“BAM”, “KAPOW” and “KABOOM”!

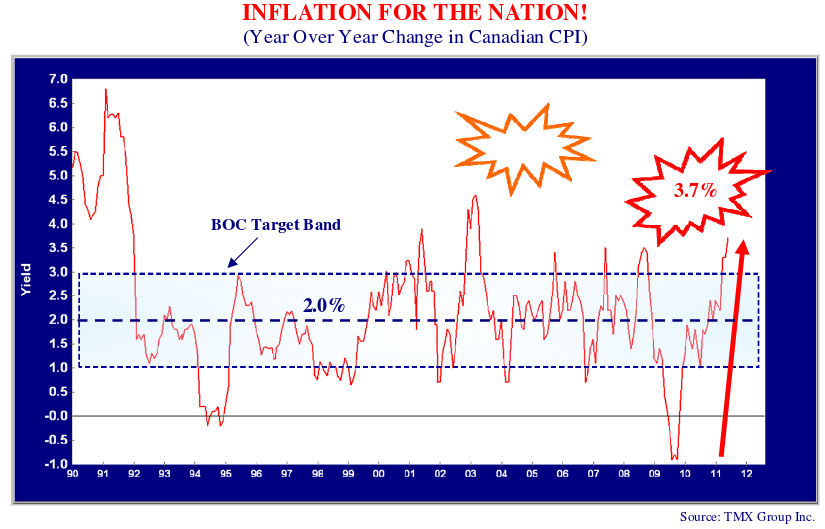

Yes, the chart below has a cartoon explosion with the number 3.7% in it. This is even more explosive than the words above for Canadian bond investors. It is the Statistics Canada year-over-year change in the Consumer Price Index for May 2011.

An inflation number of this magnitude would normally strike fear into the heart of bondholders. Hearing their panicked screams, the Super Governator of the Bank of Canada, Mark Carney, would then swoop down from his icy Fortress of Central Banking Solitude to save bond investors from an evil fate. Alas, not all comic books or economic periods end happily. In this case, our hero has stayed in his icy lair, mumbling central banking incantations and hoping like heck that inflation moderates before he is forced to spring into action.

Anybody Awake at the Bank of Canada??

Mr. Carney does have an excuse to act. Starting in 1991, the Bank of Canada has had an explicit inflation target of 2%. We quote from the Bank’s website:

“Inflation-control targeting has been a cornerstone of monetary policy in Canada since its introduction in 1991. At present the target range is 1 to 3 per cent, with the Bank’s monetary policy aimed at keeping inflation at the 2 per cent target midpoint. The inflation-control target has helped to make the Bank’s monetary policy actions more readily understandable to financial markets and the public. The target also provides a clear measure of the effectiveness of monetary policy. One of the most important benefits of a clear inflation target is its role in anchoring expectations of future inflation. This, in turn, leads to the kind of economic decision making — by individuals, businesses, and governments — that brings about non-inflationary growth in the economy.” www.bankofcanada.ca

Hello? Anybody awake at the Bank of Canada? 3.7% inflation is considerably above the 2% target. From the previous chart, we can see that inflation has very seldom been this far above the 3% upper band. What is Mr. Carney waiting for? As the BOC itself says, inflation targeting “provides a clear measure of the effectiveness of monetary policy”. Mr. Carney has overshot with his deflation fighting and sent inflation well above his 2% target. Right now, Canadians can only render a verdict that monetary policy is leaning too much towards stimulating the economy.

While publicly scolding Canadians for borrowing too much, Mr. Carney is seeking refuge in his belief that the higher inflation is temporary. He is desperately hoping that inflation falls on its own, since raising interest rates would crater the Canadian consumer, the red hot residential housing market and therefore economic growth. Mr. Carney’s answer to the credit crisis of too much debt was to create much more debt. Canadians are not stupid. They have every reason to borrow and none to save with interest rates well below inflation. With 90 Day T-Bills at 1% and inflation at 3.7%, the real short-term interest rate is -2.7%. We have dealt with the issue of negative real interest rates in more depth in our latest Canso Market Observer. Suffice to say that very bad things happen to inflation and the bond market when negative real interest rates persist for too long.

