Be Careful What You Wonder About

We were writing about the confused state of political and economic affairs in June and wondered, like the Marvin Gaye song title, “What’s Going On?”. We marvelled at how the financial markets were ignoring any bad news in their haste to move ever upwards in price. Our comment on U.S. politics said:

“The U.S. also seems to be melting down from the strains on the American judicial and political system from the Biden/Trump presidential rematch. With 4 months to go, we wonder how the situation could get worse after the recent Presidential Debate and the Supreme Court decision on presidential immunity, but it very much could.”

Despite our wonder at what else could go wrong, in the past quarter, things have gotten much worse, both in the U.S. and other parts of the world. Joe Biden dropped out of the U.S. Presidential election and Kamala Harris took his place as the Democratic Party’s nominee. Donald Trump survived an assassination attempt at one of his rallies and then the Secret Service prevented another one. Despite all this tumult, the U.S. Presidential election remains too close to call, with polls showing a statistical dead heat.

Internationally, Ukraine continues to fight the Russian invasion and regain its territory, but has itself invaded a part of Russia, the first time a foreign army has occupied Russian territory since WW2. Russia then updated its Nuclear Strategy to include the use of nuclear weapons in conventional wars and against non-nuclear enemies, a clear threat to Ukraine and its U.S. and NATO allies. Israel continues its Gaza battle against Hamas and has opened a new front in Lebanon with strikes on its senior Hezbollah leadership leading to a missile barrage against Israel by Iran. The world awaits Israel’s response to Iran’s attack.

Leaping Walls of Worry

Clearly, there’s a lot to worry about if you want to worry, but the “Risk Markets” continue to climb this veritable wall of worry as bull markets frequently do. On the other hand, this rally has been quite an abnormal bull market. After the pandemic stock boom, the market stepped back in 2022 with rising inflation and rising interest rates, but stock prices rose once again in 2023 and have continued to rise into 2024 thus far. We think this reflects the huge increase in money supply during the pandemic that is still being thrown at investment opportunities and reflects a fairly good U.S. economy. The enthusiasm behind AI is powering a mania in some equities but the bond market is in its own mania, drooling over Federal Reserve (Fed) rate cuts galore.

Dreams Dashed by Strong Job Market

The U.S. bond market reverts to its dream outcome of back to almost zero interest rates on any weak economic data. It quickly pencils in very immediate and large drops in the Fed Funds rate on any signs of weakness, but then again it has been doing this ever since the Fed tightened monetary policy in 2022. The bond market was encouraged that Powell, and his Federal Reserve colleagues defied expectations and made a jumbo 0.5% drop at the last Fed meeting in September. The fly in the bond market’s low rates soup is that things don’t seem all that terrible now.

As we were writing, the strength in the recent U.S. Employment Report caused an immediate correction as all the bond market hopes and economists’ professional worrying about the U.S. economy were once again dashed upon the rocks of fairly good economic news. As the New York Times put it:

“Fresh employment data for September showed that hiring picked up strongly, the unemployment rate dipped and wage growth came in strong — adding to a string of recent data pointing to economic resilience … And the incoming evidence points to a clear conclusion: The economy is robust … In fact, the report reinforced that by many measures, the job market is as healthy as it has ever been”. 1

U.S. bond yields shot up on this “bad” bond market but actually good economic news, undoing much of the optimism about the speed and size of further monetary policy easing.

