocrisy

Talk about a double standard. The very politicians clamouring over SNC seem to forget that their very own political parties have had brushes with the law and scandal without charges. The Conservative Party and their Leader Andrew Scheer are all over Prime Minister Justin Trudeau and the Liberals over the “SNC Affair”. He might consider a little introspection. We can’t help but wonder at the selective morality when we think of the “Airbus Affair” involving bags of cash exchanged in hotel rooms, which the Oliphant Commission investigated without charges in 2010.

The Trudeau Liberals are under siege after the testimony of Ms. Wilson-Raybould to the Parliamentary Justice Committee. We have a hard time understanding her discomfort at being “politically pressured” to spare SNC, given that she is still a member of the Liberal Party of Canada. The Liberals had their own brush with the law not that long ago with the “Sponsorship Scandal”. The 2005 Gomery Inquiry concluded that the Liberals linked government advertising contracts with donations to their party among other things. There were no criminal charges against the party.

The politicians in Ottawa of every party should be ashamed of their hypocrisy. The double standard is flagrant in the “SNC Scandal”, but then again “That’s Politics”.

Mean Diversion

When the most exciting thing to happen in February was Super Bowl MVP Julian Edelman shaving his beard on the Ellen show, you know times are tough. To add insult to injury, entertainment is also becoming more expensive. Netflix raised prices on the very products that they addicted us to. If that’s not bad enough, the U.S. election campaign is in full swing – yes that’s right, the 2020 election campaign. From what we’ve heard so far from President Trump and his many potential Democratic Presidential candidates, the discourse promises to be even meaner than during the 2016 election. Perhaps the motto of both parties should be “No Blow Too Low”!

Sports offer some hope for diversion. The Stanley Cup playoffs are just a few weeks away, making the Maple Leafs a few weeks away from playoff elimination. (Editors Note: This was written by an Edmonton Oilers Fan!) The U.S. College “March Madness” basketball national championship is now underway, which promises some hope for taking our minds off things. Speaking of basketball and hope, the Toronto Raptors are looking great and are bound for the playoffs. We know that other Canadians don’t like to cheer anything Toronto, but even our Edmonton Oiler fan is excited about the Raptors!

On a Slow Boat to China

Financial market consensus is a fickle thing. Concerns over slowing global economic growth, especially in China due to the Trump trade tariffs, have recently created fears of a global recession that would impact North America. This means the direction and pace of Central Bank actions are now hotly debated. Six months ago it was taken for granted that the U.S. Federal Reserve would continue to raise and “normalize” interest rates. It was also expected to reduce its bloated balance sheet by selling the bonds it bought in the aftermath of the Credit Crisis and the Great Recession. Then President Trump took to Twitter.

Monetary “Guiding Missives”

Trump has not just broken many U.S. political conventions, mores and traditions, he has blown them to oblivion so many times that nobody seems to care anymore. Why not, when it seems to work for him? Trump seems to like getting his way on monetary policy, breaking sharply with the tradition of other Presidents of not commenting on Federal Reserve policies.

Trump’s tweet attacks on the Fed and its Chair Powell are not oblique, they are brutal and direct like “He (Powell) seems to like raising interest rates” and the Fed is “going loco” for raising interest rates. The attacks by Trump have seemed to spook Powell and the Fed. Powell is on record as saying that Trump’s attacks aren’t affecting monetary policy but the Fed stopped raising rates soon after them. At their meeting ending March 20th, the Fed just confirmed it is on hold for the rest of 2019. It also now seems they will delay the sale of the bonds they bought during the emergency “Quantitative Easing” in the aftermath of the Credit Crisis and Great Recession. There is even discussion within the Fed of allowing inflation to be “above trend” or higher than its 2% target, to “recover” from the “below trend” years of lower inflation. Trump and the market loved it. Equities soared and credit spreads tightened.

Zero Interest

It is obvious what Trump wants the Fed to do. He is on record as saying that “Obama had zero interest rates” and he wants them too. We also know he is a big believer in debt and leverage from his business career. Unlike us, Trump has no interest in history. If the stories are true, he does not read anything and refuses to focus on “boring” policy documents. It seems that Trump’s current economic policy is for the stock market to go up, as he believes this validates his Presidency.