Canadian Bondholders Demand a Yield Under Inflation!

Despite our hero not flying to the rescue, rising Canadian inflation was surprisingly good for the Canadian bond market in 2Q 2011. “Pay us a yield under inflation” seemed to be the demand of Canadian bond investors. The chart below shows that long Canada yields fell over the quarter as inflation rose. Who would have thought a year ago that with a 3.7% CPI we would have had long bond yields fall to 3.4%?

Yes, there were many reasons for low yields: slowing economies in the U.S. and China, the looming debt default of Greece and ultra loose monetary policy globally.

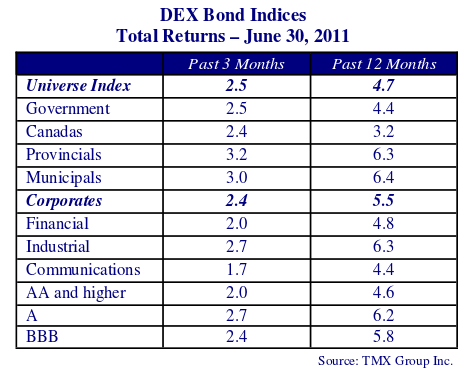

Falling yields raised bond prices. Bond returns were good over the quarter with the DEX Universe returning 2.5%. Provincial bonds outperformed by a fair margin with a 3.2% return due to their longer term.

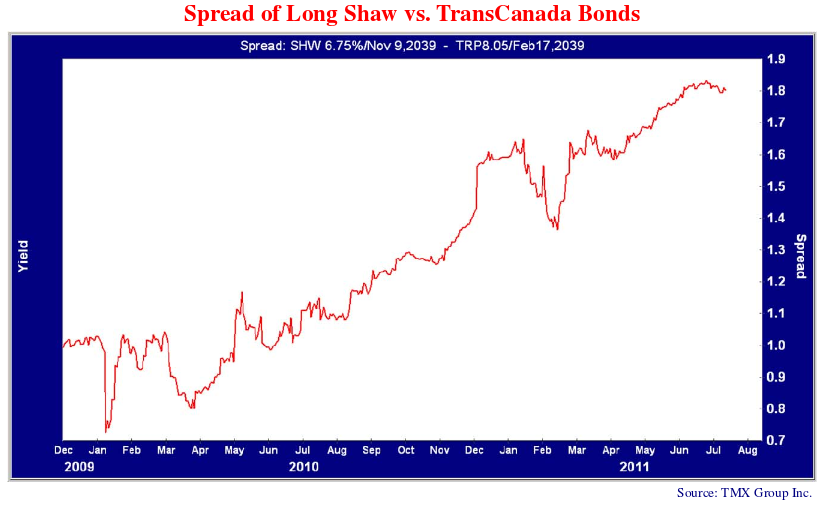

With the worries over the Euro debt crisis and a weakening global economy, risky assets sold off. Corporate bonds lagged, as their yield spreads widened. Industrial bonds performed well in a period of credit discomfort, returning 2.7%. It was Financials at 2.0% and Communications at 1.7% that lagged considerably. In particular, long telecom bonds came under selling pressure as dealers attempted to reduce their inventories. With considerable issuance over the past year, there was no lack of sellers and spreads moved wider as “fast money” accounts sold and dealers reduced inventories. This can be seen in the chart below of the yield spread between long Shaw and TransCanada bonds.

