When I Find Myself In Times of Trouble

These are trying times for rational human beings. Although we can’t imagine the irrational ones are having much fun either. The U.S. remains focused on impeachment (the pessimists) and elections (the optimists), the U.K. on Brexit (pessimists and optimists) and the rest of the world on everything the U.S. and U.K. are ignoring, including global warming and, of course, the much hyped sequel to Frozen (ingeniously titled Frozen 2).

And In My Hour of Darkness

In the murky world of private finance, WeWork became the latest victim of “unicorn overoptimitis”. Very smart people couldn’t get enough of WeWork – until they couldn’t give it away. At $8 billion, the latest valuation for the money-losing leaser of hipster office space is a fraction of its peak $47 billion, but still eye watering. In public markets, equities reached new highs while yields on a significant portion of the bond universe remained negative, or if positive, just barely so. The ECB and the Fed lowered rates again. One wonders what Paul Volcker, the man who tamed U.S. inflation in the 1980’s, would say about today’s monetary policy, or the shared office space concept for that matter. Rest in peace Paul.

Just One Look

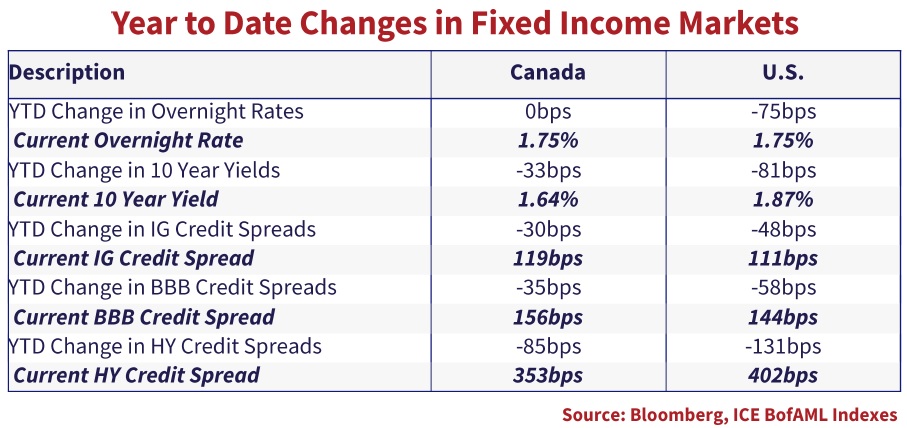

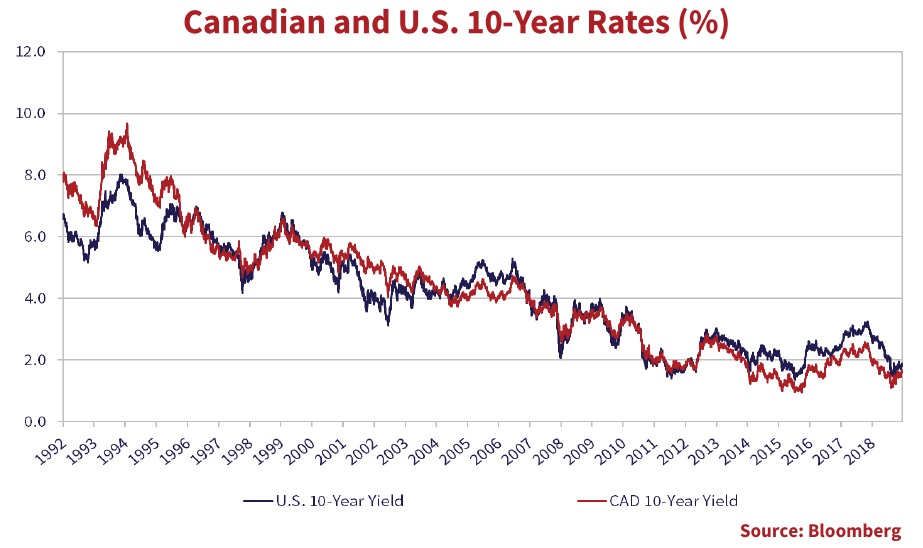

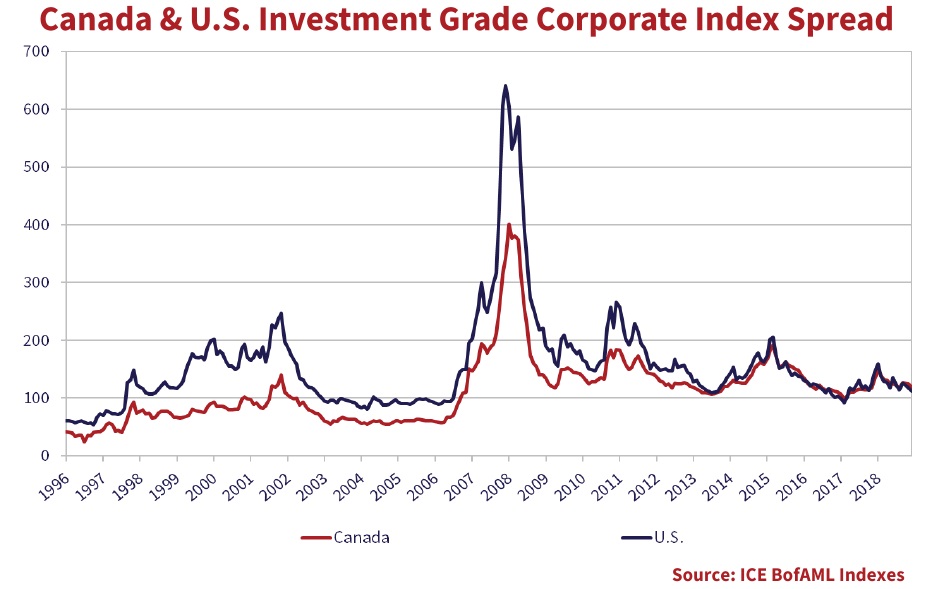

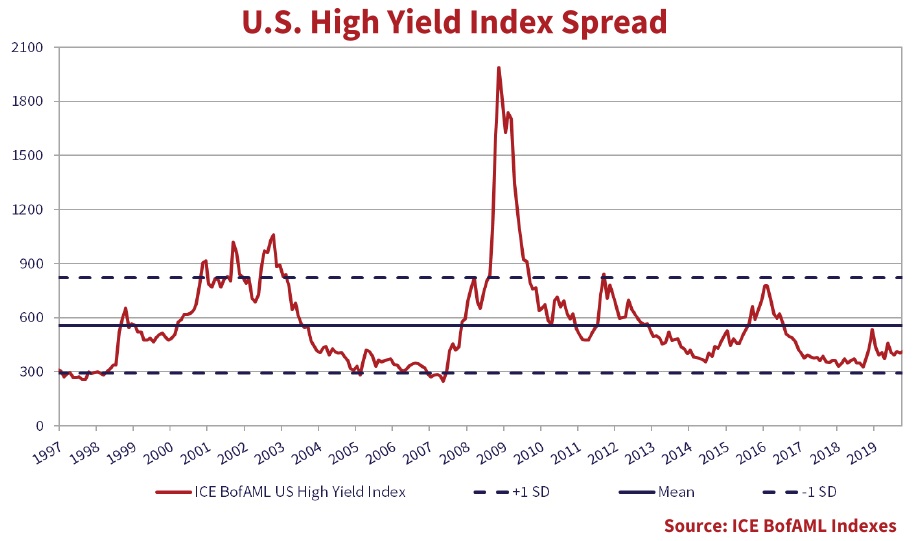

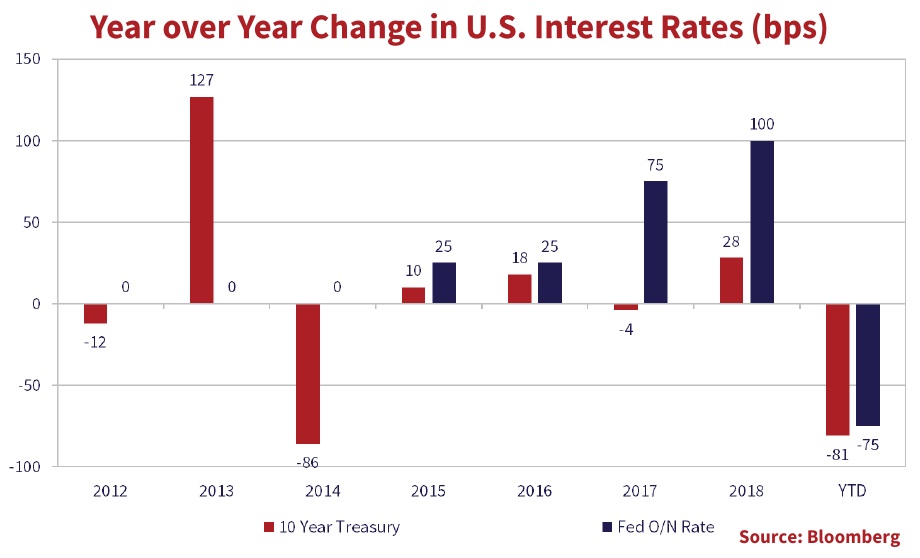

With the end of the year fast approaching, a recap of this year’s market moves is in order. In Canada, the BOC remained on hold and Government 10-year yields fell 33bps. In the U.S. the Fed lowered rates 75bps, in a series of what were dubbed “pre-emptive moves” and U.S. 10-year Treasury yields fell 81bps. Spreads on investment grade and high yield bonds in both markets tightened, more in the U.S. than in Canada.

