Dear Clients and Friends of Canso,

With all that is happening with the COVID-19 pandemic and the turmoil in the financial markets, we wanted to assure you that we are taking this medical emergency seriously and have been for some time. We also wanted to let you know that our offices are open, our investment operations are working well and that we are finding some great values in the markets.

We have been through a pandemic situation before. You might remember that one of the areas worst hit by SARS in 2003 was Richmond Hill. A patient was transferred from a hospital in Scarborough to Mackenzie Health in Richmond Hill before testing positive for SARS. One of our colleagues, Gail Mudie, was on the Board of Mackenzie Health at the time and was at a meeting when the patient was at the hospital. Gail was required to self-quarantine at that time. Several family members of our staff had also visited that hospital and were required to self-quarantine.

All of our staff members during the SARS outbreak are still with Canso, so we understood the potential impact on our operations shortly after the first instances of COVID-19 were reported and we prepared appropriately. We were also very fortunate to have several staff members from the Hubei area of China. They let us know in early January that this was a very serious medical problem, based on reports from their families.

We instituted our Pandemic Response Plan in January. This consisted of:

- Key staff members from all of our operational areas stayed out of our office and worked from home on a rotating basis. This ensured that no incident of infection would affect our entire staff;

- Employees with flu-like symptoms were required to report their symptoms and stay out of the office. This policy extended to employees with sick family members; and

- Our investment meetings were conducted using our secure Cisco Webex video conferencing system to ensure all those out of office were able to participate.

We have continued to implement our Pandemic Response Plan and have recently had all non-essential staff work from home and limited visitors to our offices and corporate travel.

On the investment front, we have been quite busy in recent days. As you know from our previous reports and newsletters, we had been increasing in quality in our portfolios, as we sold many of our lower quality positions into the strong credit markets of the past few years. This meant we had built up considerable weights in very high quality and liquid securities, including covered bonds and NHA MBS. With the sell off in “risk assets” due to the COVID-19 scare, we have seen great values emerge in a number of issuers.

The markets have been quite illiquid, as market makers have stepped back and have only traded on an agency basis for clients. Even the U.S. Treasury market has been illiquid, despite the various Fed announcements and “accommodations”. Traders have told us that the average trade size in the Treasury bond market has been reduced to $30 million, with traders still seeking to build in a substantial margin on trades to protect against adverse moves.

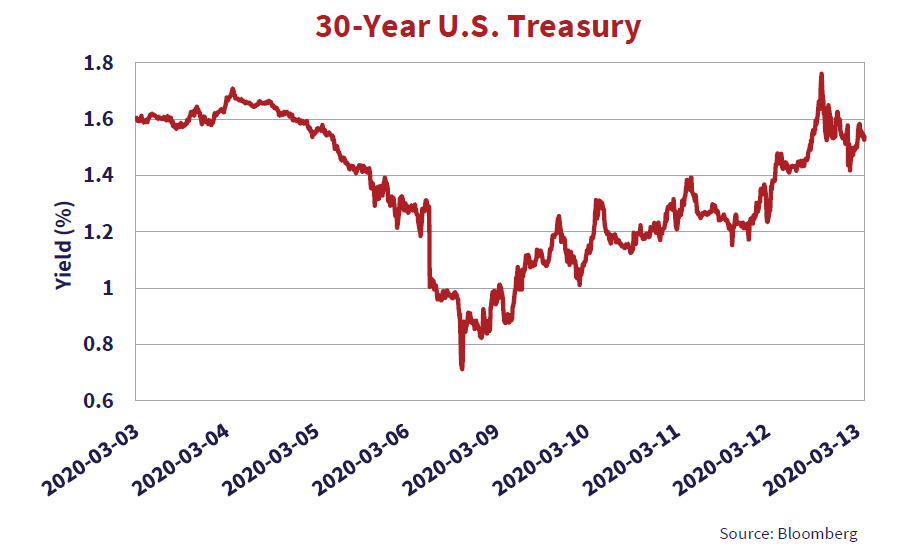

This has created a very interesting situation where large movements in yields don’t really represent market consensus or future forecasts, rather they indicate a particular trade at that time which has unsettled the markets. This was the case on Thursday where a “risk off” day with a record stock market decline ended with long Treasury yields actually increasing!

Our quick take on things economic is that the dislocation from COVID-19 creates a severe “air pocket” in both demand and supply that will eventually be remedied by a restoration of both as things get back to normal. The demand drop in travel, conferences, restaurants and hotels will take much longer to work out, based on how long lasting the changes in behaviour finally are. After 9/11 in 2001 and SARS in 2003, there was a lengthy period of several years before travel and recreation went back to pre-crisis levels.

The long end of the bond market seems to be picking up on the willingness of politicians to bend both monetary policy and fiscal policy to their electoral needs. It seems to us, as we’ve stated in our latest newsletters, that conservative fiscal and monetary policy has been sacrificed on the altar of populist politics.

The current response to COVID-19 by central banks around the world is proof positive that they have been very politicized and believe their policy priority is to rescue financial markets from their stupidity and keep the economic engine oversupplied with cheap credit of all types.

The proper response to this situation would be targeted short-term fiscal stimulus like paid leave and no cost medical treatment for individuals sick or quarantined, with assistance to industries that have been negatively impacted. That said, it is very difficult to cut a benefit or program once it is in place. We remind you that income taxes were a temporary measure in western democracies to fund the First World War!

The chart above shows the yield of a 30-year U.S. Treasury bond, which was 1.5% at the time of writing. It had dropped as low as 0.71% on Monday March 9th as the COVID-19 situation worsened. Interestingly, it has been in an upward trend since then, as bond investors seemed to realize that the prospects for inflation were not grim and that further fiscal stimulus meant no looming shortage of long-term government debt. We were surprised that long Treasury yields actually increased on the day of the record stock market drop on Thursday, March 12th. Yields then increased further on Friday, staying up even after the Fed announced that it would buy long bonds!

We have to agree with Mr. Market on long Treasury yields. It does not seem to us that 1.5% is a great deal with U.S. inflation running at 2.4% and the Fed targeting 2%. When things get back to a reasonable “normal” and the Fed striving to please politicians, the risk is for higher inflation, not lower.

We are taking advantage of the illiquidity in the markets to buy bonds at very attractive yield spreads. The distress in the markets has seen prices of some reasonable bonds drop by 30-50%. We are selling down high quality and very liquid bonds that we bought over the past few years to make these purchases.

We always find the markets “difficult” when we cannot find good investments at reasonable prices. Contrarily, we are now finding great values while most other investors find the markets “difficult”. We look forward to adding considerable value to your portfolio in the days and weeks ahead!

If you have any questions about our Pandemic Response or our investment activities, please give us a call.

Sincerely,

John Carswell

President and CIO