We ended last year with terrified global financial markets fixated on the “debt crisis” in Europe’s periphery. The financial end was nigh to the financially naïve in the thrall of their flat screen televisions. Your trusty correspondents of things financial spent much time convincing sundry clients, consultants and even in-laws that things were better economically and financially than represented by the doom spewing from the financial media.

Survivor Eurozone

We made some presentations to retail investment advisors in November 2011, which demonstrated to us the hysterical nature of the discourse. The other speakers, economists and investment strategists, were convinced the entire global financial system was about to be swallowed up by the Black Hole of Eurozone monetary disarray. Insolvent banks and countries alike were to be sucked whole into the Euro event horizon where financial disintegration was inevitable. When markets are panicked, there are reasons and rationales aplenty to explain it and the purveyors of financial doom hold sway. This time was no different and the mavens of the black financial arts were pa id very handsomely for their Stephen King do over of things financial. This made for riveting reality TV on Survivor Eurozone : “Will Frau Merkel and Herr Schaubel ally to vote Greece off the Euro Island?” or “Will Slovakia steal the Immunity Idol from wayward Italy?”

To us, it seemed that the negatives were well known and any positives were discounted. As always, the chorus of dread and doom hit its crescendo just about the time that the market bottom was reached. As we predicted in our last report, the Long Term Refinancing Operation (LTRO) facility of the European Central Bank announced in November did the trick. European banks could tender a wide variety of collateral to th e ECB in exchange for newly minted or electronically created Euros and pay a mere 1% on these 3 year loans. Yes, as skeptics pointed out, much of this monetary largesse was deposited immediately in the very same ECB by terrified banks. On the other hand, banks brimming with cash reserves are very liquid and don’t have to sell assets at fire sale prices to stay in business. We thought the LTRO was the turning point of the Euro Debt financial crisis and it was.

Stunned by the Shunned

Year end forecasts for 2012 by morose economists and strategists working for bonus slashing and struggling financial institutions were inevitably morose. This bearishness set the scene for quite a rally in the first quarter of 2012, particularly in those things shunned the most in the sell off. Quoting our year end missive:

“As contrarians, we think the assets shunned by others at present will prove to be great value going forward. What is truly loved by investors? The government bonds they shunned in early 2011 since inflation and interest rates would certainly rise. What is absolutely hated? Anything “risky”, especially anything to do with Europe and banks since everyone knows that both Europe and all banks (other than Canadian) are destined to fail!” Canso Market Observer, January 2012.

It was quite apparent by the end of January to even the investment proletariat that the world was not ending and a rally was well underway. It looked like the Euro crisis was moderating and although there were many other things to worry about, risky assets were going up in value and safe haven government bonds down in price. This momentum c ontinued into February which made the professional investment chattering classes very nervous. You can be forgiven for missing a “tail risk” downdraft in the markets but missing a rally is career limiting if not ending. Strategists raced to revise their views to capture the rally they had just missed. They justified their nascent bullishness for a variety of reasons. Our favourite was the strategist whose mea culpa included a defence that ran along the lines of “who could not have been affected by all the negativism?”

A Trashy Rally

Well, we weren’t affected by the negativism. Ours is a simple craft. If everyone is selling something it is probably cheaper than if they are buying. Contrary to our investment souls, we deployed money into a variety of out of favour financial assets throughout the fa ll’s financial panic. Those convinced that rates could only rise at the start of 2011 had thrown in the towel and had bought every last long Canada bond they could, driving down their yields to absurd levels. This gave us the opportunity to sell some longer bond positions at prices that had been boosted 25% by the drop in long yields and further by the significant tightening in yield spreads.

The rally in the first quarter of 2012 has been powerful. Market observers are shocked that the most hated financial assets of last year have now rallied the most. To them, the rising price of tr ashy securities is evidence of the ridiculousness of the rally. Things are awful and they should stay awful. The problem with this view is that it defies how markets truly work.

Antsy Investors

When bids evaporate and sellers still have to sell, prices then fall in illiquid markets. The most illiquid assets fall the most as selling outpaces buying. Potential buyers hold back and desperate sellers hit bids which causes sharp price drops. Financial economists call such rapid price movements “discontinuity”. Investment professionals call this “price gapping”. When liquidity is restored, as it was after the LTRO, the nervous money doesn’t have to sell and any buying drives up prices which then “gap” upwards on dwindling supply. Greed then takes hold and, like ants swarming to a food source, momentum traders are then attracted to rising prices which lead to further sharp price increases.

