Oh, Those Russians

Not since German singing sensations Boney M belted out “Ra Ra Rasputin” has a Russian received so much air time in the good old USA. From conspiracy, to hacking, to spying, Russia’s President Putin has been accused of just about everything in the last 6 months – everything, that is, except financial speculation.

Truth be told, if Mr. Putin were so smart, wouldn’t he have shorted the bond market and gone long the equity markets in anticipation of his new best friend Mr. Trump’s shocking presidential win? Surely the financial windfall would have been more rewarding than simply foiling Secretary Clinton’s bid for the White House.

We at Canso predicted neither the Trump victory nor the subsequent stock market rally that followed. As Arthur Fonzarellie once struggled to admit in Happy Days “we were wwwwrrrrr [wrong]”. Humility aside, we point out we’ve been calling for interest rates to move higher since Obama’s first term and, at least for the moment, we seem to have been vindicated.

Rave On It’s A Crazy Feelin’

It would be an understatement to say it has been an upside-down time in US politics and indeed US history. Not since Lyndon Johnson showed off his gall bladder scar has a Commander in Chief demonstrated so little public awareness and tact. No matter how absurd the claim or ridiculous the fabrication in President Trump’s tweets – the financial markets seem to be taking it all in stride.

Trump’s tweets have overshadowed what in normal times would have been enormously important events including the Oscar mix-up (“The winner is La La Land, no wait…”), the Cubs winning the World Series and Brangelina’s divorce. With normal news pushed to the back pages of the internet, there doesn’t seem to be much room for good old fashioned financial reporting either. It is now passé to speak of Brexit implications, deficit concerns or quantitative easing. Infrastructure spending, tax cuts and regulatory relief are today’s good copy. A new age is dawning where headlines suffice as news. Why fret the details when everyone is getting rich being long stocks!

Tangled Up in Blue

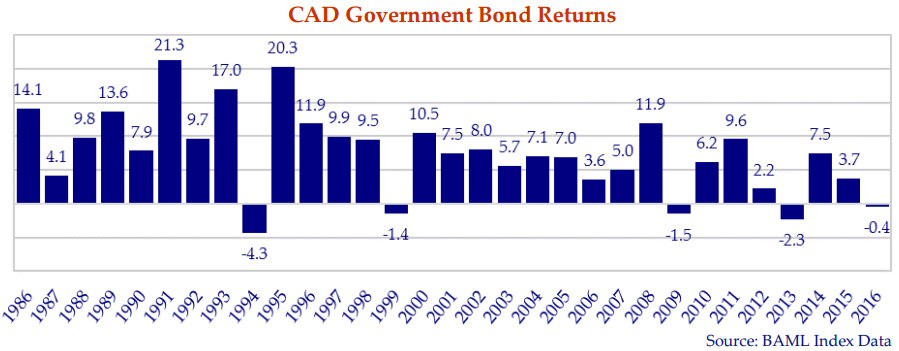

Following Trump’s victory, equity markets soared while bond markets slumped. For bond investors, the available clichés are many: “it is hard to be right all the time”; “for every winner there is a loser” and; of course, “what goes up must come down.” For the Canadian government bond investor, lower bond prices have been tough medicine to swallow. Many are gagging since the Canadian bond market has generated positive returns, often generously so, in all but 5 years since 1986 as can be seen in the chart below. Owning government bonds as yields declined was an easy game to play.

The game has not proved so easy of late. Over the last 8 years, Canadian government bonds generated negative annual returns 3 times. It is not out of the question 2017 could produce the heretofore unthinkable – two consecutive years of negative government bond market returns!

The Fed is poised to hike rates multiple times this year, inflation appears to be making a comeback and Canadian rates remain stubbornly below US levels. All these factors suggest 2017 could be another tough year for Canadian fixed income investors. In Q4 2016 government bond markets fell 4.0%. Fixed income investors are on edge.

Where Do We Go From Here

Yields bottomed after Britain’s Brexit vote in early July and then rose steadily through Q4. Fixed income investors finished 2016 feeling at best bruised and at worst downright blue.

