Crawling From the Wreckage

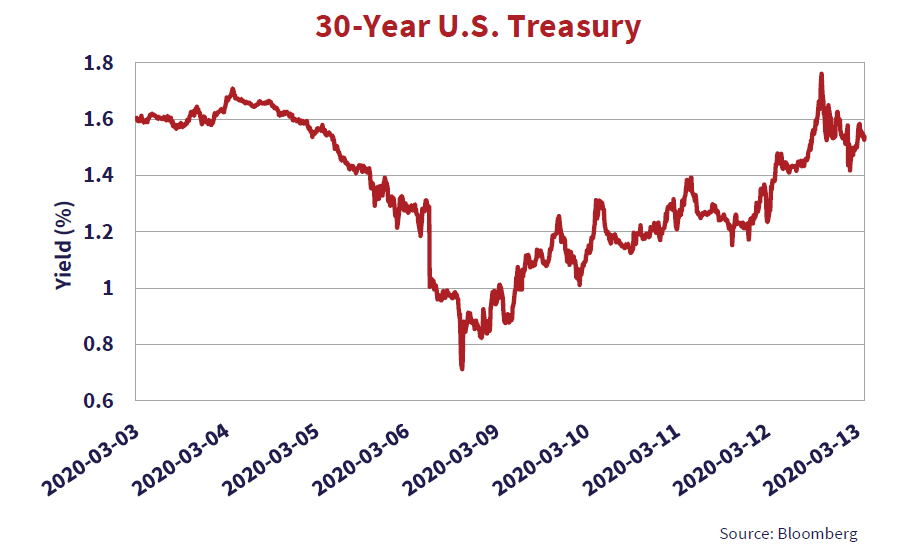

On March 3rd, authorities at the Federal Reserve unanimously voted to step in front of the runaway Coronavirus train. Concerned COVID-19 posed “evolving risks” to an otherwise “strong” U.S. economy, the Fed slashed overnight rates 50bps. Investigators continue to sift through the rubble but initial reports suggest a wide debris field.

The accident occurred in broad daylight and left onlookers stunned. Victims included a tangle of confused, disappointed and disbelieving financial markets. There are unconfirmed but plausible reports the Fed’s credibility disintegrated during the accident. The FOMC survived the impact and rolls haplessly on to its regularly scheduled meeting on March 18th. Similar catastrophes were reported in Canada (BOC cut 50bps March 4th) and Australia (RBA cut 25bps on March 3rd).

Paint It Black

The Coronavirus continues to dominate headlines, conversations and behaviours. The facts on COVID-19 disclosed by the World Health Organization as of March 4th include: 3,198 confirmed deaths, 93,090 confirmed cases, and billions confirmed concerned about what will happen next. COVID-19 is nothing to joke about and poses a grave medical threat that only now seems to be taken seriously by the Trump administration.

As news on Coronavirus turned from a trickle to a torrent, the financial markets at first paused, next blinked and then panicked. Having hit all time highs in the third week of February, the TSX and S&P 500 then plummeted. The markets then rebounded, buoyed by hopes of imminent central bank easing, then plummeted again when the Fed actually eased and finally rose on, of all things, a strong showing by Joe Biden on Super Tuesday. For the year the TSX is down -1.7% and the S&P 500 -3.1%.