Quality Spreads Moved Wider

Shaw, the primarily western Canadian cable company, is rated BBB (low), at the low end of investment grade. TransCanada, the energy transportation company, is rated A (low), which is a full rating category higher and is viewed by investors as a stable credit. The yield spread between these two bonds represents the extra yield necessary to lure investors into the riskier Shaw bonds. In late 2009, long Shaw bonds yielded 1% more than similar term TransCanada 2039 bonds. At the end of 2010 this had increased to 1.3%. In the first six months of 2011, this has increased to 1.8%, with much of this occurring in the second quarter. Some of this reflects factors unique to Shaw, like further long-term debt issuance, the purchase of the CanWest broadcasting assets and increased competition from Telus. We believe that a good part of the spread widening reflects the “flight to quality”, since the market views TransCanada as a more stable business model.

Negative Flows Depress High Yield Prices

The flight to quality has also affected the riskier sectors of the credit markets. Fund flows turned negative into high yield and bank loan funds. As our readers know, we at Canso believe that the high yield market in particular is “flow traded”. When retail investors place their money into high yields funds, the portfolio managers are forced to buy whatever they can and prices go up. When retail investors sell out of the funds, the flows turn negative and the portfolio managers sell whatever they can to fund the withdrawals.

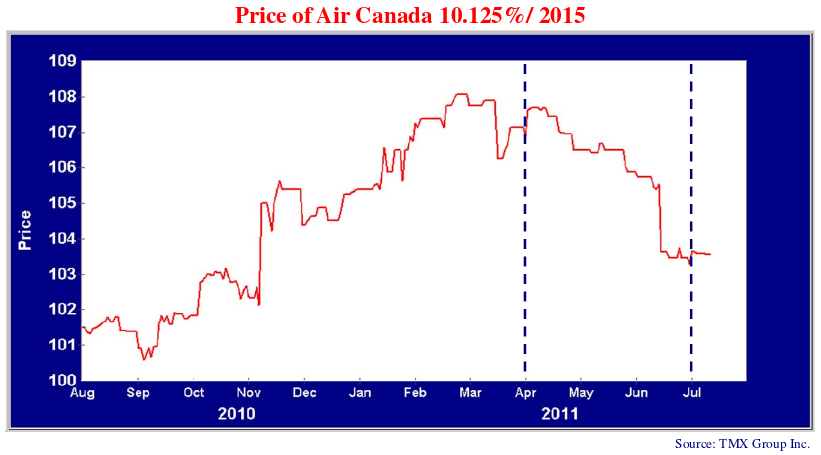

The following chart shows a perfect example of this phenomenon. Air Canada issued a high yield bond in July 2010 with both a Canadian and U.S. dollar tranche. With the firm bid for HY issues as money flowed into HY mutual funds and ETFs, the C$ 10.125%/ 2015 issue traded well up at issue. It then continued an upwards price trend to $108 in March 2011. Then the Euro debt crisis and the weakening economy put fear back into the investment equation.

Retail investors pulled money out of high yield funds and high yield bond prices dropped. By the end of the quarter, the Air Canada issue was down $4, half of its price gain. Most high yield issues in Canada and the U.S. fell in price, with the average decrease in the 2-4% range.

Red Hot to Very Nervous

A number of the recent crop of “Made in Canada” high yield issues fared quite a bit worse as investors grew nervous and selling pressure increased. OPTI Canada second lien bonds traded into the low $40s on bankruptcy fears which were later borne out. Sino Forest, the TSX listed Chinese timber trading organization, plunged after a short side research report questioned whether its financials were fraudulent.

The desire of Canadian investment bankers to keep the income trust gravy train going has also caused problems. The pitch of investment bankers was that former income trusts should lever up their balance sheet with high yield debt. This would allow them to pay high dividends once they convert from a trust to a corporation. The former income trust portfolio managers bought this pitch and morphed into high yield bond managers who were willing victims for this latest Bay Street fad.