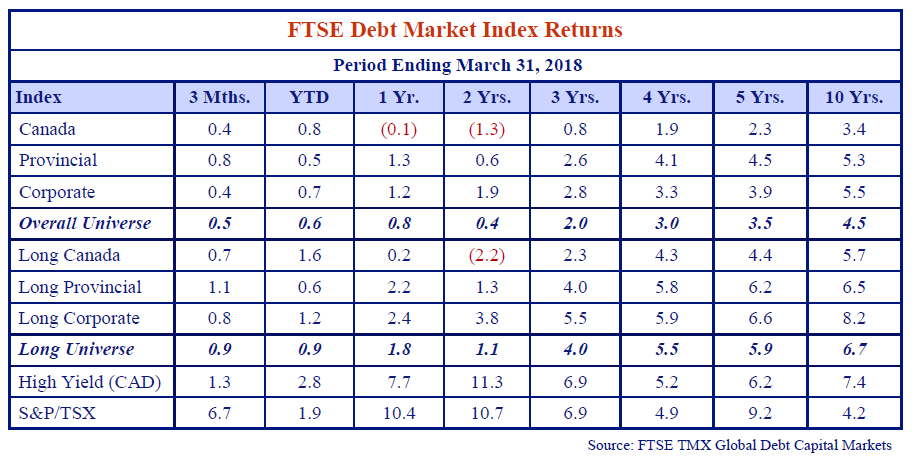

Corporate bonds were the way to avoid the worst of the bond downturn. Steady spread compression from February 2016 through the end of the year drove outperformance in Investment Grade Corporates versus Provincials and Canada bonds. Corporates returned 3.7% for the year versus 1.8% for Provincials and negative 0.3% for Canada bonds. The backup in yields in Q4 overwhelmed the positive impact of spread compression as Corporates generated a negative 1.8% return but still outperformed versus Provincials negative 4.9% and Canada’s negative 3.9% returns.

We’ve written extensively in past newsletters of the dangers lurking in longer duration strategies and of reaching for yield out the curve. Losses in longer duration securities were amplified in Q4 as rates backed up in both Canada and the US. Long Canadas generated a very negative 9.4% return, long Provincials negative 4.9% and long Corporates negative 5.1%.

High yield investors, regardless of politics, found 2016 a year of pure joy as the 16.9% return of the Canadian High Yield Index and 17.5% return of the US High Yield Index trounced all other bond markets as energy bonds came roaring back from their February lows. High yield returns were within a 9 iron of the dizzying 21.1% return of the TSX.

Big Yellow Taxi

Politics aside, a few short months ago the markets fretted about low growth and negative bond yields. Fast forward and today the press is full of apocalyptic predictions of soon to be sky-high US treasury yields. It is now cool and consensus to speak of Federal Reserve balance sheet reduction ($5+ trillion of US government bonds inventory), Chinese US treasury sales ($1+ trillion in holdings) and, wait for it, higher inflation (recent print of 2.1% annualized), none of which are positive for US government bond prices.

“Don’t it always seem to go that you don’t know what you got till its gone” sang Joni Mitchell. The Obama presidency if nothing else will be marked by both its relative civility and extraordinarily low interest rates. The US election campaign destroyed any notion of a kinder gentler America. The bond market backup since Mr. Trump’s election is threatening to assign the Post Credit Crisis jargon of “Low for Long” and the “New Normal” to the scrap heap of investment sloganeering.

