Dear Clients and Friends of Canso,

We hope this letter finds you healthy and our thoughts are with you and your families in this time of medical, societal and economic turmoil.

Canso Is Open For Business

As you know from our letter last week, we implemented our Pandemic Response Plan in January. Our major investment in technology has permitted us to move to remote operations for most of our staff. We still have a small group working at our offices, but we are preparing to operate completely remotely if we cannot use our offices. We have been quite active in the markets over the past couple of weeks and we thought you would be interested in hearing about what we are doing in the midst of the recent sell off in the financial markets and get our take on what is going on.

A Great Time to Buy Corporate Bonds!

You know about all the bad news on COVID-19, the economy and the financial markets but there is also some good news that we thought we should tell you about. Our very conservative positioning protected your corporate bond portfolios and we have been finding amazing values in the market carnage. There are very cheap securities out there and this is an amazing time to invest in corporate bonds. If you have large positions in cash or government bonds, this is the time to use that liquidity to buy corporate bonds and loans from those who have to sell. As I told a client recently, “If you give us cash now, we can put it to work and probably make you a lot of money”.

What We Are Seeing in the Markets

You are well aware from reading our newsletters over the past couple of years that we thought the credit markets were overvalued and frothy. We thought the next crisis would be a market sell off and not a problem with financial institutions like the Credit Crisis of 2008. We also worried that if markets started down for some reason that leveraged credit funds would be forced to liquidate and ETFs that invested in equities, corporate bonds and loans would be under severe pressure to sell their holdings. This is now happening.

We never expected the cause of the market downturn to be a virus pandemic with large sectors of society and the economy just shutting down. The stock market was reaching new highs just a month ago in mid-February, a full month after the scale of the COVID-19 problem became evident in China.

