The global financial markets fell back into a familiar despondency in the second quarter of 2012. The smoldering Euro zone crisis flared up again in May into full crisis mode, stoking fears of another financial meltdown. Euro hysteria combined with slower U.S. economic data to create a very negative sentiment among investors. This was a sharp reversal from the optimism at the end of the first quarter, when a powerful rally surprised investors to the upside.

Roman Bonds Burning

The media was once again filled with dire predictions. The European “financial firewall” was deemed insufficient. Politicians were fiddling while Rome’s bonds were burning. Frustrated Greeks were voting in another election. The Euro bloc was crumbling and common currency disintegration looked likely. German Chancellor Angela Merkel and her cabal of Northern European obstinacy stood in the way of any practical solution. The layabout citizens of the troubled periphery of Europe loudly and violently protested.

The play by play of the Euro crisis dominated the media and news cycle. Europe was predicted to have its own “Lehman Moment”. The European banking system would seize up and spread financial contagion globally comparable to that after the default of Lehman in 2008. How could anyone accept investment risk with such obvious calamity coming?

Covered Backsides

Retail and professional investors alike demanded lower risk from their portfolios. Risk departments abandoned their quantitative models that had served them so badly. Risk managers demanded their trading desks “reduce risk” which meant holding very lean inventories of corporate securities. If your models don’t protect you, the obvious solution is to sell anything risky. They were going to cover their backsides no matter what.

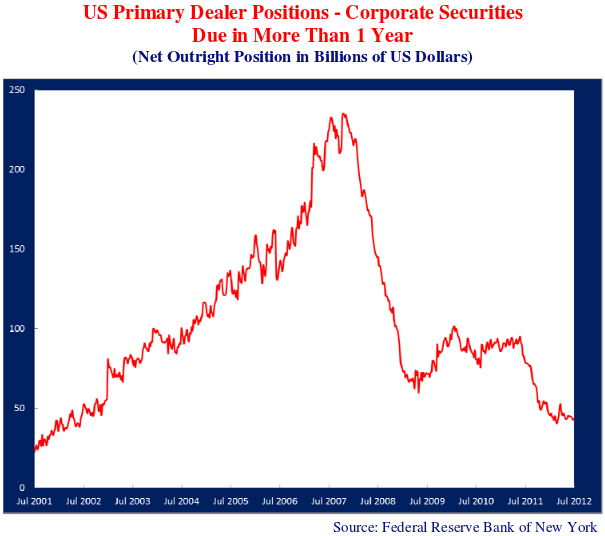

As we have previously pointed out, the result of all this backside covering is that investment dealers pared back corporate bond inventories as their risk appetites dropped. We have updated our graphs of the corporate bond holdings of major U.S. money centre banks. The following chart shows from the peak of almost $240 billion in 2008 just before the credit crisis and $120 billion after the 2010 rally, current inventories have fallen to less than $43 billion. This is lower than the $50 billion during the credit crisis in early 2009. Clearly, risk is not popular with banking bureaucrats.

The preoccupation with impending financial doom meant “risk assets” like corporate bonds were shed in favour of safer choices. Government bonds, except those of the peripheral Euro zone countries, were again a place of refuge. Stocks and corporate bonds were shunned. Market emotion swung between “risk on” and greed to “risk off” and fear on almost a daily basis.

Harpooned by the London Whale

The willingness of bank CEOs to accept risk was also dented considerably by the object and abject lesson of JP Morgan and the “London Whale”. JP Morgan, under its Wall Street celebrity CEO Jamie Dimon, had done very well during the credit crisis. It bought distressed Bear Stearns and bankrupt Washington Mutual with the Washington financial establishment cheering it along. Dimon used his reputation for financial prescience as a soapbox to lecture politicians and regulators on the wrongheadedness of their attempts to reregulate the banking industry. A well-managed and glorious bank such as JP Morgan should not have to submit to having its will restrained by mere bureaucratic mortals. As we have frequently said, Mr. Dimon should have read Greek tragedy, where hubris (self-pride) inevitably leads to disaster.

Unfortunately it turned out in April that the self-appointed Emperor of the U.S. banking system was not wearing clothes. Despite Dimon’s excellent reputation as a risk manager, reports emerged that the JP Morgan Office of the CIO was acting very much like a hedge fund. Usually a bank treasury operation invests surplus funds in government bonds and uses derivatives to hedge the risks in a bank portfolio. Bloomberg News reported that a trader, Bruno Iksil, out of the CIO trading operation in London had amassed a huge position in credit default swaps on credit indices. The size of the huge positions he was taking caused Iksil to be called the “London Whale” by traders at other institutions. Press reports suggested that these be ts risked large losses. This sparked an immediate rebuttal from Dimon that, “It’s a complete tempest in a teapot.”