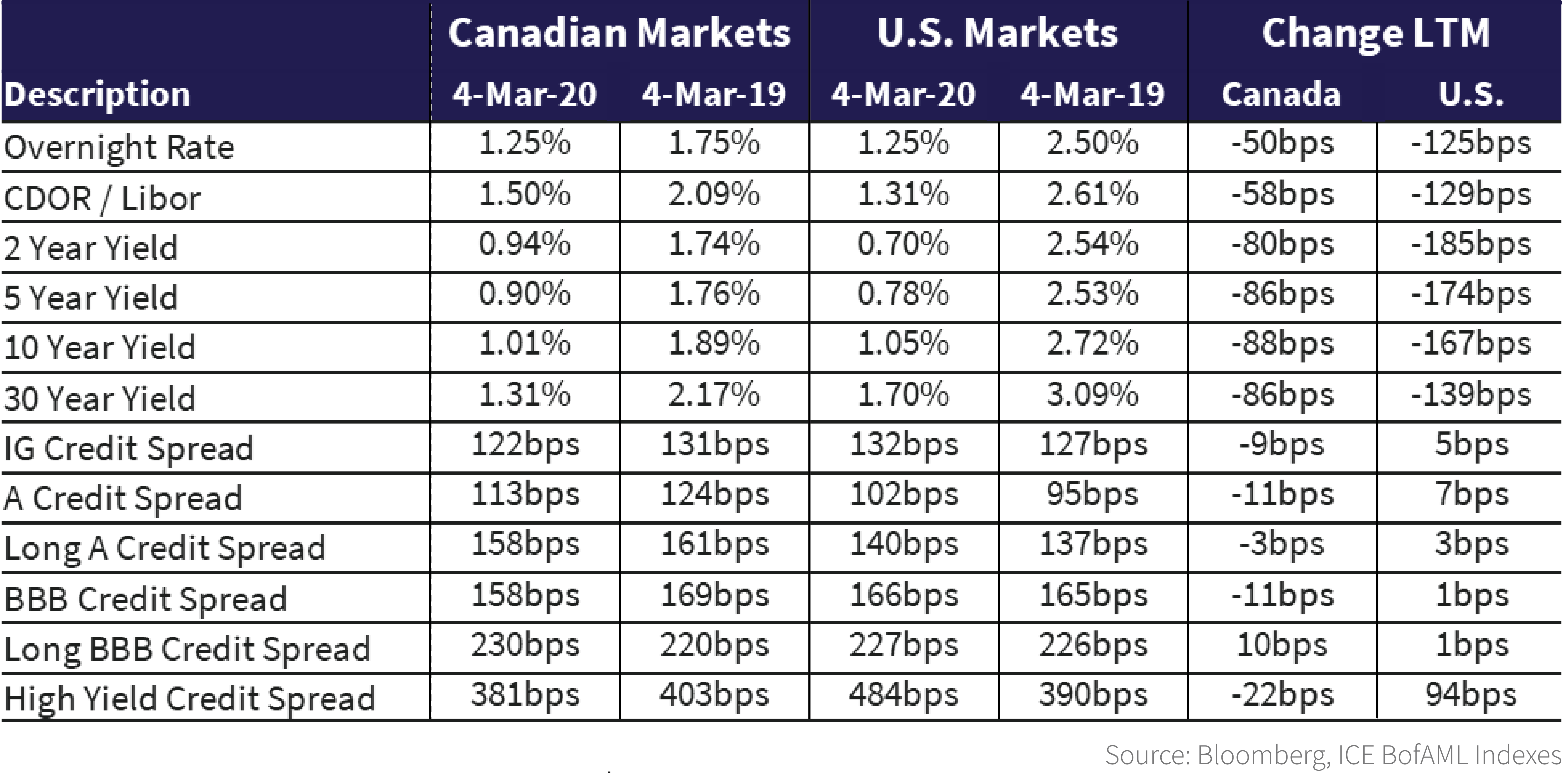

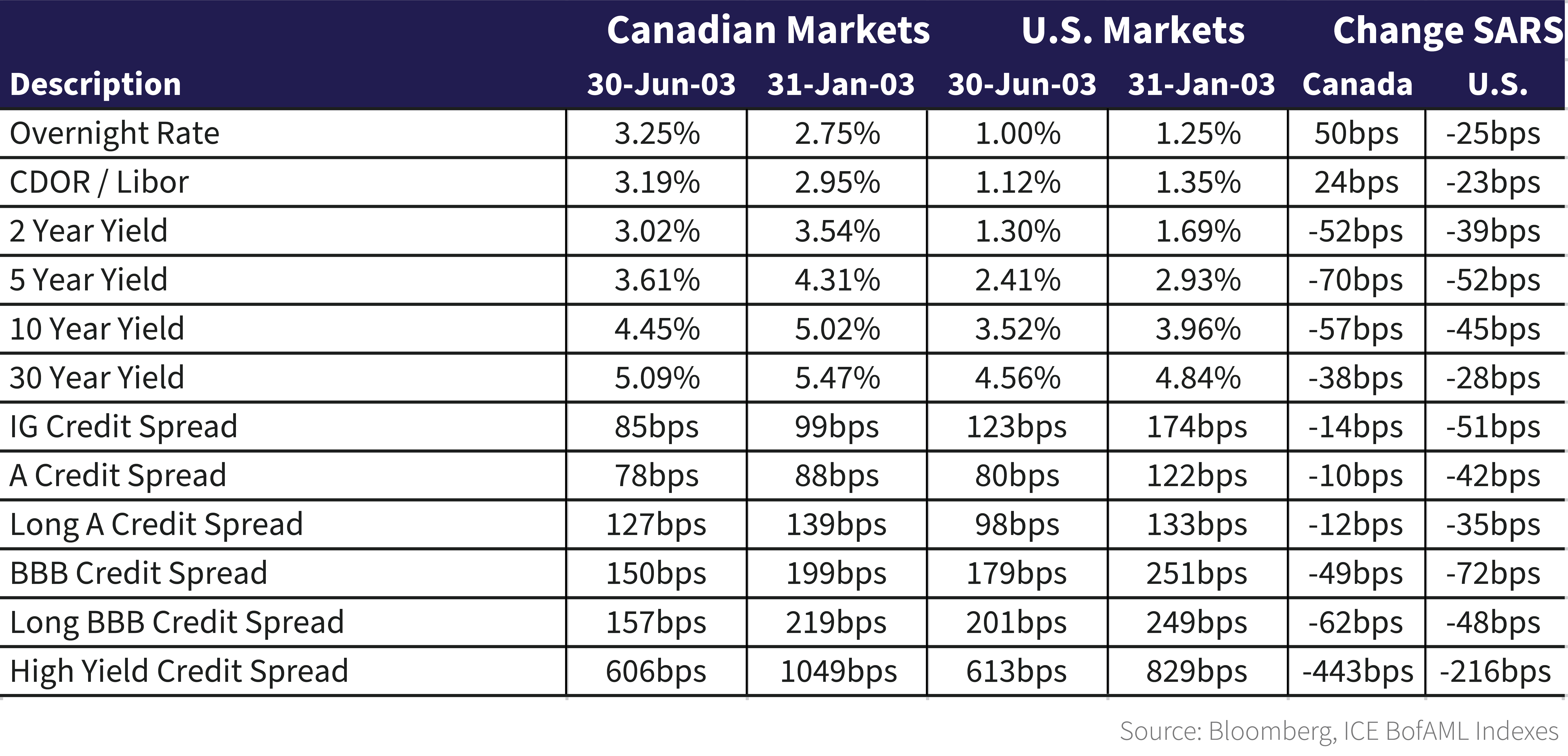

The table below shows current and year-end levels and changes in Canadian and U.S. government bond yields and corporate credit spreads year to date (YTD).

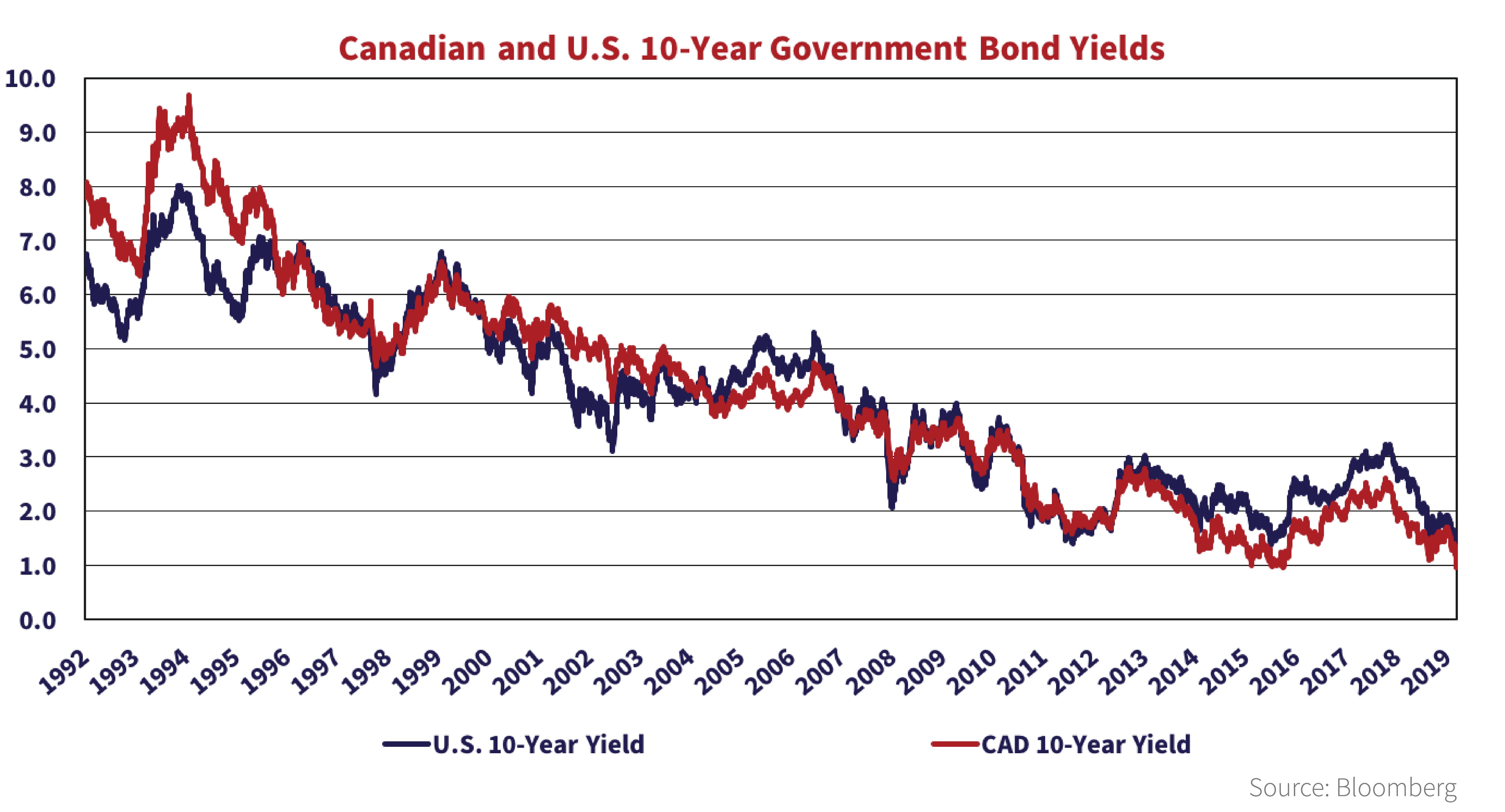

The story is a simple one. Flight from uncertainty to perceived quality drove yields on government bonds lower, risk premiums on corporate credit wider and prices on equities into freefall. Volatility is high. The virus-induced fall in yields follows an already substantial fall in yields during 2019. The government bond markets priced in economic Armageddon in 2019, despite reasonably strong economic expansion and low unemployment in the U.S. The investment grade credit markets are virtually unchanged year-over-year while U.S. high yield is almost 100bps wider than a year ago.

It’s The Same Old Song

The magnitude of the fall in yields in response to Coronavirus is greater than occurred during the SARS outbreak that lasted from January through June of 2003. During SARS, government bond yields also plummeted, albeit from much higher starting levels. The Fed cut rates by 25bps once during SARS, while the Bank of Canada raised rates 50bps.

Unlike the recent COVID-19 experience where spreads have widened, investment grade and high yield bond spreads actually tightened during SARS, in the case of high yield substantially so. At the time of SARS, financial markets and credit markets were still recovering from the collapse of the technology bubble and the bankruptcies of Enron and WorldCom.

Where Am I To Go Now That I’ve Gone Too Far?

Before Coronavirus, Canso believed that the economic situation in the United States, and to a lesser degree in Canada, was considerably brighter than government bond markets were pricing in. In our view, low unemployment and positive economic growth gave no reason for either the Bank of Canada or the Federal Reserve to change administered rates in 2020.

In fact, in the United States, the ongoing trade war with China, the enormous deficit-financed government stimulus, and 3 “pre-emptive” interest rate cuts by the Federal Reserve in 2019, suggested inflation was a bigger concern than government bond markets were pricing in.

With COVID-19, the pre-emptive 50bps rate cuts by both the Bank of Canada and the Fed, and U.S. 10 year yields already at all time lows, one wonders, what’s next?

The suggestion that economic challenges caused by Coronavirus can be solved by central bank action is not just wrong, it is ludicrous. Supply chain disruptions are a fact of life in an interconnected world. Deferred consumer and business expenditures will occur as a result of a lack of available inventory, consumer caution and quarantine constraints. As Fed Chair Powell admitted in announcing the “Emergency Cut”, none of these factors have anything to do with the level of interest rates.