Higher Lows

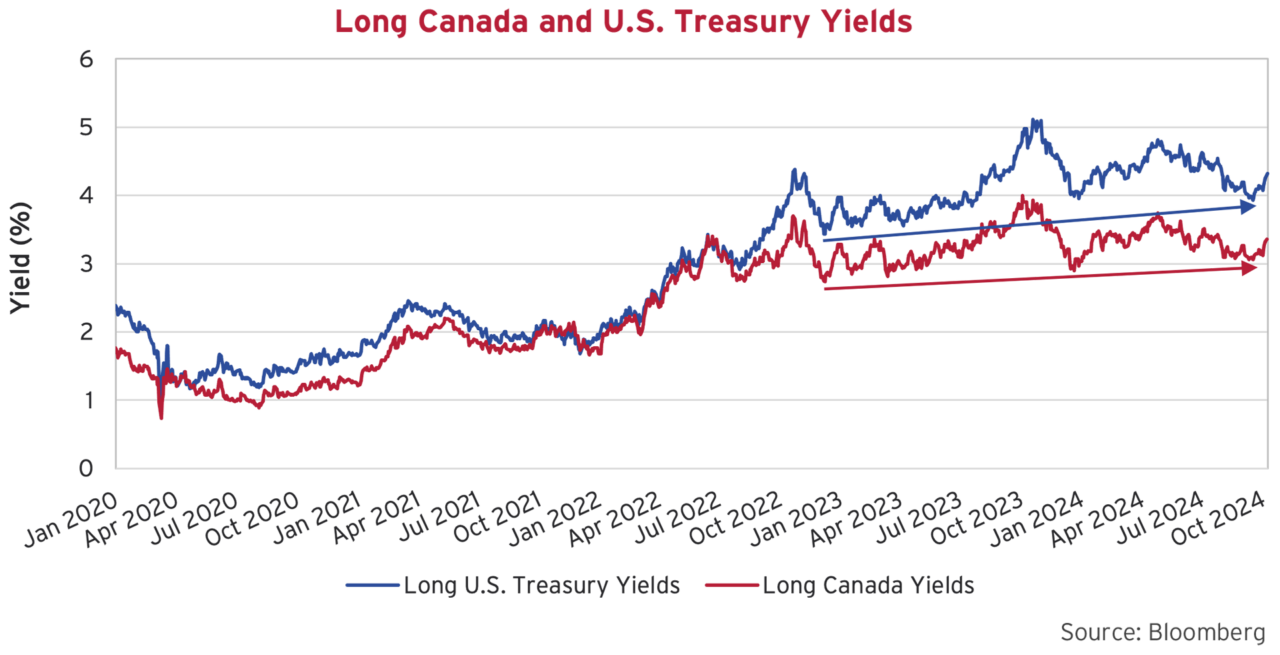

The bond market, powered by the investment strategist assertions that long bonds perform well after Fed easing, seems to have got well ahead in the rate drop game. After the Fed and Bank of Canada (BOC) began to grudgingly raise short-term rates in 2022, 30-year bond yields have soared and plunged, depending on the economic news. The chart below shows that long U.S. Treasury yields rose from 1.9% on December 31st, 2021, to 4.4% by October 24th, 2022, before plunging 1% to 3.4% by December 7th, 2022. Its yield then rose to 5.1% on October 19th, 2023, before again falling 1.2% to 3.9% by December 28th, 2023. This year things happened earlier, with yields peaking at 4.8% on April 25th, 2024, before falling 0.9% to 3.9% in September. The current yield rose to 4.3% after the strong employment report.

What interests us is the drift upwards in the low yield on the long U.S. Treasury. The 3.4% low of 2022 increased to the 3.9% low of 2023, the same as the recent 2024 low of 3.9%. The current yield of 4.3% is well above both of those. We have joined the lows in the 30-year Treasury (blue) and Canada (red). These show that the market is settling in at consistently higher yields over time.

Hubris and an Inflation Tragedy

The political and social angst over the recent high inflation meant that central bankers looked foolish and inept, a bad look that these financial bureaucrats are not used to. They are used to accolades, not criticism and ridicule. They did blow it in spectacular fashion. It took quite a while before they did what central bankers should do with inflation, tighten monetary policy. First, they assured us that “temporary supply chain disruptions” meant that inflation would not be a problem, and they could keep monetary policy loose after the pandemic. Their hubris was rewarded by inflation soaring to the highest levels in 40 years. Central banks then gapped short term rates higher to try to get inflation back under control. They have eventually succeeded, but at high cost to their professional reputations and well-tended public images. They’re the reason the most important issues for U.S. voters in the upcoming elections are inflation and the economy. Lots of money is always popular but when it leads to huge price increases to average people, the anger is palpable.

Canadian Housing Hopes Spring Eternal

The rise in mortgage rates has put quite a damper on the Canadian housing market and economy, compared to the U.S. In the United States, with 25-year term mortgages being the most common, the rise in mortgage rates has hurt new buyers, but many Americans refinanced their mortgages with no penalty at the very low rates of the pandemic and locked in for 25 years. Since mortgages can’t be ported to a new house, they lose their attractive mortgages if they sell their home, so many are staying put.

Canada, with its disproportionate reliance on the residential housing market and mortgages levered into short-term fixed rate and floating rate mortgages, is a different case. Rising mortgage rates have been difficult for many Canadian consumers. The weakness in the formerly frothy Canadian housing market has slowed the Canadian economy considerably, and strong population growth has created an oversupply of labour that has weakened employment.

Canadian housing market hope springs eternal and the fervent hope of Canadian real estate agents, homeowners and politicians is now that lower mortgage rates will reignite the bonfire of the pandemic residential housing prices. The Trudeau government’s recent loosening of mortgage tests, lengthening of amortization and increase in the maximum CMHC insurable house price is proof positive that politicians who wish to be re-elected recognize the political risk of a further housing market setback.