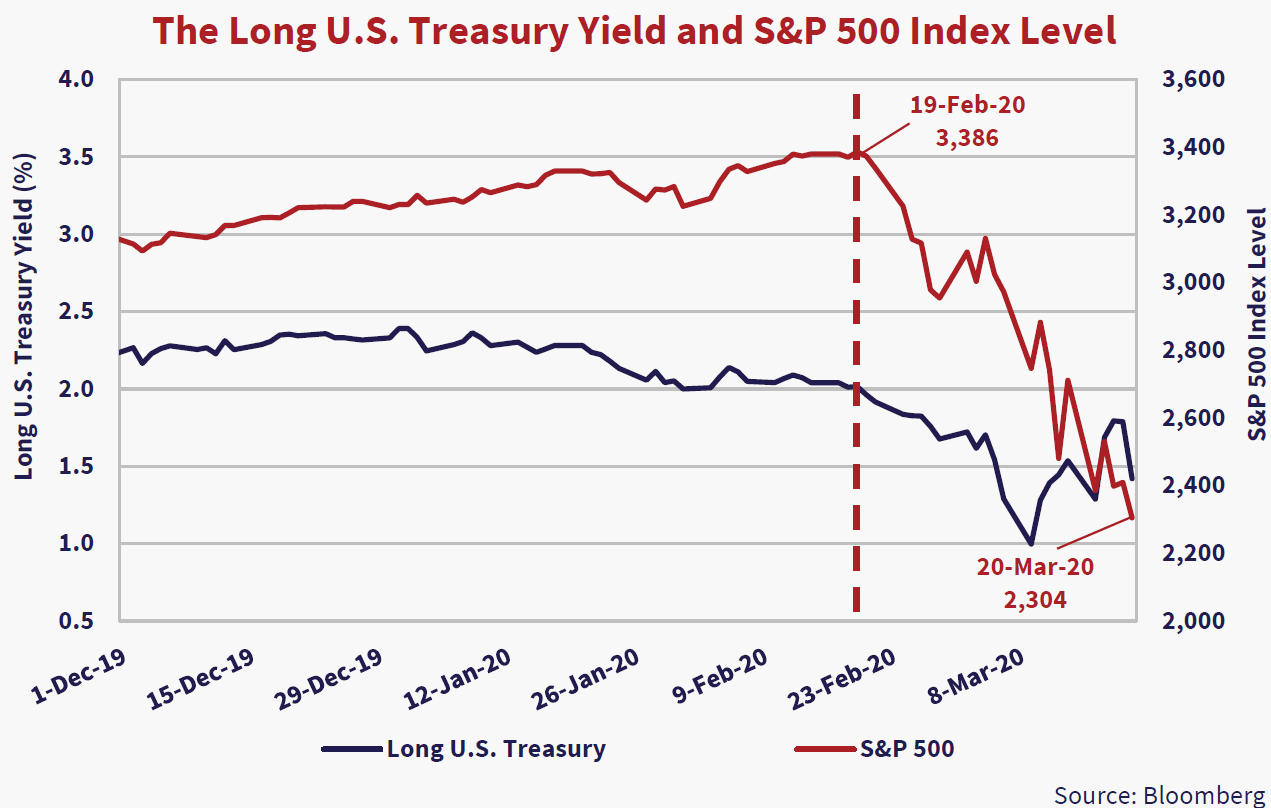

The sell off began with a vengeance in early March with a huge plunge on Monday, March 9th of -12% and things have been downhill since then. As the chart below shows, the peak of the S&P 500 Index was 3386 on February 19th. The S&P hit 2304 on Friday, March 20th. The sheer market violence of a major stock index falling -32% in a little over a month is breathtaking. This put stocks down -28% year-to-date in 2020. Other “risk assets” in the U.S. were hammered as well, with the ICE BofA U.S. High Yield Bond Index down -17% on a year to date basis.

U.S. Treasury bond yields initially fell on the initial equity collapse in a “flight to safety”. When the stock market was hitting new highs in mid-February, the 30-year U.S. T-Bond was just over 2% but hit a low record yield of .7% on March 9th, the day the equity market had its grim sell off.

It then started to rise quite dramatically to 1.9%, a full 1.2% higher in just over a week on March 18th. In the next couple of days, it declined just over .4% to close this past Friday at 1.45%, despite all the pledges of support from the Federal Reserve.

We explained last week that it was hard to draw economic conclusions since bond yields were moving on very light volumes. We also told you that monetary policy was not the answer to the problem of economic activity just stopping dead, despite the emergency moves to lower Fed Funds to zero by the Fed. The price and availability of credit had very little to do with the actual problem of disappearing revenues and jobs. We believed that the answer was fiscal policy, with programs targeted at the businesses and consumers now without income.

What a difference a week makes! We are frankly amazed about what is now happening with the scale and scope of the large spending programs in the U.S. that are being put in place to deal with the economic damage from the COVID-19 pandemic societal distancing. The numbers are staggering. At the time of writing, Congress is still debating the legislation, but we expect it to eventually to pass. The initial $1 trillion stimulus program has now jumped up to $1.8 trillion. This includes small business loans, payments to households, improved unemployment benefits and $4 trillion in lending by the Federal Reserve to affected industries.

The best we can say is that the U.S. government is doing what it has to do but the increase in Treasury bond yields reflects that there will be a lot of Treasury bonds sold to support the cash injections into the U.S. economy. The Trump Administration had already been running unprecedented peacetime deficits with 2018 at $800 billion and 2019 forecasted at $1 trillion with an optimistic growth assumption of 3%. The proposed spending, which is likely to increase, will triple the deficit to at least $3 trillion and will probably be much higher due to the drop in economic activity and tax revenues.

Governments all over the world are contemplating similar programs. Economists have no idea when the health problems will be over, as their medical colleagues struggle to figure out how long the “social distancing” is required. Our best guess is that it will be at least 2 quarters of severely reduced or no revenues for many companies and their employees. There will be an eventual recovery and rebound but it is very hard to predict the “knock on” effects.

The Few Bidders are Setting Prices

Government support programs are coming but the current stress is driving companies to draw their bank lines and issue bonds to cover the expected shortfalls in revenues while they wait. When the equity markets collapsed in March, the credit markets went “no bid”. Secondary trading has seen corporate bonds move to very wide spreads as markets are illiquid and investors are frozen in fear and indecision.

We have told you repeatedly “liquidity doesn’t matter until it’s the only thing that matters”. This is very true right now. It doesn’t really matter what you think your bond is worth if you have to sell because of a margin call or your index portfolio has withdrawals. There are many sellers and few buyers right now so whatever bids exist are setting the prices. Buyers like us are using up their scarce liquidity and want to be compensated for using up their capital and are demanding a very high yield.

