Before beginning to read this edition of the Canso Market Observer, we feel that it contains disturbing and financially graphic content that might upset you. Therefore, for the first time, we request that you read the warning below:

REALITY WARNING AND READER CONSENT:

We hereby warn you that this edition of the Canso Market Observer should make you very uncomfortable about the current state of the financial markets.

If you continue to read this newsletter you give your implicit consent to allow us to properly inform you of the reality of what is going on in the capital markets.

You also agree that you understand this is not the popular financial media that provides cheerleading and support to whatever is going up in price and our content might shock you.

Exquisitely Stupid

Now that you have been forewarned of our reckless search for reality in things financial, we will continue with our theme of a turning point for yields in the bond market, where things have gone from the ridiculous to the sublime. Current events are so exquisitely stupid on the monetary policy front, that we have a hard time believing our own eyes and ears.

The Not Normal “Normal”

President Trump’s public behaviour features name calling worthy of a primary schoolyard, but it is now so normalized that we take it in stride. Things are not that different in the financial markets. What investors now consider “normal” in the financial markets is exceptional and not reasonable by any economic or financial standard. Like our increasing resistance to Trump’s insults, we are now so desensitized to “zero interest rates”, “quantitative easing” and “huge government deficits” that this seems to be the way things should be.

We are not “normal” at Canso in our belief that interest rates are in the middle of a long bottoming trend in the developed world. Bond yields are fluctuating up and down, but the general trend is flat to increasing.

Bonds Yield to Trump

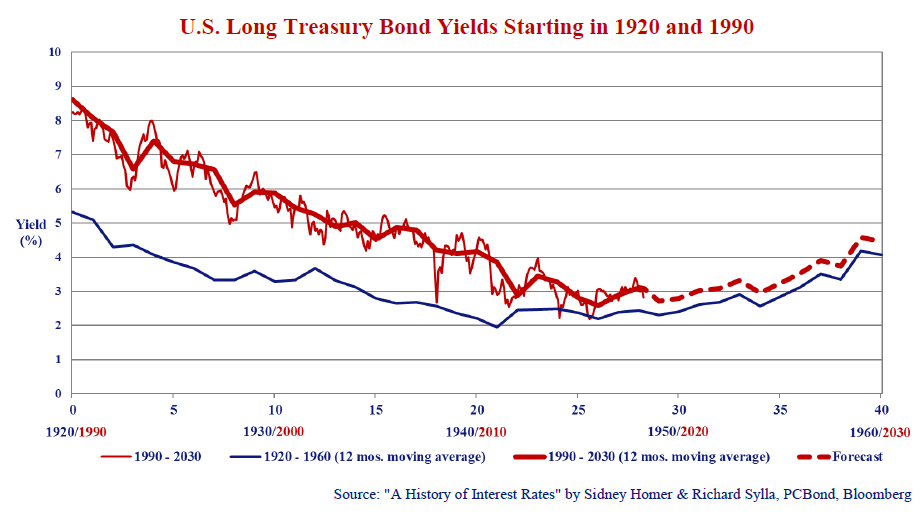

Bond yields have actually declined year-to-date as the Fed unilaterally surrendered its campaign to “normalize” interest rates to a triumphant President Trump. Since you are habituated to extraordinarily low interest rates and find it near impossible to consider that they could rise, we once again update the graph below comparing the long-term U.S. Treasury Bond yields from 1920 to 1960, to those starting 1990.

The thin red line is the current long-term T-Bond yield that, at 2.9% on April 9th, has indeed declined since the recent peak of 3.4% in October 2018. Like Pavlov’s dogs, you have been “conditioned” to low interest rates so you will probably be quite surprised that this is well above the recent low of 2.2% on July 1st, 2016. We believe this might be the low for this interest rate cycle and for many years to come. You can see this from the gentle increase in the thicker red line, the moving average of the long-term T-Bond yield. This bottomed in the summer of 2016 and has been moving up for the last 3 years.

Our loyal readers have seen this chart many times before, but we will briefly explain it for new readers. It compares the trend in the long-term T-Bond yield from 1920 to 1960, shown by the blue line, to the current experience beginning 1990, shown by the red lines. The x-axis is the years since the start of the periods, i.e. 20 is 2010 for the red line (=1990+20) and 1940 for the blue line (=1920+20).

