As our readers know, apart from generating great performance for our clients, nothing gives us more happiness than finding the perfect alignment of song lyrics and financial markets.

This may seem a strange indulgence but cut us some slack; we work in the suburbs after all. Perhaps it has something to do with the fact our office, in what the Toronto Star termed an “anonymous office building” is located in the “Entertainment District” of Richmond Hill. Perhaps it’s that our investment creativity spills over into our newsletter writing.

That said, the incredible 2014 bond market rally left us scratching our heads for a perfect opening line. The question was what chord (pun intended) to strike:

Celebratory: “We’re Having a Party” by Sam Cooke?

Carefree: Poison’s “Nothin’ But A Good Time”

Cautiously optimistic: “This Beat Goes On” by The Kings?

Apologetic: “I Don’t Want to Spoil the Party” by The Beatles?

Downer: “End of The Line” by the Travelling Wilbury’s?

Downright confused: “How Bizarre” by OMC?

We’ve settled on “You Can’t Always Get What You Want” by the Rolling Stones. At the end of 2013 we expected the U.S. economy would continue to recover in 2014, Quantitative Ease (QE) would be ended and that bond yields would continue rising. We also didn’t think the Fed would actually raise short-term interest rates in 2014.

As you well know, the U.S. economy continued its recovery in 2014, QE was ended, short-term interest rates stayed put but bond yields actually fell in 2014. Three out of four correct calls usually isn’t bad, but yields are all that matter to a bond manager.

Sometimes your logic can be flawless but Mr. Market, in his direct and brutal way, lets you know by his actions that what you think doesn’t matter a hoot. This is why we are bottom up security selection specialists versus top down interest rate anticipators.

What a Difference a Year Makes

With so many conflicting emotions, we thought it would be best to begin with a simple presentation of the facts. Suffice to say 2014 was an incredible resurrection for the bond market from its sell off in 2013. Yields fell and bond prices rose almost continuously, with the exception of high yield and bank loans that finally saw outflows and fell in price.

Despite the near unanimous predictions of interest rate increases, including yours truly, the markets defied expectations as 10 and 30-year rates closed the year .97% and .89% lower than at beginning of the year, at 1.79% and 2.33% respectively. All sorts of reasons were put forward to explain falling yields: the crisis in the Ukraine, Ebola, the rise of ISIS, the fall of the price of oil and, that monumental event in the bond market, the forced (or not) exodus of Bill Gross from PIMCO.

Yes, for once we had excitement in bond management circles. In our version of Survivor: Bond Market, Bill Gross was voted off the PIMCO island without recourse to an immunity idol or even a thank you from his colleagues in the firm he built almost single handedly:

“For some reason still unbeknownst to me, they didn’t think that was a good idea (Gross offered to scale back his role) and they did fire me,” Gross, who managed the world’s largest bond fund until his unexpected departure on Sept. 26 when he joined Janus Capital Group Inc. (JNS), said in the interview. “In the last few weeks, it blindsided me; I had no idea that an executive committee could fire a founder and the titular leader of the company.” Gross says PIMCO fired him after offer to scale back role, Bloomberg.com, January 12, 2015

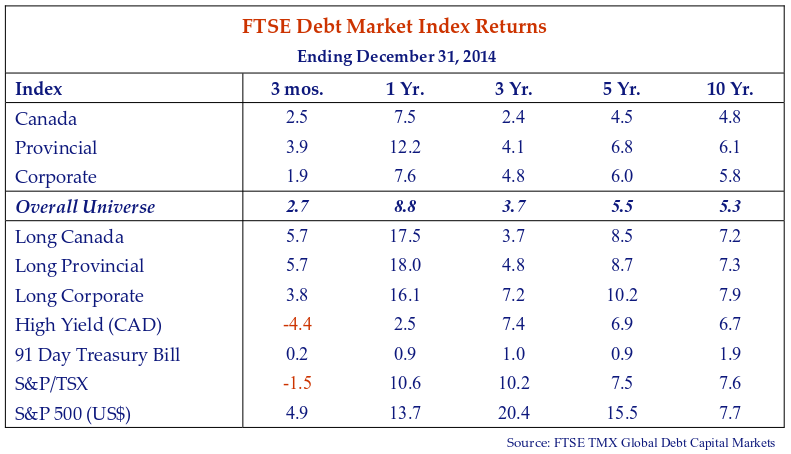

Regardless of why yields fell, they did, and bond investors reaped the benefits as a look at the table below of FTSE Canadian Debt Market Index returns for 2014 shows. Canadian government bonds returned 2.5% and 7.5% in the 3 months and 12 months ended December 31st, a vast improvement over the 2.3% loss registered in 2013. Longer duration Provincial bonds again benefitted the most from the decline in yields over the quarter, generating a 3.9% return in the last quarter and 12.2% for the year.