Un-Moored Economics

You might have missed last Friday, what we think is the most important development for bond managers in many, many years. In the lead up to the release of the Mueller report, Trump tweeted: “It is my pleasure to announce that @StephenMoore, a very respected Economist, will be nominated to serve on the Fed Board. I have known Steve for a long time — and have no doubt that he will be an outstanding choice!”. Moore is clearly in Trump’s camp, having been his campaign economic advisor. He has also stated that he believes that Trump should be nominated for a Nobel Prize in economics! To give you an idea of Moore’s potential contribution to the Federal Reserve Board, we found a quote from an interview he did on the John Catsimatidis radio show on December 22nd, 2018: “By the way, I think the trigger for this massive sell-off has been an absurd Federal Reserve Board policy that I believe the people on the Federal Reserve Board should be thrown out for economic malpractice…”.

Trump might have been trying to deflect from the pending and now released Mueller report, but it is quite obvious to us that he is trying to do with the Fed what he did by appointing “conservative” judges to the Supreme Court. Powell was appointed by Trump on the advice of his fellow Republicans, but Trump is obviously dissatisfied with him. Now Trump is going to appoint more “loyal” Fed Governors to its Board. This is a very, very disturbing “politicization” of the Fed with important implications for the financial markets. We’ve told you for some time that the monetarist resolve to not “command and control” and “guide” the economy was quickly disappearing from the monetary halls of power. We also said that central bankers were only human and did not want to be blamed for bad outcomes.

Now things have changed for the worse. With the nomination of Moore, the Fed looks to be on its way to becoming a political organization. With the Democratic Party turning leftwards, we doubt that they will object to someone like Moore who wants lower interest rates no matter what. The Republican Party under Trump has completely retreated from its previous conservative fiscal and monetary policies and embraced Trump’s populist platform that runs huge deficits and promises low interest rates and credit for all. The “Tea Party” Republicans who complained about Obama are silent.

Avoiding the Twitter Crosshairs

Powell’s anti-avoidance behaviour is not unusual in current U.S. Republican circles. The military veterans among us have been transfixed by the recent spectacle of President Trump criticizing the deceased Republican Senator John McCain. It was not so long ago that the U.S. honoured McCain at his state funeral for his service to his country. McCain was a Navy pilot who was shot down over North Vietnam and endured years of brutal captivity and torture. He was offered early release from captivity but declined it on principle.

Now we have Trump, who received a pass on Vietnam because of “bone spurs”, telling us he “never liked” McCain during a speech at an Army tank factory. What is the response of the “pro-military” Republicans in Congress? Complete and utter silence, except from Senator Lindsey Graham, who was moved to say something nice about McCain without mentioning Trump by name. Graham is a former Air Force officer and was McCain’s best friend. Anthony Scaramucci, a Trump supporter and former aide, explained to CNN that the Republicans “don’t want to get in the Twitter crosshairs”.

Powell-Less

So don’t expect too much from Powell. To us, the writing is on the wall for disciplined monetary policy. The current theme of global monetary policy is “we’ll give the politicians and markets what they want.” Trump’s fixation on the stock market suggests to us that any market distress or actual economic weakness will be met by Greenspanian torrents of liquidity. The conclusion, short term interest rates are not rising any time soon.

Thoroughly Modern Monetarists

Contrary to the market consensus, Canso continues to believe the path for administered and market determined rates will eventually be higher. Substantial stimulus remains in the U.S. in the form of still very low interest rates and deficit financed government spending. Unemployment is low and going lower. True, job creation is slowing but the participation rate is rising and there are fewer and fewer people available to hire. Wages are now rising. This makes it unlikely to us that the U.S. economy will go into recession anytime soon. Unless it does, U.S. interest rates will eventually have to rise. If the Fed doesn’t act, the market will raise rates for them.

It is also unlikely that U.S. government spending will drop anytime soon. The more radical Democratic party left wing has embraced trendy “Modern Monetary Policy” which argues that U.S. government bonds can be issued almost limitlessly. This is not too far off from the “Social Credit” theories of the 1930s which held that credit was a social good to be offered free to everyone.

Trump himself likes debt. It is said that he tells people concerned with government debt and deficits not to worry since he will be out of office when it becomes a problem. There are reasons for the Fed to “pause” due to recent slower U.S. GDP growth, but we fear the Fed policy has moved from “normalization” of interest rates to “as low as possible and as late as possible”. Those among us who read history are not surprised.

Crashing Market Reality

At Canso, we read investment books and discuss them as part of the professional development of our investment team. Our current book is “The Great Crash, 1929” by the late economist, John Kenneth Galbraith. It was written in 1955 when the Great Depression of the 1930s was still seared into people’s memories. It is a great book and we highly recommend it for any readers that want to understand the financial markets.