We believe the chart demonstrates the long-term trend for interest rates, with significant historical parallels. Simply put, the stock market and economic boom of the 1920s was followed by the stock crash and Depression of the 1930s. The current experience of stock market boom of the 1990s and economic and financial bust of the 2000s seems to be following this pattern. We plan to do a longer Canso Position Report on this graph so we’ll leave a more fulsome explanation until then.

Generationally Changed

We are now seeing the signs of a necessary “generational change” in the underlying philosophy and construct of fiscal, monetary and central bank policies that are the preconditions for higher yields and inflation. Our view that interest rates and inflation might increase is not popular, but we often go against the grain of financial market consensus.

Taxis Driving Consensus

In 2010, coming out of the Credit Crisis and Great Recession, the financial market consensus was worried about the loose monetary policy of that time, fearing it would result in runaway inflation. As we related at that time this consensus was very strong and existed outside the financial class. Our friends, assorted relatives, and even taxi drivers were convinced by the financial media that higher inflation was imminent. We did not agree. As we said in these very pages in our April 2010 Market Observer:

“The existing consensus has been very solidly behind rising interest rates and inflation, given the very loose monetary and fiscal policy in response to the global credit crisis of 2008… we believe the consensus had inflation rising well in advance of the actual danger… we think interest rates should stay low given the reduction in leverage in the financial system and the negative fiscal situation at all levels of government. Inflation will likely continue to surprise on the downside.”

Canso Market Observer, April 2010.

Unrepentantly Contrary

It was not popular to predict in 2010 that inflation and interest rates would fall. Such is the life of a contrarian investor and we are once again unrepentant contrarians. The 2019 financial market consensus now believes that inflation will never return and yields will be forever low. We vehemently disagree. The risk is growing that inflation and bond yields will be much higher than the consensus understands and is prepared for. This is what creates “market shocks”.

The economy and financial markets are in much better shape than in 2010, but monetary policy and fiscal policy are arguably much looser. So why were people worried about higher inflation and yields when things were weak in 2010, but have no concern now when things are much stronger? It has to do with the very human psychological trait of “Recency Bias”. The ultra low interest rates since 2011 have ingrained a new reality into the brains of investors. Where 4% T-Bills were “normal” before the Credit Crisis and Great Recession, the current 2.5% seems excessively high to Joe Q. Public, financial market “experts” and especially President Trump.

Blame the Chaperone

We have explained in past Market Observers that tightening monetary policy is never popular. Former Fed Chair, William McChesney, said that the Fed was “the chaperone who has ordered the punch bowl removed just when the party was really warming up”. Our concern over the past few years is that the Fed, like any human bureaucracy, would not want to be “blamed” for spoiling the financial market party and would bend to political pressure. And pressure there now certainly is, as President Trump has taken his criticism of the Fed to a new and very disturbing level.

Presidential Harassment

Trump, who calls the investigations into his administration unfair “Presidential Harassment”, pays it forward by calling Fed Chair Powell “loco” and “crazy” for seeming to “like raising interest rates”. We’ve told you before that Trump’s verbal and Twitter attacks have been very effective and cowed any Republican resistance to his massive changes to their formerly conservative economic agenda. It is not happenstance that Powell and his Fed colleagues unexpectedly halted interest rate increases in December, just after they came under an unrelenting Trump insult assault. They also announced no further increases in 2019 after their recent meeting which sent the stock market soaring.

Our assessment of President Trump’s economic and monetary policy agenda is simple. As we said in our recent Corporate Bond Newsletter, he wants the stock market to go up and thinks that Obama “got zero interest rates” and he should too. The higher the stock market and the lower the interest rates, the better for the President.

Not Firing and Furious

Trump’s problem is that even though he has broken the considerable tradition of not criticizing the Fed, he understands that he can’t just fire Fed Chair Powell. Trump has been successful in scaring Powell and the rest of the Fed Board with his insult campaign into halting their “normalization” of interest rates, but Trump is frustrated that he just can’t tell the Fed what to do. As the Wall Street Journal reported, Trump understands he is “stuck” with Powell:

“The president blasted the Fed and Chairman Jerome Powell at three meetings in the past week alone… Mr. Trump recalled a recent phone conversation he had with Mr. Powell, this person said. “I guess I’m stuck with you,” the president recalled telling Mr. Powell… This person described Mr. Trump’s drumbeat of unprompted and critical Fed commentary as the latest point on a recurring list, or “greatest hits,” that Mr. Trump likes to raise.” Trump to Fed Chairman Powell: ‘I Guess I’m Stuck with You’, Wall Street Journal by Nick Timiraos and Alex Leary , April 2, 2019.

