The global stock market recognized that global economic recovery was underway in the first quarter of 2011. Stocks moved higher but bonds struggled with the idea that the “normalization” of monetary policy and higher interest rates were at hand. The bond market decided to “get ahead” of the central banks and bond yields moved higher. The coupon on bonds was not enough to offset their price decline from higher yields. For investors used to their bonds only rising in value, this was something of an epiphany.

The DEX Universe Overall Index saw a return of -0.27% for the quarter with the DEX Federal Index down -0.37%. Corporate bonds, with their shorter term and higher yield, turned in a positive +0.33%. Long bonds suffered in the quarter as yields rose. The yield on the DEX Long Overall Index rose to 4.49% from 4.31% at the beginning of the quarter. As a result, the DEX Long-Term Federal Index returned -1.97% in the quarter. Long corporate bonds, with their higher yield and some spread narrowing, were down only -0.44%.

Yield Stretched?

Even the “stretch for yield” was interrupted in the quarter. Perhaps it was the stunning realization that bonds could actually fall in value. The Japanese earthquake and tsunami, the Fukushima reactor leak, revolt in the Arab world and outright civil war in Libya all put quite a scare into the credit markets. A great deal of issuance also widened yield spreads on Canadian corporate bonds. This was particularly felt at the long end of the credit yield curve as both Rogers and Shaw decided to take advantage of low absolute yields to lock in their funding costs.

In particular, Shaw reopened their 2040 deal which pushed secondary long telecom spreads out a good 40 basis points to 3.3% above Canada bonds. To us, this long Shaw issue is something of a turning point for the Canadian corporate bond market. It used to be that it was very difficult to do a BBB (low) deal at any term, let alone a long issue. With the reopening, this issue is $1.3 billion outstanding in total which is a Canadian record of sorts!

Not So High on Yield

High yield issues did well in the quarter, although they faded into quarter end with the market uncertainty. The “only one way and higher” trade in the high yield market reversed quickly. The Air Canada high yield issue that was marked at $108 before the Japanese disaster and Libyan civil war fell to $104 bid on the “risk on” market turn. High yield issuance was strong in volume but increasingly weak in quality, particularly in the Canadian market. More and more of the issuance is “Dividend Recap”. The purpose of these deals is to pay out dividends or other equity extraction to private equity sponsors of very highly leveraged transactions. This weakens the credit worthiness of these companies and is not a good thing for debt investors.

Our question, as always, is whether the risk of these deals is justified by their potential return. The answer can be discerned by the fact we are not buying them. The investors who are buying them are buying them because of the money piling up in their “high yield” funds. Money is piling up because of the marketing pitch that high yield is an inflation hedge. This is actually true, since high yield bonds generally have higher coupons and therefore more money to invest at higher levels in a rising yield environment. What the proponents of this argument fail to tell the unsuspecting is that the capital risk of these investments is very high. Witness the 40% drops in high yield bond prices in the credit crunch.

We are at the point in the credit cycle where the apologists for anything with credit risk point to the very low current default rate to justify investment in completely stupid securities. Study of default rates shows that periods of very low default rates are inevitably followed by periods of very high rates. A skeptic might think that the deals flogged in a period of very low default rates are bought by those unconcerned by default. This probably means that these investors are not properly compensated for the risks they are assuming or don’t fully understand the downside of these investments.

Deals du Jour

We think this is the case at present. The “deals du jour” are increasingly weak in investor protections and bought by portfolio managers eager to reduce their cash positions. Investment dealers are happy to fill the demand (and generate underwriting fees) by flooding the market with issues by increasingly speculative borrowers. Very weak CCC issues are an increasing part of the U.S. high yield issuance but they’re in the indices so who really cares?

So, our position on high yield bonds and credit in general is that the speculative blow off will occur after monetary policy tightens and interest rates rise. The real question is when will interest rates rise? We seek some help from the following charts. It is very clear that the Fed and other central banks don’t really want to raise interest rates and will postpone doing so until the very last moment. The real question is what will inflation do? Inflation is also not something central bankers really want so when the tradeoff tips too far towards higher inflation they will be forced to react.

The Inflation Nation

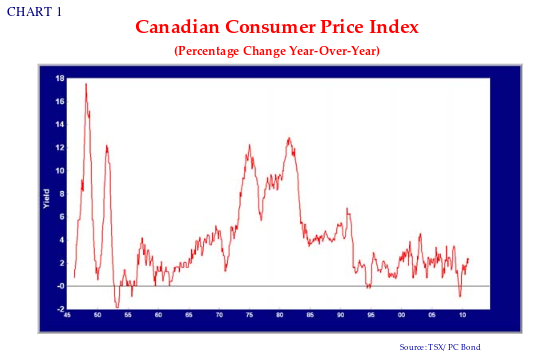

What constitutes higher inflation, you might ask. Inspection of the chart below shows that Canadian inflation since 1945 has ranged from a high of 18% when wage and price controls came off after the Second World War to -2% and deflation in the mid 1950s. One can also see we are very far from the double digit highs of 1973 to 1981 when the CPI ranged from 6% to 14%. Remember the “6 and 5” civil service wage restriction of the Trudeau government? This was an attempt to lower inflation expectations.

Promotional Gold

The amount of television and internet advertisements promoting gold as an investment is staggering. Certainly it suggests that investors are concerned that the monetary inflation engendered by the bank bailouts during the credit crisis will lead to at least a 1970s inflationary spiral. We suggest that investors focus on the period from the early 1990s to the present. We have provided a close up of this period in the chart below.