Corporate bonds, our investment of choice, returned 1.9% over the quarter and 7.6% for the year. The shorter duration of corporates and the second half yield spread widening resulted in only modest outperformance versus benchmark governments and underperformance versus longer duration provincials in 2014. The energy heavy High Yield index returned -4.4% in the quarter, under pressure from falling oil prices, and 2.5% in the 12 months ended December 31st.

It was interesting to us that the commodity heavy S&P/TSX actually outperformed supposedly “safer” Canadian High Yield bonds, generating a -1.5% return for the 3 months ended December 31st compared to the -4.4% return of the High Yield Index. The S&P/ TSX still returned an impressive 10.6% over the past year, again well ahead of the 2.5% for High Yield. Equities were strong globally with the S&P 500 U.S. equity index recording a 4.9% return for the quarter and a 13.7% for the year in U.S. dollar terms.

Every Picture Tells a Story

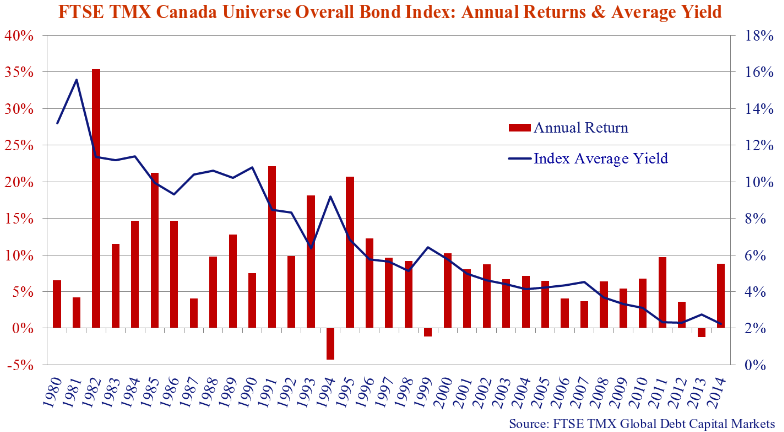

A look at the performance of the long indices in the table above shows that they “shot out the lights” with returns 7-8% above the market returns. All else being equal, in a falling rate environment, longer duration securities outperform. In 2014, long Canada, Provincial and Corporate bonds returned 17.5%, 18.0% and 16.1% respectively. Overall the universe returned 8.8% – a positive return for the 32nd time out of the last 35 years.

Bond portfolio managers with shorter durations are rueing the day that they decided to shorten term. A couple of years short of your benchmark in a year like 2014 is more than enough to get yourself fired. The pressure to end the pain will be inexorable. Bond managers are now trying to figure out how to sell their underperformance before the awkward client meeting moment. It is a much easier pitch to have the problem solved in advance. Many of those offside will throw in the towel and lengthen duration. We are watching the current run-up in bond prices in mid-January. We wonder how much of this rally is capitulation, as a technical analyst would put it.

Lengthening duration at present might not be such a great idea. The longer a bond’s term, the more sensitive it is to interest rate changes. The chart above shows Universe index returns versus the yearending yield on the index. As yields have fallen the duration on the Universe index has lengthened and the “cushion” provided by the income earned on the portfolio has shrunk considerably. If and when rates start to climb the impact on longer dated securities (and indices) will be dramatic.

At the risk of sounding like a broken record, a phrase likely as unfamiliar to younger readers as the singers and songs we reference, Canso theorizes that “normal” levels of short-term interest rates are at inflation plus 1-2%. With current inflation of 1.6% this implies short-term interest rates of 2.6 – 3.6%. A positively sloped yield curve implies long rates of 4.6 – 5.6%. Even with a flat or 0% inflation rate, bonds are now fully valued in the 2% range.