The world is likely to experience an economic slowdown and potential contraction for an unspecified period of time. The impacts will include supply chain disruptions, empty shelves, deferred spending and investment, temporary layoffs and delayed hiring. While it is likely all of these factors are temporary, things will get harder before they get easier. Once the Coronavirus is under control, economic growth will return, and likely at an accelerated pace, as consumers and businesses seek to “catch up”.

Interest rate adjustments by central banks should be taken to influence economic activity and to achieve a policy objective. As lower interest rates will not influence COVID-19 related declines in economic activity, the correct policy response for central bankers in this environment would have been to do nothing. We therefore expect that, given the central banker enthusiasm to do something, anything, more central banks will follow the Bank of Canada, the Fed and RBA in cutting cut rates.

Eve of Destruction

As Canadian and U.S. government bond yields hit all time lows, the impact on financial markets is significant. Creditworthy issuers should borrow for the longest terms possible and they seem to be taking advantage of the unexpected drop in bond yields. For example, on February 25th, 2020, Hydro One priced a multi-tranched deal which included a February 28th, 2050, long bond with a coupon of 2.71% (credit spread of 140bps)! We believe this is the lowest corporate long bond coupon ever issued in the Canadian capital markets.

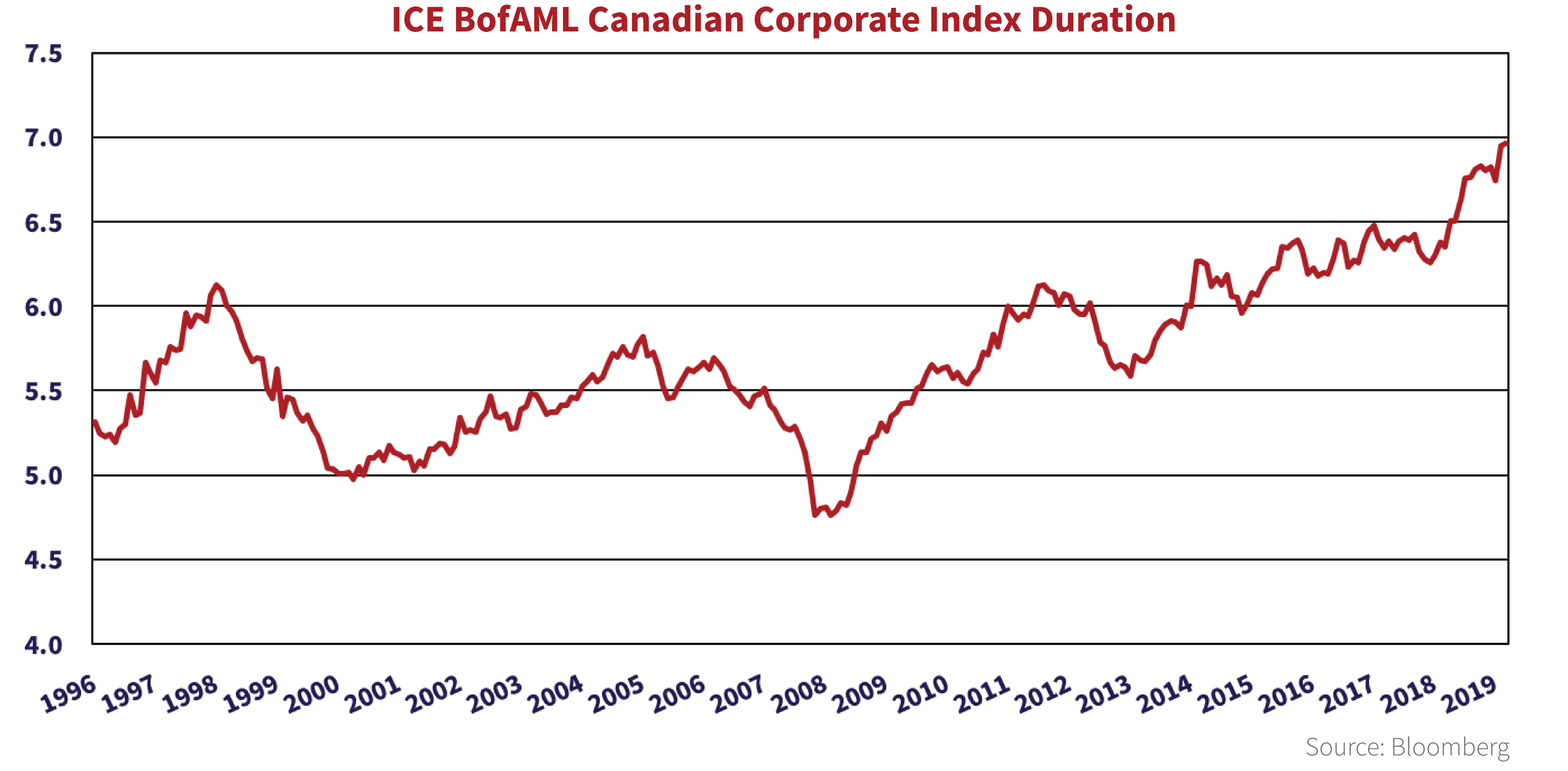

The chart below shows the ICE BofAML Canadian Corporate Bond Index duration at 7.0 years. The fall in yields over the last 12 months contributed to its lengthening. It is more than a full year longer than pre-Credit Crisis levels. The duration extension is due to the fall in government yields, tighter credit spreads and issuers prioritizing long bond issuance to lock in low fixed rate borrowings.

The next obvious question is: why does it matter? The longer duration significantly heightens risks to the bond market as increases in government rates or widening credit spreads have a larger impact on investors than in the past. Investors benchmarked against the Corporate Index face returns more sensitive to movements in government yields and corporate spreads than ever. Investors are forced to choose between extension to keep up with the Index or deviation from the Index.

I Was Born in a Small Town

Lost in the midst of COVID-19 worry, financial market panic, Australian wildfire horror and Parasite’s Oscar victory, was songwriter John Mellencamp’s endorsement of Michael Bloomberg’s democratic presidential candidacy. Mellencamp’s Seymour, Indiana (population 19,480) roots, would have made him a natural to endorse former South Bend, Indiana Mayor Peter Buttigieg.

Proving few things are predictable anymore, the Farm Aid crooner threw his anti-establishment weight firmly behind an establishment candidate. After Super Tuesday, Mellencamp can stick to singing and Bloomberg can stick to owning his namesake company. Whether hard charging Joe Biden or hard left of center Bernie Sanders, one hopes whoever the Democratic nominee, they give the incumbent President Trump a run for his money in November. The good news? Only 8 months to go until election day!

I Just Can’t Wait to Be King

Speaking of small towns, Mr. Harry, Ms. Meghan and Master Archie decamped from London, England to Victoria, British Columbia leaving the glamour and rigour of the royal life behind. Upon their arrival, the average age of British Columbia’s capital city fell considerably. Madonna suggested Canada was too boring for the newly liberated royals, demonstrating she hasn’t kept up on the news lately. What’s boring about watching the Maple Leafs lose to their own 42 year old Zamboni driver? Elsewhere Jack Welch, of General Electric notoriety, passed away. Liverpool inched closer to the Premier League title, the Houston Astros offered a lukewarm apology for cheating (more on this later) and the Raptors are thriving without Kawhi Leonard. It’s an easy game apparently.