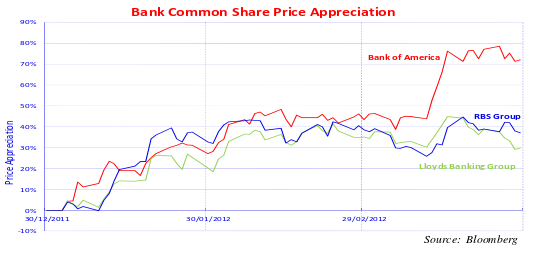

Risky assets are now back in vogue as momentum investors jump on board. European and American bank stocks and bonds have moved up sharply as fears of a financial meltdown faded. In the chart below, we show the price appreciation of Lloyds, RBS, and Bank of America common shares which are up 30%, 37% and 72% respectively in the quarter. Junk bonds and leveraged bank loans also “caught a bid” as investors plowed money into these asset classes. The sparse inventories of investment dealers means the only way to “get invested” is the new issue market. New issuance of corporate bonds is setting records in the U.S. with risky junk bonds leading the way. The European economy has defied prognostications of deep depression with a much shallower outcome and the Americans seem to be dragging the rest of the world along with its recovery. This has put stock in dices close to their previous highs. Even the peripheral European sovereign debt markets have rallied. The other side of the trade is that the “safe” U.S., Canadian, German and Dutch government bonds have fallen in price as investors seek higher returning assets.

All Hail the Fed!

Now all eyes are turned to the U. S. Federal Reserve. The Fed has been printing, pumping and primping to keep its record low interest rates at record lows as Professor Bernanke continues his quest to slay the deflation dragon. The question is whether the Fed will continue its expansive ways. While market consensus has pointed to the implementation of QE3, further asset buying by the Fed, the improving economy now risks monetary status quo. On April 3rd, the publication of the March Open Market Committee suggested that most Fed Governors were happy to wait and see if the economic recovery could continue on its own before they tried more from their innovative policy bag of tricks.

The market responded by selling off gold, oil, stocks and long Treasuries. We think this was a trifle overdone and reflected the shock of traders at the unexpected news. Modern financial markets claim efficiency but exhibit the tantrums of spoiled and over paid “fast money” traders.

An Affair or Orgy?

Despite bumps along the way, we think the recovery in both the financial markets and economies is intact. The weak nature of this recovery reflects the strength of the prior debt binge. Regulators now demand financial probity from the very banks they encouraged to “innovate” in the build up to the debt implosion of 2008. With levels of debt falling, increases in spending have to come from income gains which are a much more sedate affair than the wild debt orgy caused by financial deregulation.

Rushing the Commodity Exits

We think a surprise could be building in the commodity markets, which have seen prices move only upwards for a number of years. An outlying scenario that is so farfetched that it appeals to us is a collapse in commodity prices. The Chinese are beginning to mop up the debt excess created by their stimulation in the aftermath of the financial crisis. This means they are now focused on improving the lot of their citizens more than the wild capital spending boom of the past 3 years. We do not believe this augurs well for the prices of commodities. The lack of buying by the Chinese could be joined by selling by investment funds. There has been a lemming like rush of institutional investors into “inflation sensitive” commodities which could reverse suddenly with price weakness. The boom in exchange traded commodity ETFs could also reverse, adding to the selling pressure. When a commodity ETF has money withdrawn, it has to sell. There could be considerable forced selling if retail investors run for the exits. Reports that the sale of gold coins is slowing is not a positive portent for gold ETFs. A drop in commodity prices might not be such a bad thing and could be just what the global economy needs. This would lower inflation pressures and free up more consumer spending power.

Don’t Worry, Be Investment Happy

As in every market recovery, there’s a “wall of worry” to surmount and today is no exception. The talking heads are still possessed with the debt collapse that they ignored until it happened. As we said last quarter, we think Europe will escape total financial destruction and the U.S. should continue to grow, albeit slowly. We don’t think there is much of a chance that monetary policy will tighten substantially in the next couple of years, even if inflation does rear its ugly head.

We like the prospects for risky assets, especially those supported by strong cash flows. It’s a time to generate income rather than sit in riskless but “incomeless” Treasury Bills. Don’t worry, be investment happy!