A Nobel in Trumponomics

Frustrated with the Fed, Trump has now decided to establish a more “loyal” Federal Reserve Board. Trump’s proposed appointment of Steven Moore to the Fed Board is a stark reminder of what Trump wants. Apart from the fact that Moore is an unabashed and unquestionably loyal Trump supporter, Moore has already said he believes that interest rates should immediately be dropped and that the Fed has grievously erred in hiking interest rates as much as they did:

“Moore, a former CNN analyst and Trump campaign adviser, told the Times on Tuesday that he was “really angry” about the Fed’s “inexplicable” decision to raise interest rates in December. “I was furious — and Trump was furious, too,” Moore said.” CNN Business, March 27th.

Moore, a “conservative” economist with the right-wing Heritage Foundation, used to believe that ultra-loose monetary policy would result in hyperinflation, at least under the Obama Administration. When the economy was very weak and below capacity in the aftermath of the Credit Crisis and Great Recession, Moore was on record as being solidly against the Fed’s loosening of monetary policy to stimulate the economy. Something obviously changed for him after he served as economic advisor to Trump’s 2016 election campaign. Moore is now a big believer in lower interest rates and economic stimulation, even though the economy is clearly much stronger than during the Great Recession. It could be partly hero worship, as he is on record as saying that President Trump should get the Nobel Prize in economics.

Raising Cain

Not content with nominating Moore to the Fed Board, Trump recently has announced his intended nomination of Herman Cain. Cain was a 2012 Republican Presidential primary contestant who lost to Mitt Romney. Cain is not an economist, but has actually served on regional Federal Reserve Bank boards and has a very strong business background so he is not a terrible choice. Cain is a member of the right-wing Tea Party faction of the Republican Party that obviously attracted the President’s notice. Nominating two conservative Trump backers to the Fed is an obvious sign of Trump’s displeasure with current Fed policy.

Rocketing Into Trumponomics Heaven

If there was any doubt about what Trump actually wants from the Fed, on this past Friday night after the market closed, he very elegantly summarized it. As Bloomberg News reported “President Donald Trump called on the Federal Reserveto open the monetary floodgates to turn the world’s largest economy into a Rocket Ship”

. Yes, you are reading this correctly. This is not journalistic excess or “fake news”. His exact words were:

“I personally think the Fed should drop rates. I think they really slowed us down. There’s no inflation. I would say in terms of quantitative tightening, it should actually now be quantitative easing,” he told reporters as he departed the White House on Friday. “You would see a Rocket Ship…” Trump Urges Fed to Open Up Monetary Floodgates to Juice Economy, Bloomberg News, by Margaret Talev, Craig Torres and Liz McCormick, April 5, 2019.

Despite market fears, if we are looking at employment a weak economy the U.S. is not. The Bloomberg News report went on to say that Trump’s “request for Fed assistance” came on the heels of a very good jobs report that showed unemployment at a 49 year low. Trump’s calls to, as Bloomberg put it, “open the monetary floodgates to turn the world’s largest economy into a Rocket Ship” go against the financial prudency that Republicans have been promoting for many years.

Tea Partying On

Like Moore, the previously financially prudish Republicans were dead set against the loosening of monetary policy by the Bernanke Fed during the Credit Crisis, fearing hyperinflation that actually never occurred. The Republican controlled Congress also severely limited the Obama Administration’s fiscal policy response to stem the Great Recession. The conservative “Tea Party” faction of the Republican Party, which includes Herman Cain, was founded in 2009 as a right wing political response to the Credit Crisis and government intervention. The Tea Party’s agenda of small government and balancing the federal budget is a long way from the Trump administration’s massive spending, deficits and Trump’s calls for a monetary policy launch pad for his economic “Rocket Ship”.

Kudos to Kudlow!

We think it apt that Larry Kudlow quit his market cheerleading job with CNBC to be President Trump’s chief economic cheerleader as Chair of the National Economic Council. It is also ironic that Kudlow was a member of the anarchist and socialist “Students for a Democratic Society” during his college days. He now literally works for “The Man” instead of “sticking it” to him. Kudlow must ruefully appreciate Trump’s verbal bomb throwing and the anarchy it’s creating at the Federal Reserve.