Galbraith recounted that our great-grandparents were transfixed by the stock market boom in the 1920s. Financial speculation was totally detached from economic reality. The speculation in stocks had actually become an end in itself and a national mania. It is hard to exaggerate how stupid and dangerous the stock market had become. Promoters ran stocks up and down, rigging the market. Margin stock lending was the major way that banks made money. “Investment Trusts” developed as a way for the average person to “get into the market”. These were pools of money that bought stocks and there were so many that they drove up the price of actual stocks. The current inanity with ETFs comes to mind. The more popular trusts were levered with debt and preferred shares to juice returns which added cascading leverage to an already speculative market.

Bursting with Reality

People didn’t care about the actual business prospects of companies. They were excited to “get rich”. Galbraith points out that the Federal Reserve and more prudent people knew that the bubble would eventually burst with terrible consequences, but this was not a popular thing to say. The “experts” in academia and finance were on the side of the boom and anyone who questioned the wisdom of what was going on was literally called “Un-American”. Think Trump and the Fed.

Many of those who suggested the bubble might burst were wrong so many times that they just gave up and stayed silent. We have told you many times that more money is always more popular than less money. We are not saying that the current bubble is about to burst imminently, but we are saying that things are getting expensive and markets, particularly in leveraged loans, have departed from credit reality.

Curves Are Popular

We expect you are thinking, like President Trump at a policy briefing, “Enough with history, what is going on now!” For interest rates, we turn to curves to make it visual like President Trump likes. Forget J Lo and the Kardashians bringing back curvaceous, curves are also popular in the financial business. People often talk about the “shape of the yield curve” because it shows interest rate expectations and can provide information about market expectations. It also is a good economic predictor. A “steep yield curve”, where longer term bond yields are higher than shorter, is a very powerful indicator of a strong economy. A “flat yield curve” is a very good indicator of approaching recession.

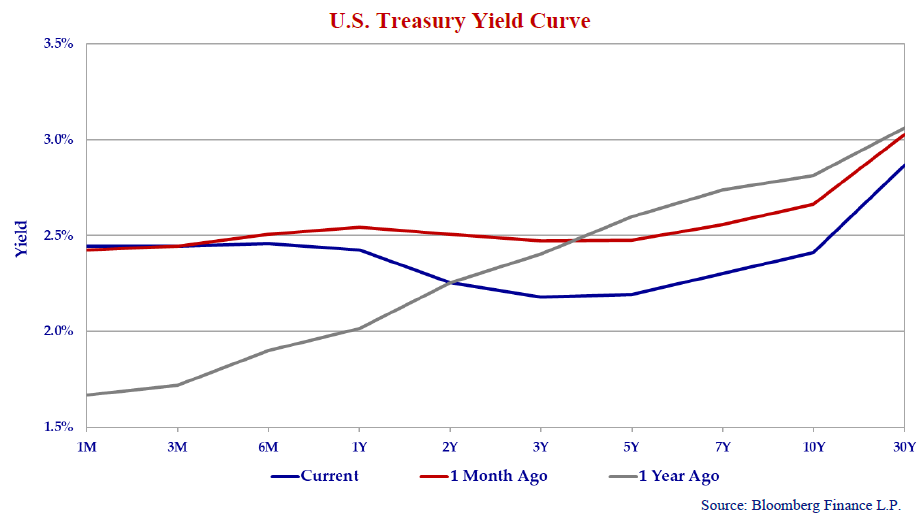

The graph below shows the U.S. Treasury yield curve today (blue line) versus a month ago (red line) and a year ago (grey line). Very short-term bond yields less than 3 years have risen as the Fed raised administered rates. For example, the 1-year T-Note has risen from 2.0% to 2.5% and the 2-year T-Note from 2.3% to 2.4% in the past year.

Longer term bond yields have fallen during the same period as fears over the economy rose and the prospect grew that the Fed could pause its “normalization”. The 5-year T-Note yield has fallen 0.3%, from 2.6% to 2.3%. The 10-year yield has declined 0.2%, from 2.8% to 2.6%. The 30-year has dropped only 0.1%, from 3.06% to 2.96%. This is important for us.