Getting Real on Canadian Mortgage Rates

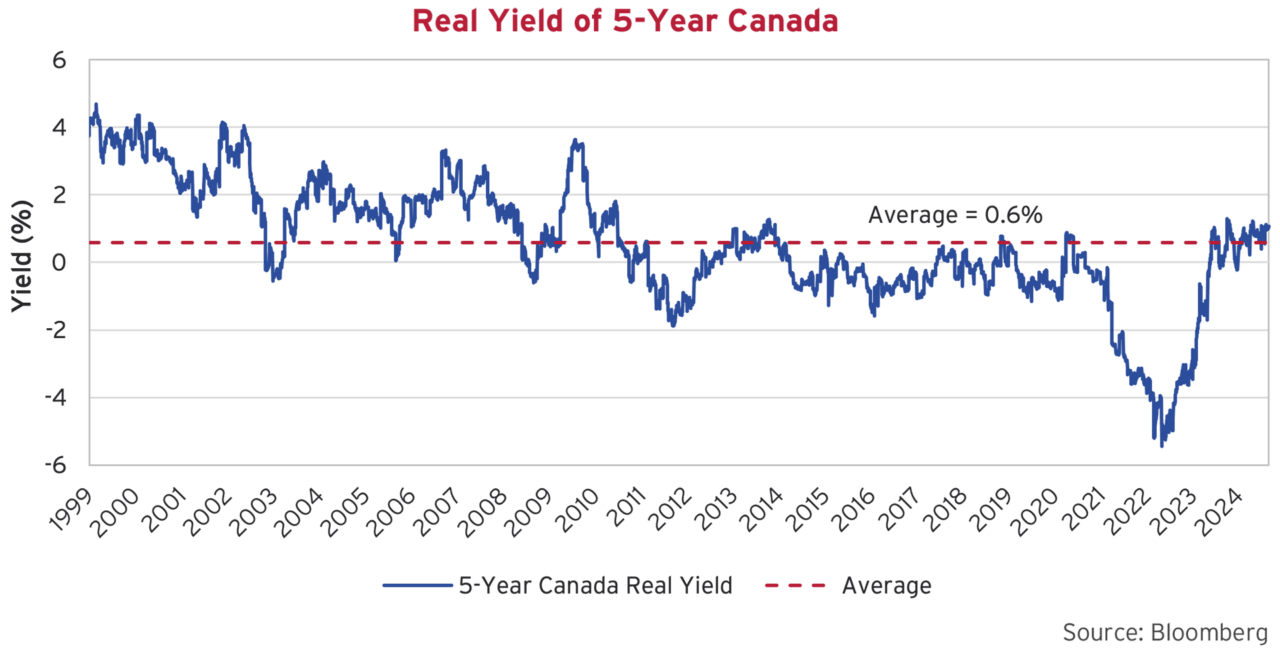

The problem might be that tomorrow’s mortgage rates might not be much different than todays’. The bond market enthusiasm for monetary easing has put yields of shorter bond terms not too far from where they should be, given inflation at or near the BOC’s 2% target. Since underlying Canadian wages are running in the 5% range, it is not certain inflation will fall from the current level. The chart below shows that the real yield (yield less YoY CPI) on the 5-year Canada bond is currently just over 1%, around the historical average since 1999. It rose from very negative during the high inflation period following the pandemic when the yield on the 5-year bond was far below CPI. Bond investors anticipated tightened monetary policy would work very quickly, which was obviously not the case. The current level would not be abnormal for the 2004-2011 period but is higher than the negative real yields during the Zero Interest Rate stupidity that followed the 2008 Credit and 2011 Euro-Debt crises.

So, the current 5-year Canada at 3% is actually not too far from where it should be, given a normal economy with inflation at 2%. That means that current fixed mortgage rates, which are based on Canada bond yields, don’t have a lot to fall if the BOC brings short-term rates towards 3%, which would only be 1% above the BOC target 2% inflation. Variable rate mortgages would fall considerably, since the current BOC rate is 4.25%, much higher than the 5-year Canada at 3%. Given the disastrous experience of Canadians with variable rate mortgages that went from 0.8% to 6%, we don’t think variable rate mortgages will be a popular option for many Canadian borrowers.

Double the Whammy

As we’ve pointed out in the past, the residential housing market forms a much larger part of the Canadian economy than is the case in the U.S. Which means Canadians have the double whammy of a weakening housing-dependent economy and higher rates biting into disposable cash flow for consumers with mortgages. That suggests to us that Canada will be much weaker economically than the U.S. That puts more pressure on the BOC to lower rates, but with short Canada bonds at under 3%, there isn’t much room for further monetary policy accommodation. After the post pandemic inflation debacle, we wonder how aggressive central bankers will truly be. Critics are already pointing out that, given the recent strong U.S. employment report, it looks like the 0.5% reduction in Fed Funds was a mistake and overkill, given the economic strength. Absent a severe Recession, we don’t see the BOC taking short-term interest rates to the extremely negative levels of the Zero Interest Rate Policy period from 2011 to 2019.