Hot Dog

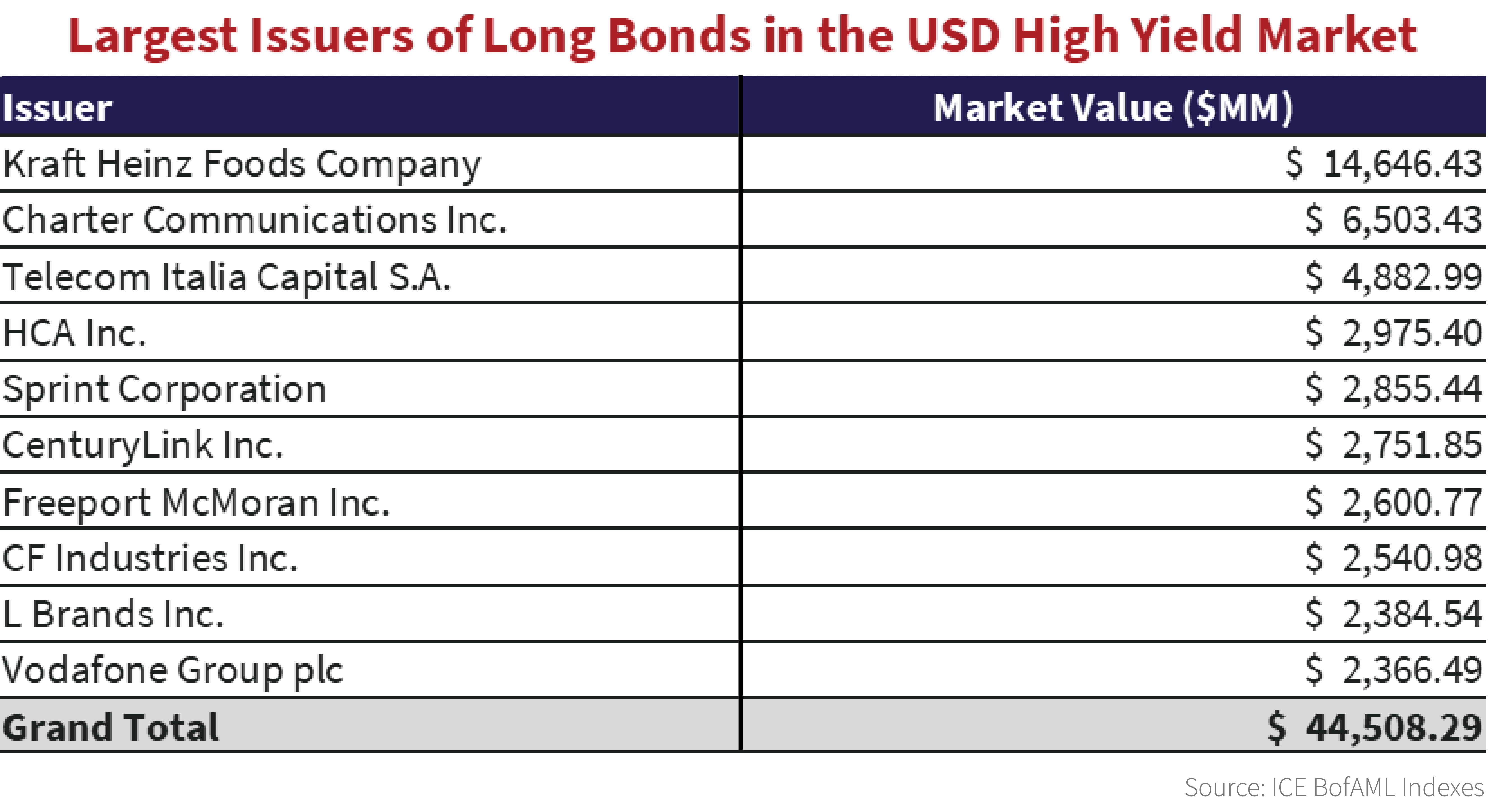

On Valentine’s Day, Fitch and S&P downgraded Kraft Heinz from BBB- to BB+, knocking one of the world’s finest condiment makers out of the Investment Grade Corporate Index effective at month-end. Per the table below, Kraft Heinz is now the third largest issuer in the U.S. $1.25 trillion high yield market.

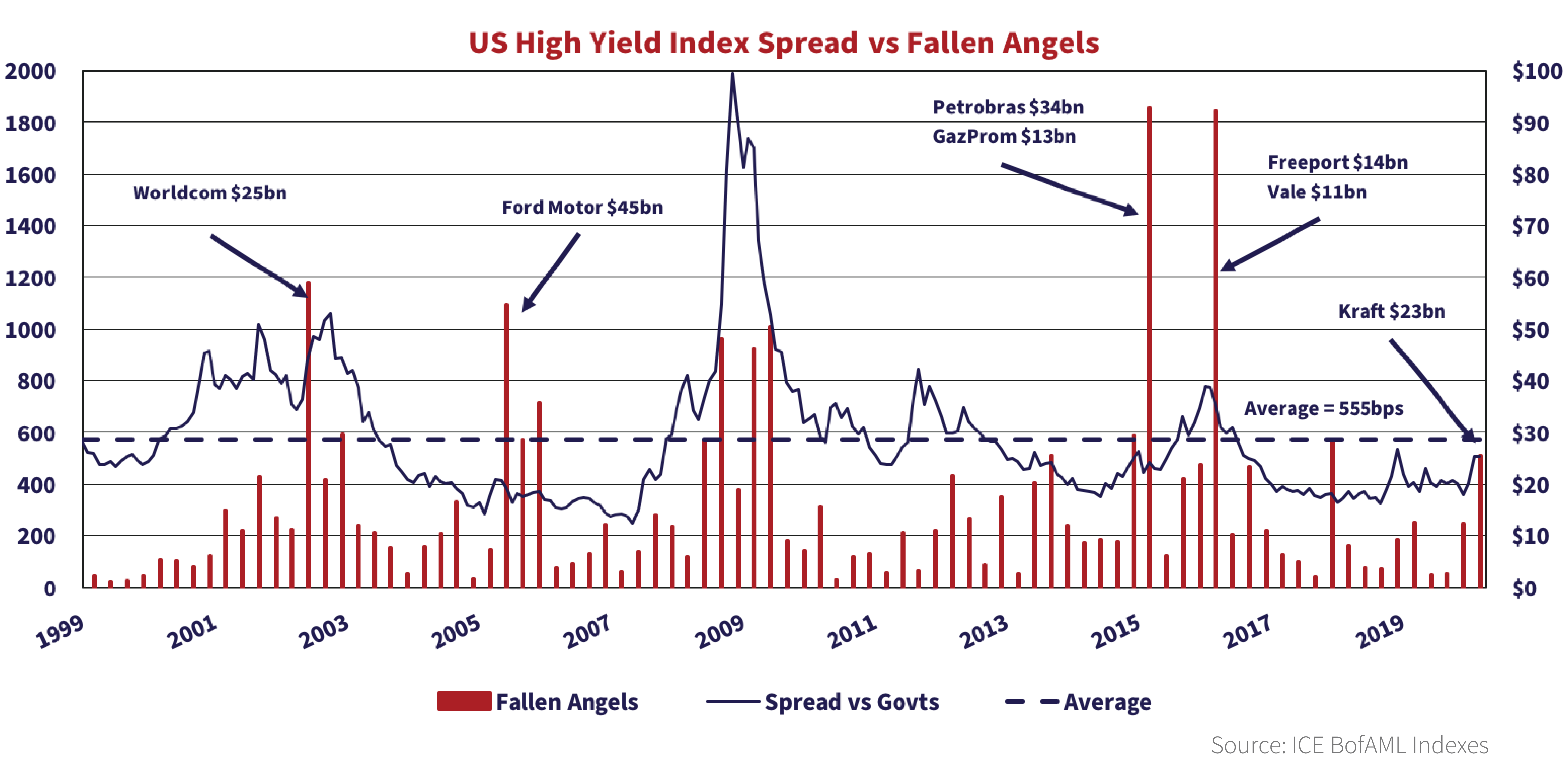

Downgrades of BBB rated corporates to high yield, so called crossover or fallen angel downgrades, may or may not be disruptive to the spreads of the issuer or the broader high yield market. The impact depends on a variety of factors, including the point in the credit cycle the downgrades occur, the nature of the individual credits downgraded and supply demand imbalances at the point of downgrade.

The downgrade of Kraft occurred when credit spreads were tight and fears of the Coronavirus were rippling through the financial markets. The significant widening in high yield credit spreads shown in the graph below likely had less to do with Kraft and more to do with general market volatility.