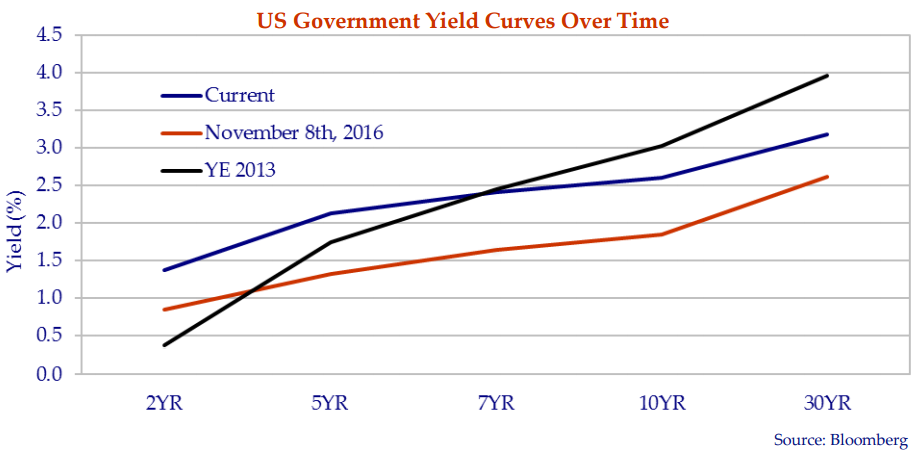

The Blue line in the graph above is the current US government yield curve. The Red line is the curve on November 8th, 2016 election day. As of today, 30 year UST yields are up 54bps and 10 years up 71bps since November 8th and an even greater 84bps and 97bps, respectively, since September 30th, 2016.

Looked at another way, if you purchased a 30 year US Treasury bond on September 30th to lock in a low risk return in an uncertain environment – snake eyes. Fast forward to today and congratulations – not only is Donald Trump your President – you’ve lost 16.4% on your bond investment. Not your grandfather’s White House and not your grandfather’s fixed income return.

I Knew You Were Waiting (For Me)

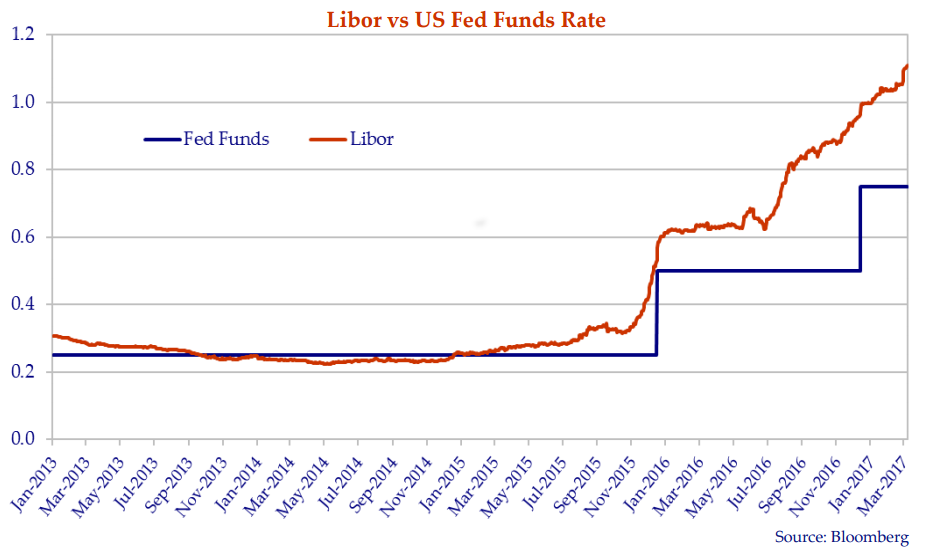

At the Federal Reserve’s December meeting, amidst all the Trump induced chaos, Janet Yellen kept her cool and did what everyone expected her to do – raised the Fed Funds rate 25bps. The Fed’s first action in just over a year came on the back of higher inflation numbers and higher bond yields.

After nearly a decade of worrying about raising rates too quickly, the FOMC now appears concerned with moving too slowly. It is quite possible the FOMC will raise the Fed Funds rate two if not three times in 2017 – including as early as the March 15th meeting.

