The year 2010 actually turned out to be a decent one for the bond markets. Despite investor misgivings about loose monetary policy, we believed that the economic headwinds and deleveraging of financial institutions would result in lower growth and inflation for 2010 than most expected. This is what actually happened and yields in the Canadian bond market ended the year considerably lower than where they started.

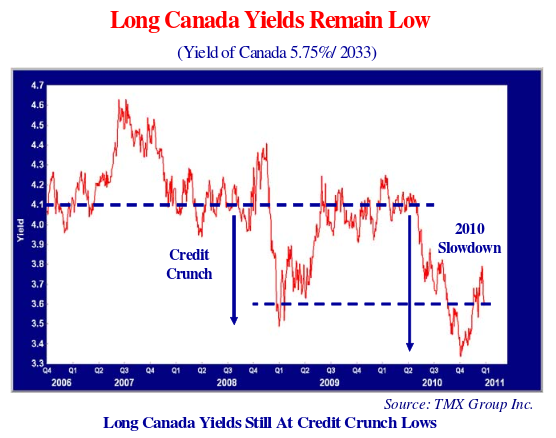

The consensus for stronger growth and inflation continued into 2010. As the chart below shows, yields on long Canada bonds plunged during the 2008 credit crisis but moved back up by March, 2009 when the “fear trade” came off. Yields then stayed there for a year until March, 2010.

Long yields then plunged again in mid 2010 as investors recognized the slowing global economy and sought safety from the Euro zone credit crisis. This took the yield on the long Canada down by .8% to 3.3%, lower than during the credit crisis. This trend was partially reversed in the fourth quarter of 2010 as an improving economy, stock markets and a less dire outlook for the Euro peripherals seized the consensus and sent bond yields up.

Long on Performance

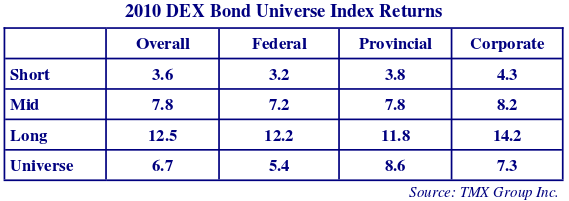

The table below shows that falling yields and rising bond prices gave the DEX Universe Bond Index a very respectable return of 6.7% for 2010. The longer term DEX Long Universe Index turned in a strong 12.5%. Corporate bonds once again outperformed the other sectors on a term equivalent basis with a 7.3% overall return. Long corporate bonds once again led the pack with an excellent and equity like 14.2% return.

The Death of Bond Bull?

The consensus fixates on the most recent stimuli and this time is no different. Bond managers had shortened their term early in 2010, with the expectation of a stronger economy and higher inflation. They were then hung out to dry as yields plunged. Undoubtedly many then extended term to “keep up with the performance Joneses”. Bond managers and retail investors alike are now experiencing the acute pain of rising interest rates on their bond portfolios. There’s nothing like a “safe bond” investment going down in value to make people unhappy.

The consensus is now fulfilling its purpose, explaining what is happening to those unable or unwilling to form their own opinion and giving them comfort that they are not alone. As we enter 2011, the financial press and media are replete with stories of the end of the great bull bond market that started in 1981. Even the media personalities of PIMCO are declaring the death of the very bond bull market that brought them fame and fortune. Perhaps the cruelest blow of all is the recent news that Bill Gross of PIMCO, the Oprah of bonds, is adding equity-linked notes to the “World’s Biggest Bond Fund” and rolling out equity mutual funds.

Trepidation and Equivocation for the Nation

Bond investors are thus eyeing the year ahead with some trepidation. Are yields headed up inexorably with no quarter given to those who need financial income without equity risk? The facts on the ground, so to speak, are not conclusive. Our answer is an equivocal “it depends”, reflecting the importance of policy to the year ahead. We know that our equivocation seems a tad wimpy after our clarion calls on credit debauchery before the credit crisis and outstanding corporate value when everything was melting down.

Unfortunately, despite our inclination towards animal spirits and rather fuzzy logic, we are forced by our lack of conviction to yield to the evidence. Another inspection of our chart above shows that long Canada bond yields have basically bounced around 4% for most of the past 5 years, as shown by the upper blue dashed line. The exceptions to this were the significant drop in yields during the credit crisis of 2008 and the recent drop in mid 2010.

Despite the pain that bond investors now feel from rising rates, long Canada yields are still at the lows reached during the credit crisis as shown by the bottom blue dashed line. To put the great interest rate debate into graphical terms using our chart above, what is the chance that we move from the current level of long yields to the upper level or above? Our answer is “pretty good” since we believe the underlying global economy is definitely in recovery. On the other hand, we know policy and politics will drive the debate so this humble stab at a forecast is only a plan to be deviated from.