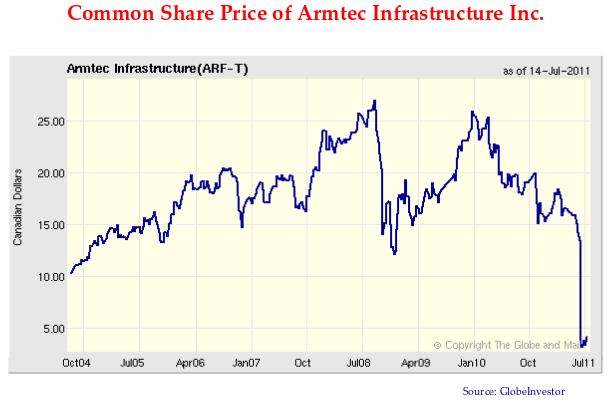

Armtec’d and Dangerous

Armtec Infrastructure Inc., the former Armtec Infrastructure Income Fund is a good example of how this pitch has worked out well for the investment bankers but not for investors. Armtec, which had grown considerably through acquisition, built up considerable debt along the way. In the last year it has done equity, convertible bond and high yield issues to repay the bank debt that it had built up on its spree. These issues have not worked out very well for the investors who purchased them. The graph above of the Armtec share price is instructive. The shares were first issued as income trust units in 2004. By 2008 the units had traded over $25 as its earnings grew from its acquisitions. The price fell during the credit crisis in 2008 but recovered back to just over $25. As its pace of acquisitions slowed, its price fell to $15, where it did an equity issue in early 2011.

With its growth slowing and inclement weather affecting its projects, Armtec announced in June that it expected to breach a bank covenant due to its fallen EBITDA. The stock price collapsed to $4 as investors questioned how it would deal with its bankers. The market was right to worry. Despite being paid down substantially and requiring that the dividend be suspended, the worried bankers must have been pressing. Armtec recently announced that it has refinanced its bank debt with a facility from distressed specialist Brookfield. This is a senior financing with healthy fees and an added 15% equity warrant package as a “kicker”.

We had passed on the high yield issue that Armtec brought to market in the hot market of last fall. The potential for substantial subordination given the loose convenant package and the substantial debt that could be put ahead of the “senior” unsecured bonds were significant issues for us. It now seems that we were right to be concerned since the Brookfield refinancing has deeply subordinated the bondholders. The bonds quickly traded down below $60 and have now stabilized in the low $80s.

Not Exactly Mellow Yellow

Another example of a credit in decline is Yellow Media, the former Yellow Pages. This was an LBO out of Bell Canada which eventually became an income trust. Its main print directory business is in decline and margins in its growing digital business are much lower. In June, with market sentiment souring, the equity began falling and analysts piled on to reduce their price targets. Why not kick someone when they’re down, especially when there’s not much underwriting fee income to sacrifice?

The equity fell from the $6 range to almost $2 on the selling pressure as analysts rushed to “revise” their price targets to reflect the new reality of a much lower stock price. The bonds fell in sympathy as the market recognized that the BBB (low) rating was in jeopardy as can be seen in the chart below. The Yellow Media 7.75%/ 2020 were $102 at the start of June and traded in the low $80s by the end of the month. That is a pretty steep drop for an investment grade bond.

Not High on High Yield

We are concerned with how quickly high yield bonds have sold off in this recent soft patch. The sales pitch for high yield has concentrated on how well they do in rising rate environments and fails to point out their considerable downside risk. We believe that when monetary policy eventually tightens, the resulting rising rates will prove a considerable problem for high yield bond valuations. Rising rates will both slow the economy and make capital more expensive for levered borrowers.

Rising interest rates also will make for difficult comparisons for today’s crop of high yield bond issues. A 6% coupon for a high yield bond might seem attractive now when T-Bills are 1% but paltry when and if T-Bills reach 4%. Witness the Armtec 6.5%/ 2017 bonds, which seemed attractive at a coupon of 6.5% with T-Bills at 1%. It didn’t take much in the way of a sentiment change for this bond to fall more than 20%!