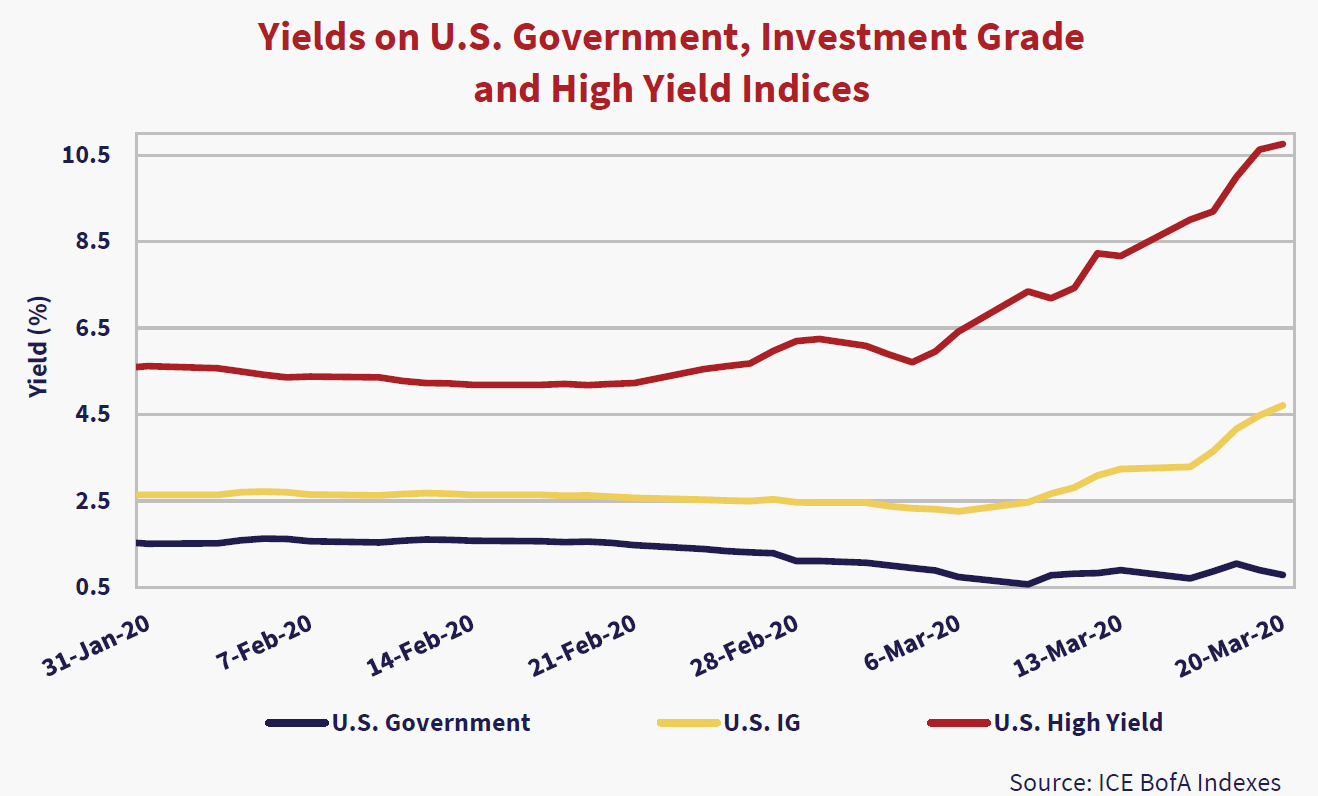

The graph above shows the yield of the ICE BofA U.S. Government, U.S. Investment Grade and U.S. High Yield Indices. This shows that the yields for the private sector have increased substantially despite the drop in U.S. Government yields. At December 31st, 2019 the ICE BofA U.S. Treasury Bond Index had a yield of 1.8% with the U.S. Investment Grade Index at 2.9% and the High Yield at 5.4%. Today, the U.S. Government Index is .8% for a decrease in yield of 1%. The Investment Grade Index has increased in yield to 4.7%, up 1.8%! High yield bonds had a yield of 10.8%, up 5.4%! This means the private sector is seeing the perfect credit storm, with no revenues for many companies and very high interest rates on any credit that is available.

