Interest rates continued to rise over the second quarter of 2007 with the yield curve in the United States “normalizing” from its slight inversion earlier in the year. This reflects the steady drumbeat of decent economic statistics and the shifting of global monetary policy away from ultra ease. The real drama in the bond market occurred on the credit front, as tighter money and a return of credit risk made for a turbulent quarter for bond managers.

Credit risk had disappeared from the investment horizon over the past few years, as credit rating analysts, bond managers and bankers wallowed contently in their quantitative risk models. These models demonstrated conclusively to them that lending money to anyone for any purpose was a “no lose” proposition. Credit investing meant shoveling money out the door as fast as possible, for fear that credit spreads and interest rates would reach zero before portfolios were fully invested. The almost default free environment of the past few years resulted from issuers being able to refinance on easy terms for almost any purpose.

Credit Whoopee Cushions?

Those halcyon days in the corporate bond market were a result of a perfect juxtaposition of ultra loose monetary policy, the structured product mania and mindless quantitative models which based credit ratings on asset values and statistical “credit cushions”. The fact that almost every credit implosion in history was caused by lending on financial asset values seems to have escaped the major credit rating agencies and the investors who relied on their faulty ratings. The culmination of this orgy of greed and investment stupidity occurred in the past three months by our high subjective reckoning.

Credit “Greater Fools”

This was about the time that bankers were moving in their lemming like manner into “covenant lite” loans in the hope of producing more loans to shove into their Collateralized Debt Obligations (CDOs). Bankers originating loans found removing restrictive covenants popular with potential borrowers, especially the all-important private equity funds whose financing decisions showered the investment banks with fees. The fact that most of these deals were for payouts to the private equity funds and for their highly levered financings for private buyouts was not a problem. These loans were meant for sale to CDOs, the credit “greater fools” of our time, so creditworthiness was not a big issue to those negotiating the loan structures.

It was also about this time that “Toggle” bonds were pitched by underwriters trying to finance levered private equity acquisitions. These allowed the buyers to defer cash interest by “paying in kind” and issuing new bonds instead of cold hard cash. This harkened back to the “zero coupon” high yield telecom issues of the late 1990s, most of which defaulted and were worked out for a few cents on the dollar. The spectacle of bankers lending money with no strings attached and high yield bond investors signing up to forgo cash interest in favour of IOUs is conclusive evidence to us that a speculative peak was reached in the credit market during the last quarter.

The Sub-Prime Gross Out

We now believe that we are in a credit bear market. When the Wall Street Journal features the sub-prime mortgage meltdown and the liquidation of the Bear CORPORATE BOND Newsletter Stearns CDO hedge funds on its front pages and the world’s biggest bond manager, Bill Gross of PIMCO, compares CDOs to “hookers in six inch heels”, we know that the credit cycle has turned on the media front as well.

We have been beating the credit war drums on CDO and sub-prime mortgage underwriting rather stridently for a few years now so it is nice to have some mainstream company on these issues. We are also seeing the popular financial press take up private equity debt risk. Rather than gasping in admiration at the latest bold acquisition by the private equity mavens, commentators are now seizing on the increasing spreads and decreasing popularity of the huge new debt issues of the private buyouts. This suggests to us that the private equity credit excess is also in its very late stages.

Our clients and readers know that we at Canso are not enamored with quantitative credit models that are based on probability distributions that have no grounding in human reality. Historical mortgage loan losses bear no obvious relation to sub-prime mortgage lending by third party brokers greedy for production fees and who will hold no lasting interest in their mortgages. Prudent underwriting was replaced by the quantitative models of Wall Street investment banks eager to assemble pools of assets to be sold to their yield deprived clients at substantial profits.

“Eyes Wide Shut” Credit Rating Policy

The “objective” credit rating agencies that received huge fees for assessing these complex and inane offerings proved that the lure of money usually triumphs over objectivity and skeptical consideration of the investment facts. Credit rating models based on asset values and “credit enhancements” are open to abuse, especially given that looser standards meant more deals and more revenues for the rating agencies.

The antiquated notion that borrowers might actually default has returned with a vengeance, especially in the sub-prime mortgage market. Models based on rising home values and easy refinancing in the Greenspan’s ultra low interest rate environment don’t have much validity in today’s environment. That does not disturb the intrepid rocket scientists in the structured product areas of the major credit rating agencies. As a recent Bloomberg article pointed out, “S&P, Moody’s Mask $200 Billion of Subprime Bond Risk” (Bloomberg Financial 7/4/2007 by Mark Pittman), even though their own standards suggest imminent credit disaster and downgrade, they have to wait to make sure:

“ ‘Don’t misunderstand me: I’m not saying these other (CDOs) are performing great,’Robert Pollsen a director in S&P’s residential mortgage surveillance in New York, said in an interview last month. ‘And they certainly might warrant our attention several months from now, which is obviously (what) we’re going to do’” Bloomberg Financial

The problem is that there are huge amounts of CDOs that are rated investment grade which have mortgage collateral that has depreciated substantially in value. It seems that ignorance is bliss in the bond market which has developed its own “Eyes Wide Shut” policy on CDO credit ratings. According to the Bloomberg article, 190 out of 300 bonds in the ABX index of CDOs fail to meet the S&P standard for credit support. This means that sooner or later that these CDOs will be downgraded and that many of the insurance companies, endowments and pension funds that bought them will have to sell them since they have investment policies that preclude holding lower rated debt. As we have said in prior reports, the quantitative credit rating alchemy that made credit gold out of loan and mortgage lead will prove to be as illusory as the chicanery of gold alchemy in the middle ages.