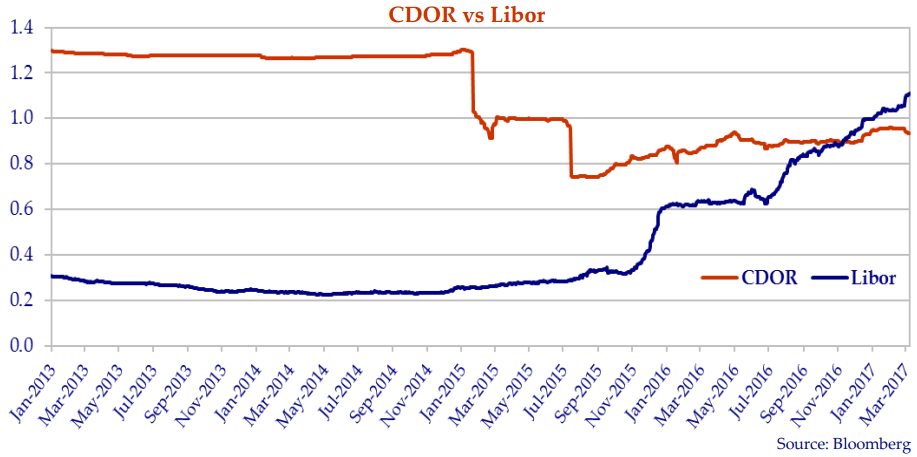

The graph above charts Libor (London Interbank Offered Rate) – the rate banks lend to each other in the overnight market versus the Fed Funds rate – the rate the Fed lends to banks in the overnight market. The current differential stands at 35bps.

In our view the US economy is doing well, the prevailing political winds are inflationary and unemployment has more than halved since the depths of the Credit Crisis. With all of that we believe the Fed Funds rate remains artificially low. The path is set for administered rates to move higher and the market would appear to be charting the path for the Fed to follow.

North Country Blues

In Canada, we remain concerned with high consumer debt levels, inflated housing prices and sluggish manufacturing activity. The recent measures introduced by the government to control the ‘frothy’ housing market are welcome, long overdue and not guaranteed to work as long as Canadian interest rates remain low. Canadian households are vulnerable to even a modest rise in interest rates.

At its March 1st meeting, the Bank of Canada kept rates unchanged – the target for the overnight rate at 50bps where it has stood since the Bank last cut rates in July 2015. The BOC’s outlook for economic growth for 2017 and 2018 remains a modest 2.1%. The Bank highlighted the importance and the uncertainties of US trade policy to its forecast. As administered rates in the US move higher there will be pressure on the BOC to adjust Canadian rates.

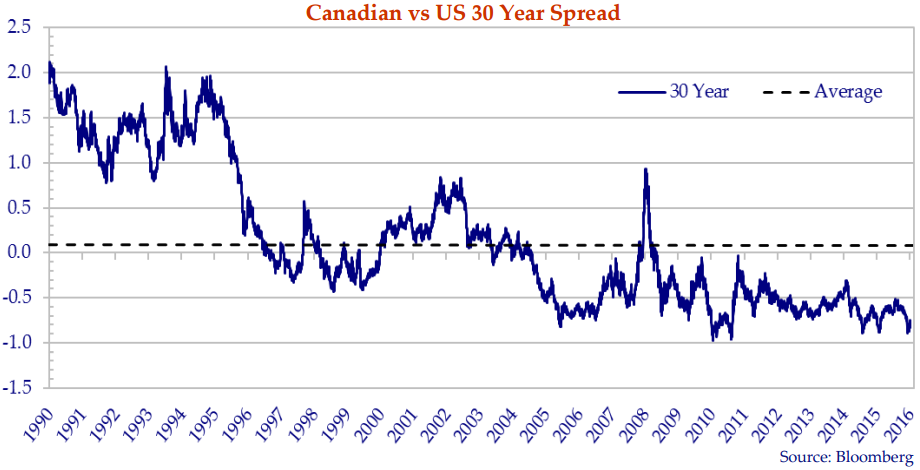

The chart above shows the spread between CAD and US 30-year government bonds. Until the mid 1990s, Canada long bonds traded 1-2% in yield above their US Treasury counterparts. In recent times CAD bond yields (except for administered rates) have been well below the US. We think this is unwarranted as weakness in the Canadian economy and risk inherent in high Canadian consumer debt levels do not justify a Canadian “premium”.