“I Didn’t Have a Clue”

Unfortunately for JP Morgan’s sterling reputation and Mr. Dimon’s credibility, it turned out that neither JP Morgan risk managers nor senior management had any idea about the outsized be ts being taken by their traders. When it became apparent that large losses, estimated between $2 billion and $9 billion, would have to be taken on these trades, Mr. Dimon changed his tune. In quite a mea culpa he stated: “In hindsight, the new strategy was flawed, complex, poorly reviewed, poorly executed and poorly monitored. The portfolio has proven to be riskier, more volatile and less effective an economic hedge than we thought.” Loosely translated, “I didn’t have a clue!” or perhaps more appropriately “We didn’t know what we didn’t know.”

Moody and Blue

Our belief has been for some time that markets have impounded the depressed mood of the investment and finance professionals. From the repeal of Glass Steagall in the late 1990s, the Idiot Savants of quantitative finance and basically anyone who looks good in a suit could earn huge amounts of money in the financial markets for doing very little that was constructive for the real economy. Increasingly, with voters understanding how much the financial class has been paid for causing such economic damage, even the politicians are being forced to accept that the financial system is broken.

The realization that the era of “financial innovation” is coming to a close, and with it the rapacious fees taken from the unsuspecting, has cast a pall on those charged with building enthusiasm for investment. A talk to a retail financial advisor gives a picture of very many dissatisfied clients and much aversion to investment risk. Simply put, their clients have seen their investments languish for many years and are getting tired of high risk and low returns.

Bankers and the Neuroscience of Greed

The lay investor can be surprised by such swings in mood, but as we have said for many years, markets incorporate human emotion and behaviours. They are not the clinical and efficient allocators of capital chronicled in economic textbooks. They are prone to human foibles. In an article in the Guardian, Bankers and the neuroscience of greed, Ian Robertson discusses the recent LIBOR scandal where Barclays admitted its traders manipulated the LIBOR interest rate setting for their own gain. This is not much of a shock to those who have dealt with bonus crazed traders but it seems to have shocked politicians, the regulators and even senior bankers. Bob Diamond, the Barclays CEO who was forced to resign over the scandal, recently recounted to a British parliamentary committee that he was “physically ill” when he learned of the emails between traders bragging about fixing th e rate used by lenders worldwide.

Diamond wouldn’t have been sickened by the greed of his traders if he had followed the advances of neuroscience. In his excellent article, Robertson discusses the neuroscience of power and how it changes the brain. It really does seem that “power goes to the head.” It also seems the saying “absolute power corrupts absolutely” in politics, applies to the financial realm as well. We made this point several editions ago and Robertson confirms the science behind the intoxication of power:

“The ‘masters of the universe’ who have arisen out of a deregulated world financial system were given unprecedented power that inevitably must have caused major changes to their brains. While power in moderate doses can make people smarter, more strategic in their thinking, bolder and less depressed, in too-large doses it can make them egocentric and un-empathic, greedy for rewards – financial, sexual, interpersonal, material – likely to treat others as objects, and with a dulled perception of risk…

This power-primed boldness and forward-looking focus on rewards arises from a neural “approach mode” that biases attention, memory, action and emotions towards thoughts and feelings linked to success and conquest.” The Guardian, July 2, 2012, Bankers and the neuroscience of greed, by Ian Robertson July 2012

Our clients and readers can be excused for worrying that we are about to launch off into another “Bankers Behaving Badly” installment of the Canso Market Observer. Fear not. We will spare you the gory details of Jamie Dimon’s trading disaster or Bob Diamond’s LIBOR problems. We expect such behaviour and firmly believe that the financial markets employ a large variety of very smart people with the express goal of removing fools from their money.

Oh How the Financial Mighty Are Falling!

What struck us is the equal and opposite reaction in a neurological sense. We have been saying for some ti me that the sentiment among investment and banking professionals is at an all-time low, both individually and in aggregate. As we’ve said in our recent newsletters, when you’re worried about your employment prospects and personal financial situation, it is hard to stick your neck out and go against the consensus.

So now we have a whole market full of investors who have profited immensely from financial deregulation and have enjoyed power and prestige that flowed from it. With the “Greenspan Put” they saw more and more money created that they easily carved chunks out of. They were stupefied by the credit crunch as their cozy quantitative construct collapsed about them. They were temporarily emboldened by the run up in the markets in 2009 after the Fed threw everything but the kitchen sink into rescuing them.

Oh How the Financial Mighty Have Fallen!

Now, with banking scandal upon scandal laying bare the naked self-interest of the financial class, it is increasingly clear that the jig is up. This means a lot less money and a lot less employment in “financial innovation”. A Bloomberg News article, Investment Bankers Face Termination as Europe Fees Fall, reports that Richard Bove, a bank analyst at Rochdale Securities, expects up to 100,000 job losses in European banks in the next 18 months.

