A meek professor becomes an omnipotent superhero, harnessing the power of unlimited money creation to save his nation from a dire economic fate.

With a stroke of his computer keyboard, Ben “Buzz Lightyear” Bernanke creates money which courses at the speed of light into the world financial system. A villain to his arch conservative foes, who wish economic suffering on the poor and oppressed, Ben /Buzz is a beacon of hope to the unemployed and Democratic election hopefuls. Reporters asking about the strength of his new power were met with his battle cry:

“TO INFINITY AND BEYOND!”

Since the United States dollar remains the global reserve currency, the latest heroic efforts of Federal Reserve Chair Ben Bernanke matter globally. Truth is often stranger than fiction and the storyboard above is close to the present reality in the United States monetary system. Hoping to not fall into the trap of tightening monetary policy too soon, as his monetary forebears did in the Gr eat Depression, Mr. Bernanke sprang into action with a long anticipated third round of quantitative easing (QE3).

QE Infinity

After the hotly debated QE1 and QE2 left room for interpretation, Mr. Bernanke left no doubt about his intentions for QE3. His latest monetary easing boiled down to an open ended bond buying program that would only cease after the recovery was well underway. To further make its intent obvious, the Fed is going to buy enough mortgage backed securities to effectively finance much of the issuance of U.S. residential mortgage debt. This unprecedented open ended and creative use of monetary policy gave rise to the new moniker “QE Infinity” among market wags.

For a Few Dollars More

If Mr. Bernanke’s heroic defence of the world financial system was not enough, gunslinger Mario Draghi of the European Central Bank joined the battle against financial evil doers. In a plot line straight out of a Spaghetti Western movie, quick gun Draghi stood at high noon on the dusty main street of Euro Dodgy City. He challenged any speculator foolish enough to take a run at weakened Euro sovereign bonds to consider the unlimited monetary firepower of his central bank. It worked: “Our decisions as regards Outright Monetary Transactions have helped to alleviate (financial market) tensions over the past few weeks, thereby reducing concerns about the materialisation of destructive scenarios,” he said.” The Telegraph; ECB Bond-Buying Bazooka is ‘Ready’.

For those not familiar with the Spaghetti Western genre (Wikipedia—Spaghetti Western), this was a spate of Cowboy/Western movies produced and directed by Italians in Europe in the 1960s. Very appropriately to Mr. Draghi’s efforts, two of the best were called “A Fistful of Dollars” and “For a Few Dollars More” which featured the then unknown Clint Eastwood.

Buzz Lightyear and Spaghetti Westerns you are thinking? What gives at Canso?? Well, we think we deserve a little slack. We last left you, our intrepid readers, in our July 2012 edition at the point where the market consensus despaired th at anything could go right in the global economy and financial markets. The rally of the first quarter 2012 seemed a distant memory. Investors had been knocked down to the mat repeatedly by the Euro debt crisis and then suffered the ignominy of being kicked when they were down. They were definitely not optimistic and verged on the morose, if not fatalistic.

Rallies Don’t Make Sense

Then the equity and credit markets s hocked investors in third quarter of 2012 with a powerful rally. Investors influenced by the negative financial media watched stupefied from the sidelines. “This cannot happen” they cried. “What about the riots in Greece and the political discord in Europe and the U.S.?”

Of course this rally did not make sense. They never do. Conventional wisdom is usually negative and the pundits explain them well after the fact. Our closing advice to you in our last newsletter was:

“Close your newspaper, power off your iPad, turn off the TV news and relax. A lot of bad things are priced into the financial markets. Will bad things happen? Who knows?

All we can say is that we are being paid to wait!”

Where did we get the confidence to stay invested when those around us were terrified? As we say to our young investment analysts, when you are immersed in data it is essential to take a longer term look at a company’s business and financial statements. This advice applies to the macroeconomic realm as well. It helps to get some altitude above a current crisis and look at a longer swath of economic history.

Experts Fighting and Fleeing

Our economic view is very long term. You will note that part of our rationale to stay invested in corporate bonds versus overvalued government bonds was a look at where U.S. Treasury Bond and Corporate Bond yields were in the Great Depression of the 1930s. (“It’s the Yields Stupid”: July 2012 Market Observer) You can complain about the current state of the developed economies but our opinion is that things were worse for our grandparents than it is in our current version of deflation. In any event, those dependent on financial income need yield and during the Great Depression credit yield spreads narrowed for high quality corporate bonds. We believed that corporate bonds were cheap no matter what the economic and political outcome.