What We Are Seeing in the Markets

Our investment research team is “triaging”, looking at issuers quickly and thinking about what their “normalized” situations will be and how they will get through this period, much as we did in the Credit Crisis. Our portfolio management and trading teams have been very active, particularly in the U.S. markets, where there has been much more liquidity than in the Canadian credit markets. Corporate traders were essentially frozen by the carnage in equity markets apart from brief periods of elation when the equity markets rallied at the Fed “emergency” rate decreases.

The first week after the equity market sold off hard on Monday, March 9th saw markets very illiquid. We were able to buy reasonable amounts of distressed bonds in the U.S. during this week. Most of these purchases seemed to be liquidations by leveraged credit funds, forced to sell by margin calls. We funded this with sales of our NHA MBS positions that we sold at small discounts to buy much cheaper bonds.

Canada was particularly illiquid in corporate bond trading, as the major bank owned investment dealers had reached the maximum trading books allowed by their risk management. The Canadian banks were also under capital and cash constraints as banking clients drew down on their bank lines to prefund their businesses. Banks needed to fund this cash need so traders had little room in their already brimming inventories.

At one point, a major bank fixed income desk refused to bid on their own covered bonds, the most senior and highest rated bank bonds at AAA. We had seen this behaviour during the early days of the 2008 Credit Crisis, so things were not good in the Canadian credit markets. There was little trading in the Canadian corporate bond market and the valuations of Canadian dollar bond issues did not reflect the much wider spreads of the same issuers in the U.S. market. One Canadian corporate issuer saw its USD long bonds trading well above 400 bps while its Canadian equivalent issue was not trading but still being “marked” by Canadian traders at 250 bps.

Markets Opened Up Last Week

This past week saw the U.S. credit markets open up with the Federal Reserve reactivating a Credit Crisis era Primary Dealer Repurchase facility. This allowed U.S. investment banks to pledge a wide variety of collateral to the Fed in exchange for cash that freed up capital and produced cash to fund loan draws and trading books. The Fed is also creating the securitized SMCCF that will purchase “secondary market corporate bonds issued by investment grade U.S. companies and U.S.-listed exchange-traded funds whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds. Treasury, using the ESF, will make an equity investment in the SPV established by the Federal Reserve for this facility.” This should help things as well by providing liquidity to the corporate bond mutual funds and ETFs that have to sell to fund withdrawals.

The most impressive development of last week was the new issuance in the U.S. and even the Canadian market. This started on Tuesday with a U.S. $2.7 billion deal by Exxon Mobil at very attractive spreads. We bought a major position in the 30-year offering. The following days saw a number of new issues for Disney, Coca Cola, UPS and Intel, some of which we participated in. Canada saw a 5-year issue by Bell Canada at a very wide 290 bps that we bought for accounts.

We were very active in the U.S. secondary market and we finally were able to do some reasonable size in our home market. The Bank of Canada (BOC) created a Repurchase facility for Bankers Acceptances (BAs) that will allow Canadian banks to fund the bank loan draws by their clients by converting them to BAs pledging them as collateral to this facility. The BOC has also created a funding mechanism for Canadian financial institutions that will allow them to borrow against a wide range of collateral pledged to the BOC. We are hopeful that this will allow Canadian investment dealers the room to buy corporate bonds and create liquidity for Canadian corporate bonds, particularly in high quality bank bonds.

Buy Corporate Bonds When Things Appear Darkest

We have been trading hundreds of millions of bonds over the past two weeks, with more than a billion in trading in one day last week. Liquidity will eventually improve with the government support and central bank liquidity programs but the uncertainty about the economy and company prospects mean that corporate bonds and the equity markets will struggle for some time.

As you know, we sell when others are buying and buy when they are selling. We are certainly now buying. We think the next few weeks are the time to buy corporate bonds, as they will see their cheapest levels when things appear the darkest. Please contact our Client Service team if you want to increase your allocation to corporate bonds and/or bank loans.

Sincerely,

John Carswell

President and CIO