“Here Comes Lucky…”

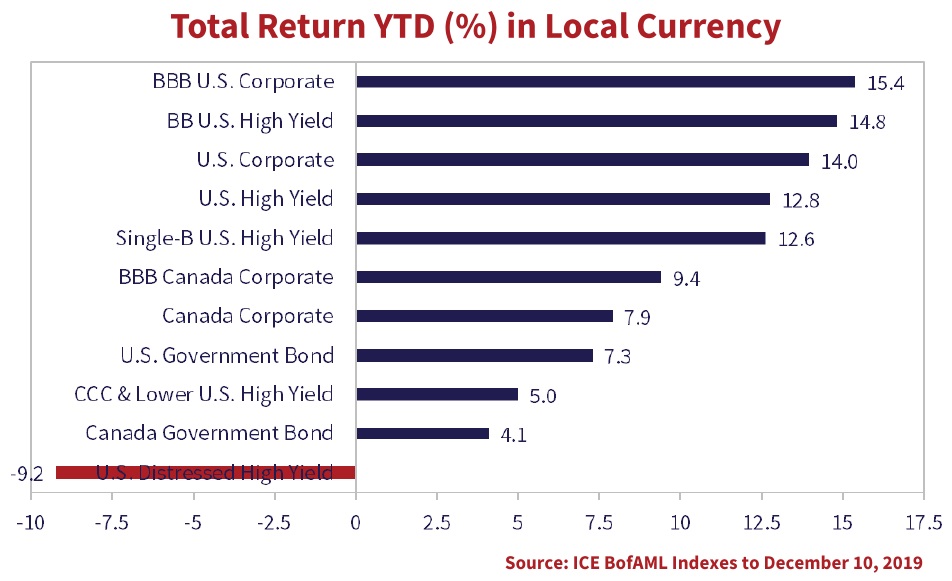

As the table below shows, falling yields and tightening credit spreads propelled the U.S. BBB Corporate Market to top of class performance of 15.4% YTD. U.S. High Yield came in a close second at 14.8%. The lowest rated CCC and distressed segments recorded returns of 5.0% and -9.2%, respectively, reflecting concerns about the default and recovery risks in the lowest rated segments of the credit market.

BBB Canadian Corporates recorded a 9.4% return YTD versus 7.9% for the overall Canadian corporate market. The stronger performance of BBB corporates in both Canada and the U.S. comes despite significant press coverage warning of the dangers of excessive corporate leverage and the dire consequences BBB corporate debt downgrades could have on the lower rated segments of the credit markets.

And When The Night Is Cloudy

So, after an extraordinarily strong year for the fixed income markets with credit products generating equity like returns, where do we go from here? You’d be forgiven for answering a question with another question: Just where is “here” exactly?

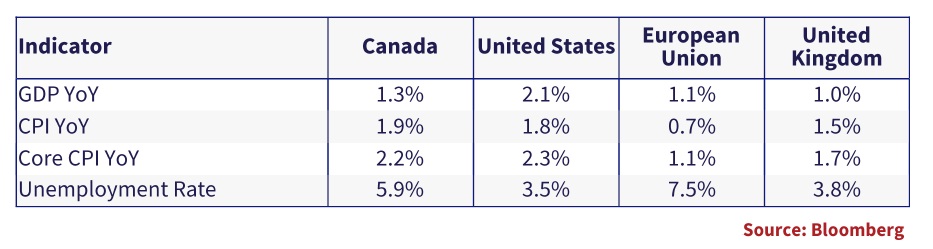

As the table below shows, “here” has the economic situation in Canada and the U.S. in much better shape than the European Union and the United Kingdom. Inflation is substantially higher in North America.

Following three 25bps rate reductions by the Federal Reserve, overnight interest rates in Canada and U.S. are equivalent at 1.75%.

10-year yields have moved off the recent lows and are currently 1.64% and 1.87% in Canada and the U.S. respectively.

Both investment grade and high yield credit markets reflect continued optimism about economic expansion and corporate cash flows.

So “here” finds the interest rates market still predicting recession while the credit markets suggest all is well with the economic future in Canada and the U.S.

When The Broken-Hearted People Living In The World Agree

The general consensus heading into 2020 is interest rates will stay low for longer and corporate credit will continue to do well. When consensus calls for a continuation of what not long ago would have been unthinkable – pause and give your head a shake. The risks in today’s fixed income markets are significant. Those seeking returns by buying longer duration assets or lower quality credit take the risk that the fixed income party, which has been going on for an extended period, comes to an abrupt halt. Buying expensive assets hoping they become more expensive is not an investment strategy. Resist the temptation as a market selloff could come in many forms.