We have also believed for some time that the financial chattering class, the well coifed talking heads of the business news, is shaken to their self-interested souls. Their well-paid sinecures are increasingly exposed to “revaluation risk” as the huge leverage that translated into profits and their huge bonuses are wrung out of the financial system by regulation. This personal financial danger has put these experts in a “fight or flee” mindset that intensely colours their professional opinions.

To us, this meant the drum beat of doom over the European financial crisis was not something to be relied upon in forming an objective investment opinion. As we said in our January 2012 edition “Europe has survived many centuries despite war, famine, pestilence and financial crisis”. Our sangfroid approach to Euro financial calamity was recently confirmed by a good friend of Canso, the inestimable Tom Fernandez of Bank of America Merrill Lynch. Tom just returned from a vacation in Italy where he struck up a conversation on the crisis with a local. This Italian explained succinctly to Tom that Italy “had been through worse” over the centuries and would survive the current crisis.

This mental schism between the terrified denizens of financial world and the real world is getting wider. The financial world is seeing, and will see for some time to come, a depression in its prospects and employment. The hyper prosperity of the financial sector from the late 1990s to the credit crunch of 2008 was created by deregulation and the adoption of quantitative methods in financial regulation. These hugely increased both leverage and revenues. The current pressures on the financial sector are both self-imposed through increased risk aversion and demanded by regulators. The result is both decreasing leverage and an increasing unwillingness in bank management to undertake risky trading speculations.

Demented Program Trading

The “Flash Crash” and other trading accidents resulting from demented program trading are a case in point. How many of these stupidities do we have to have before financial regulators cotton on to the fact that these abominations do not make the allocation of capital more efficient? We find at Canso that we are “pennied up” by the “Algos” in trading the securities of small Canadian companies. This translates to a computer program (algorithim) putting in orders to top our bid (pennying up) because if we want it, the computer wants it. Most of the volume in global stock trading is now these silicon simpletons. It is for good reason that retail investors have fled the stock market. As opposed to the highly educated and accepting regulators, the great investment unwashed understands that it is being gamed.

Efficient Losses

The good news is that, despite regulators’ reticence to question the efficient markets bunkum that they learned in school, the basic human instinct of self-preservation is causing senior bank management to question their commitment to this type of speculative activity. Shareholders are not far behind as they watch their equity value being frittered away in trading losses.

Jerome Kerviel, a junior trader at Societe General was supposed to be arbitraging equity and equity derivatives when he lost almost $7 billion in 2008. He was convicted of forgery and unauthorized use of computers. His defence was that his superiors knew what he was doing and it was common practice at his bank. Things have not been much better after the credit crisis. Kewku Adoboli blew $2.3 billion for UBS in 2011 in supposedly safe “delta trading” that Kerviel was doing. In 2012, Bruno Iksil aka “The London Whale” is said to have lost at least a $7 billion in credit default swap trading. Clearly, the easy money in trading has been made. What bank management now wants to speculate in CDS mispricing and risk the opprobrium so well deserved by Mr. Dimon?

Full of BIS

A way to think about what happened is that banks used depositor monies and cheap money market financing to borrow short and invest in a wide variety of risky securities. They were empowered by the BIS (Bank of International Settlements) standards that let them buy unlimited amounts of “riskless” debt like AAA rated residential mortgage securities or “safe” Greek sovereign government bonds. Banks moved from 10 times assets to equity to over 30 times. Some covered bond banks approach ed 100 times leverage by focusing on sovereign issues.

The result of this amazing financial imprudence was vastly increased profit and revenue. From return on equity of 10%, the thoroughly modern universal banks claimed returns on equity of 20-30%. A good example of the increase in leverage can be seen in the trading assets of U.S. money centre banks. As we’ve showed you previously (July 2012 Market Observer) the inventories of corporate securities reported by these banks to the New York Fed grew from $25 billion in 2001 to $280 billion in 2007 before the credit crisis. They have now fallen to $46 billion as of the end of September 2012.

Back to Boring ROEs

In the boring old days, banks kept 10% of their assets in equity. On $100 of loans, they made a net interest margin of 2% or $2, the difference between the interest rate they collected on their loans and paid on their deposits. After operating expenses, this gave a net margin of 1% or a $1 profit on their $10 of equity capital creating a ROE (return on equity) of 10%.