Get Real

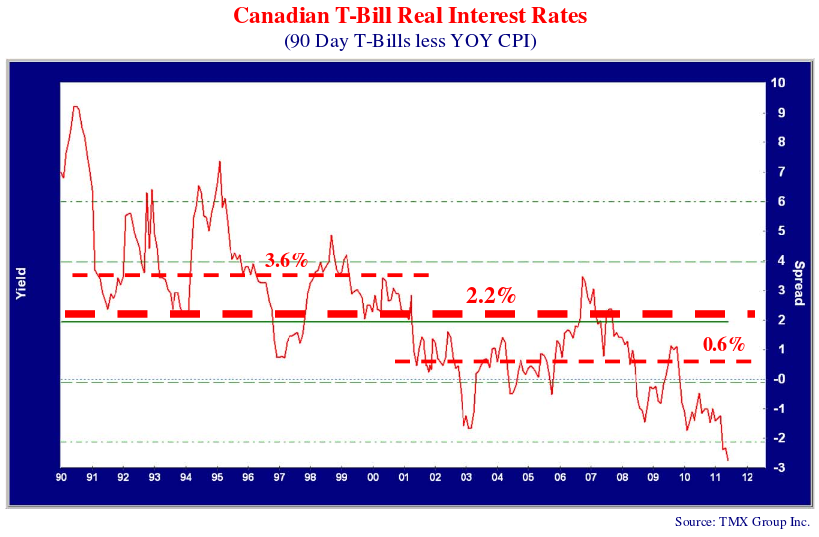

We expect that when monetary policy is normalized that real interest rates will return to their long term average levels. Since the BOC began inflation targeting in 1991, the real rate has averaged 2.2% as can be seen in the chart below. This is made up of a couple of distinct periods. From 1991 to 2000, the real interest rate averaged 3.6%. From 2000 until now, the real interest rate has averaged .6%.

Monetary policy has been extremely loose since 2000 as central bankers attempted to stimulate economic growth with very low real interest rates. In the aftermath of the dot.com crash, real interest rates were pushed quite low by the BOC and Federal Reserve policy response. This engendered very fast and loose credit creation and the resulting implosion we know as the Credit Crisis.

Mr. Carney’s problem is that he has to raise rates if he does not want 1970s style stagflation. When and if he ever gains enough gumption to normalize monetary policy, we would expect a real interest rate somewhere in the 2% range. Given the current inflation rate of 3.7%, this implies a 5.7% T-Bill rate (2% real yield + 3.7% inflation). Even if we use the BOC 2% inflation target we are talking 4% (2% real yield + 2% inflation). We do not expect Mr. Carney to move to this level very quickly given the leverage in Canadian households.

Mr. Carney will be under tremendous pressure to delay raising interest rates. In the last cycle, Alan Greenspan of the Federal Reserve broadcast that he would normalize U.S. monetary policy by raising the Fed Funds rate by .25% after each meeting of the FOMC. He expected that the financial markets, being “efficient” would impound this into their forecasts. Once the Fed raised rates from 2% to 4%, subprime mortgages started exploding and banks started going bankrupt. So much for efficient markets!

We think it will take some time for the Fed to tighten monetary policy and the Bank of Canada will delay as long as is possible. Given the speculative state of the credit markets and the terrible credit formation as a result of the ultra loose monetary policy, we expect that it won’t take too much to impact credit market valuations. We expect rising interest rates will again be very negative for the more speculative sectors of the credit markets.

Our view on the economy is unchanged. We are in a slow grudging recovery, as is always the case after a credit crisis. Fiscal policy stimulation is out of political fashion. Monetary policy can only do so much before inflation becomes a problem.

An economy strong enough to warrant tightening monetary policy will mean that credit spreads should do well. Credit spreads on investment grade bonds are still high by historical standards so we remain fully invested. Pension funds and others with long duration liabilities can lock in very attractive spreads at present on long corporate bonds. We think long Canadian telecom bonds are good value at their current wide spreads. We also like floating rate bonds which give up little running yield versus the short fixed rate equivalent and will do well as interest rates rise.

Watch what you are buying and look out below when monetary policy tightens!