Stay Off The Moors

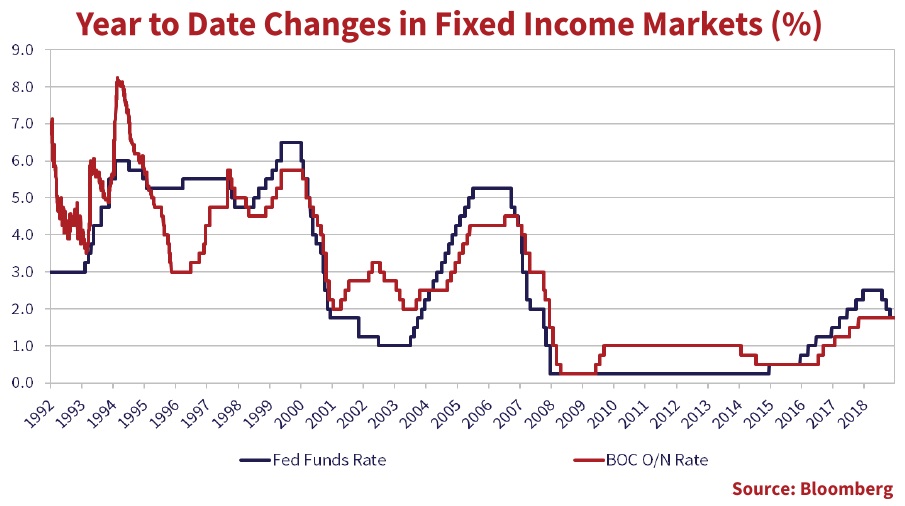

We expect the Bank of Canada and the Federal Reserve to leave overnight rates at the current 1.75% level. However, a selloff in non-administered interest rates precipitated by an increase in inflation above current expectations is a substantial risk. While the Fed, the BOC and the world’s other central banks control administered rates, ultimately the market determines the level of longer-term interest rates. As the chart below shows in 2013 and 2014, years which the Fed kept the overnight rate at a constant 0.25%, 10-year U.S. Treasury yields climbed and then fell 127bps and 86bps, respectively.

The lesson is a lack of central bank activity is no guarantee of static longer-term rates. The U.S. trade dispute with China, the massive current and future deficit financed by U.S. central government spend and the three rate cuts by the Fed are all inflationary in and of their own right. Combined, these three could drive substantially higher inflation. If inflation rises and stays consistently in the mid 2’s or closer to 3%, we do not believe the 10-year U.S. Treasury yield will be anywhere close to its current 1.87%. As quickly as rates fell 81bps year to date, they could easily revert.

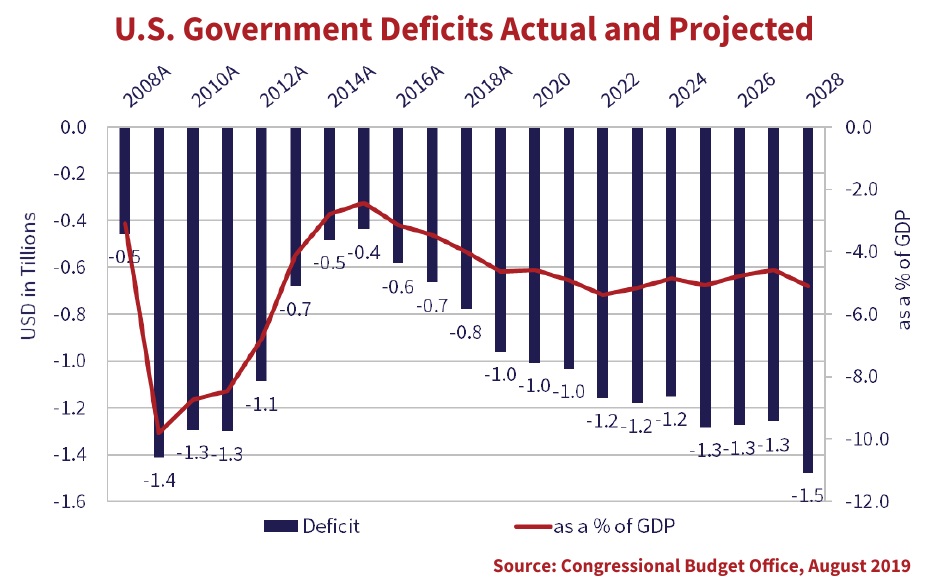

The latest CBO projections shown above forecast $1 trillion plus deficits for the estimable future. By 2029, at the current pace of borrowing, debt held by the public will increase to $29.3 trillion, or 95.1% of U.S. GDP, from $15.8 trillion, or 77.8% of GDP at the end of 2018. The dramatic increase in U.S. government debt is overwhelming repo markets, forcing the Fed to intervene to provide cash to fund the deficits. At some point, the markets will recognize the dramatic deterioration in the credit quality of the U.S. government and demand higher rates of interest to own U.S. Treasuries. We expect the rating agencies to adjust U.S. credit ratings lower as well. A combination of higher inflation, overwhelming U.S. Treasury supply and credit rating adjustments could drive substantially higher U.S. market determined interest rates.

The Four Horsemen of the Apocalypse

In the Book of Revelations, the coming of the Four Horsemen signals the coming end of The Last Judgement. In credit markets, we feel no market is more worthy of a little divine retribution than the Leveraged Loan market. Canso invests in Leveraged Loans, but we are not fans of the market at present, excepting a few special situations. In past Newsletters we’ve articulated concerns with the Leveraged Loan Market. Let’s dig in again, a little deeper this time.

