The bond market stands resolute in its conviction that long-term interest rates can never rise. Besides, the omniscient and ever vigilant U.S. Federal Reserve stands at the ready to rescue financial incompetence wherever and whenever it occurs. The financial markets believe that the new Fed Chair, “Helicopter Ben” Bernanke, will continue the Greenspanian propensity to inflate the money supply to defeat all financial enemies of American prosperity, real or imagined.

We are amazed at the effort being expended in the search for an explanation of the prevailing low long-term yields. Alan Greenspan worried about his “connundrum” of inexplicably low long term bond yields when he was still the Fed Chair. His successor, Ben Bernanke, is fond of the “surplus of savings” argument which suggests that there is a glut of global savings looking for a safe home in the U.S.A. Neither Alan nor replacement Ben seem destined for stardom in the television series Crime Scene Investigation.

CSI Washington Federal Reserve…………

“Gee whiz guys, you printed all this money” would be the opinion of CSI Gil Grissom. “My blue light analysis of the crime scene shows copious amounts of cash, credit spreads ludicrously low, and financial, commodity and asset markets bubbling with speculative froth. Looking at CSIs Greenspan and Bernanke, he would point to the numbers on his ultra modern wall mounted plasma display. “Forensic accounting shows a money trail of investing by Asian central banks whose manufacturers are selling all the neat stuff that Americans are buying with their home equity cash outs.” Shaking his head pensively, he would deliver his softened professional criticism. “Look first at the obvious….. why try to complicate matters with complicated explanations. Long term rates are low because there’s a lot of money chasing investments. Money you printed!”

A Flood of Long Bonds

The Financial Times recently reported that Paul Tucker, head of markets at the Bank of England, is urging the U.K. government to “alleviate problems caused by artificially low yields on long-dated bonds”. Mr. Tucker was concerned particularly about “a feedback effect from pension funds buying bonds to match assets to liabilities and a consequent fall in real yields, which in turn caused a rise in funds’ measured liabilities and an (further) increase in demand for long-term bonds” (Financial Times; Top Bank Official Calls for Action on Gilts; February 15, 2006).

The article goes on to say that many economists are urging the government to “flood the market with long-dated index-linked gilts to increase supply”. What interests us is the tone of the article, especially given the prestige and conservatism of the Financial Times, in relating this debate.

Economists urging the government to flood the market with bonds to increase interest rates! In a more economic orthodox time, the Financial Times would have been suggesting forcible confinement in a psychiatric facility for those advocating such a policy. The tone of the article suggests appreciation of the sober reflection of the U.K. monetary experts.

What this points out to us is the dangerous juncture that we are at for the world’s bond investors. One of the easiest ways to fix the balance sheets of pension plans with shortfalls is to allow a significant rise in long term interest rates. Governments can choose to issue as many long-term bonds as they want, absent credit rating problems. Easy monetary policy and higher levels of inflation would combine with an increased supply of long-term government bonds to raise long-term yields very promptly.

Mortgage Madness

When the bond market decides to focus on the negatives, long yields could snap upwards with a vengeance, fuelled by the potent fuel of U.S. mortgage hedging. This strange financial alchemy takes 25 year mortgage securities, adds considerable marketing of prepayment models and turns them into short-term bonds peddled by very prosperous investment bankers. When interest rates rise, abracadabra presto gizmo, prepayments plummet and they turn back into 25 year bonds which then fall considerably in price due to rising rates and liquidation by their terrified owners. Orange County went bankrupt in 1994 when their mortgage security portfolio imploded due to rising rates and Fed tightening. Are today’s mortgage investors really that much more astute?

Expensive Canadians

The Canadian bond market is much more expensive than its American cousin to the south. The news for the Canadian bond market could not be much better than that currently; high commodity and energy prices, a strong economy, an appreciating Canadian dollar and low inflation. The Canadian economic picture has seldom been brighter or interest rates lower. All this optimism on Canada finds its ultimate expression in the long end of the bond market. It is extraordinary to have long-term Canadian yields near 4% when long-term U.S. yields are over 4.5%. Canadian long-term bonds risk severe disappointment should things turn for the worse.

Is There a New Normal for Corporate Bond Spreads?

On the credit front, the classic stretch for yield continues. At Canso, we believe that corporate bonds are very expensive and that credit and event risk is increasing. Now is a time for very high quality. This view is shared by very few bond investors, as they seek the higher performance from credit spread to compensate for the tough slog in yield curve and term strategies. When asked by Canso who was buying today’s popular and overpriced new issues, a very seasoned corporate bond trader responded: “those who think they have to!”

The rationale for these market top risk seekers is a benign and consensus credit view. There is a “new normal” for credit spreads they believe. Spreads deserve to be this low, goes the thinking, since the economy is strong and defaults are low. Financial innovation and credit derivatives also allow the bond market to deal better with risk. Today’s modern bankers have sophisticated quantitative credit models to more properly assess credit risk. Too bad today’s financial engineers are not students of credit history. They would know better. Periods of loose monetary policy and credit inflation lead to speculative financial markets and credit excess.

The last refuge of the corporate bond scallywag is the sales pitch often heard at market tops:

“Yield spreads are low because interest rates are low!”The pitch continues: “There’s a shortage of interest product and you have to pay up to get it.” As the willing investor brims with excitement, the salesperson moves in for the kill: “The corporate bond spread as a percent of the total yield is historically high”. This of course begs the question of why should anyone care about the ratio of corporate bond spread to interest rate.

As our faithful readers know, LOAN LOSSES ARE A PERCENT OF INVESTED CAPITAL!

Whether the underlying interest rate is 6% or 3%, the corporate bond investor will lose a part of the principal lent. Historical loan losses are statistics based on the amount of principal advanced, independent of the prevailing interest rate of the time.