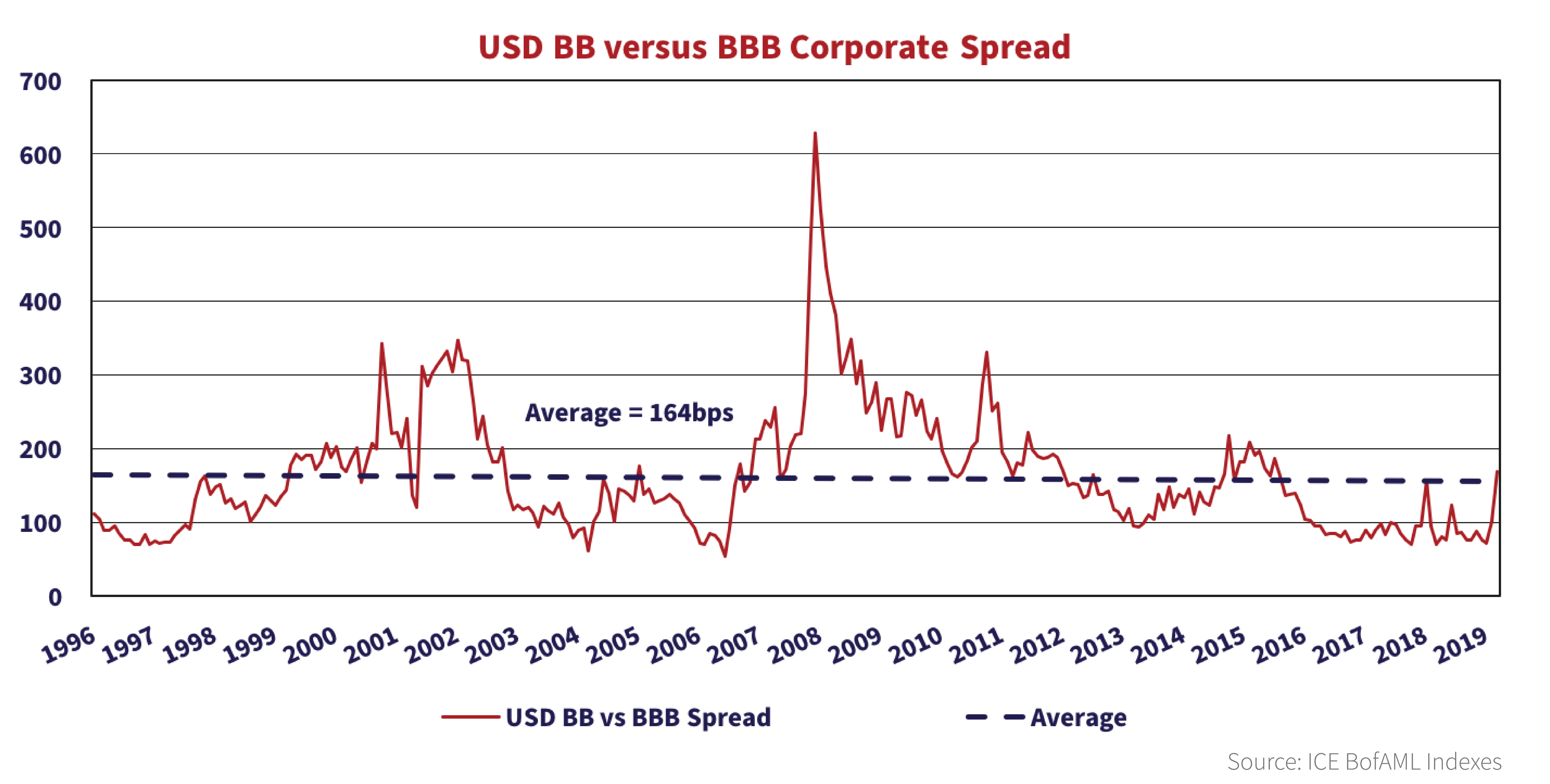

As Kraft Heinz was adjusting to life as a lower quality credit, the spread between BB and BBB corporates widened significantly. Again, this has little to do with Kraft but everything to do with the flight to quality trade occurring because of COVID-19. High yield credit spreads have widened considerably more than investment grade credit spreads.

Big Daddy of Them All

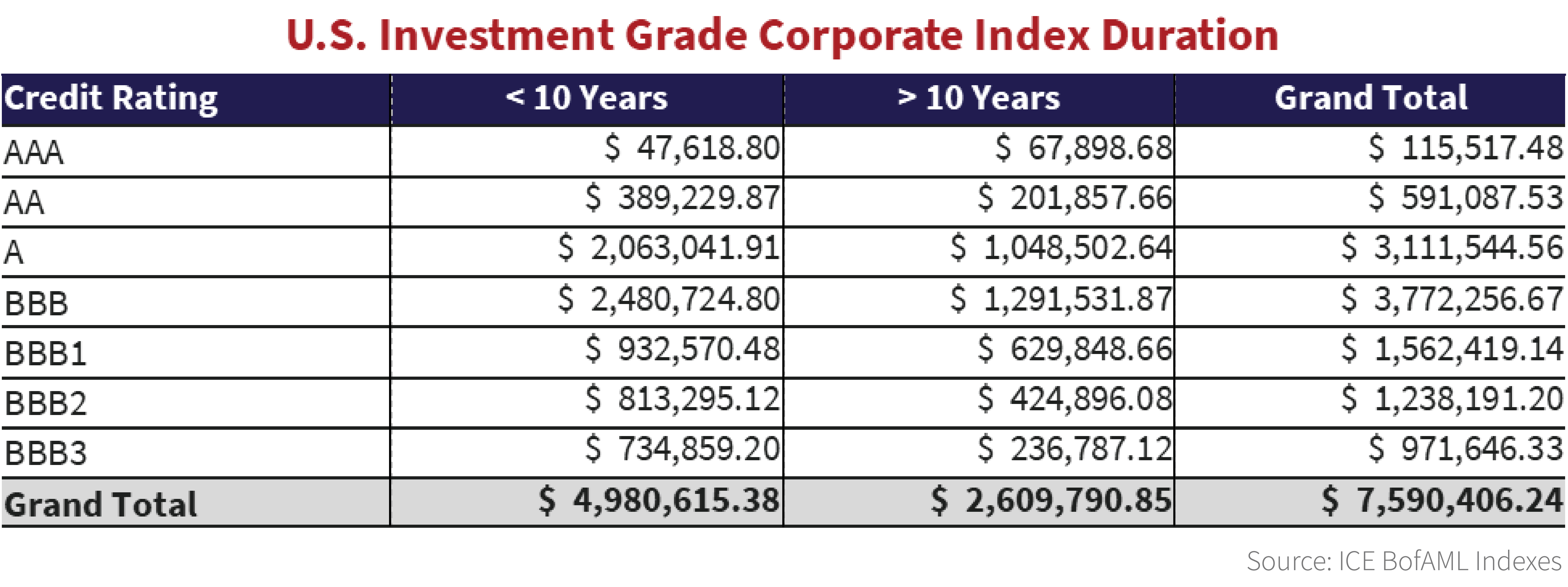

The high yield new issue market is limited to 10 years and under. Of the $1.25 trillion U.S. high yield bonds included in the ICE BofAML High Yield Index, only $84.9 billion have a term to maturity of greater than 10 years. Most, if not all of these, were bonds that issued as investment grade bonds. By comparison, 34% of the investment grade market report a term to maturity greater than 10 years.

The downgrade of Kraft Heinz is notable for the substantial amount of duration it brought to the High Yield Index. The table below shows the amount of bonds with a remaining term to maturity of 10 years or more. Kraft Heinz is the largest issuer of longer duration bonds by a wide margin.

BBB rated bonds account for 41% and 50% of the ICE BofAML Canadian and U.S. Investment Grade Corporate Indices, respectively. Twenty years ago, BBB’s accounted for 8% and 34%, respectively. As the percentage of BBB’s in Corporate Indices increased, so too has concern about the high yield market’s ability to absorb downgrades of BBB rated bonds.

As the chart above shows, the high yield market has been resilient in absorbing fallen angels in the past. Of course, timing is everything, and if the credit markets are expensive and investors jittery, then the absorption process may be a little less smooth. Over the last 5 years, the absolute dollar value of high yield bonds contracted by $150 billion as bond issuance gave way to the rapidly increasing leveraged loan market. It is likely the contraction of the high yield bond market signals some pent up demand for additional new high yield issuance or fallen angels.

The table above breaks down the ICE BofAML U.S. Investment Grade Corporate Index by term to maturities of less than 10 years and more than 10 years. A downgrade of a BBB issuer with long duration securities might prove more challenging for the high yield market to absorb.