I See Red… I See Red… I See Red…

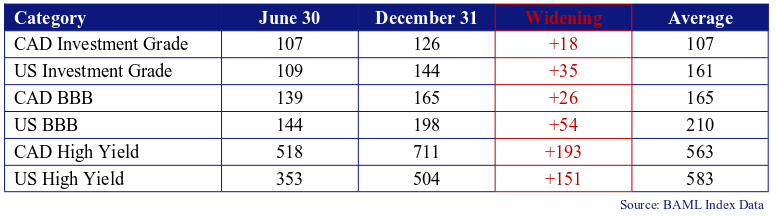

Investment grade corporate bonds saw wider yield spreads in the second half of 2014. High yield also saw significant spread widening and falling prices as outflows from high yield mutual funds and ETFs soared. The table on the next page shows the damage in the last half of 2014.

U.S. investment grade corporates widened 17 bps more than Canadian, but the significant energy exposure of the Canadian high yield index saw widening of +42bps more than the U.S. The Canadian investment grade and high yield indexes are now +19bps and +148bps wider than their historic averages. In contrast, U.S. yield spreads are -17bps and -79bps tighter than their historic averages.

A Slightly Different Take on One of Canso’s Favorite Charts

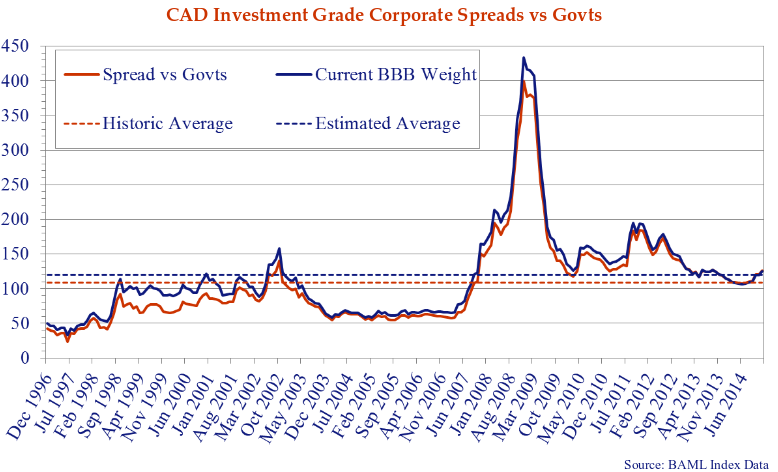

In previous Bond Letters we highlighted the growth in the BBB market in Canada. We stated our belief the increased percentage of BBB credits in the investment grade indices merited a higher aggregate corporate yield spread than in years gone by.

In the chart above we estimate the impact of the increase in BBB weight in the index from 5.2% in 1996 to its current 33.6%. We have taken the current BBB weight of 33.6% and applied it retroactively to the BAML Index. The average corporate spread moves higher to +119bps versus the actual corporate yield spread on the index of +107bps.

The current index spread is +126bps up from a recent low of +107bps touched in June. While off their recent tights based on our revised historic average investment grade credit markets are near fair value. Given the headwinds currently facing the Canadian economy including falling oil prices and the Bank of Canada’s suggestion that Canadian housing prices may be up to 30% overvalued the potential for a substantial compression in yield spreads seems unlikely.

The End Wasn’t Near

Despite the end of the Federal Reserve’s experiment with Quantitative Easing (QE), the anticipated “End for the Market” wasn’t near. While some analysts predicted doom times with the end of QE, U.S. economic activity has continued to impress and recent data suggests the expansion is accelerating. The U.S. economy grew at a near miraculous annualized 5.0% rate in the third quarter of 2014. This obvious economic strength is hard to discount. The Fed spent the majority of their 2014 PR time and budget preparing the markets for the end of their bond buying spree but also for the inevitable increase in short term rates. The rallying stock and bond markets caught many offside and perhaps forced the naysayers to finally “get invested”.

A New Type of Rig Count?

2014 was another trying year for the world’s major banking institutions as their past transgressions continued to haunt them. Those who research the oil and gas industry are familiar with the “Rig Count” of active drilling rigs. A new type of “Rig Count” now seems to be necessary for financial misdeeds of traders and their financial institutions.

The list of possible wrongdoings seems to include many popular financial activities, including Mortgage Backed Securities sales, LIBOR fixing and FX trading. Regulators might be accused of going easy on Wall Street over the Credit Crisis but now are hitting them with the constant drumbeat of continued lawsuits and even criminal charges for errant employees. The payments to settle with disgruntled investors and fines from unhappy regulators have been huge, not to mention the obviously expensive ongoing legal advice. This has restricted the banks’ ability to pay dividends and repurchase shares.