The BIS standards unleashed a quantum leap of debt creation. They allowed banks to have their 10% equity on “risk adjusted assets”. Since “safe” AAA and sovereign governments were viewed by BIS as riskless, they virtually could buy unlimited amounts of these favoured assets. Banks also could hedge the credit risk of their portfolios by buying credit default swaps from AAA issuers like AIG and MBIA which allowed them to lay off the risk to these supposedly very high quality insurers.

The result of all this thoroughly modern “financial innovation” was a large increase in the balance sheets of banks. The new rules meant banks could have 30 times leverage or $300 in assets per $10 in equity. This gave them $6 in income at a 2% net interest margin or $3 net income after expenses. Making $3 in income on $10 in equity created the 30% ROE.

Pay Pain

Stodgy banks were forced to mimic the superstars as shareholders demanded higher returns. Merrill Lynch CEO Stan O’Neal and Citibank Vice-Chairman Robert Rubin exhorted their organizations to move up the ROE food chain and mimic trading banks like Goldman Sachs. Of course, when this all came a cropper, the leverage which juiced returns to the upside endangered the very existence of the banking system. A AA mortgage and sovereign bonds alike provided huge capital losses. The AAA credit reinsurers like AIG and MBIA went on life support and fell to junk status. Banks who thought they had insured the risk of dodgy assets were stuck with them.

The hyper profit illusion is not coming back. Banks around the world are now moving their ROE targets down to reflect the new reality of higher capital and lower leverage. This means back to banking basics which doesn’t leave much on the table for the banking bureaucrats, macro strategists, nonsensical traders and other financial buffoons to feast upon. Compensation is falling at banks which are busy revising their “compensation structures” as cost reduction becomes one of the few ways to grow earnings. The masters of the trading floor can’t migrate to another investment bank since all banks are under the same pressures.

Discredit Creation

Unfortunately the other side of the regulatory renewal is much less credit creation. It takes a lot more equity to create the same amount of lending. A stodgy old school bank only creates $10 of loans for each dollar of equity where the universal modern banks were creating $30. The shadow credit markets offered even more credit creation. Credit card securitization structures only had equity of 1% in the salad days of the credit boom. This meant only $1 of equity supported $100 of credit card balances of American consumers.

The newfound zeal of regulators to actually understand what is going on with the banks they regulate is a far cry from their “light touch” of the deregulatory era. Their stupefaction that they were used by bankers seems to have now shocked them into excessive action. In the United States, the massive Dodd Frank “Wall Street Reform and Consumer Protection Act” runs to hundreds of pages. If the regulators and politicians w ho removed Glass Steagall in the 1990s would just admit they made a mistake, we could go back to a simpler world. Glass Steagall separated investment and commercial banking in the 1930s as a response to the financial speculation that caused the Great Depression. As we predicted many years before the credit crisis, those (Alan Greenspan, Robert Rubin, Larry Summers, Tim Geithner) who thought that spread sheets made us smarter than our grandparents were sorely disabused of this notion.

An Acronymic Regulatory Orgy??

Not to be outdone by the Damned Yankees, international bank regulators are engaging in an orgy of acronymic and euphemistic activity. The BIS, whose risk adjusted capital standards caused the credit crisis, has sprung into action. The very new Financial Stability Board (FSB) has also joined the fray.

Universal banks might have been spared the heartbreak of divesting their investment banks but must now concern themselves with LCRs (Liquidity Coverage Ratios) and NSFRs (Net Stable Funding Ratios). A banking fate worse than death is to be declared a SIFI (Systemically Important Financial Institutions) with higher capital requirements based on large size. Regulators are demanding “living wills” (statutory wind up provisions) “ring fencing” (separating deposits from trading) and “bail in bonds” (senior creditors can be attributed losses).

The Point to Our Bank Bashing

You are now thinking that we are back to our bank bashing ways and you may be right. We do have a point, however. All these changes cause much higher levels of capital and liquid assets as well as a punitive approach to trading assets. Dodd Frank in the U.S. prohibits banks from taking proprietary trading positions which is one of the reasons that corporate securities inventories in the U.S. are currently so low.

The Vickers Commission on banking reform in the U.K. recommends “ring fencing” risky investment banking from deposit taking activities. Ed Miliband of the British Labour Party speaks for many when he says,

“The banks and the Government can change direction and say they are going to implement the spirit and principle of Vickers to the full. That means the hard ring-fence between retail and investment banking. We need real separation, real culture change. Or we will legislate.” The Telegraph; Ed Miliband to British banks: ‘Reform or We Will Legislate’.