LVMH in the Sky with Diamonds

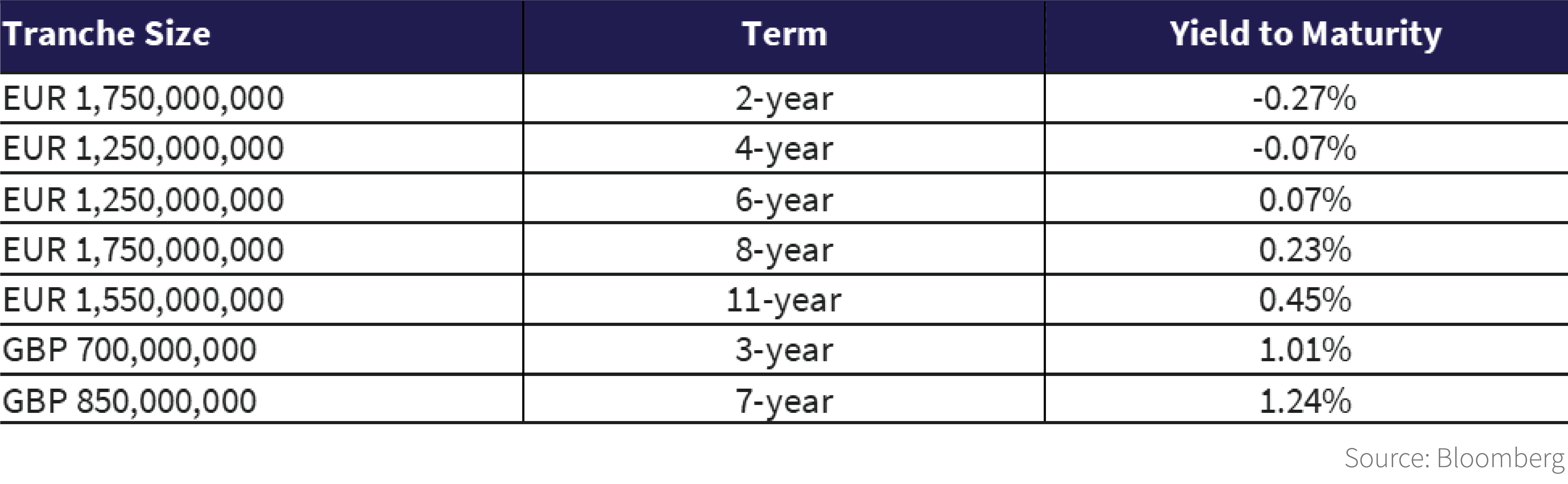

Just in time for Valentine’s Day and ahead of the market rout, luxury goods conglomerate LVMH blitzed the European bond market raising proceeds for its U.S.$16.6 billion acquisition of Tiffany & Co. In the second largest bond deal in European history, A+ rated LVMH Moët Hennessy Louis Vuitton SE raised over €9 billion across 7 tranches. What’s truly eye-opening about this deal is not the size, but the yields at which the bonds were priced.

Penny Lane

As the table above shows, LVMH issued €3 billion of bonds at negative yields and an additional €4.55 billion at yields below 0.50%. Euro bond investors were forced 6 years out the curve before receiving a positive yield. To illustrate how this 0.07% positive yield is achieved, a “bond investor” would advance the company, LVMH, €99.59 today, and in February 2026 would be returned €100.00. No interest payments along the way. No coupons. No dividends. A cumulative 6-year gain of 41 euro pennies.

Help!

We need somebody, we’ll take anybody, to explain to us how the ECB’s bond buying program is good for the long-term health of the European credit markets. The ECB’s Asset Purchase Program (APP) dates to 2014 and includes programs to purchase asset backed securities, corporate bonds, covered bonds and public sector securities.

The Corporate Sector Purchase Program (CSPP) granted the ECB authority to buy euro-denominated bonds issued by non-bank corporations starting in 2016. ECB purchases of European corporate bonds distorts European corporate bond pricing just as it has in Euro government and covered bond markets. Public money finances bond purchases driving yields negative. How can long-term investors price and accept risk when the ECB is an indiscriminate buyer and investors are guaranteed no return?

They Took All the Trees…

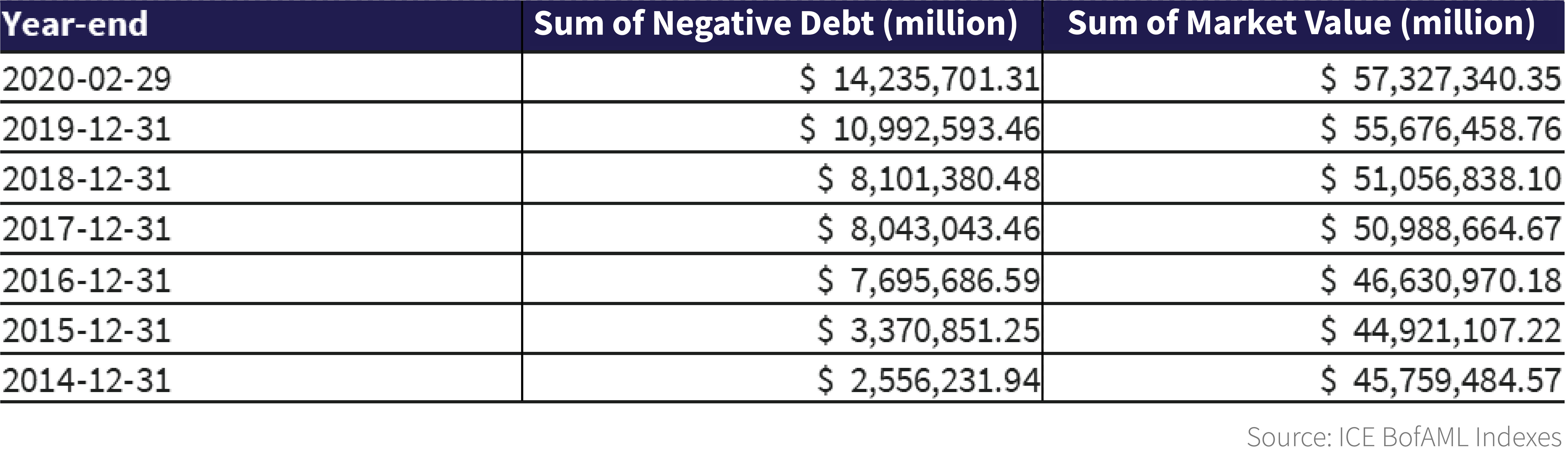

The table below shows the amount of negative yielding debt out of the total ICE BofAML Global Broad Market Index. At the end of February, some U.S.$14+ trillion of debt carried a negative yield. The bulk of that negative yielding debt comes from European Union countries and Japan. The EU and Japan share two things in common, central banks with administered rates below zero and aggressive bond buying programs.

Put ‘Em In a Tree Museum

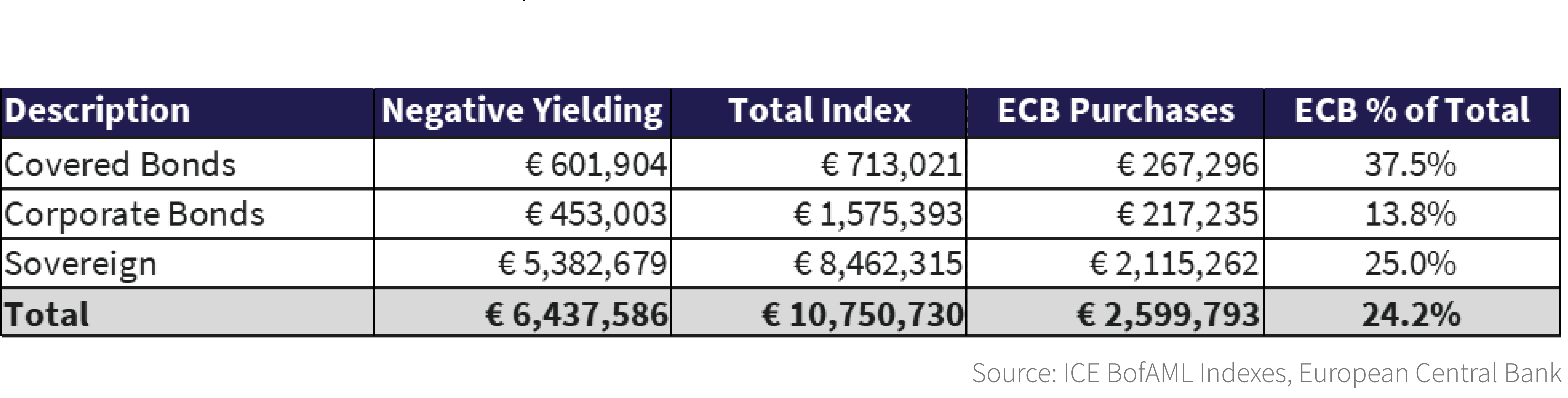

The table below highlights the extent of ECB bond buying in debt issued by Euro market countries and corporations. €6.4 trillion of the €10.8 trillion ICE BofAML Euro Broad Market Index debt carries a negative yield. Through the ECB’s APP, 37% of Index eligible covered bonds, almost 14% of corporates and 25% of sovereign and quasi sovereign bonds are held by the ECB. These figures are remarkable. The distorting impact of the ECB buying its member countries’ debt instruments, along with negative administered interest rate policy, cannot be overstated.