Market Curve Balls

What truly interests us is the “shape” of the yield curve. As we’ve said, economists and financial strategists put considerable emphasis in their work on what message the yield curve is sending. The short end of the U.S. T-Bond curve has “flattened”, but note that the very longer-term bonds have dropped less in yield than shorter term bonds. Not so long ago, those worried about the economy were petrified that a “flattening” yield curve was presaging a coming recession. Some of this worry was self-interested market strategists begging for the Fed to stop its “normalization” of interest rates. As we’ve told you many times, lower rates are always more popular than higher rates and the financial lobby for lower rates is vociferous.

Now we are witnessing a “steepening” of the yield curve at the long end, as can be seen on the chart. A year ago, the 30-year T-Bond yield of 3.06% was 0.26% higher than the 10-year yield of 2.8%. The current 30-year yield of 2.96% is 0.36% higher than the 10-year yield of 2.6%. The extra 0.1% between the 10-year and 30-year yields means that the yield curve has “steepened 10bps” in bond market parlance. It’s not much but the yield premium that investors are now demanding to hold longer term bonds is growing.

You are probably saying “So What!”. Well, a steepening yield curve is one of the most potent indicators of a stronger economy. This makes sense. A steepening yield curve suggests that investors are worried about a strengthening economy with higher inflation and bond yields. They prefer to avoid the capital losses on existing bonds from rising yields, staying shorter term and benefitting from reinvesting at higher yields as interest rates rise.

Vacant Inflation Expectations

To us, it makes sense the longer end of the yield curve now has a higher yield premium when fiscal policy is the reckless “borrow now and pay later” philosophy of the Trump administration. It also makes sense when the Fed is looking at ways to permit and even encourage higher inflation, especially with Trump nominating “Loyal” Fed governors like Moore. We expect the steepness of the curve to increase, as it becomes clear that the Fed has vacated its inflation control policies in favour of doing whatever is popular with the markets and politicians.

Without a recession, we don’t think the Fed will be lowering rates any time soon. Now that it has completely buckled to Trump’s pressure, we doubt the Fed will have the courage to raise rates for some time, if at all. The long end of the bond market might do the Fed’s work. If the economy continues on its merry way with rising wages, costs and inflation with the Fed “standing pat”, we think the long end of the T-Bond curve will snap upwards. A yield of 4% on the 30-year T-Bond would still only offer a 2% premium on the Fed’s 2% target. If inflation rises and the Fed allows it to be “above trend” for a protracted period, we think investors will be demanding a much higher inflation risk premium.

Middle Crass??

What about Canada? Our politics are messy and Canadian economic data is weak. Canadian interest rates are still low, but this does not eliminate the possibility of further Bank of Canada hikes. Politicians are elected to crassly spend money so Canada is embracing fiscal stimulation as well. The election year and crisis plagued Liberals are doing their part on the fiscal stimulation front with their recent “Middle Class” budget. Even if the Conservatives get into power, we expect they will emulate the U.S. Republican tax cuts so we don’t expect any budgetary discipline in Canada any time soon. If and when the Fed is finally forced to raise rates, we think it likely that the Bank of Canada would have to grudgingly follow suit to defend the currency.

The Normal Rules Do Not Apply (Until They Do)