Hallelujah

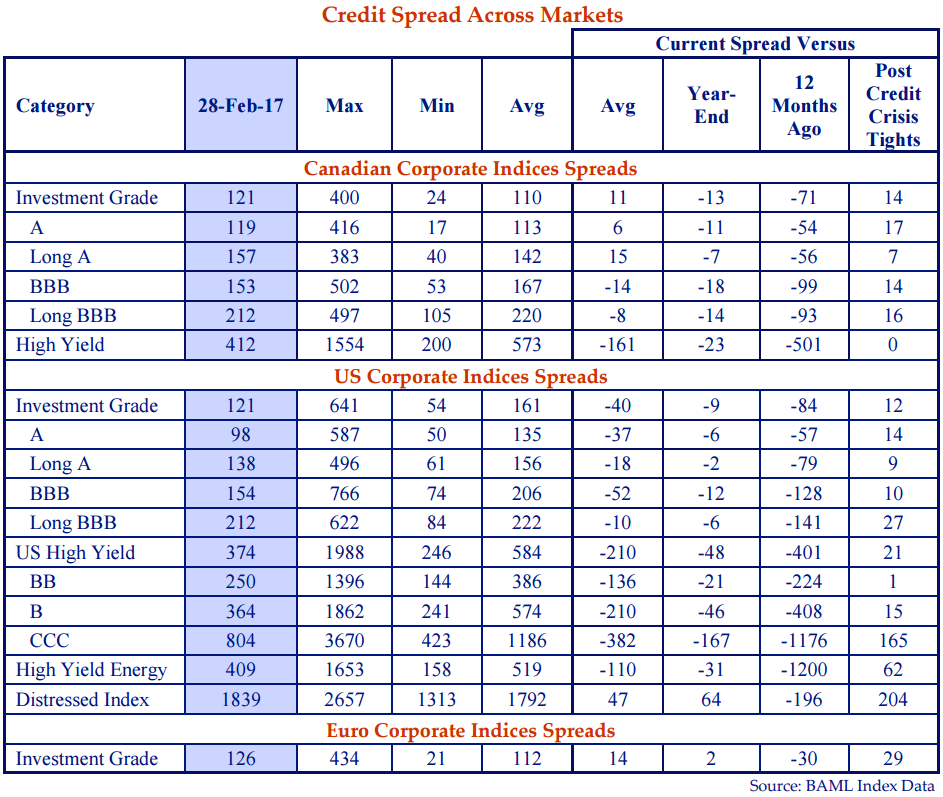

Following a dramatic widening in February 2016, corporate credit spreads began a near straight line march tighter. Contracting credit spreads drove the outperformance of Canadian and US corporates versus other fixed income markets in 2016.

In Canada BBB, long BBB and high yield spreads are trading through historic averages. In the US all categories are trading through historic averages except for the Distressed Index. The High Yield Energy experienced the most dramatic reversal with spreads compressing 1200bps (12%!) since February of 2016, even though energy prices are well below their peaks. All corporate categories are approaching post-Credit Crisis tights of June 2014.

We talk and write often of how we assume risk when we are compensated for doing so. Our portfolio management process occurs through a series of individual security selection decisions each based on its own relative value merits. In this environment, these individual decisions have led to security selection of securities with shorter duration and higher credit quality coupled with select special situations. Our bias is to higher quality.

In My Secret Life

At Canso, we do bottom up fundamental company analysis. We dig through financial statements, read notes not even auditors read and talk to management (and then talk amongst ourselves about management). We study trust indentures and read prospectuses as if our lives depend on it because, well, our lives do depend on it. It is a tough job but that is what our clients pay us to do. Our analysis is as exhaustive as any analysis can be.