Kudlow certainly is earning his pay. This past Sunday, he made the rounds of the Sunday morning political TV shows, saying with a straight face that Trump is not trying to interfere with the Fed’s independence, which is obvious to anyone who has listened to Trump. Kudlow said on CNN’s State of the Union that Trump “has every right to put people on the Federal Reserve Board with a different point of view”. That seems to us to be the understatement of the year, if not the century. Kudos to Kudlow! A basic propaganda principle is if you’re going to tell a lie, make it a whopper and people will believe it!

Spaced Out Response

You might wonder about the financial market reaction to Trump’s unprecedented demands for opening the monetary floodgates. Complacency abounds and concern is sadly lacking in the financial markets. They want to rally and keep the party going. The bond market in particular seems to want yields to fall, no matter what. Pardon our pun but this seems more than a little “spaced out” to us. Good news of economic strength, let alone Trump’s economic “Rocket Ship”, is usually met with inflation fears and rising bond yields. The opposite actually happened after the good employment report on April 5th when yields fell just after the jobs report. Yields didn’t even rise later in the day after Trump’s rocketing rhetoric. Bond managers want lower rates and it seems they are sure they will get them:

“(Bloomberg) — The bond market remains confident after the latest U.S. jobs data that the Federal Reserve’s next move will likely be to lower rates. But traders are scratching their heads when it comes to President Donald Trump’s suggestion that policy makers should restore quantitative easing… Traders see about a 70 percent chance of a quarter-point Fed cut in 2019, even as a report Friday showed U.S. hiring in March rebounded more than analysts expected. But that doesn’t mean the market views the economy as weak enough to justify Trump’s call less than two hours later for the Fed to open the monetary floodgates.” Bond Traders Betting on Rate Cut Scratch Heads on Trump QE View, Bloomberg, April 5th, 2019.

Moore-d in Weimar

The Fed is not alone in yielding to political pressures. The European Central Bank has just responded to fears of weakening European economies and impending Brexit economic damage if and when “perfidious Albion”, as Britain used to be called, finally quits the European Union. The ECB has reinstituted the very quantitative easing policies that Trump so desperately wants back. We think it quite ironic that the ECB itself was founded on the “tight money” principles of the German Bundesbank. The Germans had experienced the hyperinflation of the 1920s Weimar Republic, the extraordinary inflation that Steven Moore used to fear. They had to be assured that the ECB wouldn’t fall pressure to political pressures on monetary policy with similar disastrous results before going off their beloved Deutschemark and adopting the Euro. The Germans particularly objected to the “monetization of government debt” where the central bank bought bonds. That whole concept seems a tad quaint now that the ECB has bought enough bonds to force yields negative.

ZIRPing and NIRPing to New Highs

As we often tell you, more money is always more popular than less money among financial apparatchiks. Like President Trump, bank economists, investment strategists and a very pliant financial press are breathless in their enthusiasm for more money and cheering markets upwards. This currently takes the acronymical form of “Zero Interest Rates Policy” (ZIRP) and “Negative Interest Rates Policy” (NIRP). The enthusiasm among market mavens for more money stems from its propensity to juice the stock and credit markets to new highs. It is no coincidence that the stock market has soared since the Fed ran up its flag of surrender to Trump’s insult broadsides.

The Mammoth Need For Yield

One of the tried and true Canso maxims is that if you make capital too cheap, people will waste it on speculative investments. This time is no different we thought as we recently read some “credit research” from the European Credit Research analysts at Bank of America Merrill Lynch. We were reminded of a Wall Street Journal article published in January 2007 called “Investors Riding the ‘Cash’ Rapids”. The theme of the article was basically that there was so much cash around, that everything would keep on going up in value and it was difficult to see what could stop this. We commented at the time that we had no difficulty at all in seeing what would bring things crashing down, suggesting sub-prime mortgages and securitized products. Unfortunately, the Credit Crisis proved us right.

The 2019 BAML analysts came to very similar conclusions as the 2007 WSJ writers:

“It’s hard to escape the obvious, that once again there is a mammoth need for yield across the bond market, as central banks paint themselves into a dovish corner… Turbo-charging the bid for Euro credit is the surge in negative yielding assets… The negative yield phenomenon is also starting to take over corporate bond markets… All this, in due course, points to the return of beta-compression, supporting the performance of sub banks, hybrids and quality single-Bs. Conversely, watch for the risk that companies issue negative debt to please shareholders: those that missed the window to lever-up during the QE years now get a second chance.”