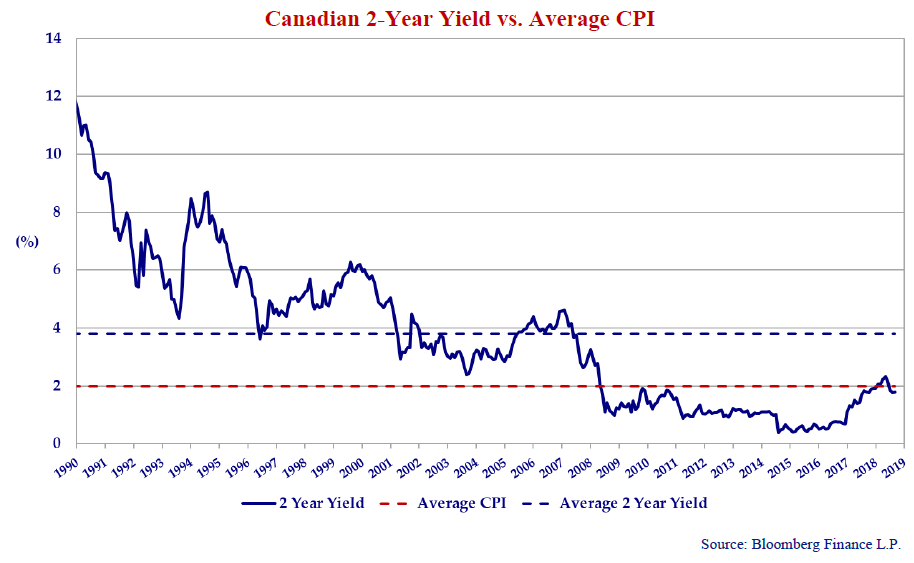

At Canso, we’ve written at length about the likelihood of interest rates normalizing after a period of exceptional and prolonged Central Bank actions. These actions created massive and lingering impacts on the financial markets including exceptionally low interest rates. The graph below shows the 2-year Canada bond yield (blue solid line) since 1990 when the Bank of Canada started its “inflation targeting” regime to keep inflation between 1% to 3%. It shows the Bank has hit its target since the average inflation (red dashed line) over the period has been close to 2%. The average 2-year bond yield for the period (blue dashed line) has been close to 4%.

The New Abnormal

The graph above highlights Canso’s view of “normal” interest rates. No matter how you cut it, “normal” over financial history is inflation plus a real rate of around 2%. This provides a positive return to savers after inflation. The Canadian CPI for February was 1.5% year-over-year, with the core rate (ex food and energy) at 1.8%. We’ll do the math for you again. That would indicate 3.5% for Canadian short-term interest rates (= 2.0% + 1.5%). If Canadian inflation is destined to decline to 1%, then history suggests short term rates in Canada at 3% (=1% + 2%). Let’s say that things are “really different this time” and the historical 2% real rate drops to 1% and inflation to 1%. That would suggest 2% short term interest rates in Canada (= 1% + 1%). The current 2-year Canada yield is even lower than this at 1.6%, having fallen in the past year from 1.8%. After the 1.5% inflation, the saver is getting a 0.1% “real return” (= 1.6% yield – 1.5% CPI). That’s before tax, which is levied against the nominal return. Is there any surprise that people are falling all over themselves to “get a higher yield”?

So why do people think interest rates are high? Well, like President Trump wanting the zero interest rates that Obama had, rates have been so low for so long that people find it hard to conceive of anything different. As the chart above shows, the 2-year Canada bond hit its low of 0.47% in February 2016. The current 1.6% now seems “high” but it is still much, much lower than the 3% range before the Credit Crisis and Great Recession.

“I See Nothing, I Know Nothing”

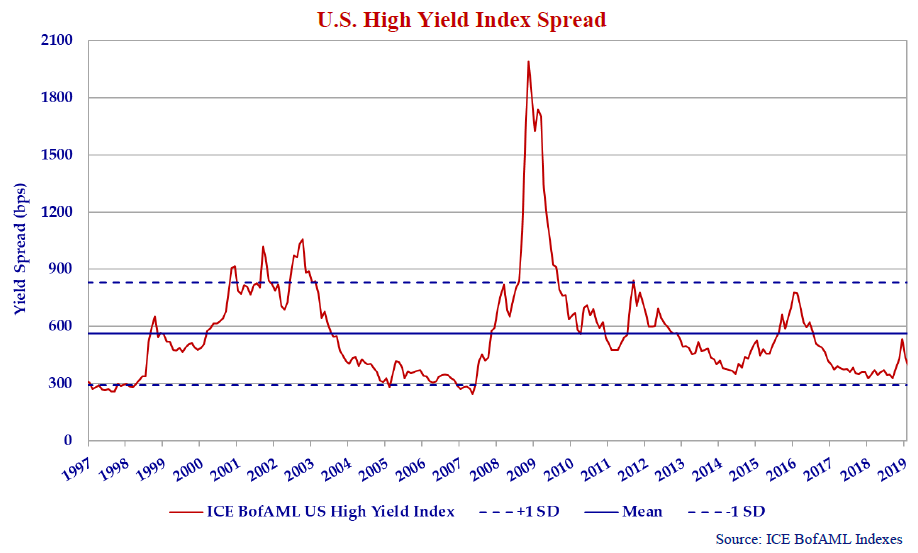

We always caution that investors should be “compensated for risk assumed” and we see risk in the non-investment grade markets. If a calamity is in the making, the U.S. high yield market seems blissfully unaware. In the words of the incomparable Sergeant Schultz of Hogan’s Heroes fame, “I see nothing, I know nothing”. The graph below shows that high yield spreads widened in Q4 2018 only to rebound 170bps tighter this year.