Conquest

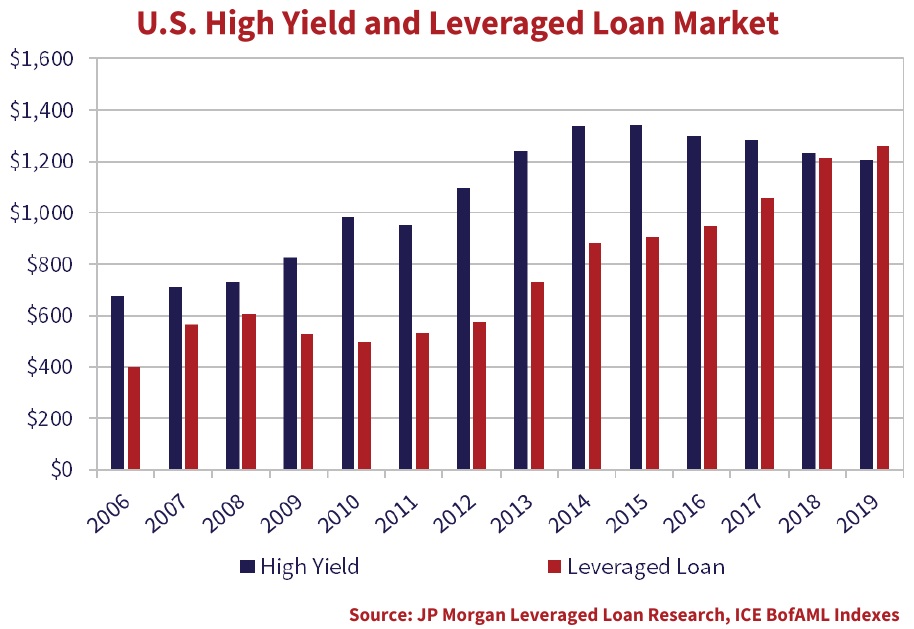

The chart below shows the growth in the Leveraged Loan market from $497 billion in 2010, or one-half of the size of the U.S. high yield market, to $1,259 billion today. The rapid growth of the Leveraged Loan market comes at the expense of the high yield market which is $174 billion smaller than in March 2016.

The extraordinary growth in the Leveraged Loan market has not only been a boon to Wall Street, it has been driven by Wall Street. Wall Street banks earn substantial fee income through the arrangement, distribution and trading of loans and collateralized loan obligations (CLO’s). CLO’s comprise the largest investor class in Leveraged Loans. In addition to a steady income stream from capital markets activities, the evolution of the loan ecosystem has altered the risk profile of banks as direct lending to lesser quality credits has migrated to indirect exposure through the purchase of higher rated tranches of CLO’s. More fees, less risk is not bad business if you can get it!

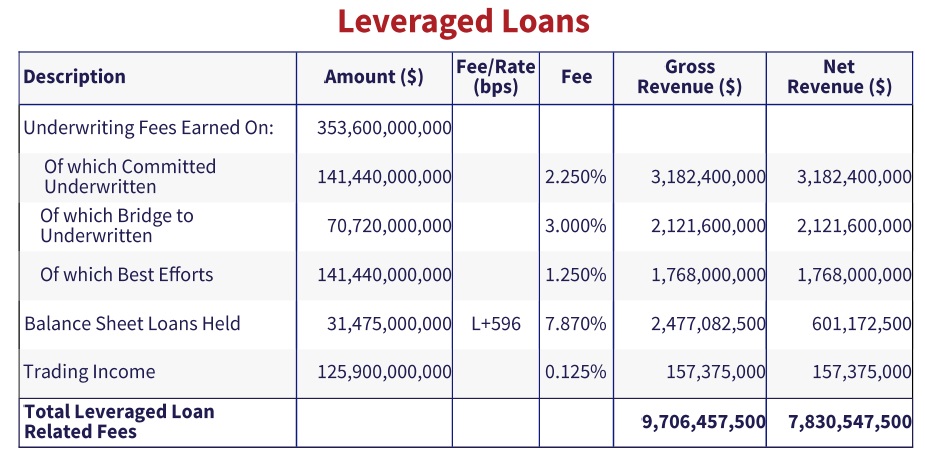

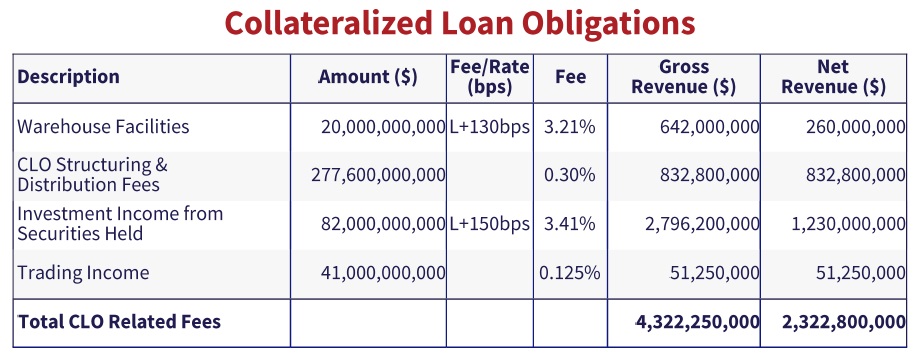

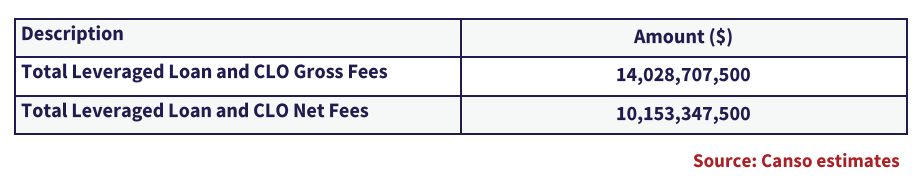

In the tables below, we estimate revenue generated by Wall Street banks from Leveraged Loan and CLO related activities.