Translated into plain speak, they are really excited that the ECB is buying up bonds and once again driving yields negative. They are especially excited that investors are also rushing to buy everything, especially the corporate bonds that pay the commissions that their bonuses depend on. Even better, forget telling people to not buy utter crap, “beta compression” (risky assets have beta) suggests buying absolute crap, which probably pays higher commission anyways. The only risk that they can see is that companies have a second chance to issue lots of “negative debt”.

Ugh!! NEGATIVE DEBT!!!

We commented on the first cut at European QE and negative interest rates that this was just stupid. Let’s see, people will pay you to issue debt. I wonder, should I buy a house, not pay rent and have a bank pay me interest on the mortgage I take out?? Yuppers, there will be a shortage of people willing to be paid an income to go into debt.

What is really happening here, is that current bank regulation says that banks must hold very high quality and liquid assets that they could sell very quickly in a financial crisis. Since the ECB is buying all the government and corporate bonds it can find, the banks have to pay such high prices that the yield to maturity is negative (i.e. the bank has to pay $101 for a bond that matures at $100 in a year, losing 1% of their money).

The Canso Mansion

Yes, investment strategists and other assorted economic wonks are all over this cool and groovy new financial fad of “negative yields” for the second time. We predict unfortunately that, like any other fad: Tickle Me Elmo, Tamagotchi and Pokémon Go, the enthusiasm will soon die. If we are wrong, you will find us at the Canso Mansion on our private Caribbean island. We will have stuffed an issue of $1 Trillion Euros at -2% into the hands of willing buyers and will be living it up on our handsome $200 Million Euro income stream. Why manage money and get criticized for not buying negative yielding bonds when we could issue them and live a life of luxury? Unfortunately, we suspect that the odds are more on the side of us continuing to manage money.

Repetitive Pausing

We were more than a little impressed that when we Googled “Wall Street Journal” and “Cash Rapids”, we were directed to our very own January 2007 Market Observer. Given to liking our own prose, we gently caressed the text with our eyes and were quite startled to read:

“Federal Reserve Chair Ben Bernanke declared a ceasefire on increases in the Fed Rate in June and waited for the U.S. economy to slow. The financial markets took this as the all clear signal for this monetary cycle and began to anticipate a drop in interest rates. This caused the previously faltering stock and bond markets to rally strongly in the final 6 months of 2006.” Canso Market Observer, January 2007.

Who says history doesn’t repeat itself? Let’s see, a new Fed Chair “pausing” interest rate increases and sending the stock market and bond markets soaring? Sound more than a tad familiar? The first quarter of 2019 saw stocks go way up and credit spreads tighten on the back of the new Fed Chair’s “pausing” of interest rates increases.

Trump Has Got It Right

At Canso, we think Trump has got it right. He should probably get a Nobel for market psychology since he understands that opening “the monetary floodgates to turn the world’s largest economy into a Rocket Ship” will get the markets excited. Investors aren’t worried about the strength of the economy or the eventual direction of interest rates. They are increasingly most worried about missing the rally than anything else. As the Wall Street Journal described:

“Investors are putting more money into U.S. stocks as 2019’s rebound continues, a shift that some analysts expect to drive markets higher despite the recent rally in government bonds and an expected slowdown in economic growth… the Federal Reserve’s signaled halt to interest-rate increases propelled the S&P 500 to its best quarter since September 2009… investors say they are increasingly wary of missing out on further gains…“People are trying to get really aggressive now,” said Benjamin Lau, chief investment officer of Apriem Advisors. “Clients do not want to miss out on the upswing in the market… The hard part is keeping their expectations in check.” ‘Fear of Missing Out’ Pushes Investors Toward Stocks, Wall Street Journal, March 31st, 2019.

In a Bad Relationship

The financial markets are locked into a bad relationship with their Bad Boy President. The market loves what Trump is doing, despite knowing down deep it will not end well. This is not even close to normal. The very idea of an “independent” central bank was to insulate it against self-interested politicians trying to use monetary policy for their political gain. Now, we have President Trump very obviously bullying and trying to stack the Fed with “loyalists”. You can’t blame him since it works for him, and he really doesn’t care what happens after he leaves office. Like any bad relationship, the excitement and sizzle will fade and the anger and disappointment will emerge. The bond market currently doesn’t care about future inflation but eventually it will be all that it cares about.