Playing Possums?

A further Bloomberg article, “Bear Stearns Meets Possums in Georgia as Foreclosures Increase” (Bloomberg Financial 6/29/2007 by Kathleen M. Howley and Bob Ivry), points out the problem with foreclosures and the mechanism for disposing of the depreciating residential real estate collateral that backs many of these loans. The major mortgage banks have become major involuntary owners of houses that they have foreclosed on. The unoccupied houses are deteriorating in condition, hosting possum gatherings in the backyards, as the mortgage servicer decides whether to spend money on maintenance. Since these homes are unoccupied and not producing any cash flow, the incentive for the lender or servicer to dispose of the properties is high. Fire sale prices, however, risk a downwards spiral in real estate prices that will damage other home values in other pools. As the sub-prime mess is sorted out, much of the underlying collateral will prove to have disposal values far beneath the book value of the loans made which is another threat to CDO values.

“Whether selling at auction or using a real estate broker, lenders usually get ‘cents on the dollar’, which undermines the confidence of mortgage bond investors by showing property values are nowhere near the loans they collateralize, said Keith Shaugnessy, president of Foundation Mortgage Corp. in Littleton, Massachusetts.” Bloomberg Financial

It is truly amazing how quickly the worm has turned for CDO investments. The bad news on Bear Stearns mortgage hedge fund implosions came out in mid June. On June 1st, a few weeks before, a Bloomberg article entitled “Banks Sell ‘Toxic Waste’ CDOs to Calpers, Texas Teachers Fund” (Bloomberg Financial, June 1, 2007 by David Evans) covered the growing trend of CDO investment by public sector pension funds eager for yield.

“At a sales presentation of the bank’s CDOs to 50 public pension fund managers in a Las Vegas hotel ballroom, Jean Fleischhacker, a Bear Stearns senior managing director, tells fund managers they can get a 20 percent annual return from the bottom level of a CDO. ‘It has a very high cash yield to it,” Fleishhacker says at the March convention. ‘I think a lot of people are confused about this product and how it works.” Bloomberg Financial

A Taste for Toxic Waste

As opposed to Ms. Fleischhacker, we think that the marketing of CDOs depends on confusion. As our loyal readers know from our prior discussion of CDO “slicing and dicing”, the bottom tranches of CDOs are called the “equity” and are the first to take the losses on the CDO asset pools which protects the higher rated tranches. The so-called yield is really the cash payment expected given the spread sheet assumptions of the investment bankers. Since the CDO equity could easily be wiped out by loan losses, they are also called “toxic waste”.

“Fleishhacker, 45, says she doesn’t associate toxic waste with the equity tranches she’s selling. Pension funds in the U.S. have bought these CDO portions in efforts to boost returns.” Bloomberg Financial

We hope that Ms. Fleishhacker was well bonused for her CDO sales efforts. We expect the next few years will be leaner in CDO underwriting and sales. According to the article, the sales of CDOs have exploded since 2003 with $503 billion issued last year, a fivefold increase in 3 years. We don’t expect this to continue. It doesn’t take too many page one stories to have boards and bosses give the proverbial “tap on the shoulder” to those responsible for investment programs. By July 3rd, a Bloomberg article, Cioffi’s Hero-to-Villian Hedge Funds Masked Bear Peril in CDOs, chronicled the fall from grace of Ralph Cioffi, the Bear Stearns mortgage guru who ran the two problem mortgage security hedge funds.

Mortgage and CDO hedge funds are now seeing substantial client withdrawals and having to liquidate some very illiquid investments. Other hedge funds are suspending client withdrawals. The well publicized CDO and sub-prime mortgage problems have dried up this demand for bonds and loans for securitization into CDOs. The dearth of CDO demand is pressuring credit spreads outwards, which is putting pressure on new corporate bond deals. With the recent private equity acquisitions requiring financings well into the billions, spreads are pushing out in sympathy.

The Canadian Corporate Bond Market

The credit fireworks extended to the normally sedate Canadian bond market. The acquisition of BCE by private equity players headed by Ontario Teachers which occurred right at quarter end will be the largest deal on record if it goes through at $48.5 billion. The debt financing of $27 billion is said to include a $10 billion high yield issue. If the existing $6 billion in soon not to be investment grade debt is included, BCE will be one of the largest global high yield issuers. A truly macabre fate for the most widely held Canadian corporate bond!