With all the regulatory change, banks are under considerable capital pressure and have been reducing assets and building capital by retaining earnings and issuing shares. We think that banks are now hindering the normal transmission of monetary policy with their newly conservative credit ways. This could be an antidote to the extremely loose monetary policy which many fear will create an inflation problem.

Money, Debt and Spending

We’ve done some thinking about this linkage. We have said in previous newsletters that we believe that the massive monetary policy ease globally means there is a risk of higher inflation. On the other hand, we believe that much of the money created has gone into restoring the health of banks. A central bank crediting a billion dollars to its account with a commercial bank will only result in economic activity if the commercial bank lends it out.

So far, this does not seem to be happening. Not only are the banks not lending the money, it seems to have been invested in government bonds or deposited with the very central bank that created it in the first place. Much of the cash received from the Fed buying bonds in QE1, QE2 and now QE3 has been deposited back into reserves at the Fed and banks seek to meet liquidity requirements. Likewise, much of the LTRO (Long Term Refinancing Operation) of the European Central Bank was deposited with the ECB. While this money did not end up in loans, which would have been best for credit creation and the economy, it certainly provided cheap financing and stopped any fire sale of assets as banks sought to reduce their balance sheets under regulatory pressure.

But what if the economy recovers and the bankers regain their lending mojo? Won’t all this liquidity turn into credit and very high levels of inflation? Perhaps, but we’re not convinced that th is is imminent. Using simple mathematics and some simplifying assumptions we can get a picture of what’s going on.

Securitize It and They Will Borrow!

In the glory days of the credit boom, everything from residential mortgages to auto loans was “securitized”. Just $1 of bank capital could support $30 of financial assets, most of which were credit products that ultimately financed consumer spending. Now accounting and regulatory changes mean that $1 of bank capital finances $10 of financial assets. The only way to get to the same level of credit would be to expand th e money supply by at least 3 times. The finance and banking aficionados out there are probably questioning our simplifications. They remember that money lent becomes money that can be used to lend more, depending on reserve requirements. They also would suggest that since leverage levels of non-bank products were much higher and some consumer assets were rated AAA and required no capital, the actual level of money supply expansion required to stay even would be far higher.

It is enough that you understand what we’re talking about. It is going to take a lot of money to replace what has gone missing in credit creation. How much is anyone’s guess but it is probably much more than has currently been created by central banks. We know that the outstanding debt compared to Gross National Product expanded hugely with the “financial innovation” of the credit boom. The “debt multiplier” of the financial system is much lower now than it was. We also see that despite all the money creation, inflation has moved lower.

A recent Bloomberg News article highlighted the changing debt landscape as it chronicled that outstanding debt compared to GDP in the U.S. which has dropped to a 6 year low:

“Total indebtedness including that of federal and state governments and consumers has fallen to 3.29 times gross domestic product, the least since 2006, from a peak of 3.59 four years ago, according to data compiled by Bloomberg. Private-sector borrowing is down by $4 trillion to $40.2 trillion.” Bloomberg News; U.S. Downgrade Seen as Upgrade as US. Debt Dissolved; John Detrixhe, 8 Oct 2012

Bloomberg also pointed out that consumer debt declined to $11.4 trillion in June 2011 from the peak of $12.7 trillion at the end of 2008. Most interesting is Commercial Paper (CP) which dropped to $975 billion in July 2011 from a record $2.2 trillion in July 2007. The decline in bank inventories of corporate securities means that banks don’t need to finance in the CP market. Many of these corporate securities were securitizations which financed consumer product sales. Other non-bank CP issuers such as Asset Backed Commercial Paper trusts were also financing the spending of American consumers. The $1.2 trillion reduction in CP outstanding directly translates into less consumer spending.

Consumers around the globe were spending debt with abandon in the credit boom. It now takes a lot more money supply to create the same debt. Central banks worldwide have lowered interest rates to artificially low levels to allow this prodigious outstanding debt to be serviced. Without an offsetting gain in incomes it will be hard to increase debt in the new regulatory reality. This has created the slow growth and deleveraging economy that will persist for some time.

The Innate Human Capacity for Financial Self-Destruction

This does not mean that the innate human capacity for borrowing, spending and financial self-destruction will not eventually take hold. On the other hand, the behavior of both lenders and borrowers has probably been changed for a couple of generations to come by the searing experience of the credit crunch and subsequent recession.