The Parallel Inflation Universe

Is there inflation? That would seem germane to any discussion of monetary policy, since keeping inflation under control is a major objective. We just read from Bloomberg that President Trump told the White House journalists that “There’s no inflation” in his diatribe in favour of quantitative easing to power his economic “Rocket Ship”. We listened to a recent CNN interview with Steven Moore who also categorically said: “There is no inflation”. The truth, which is scarce in Washington these days, is that the latest Consumer Price Index for March was up 0.4% for the month and up 1.9% year-over-year.

So why do Trump and Moore insist there is no inflation in their parallel inflation universe? Having actual inflation is a bit of an “inconvenient truth” to those who want lower interest rates. Why not be more than a little selective in your numbers or even use “alternative facts”, as the White House has called them. It seems that Trump and Moore have invented their own inflation theories and have landed on a very narrow definition of commodity prices for their outlandish statements of “no inflation”. Catherine Rampell of the Washington Post looked at Moore’s inflation claims and wrote an opinion piece that ex-plained how Moore was nominated for the Fed:

“President Trump reportedly chose Stephen Moore for one of the vacancies at the Federal Reserve Board after reading a Wall Street Journal op-ed Moore wrote attacking the Fed. The piece, co-authored with Louis Woodhill, made two central claims: (1) we’re experiencing deflation, and (2) the way to address it is to follow a rule adopted by Paul Volcker in the 1980s. Slight problem though: Both of those claims are flat-out false. There is no deflation, and Volcker never created the imaginary “rule” Moore is now attributing to him. I know, because I asked Volcker — as Moore once suggested I do.”

Where’s The Beef??

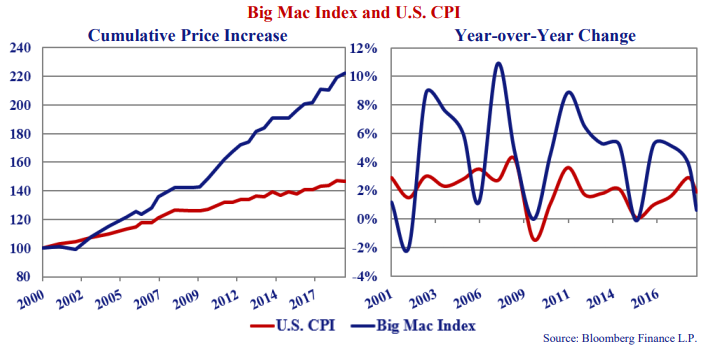

“Making up Sh#@” seems to be the way things are now done in the Trump Administration, so Moore is both ideologically and behaviourally correct for his new boss and role. We prefer to deal in “Actual Facts” although our fellow bond portfolio managers seem to prefer the alternative facts inflation reality. We turn to the real world to confirm whether the average U.S. consumer is seeing inflation or not. The Economist publishes its Big Mac Inflation Index that records the prices of Big Macs at McDonalds around the world. As the old lady in the Wendy’s commercial used to say: “Where’s the Beef”!! We show the cumulative graphs of the U.S. CPI Index and the U.S. Big Mac Index as well as the year-over-year changes since 2000.

We’ll leave it to you to decide whether there’s inflation. Starting at a base of 100 in the year 2000, the CPI has increased to the present 147, a compound growth rate of 2.1%. The Big Mac Index that started at 100 in 2000 is now 222, a growth rate of 4.4% over the same period. The year-over-year numbers are also interesting. You will see that the CPI has moved up and down but seldom stayed negative for long. The Big Mac Index tended to follow the YOY movements of the CPI but at higher levels.

Bracing Orthodoxy

Economic orthodoxy has changed over the years. The great advantage of age is greater experience and hopefully, wisdom. Turning points are very hard to predict and most often not even noticed until well after they have occurred, so we are not even going to try. We will therefore relate to you what we have seen over the last 40 years of monetary and fiscal policy, with some pointed commentary along the way and hope to provide you with some insight that is sorely lacking among economists at present.

The Classical Period

Before the stock market crash of 1929 and the Great Depression, the economic orthodoxy was “Classical” and the role of Central Banks was to provide liquidity in financial crisis to the commercial banks. Everyone believed governments should run balanced budgets and only provide essential services. Governments were financed by sales taxes, property taxes and duties. Income taxes were a temporary measure used to finance wars.