As an example, in December Citibank announced an additional $2.7 billion in legal charges against its Q4 results and a further $800 million in repositioning costs. In its statement, Citibank CEO, Michael Corbat stated “we believe these legal charges should cover a significant portion of our outstanding legal matters based on current information”. Well we should hope so! Add these charges to the $3.3 billion of similar charges taken in the first 9 month s of 2014, $3.7 billion of charges in 2013 and $4.2 billion in 2012. A charge of $11.2 billion over 3 years for one errant financial institution indicates the magnitude of the issue for financial institutions. Overall these settlements and charges are running into the hundreds of billions. While the traders and managers were getting great bonuses during the mania before the Credit Crisis, the collateral damage to shareholders has been immense.

That said, in spite of the ongoing financial cost of addressing past failures while never quite admitting to them, Canso continues to see ongoing financial and operational improvements in many of the global banks it follows. Improved capital ratios, reduced reliance on capital markets activities and increased regulatory scrutiny are all credit positives in our view.

Regulatory initiatives such as the European Central Bank’s recently completed Asset Quality Review, the implementation of the Financial Stability Board’s Total Loss Absorbing Capacity and Basel III’s Liquidity Coverage Ratio all enhance the stability of the global banking system in our view.

Still unresolved is any clarity on bail-in regimes and implications for bondholders in Canada and other jurisdictions.

We Liked Them So Much We Bought the Company

Private equity firms Carlyle Group and Warburg Pincus agreed to acquire the Canadian headquartered Dominion Bond Rating Service (DBRS) in November. DBRS was founded in 1976 by Walter Schroeder who is also a participant in the acquiring group. The rumoured acquisition price was $500 million.

We wonder what the fast talking, suspender wearing and private plane flying moguls see in a modest hard working Canadian rating agency more famous for its role in the Asset Backed Commercial Paper debacle than for its role in international finance? Despite the obvious and well established inadequacies of credit ratings, the acquirers apparently see a path to incremental riches through a global expansion plan and increased market share.

Does the world need a bulked up DBRS? People would often ask us why we didn’t just invest using credit ratings before the Credit Crisis. Our reply was that Credit Ratings were legally just an “opinion” and exceedingly unreliable. At the time, this was often met with stupefaction, if not disdain. We find it much easier now that most observers, including the U.S. government, disparage the obvious inadequacy of credit ratings.

Will DBRS gain at the expense of Fitch, Moody’s and S&P? We don’t know but we still believe that excessive reliance on credit ratings is the quickest road to credit oblivion. Keep in mind DBRS expanded rapidly in Europe just prior to the Credit Crisis and closed up shop almost as quickly as it set up.

Canadian bond market watchers will recall Canadian Bond Rating Service was acquired in October 31, 2000 by Standard & Poor’s Corporation. In the months that followed CBRS was absorbed into S&P and the CBRS name and ratings scale (who could forget B++ = BBB) consigned to the history books. That union resulted in the “normalization” of CBRS ratings with S&P’s global standards. In most cases that resulted in a rating reduction from a “Made in Canada” A rating to BBB. No such “re-evaluation” of existing ratings is expected following this acquisition.

I See A Bad Moon Rising

The recent plunge in oil prices has cut a wide swath through the financial results of oil and gas producers and shocked many of those who invest in the sector. Undoubtedly there will be casualties, with Southern Pacific Resources (Southern) apparently the first. Southern is a SAGD (Steam Assisted Gravity Drainage) oil sands producer. We owned the senior bank loan of this company but exited the position a few years ago. The bank loan was refinanced with a “senior” unsecured bond issue which we passed on. We thought that the growing shale oil production from the U.S. would eventually lower the price of oil. I guess we were right!

Overextended and high cost companies will be forced to restructure by reducing capital expenditure programs. Workforces will be slashed. Better capitalized firms will be able to bargain hunt though the going will be tough for weaker firms. Shareholders and lenders, particularly unsecured lenders, face some tough days ahead.

We have mentioned in past editions that the structure of the recent crop of Canadian high yield issuance has been very poor. Most deals allowed almost unlimited senior ranking debt in front of the unsuspecting high yield investors. The “Never Again” of people who were burned in the Credit Crisis soon became “Get Me In” when cash piled into high yield funds.

