“Low short term interest rates and a steep yield curve provide powerful incentives to boost leverage, undertake carry trades, and seek yield by going out the risk spectrum. There is a real risk of investor complacency in a low interest rate environment. An unanticipated spike in yields and volatility in the US treasury market could also trigger a widening of credit spreads in mature and emerging markets and encourage an unwinding of carry trades and leveraged positions” – International Monetary Fund Global Stability Report

Alarm at Low Interest Rates

The analysts at the International Monetary Fund are sounding an alarm in their elegant bureaucratese. Loosely translated, they are saying that the very lax monetary policy and artificially low interest rates engineered by the U.S. Federal Reserve is resulting in very stupid “stretching for yield” by investors. We agree wholeheartedly and look no farther than the Canadian corporate bond market for a stellar example.

Yellow Pages Peril

We let our “fingers do the walking” through the details of the recent Yellow Pages Holdings issue. This BBB (low) income trust was able to issue $750 million of 5 and 10 year bonds at spreads of 66 and 100 basis points (bps), respectively. This is perhaps the most expensive corporate bond issue that we have seen in our many years of collective bond market experience. Investors were so enthusiastic that the deal was oversubscribed more than two times!

No Compensation for Credit Loss

A BBB (low) rated issue has a very real risk of downgrade and even default. In a five year period, a Moody’s Investor Service study (1) found that Baa (Moody’s BBB equivalent) issuers had a default rate of 4.8%.

Compared to the current spreads of other 2009 issues such as AA rated Nav Canada at 40 bps and A rated Bell Canada at 42 bps, the 66 bps of Yellow Pages five year spread is little compensation for the credit risk assumed by investors.

Spring Credit Fever?

In the spring of 1998, we saw a similar period of investor enthusiasm for credit risk. Interest rates were low in absolute terms and corporate bonds had delivered several years of impressive performance.

The new issue “road show” presentations from this period concentrated on the excellent historical performance of corporate bonds rather than the merits of the subject issuer. The spreads on these deals were very tight.

At the time, we were perplexed as to how someone could attain the 2 to 3% in out performance from corporate bonds when starting with spreads less than 1% over Canada bonds. We were not popular when we asked this question of the underwriters promoting their issues!

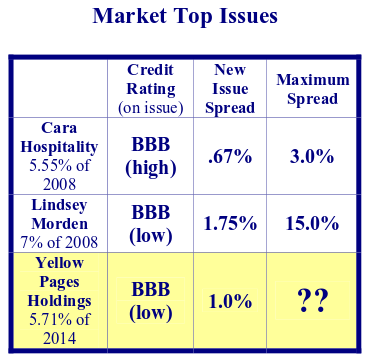

A Top ‘O the Market to You

We have compared two “market top” ten year bonds issued in 1998, Cara Hospitality and Lindsey Morden, to the ten year tranche of the recent Yellow Pages issue. Most notable is the 100 bps Yellow Pages new issue spread which is .75% tighter than the similarly rated Lindsey Morden in 1998! The spread at issue was pretty well the tightest spread seen for both Cara and Lindsey Morden bonds, which widened to 300 bps and 1500 bps, respectively.

Distorting Capital Allocation

The Yellow Pages issue speaks volumes about the current lack of investor discipline. Financial markets exist to allocate between savings and consumption. The forcefully administered low interest rates are distorting the allocation of capital in many ways.

The most obvious of these is the large increase in financial asset prices and the very low income available from them. From treasury bonds and stocks to strip mall real estate, investors receive very little income for the monies they invest.

Increasing asset value seems to be the only way to generate a reasonable investment income. This has encouraged very risky behaviour by investors and increasingly speculative financial markets.

Increasing Interest Rates

We worry about the potential for a substantial increase in interest rates, far beyond the intent of the Federal Reserve upon any monetary tightening. We see the mechanism for this increase in the “mortgage hedging” activity of investors and the mortgage banks, the Government Sponsored Entities (GSEs) such as Fannie Mae and Freddie Mac.

It could be fate that Alan Greenspan’s career as the serial rescuer of financial follies started with the “Black Monday” crash of October 19th, 1987. The major cause of this crash was “Portfolio Insurance”, a stupid concept masked in elegant mathematical formulae. Basically, the practical result of this “dynamic hedging” of stock portfolios was buying into rising equity markets and selling into falling markets. This led to the seemingly ever rising equity markets in 1987 followed by a huge fall on Black Monday.

Mathematically Elegant Stupidity

“Mortgage Hedging” is the conceptually stupid equal of the portfolio insurance craze. Like dynamic equity hedging, its mathematical elegance belies its lack of common sense. The basic prescription of mortgage hedging is to buy bonds when interest rates are falling (bonds are rising in price) and sell bonds when interest rates are rising (bonds falling in price). Let’s see, buying into rising prices and selling into falling prices. Where have we heard this before?