We agree with the assorted gold bugs and fiat money crowd that ultimately unlimited money growth results in unlimited inflation. Zimbabwe recently proved this. It’s a question of degree. If the central bankers can turn off the monetary tap in time, we will avoid out of control inflation. This is a big “if”. Mr. Bernanke has made a point of saying that his QE Infinity will end “well after” the recovery is in place. He wants people to understand he will tolerate higher inflation to ensure the economic recovery is well entrenched. This makes many suspicious of how high a level of inflation he is willing to permit.

Back From the Monetary Brink

We turn to the comments of a couple of investment thinkers that we respect very much. The first is Paul Volcker, the Federal Reserve Chairman who conquered inflation in the early 1980s. Mr. Volcker recently commented that monetary policy in the U.S. was as easy as he has seen and the most recent QE3 was “the most extreme easing of monetary policy” that he knew of.He also commented that risk of inflation was not imminent, perhaps seeing, as we do, that it is going to take a lot of money to make up for the reduced leverage in the financial system:

“Mr Volcker stressed that although the risk of inflation was not imminent, central bankers had to be careful. “The risk is that central bankers are not able to tighten policy in time. Will they be able to pull back fast enough from loose monetary policy?” he said.” The Telegraph; QE3 will not fix America’s problems, warns Paul Volcker

Mr. Volcker’s second point on “pulling back” monetary policy is something we have been thinking about. Many th ink that this will be easier said than done. We turn to another sage thinker, none other than Canso’s own Bob Swan, fresh from rafting the Grand Canyon. Bob made a point recently at our investment meeting that perhaps withdrawing money from a bank using a computer keystroke is cleaner and more efficient than sopping up paper money in the old days. Will Ben Bernanke be ready to suck liquidity out of the system when it is necessary even if it is easy?

Tough Love from “Gentle Ben”?

We are not sure if Mr. Bernanke will be up for the application of this monetary “tough love” when it is needed. Alan Greenspan, Mr. Bernanke’s predecessor as Fed Chair, was good at fixing financial crises by applying large doses of money but he never seemed to have the courage to prick a bubble. He called this “asymmetric policy” and said it was impossible to see a bubble when you were in it. We think his reticence could very well have stemmed from his human desire to be popular and well liked .Mr. Bernanke’s commitment to not tighten policy until “well after” the economic recovery is underway is important to us. We think his tolerance for inflation might be well higher than 2%.

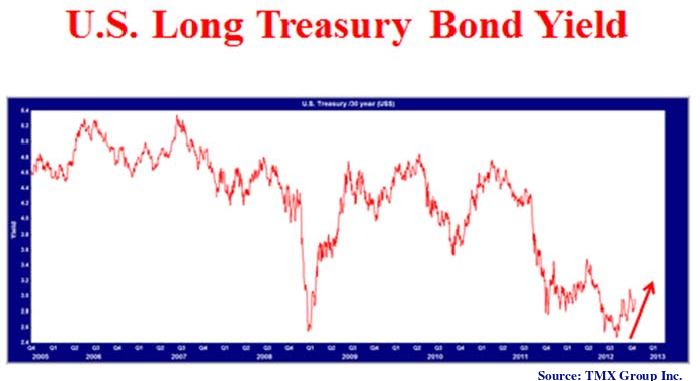

We think the longer end of the bond market will pick up on the improvement in the economy well before any tightening of monetary policy occurs. The current 2.9% yield of long Treasuries is very low from a historical viewpoint and reflects the bond buying of the quantitative easing programs. In normal circumstances, T-Bills are 2% over inflation (see Canso Px on interest rates) and longer term bonds should be at least another 1%. With the latest U. S. CPI at 1.7% that puts T-Bills at 3.7% and long Treasury yield at 4.7% in a normalized monetary policy and interest rate environment. That puts the long government bond yield up at least 2% from current levels. As the following chart shows, the long U.S. Treasury bond has already moved off its low yield and seems to be in a rising pattern.

As opposed to our view on corporate bonds in July, this means there is a lot of negativism built into the current ultra-low level of government bond yields. It’s a time for caution. You are not being paid to wait in government bonds with negative real yields. Not much has to go right economically or politically for the bond market to react. A 1% rise in long Treasury yields would result in a 14% capital loss. Moving up 2% to normalized levels would inflict a 25% capital loss, far from offset by the current meager 3% yield.

Retail and institutional investors alike have fled in to the perceived safety of bonds. They might rethink this strategy with rising yields.