Canso avoided investment in oil and gas related securities for two principal reasons:

1. Potential high volatility of cash flows; and

2. Structural subordination of unsecured notes.

To illustrate the potential volatility of cash flows, most oil and gas companies disclose sensitivities to changes in commodity prices. We provide an example from Canadian Natural Resources Ltd. 2013 Annual Report below for illustrative purposes:

Most analysts optimistically looked at the above and calculated a WTI increase of $10 would increases cash flow by $1.2 billion! This thinking prevails during what we call the commodity mania. As credit analysts we are naturally skeptical and think the opposite – what if oil prices fall? Assuming WTI dropped to $50 from $92 on the 1st day of 2014 CNQ’s Cash Flow would have been reduced by approximately $6 billion. The hypothetical impact on Cash Flow to Total Debt is a drop from 75% to 13% – a material erosion in credit quality.

To illustrate structural subordination below is one of the Risk Factors from the Paramount Resources Ltd. Prospectus dated November 29, 2012 for the company’s $300,000,000 7.625% Senior Unsecured Notes Due 2019. We point out this covenant structure is not unique to Paramount or oil and gas companies for that matter:

“The Notes will be unsecured obligations of the Company…The Notes will be effectively subordinated to all existing and future secured obligations of the Company to the extent of the assets securing such obligations. If the Company is involved in any bankruptcy, dissolution, liquidation or reorganization, the secured debt holders would, to the extent of the value of the assets securing the secured debt, be paid before the holders of the Notes. In that event, a holder of Notes may not be able to recover any principal or interest due to it under the Notes.”

As of September 30, 2014 Paramount maintained senior secured credit facilities in the amount of $700 million (increased from $400 million in 2013) secured by the assets of the company and ranking senior to the unsecured notes. There are many things we don’t like but in a worst case scenario watching bankers take our security is top of the list.

The best management team with the best operations and the best laid plans is helpless in the face of the vagaries of the commodity markets. Rising commodities prices instill unbridled optimism while falling prices instills near panic reactions.

The impact on the Canadian bond markets of falling energy prices is particularly acute in high yield. Oil and gas related companies (including Paramount) comprise 34.6% of the BAML Canadian High Yield Index by market value or 20 of the 53 outstanding issues. On a Price Basis the index is down 8.4% since June!

“Who’s Cheatin’ Who?”

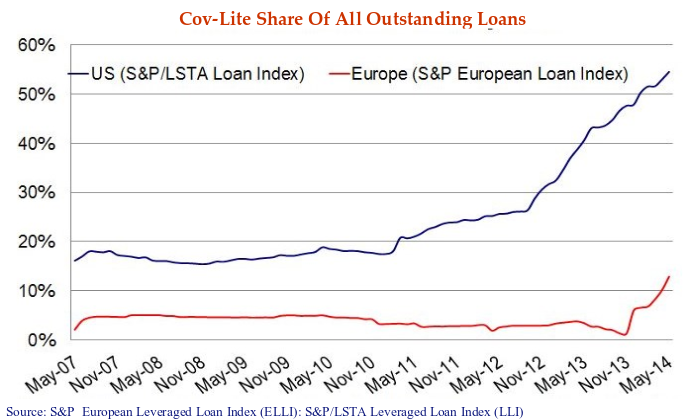

In previous Newsletters, Canso pointed out the pitfalls of “Covenant Light” deal structures and the incurable “madness” of the U.S. high yield and leveraged loan markets. We counselled first caution and then outright avoidance. We now present some statistics to back up our rants. Moody’s stated in an October report “Covenant-lite loans accounted for just 3% of total institutional loans in 2010, and now account for 60% of total loans.” The chart below confirms Moody’s assertion.