A Real Explanation

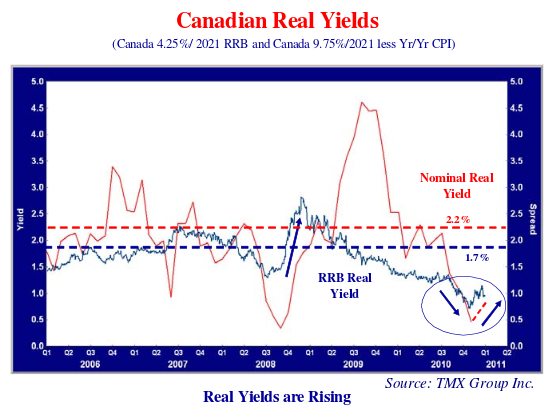

The chart below on Canadian Real Yields helps in our quest for explanation. We believe that the recent rise in yields results from an increasing real interest rate due to the increasing demand for capital rather than a change in inflation expectations. The current real yield on the RRB (blue line) is .9% compared to the nominal equivalent real yield (red line) of .8% (3.2% Canada yield minus 2.4% CPI). The fact that both the nominal and inflation-linked 2021 maturity Canada bonds currently have much the same real yield shows that most investors don’t really see the need to purchase inflation protection.

As the chart shows, the nominal real yield has averaged 2.2% since 2006 and the RRB real yield has averaged 1.7% over the same period. This reflects the fact that the holder of the RRB “pays up” or receives a lower real yield for the inflation protection of the RRB. Both the RRB and nominal real yields are presently very low compared to these averages. This to us suggests a low real interest rate due to very loose monetary policy and an investor risk preference away from equities and other risky assets. The RRB and nominal real yield have both risen recently by the same amount which confirms to us that the recent increase in yields is not driven by higher inflation expectations but an increase in the real rate. The Fed and other monetary authorities are still keeping money easy but capital is moving from “safe” government bonds to riskier assets like equities, commodities and emerging markets. Perversely, we think the Federal Reserve announcement of renewed quantitative easing “QE2” has assured investors that they can invest in risky assets without fear of a “double dip” recession. Rather than lowering longer term interest rates as QE2 was meant to, it has actually encouraged a flight from safer government bonds into risky assets and raised real interest rates and long term yields.

Joe against the Pros

There are many major risks to our forecast. As we point out in our Canso Market Observer, the economic outcome is really up to the policy makers. Yes, copious amounts of money have been pumped and primed into the global system by almost every central bank. This has succeeded in averting a debt deflation but much banking capital has been destroyed and still needs to be replaced. This is evidenced by the real estate meltdown in Ireland and many of its Euro brethren.

While the consensus holds that all this monetary liquidity will end up with a flood of inflation, the risk now seems to us to be increasing political unpopularity of government financial intervention. Joe Q. Public gets that Fat Cat Banker has done pretty well at his expense. This voter and tax payer frustration has sparked a conservative political movement which has already turned fiscal policy decidedly negative. We believe that similar “born again” conservatism will make its way into central banking circles. This is not great for banking lobbyists and the financial apparatchiks who manage the “to big to fail” banks. More dangerously, it could proscribe further monetary stimuli even if it is necessary.

Tighter monetary policy in the top three global economies would definitely slow things down. The debt problems of the U.S. and Europe are well known but China has engendered its own credit mania with its response to the credit crisis and global recession. You don’t force a bunch of bankers to lend money willy nilly without creating a bunch of duff loans.

Canada, Thank the “Cash Man”

Thankfully, Canada is in better condition. A strengthening global economy has stoked the global demand for commodities and our banks survived the credit crisis relatively unscathed. What is not well known in the sweet afterglow of financial mayhem avoided is that Canada bailed out its banks as well. This was accomplished covertly through the direct purchase of residential mortgages by the Federal government. The banks and consumer spending were propped up during the credit crisis by the massive $125 billion mortgage buying program of Messrs Flaherty and Carney.

The “Cash Man” Jim Flaherty, the Minister of Finance, didn’t have a television commercial waving dollar bills but Canadian bankers rushed to turn their mortgages into cash. In a nutshell, the Insured Mortgage Purchase Program (IMPP) allowed the banks to sell mortgages they had already insured with CHMC (backed by the Federal Government) to the Department of Finance. The mortgages were sold to the government at much lower interest rates than they were originated at, giving the banks a tidy profit.

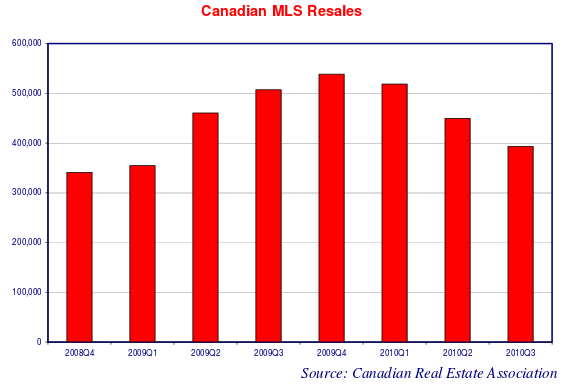

The bankers then turned around and used the cash to grant new mortgages which they then sold once again to Mr. Flaherty at a tidy profit. The Canadian covert bank liquification was as effective as the Chinese edict to “lend more money”. The previous chart on Canadian MLS resales shows the massive 57% increase from 4Q 2008 to 4Q 2009. The chart also shows that housing sales are now falling rather quickly. The Canadian residential real estate bubble will eventually burst but our dutiful and rather naïve government has assumed most of this risk.