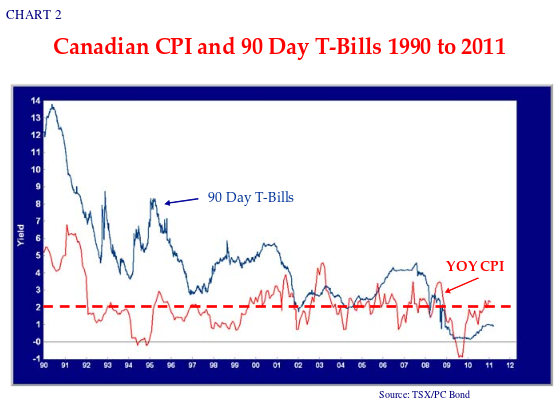

What we have displayed is the year-over-year CPI for this period as the red line. This is the period where the Bank of Canada adopted its “inflation targeting”. Although the CPI has moved from -1% to almost 7% in this period, the “central tendency” as shown by the dashed red line is 2%. It looks like the BOC has been successful in quest for low and predictable inflation over this period. Granted, the John Crow target of 0% changed to the Gordon Thiessen and David Dodge target of 1- 2%. Recent statements by Mark Carney, the current BOC Governor, suggest that he has adopted the Bernankian imperative of avoiding deflation at all costs so anything below 2% now seems to be fought at with some vigour.

Zimbabwe Here We Come?

What should be clear is we are currently very far from a Zimbabwean style devaluation of paper money, at least in Canada. Could it happen? As we explain in our Canso Market Observer, perhaps in the United States but we think it is much less likely in Canada. We do believe monetary policy needs to be “normalized” after its incredible ease in the aftermath of the credit crunch. To consider what “normal” interest rates are, we direct you to the blue line on the chart above which is the 90 Day T-Bill yield over this period. Note that the 90 Day T-Bill yield is normally quite a bit above the CPI as real interest rates are normally positive. Investors seek compensation for lending their money above inflation. It is quite unusual for inflation to be significantly above CPI as it is now.

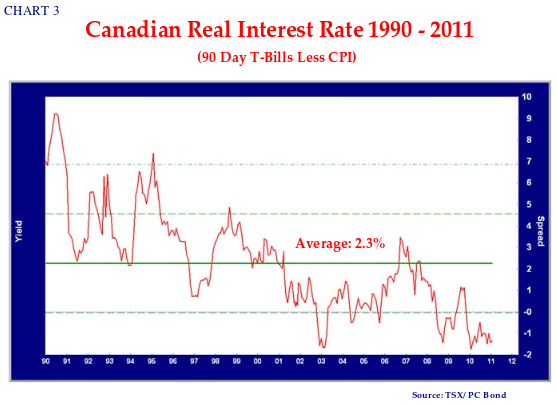

For ease of analysis, we have subtracted CPI from the T-Bill yield in the following chart. This shows the “real yield” of T-Bills over the period 1990 to present. During this period, the average real rate as shown by the green line is 2.3%. From 1990 to 2001, the real rate averaged much higher as investors still had fresh memories of the high inflation 1970s and early 1980s. The drop in 2001 is the monetary easing and low real rates after the dot.com equity market bubble burst. The troubling thing about this chart is that the current real yield of -1.5% was only equaled in 2003.

Mother-of All Credit Booms

In our view, this set off the “mother-of-all” speculative credit booms in the credit markets which ended very badly in the credit crunch of 2008. We have now seen a longer period of negative real T-Bill yields than in 2003 which is very dangerous for the financial markets. In 2005 and 2006 we were beating the drums of caution. We also believed that the scale of the credit boom was such that the bursting of the credit bubble would be extremely severe. We were right and this is what scares us about the current situation in the credit markets.

To us, firm believers in a credit cycle, we think that this cycle from bust to boom has been very short in time span and powerful in credit creation and subsequent speculation. Looking at this chart, Mr. Carney and the Bank of Canada should be worried and should be removing the excess stimulus that will eventually end very badly in a speculative credit bust. As we have said earlier, we are seeing clear signs in deteriorating structure and issuers that the high yield and bank loan market have departed from reality into the realm of credit fancy and sheer speculation.

Horror of Interest Rate Horrors

The chart above also shows where administered rates could be headed. An average real yield on T-Bills of 2% would be sensible. Add that to the 2% inflation that Mr. Carney seems to be targeting, we’re looking at 4% T-Bill yields. Yes, our loyal readers and Mr. Carney are recoiling in horror at the thought of 4% T-Bill yields. Impossible, you might think, having been sensitized to the present as the best forecast of the future. Your attention is directed to Chart 2, which shows that Canadian T-Bill yields were above 4% from 2006 to 2008 when the Canadian CPI ran in the 2% range.

The extraordinarily indebted Canadian consumer would have his or her floating rate heads handed to them. This is why we think Mr. Carney will strive to raise rates as little as possible. We look to have 2-3% nominal rates and a 0-1% real rate until inflation gets out of hand, which it probably will at some point. Working in Mr. Carney’s favour is the strengthening Canadian dollar which will moderate imported inflation.

What if Mr. Carney pulls a Bernanke and decides to please his political masters? All bets are off. Central bankers in the 1970s kept monetary policy too easy in the face of a weak economy. This proved decisively that monetary stimulation in excess of the needs of the real economy did ultimately cause inflation.

Scared You!

Now that we have scared you with talk of credit bubbles and inflation, it is time to consider our portfolios. Investment grade corporate bonds are still cheap on a historical spread basis and amply compensate the holder for credit risk, especially long BBB bonds. Accounts that need duration are well invested in corporate issues. For accounts without duration targets, we expect short yields to “normalize” and thus are holding some floating rate notes. These basically pay us the same as shorter term fixed rate bonds with some upside if administered rates rise as we expect.

We are watching the real yields which will warn of a potential credit or inflation blowout well ahead of time. The ball is in the central bankers’ court. It is time to do your job and take the pain it will cause.