In all, we estimate gross annual income derived from fees and income generated by Leveraged Loans and CLO’s at $14.0 billion. Assuming banks finance a portion of these activities at Libor yields net fees of $10.2 billion.

The current configuration of the market has dramatically shifted Wall Street banks’ exposure to Leveraged Loans. Not too long ago, banks would finance a company and syndicate out a portion of the loan to institutional investors. The shift from syndication with a meaningful risk retention element to syndication with only modest retention has had a significant impact on the loan market.

As Wall Street’s direct exposure to Leveraged Loans decreased, the incentive to maintain stricter lending standards or to push for more advantageous pricing also decreased. Translated, “if I’m not lending a company money, why sweat the details”. That 87% of Leveraged Loans issued today are “covenant lite”, or issued without maintenance covenants, versus only 6.5% in 2009, illustrates this point. In addition, pro-forma EBITDA manipulations, higher tolerated 1st lien leverage and asset sale carve-outs are further examples of weakening of lender protections to the benefit of Leveraged Loan issuers.

War

CLO’s comprise the largest buyers of Leveraged Loans. A CLO is a structured vehicle designed to invest in a portfolio of loans. The life cycle of a CLO approximates 10 years and includes a Warehouse Period of up to 12 months, Ramp-Up Period of up to 6 months, Reinvestment Period of 4-5 years and Amortization Period of 4-5 years. A typical CLO actively invests in Leveraged Loans for up to 6.5 years as a closed pool of capital.

CLO’s are funded by issuing tranches of debt from AAA, AA, A, BBB, BB and equity. Capital is distributed to investors by an agent bank and funds raised are used to repay the bank providing the Warehouse Facility and to purchase additional loans during the Ramp-Up Period.

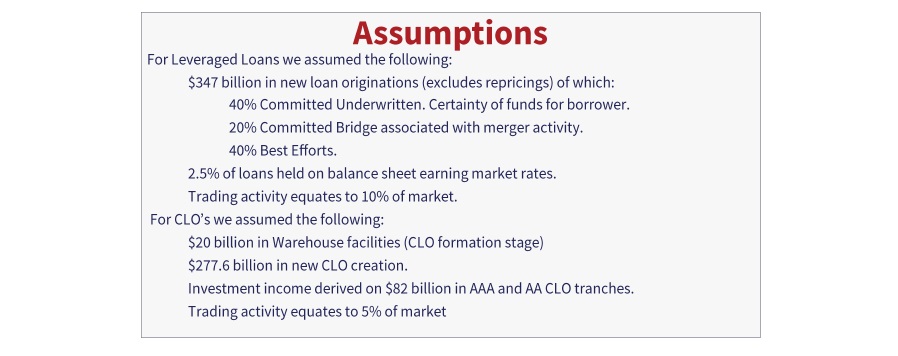

Concentration of CLO debt investors is illustrated in the table below.

The majority of Wall Street’s risk is taken in higher rated AAA and AA rated tranches of CLO debt. Risk of loss is apportioned according to a waterfall. Any losses incurred by the CLO are first attributed to the equity and to each successive tranche of debt.

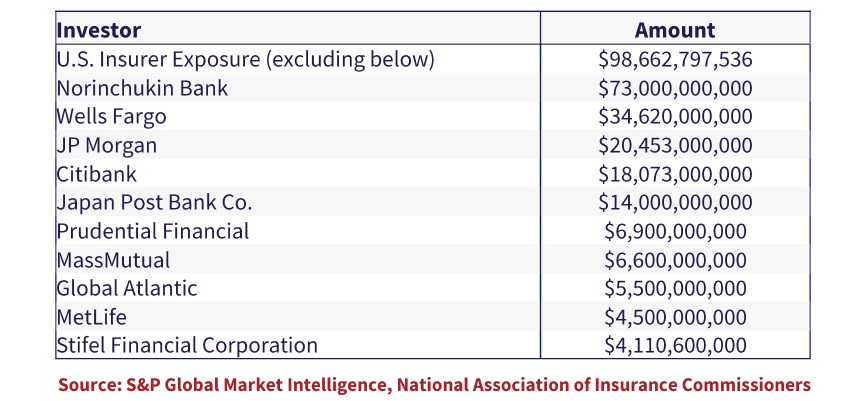

The chart below highlights net new issuance of Leveraged Loans and CLO’s.

In 2017 and 2018, CLO creation significantly outpaced net Leveraged Loan issuance. As a consequence, CLO purchasing capacity, which includes capital from new CLO formation and proceeds from loan paydowns within existing CLO’s, has exceeded new issue supply as well as redemptions from retail loan funds. CLO’s have backstopped the Leveraged Loan market and CLO’s have in turn been backstopped by Japanese and Wall Street banks.

Famine

Banks win, borrowers win, Porsche dealers win, and no one gets hurt. What’s the problem? The problem, as history informs us, is any market reliant on cheap capital which consistently underprices risk eventually faces a reckoning. Similar to the CDO/Mortgage Markets Pre-Credit Crisis we believe Leveraged Loan participants are mis-pricing credit risk and overstating liquidity.