An expanding global economy is good for commodity exports and resurgent U.S. demand should help Canadian manufactured exports. Although the Canadian consumer is tapped out by most reports on the debt front, upward pressure on the Canadian dollar should keep interest rates low as the Bank of Canada tries to protect Canadian exporters. A moderation of domestic demand through a downturn in the housing market would be good for inflation.

The Hard Canadian Dollar

It is pretty impressive for us to see the Canadian dollar referred to as a “hard currency” and a refuge of monetary safety. Remember the talk of Canada “hitting the wall” and needing IMF intervention in the 1990s? We haven’t even heard an economist argue for Canada to adopt the U.S. dollar in the last few years. This leads us to believe that the pressure upwards on Canadian interest rates should be less than that on U.S. rates if indeed we move into an increasing rate scenario.

Our real question on Canadian interest rates is how much will they “normalize”. The Bank of Canada doesn’t really have a strong rationale to keep monetary policy ultra loose since we escaped the worst of the credit crunch with reasonable economic momentum. The Governor of the Bank of Canada, Mark Carney, seems to be signaling increasing rates with his sermons on consumer debt responsibility. To us, this is a trifle hypocritical. Yes, the Canadian consumer has record debt levels but it is government guaranteeing consumer mortgage debt that has allowed this to develop. It’s a bit like promoting safe sex by throwing an orgy. Why would a banker turn down a loan that the government has assumed all the risk on?

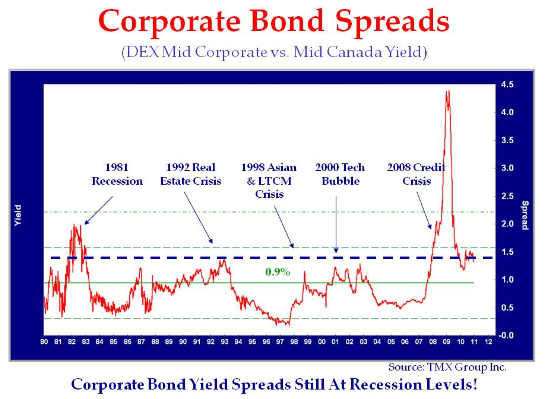

Corporate Spreads Still Attractive

If the course for Canadian interest rates is moderately upwards due to a reasonable economy, the prospects for corporate bonds are relatively good, compared to other fixed income sectors. Interest rate spreads typically narrow with a stronger economy. As can be seen from the chart below, the current spread on Canadian corporate bonds is still historically attractive.

The current 1.4% yield spread for the DEX Corporate Index above the Canada Index is very attractive at recessionary levels. A reversion to the average of .9% would go a long way to offset increasing government yields. We note that the level more typical of recoveries would be in the .5% area which would offset a 1% increase in government yields. We think long corporate bonds are very attractive, especially BBB issues and P3 issues which have very wide historical spreads.

Credit Fundamentals are Sound

The fundamental credit picture is sound, with issuers in strong financial condition and the credit markets very liquid. As we said in 2007, it is difficult to default when people will lend you more money. As the S&P ratings agency says:

“Corporate borrowers in the U.S. have enjoyed much more welcoming markets since the abatement of the credit crunch that dominated 2008. As such, many of our 2010 rating upgrades were related to market liquidity and the ability of leveraged borrowers to refinance their debt.” Standard and Poors, Market Access At Favorable Rates, January 3, 2010.

A unique feature of this market is the shift of credit risk from banks to investors. High yield and Bank Loan mutual funds are seeing strong inflows and money managers are looking for places to invest. Both the bank loan and high yield bond markets are seeing surging issuance and this is due to investors falling over themselves to use up their cash so they don’t fall short of their index benchmarks. The strong new issue market is allowing issuers to pay down restrictive bank debt and even fund dividends to sponsors. The credit crunch of 2008 is now a distant memory in their haste to invest. Default rates are falling and the “refinancing wall” that worried analysts in 2009 seems to be forgotten in the current enthusiasm for credit risk. We always worry when we see credit caution thrown to the winds but it’s good for issuers to have ready buyers for their bonds.

As can be deduced from our equivocated forecast, we are not wholly convinced that Canadian yields will increase substantially. Prime among our reasons is a Canadian dollar on an upwards trajectory from strong commodity prices and a quickly slowing Canadian housing market. These should create a subdued Canadian inflation picture.

Current very high long corporate yield spreads offer considerable protection from increasing long yields. Given our contrarian natures, we like the following chart of long Canadian corporate bond yields. Note that the absolute level of yields is much the same as prevailed in the 1960s. If inflation does not rear its ugly head, long bonds are not a bad deal at close to 6%.

We continue to believe that Canadian corporate bonds offer tremendous value compared to other fixed income investments. If the course of Canadian interest rates is upwards, corporate yield spreads will narrow and offer considerable protection. If things are slower and rates are lower, then the extra yield spread on corporate bonds will be even more valuable.