We are often asked to share specifics of our research process with clients. “Do you have a checklist you maintain for each credit?” is a common question. We know other investment firms discuss the importance of completing the “checklist” before making an investment decision. There is no magic solution to effective investment research and analysis. We think common sense and hard work are our secret sauce. We conduct thorough and independent analysis and only assign our Canso ratings and Maximum Loss when we are satisfied we have done all we can. We complete our extensive analysis of issues and issuers before they are purchased, not falling prey to the frenzy of hot markets.

Recent high profile white collar corporate casualties illustrate the limitations of checklists and due diligence in general. In a short span in 2016 Wells Fargo CEO John Stumpf resigned in a cloud of controversy after it came to light millions of bank customers were defrauded. Leon Cooperman, legendary hedge fund investor at Omega Advisors, was charged with insider trading. Roger Ailes, the CEO of Fox News, was shown the door after accusations of sexual misconduct surfaced. It seems some of those at the top just can’t help but bend the rules.

We bring this up to highlight that even the most thorough due diligence work may not have uncovered any of the transgressions noted above. Tenacious analysts also could not have predicted the Deepwater Horizon blow-up (BP), bribing government officials (SNC Lavalin) or an emissions scandal (Volkswagen). Our analysis approach is thorough and our emphasis on Covenant and Indenture analysis ensures when the unexpected happens we understand our remedies and recourse. Our Maximum Loss discipline ensures we do not bet the farm on any singular investment.

Knockin’ On Heaven’s Door

The world has said goodbye to some amazing musical talents over the last 12 months including David Bowie, Prince and a few we’ve referenced in this newsletter, George Michael and Leonard Cohen.

We also acknowledge the passing of golfing legend Arnold Palmer. Arnold’s approach to golf provides a number of lessons for investing in the financial markets. In an interview published in Harvard Business Review Mr. Palmer noted:

“The most important thing is to establish a system you have confidence in and rely on it when you get into tough situations. I’m talking about techniques, the fundamentals of the game you’ve practiced all of your life”

At Canso our 27 person strong investment team applies a well defined and proven process. Our process emphasizes both upside and downside analysis. Our collective investment approach results in a determination of a Canso rating and Maximum Loss for every security we purchase. The continuity of our investment team ensures our techniques remain consistent. Mr. Palmer continued:

“My father…told me that I could start talking to coaches and listening to all the advice they’d give me about my game – or I could play my own way.”

In short there are lots of people willing to tell you what to do, how to do it and of course how they could do it better. At Canso, our success depends on disciplined, independent analysis. We do not rely on nor pay attention to Bay or Wall Street analysts or strategists, rating agencies or market pundits. Thankfully our Richmond Hill location ensures we rarely cross paths with these types.

“When I lost, I always learned something to help me in the next situation.”

Within the investment industry it is not cool to admit you aren’t perfect. At Canso we are more than willing to own up to our mistakes and believe if you’ve never made a mistake you likely aren’t taking enough risk. Canso’s Maximum Loss discipline ensures if we do misjudge an investment the performance impact on portfolios is limited.

Shelter From The Storm

Higher government bond yields and tighter credit spreads summarize 2016’s credit market activity. What lays ahead for the balance of 2017? We have cautioned for an extended period of the risk of increases in interest rates – both administered (overnight rates) and market determined (the yield curve) and believe interest rates in both the US and Canada will move upwards. We believe credit spreads are nearer fully valued than at attractive levels.

We are increasingly finding higher quality bonds better value than lower quality issues and floating rate debt more attractive than fixed rate. As a consequence, across our mandates we have stocked up on high quality floating rate notes – assuming credit risk without the associated interest rate risk. We prefer to be early as opposed to late for our floating rate trade since it doesn’t take much of a yield increase to knock down the price of a fixed rate bond. That being said, we still hold some longer dated BBB rated securities and select special situations with attractive valuations.

Closing Time

We remind our clients and ourselves that successful investing generates returns over long periods of time and through the extremes of economic, financial and political cycles. We will adjust over time as opportunities present themselves. We are comforted that no matter the season, year or decade, the financial markets prove remarkably inefficient. When not compensated for risk we will not assume it and will accept short periods of unexciting results to set our portfolios up for long term outperformance.