Retail buyers of Leveraged Loan mutual funds are being sold a good and persuasive story: “floating rate assets with no interest rate risk, senior security and 5-6% yields”. It sounds terrific, manna from investment heaven, but like most investment stories, it is too good to be true. The deterioration in the credit quality of the underlying issuers and collateral forms the biggest risk to the market and ultimate recovery. Looser lending standards will drive recovery rates substantially lower than in previous corrections.

We are skeptical of any manager’s ability to stay on top of the 150-250 names in a CLO portfolio and believe the majority of managers rely on diversity of names rather than credit acumen when making portfolio decisions. Translated, if a new loan ticks a box, it’s in the portfolio, pricing and protections be damned.

The Leveraged Loan market exists and depends itself on the leverage imbedded in CLO’s. A reduction or cessation of CLO growth will have an immediate impact on the loan market as they have been the primary market participants. Also hit will be the profitability of Wall Street banks as both underwriting fees and interest income from securities held will fall.

Death

The last several years have been a great time to be a borrower, Leveraged Loan portfolio manager and underwriter. It is very definitely not a great time to be an investor. We think the bubble in the Leveraged Loan market will burst and investors will pay the price. There will be only sellers with few buyers, so prices will plummet.

What is it that brings this wonderful Leveraged Loan party to an end? We suggest several possibilities, any one of which could significantly alter the economics of the market or alter investor confidence:

- Regulatory Changes. Recently each of the Bank of England, Bank of Japan, European Central Bank and Federal Reserve launched a review of the risks in the Leveraged Loan markets. A change in regulation impacting banks’ ability to hold CLO debt securities could impact the viability of the entire market.

- Increase in Default Rates. Default rates near 2.6% are still well below the long-term average of 3.1%. A significant increase in default rates coupled with reduced recoveries on restructure or liquidation will roil the market.

- Failed Transaction. The failure of a large Bridge to Underwritten deal leaving a bank or group of banks with outsized loan exposure.

- Rating Methodology Change. Any change requiring more subordination in the capital structure.

- Market Skittishness. The market is susceptible to significant price volatility, and liquidity freezes (caused by concentration of funding) which could cause lending to new CLO’s to dry up which in turn would cause the new issue market to freeze up.

In 2008, the U.S. High Yield Index returned -26% and Leveraged Loans were down approximately 30%. We are gearing up our Leveraged Loan analysis in anticipation of the inevitable market disruption and forced liquidation which will bring great values to those willing to step in.

There’s Your Trouble

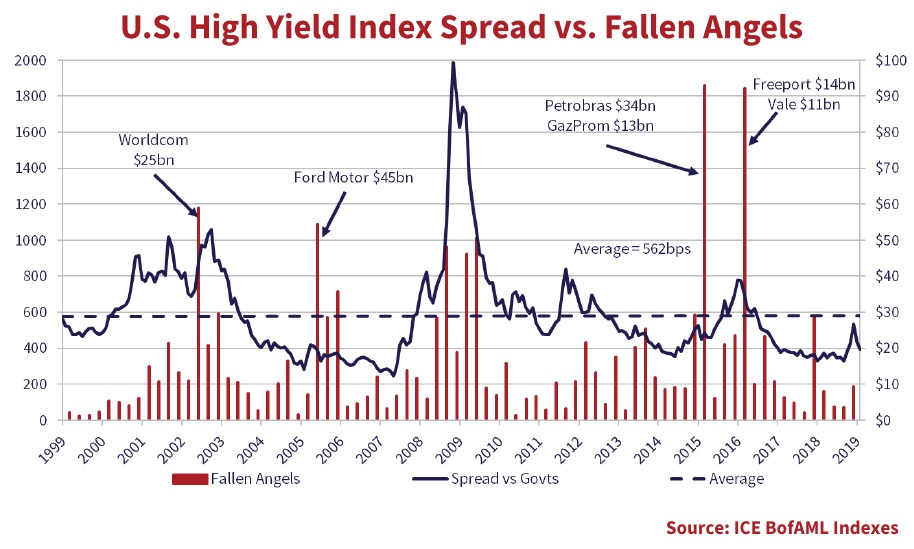

We caution investors should be “compensated for risk assumed” and we see risk in the non-investment grade markets. If a calamity is in the making, the U.S. high yield market seems blissfully unaware. As the U.S. High Yield Index Spread graph shows, high yield spreads are 131bps tighter this year. Part of this compression in spreads may be due to technical factors caused by a reduction in the size of the high yield market.

Look Out Below

Much attention has been paid to the increased leverage and corresponding erosion of credit quality of corporate America. Evidence presented includes the growth in the BBB segment of the credit market. At November 30th, in Canada, BBB’s comprise 41.1% of the CAD investment grade corporate bond market. The BBB percentage of the U.S. investment grade corporate market is 50.1%.