Keying on Keynes

After the severe Great Depression with huge social costs and over 30% unemployment, the judgement was that Classical economic theory made things worse. That gave rise to the economic theories of John Maynard Keynes, who argued governments could step in with deficit spending when the private sector could not.

Postwar governments and central banks embraced these “Keynesian” policies. Anyone sitting in an Economics 101 class would hear how central banks could stabilize the economy by lowering interest rates to encourage borrowing and spending. Governments would do their part by spending on public works projects and running deficits in recessions that they financed with debt and paid with taxes.

The problem was that politicians always liked to spend. They conveniently forgot that Keynes recommended running deficits in recessions but raising taxes and running surpluses in stronger economies to slow things down. They ended up with deficits all the time and central banks provided easy money even to strong economies.

Volcker’s Rule

The result was the runaway inflation of the 1970s that people at the time believed would last forever. Fed Chair, Paul Volcker, then raised interest rates above 20% and crushed inflation. The economic orthodoxy became “Monetarism” which held that altering money supply could not really change the economy and the only job of a central bank was to keep a steady growth of money supply, no matter what the economy was doing. Things would “self-regulate” and smooth out the “policy errors” that caused booms and busts. Central banks adopted “inflation targeting” which made 1-3% inflation their goal.

The Maestro of Bubbles

Then came Alan Greenspan, The Maestro, who made his role that of the financial market saviour. He famously said he couldn’t prevent bubbles, only clean up after them. His bubbles became bigger and bigger as the markets caught on until the bust of the Credit Crisis which resulted in the Great Recession. We were then back to the Keynesian pump priming and running government deficits that we have had since 2008.

The School of Rock ‘n It Economics

What of Trump’s “Rocket Ship” monetary policy prescription for stock market and economic success? Well, we don’t know of any economic school of thought that suggests using loose monetary policy to power an already strong economy into orbit. All we can say is the writing is on the wall for independent and prudent monetary policy in the U.S..

No Inflation Worries Mate

What will happen to inflation and bond yields? It is clear that the very loose monetary policy and monetization of government debt did not result in high levels of inflation after the Credit Crisis and got us out of the Great Recession. Like Steven Moore, nobody worries about inflation anymore.

51 Million Reasons to Worry

We worry, as it is also clear from history that unbridled monetary expansion results in hyperinflation. We sent our clients an actual One Trillion Zimbabwe Dollar note not so long ago, which was not enough to buy a loaf of bread before the Mugabe regime suspended printing money. What happens when politicians take over monetary policy? The current situation in Venezuela with an ineffective and corrupt socialist government ruining their economy comes to mind. In Venezuela’s case, inflation just reached 51 million percent, rendering the currency worthless.

Bullies Spiking the Punch Bowl

We worry that nobody but us seems worried about the change to politically determined monetary policy, but then again, that seems to be our lot in life.

As we’ve said many times, we tend to worry about things that most people take for granted. The political pressure on the U.S. Federal Reserve is probably the highest in its history. After Trump’s latest antics to get the Fed to do his economic bidding, we give you an update of the “Punch Bowl” Fed analogy:

“The current Fed is like the chaperone trying to remove the punch bowl as the party goes out of control into a drunken mob. A yelling screaming and name-calling group of bullies surround the chaperone. She freezes in terror as the bullies prevent her from getting to the punch, then demand she add even more alcohol to their brew. The party ends up out of control as the drunken guests smash the furniture and steal whatever they can.”

What’s Ahead For Markets?

What’s ahead for markets? We don’t expect imminent hyperinflation or even very high inflation in the U.S.. The problem is, with yields currently so low, even 3-4% inflation would shock the markets. We don’t expect monetary policy in the U.S. will be tightened any time soon, because of Mr. Trump’s “interventions”. We expect bonds to start recognizing the potential for future higher inflation, and this would be reflected in a steepening yield curve as investors demand extra yield for longer bonds to make up for their increased inflation risk. As we said in our recent Corporate Bond Newsletter, a steep yield curve is a very potent indicator of economic strength ahead.

The stock market will probably continue upward with its higher octane monetary fuel provided by the Trump compliant Fed. Credit spreads should narrow as well as investor enthusiasm grows.

We will once again leave the party early as it goes out of control, and head back home to higher quality. Lower quality securities have too much risk for our liking and too little upside for us at present.