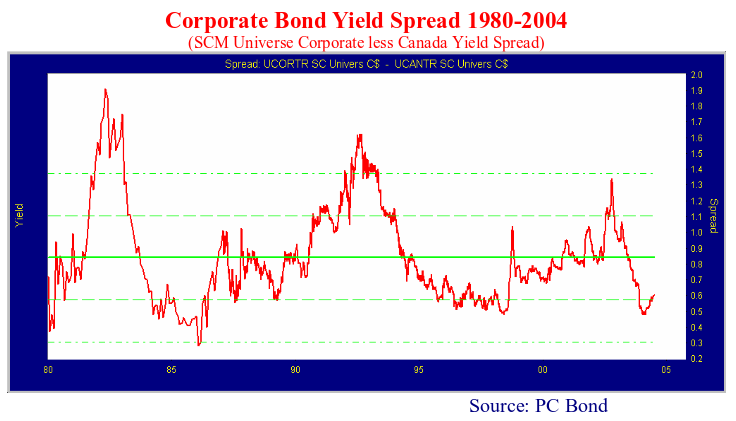

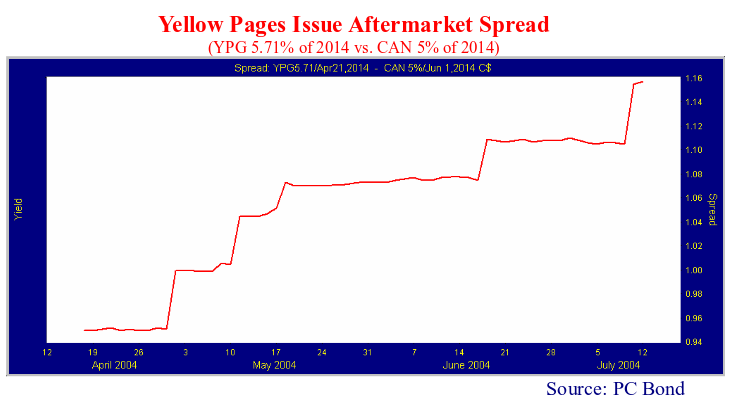

The Canadian corporate bond market seems to have hit its tight yield spreads for this cycle, as can be seen by the chart below of the Corporate Bond Index yield spread. The recent Yellow Pages 10 year issue has widened from the issue spread of 95 bps to 116 bps. Where BBB (low) Yellow Pages seemed attractive at .9% above 10 year Canadas in the 4% range, it might not seem adequate when 10 year Canadas are above 7%!

We see this retrenchment in below investment grade debt as well. The spectre of rising rates makes a mockery of “high yield” with a cash yield of 5% when Treasury Bills might have the same yield in the not too distant future.

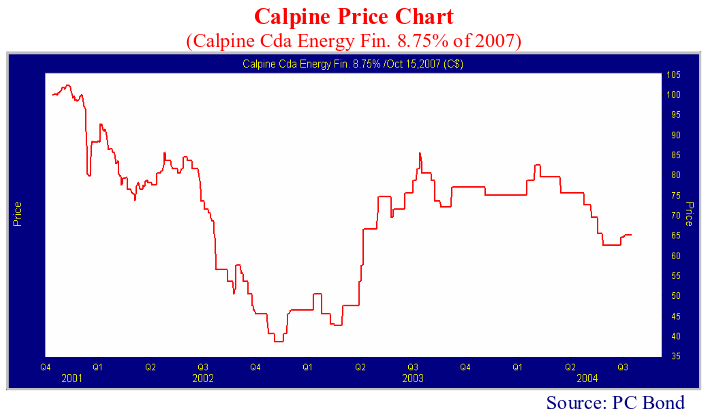

This declining enthusiasm for risk can also be seen in many distressed debt names. After major price jumps in 2003, in tandem with the strong equity market, many have settled back substantially. Calpine the fallen angel power generation company, shown in the chart below, had recovered from its low of $35 in the fall of 2002 to $80 in early 2004. It now trades in the low $60s as worries about its long term viability and the increasing subordination of its unsecured debt combine with the general decrease in market liquidity.

While we continue to think that the economy and improving credit risk are on the side of corporate bonds, they are very expensive in historical terms. This is due to the loose monetary conditions and the consequent stretching for yield by investors starved for income. The credit spread between corporate bonds favours higher quality issues at present. The spreads on longer term issues have backed up making them relatively attractive compared to shorter term corporate bonds. We look for spreads to widen as monetary policy is tightened. We think that the spread widening will be felt the most in the lower quality and more liquid issues. We look for a slow but steady increase in spreads, with “gapping” in issuers and sectors falling out of favour due to disappointment. A financial accident could move spreads out dramatically, given the Fed tightening and the reduced liquidity in the markets. These are hard to predict, but inevitably occur during the tightening cycles. Given the enormous complexity of the current vogue of financial products, it is hard to pinpoint the potential stress points. Our candidates would be mortgage hedging in the U.S. or a Russian or Chinese financial problem.