No Where To Run, No Where To Hide

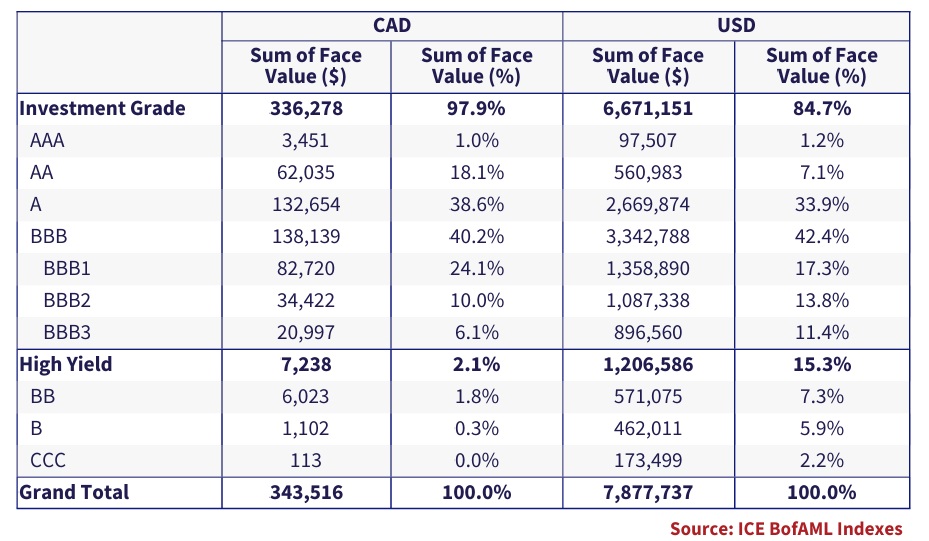

The table below combines the ICE BofAML CAD and U.S. Investment Grade and High Yield indexes.

Generalizations about the growth of the BBB market and the threat downgrades pose to lower rated segments need to take into account subcategories within the BBB segment. The generalizations presume corporates rated BBB+ are as likely to be downgraded to non-investment grade as those rated BBB- which is not the case.

Importantly, while the BBB segment now comprises 42.4% of the overall U.S. credit market versus 36.7% in 2015, the BBB- category measures 11.4%, virtually unchanged versus 2015. The U.S. BBB rated category is 5.9X larger than the BB segment of the high yield market. More relevant in our view, the BBB- category is only 1.6X larger than the BB category. In our opinion the BBB overhang is not as ominous a threat to the high yield market as the headlines would suggest.

In Canada the BBB portion of the ICE BofAML U.S. Investment Grade Index has grown from 5.1% of the overall corporate market in 1996 to 40.2% today.

What separates Canada from the U.S. bond market is the absence of a well-developed high yield market. The Canadian BBB segment is a 23X multiple of the entire high yield market and the BBB- category 3.5X the BB portion of the CAD high yield index. In Canada the downgrade of a large BBB credit could have a significant impact on the CAD high yield market.

Hang On, Help Is On Its Way

Actual experience shows downgrades of BBB rated corporates to high yield, so called crossover downgrades, may or may not be disruptive. The impact likely depends on a variety of factors including, the point in the credit cycle downgrades occur, the nature of the individual credits downgraded and supply and demand imbalances within the high yield market at the point of downgrade.

The chart above shows the U.S. High Yield Index Spread versus volumes of Fallen Angel downgrades or investment grade companies downgraded to non-investment grade. Since 1999, Fallen Angels are created at an average $15.7 billion every quarter. Large crossover downgrades in the past do not always coincide with widening credit spreads.

How Do You Do What You Do to Me

We are continually discussing potential opportunities, both primary and secondary, in specific credits and markets. With a large investment team, we can quickly mobilize resources to analyze any situation. Opportunities exist in all markets.

We are in ‘monitoring mode’, watching many issuers across a variety of markets including in the Leveraged Loan market. If prices fall significantly, we expect to take on additional exposure at wider spreads.

Speaking Words of Wisdom

Conventional wisdom suggests the financial markets operate efficiently. Prices of stocks and bonds are where they are because that is exactly where they should be. Canso exists because we believe the financial markets, and specifically the credit markets, are inherently inefficient and securities are frequently mispriced.

Through independent analysis and active management, Canso exploits market inefficiencies on behalf of our clients. The complexion and composition of our portfolios can change quickly as inefficiencies manifest in the marketplace. Canso’s mission to “buy cheap stuff” is ongoing. Though the markets can play chicken for extended periods, over the long term they always blink.

It is a challenging time for investors. Choices made today will have a lasting impact on their financial wellbeing. Canso invests for the long term and we expect to outperform markets over the credit cycle. That said, we do not expect to outperform in each and every reporting period. We take risk only when our investors are compensated for doing so.

Buying expensive duration or expensive credit in hopes it becomes more expensive is gambling, not investing. There are lots of casinos in Canada for investors to gamble in, but the market shouldn’t be one of them. If the rates markets, or the credit markets, or both reprice, we expect there to be some extraordinary opportunities in investment grade, high yield and Leveraged Loan markets. It is difficult to predict when these repricing events will occur. We are confident markets remain cyclical. At some point securities which are expensive today will become less so, possibly much less so, and Canso will be ready.

Let It Be

From your friends at Canso, best wishes for a happy, healthy and safe Holiday Season and New Year.