We have no idea what the ultimate affect on mortgage portfolios will be when interest rates finally rise. Like portfolio insurance, we think that the damage from mortgage hedging will be great. It is a concern that many U.S. banks and financial institutions have invested heavily in Mortgage Backed Securities (MBS) since regulators consider them a “riskless” asset. These lenders borrow short at low to zero interest rates on their deposits and make a considerable spread since the coupon on MBS is set off long term bonds.

As Alan Greenspan’s tenure as Federal Reserve Chairman runs out, it looks like his last heroic rescue of financial market incompetents will be directed at the mortgage market.

In the credit markets, the deluge of liquidity that followed the Dot.com equity market crash has drowned lender’s caution in a classical stretch for yield. With administered interest rates at 1% in the United States, investors are starved for income. This has bid up the prices for income producing assets to ridiculous levels. Junk bonds, bank loans and corporate bonds have seen their yield premiums narrow to levels which we do not believe adequately compensate investors for credit risk.

THE CANADIAN CORPORATE BOND MARKET

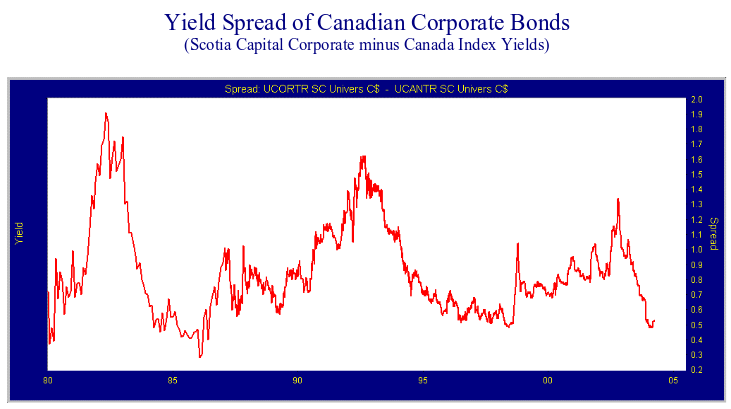

The Canadian corporate bond market narrowed in spread alongside the powerful rally in U.S. credit spreads in the first quarter of 2004. Plentiful liquidity and low yields combined to force fixed income investors into spread product, to try to augment their historically low portfolio yields. It didn’t hurt that corporate bonds had outperformed over the previous two years, as bond managers were herded into index weightings in corporate bonds.

The chart below shows that the yield spread on Canadian corporate bonds is now the tightest that it has been since 1998 and has only been tighter once since 1980. While we believe that the economic recovery is firmly established, we think that corporate yield spreads already amply reflect this. Given the low absolute interest rate level and tight yield spreads, there is little “margin of safety” in corporate bonds.

With 10 year treasury and Canada yields in the 4% area and credit spreads less than 2% for some below investment grade issuers, we now have very low coupons for “high yield” issues. While Rogers Cable has obtained low cost financing with its latest U.S. issue, we do not see how the 5.5% coupon of 2014 offers much yield to compensate an investor’s portfolio for future credit losses!

We remind readers that credit losses are statistically a percentage of principal risked. This is independent of the loan interest rate. Investors in high yield bonds have much less yield in today’s 56% range to offset their inevitable credit losses than when their portfolio yields were above 10% less than two years ago.

We are very cautious on the very tight spreads of new issues and believe that there is little incentive in spread to step down in credit quality. This enthusiasm for new issues is a concern, as it shows that investors’ fear of “being left out” has overwhelmed their fear of credit loss.

Dodge-y Credit Spreads?

Remarkably, we are joined in this opinion by David Dodge, Governor of the Bank of Canada. In a recent appearance before the Senate banking committee, Dodge remarked on the “narrow yield premiums” on corporate bonds:

“It makes us all a little bit nervous that with these narrow spreads that (investors) aren’t fully taking into account the risks that are there,”Dodge said in testimony to the Senate’s banking committee in Ottawa. “The potential for those spreads to widen out now are quite high.” David Dodge Source: Bloomberg News

In the same article Mark Carpini, a Canadian bond manager, commented:

“I don’t know if that’s a prudent thing for a central banker to say,” he said. “ What do you expect in an environment where interest rates are at record lows — people are paid not only to go out on the yield curve but to take risks.” Mark Carpani of Mulvihill Capital Management Source: Bloomberg News

As corporate bond specialty managers, we at Canso Investment Counsel Ltd. are very worried about the potential for spread widening. We do not agree with Mr. Carpini. People are not being paid to assume risk, either yield curve or credit. We expect to be paid for assuming risk, even when interest rates are at record lows.

When money is easy, marginal corporate bond investors are willing to put money into very risky bonds for very little additional interest. It is when monetary policy is tightened and money becomes dearer that credit spreads will widen. Investors in expensive corporate bonds will see substantial capital depreciation on their investments.

We are improving our credit quality and find little incentive to take on credit risk. At some point in the not too distant future, the credit markets will be once again in disarray and there will be cheap bonds in the bargain basement of the corporate bond market. Until then, wise investors will avoid risk!