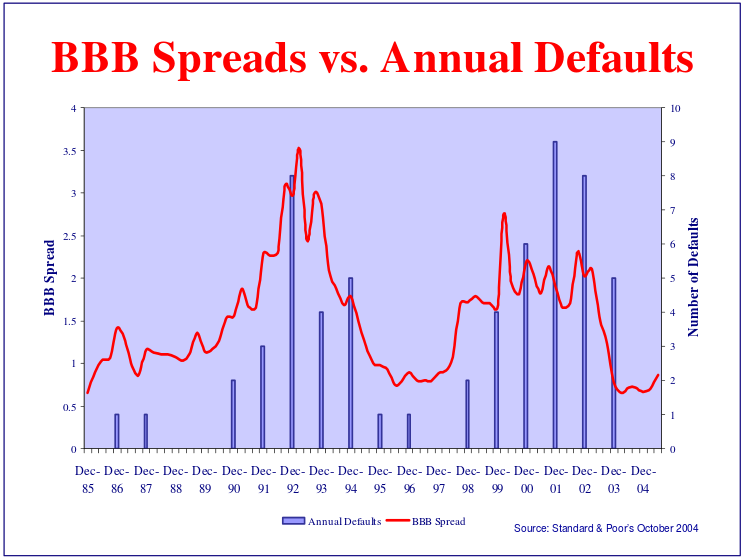

Credit spreads should also not be affected by the prevailing credit situation. Alas, this is not the case. As the chart below shows, corporate bond spreads tend to react to the prevailing credit conditions of the time. This chart shows the number of Canadian defaults compared to the yield spread on corporate bonds. Corporate bond spreads are low when defaults are low and high when defaults are high.

The cyclicality of defaults is also very evident from the chart. This is a result of a few factors. One of the factors is monetary policy. When central banks print a lot of money, this presents a problem for the bankers and portfolio managers who are charged with investing this deluge of cash. Lots of money chases the higher quality investments available and forces down the market yields. This means a decrease in credit quality is the only way to keep interest income up. In a time of low defaults, investors are also emboldened by the easy credit environment and assume substantial credit risk for very meagre compensation. Very poorly structured deals of weak and speculative companies find willing markets and eager investors.

The cyclicality of defaults is also very evident from the chart. This is a result of a few factors. One of the factors is monetary policy. When central banks print a lot of money, this presents a problem for the bankers and portfolio managers who are charged with investing this deluge of cash. Lots of money chases the higher quality investments available and forces down the market yields. This means a decrease in credit quality is the only way to keep interest income up. In a time of low defaults, investors are also emboldened by the easy credit environment and assume substantial credit risk for very meagre compensation. Very poorly structured deals of weak and speculative companies find willing markets and eager investors.

The seeds of default are thus sown for later in the credit cycle when tighter monetary policy combines with weaker business conditions to cause a surge in bankruptcies and defaults. This usually takes three to four years as is shown by the spikes in defaults in 1992-94 and 2000-02 which were four years after the low default and yield environment of 1987-89 and 1996-98.

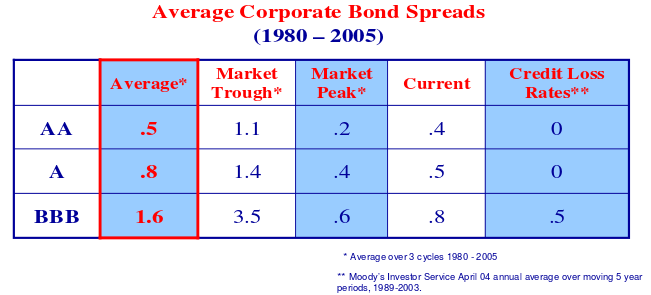

The question at present is whether the rather thin yields available in the Canadian corporate bond market justify the historical loan loss experience on Canadian corporate bonds. We have combined the historical default rates for Canada from several sources (MoodyÕs, S&P, DBRS) and we have averaged the corporate bond yield spread data for the period 1980 to 2005 in the table below. This shows, for example, that although the average yield spread on AA rated bonds was .5% in the period, the average at market troughs was 1.1% compared to .2% at market peaks.

Generally, the experienced loan losses on AA and A bonds are negligible. This is not the case for BBB rated bonds, however, as the annualized average credit loss is .5%, which is not too different than the BBB bond spread of .6% at the market peak! The average BBB bond spread of 1.6% provides substantial compensation for the assumption of BBB credit risk, as does the healthy 3.5% average spread at market troughs. Clearly, it makes a substantial difference when one buys corporate bonds!

Fear, Greed and Financially Challenged Engineers

At Canso, despite all we’ve been forced to learn about efficient markets, we are firm believers in the credit cycle. We believe this phenomenon reflects the tried and true human investing weaknesses of fear and greed. The propensity of bankers and bond investors to lend stupidly when the credit good times are rolling and curl their portfolios into a high quality fetal position when defaults are high is evident from our analysis above. Many better educated and smarter people have challenged our simplistic views on this subject, but we have been content to avoid such debates and let our portfolios speak for themselves.

We cannot however, resist some recent validation of our rather quaint views on the so-called efficiency of markets. Recent psychological research using Magnetic Resonance Imaging shows that humans use a different area of the brain when they are fearful and tend to make very emotional and irrational decisions. An economic experiment in investing decision-making in Germany had students playing a market game for real money. The results showed that the rational engineering students were the worst by far, jumping on market trends and popular investments. Economists were almost as bad. Psychology students, with little formal training in investments, did the best by far. It seems they watched the others and invested in a contrary fashion! The culmination of this credit cycle could be very interesting, given the use of quantitative lending models and the legions of “financial engineers” hired by financial institutions.