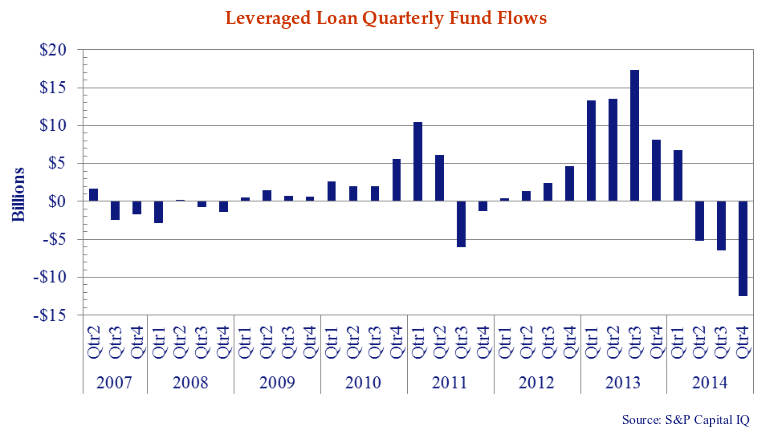

At a time when pricing was becoming more aggressive protections were becoming weaker. We suggested that the indiscriminate buying by ETF’s, Mutual Funds and most notably CLO’s that created this phenomenon as cash chased yield would eventually reverse. Selling began with a vengeance in the second quarter of 2014 and is now continuing unabated.

The distributors (formerly known as underwriters) of leveraged loan product are not interested in taking secondary loan positions onto their own balance sheets. Couple a reduction in risk appetite with the administrative burden of settling loan trades and this spells trouble for leveraged loan investors. We see continued pricing pressure in this sector.

Deal structures and pricing still heavily favour borrowers over lenders. That said there are many decent companies that have accessed the leveraged loan markets – just at rates we didn’t agree with. At some point opportunities will emerge. Until the market demands and can extract reasonable terms from underwriters and borrowers, we at Canso prefer to watch from the sidelines.

Apologies to Andy Warhol

On a few occasions when describing Canso’s investment approach we likened our deep value security selection process to rummaging through the debris at a garage sale. If you show up often enough, every once in a while you might come across a slightly dusty picture selling for a few dollars only to recognize it’s a Warhol worth a few hundred thousand dollars. Someone’s junk clearly can be someone else’s treasure.

But no one was more surprised than Canso when in a November 2014 Christie’s auction Andy Warhol’s “Triple Elvis,” a 1963 silkscreen of the King himself (Elvis Presley), sold for $82 million and “Four Marlons,” a 1966 depiction of four images of a young Marlon Brando, sold for $70 million. Clearly we need to do more due diligence on the high end art world.

Despite undervaluing Warhol’s art by at least a few millions, we believe the analogy stands. The financial markets are ripe with junk disguised as diamonds and hidden gems kicked to the curb as trash. The true value of an active manager is to utilize their experience and skills to identify the valuable and to acquire these at a discount on behalf of their investors.

Some Positive Canso Feedback

Our readers know that we have been bearish on the Canadian dollar and oil prices for some time. Sometimes very good insight falls prey to inaction as “the path to investment hell is paved with inaction”. Late last year, after the oil price plunged and many high yield bonds followed, we got some interesting and rewarding feedback from an Investment Advisor (IA) invested in a mutual fund that we manage.

He had been an IA for many years and he had listened to many marketing pitches. When he found out that we held almost no oil and gas issues, he phoned us expressly to say that it was the first time that he could recall that a portfolio manager had lived up to its marketing. He thanked us for this but investing money well for our clients is what we do. Sometimes, not often, we even get thanked for it!

Our focus on analysis supports our decision making. We get things right a lot of the time and sometimes we get things wrong. It is our “Maximum Loss” risk management that protects against our mistakes. Our experience is that corrections occur often and are usually violent and irrational. Canso exploits these market inefficiencies through investments in mispriced securities across the capital structure of issuers from around the globe.

Our investment success depends on the experience, knowledge, patience and collaboration of our investment staff. We eliminate bias in our approach by avoiding traditional analyst segmentation along asset class and industry lines. We rely neither on external analysts or rating agencies as part of our investment process. We assign internal credit ratings and maximum loss estimates to all of the issues held in our portfolios.

You Got To Know When To Hold ‘Em. Know When To Fold ‘Em.

Kenny Rogers counselled discipline and patience to his whiskey toting fellow traveller in his song “The Gambler”. At Canso we do not “reach for yield” when we are not compensated for risk. Our bottom up research and valuation discipline tends to move our portfolios towards higher quality as the credit cycle matures. We are increasingly finding higher quality bonds are better risk-adjusted value than their lower quality peers.

The Canso investment approach ensures that we are paid for the risk we assume in our portfolios. We are always at the table looking at countless transactions and “Fold Em” on most. We never go “all-in” and gamble, but use our Maximum Loss methodology to maximize return potential without risking the farm.

Risk is rising in the markets but we still continue to believe that it will take a tightening of monetary policy for the risk markets to turn.

Best wishes for a healthy and happy 2015 from your friends at Canso.