This compression in spreads may be tighter in part to a reduction in the size of the high yield market. Over the last 2 ½ years, the par value of the high yield market has fallen by $165 billion. The leveraged loan market, long a source of underpriced risk and uninformed investor optimism, is now the same size as the high yield bond market at $1.2 trillion.

Canso invests in leveraged loans but we are not fans at present, excepting a few special situations. We have a long list of grievances with the Leveraged Loan Market, which include:

- Issuance is driven by passive ETFs and structured vehicles like CLOs who don’t care what they are buying and don’t understand the risks inherent in the loans they are acquiring;

- Erosion of covenant protections. JP Morgan reports that Covenant Lite with few investor protections comprises 87% of new issue volume versus 6.5% in 2009;

- Likelihood that recovery rates will be substantially lower than in previous downturns;

- Tight pricing driven by indiscriminate buying could easily reverse if fund flows turn negative;

- Liquidity mismatch between funds offering investors 2 day liquidity for loans that can take up to several weeks or months to settle;

- Rapid growth of the loan market from half the size of the high yield bond market a few years ago to the same size as the high yield market; and

- The Agent or underwriting banks are no longer holding significant pieces of loans so they are less incentivized to push for either tighter covenants or better pricing.

We do not believe lenders are compensated for the risks they are being asked to take in the leveraged loan market. Retail investors are being sold a good and persuasive story: “floating rate assets with no interest rate risk , senior security and 5 – 6% yields”. It sounds terrific, manna from investment heaven, but like most investment stories, it is too good to be true. The last several years have been a great time to be a borrower, leveraged loan portfolio manager and underwriter. It is definitely not a great time to be an investor. We think the bubble in the leveraged loan market above will burst and investors will pay the price. There will be only sellers with few buyers so prices will plummet. We are gearing up our leveraged loan analysis in anticipation of the inevitable market disruption and liquidation, which will bring great values to those willing to step in.

The Reality of Falling Prices

We have been writing our newsletters for the past 22 years and have seen many different markets along the way. Our comments on the Levered Bank Loan market tell you that we are seeing speculation growing in the financial markets and worry about it. President Trump wants to get reelected and is encouraging the markets to go higher and discouraging the Fed from tightening monetary policy and raising rates. His efforts might not end well for the markets.

We close our thoughts with some very prescient comments from Galbraith’s “The Great Crash, 1929” with our emphasis:

“As already so often emphasized, the collapse in the stock market in the autumn of 1929 was implicit in the speculation that went before. The only question concerning that speculation was how long it would last. Sometime sooner or later, confidence in the short-run reality of increasing common stock values would weaken. When this happened, some people would sell, and thus destroy the reality of increasing values. Holding for an increase would now become meaningless; the new reality would be falling prices. There would be a rush, pell-mell, to unload. This was the way past speculative orgies had ended. It was the way the end came in 1929. It is the way speculation will occur in the future.”

The current edition of the book was published in 2009, 80 years after the Great Crash of 1929. The foreword to the book was written by Galbraith’s son, James, a noted economist himself. The younger Galbraith opined on the similarities between the stock market crash of 1929 and the Credit Crisis of 2008: “The main relevance of The Great Crash, 1929 to the Great Crisis of 2008 is surely here. In both cases, the government knew what it should do. Both times it declined to do it…”

Jerome Powell and his Federal Reserve colleagues are smart people and know what they should be doing but they are declining to do it. Their current problem is that they want to be popular with other people, especially President Trump. They certainly do not want to be blamed for the next recession so they are currently twisting themselves into economic pretzels to create excuses to keep interest rates low.

Financial Danger is Growing

The danger in the financial markets is growing. We have told you for years that when capital is too cheap, people waste it.

We have been witnessing increased speculation for some time. Markets fall but then soar on central bank “rescues”. Levered Bank Loans, ETFs and Pot Stocks are showing signs of an approaching speculative blow off. Canadian residential real estate is straining under the pressure of higher rates and tighter mortgage credit. Bitcoin and other crypto-currencies have already bitten the proverbial dust.

Will things get worse? It is hard to call market tops but we think that capital is plentiful and too easily available so this means trouble ahead. People are chasing investments with large risks and low potential returns without really understanding what they are getting themselves into.

Our job, as we have constructed it, is to assume only risks that we understand and risks that we are properly compensated for. It sounds easy, but it is not easy in practice. Cheap things are unpopular and popular things are expensive. Going against the grain is a necessary, but very unpopular behaviour.

We are still finding some unwanted and unloved securities to buy, but for the most part we are finding better value in higher quality securities.