“Bankers are really gloomy and a lot of people are worried about their jobs,” said Edward Cumming-Bruce, a partner at London-based advisory firm Gleacher Shacklock LLP who has more than 20 years’ experience. “Banks are under remorseless pressure to cut cost s and balance sheets as we witness a significant change in the way the financial industry works.” Investment Bankers Face Termination as Europe Fees Fall, bloomberg.com, July 10, 2012

We believe that this pressure on incomes and employment in financial institutions will continue to grow. Activist investor Nelson Peltz and his hedge fund Trian Capital has assembled a 5. 1% position in NYSE listed investment bank Lazard whose stock has languished for some time. The hedge fund is taking the position that perhaps the large percentage of revenues paid in compensation to Lazard employees would be better passed along to its shareholders. The PowerPoint presentation to the Lazard management on controlling compensation reportedly cast a chill on the bankers watching. Oh How the Financial Mighty Have Fallen!

Worried About Threats and an Uncontrollable Future?

So what does the removal of their power do to these formerly very powerful people? Mr. Robertson reported what neurologists had to say on the subject:

“Low power, on the other hand, tends to trigger a neural “avoidance mode”, where mood is low and anxiety high because of worries about threats and future uncontrollable events.”

Let’s see, a bunch of investors threatened by an uncertain future. Sound familiar? The current Euro hysteria would seem to be a classic case of avoidance mode with anxiety high and mood low. Even the “risk on” and “risk off” trading pattern can be explained by these mood swings.

“The wild oscillations of financial markets are partly the result of traders’brains lurching between these two modes: it is a characteristic of being in one mode that it is hard to think in terms of the other – a bit like finding it hard to imagine a sunny day in the middle of a bleak, dark winter day, or vice versa.”

Remember the Goldman market strategist’s mea culpa for missing the powerful rally of the first quarter: “How could anyone have been bullish in December?”

“It is a feature of these mental modes that even remembering events or facts which run counter to the prevailing mood is hard – hence depressed, anxious people find it difficult to remember good things that have happened to them, making it even harder to escape the depression.”

Discounting a Pretty Negative Future

As we have said in previous news letters, we do not claim to have the macro answers on whether Europe will disintegrate and whether the financial world will be torn asunder. All we know is that corporate bonds are cheap. Many European financial bond issues are trading at huge discounts to their value if the financial system doesn’t implode.

We might not explain things as scientifically as the neuroscientists but we think that investors are discounting a pretty negative future. Thankfully our craft is to buy cheap things and leave the macro puzzles for much smarter people.

It’s the Yields Stupid!

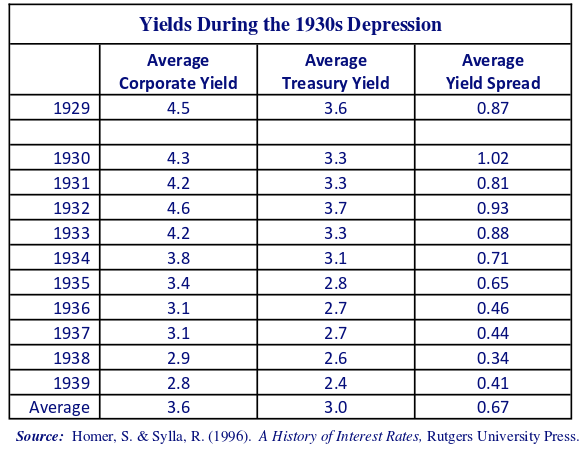

This is a good time to be looking for cheap investments and a time to beware of government bonds which, as a refuge for the terrified, are looking very expensive. Since even we wonder at times how far we are sticking our necks out, we have once again consulted Sidney Homer’s “A History of Interest Rates” to give us comfort against the consensus view. We show the average yield on long term U.S. Treasury Bonds and Corporate Bonds during the 1930s Depression decade in the table below:

The long U.S. Treasury Bond averaged 3.0% during the decade from 1929 to 1939 in the depths of the Great Depression. How does this compare to our current situation? Unemployment ran above 25%, there was no social safety net, bank failures led to the banking holiday of 1933 and the implementation of deposit insurance. Inflation turned very negative to outright nominal deflation.

The long U.S. Treasury is currently at 2.6%. This is lower than the darkest days of the bank run of 1933 and not too much higher than the 2.4% recorded in 1939 after 10 years of economic and financial calamity. We would respectfully submit that no matter how dire the current situation, it is still better than what our grandparents experienced in the “Dirty Thirties”. Yes, it could get worse but we would hazard a guess that the Treasury bond market is pricing in a pretty dire outcome.

Aha, you say. Why do you think corporate bonds are cheap when Treasuries are pricing something very, very bad? Well, turning once again to the facts, corporate bonds started the Depression decade at 4.5% and averaged 3.6% through this period. This give s an average corporate yield spread (Corporate-Treasury Bond Yields) of 0.67% for the decade. Corporate bond yield spreads actually fell during the Depression years of the 1930s, meaning their risk premium decreased. We are very happily buying long corporate bonds at yield spreads of nearly 2% above government bonds which we think is very cheap.

Close your newspaper, power off your iPad, turn off the TV news and relax. A lot of bad things are priced into the financial markets. Will bad things happen? Who knows?

All we can say is that we are being paid to wait!