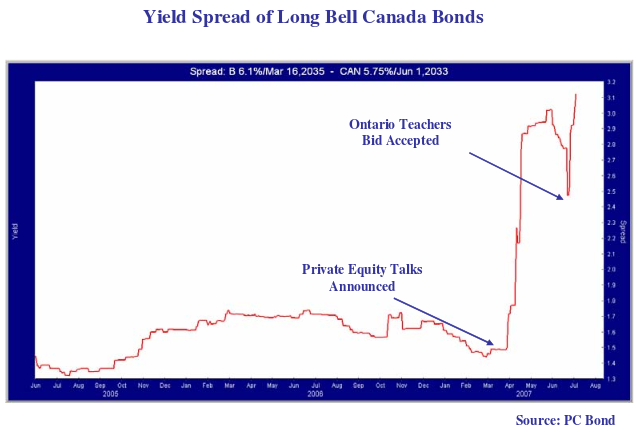

The private equity stalking of BCE terrorized Canada’s bond managers and blew spreads out on Bell issues as can be seen in the chart above. The long bonds had been trading at 150 basis points (bps) or 1.5% over Canada bonds and very quickly moved to 290 bps on the news. The spreads moved in with the announcement that Telus had joined the fray but moved back out even wider to 320 bps in early July after the BCE board accepted the Teachers offer.

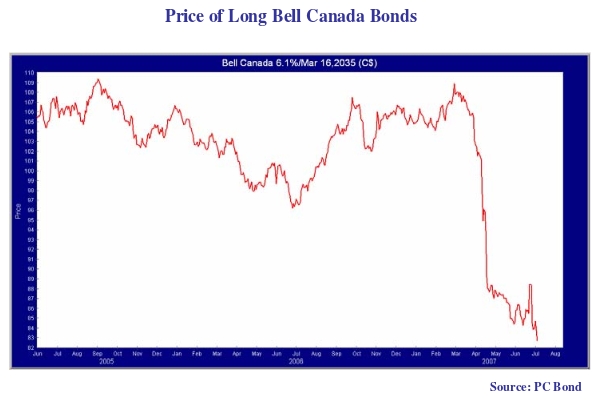

While this might not sound horrific in spread terms, a look at the price chart below of a long Bell Canada bond shows the utter devastation wrought on the portfolios of unsuspecting Canadian bond managers and their clients. The Bell Canada 6.1% of 2035 were trading at nearly $109 prior to the private equity discussions leaking out and plunged to $85 by quarter end. This was a 22% drop which translates to almost 1% of portfolio damage on a 4% position. Considering that the annual difference between top quartile and bottom quartile bond managers is half of this, the BCE “shareholder value maximization” certainly hurt the bond performance of many portfolios.

The credit damage was not limited to BCE. Any likely or possible takeover candidate was moved wider by market fears. It was a baptism of fire for bond managers who had not experienced a prior credit meltdown. They will likely be bailing out of problem positions and “lightening up” on credit for some time to come.

Accentuate the Negative

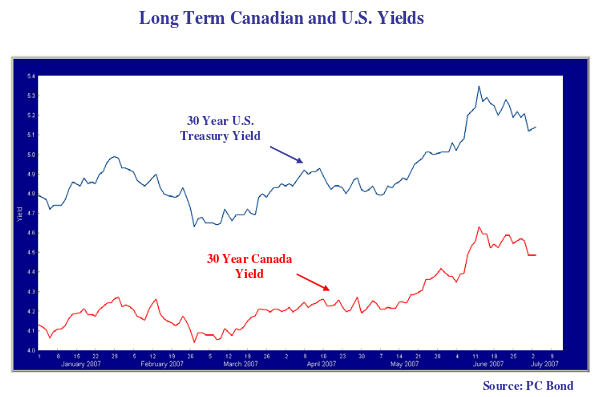

All in all, it was a grim quarter for Canadian bond portfolios. The SC Universe Index had a negative return of -1.7%. As the chart below shows, interest rates increased in the Canadian bond market over the quarter, particularly at the long end. This damage to bond prices was pushed into the background by the more dramatic credit carnage, but it hurt portfolios just the same. Investors who moved from corporate bonds into long Canadas expecting a “flight to quality” rally did not find safe harbour in the long end of the Canadian bond market. The price decline of 4% on long Canada bonds was not offset by their 1% in yield over the period and the SC Long Federal Bond Index showed a return of -2.8% in the quarter.

Outlook

Given strong world economic growth and the economic firming in the United States, we think the course of global interest rates is upwards. This will particularly be the case in Canada, as strong employment and wage growth look to move the Bank of Canada back to raising interest rates.

We expect that slowing profit growth in the face of rising costs and interest rates will deepen the credit bear market. As our readers know, we have expected this credit downturn for some time. Our readers also know that we believe the credit excesses of this cycle are unprecedented in modern financial history. The length and severity of the credit downturn will reflect this.