No Shortage of Money

No matter what we think about monetary policy, there certainly is no shortage of money around from what we are seeing day-to-day in the financial markets. All that pandemic money that wasn’t spent by consumers was saved and ended up either directly or indirectly in the capital markets. The stock and corporate bond markets are still roaring as investors are desperate to put their money to work and not be left behind. Stocks soar ever upwards and corporate bond new issues are met with massive demand. When money is easy, it is a mortal portfolio management sin to be left behind in a rallying market. There’s few professional forecasters to provide caution when their compensation depends on the continued irrational exuberance of their clients. Not many question the very enthusiastic consensus of “Ever Upwards” when their bonuses are doing the same thing.

Financial Innovation Sells Dreams

All that extra money in circulation means happy days are also here for those who sell things financial. It also means that financial “innovation” is rampant again. We have talked about the private debt bubble, but now the simple ETF value proposition of index-like returns and low fees has been turned on its head. Changes in U.S. regulation, ostensibly to “democratize” investments for the little people, is seeing very complicated and risky financial products being sold directly to retail investors such as ETFs. As we’ve told you many times, the current security regulation was created in 1933 to bring order to wild stock markets that saw pump and dump schemes that literally stole money from unsophisticated investors. It seems those days are back with Meme stocks and derivative based ETFs.

The bundling of high fees and high risk into formerly plain vanilla ETF has turned the sales pitch into “Do you want to be rich?” We admit to a certain trepidation when those constructing sophisticated financial products compare them to selling sneakers and potato chips. The financial markets, as Estee Lauder used to say about cosmetics, are now selling dreams, not investment products. As Bloomberg points out in an excellent article, the day traders who flocked into Meme stocks based on “Reddit Research” are now buying very complicated derivative products:

“‘100%’ Yields Are Fueling a Retail Boom in New Quick-Buck ETFs”

“Amateur investors are plunging into the complex world of derivatives-powered ETFs that can dangle huge payouts riding big-name stocks, among other goodies. Industry pros and regulators urge caution.”

That caution of “industry pros and regulators” has been subsumed into the glee of marketers:

“There is a breaking down of traditional barriers because ETFs are direct-to-consumer products,” says Gavin Filmore, chief revenue officer at Tidal. “The minute I launch a product, every trader at home can buy it. It’s like a sneaker, it’s like a potato chip.””2

Money in Your Pocket

That excess money is also making it into the real economy and working peoples’ pockets. As we’ve told you in the past, if there’s enough money around, employers can pay more to their employees if it is attractive to increase revenues and profits. Gone are the days when your employer could give you little to no raise and tell you that you were lucky to have a job! Both in the U.S. and Canada, wage growth has moderated but stayed strong in the 4-5% range, a substantial increase over the 2-3% before the pandemic. That’s the average wage increase but employees with economic clout are obtaining some eye-popping raises. In Canada, Air Canada pilots received 26% increase, backdated a year to September 30, 2023, with further 4% annual increases until 2026, totalling an almost 40% increase by the end of their contract. In the U.S., the International Longshoremen’s Association have agreed to a 61.5% increase over six years!

Electing to be Cautious

You will excuse us for saying that since there is now less than a month until the U.S. elections, any forecast is bound to be wrong. Both Trump and Harris are courting voters by proposing expensive programs and both are promising to lower taxes on tips to attract service sector voters. Trump is also promising to extend his expensive tax cuts and to end taxation on overtime wages and even Old Age Security. Neither Trump nor Harris and their respective parties have even mentioned taming the U.S. deficit. No matter who’s elected, there will be massive budget deficits.

The non-profit Committee for a Responsible Federal Budget estimates that Harris’ economic plan would add $3 trillion to the national debt over the next decade and that Trump’s plan would add $7.5 trillion, more than double his opponent’s tally. The budget orthodoxy of the Republican Freedom Caucus in Congress has given way to agreeing with anything that Trump says. Trump has also mused about “directing” the Fed in setting monetary policy, given his self-admitted business genius, and promises huge tariffs on goods entering the U.S., which would be very inflationary. That should scare bondholders, but they’ve been busy buying bonds to avoid missing the bond market rally as the Fed eases policy and lowers interest rates. It looks to us like most of the bond rally has already occurred so there’s not too much to miss.

An October Surprise?

Nobody seems to care about deficits or inflation in the current market. Our rather simple take on things is that when nobody cares about risk, usually risky investments don’t pay enough to be attractive. With bond yields already impounding 2% inflation and credit spreads tight on lower quality bonds, that is certainly the case now. Unless interest rates and bond yields drop back to the ultra-low levels of the Zero Interest Rate Policy days, we think investors will soon be regretting many of their current holdings. Our many years of investment experience have made us wary of October. That’s the month when an overheated market can hit the wall, as in Black Monday in 1987 and the Credit Crisis in 2008. Just when a good quarter has been booked, things can be very different in just a few weeks!