And Now For My Next Experiment

The negative interest rate experiment is just that, an experiment. It is an experiment with unknown results conducted by relatively few central banks, including Denmark, the European Union, Japan, Sweden and Switzerland.

Negative rates are a reaction to the failure of traditional monetary policy – lowering overnight rates to stimulate economic growth. In Europe and Japan, lowering rates did not result in any meaningful uptick in economic growth. So the central banks resorted to non-traditional measures which included buying enormous quantities of government and, in the case of the ECB, corporate bonds and taking administered rates into negative territory. While the Fed also purchased large quantities of U.S. treasury securities, they did not move administered rates into negative territory nor did they acquire corporate securities.

Do Two Negatives Make a Positive?

These are new phenomenons and we do not believe anyone fully comprehends either the benefits (in terms of economic stimulus) or the drawbacks (on financial institutions and investors) negative rates are having on the various economies where they exist.

We do know, whether effective or not, these unconventional methods are unsustainable and are meant to be temporary. Eventually rates need to normalize, with normal defined as not just positive territory but positive from a real rate point of view. We note Sweden’s Central Bank (Riksbank) gave its citizens an early Christmas present by moving rates up to 0%!

What are the catalysts for this move from negative to positive? Two things. First, following the resolution of the Coronavirus situation, a return to positive economic growth in the U.S. which will underpin positive global economic growth. Second, aggressive fiscal policy responses by governments allowing for the withdrawal of monetary policy stimulus.

The response to European economic stagnation has been largely a monetary policy response through the European Central Bank and the Bank of England. What has been absent is a coordinated fiscal policy response. We would expect Christine Lagarde, the new head of the ECB who has enormous influence and credibility, to pressure reluctant governments to be more aggressive fiscally.

Help, I’m Stepping Into the Twilight Zone

Things are happening so fast it is difficult to stay up to speed with the craziness. Central Bank rate cuts and negative interest rates are just a few examples. Don’t overlook the President’s pardon of Michael Milken, the junk bond king and engineer of the savings and loan crisis. For the record, Mr. Milken pleaded guilty, served time, kept most of his dough and has been free for a long time. He’s doing just fine thank you.

Then there is Fed nominee Judy Shelton who apparently believes the Fed should not exist. This is tantamount to applying for a job at 7-Eleven if you don’t believe in Slurpees™. Okay, it’s worse than that but you get what we mean. The shenanigans in and around the financial markets make Elon Musk’s Boring Company dream of transporting inebriated Las Vegas tourists in an underground tube at 155mph seem rather sane.

One Particular Harbour

In uncertain times, many investors shun risk and execute flight to quality trades. The U.S. government is viewed as a safe harbour in uncertain times. At Canso, a critical part of our bottom up fundamental analysis process is evaluating a company’s management team and the likelihood (or not) the management team can execute the business plan in a manner that ensures our investors are repaid interest and principal when due. We invest with an expectation of generating a return.

The world’s biggest debtor, the U.S. Government, is suffering from particularly bad management at the moment. The fiscal irresponsibility with which the President and his cabinet are executing his plans is remarkable. So an investor should ask – do I want to lend money to the U.S. for 10 years at the current 1.05%? An investor should also ask, given the potential for a management change within a year, would I lend money to any of the opposition candidates for 10 years at 1.05%? We think the answer in both cases should be a resounding NO!

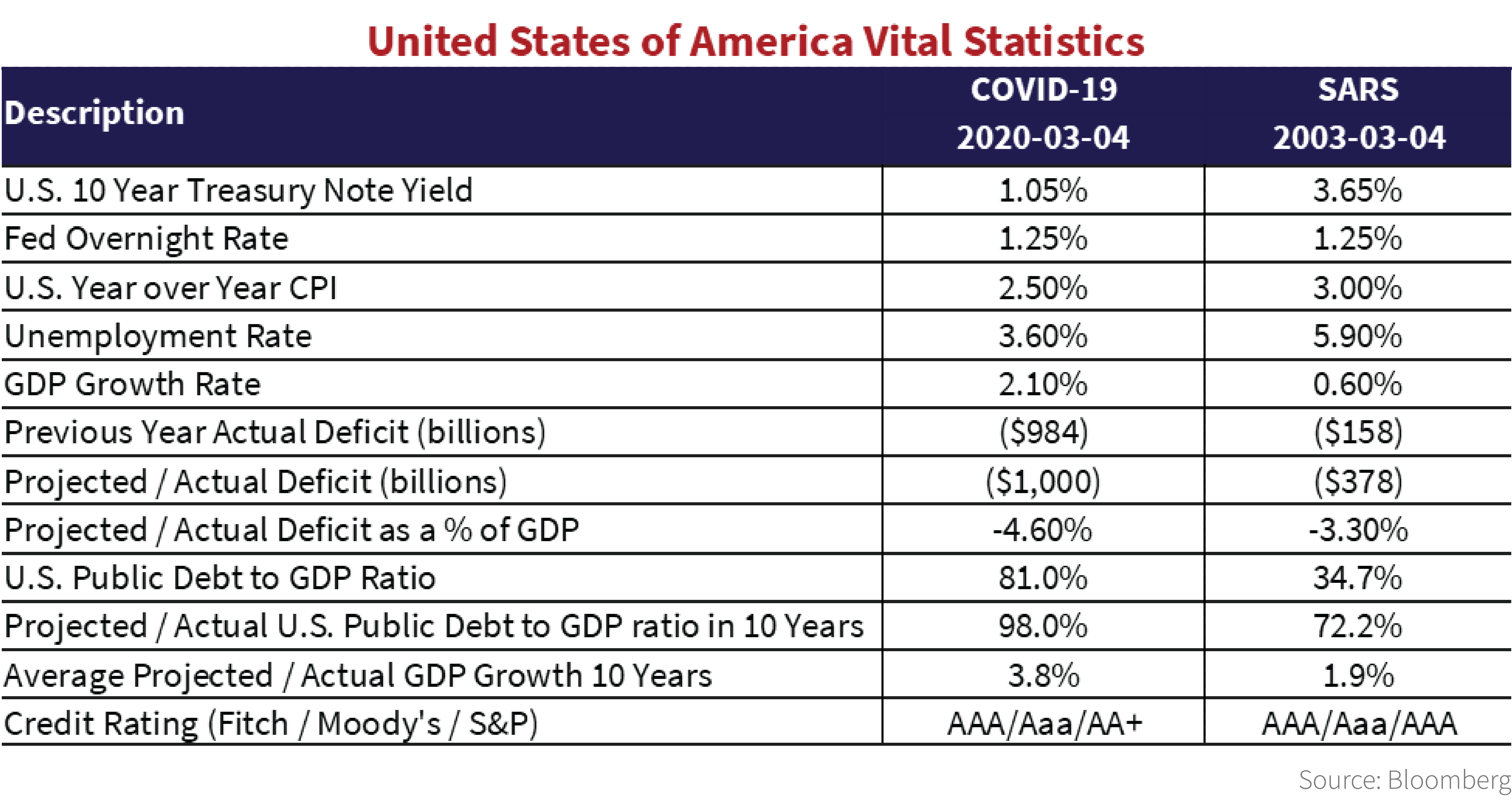

This Diamond Ring Doesn’t Shine for Me Anymore

To illustrate our concern, below we provide a comparison of certain key U.S. indicators today versus February 2003, near the start of the SARS crisis. Today, interest rates are low and real yields are negative. Prior to Coronavirus, the economy was in good shape and in an expanding economy the country’s fiscal situation should be improving. The credit metrics for the U.S. continue to deteriorate and even with rosy economic projections will continue to weaken for the foreseeable future. What a difference a few years and one leader can make. We do not believe the U.S. is worthy of its AAA/Aaa credit status at Fitch and Moody’s.

Everybody’s Doing a Brand New Dance Now

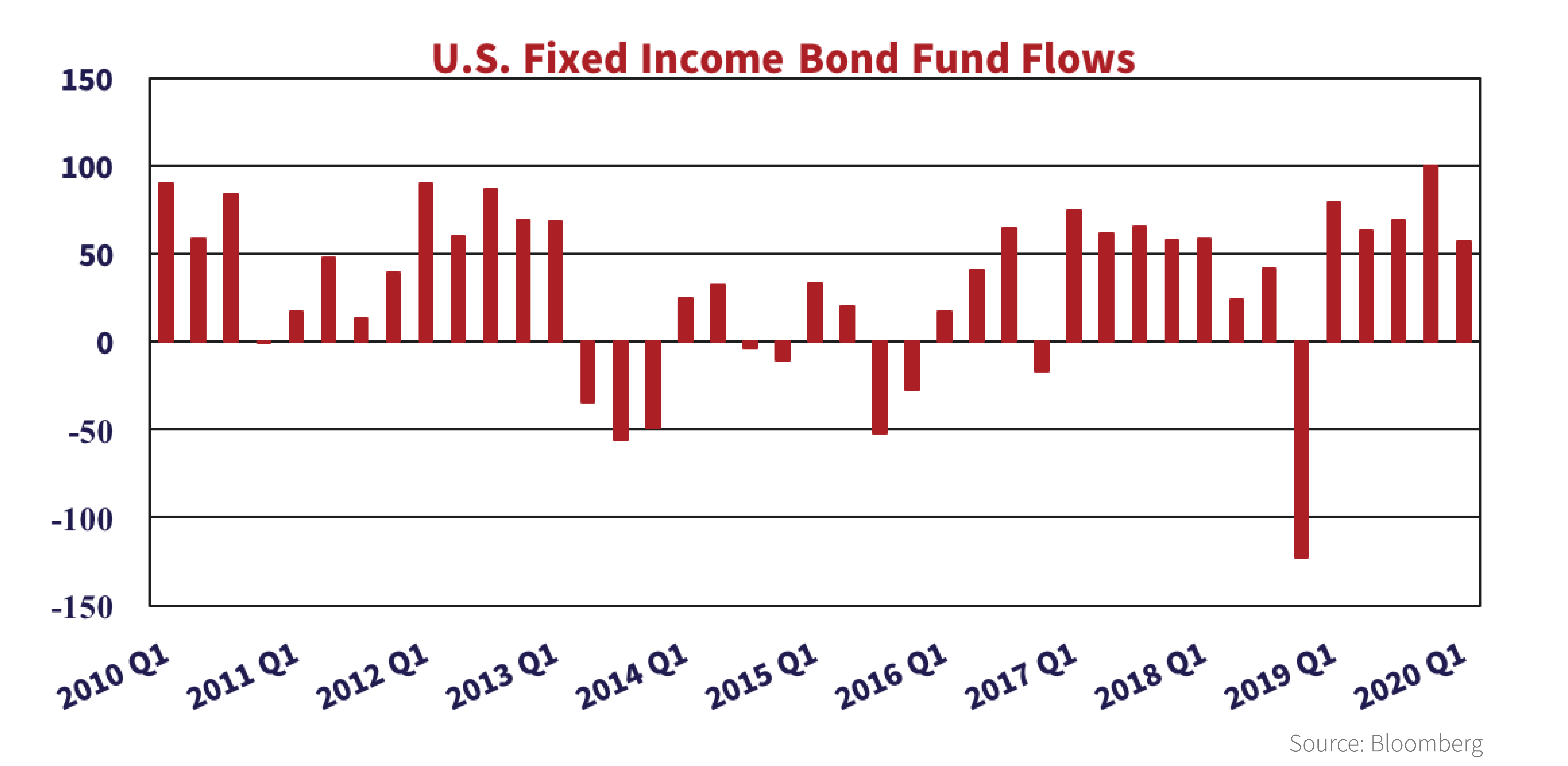

The chart below shows the inflows into U.S. bond funds back to 2010. Over the last 12 months some U.S.$290 billion has poured into fixed income funds. This is a very large number. Fortunately the U.S. government stands willing to sell $1 trillion plus of new treasuries each and every year. Keep those inflows coming! As a reminder the first edition of the new 20-year U.S. Treasury note goes on sale at the June 1st auction. Only $10 billion offered so get your orders in now!

Planes, Trains and Automobiles

Many people give up chocolate for lent. In a debt induced purge, Bombardier gave up two big things changing the entire profile of the firm. First, they handed over the plane formerly known as the C Series to Airbus in exchange for some cash and eliminated capital spending requirements. They also agreed to sell the rail segment to Alstom. If Bombardier had an automobile business they likely would have sold that too. The company will focus on its profitable business jet business.

Would I Lie to You?

With the passing of Bernie Ebbers, we reflect on the impact of the bankruptcy of WorldCom on the credit markets. WorldCom’s bankruptcy in 2002, the largest in history at the time, shook the credit markets still recovering after the collapse of Enron six months earlier. After the accounting scandal was revealed, investors began to question the accounting practices of all telecommunications companies, especially those with high leverage.

This panic created opportunity for investors. One example that illustrates this point is the Telus Communications 10.65% of 2021 bonds. The bonds were trading around $110 prior to the revelation of the WorldCom scandal and over the next month dropped to $70. Less than 1 year after the revelation of the accounting misstatements, Telus bonds were up to $140.

It never ceases to amaze how investors can be drawn in by a good story and a good storyteller. Bernard Ebbers, Bernie Madoff and Eike Batista are just a few of the infamous liars who for a very long time were perceived as smarter than the markets. It also never ceases to amaze how troubles at one company can be conflated to an entire industry. Telus was a perfectly sound investment tainted by WorldCom. For those able to see through the noise, an incredible investment opportunity was created.

I Just Want to Bang on My Drum All Day

Speaking of frauds, the Houston Astros remain front and center for all the wrong reasons as spring training for America’s game gets underway. It seems the Astros systematically stole opponents’ pitching signs during the 2017 and 2018 seasons. Sign stealing by baserunners is as old as baseball itself, but the Astros antics were sleezy not stealthy. Video technology recorded catcher signals. Excel spreadsheets deciphered signs. Expected pitches were relayed from bleachers, to dugout to batter. The sophisticated scheme, known as Codebreaker, involved banging on a drum for an off speed pitch and doing nothing for a fastball. Swing!

Act Like You’ve Been There Before

We wonder what the Astro’s spreadsheet would make of the following inputs.

- COVID-19 virus spreading,

- Bank of Canada and Fed cut overnight rates 50bps out of desperation,

- Record levels of corporate and consumer debt,

- Distorting central bank QE policies in Europe and Japan,

- U.S. treasury yields at all time lows,

- Record U.S. deficits and treasury issuance,

- High yield credit spreads well inside long term averages,

- Covenant protections eroded for lesser quality credits,

- Illiquid private credit in vogue.

We suspect Codebreaker’s analysis would have resulted in multiple error messages and circular references. Astro batters would have been left standing in the batter’s box paralysed. The government bond and equity markets suggest the world’s spreadsheet is broken too. Central banks are trying to save the world by making money cheaper to offset that which cannot be offset. All of the above spell trouble to us.

Put Me In Coach, I’m Ready to Play

Canso is an active manager and the complexion and the composition of our portfolios changes as opportunities present themselves. We won’t always outperform in every reporting period but over the cycle we are confident we will. It’s not hard to act when you’ve been there many times before. We were buying Telus 18 years ago in 2002 at steep discounts and made a handsome return in a very short period of time.

Unlike the Astros, we rely at Canso on good old fashioned hard work as we strive to outperform the markets over the long term. No spreadsheet is a substitute for lending experience and managing through credit cycles, and we are very lucky to have the breadth and depth of experience of our investment team. When you look at Canso’s track record, the people responsible for that track record are still with us and still contributing.

Financial market success depends on whose agenda one follows. Most investors are dictated to and accept the conclusions and prices proffered by the markets, the companies that comprise the markets and the investment dealers who earn commissions trading the markets. Today’s dictation and consensus belief would have one believing interest rates are going to zero and the safety of U.S. treasuries is the place to be.

We take risks when our investors are adequately compensated for doing so. We are concerned by the extraordinarily low level of administered rates, the likelihood of substantially higher inflation post Coronavirus, the erosion of creditworthiness of the U.S. government and the general erosion of lending standards for lower quality corporates. We fear the recent violent fall in yields may reverse with an equally violent increase in yields. This is a very negative thing for longer duration fixed rate assets.